Best Mercedes-Benz SLK-Class Car Insurance in 2025 (Check Out the Top 10 Companies)

Geico, State Farm and Progressive stand out as top choices for best Mercedes-Benz SLK-Class car insurance. These providers offer competitive rates starting at $30/mo, along with a range of coverage options and discounts tailored for luxury vehicles. Explore their offerings to find the best fit for your SLK-Class.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Aug 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Mercedes-Benz SLK-Class

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Mercedes-Benz SLK-Class

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Mercedes-Benz SLK-Class

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsGeico, State Farm, and Progressive offer the most competitive rates for Mercedes-Benz SLK-Class insurance, with prices starting around $30 per month.

Among these, Geico stands out as the top choice due to its affordable car insurance premiums, comprehensive coverage options, and numerous discounts. Whether you prioritize cost savings or coverage flexibility, these providers cater to the needs of SLK-Class owners.

Our Top 10 Company Picks: Mercedes-Benz SLK-Class Car Insurance

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Affordable Rates | Geico | |

| #2 | 17% | B | Reliable Service | State Farm | |

| #3 | 20% | A+ | Customizable Plans | Progressive | |

| #4 | 10% | A+ | Comprehensive Cover | Allstate | |

| #5 | 15% | A++ | Military Families | USAA | |

| #6 | 12% | A | Coverage Options | Liberty Mutual |

| #7 | 10% | A+ | Personalized Service | Nationwide |

| #8 | 10% | A | Customer Support | Farmers | |

| #9 | 29% | A | Customer Loyalty | American Family | |

| #10 | 15% | A++ | Variety Discounts | Travelers |

Explore their offerings to find the best fit for your luxury vehicle. To see fast, free Mercedes-Benz SLK-Class insurance quotes right now, just enter your ZIP code above. We’ll provide you with personal Mercedes-Benz SLK-Class insurance rate from top companies right away.

- Geico offers the best rates and extensive discounts for Mercedes-Benz SLK-Class

- Rates start at approximately $30 per month, making luxury coverage affordable

- Compare quotes to find the ideal insurance plan for your SLK-Class luxury vehicle

