Best Mercedes-Benz E-Class Car Insurance in 2025 (Your Guide to the Top 10 Companies)

The best Mercedes-Benz E-Class car insurance providers are State Farm, AAA, and USAA, offering the most competitive rates starting at just $40 monthly. These providers are distinguished by their excellent coverage options and commitment to affordable solutions specifically for Mercedes-Benz E-Class owners.

Read more

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Mercedes-Benz E-Class

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Mercedes-Benz E-Class

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Mercedes-Benz E-Class

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best Mercedes-Benz E-Class car insurance are State Farm, AAA, and USAA, known for their comprehensive coverage and customer satisfaction.

These companies excel in offering tailored policies that cater specifically to the needs of Mercedes-Benz E-Class owners, ensuring optimal protection and value. See more details in our guide titled, “Cheap Car Insurance.”

Our Top 10 Company Picks: Best Mercedes-Benz E-Class Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 11% B Many Discounts State Farm

#2 15% A Online App AAA

#3 12% A++ Military Savings USAA

#4 10% A Local Agents Farmers

#5 14% A+ Usage Discount Nationwide

#6 13% A+ Add-on Coverages Allstate

#7 9% A+ 24/7 Support Erie

#8 16% A+ Innovative Programs Progressive

#9 18% A Customizable Polices Liberty Mutual

#10 17% A++ Custom Plan Geico

By prioritizing safety features and the unique requirements of this luxury vehicle, they provide policies that enhance the driving experience while ensuring substantial coverage. When searching for premium insurance for the Mercedes-Benz E-Class, consider these providers offer a blend of affordability and quality that stands out in the market.

Read on to learn all about Mercedes-Benz E-Class auto insurance rates and then enter your ZIP code above for a free car insurance comparison.

- State Farm leads as the top pick for Mercedes-Benz E-Class insurance

- Tailored coverage meets the specific safety features of the E-Class

- Policies focus on the luxury and performance aspects of the E-Class

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Package Savings: State Farm offers substantial reductions when you combine multiple insurance plans for your Mercedes-Benz E-Class, maximizing your savings. Learn more by reading our guide titled, “State Farm Car Insurance Review.”

- Mileage-Based Reductions: State Farm provides significant price cuts for low-mileage drivers, making it an excellent choice for those who use their Mercedes-Benz E-Class sparingly.

- Diverse Policy Options: State Farm delivers a broad spectrum of coverage plans tailored specifically for the varied requirements of Mercedes-Benz E-Class owners.

Cons

- Moderate Bundling Discount: While beneficial, State Farm’s bundling discount for Mercedes-Benz E-Class coverage may not be as competitive as some other providers.

- Premium Rates: Even with available discounts, the cost of State Farm’s premiums for Mercedes-Benz E-Class insurance might be higher than similar options from other insurers.

#2 – AAA: Best for Online App

Pros

- Online Convenience: AAA excels in offering a user-friendly digital platform for managing your Mercedes-Benz E-Class insurance, streamlining everything from quotes to payments.

- Loyalty Incentives: AAA provides generous loyalty benefits, allowing Mercedes-Benz E-Class owners to reduce their premium costs over time. Delve into our evaluation of AAA car insurance review.

- Superior Customer Support: With an A.M. Best A rating, AAA ensures reliable support and claims processing for Mercedes-Benz E-Class policyholders.

Cons

- Digital Dependence: Although convenient, AAA’s emphasis on digital solutions may not appeal to every Mercedes-Benz E-Class owner, especially those who prefer face-to-face interactions.

- Restricted Coverage Variety: AAA’s selection of policies for Mercedes-Benz E-Class owners may be more limited than those offered by insurers with broader options.

#3 – USAA: Best for Military Savings

Pros

- Exclusive Military Discounts: USAA offers specialized savings for active military personnel and veterans, providing tailored Mercedes-Benz E-Class insurance plans with added benefits.

- Outstanding Service: Mercedes-Benz E-Class owners benefit from USAA’s top-tier customer service, which consistently receives high ratings. Discover insights in our guide titled, “USAA Car Insurance Review.”

- Extensive Coverage Choices: USAA offers a comprehensive range of policies, ensuring that Mercedes-Benz E-Class owners can find a plan that meets their specific needs.

Cons

- Membership Limitations: USAA’s insurance options for Mercedes-Benz E-Class vehicles are restricted to military members and their families, excluding the general public.

