Best Mercedes-Benz GLS 450 Car Insurance in 2025 (Your Guide to the Top 10 Companies)

Liberty Mutual, Geico, and USAA provide the best Mercedes-Benz GLS 450 car insurance, with monthly rates starting as low as $78. These companies stand out for their comprehensive coverage, competitive rates, and excellent customer service, ensuring Mercedes-Benz GLS 450 owners receive top-notch protection.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Aug 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Mercedes-Benz GLS 450

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews

Company Facts

Full Coverage for Mercedes-Benz GLS 450

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Mercedes-Benz GLS 450

A.M. Best Rating

Complaint Level

Pros & Cons

Liberty Mutual, Geico, and USAA are the top providers of the best Mercedes-Benz GLS 450 car insurance. This article compares their coverage options, customer service, and pricing to help you make informed decisions.

Discover how each company meets the unique needs of GLS 450 owners and explore tips for securing affordable insurance rates.

Our Top 10 Company Picks: Best Mercedes-Benz GLS 450 Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A Comprehensive Coverage Liberty Mutual

#2 25% A++ Affordable Rates Geico

#3 10% A++ Military Discounts USAA

#4 20% B Customer Satisfaction State Farm

#5 12% A+ Usage-based Discounts Progressive

#6 8% A++ Hybrid Discounts Travelers

#7 20% A+ Broad Coverage Nationwide

#8 10% A++ Local Agents Auto-Owners

#9 25% A+ AARP Benefits The Hartford

#10 25% A+ Unique Features Allstate

Whether you prioritize cost, coverage, or service, this guide ensures you find the best protection for your luxury SUV. Learn more in our guide titled “Best Full Coverage Car Insurance.”

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code above to begin.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Liberty Mutual: Top Overall Pick

Pros

- Bundling Reduction: Liberty Mutual provides a notable 25% discount for covering multiple vehicles under a single policy, making it a standout option for Mercedes-Benz GLS 450 drivers looking to protect several cars at once. Unlock details in our article called, Liberty Mutual car insurance review.

- Comprehensive Solutions: Liberty Mutual shines when it comes to offering thorough protection plans specifically crafted for luxury SUVs like the Mercedes-Benz GLS 450, ensuring coverage against both common and uncommon incidents.

- Adaptable Coverage Choices for Mercedes-Benz GLS: Liberty Mutual delivers an array of protection levels that can be customized to meet various requirements, from accident to comprehensive coverage, all while allowing for a high degree of personalization.

Cons

- High Premiums: Even with discounts, the cost for securing the Mercedes-Benz GLS 450 with Liberty Mutual can remain elevated, particularly when opting for more extensive protection levels.

- Slower Claims Handling: The claims process at Liberty Mutual, especially for luxury models like the Mercedes-Benz GLS 450, can occasionally be less streamlined than competitors with more refined services for high-end vehicles.

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico’s 25% discount on multi-car policies makes it an economical choice for Mercedes-Benz GLS 450 drivers aiming to cut down on insurance expenses.

- Top-Tier Rating: Backed by an A++ rating from A.M. Best, Geico’s financial strength ensures that Mercedes-Benz GLS 450 policyholders can rely on the company’s stability through various economic conditions.

- Tailored Protection: Geico provides coverage that is both affordable and sufficient for luxury vehicles like the Mercedes-Benz GLS 450, with careful attention to details specific to high-end cars. See more details on our guide titled, Geico car insurance review.

Cons

- Limited Flexibility: Although Geico offers competitive pricing for the Mercedes-Benz GLS 450, the customization options for luxury-specific needs might not be as broad as with other insurers.

- Higher Deductibles: For those seeking lower premiums on the Mercedes-Benz GLS 450, Geico’s policies may come with the trade-off of higher deductibles, which could be less desirable for some.

#3 – USAA: Best for Military Discounts

Pros

- Unique Military Discounts: USAA delivers significant savings for military members, allowing Mercedes-Benz GLS 450 owners in the armed forces community to benefit greatly from lower premiums.

- Exceptional Financial Stability: With an A++ rating from A.M. Best, USAA offers unwavering reliability for Mercedes-Benz GLS 450 owners, ensuring long-term security.