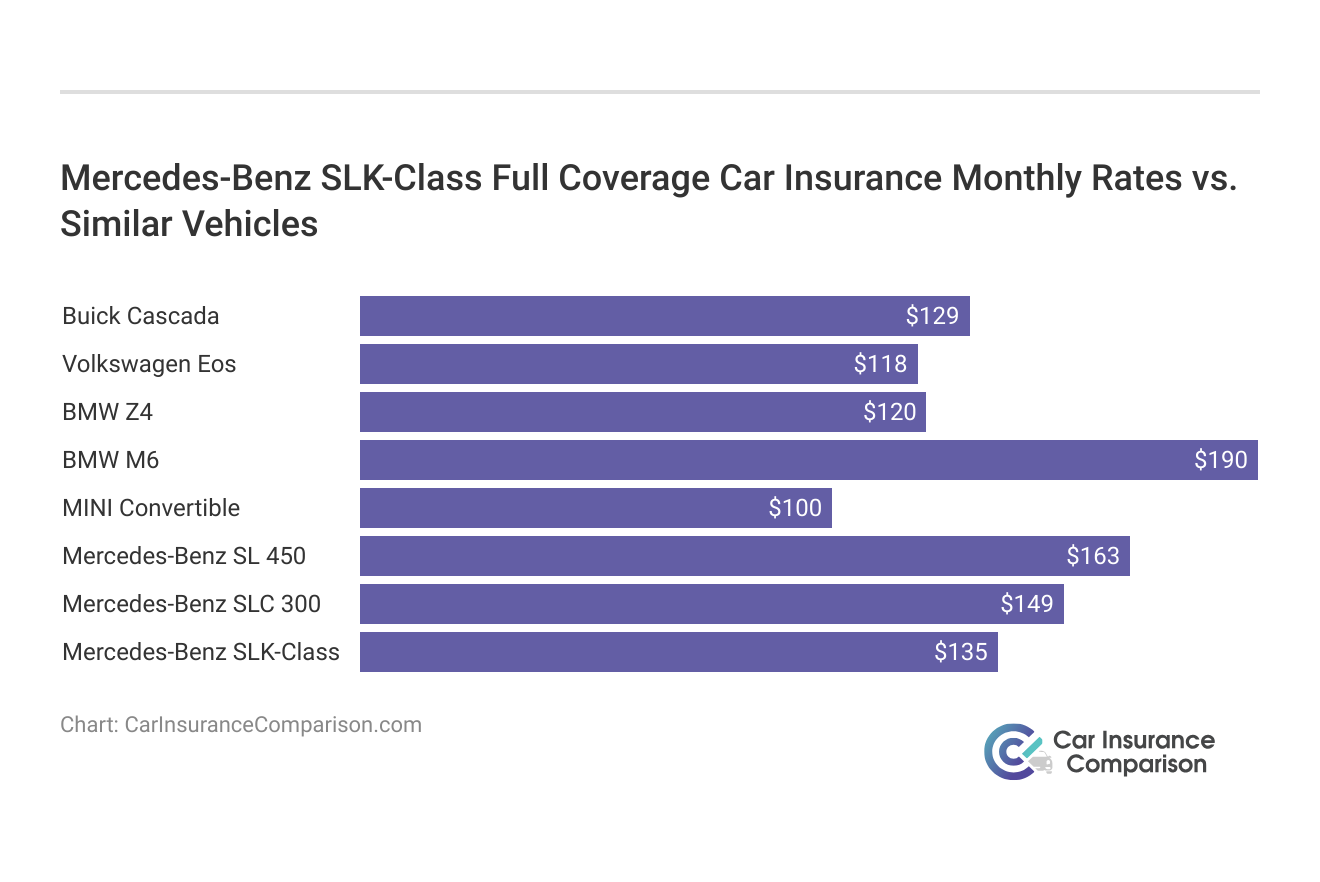

Insuring Vehicles Like the Mercedes-Benz SLK-Class

The Mercedes-Benz SLK-Class is a high-end vehicle, so getting the correct coverage at a reasonable price is essential. The top three companies that provide low rates and all-inclusive coverage for the SLK-Class are highlighted in this article: Progressive, State Farm, and Geico.

Mercedes-Benz SLK-Class Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $45 | $135 |

| American Family | $39 | $126 |

| Farmers | $43 | $132 |

| Geico | $35 | $120 |

| Liberty Mutual | $42 | $128 |

| Nationwide | $48 | $137 |

| Progressive | $38 | $125 |

| State Farm | $40 | $130 |

| Travelers | $46 | $129 |

| USAA | $30 | $110 |

With starting rates as low as $110 per month, you can protect your Mercedes-Benz SLK-Class affordably. This allows you to secure coverage without straining your budget.

Read on to discover the best options for insuring your luxury vehicle and make an informed decision. Discover our comprehensive guide to “Where can I find the lowest car insurance quotes?” for additional insights.