- Potentially High Premiums: Despite offering discounts, USAA’s premiums might still be on the higher side for Mercedes-Benz E-Class owners without military connections.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Farmers: Best for Local Agents

Pros

- Custom Service: Farmers provides Mercedes-Benz E-Class owners with the benefit of local agents who offer personalized advice and support tailored to their specific requirements.

- Comprehensive Discount Options: Farmers offers a variety of discounts, including multi-policy savings, that can significantly lower the cost of insuring a Mercedes-Benz E-Class.

- Strong Coverage Plans: Farmers presents an extensive selection of coverage options, allowing Mercedes-Benz E-Class owners to choose policies that provide robust protection. Access comprehensive insights into our guide titled, “Farmers Car Insurance Review.”

Cons

- Higher Minimum Costs: Farmers’ starting premium rates for Mercedes-Benz E-Class insurance may be higher than those offered by other insurers for similar coverage levels.

- Geographic Limitations: The availability of Farmers’ agents and specific policies for Mercedes-Benz E-Class owners may vary by region, potentially restricting access.

#5 – Nationwide: Best for Usage Discount

Pros

- SmartRide Initiative: Nationwide’s usage-based SmartRide program rewards Mercedes-Benz E-Class owners with discounts based on safe driving habits, with incentives linked to actual driving patterns.

- Broad Discount Spectrum: Nationwide offers an extensive range of discounts, including substantial savings for insuring multiple Mercedes-Benz E-Class vehicles under one policy.

- Strong Financial Stability: With an A+ rating from A.M. Best, Nationwide provides dependable coverage and claims handling for Mercedes-Benz E-Class insurance. Discover more about offerings in our complete Nationwide car insurance discounts.

Cons

- Technology-Dependent Savings: The reliance on telematics to qualify for discounts might not be appealing to all Mercedes-Benz E-Class owners, particularly those wary of tracking technology.

- Limited In-Person Support: Compared to insurers with more widespread agents, Nationwide may offer less face-to-face assistance for Mercedes-Benz E-Class insurance.

#6 – Allstate: Best for Add-on Coverages

Pros

- Combined Benefits: Allstate provides substantial savings opportunities when combining multiple insurance policies, helping Mercedes-Benz E-Class owners enhance their coverage without breaking the bank.

- Enhanced Protection: Owners of the Mercedes-Benz E-Class can take advantage of Allstate’s specialized supplemental coverages, such as accident forgiveness and replacement for new vehicles. Learn more in our complete Allstate car insurance review.

- Tailored Solutions: Allstate’s supplementary features empower Mercedes-Benz E-Class drivers to personalize their insurance plans to fit specific requirements, all backed by an A+ rating from A.M. Best.

Cons

- Elevated Premiums: Despite offering supplemental coverages, Allstate’s insurance rates for the Mercedes-Benz E-Class may remain higher than those of some competitors, particularly for comprehensive coverage.

- Restricted Discounts: Although Allstate presents a variety of discounts, Mercedes-Benz E-Class drivers might find these savings less competitive when compared to other insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Erie: Best for 24/7 Support

Pros

- All-Hours Support: Erie excels with its around-the-clock customer service, ensuring that Mercedes-Benz E-Class owners can receive assistance whenever they require it. More information about this provider is available in our “Erie Car Insurance Review.”

- Customized Service: Erie’s attentive customer support is ideal for Mercedes-Benz E-Class drivers who prefer a more personalized interaction, and this is reinforced by their A+ rating.

- Adaptable Policies: Erie offers flexible policy customization, allowing Mercedes-Benz E-Class owners to modify their insurance plans to suit their unique needs, including rare discounts for advanced safety technology.

Cons

- Geographic Constraints: Erie’s insurance options are somewhat limited by region, which could pose challenges for Mercedes-Benz E-Class owners who frequently travel or plan to relocate.

- Fewer Discounts: While Erie does offer some discounts, Mercedes-Benz E-Class drivers may discover fewer opportunities for savings compared to larger insurance providers.

#8 – Progressive: Best for Innovative Programs

Pros

- Snapshot Initiative: Mercedes-Benz E-Class drivers can benefit from Progressive’s Snapshot program, which rewards careful driving with considerable savings. See more details in our guide titled, “Progressive Car Insurance Review.”

- Varied Discounts: Progressive offers a broad range of discounts, including those that specifically benefit Mercedes-Benz E-Class owners, such as discounts for insuring multiple vehicles or policies.