- Service-Focused Coverage: USAA’s offerings for the Mercedes-Benz GLS 450 are crafted with the military lifestyle in mind, providing tailored options such as special deductibles and coverage during deployments. Delve into our evaluation of “USAA Car Insurance Review.”

Cons

- Restricted Eligibility: USAA’s substantial military discounts and tailored policies are available only to current and former service members, leaving non-military Mercedes-Benz GLS 450 owners unable to benefit.

- Narrow Coverage Options: While USAA caters specifically to military members, the range of luxury-specific coverage options for the Mercedes-Benz GLS 450 may not be as extensive as other providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Customer Satisfaction

Pros

- Exceptional Service: State Farm’s top-notch customer service makes it a strong option for Mercedes-Benz GLS 450 owners seeking a personalized and supportive experience with their insurance.

- Policy Bundling Savings: State Farm extends a 20% discount for bundling, offering significant savings for Mercedes-Benz GLS 450 owners covering multiple vehicles.

- Expansive Agent Network: State Farm’s vast network of agents ensures that Mercedes-Benz GLS 450 drivers have easy access to assistance and claims support no matter their location. Discover insights in our guide titled, “State Farm Car Insurance Review.”

Cons

- Weaker Financial Strength: State Farm’s B rating from A.M. Best raises concerns about long-term financial security for Mercedes-Benz GLS 450 owners looking for reliability in their insurance provider.

- Pricey Premiums: Even with available discounts, Mercedes-Benz GLS 450 owners may find State Farm’s premium rates higher compared to other companies offering similar levels of coverage.

#5 – Progressive: Best for Usage-Based Discounts

Pros

- Usage-Based Discounts: Progressive offers discounts based on driving habits, which can be advantageous for Mercedes-Benz GLS 450 owners who drive less.

- A+ A.M. Best Rating: Progressive’s A+ rating indicates strong financial stability and reliability for Mercedes-Benz GLS 450 coverage. More information is available about this provider in our guide titled, Progressive car insurance review.

- Flexible Coverage Options: Progressive provides a variety of coverage options suitable for Mercedes-Benz GLS 450 drivers.

Cons

- Higher Rates for High Usage: Progressive’s rates may be higher for those with extensive driving history for the Mercedes-Benz GLS 450.

- Complex Pricing Structure: Progressive’s pricing structure can be complex, potentially leading to confusion about coverage costs for the Mercedes-Benz GLS 450.

#6 – Travelers: Best for Hybrid Discounts

Pros

- Hybrid Vehicle Discounts: Travelers extends an 8% reduction on multi-car policies, particularly benefiting Mercedes-Benz GLS 450 owners with hybrid or fuel-efficient models.

- Top-Tier Financial Stability: Holding an A++ rating from A.M. Best, Travelers guarantees that your Mercedes-Benz GLS 450 is supported by a robust financial entity.

- Varied Discount Options: Travelers’ hybrid-oriented discounts can be combined with additional savings, offering substantial benefits for those covering multiple vehicles, including the Mercedes-Benz GLS 450. Read up on the “Travelers Car Insurance Review” for more information.

Cons

- Limited Multi-Vehicle Savings: The 8% discount offered by Travelers for multi-car coverage, such as for the Mercedes-Benz GLS 450, may not match the more substantial reductions provided by some rivals.

- Complicated Qualification Requirements: Obtaining the full hybrid-related discounts for your Mercedes-Benz GLS 450 can involve complex eligibility criteria, complicating the process.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Broad Coverage

Pros

- Generous Multi-Car Discount: Nationwide provides a 20% discount for insuring multiple vehicles, greatly benefiting owners of multiple high-end cars like the Mercedes-Benz GLS 450.

- Broad Coverage Options: Nationwide offers a wide array of policy choices specifically designed for the Mercedes-Benz GLS 450, addressing the vehicle’s advanced features.

- A+ Rated Dependability: With an A+ rating from A.M. Best, Nationwide offers reliable financial backing for your Mercedes-Benz GLS 450 insurance needs, ensuring long-term security. Discover more about offerings in our article called, “Nationwide Car Insurance Discounts.”