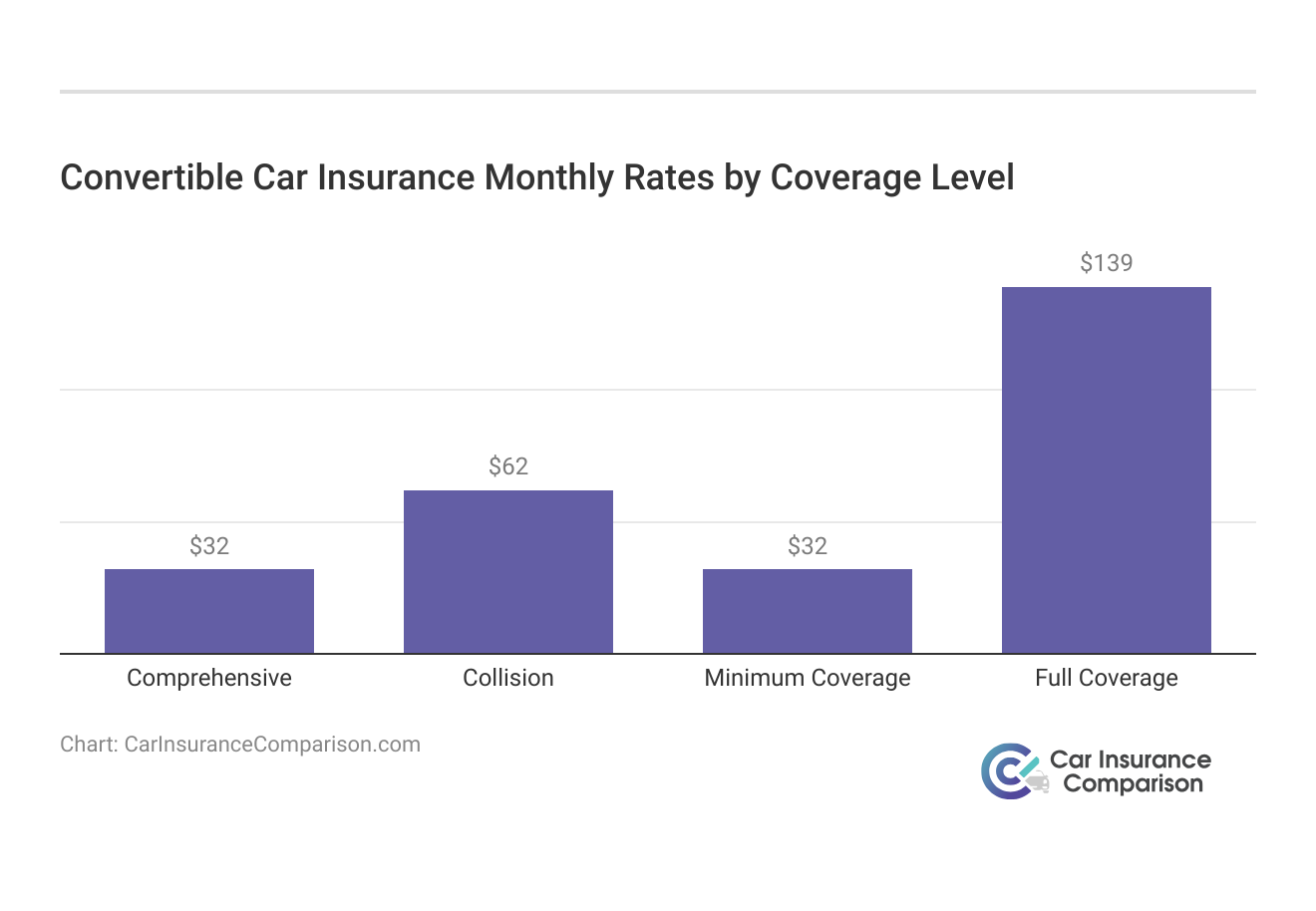

Examine the insurance costs for Mercedes-Benz SLK-Class cars that are comparable to yours. You may get a decent indication of what to expect by looking at the insurance prices for other convertibles, such as the Mercedes-Benz SLC 300, Infiniti G Convertible, and Lexus IS 350 C.

Mercedes-Benz SLK-Class Car Insurance Monthly Rates vs. Other Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Buick Cascada | $28 | $55 | $33 | $129 |

| Volkswagen Eos | $25 | $44 | $36 | $118 |

| Mercedes-Benz SLC 300 | $36 | $67 | $33 | $149 |

| Mercedes-Benz SL 450 | $40 | $77 | $33 | $163 |

| BMW M6 | $43 | $94 | $38 | $190 |

| MINI Convertible | $25 | $45 | $22 | $100 |

| BMW Z4 | $28 | $51 | $30 | $120 |

| Mercedes-Benz SLK-Class | $34 | $65 | $32 | $135 |

Selecting the best insurance for your SLK-Class Mercedes-Benz doesn’t have to be difficult. You may find the ideal solution for your needs with low prices, top-notch customer support, and extensive coverage options from companies like Progressive, State Farm, and Geico. Safeguard your investment and feel at ease knowing that your high-end car is in capable hands.