- Customizable Coverage: Progressive’s innovative approach enables Mercedes-Benz E-Class drivers to design an insurance plan that aligns with their unique driving patterns, supported by an A+ rating from A.M. Best.

Cons

- Inconsistent Pricing: Progressive’s insurance rates for the Mercedes-Benz E-Class can vary significantly depending on the chosen coverage options, potentially leading to higher costs.

- Complex Claims Process: Some Mercedes-Benz E-Class owners might find Progressive’s claims process to be less intuitive, which could result in processing delays.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Flexible Policies: Liberty Mutual is excellent at providing personalized policies that allow Mercedes-Benz E-Class owners to adjust their coverage to meet their specific needs. Read up on the Liberty Mutual car insurance review for more information.

- Exclusive Discounts: Mercedes-Benz E-Class drivers can take advantage of Liberty Mutual’s exclusive discounts, such as savings for vehicles with advanced safety features and for maintaining a clean driving record.

- Replacement Cost Coverage: Liberty Mutual stands out by offering new car replacement coverage, which ensures Mercedes-Benz E-Class owners receive a comparable model if their vehicle is totaled.

Cons

- Higher Insurance Costs: Liberty Mutual’s personalized policies may come at a higher price for Mercedes-Benz E-Class owners, particularly when adding specific coverages.

- Limited Availability: Liberty Mutual’s most desirable discounts and features might not be accessible in all areas, affecting some Mercedes-Benz E-Class drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Geico: Best for Custom Plan

Pros

- Cost-Effective Customization: Geico offers cost-effective options for Mercedes-Benz E-Class drivers who want to tailor their insurance policies without exceeding their budget, boasting an A++ rating from A.M. Best.

- Military Benefits: Mercedes-Benz E-Class owners with military connections can take advantage of Geico’s significant discounts, including special rates and benefits.

- Multi-Vehicle Discounts: Geico provides attractive savings for Mercedes-Benz E-Class owners insuring more than one vehicle, making it a top choice for families. Check out insurance savings in our guide titled, “Geico Car Insurance Review.”

Cons

- Online-First Service: Mercedes-Benz E-Class owners who favor face-to-face service might find Geico’s digital-first approach lacking.

- Repair Network Restrictions: Geico’s repair network might not always include preferred facilities for Mercedes-Benz E-Class repairs, which could lead to inconvenience.

Mercedes-Benz E-Class Coverage Comparison

Understanding the monthly rates for Mercedes-Benz E-Class car insurance across various providers and coverage levels is crucial for making an informed decision. Below, we present a comprehensive breakdown of both minimum and full coverage options.

Mercedes-Benz E-Class Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $60 $188

Allstate $62 $186

Erie $67 $205

Farmers $40 $137

Geico $58 $180

Liberty Mutual $74 $231

Nationwide $71 $209

Progressive $88 $255

State Farm $53 $148

USAA $72 $233

The table illustrates that Farmers offers the most competitive rate for minimum coverage at $40 per month, making it an attractive option for budget-conscious E-Class owners.

On the other hand, Progressive demands the highest premium for full coverage at $255 per month, reflecting its extensive protection. State Farm emerges as a balanced choice with its $53 monthly rate for minimum coverage and $148 for full coverage, offering a mix of affordability and comprehensive benefits.

This detailed comparison allows Mercedes-Benz E-Class owners to align their insurance choices with their coverage needs and budget preferences. See more details in our guide titled, “Compare Collision Car Insurance: Rates, Discounts, & Requirements.”

Key Safety Features of the Mercedes-Benz E-Class

The Mercedes-Benz E-Class is equipped with cutting-edge safety features designed to protect its occupants and enhance driving security. These advancements include a range of technologies aimed at preventing accidents and minimizing their impact.

- Drowsiness detection technology to assist with driver attention.

- A pre-safe system that prepares the car for potential crashes.

- Automatic headlamp adjustment for better night vision.

- Lane-keeping cameras to monitor weaving.

- Front, side, and curtain air bags for safety.

All of these safety features combine to make the Mercedes-Benz E-Class one of the safest vehicles on the market today.

Car insurance companies look very favorably on cars that have above-average safety features and generally give a lower rate proportional to the overall cost of the vehicle.

To be sure that you actual get credited for these features you will have to make certain that you know all of the features and you mention them to the insurance agent when you are getting your quote.