Cons

- Elevated Premium Costs: Despite the broad coverage, Nationwide’s insurance premiums for high-end vehicles such as the Mercedes-Benz GLS 450 might be higher than anticipated, diminishing some of the discount advantages.

- Fewer Hybrid-Specific Discounts: Although Nationwide provides extensive coverage, their hybrid-specific discounts for a Mercedes-Benz GLS 450 are less pronounced compared to competitors like Travelers.

#8 – Auto-Owners: Best for Local Agents

Pros

- Customized Assistance: Auto-Owners connects Mercedes-Benz GLS 450 drivers with local agents who deliver tailored service suited to the luxury and performance aspects of the vehicle.

- 10% Multi-Car Savings: Auto-Owners offers a 10% reduction on multi-vehicle policies, including for the Mercedes-Benz GLS 450, which can help lower overall insurance expenses. Check out insurance savings in our complete article called, “Auto Owners Car Insurance Review.”

- A++ Rated Reliability: With an A++ rating from A.M. Best, Auto-Owners ensures that your Mercedes-Benz GLS 450 is insured by a highly stable and financially secure provider.

Cons

- Less Competitive Multi-Vehicle Discount: The 10% discount on multi-car coverage, including the Mercedes-Benz GLS 450, is not as competitive as the offers from insurers like Nationwide or The Hartford.

- Limited Digital Resources: While the emphasis on local agents is strong, Auto-Owners’ online tools and resources for managing Mercedes-Benz GLS 450 policies may not be as advanced as those of more tech-forward competitors.

#9 – The Hartford: Best for AARP Benefits

Pros

- AARP Member Savings: The Hartford offers AARP members a substantial 25% discount on multi-vehicle policies, significantly benefiting those insuring a Mercedes-Benz GLS 450. More information is available about this provider in our guide titled, “The Hartford Car Insurance Discounts.”

- Senior-Focused Policies: The Hartford’s insurance plans for Mercedes-Benz GLS 450 owners are designed with features catering specifically to seniors, including options for lifetime renewability.

- A+ Rated Security: With an A+ rating from A.M. Best, The Hartford provides reliable financial protection for your Mercedes-Benz GLS 450.

Cons

- AARP Membership Requirement: The 25% discount for your Mercedes-Benz GLS 450 is available only to AARP members, which limits the offer to those with membership.

- Narrower Focus: The Hartford’s coverage and discounts are heavily tailored to senior drivers, which may not be as appealing to younger Mercedes-Benz GLS 450 owners seeking more comprehensive options.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Unique Features

Pros

- Innovative Coverage Choices: Allstate offers a variety of unique policy features, such as accident forgiveness and safe-driving rewards, specifically designed for high-end vehicles like the Mercedes-Benz GLS 450.

- Significant Multi-Car Discount: Allstate provides a 25% discount for insuring multiple vehicles, including the Mercedes-Benz GLS 450, which maximizes savings for households with several cars.

- A+ Rated Financial Security: Backed by an A+ rating from A.M. Best, Allstate ensures that Mercedes-Benz GLS 450 owners receive coverage from a financially solid and dependable insurer. Learn more in our article called, “Allstate Car Insurance Review.”

Cons

- Higher Premiums: The innovative features offered by Allstate for Mercedes-Benz GLS 450 owners come at a price, with premiums potentially higher than those from other insurers, despite the available discounts.

- Complex Policy Structures: While offering a range of coverage options, Allstate’s policies for the Mercedes-Benz GLS 450 can be intricate, making it challenging for drivers to fully optimize their plans.

Monthly Insurance Rates for Mercedes-Benz GLS 450 by Coverage Level

When choosing car insurance for your Mercedes-Benz GLS 450, comparing monthly rates across different providers is essential to find the best value. The table below highlights the minimum and full coverage monthly rates for various insurance companies, providing a clear picture of costs associated with insuring the Mercedes-Benz GLS 450.

Mercedes-Benz GLS 450 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $120 $275

Auto-Owners $99 $227

Geico $127 $291

Liberty Mutual $145 $318

Nationwide $104 $238

Progressive $78 $211

State Farm $110 $265

The Hartford $115 $252

Travelers $92 $249

USAA $89 $203

For minimum coverage, Progressive offers the lowest rate at $78 per month, followed by USAA at $89 and Auto-Owners at $99. If you’re looking for full coverage, Progressive again presents the most affordable option at $211 per month, with USAA close behind at $203 and Auto-Owners at $227.