Factors influencing the cost of Mercedes-Benz SLK-Class insurance

The average annual rate for insuring a Mercedes-Benz SLK-Class serves as a general benchmark. However, your specific insurance rates may vary significantly based on several variables. Get more insights by reading our expert “Factors That Affect Car Insurance Rates” advice.

These variables include the specific trim level of your Mercedes-Benz SLK-Class as well as personal traits like your age, place of residence, driving history, and car’s model year. Consequently, to obtain an accurate estimate of your insurance costs, take into account these particular factors in addition to the average rate, which only serves as a starting point.

Mercedes-Benz SLK-Class Crash Test Ratings

The Mercedes-Benz SLK-Class crash test ratingswill have an affect on Mercedes-Benz SLK-Class car insurance rates. Take a look at crash test results for the Mercedes-Benz SLK-Class.

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Mercedes-Benz SLK-Class C RWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2023 Mercedes-Benz SLK-Class C RWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2022 Mercedes-Benz SLK-Class C RWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2021 Mercedes-Benz SLK-Class C RWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2020 Mercedes-Benz SLK-Class C RWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2019 Mercedes-Benz SLK-Class C RWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2018 Mercedes-Benz SLK-Class C RWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2017 Mercedes-Benz SLK-Class C RWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2016 Mercedes-Benz SLK-Class C RWD | 4 stars | 4 stars | 4 stars | 4 stars |

To sum up, obtaining the most affordable insurance for your Mercedes-Benz SLK-Class necessitates comprehending how variables such as model year, age, residence, driving record, and trim level affect premiums. For your luxury car, you may get the best coverage by comparing quotes from reputable companies like Progressive, State Farm, and Geico.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