Each provider will lower your rate differently for each of these features, which is why you must look around and get quotes from as many providers as possible.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

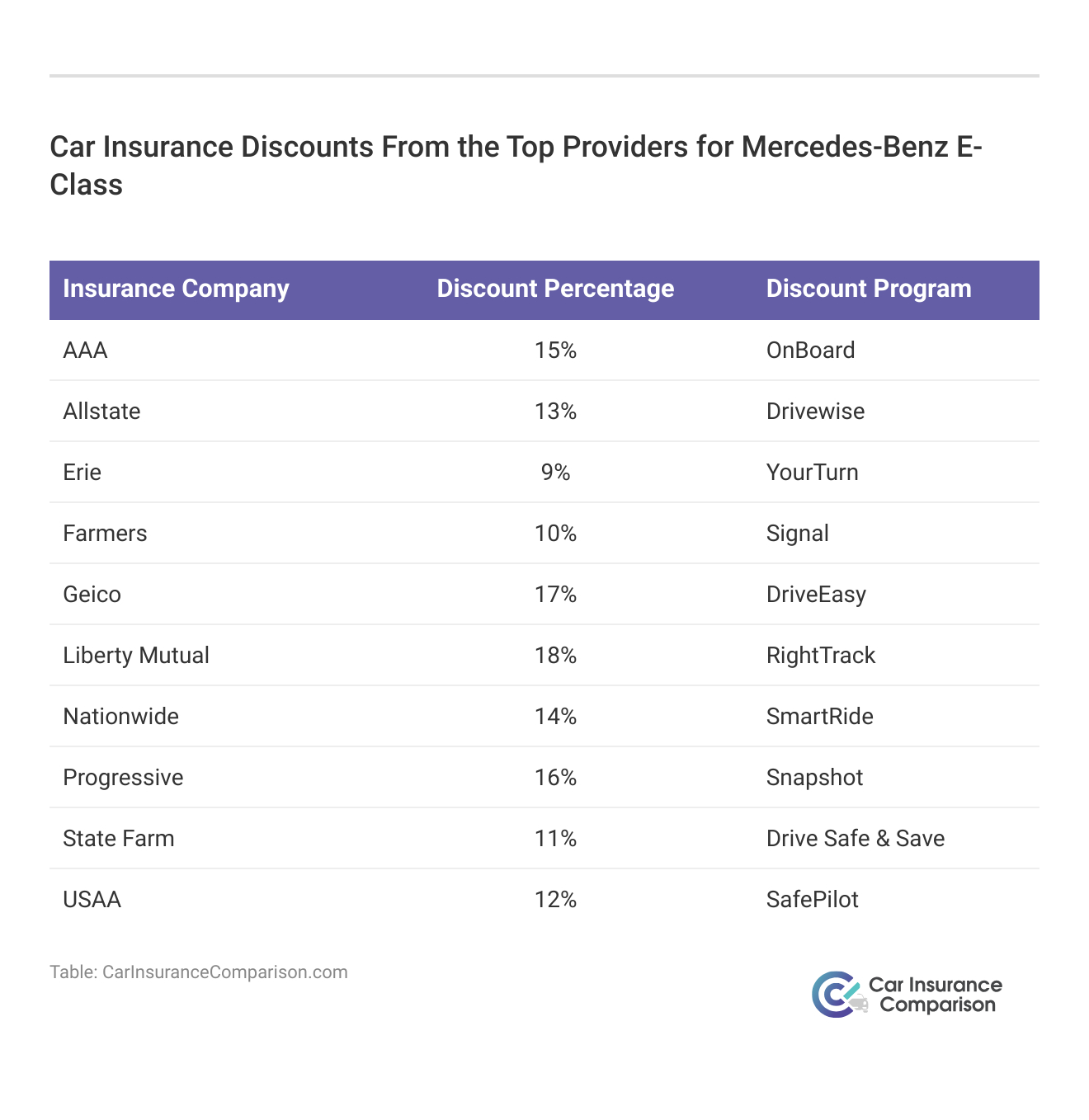

Effective Ways to Reduce Mercedes-Benz E-Class Insurance Costs

Beyond the safety features present on your vehicle, there are many other ways you can lower the cost of insuring your vehicle.

Consider choosing a policy with a higher deductible, buying homeowners insurance from the same company, and checking if the state you live in has a low-cost insurance program.

Since the Benz is a rather expensive vehicle compared to many others, you should expect to pay more than the average person, but you can still get as good a rate as possible. Find insights in our guide, “Minimum Car Insurance Requirements by State.”