Liberty Mutual and Geico, on the other hand, tend to have higher rates for both minimum and full coverage, with Liberty Mutual at $145 and $318 respectively, and Geico at $127 and $291.

This comparison helps you identify which provider offers the best rates for the level of coverage you need. Unlock details in our article called, “Do I Need the Additional Car Insurance Coverage Options?”

Liberty Mutual offers top-notch coverage for the Mercedes-Benz GLS 450, with full coverage rates starting at $318 per month.

Michelle Robbins Licensed Insurance Agent

You should take advantage of this thorough guide to help you uncover Mercedes-Benz GLS 450 rates that work for you. You can start comparing quotes for Mercedes-Benz GLS 450 car insurance rates from some of the best car insurance companies by using our free online tool now.

Mercedes-Benz GLS 450 Insurance Cost

The average Mercedes-Benz GLS 450 car insurance costs is $159 a month.

Mercedes-Benz GLS 450 Car Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $159 |

| Discount Rate | $93 |

| High Deductibles | $137 |

| High Risk Driver | $339 |

| Low Deductibles | $200 |

| Teen Driver | $581 |

Discover more about offerings in our article called, “Minimum Car Insurance Requirements by State.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Are Mercedes-Benz GLS 450s Expensive to Insure

The chart below details how Mercedes-Benz GLS 450 insurance rates compare to other SUVs like the Toyota 4Runner, Mercedes-Benz GLC 300, and Buick Enclave.

Mercedes-Benz GLS 450 Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Mercedes-Benz GLS 450 | $38 | $75 | $33 | $159 |

| Toyota 4Runner | $28 | $43 | $28 | $109 |

| Mercedes-Benz GLC 300 | $34 | $68 | $33 | $148 |

| Buick Enclave | $29 | $50 | $31 | $123 |

| Kia Telluride | $31 | $57 | $26 | $126 |

| Cadillac XT5 | $31 | $60 | $31 | $135 |

| Kia Sorento | $27 | $47 | $31 | $118 |

However, there are a few things you can do to find the cheapest Mercedes-Benz insurance rates online. If you want to learn more about the company, head to our article called, “How Do You Get Competitive Quotes for Car Insurance?”

Mercedes-Benz GLS 450 Finance and Insurance Cost

If you are financing a Mercedes-Benz GLS 450, you will pay more if you purchase Mercedes-Benz GLS 450 auto insurance at the dealership, so be sure to shop around and compare Mercedes-Benz GLS 450 auto insurance quotes from the best companies using our FREE tool below. Access comprehensive insights into our article called, “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

What Impacts the Cost of Mercedes-Benz GLS 450 Insurance

The Mercedes-Benz GLS 450 trim and model you choose can impact the total price you will pay for Mercedes-Benz GLS 450 auto insurance coverage. Discover more about offerings in our article called “Factors That Affect Car Insurance Rates.”

Age of the Vehicle

Older Mercedes-Benz GLS 450 models generally cost less to insure. For example, car insurance rates for a 2018 Mercedes-Benz GLS 450 are $159, while 2017 Mercedes-Benz GLS 450 rates are $157, a difference of $2.

Mercedes-Benz GLS 450 Car Insurance Monthly Rates by Model Year & Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Mercedes-Benz GLS 450 | $42 | $80 | $36 | $172 |

| 2023 Mercedes-Benz GLS 450 | $41 | $79 | $36 | $170 |

| 2022 Mercedes-Benz GLS 450 | $40 | $78 | $35 | $168 |

| 2021 Mercedes-Benz GLS 450 | $39 | $78 | $35 | $167 |

| 2020 Mercedes-Benz GLS 450 | $39 | $77 | $35 | $165 |

| 2019 Mercedes-Benz GLS 450 | $38 | $76 | $34 | $163 |

| 2018 Mercedes-Benz GLS 450 | $38 | $75 | $33 | $159 |

| 2017 Mercedes-Benz GLS 450 | $37 | $73 | $35 | $157 |

This insight helps car owners make informed decisions about purchasing or maintaining their vehicles, balancing the potential savings in insurance costs with other factors like maintenance and vehicle depreciation.