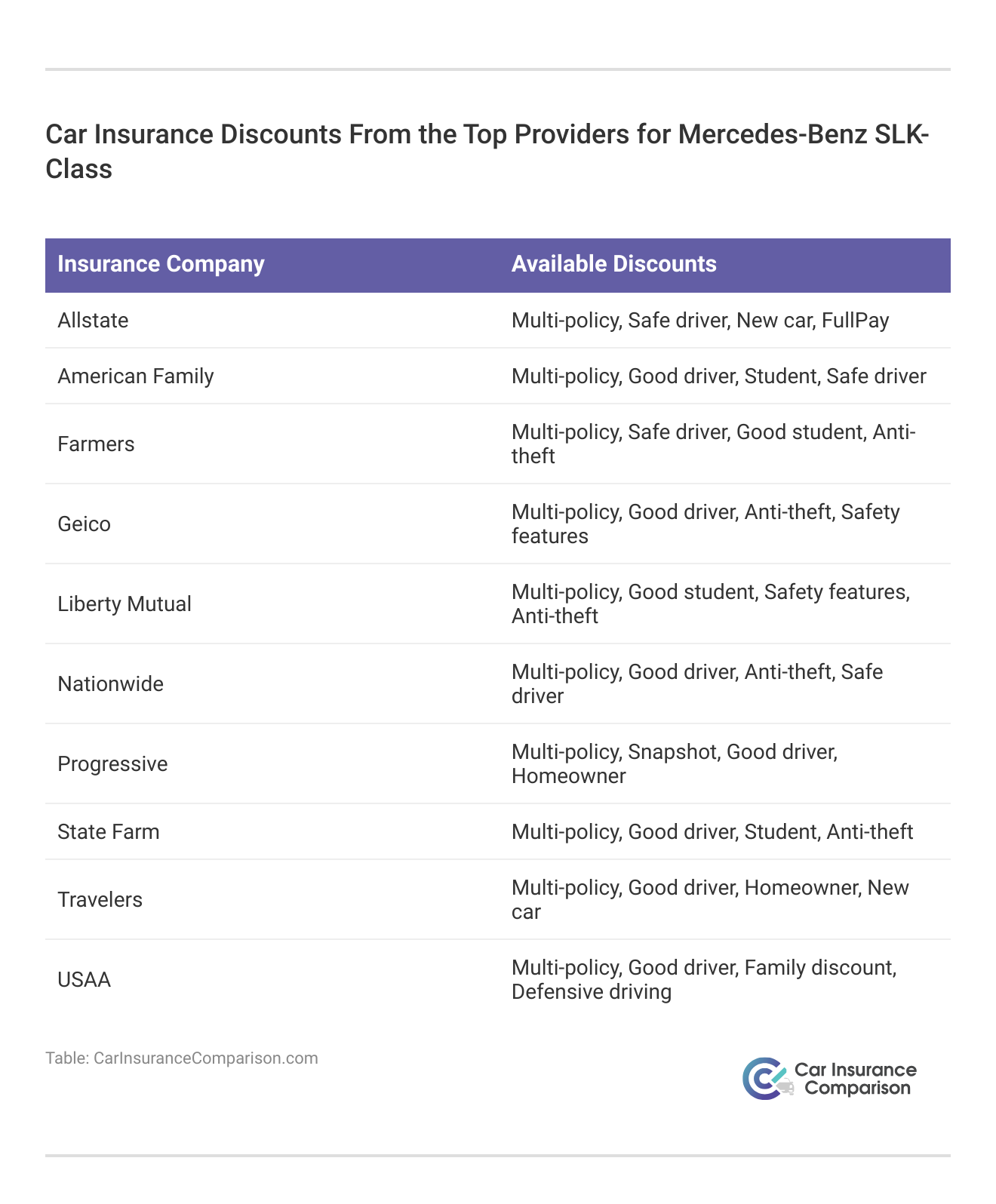

Strategies for Reducing Mercedes-Benz SLK-Class Insurance Costs

When looking for the finest insurance for your Mercedes-Benz SLK-Class, premium companies with competitive prices, like as Progressive, State Farm, and Geico, should be taken into consideration.

Your insurance costs can vary based on several factors including your age, driving history, and the car’s trim level. Understanding these elements will help you find the most affordable and comprehensive coverage for your SLK-Class.

If you want to reduce the cost of your Mercedes-Benz SLK-Class insurance rates, follow these tips below:

- Compare Mercedes-Benz SLK-Class quotes for free online.

- Renew your Mercedes-Benz SLK-Class insurance coverage to avoid lapses.

- Ask about farm and ranch vehicle discounts.

- Use an accurate job title when requesting Mercedes-Benz SLK-Class auto insurance.

- Start searching for new Mercedes-Benz SLK-Class car insurance a month before your renewal.

Finding the right insurance for your Mercedes-Benz SLK-Class doesn’t have to be complicated. By comparing quotes from top providers and considering your personal factors, you can secure a policy that meets your needs and budget.

Stay informed and take proactive steps to ensure you’re getting the best coverage for your luxury vehicle. Learn more by visiting our detailed “How do you get cheaper car insurance quotes?” section.