Determining Factors for Mercedes-Benz E-Class Insurance Costs

When it comes to securing car insurance for your Mercedes-Benz E-Class, various factors beyond basic coverage options can influence your rates. Understanding these can help you maximize potential savings. Find out more in our guide titled, “Factors That Affect Car Insurance Rates.”

While insurance companies will give you incentives throughout the policy for not being in an accident, some will credit you right from the beginning.

Having speeding tickets and other moving violations can increase your insurance rate so you will want to make sure that you obey your local laws as well as possible.

For Mercedes-Benz E-Class drivers, State Farm delivers unmatched value and peace of mind through its extensive insurance policies.

Brad Larson Licensed Insurance Agent

How often you drive will also be considered when getting quotes from the different providers for your Benz E-class auto insurance. Enter your ZIP code to start comparing free Mercedes Benz auto insurance quotes online now.

Frequently Asked Questions

How can I compare car insurance rates for a Mercedes-Benz E-Class?

To compare monthly car insurance rates for a Mercedes-Benz E-Class, use online comparison tools where you can input your vehicle details and location to view and compare quotes from various insurers. To find out more, explore our guide titled, “Finding Free Car Insurance Quotes Online.”

Are car insurance rates the same for all Mercedes-Benz E-Class models?

No, car insurance rates vary among Mercedes-Benz E-Class models. Factors like the model year, engine size, and trim level can influence the monthly rates due to differences in value and repair costs.

What factors can affect car insurance rates for a Mercedes-Benz E-Class?

Several factors can affect the monthly insurance rates for a Mercedes-Benz E-Class, including the driver’s age and driving history, the car’s safety features, and the level of coverage chosen. See if you’re getting the best deal on car insurance by entering your ZIP code below.

Can I save money on car insurance for a Mercedes-Benz E-Class?

Yes, you can save money on car insurance for your Mercedes-Benz E-Class by maintaining a clean driving record, qualifying for discounts, choosing higher deductibles, and comparing rates from multiple insurers.

Are there any specific insurance considerations for insuring a Mercedes-Benz E-Class?

Yes, insuring a Mercedes-Benz E-Class typically requires considering the vehicle’s high value and performance capabilities. Opting for comprehensive coverage that includes collision and theft may be beneficial due to the replacement costs and repair expenses associated with luxury vehicles like the E-Class. For additional details, explore our comprehensive resource titled, “How do you get competitive quotes for car insurance?“

Is insurance higher on a Mercedes-Benz E-Class?

Yes, insurance is typically higher for the Mercedes-Benz E-Class due to its luxury status and higher repair costs.

Why is the Mercedes-Benz E-Class so expensive to insure?

The Mercedes-Benz E-Class is expensive to insure because of its high value, advanced technology, and the higher costs associated with repairing luxury features.

Which brand of car has cheaper insurance than the Mercedes-Benz E-Class?

Brands such as Toyota or Honda generally offer cheaper insurance than the Mercedes-Benz E-Class, as they are less expensive to repair and replace.

Which category of cars is cheaper to insure than the Mercedes-Benz E-Class?

Standard sedans and compact cars are usually cheaper to insure compared to luxury vehicles like the Mercedes-Benz E-Class. Access comprehensive insights into our guide titled, “Compare Car Insurance by Coverage Type.”

What is the most affordable Mercedes-Benz E-Class model to insure?

The most affordable Mercedes-Benz E-Class model to insure is typically the base E 350 model, due to its lower price point and less complex features.

Which E-Class engine is most economical to insure?

The Mercedes-Benz E-Class with a base four-cylinder engine is generally more economical to insure due to its lower repair costs compared to higher-performance models.

Which year of the Mercedes-Benz E-Class is the cheapest to insure?

Older models of the Mercedes-Benz E-Class are typically cheaper to insure as they have lower replacement values and less advanced, costly technology.

Do Mercedes-Benz E-Class cars have high insurance longevity?

Yes, the Mercedes-Benz E-Class tends to have longer insurance longevity due to its durability and robust build quality. Learn more by reading our guide titled, “Does car insurance cover performance parts?“

Is the Mercedes-Benz E-Class considered a higher insurance risk than a luxury car?

Yes, the Mercedes-Benz E-Class is considered a higher insurance risk than a luxury car due to its high repair and replacement costs.

Who typically offers the cheapest insurance for the Mercedes-Benz E-Class?

Insurance companies like Geico or Progressive often provide cheaper insurance options for the Mercedes-Benz E-Class, depending on coverage levels and the driver’s profile. Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.