Driver Age

Driver age can have a significant effect on Mercedes-Benz GLS 450 car insurance rates. As an example, a 30-year-old driver pays around $84 more each year for their Mercedes-Benz GLS 450 car insurance than a 40-year-old driver.

Mercedes-Benz GLS 450 Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $654 |

| Age: 18 | $581 |

| Age: 20 | $360 |

| Age: 30 | $166 |

| Age: 40 | $155 |

| Age: 45 | $152 |

| Age: 50 | $145 |

| Age: 60 | $142 |

Driver Location

Where you live can have a large impact on Mercedes-Benz GLS 450 insurance rates. For example, drivers in Houston may pay $117 a month more than drivers in Columbus.

Mercedes-Benz GLS 450 Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $272 |

| New York, NY | $251 |

| Houston, TX | $249 |

| Jacksonville, FL | $231 |

| Philadelphia, PA | $213 |

| Chicago, IL | $210 |

| Phoenix, AZ | $184 |

| Seattle, WA | $154 |

| Indianapolis, IN | $135 |

| Columbus, OH | $132 |

Recognizing the impact of your location on Mercedes-Benz GLS 450 insurance rates is essential for effective budgeting and financial planning. This understanding allows drivers to make better decisions about relocating or selecting their insurance provider, helping them manage and potentially reduce their insurance expenses.

Your Driving Record

Your driving record can have an impact on your Mercedes-Benz GLS 450 car insurance rates.

Mercedes-Benz GLS 450 Car Insurance Monthly Rates by Age & Driving Record

| City | Rates |

|---|---|

| Los Angeles, CA | $272 |

| New York, NY | $251 |

| Houston, TX | $249 |

| Jacksonville, FL | $231 |

| Philadelphia, PA | $213 |

| Chicago, IL | $210 |

| Phoenix, AZ | $184 |

| Seattle, WA | $154 |

| Indianapolis, IN | $135 |

| Columbus, OH | $132 |

Teens and drivers in their 20’s see the highest jump in their Mercedes-Benz GLS 450 car insurance with violations on their driving record.

Mercedes-Benz GLS 450 Safety Features

The more safety features you have on your Mercedes-Benz GLS 450, the more likely it is that you can earn a discount. The Mercedes-Benz GLS 450’s safety features include:

- Surround View Back-Up Camera

- ESP w/Crosswind Assist Electronic Stability Control (ESC) And Roll Stability Control (RSC)

- ABS And Driveline Traction Control

- Side Impact Beams

- Dual Stage Driver And Passenger Seat-Mounted Side Airbags

With the numerous safety features on the Mercedes-Benz GLS 450, you’re more likely to qualify for insurance discounts, enhancing both protection and savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Top Mercedes-Benz GLS 450 Insurance Companies