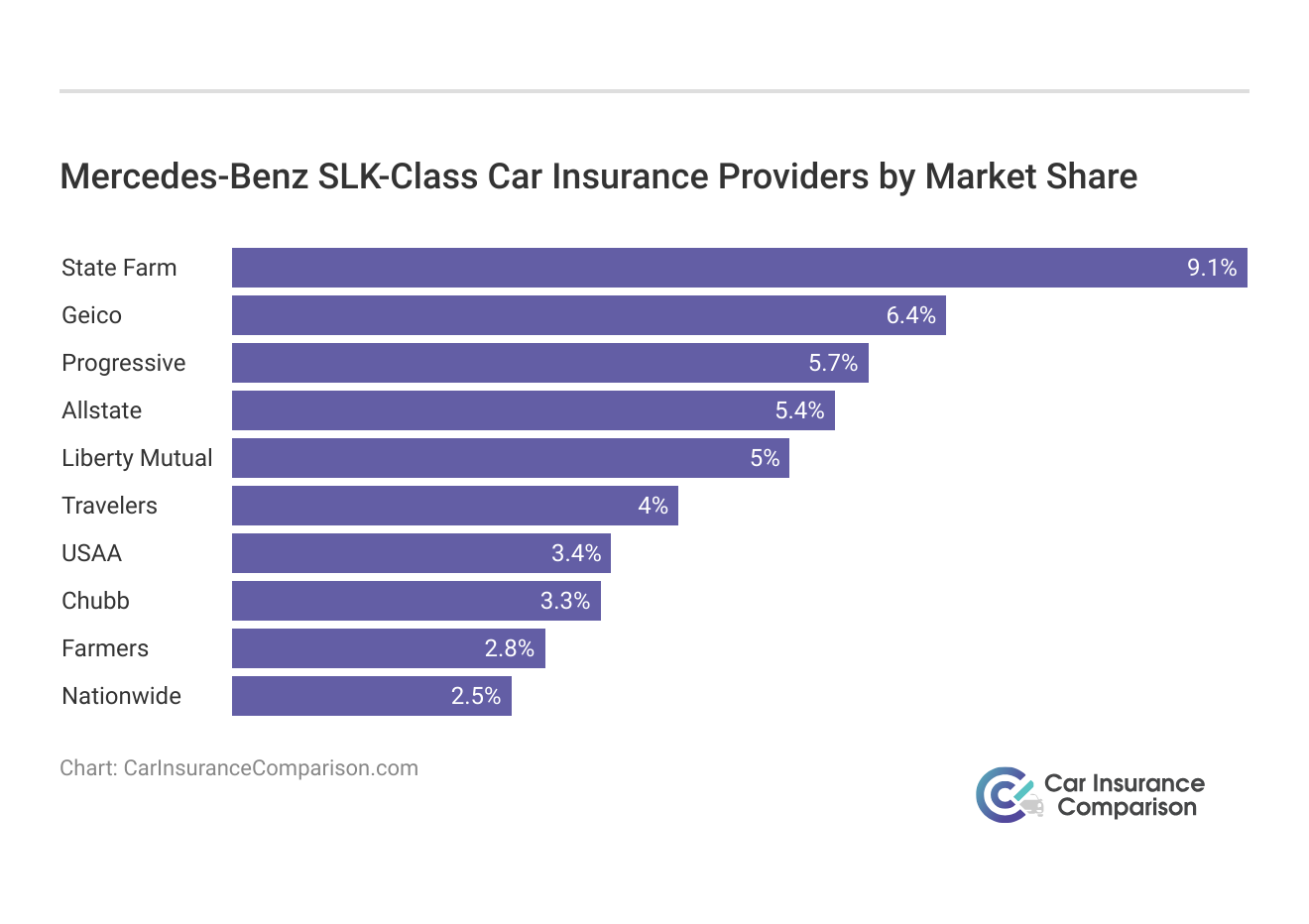

Top Mercedes-Benz SLK-Class Insurance Companies

Find the best insurance providers for the Mercedes-Benz SLK-Class; we feature businesses that have outstanding coverage options and cheap pricing.

This guide helps you choose the best insurer to protect your luxury vehicle efficiently and affordably. For more information, explore our informative “Best Car Insurance Companies” page.

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9.1% |

| #2 | Geico | $46.3 million | 6.4% |

| #3 | Progressive | $41.7 million | 5.7% |

| #4 | Allstate | $39.2 million | 5.4% |

| #5 | Liberty Mutual | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3.4% |

| #8 | Chubb | $24.1 million | 3.3% |

| #9 | Farmers | $20 million | 2.8% |

| #10 | Nationwide | $18.4 million | 2.5% |

Selecting the best insurance provider for your Mercedes-Benz SLK-Class is essential to obtaining the most value and coverage. Examine our top choices to make sure you locate the ideal supplier for your requirements and securely lock up your car.

Comparing Free Mercedes-Benz SLK-Class Insurance Quotes

Looking through and contrasting free insurance quotes online for the Mercedes-Benz SLK-Class is a good approach to get the most affordable premiums and options for coverage that meet your needs. By carefully comparing several quotations from different insurers, you may make an informed choice by learning a lot about the various coverage offerings.

