Best Mazda MX-5 Miata Car Insurance in 2025 (Check Out These 10 Companies)

The best Mazda MX-5 Miata car insurance providers are State Farm, USAA, and Geico, offering rates starting at $32 per month. State Farm excels with programs tailored for Mazda MX-5 Miata drivers, offering coverage options that cater specifically to this car’s needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Aug 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Mazda MX-5 Miata

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Mazda MX-5 Miata

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Mazda MX-5 Miata

A.M. Best Rating

Complaint Level

Pros & Cons

The best Mazda MX-5 Miata car insurance providers are State Farm, USAA, and Geico, known for their comprehensive coverage options and reliable service.

These companies stand out for their ability to cater to the unique needs of Mazda MX-5 Miata owners, offering tailored policies that enhance the driving experience. To learn more, explore our comprehensive resource on “Compare the Cheapest Car Insurance Companies.”

Our Top 10 Company Picks: Best Mazda MX-5 Miata Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 10% A++ Military Savings USAA

#3 25% A++ Affordable Rates Geico

#4 10% A+ Flexible Policies Progressive

#5 10% A+ New Drivers Allstate

#6 20% A+ Coverage Options Nationwide

#7 25% A+ Filing Claims Erie

#8 20% A Family Plans American Family

#9 15% A Customizable Policies Farmers

#10 12% A Comprehensive Coverage Liberty Mutual

Exploring these top insurers reveals a variety of benefits, from significant discounts for safety features to responsive customer support. If you need insurance for a Mazda MX-5 Miata right now, we can help.

Enter your ZIP code for free Mazda MX-5 Miata car insurance quotes from top companies.

- State Farm leads as the top choice for Mazda MX-5 Miata insurance

- Tailored policies cater specifically to the Mazda MX-5 Miata’s features

- Coverage options focus on the sports car’s unique safety needs

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Policy Bundling: Mazda MX-5 Miata owners can benefit from up to a 17% reduction by combining multiple plans with State Farm. Check out insurance savings in our guide titled, “State Farm Car Insurance Review.”

- Dependable Claims Process: State Farm delivers a strong reputation for providing Mazda MX-5 Miata drivers with efficient and prompt claims resolution.

- Customized Protection: Mazda MX-5 Miata insurance from State Farm allows for adjustable options to align with specific driving requirements.

Cons

- Lower Financial Strength Rating: Mazda MX-5 Miata owners may find the B rating less reassuring compared to other providers.

- Moderate Incentives: State Farm’s multi-plan discount might not be the most attractive for Mazda MX-5 Miata drivers.

#2 – USAA: Best for Military Savings

Pros

- Military-Specific Savings: Mazda MX-5 Miata owners who are part of the military can enjoy considerable savings through USAA’s exclusive discounts.

- Excellent Financial Security: USAA’s A++ rating offers Mazda MX-5 Miata drivers confidence in the company’s strong financial backing. Read up on the USAA car insurance review for more information.

- Wide-Ranging Coverage: Mazda MX-5 Miata policies with USAA include extensive protection, particularly suited for military households.

Cons

- Restricted Availability: USAA’s Mazda MX-5 Miata coverage is only accessible to military members and their families, limiting access.

- Standard Multi-Plan Reduction: Mazda MX-5 Miata drivers might find the 10% discount less competitive compared to other insurers.

#3 – Geico: Best for Affordable Rates

Pros

- Lowest Premiums: Geico provides Mazda MX-5 Miata owners with the most budget-friendly rates, offering discounts up to 25%.

- Top-Tier Financial Stability: With an A++ rating, Mazda MX-5 Miata drivers can trust in Geico’s financial robustness. More information is available about this provider in our guide, “Geico Car Insurance Review.”

- Mileage-Based Savings: Mazda MX-5 Miata owners who drive less can maximize savings with Geico’s pay-per-mile program.

Cons

- Basic Service: Mazda MX-5 Miata drivers may find Geico’s customer service less personalized than other providers.

- Limited Coverage Variety: Geico’s Mazda MX-5 Miata policies may not include as many specialized coverage options.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Flexibility

Pros

- Flexible Coverage: Mazda MX-5 Miata owners can customize their insurance plans with Progressive to fit their unique needs.

- Usage-Based Savings: Progressive rewards Mazda MX-5 Miata drivers through the Snapshot program, offering discounts for safe driving habits.

- Strong Financial Rating: With an A+ rating, Mazda MX-5 Miata owners can trust Progressive’s financial security. See more details in our guide titled, “Progressive Car Insurance Review.”

Cons

- Average Discount Offers: Progressive’s 10% multi-policy discount may not stand out for Mazda MX-5 Miata drivers.

- Variable Premiums: Mazda MX-5 Miata drivers may experience fluctuations in premium costs, especially with changes in driving patterns.

#5 – Allstate: Best for New Drivers

Pros

- Discounts for New Drivers: Allstate provides Mazda MX-5 Miata owners who are new drivers with tailored discounts to help lower insurance costs.