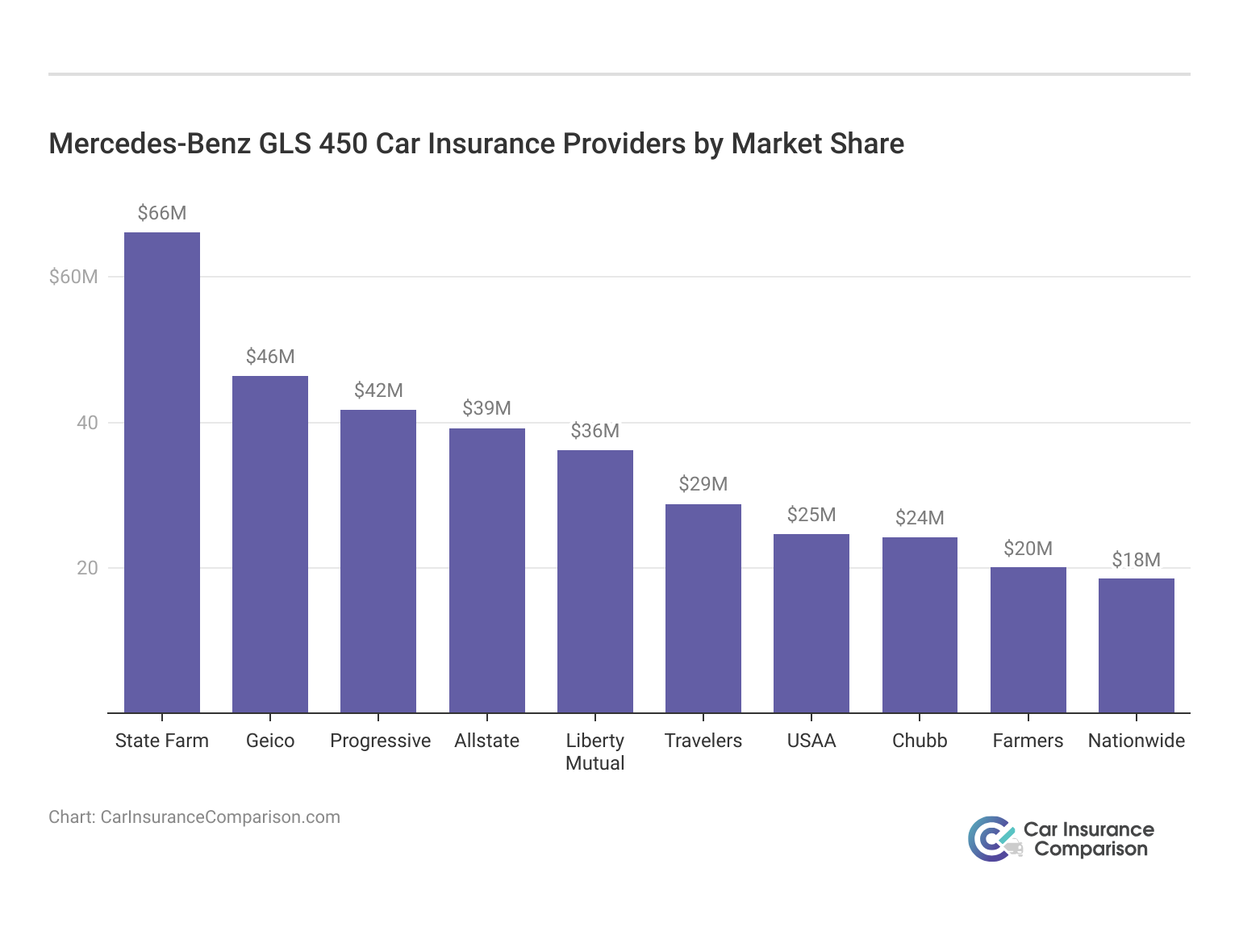

Which auto insurance company offers the best rates for Mercedes-Benz GLS 450 insurance? While the exact amount you’ll pay for coverage varies based on a variety of personal factors such as your driving record, location, age, and more, we’ve compiled a list of top insurance companies that provide coverage for Mercedes-Benz GLS 450 owners.

These companies are ranked by their market share and have a reputation for offering competitive rates and quality service to their customers. Choosing from these options can help you find the right insurance provider for your needs.

Mercedes-Benz GLS 450 Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

If you want to learn more about the company, head to our article called, “Safety Features Car Insurance Discounts.” Many of these companies offer discounts for security systems and other safety features that the Mercedes-Benz GLS 450 offers.

Methods to Reduce Mercedes-Benz GLS 450 Insurance Costs

You have more options at your disposal to save money on your Mercedes-Benz GLS 450 car insurance costs. For example, try these five tips:

- Apply for your full, unrestricted license as soon as you’re eligible.

- Ask about loyalty discounts.

- Start searching for new Mercedes-Benz GLS 450 car insurance a month before your renewal.

- Make sure you’re raising a safe driver.

- Consider using a platform like turo to lease your Mercedes-Benz GLS 450 to others.

Read more: Turo Car Insurance Review

By implementing these five tips, you can effectively lower your Mercedes-Benz GLS 450 car insurance costs. Discover insights in our guide titled, “Calculating Car Insurance Cost.”

Distinguish Free Online Insurance Estimates for Mercedes-Benz GLS 450

Comparing free Mercedes-Benz GLS 450 insurance quotes online allows you to find the best coverage options and rates tailored to your needs. Discover insights in our article called, “Is It Cheaper to Purchase Car Insurance Online?”