Geico stands out with its competitive rates for Mercedes-Benz SLK-Class insurance, offering value without compromising coverage quality.

Justin Wright Licensed Insurance Agent

Exploring and comparing free insurance quotes for your Mercedes-Benz SLK-Class ensures you get the best value and coverage for your car. Take the time to review your options and secure the most cost-effective policy. Save money by comparing Mercedes-Benz SLK-Class insurance rates with free quotes online now.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is the insurance group for Mercedes-Benz SLK-Class?

The insurance group for the Mercedes-Benz SLK-Class typically ranges from 32 to 50, depending on the specific model and trim.

How does the Mercedes-Benz SLK-Class insurance cost compare to other models?

The insurance cost for the Mercedes-Benz SLK-Class is generally higher than average due to its luxury status and higher repair costs.

Which Mercedes-Benz SLK-Class model is the cheapest to insure?

The Mercedes-Benz SLK 200 is often the cheapest model to insure within the SLK-Class range due to its lower performance specs and insurance group rating.

Explore our detailed analysis on “Compare Car Insurance by Coverage Type” for additional information.

What factors affect Mercedes-Benz SLK-Class insurance rates?

Insurance rates for the Mercedes-Benz SLK-Class are influenced by factors such as the vehicle’s trim level, the driver’s age, location, driving history, and the model year.

Which Mercedes-Benz SLK-Class has the most expensive insurance?

The Mercedes-Benz SLK 55 AMG typically has the most expensive insurance due to its high-performance features and higher insurance group rating.

What is the lowest insurance form for Mercedes-Benz SLK-Class?

The lowest insurance form for the Mercedes-Benz SLK-Class is usually Third-Party Insurance, which provides the minimum coverage required by law.

Get more insights by reading our expert “Compare Liability Car Insurance” advice.

What is the best category of Mercedes-Benz SLK-Class insurance?

The best category of insurance for the Mercedes-Benz SLK-Class is typically Comprehensive Coverage due to its extensive protection and benefits.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What does group level insurance for Mercedes-Benz SLK-Class include?

Group level insurance for the Mercedes-Benz SLK-Class includes various coverage options tailored to the vehicle’s insurance group, such as liability, theft, and damage protection.

What is the best insurance type for Mercedes-Benz SLK-Class?

Comprehensive insurance is often considered the best type for the Mercedes-Benz SLK-Class, as it provides extensive coverage for various types of damage and loss.

Continue reading our full “Compare Comprehensive Car Insurance” guide for extra tips.

How can I find the insurance group name for Mercedes-Benz SLK-Class?

The insurance group name for the Mercedes-Benz SLK-Class can be found through the vehicle’s handbook, insurance provider resources, or by using online insurance group databases.

How can I compare Mercedes-Benz SLK-Class insurance cost effectively?

To compare Mercedes-Benz SLK-Class insurance costs effectively, use comparison websites, obtain multiple quotes from different insurers, and consider factors like coverage levels and discounts.

Where can I get accurate Mercedes-Benz SLK-Class insurance quotes?

Accurate Mercedes-Benz SLK-Class insurance quotes can be obtained from online comparison tools, insurance providers’ websites, or by contacting insurance brokers directly.

For more information, explore our informative “Where can I easily finding quick car insurance quotes?” page.

What are the current Mercedes-Benz SLK-Class insurance rates and discounts?

Current insurance rates and discounts for the Mercedes-Benz SLK-Class vary by insurer, but they often include options for safe driving, bundling policies, and loyalty rewards.

What are the available insurance options for Mercedes-Benz SLK-Class?

Available insurance options for the Mercedes-Benz SLK-Class include Comprehensive, Third-Party Fire and Theft, and Third-Party Only coverage.

What should I know about car insurance for Mercedes-Benz SLK-Class?

When considering car insurance for the Mercedes-Benz SLK-Class, be aware of its higher insurance costs, the importance of comprehensive coverage, and the impact of trim levels and personal factors on rates.

Read our extensive guide on “Understanding Your Car Insurance Policy” for more knowledge.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.