By evaluating multiple providers, you can ensure you’re getting the most competitive pricing and comprehensive protection for your luxury SUV. Start your search today to secure the optimal insurance plan for your Mercedes-Benz GLS 450.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How can I compare car insurance rates for a Mercedes-Benz GLS 450?

To compare car insurance rates for a Mercedes-Benz GLS 450, gather details about your model, driving history, and insurance needs. Research reputable insurers, request quotes, and review coverage options and costs. Finally, choose the policy that offers the best coverage and price for your budget.

For additional details, explore our comprehensive resource titled “Do all car insurance companies check your driving records?”

Are car insurance rates the same for all Mercedes-Benz GLS 450 models?

No, car insurance rates can vary depending on the specific model and trim level of your Mercedes-Benz GLS 450. Factors such as the value of the car, repair costs, safety features, and historical claims data for that model can influence insurance rates. Generally, higher-priced and higher-performance versions of the GLS 450 may have higher insurance premiums.

What factors can affect car insurance rates for a Mercedes-Benz GLS 450?

Several factors can influence car insurance rates for a Mercedes-Benz GLS 450, including the model and trim level, vehicle value and repair costs, safety features, anti-theft devices, driving record, claims history, driver’s age and gender, location, coverage limits, deductibles chosen, and annual mileage.

Can I save money on car insurance for a Mercedes-Benz GLS 450?

Yes, to save money on Mercedes-Benz GLS 450 car insurance, compare quotes from insurers specializing in luxury cars, bundle with other policies, maintain a good driving record, install anti-theft devices, inquire about luxury vehicle discounts, and regularly review your coverage needs.

Are there any specific insurance considerations for insuring a Mercedes-Benz GLS 450?

Yes, insuring a Mercedes-Benz GLS 450 involves specific considerations. Choose comprehensive and collision coverage to protect its high value. Ensure adequate liability coverage against potential lawsuits. Consider specialized options like OEM parts or new car replacement coverage. Notify your insurer about any modifications or aftermarket additions, as they may affect coverage.

To find out more, explore our guide titled “Best Car Insurance for Modified Cars.”

What factors affect Mercedes-Benz GLS car insurance rates?

The factors affecting Mercedes-Benz GLS car insurance rates include your driving history, the vehicle’s age, coverage options, and location.

How can I find the best Mercedes-Benz GLS car insurance?

To find the best Mercedes-Benz GLS car insurance, compare quotes from multiple providers, consider coverage options, and look for discounts tailored to your needs.

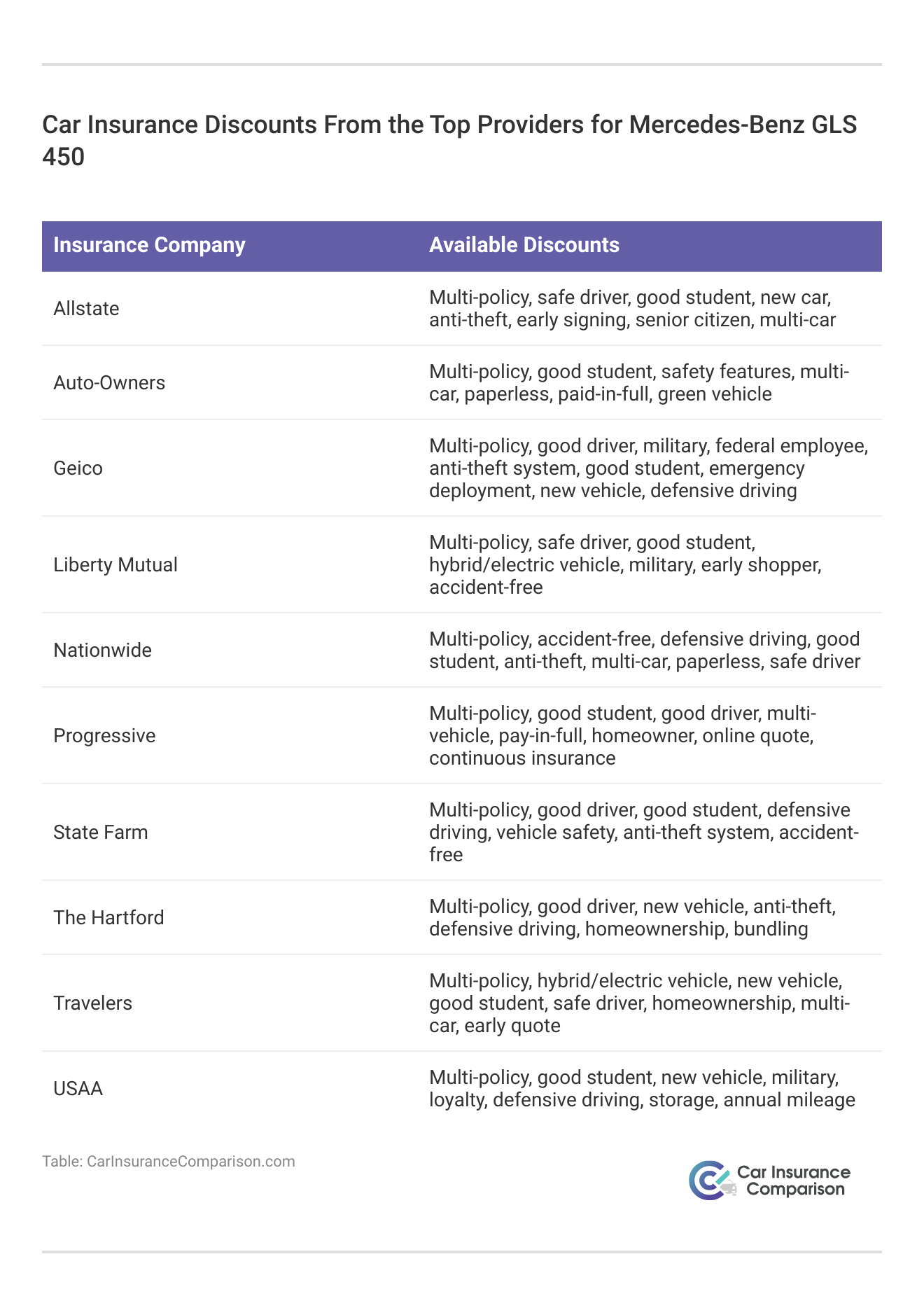

Are there specific discounts available for Mercedes-Benz GLS car insurance?

Yes, you can often find specific discounts for Mercedes-Benz GLS car insurance, such as multi-policy discounts, safe driver discounts, and loyalty discounts.

What is the average cost of Mercedes-Benz GLS car insurance?

The average cost of Mercedes-Benz GLS car insurance varies depending on factors like coverage level and provider but typically ranges between $78 for minimum coverage and $318 for full coverage.

To learn more, explore our comprehensive resource on “Car Insurance Coverage.”

Does owning a Mercedes-Benz GLS affect my car insurance premiums?

Yes, owning a Mercedes-Benz GLS can affect your car insurance premiums due to factors like the vehicle’s value, repair costs, and safety features.

Is insurance higher for Mercedes-Benz GLS 450?

Yes, insurance for a Mercedes-Benz GLS 450 tends to be higher due to its luxury classification and higher repair costs. Rates are influenced by factors such as the model year, trim, and the driver’s profile.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

What is the cheapest insurance for Mercedes-Benz GLS 450?

The cheapest insurance options for a Mercedes-Benz GLS 450 generally come from providers like USAA and Geico, known for competitive rates and discounts for luxury vehicles.

How much should I expect to pay for insurance on a Mercedes-Benz GLS 450?

Insurance rates for a Mercedes-Benz GLS 450 vary by provider, but typical costs can range from $203 to $318 per month depending on coverage level and insurer.

Learn more by reading our guide titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

Do you need special insurance for Mercedes-Benz GLS 450?

Yes, given its luxury status, the Mercedes-Benz GLS 450 often requires specialized insurance coverage that includes higher limits and comprehensive protection.

What factors impact insurance rates for a Mercedes-Benz GLS 450?

Insurance rates for a Mercedes-Benz GLS 450 are influenced by factors such as the driver’s history, the vehicle’s model and features, location, and coverage options selected.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.