- Incentives for Safe Driving: Mazda MX-5 Miata drivers can earn reductions in premiums through Allstate’s safe driving rewards program. Access comprehensive insights into our guide titled, “Allstate Car Insurance Review.”

- Comprehensive Coverage for Beginners: Allstate offers a variety of coverage options specifically designed for Mazda MX-5 Miata new drivers.

Cons

- Higher Premium Costs: Mazda MX-5 Miata owners might find Allstate’s premiums to be higher, particularly for new drivers.

- Limited Discount Variety: Mazda MX-5 Miata drivers may encounter fewer discount opportunities beyond the standard 10% multi-policy savings.

#6 – Nationwide: Best for Coverage Variety

Pros

- Policy Bundling Discounts: Nationwide offers up to a 20% reduction for combining multiple policies, which benefits Mazda MX-5 Miata owners significantly.

- Adaptable Coverage: Mazda MX-5 Miata drivers can choose from an extensive array of protection plans tailored to specific requirements. Discover more about offerings in our complete Nationwide car insurance discounts.

- Solid Financial Stability: With an A+ rating from A.M. Best, Nationwide guarantees trustworthy protection for your Mazda MX-5 Miata.

Cons

- Less Competitive Discounts: The 20% bundling reduction might not be as advantageous for Mazda MX-5 Miata owners when compared to other insurers.

- Higher Premiums: The comprehensive options available through Nationwide for Mazda MX-5 Miata may lead to elevated premium costs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Erie: Best for Filing Claims

Pros

- Superior Claims Processing: Erie is renowned for managing claims efficiently, ensuring Mazda MX-5 Miata owners receive excellent support during critical times.

- Attractive Rate Reductions: Provides a 25% discount for Mazda MX-5 Miata owners who maintain clean driving records. Delve into our evaluation of “Erie Car Insurance Review.”

- Top Financial Rating: Erie’s A+ rating from A.M. Best reflects strong financial health, offering reassurance to Mazda MX-5 Miata drivers.

Cons

- Restricted Availability: Erie’s insurance for Mazda MX-5 Miata is limited to specific states, which might limit access for some drivers.

- Less Customization: Although strong in claims handling, Erie provides fewer options for personalizing Mazda MX-5 Miata coverage.

#8 – American Family: Best for Family Plans

Pros

- Family-Focused Policies: Mazda MX-5 Miata owners can take advantage of American Family’s policies specifically designed for family needs.

- Substantial Discounts: Offers up to 20% savings for Mazda MX-5 Miata drivers with multi-car family plans. Discover insights in our guide titled, “American Family Car Insurance Review.”

- Reliable Rating: An A rating from A.M. Best ensures that Mazda MX-5 Miata owners are protected by a dependable insurer.

Cons

- Limited Flexibility in Coverage: American Family’s offerings may not provide the same level of customization for Mazda MX-5 Miata policies as some other insurers.

- Lower Financial Strength: Although strong, American Family’s A rating is slightly below the top competitors for Mazda MX-5 Miata insurance.

#9 – Farmers: Best for Customizable Policies

Pros

- Highly Personalized Coverage: Farmers allows for significant customization of policies for Mazda MX-5 Miata, catering to specific needs.

- Discount Initiatives: Provides up to a 15% discount for Mazda MX-5 Miata drivers who demonstrate safe driving behaviors. Learn more by reading our guide titled, “Farmers Car Insurance Review.”

- Reliable Financial Standing: An A rating from A.M. Best highlights Farmers’ stability and trustworthiness, important for Mazda MX-5 Miata coverage.

Cons

- Elevated Costs: The personalized policies available through Farmers for Mazda MX-5 Miata might result in higher premium rates.

- Moderate Discount Opportunities: The 15% discount might not be as appealing to Mazda MX-5 Miata owners seeking larger savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Comprehensive Coverage

Pros

- Thorough Protection: Liberty Mutual provides extensive coverage for Mazda MX-5 Miata, including comprehensive, all-encompassing plans.

- Safe Driving Discounts: Mazda MX-5 Miata drivers can qualify for a 12% reduction by maintaining a safe driving history. Read our Liberty Mutual car insurance review for more details.

- Strong Rating: An A rating from A.M. Best signifies that Liberty Mutual offers dependable coverage for Mazda MX-5 Miata.

Cons

- Higher Premiums: The extensive coverage options offered by Liberty Mutual might lead to increased premium costs for Mazda MX-5 Miata owners.

- Lower Discount Percentage: The 12% discount for safe Mazda MX-5 Miata drivers is less competitive compared to what other insurers might offer.

Mazda MX-5 Miata Insurance Costs by Coverage Level

When choosing car insurance for your Mazda MX-5 Miata, it’s crucial to compare how much you’ll pay for minimum versus full coverage across different providers. This comparison not only helps in budgeting but also in determining the level of protection that suits your needs.

Mazda MX-5 Miata Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $50 $101

American Family $47 $89

Erie $42 $120

Farmers $51 $92

Geico $38 $127

Liberty Mutual $56 $118

Nationwide $45 $96

Progressive $32 $85

State Farm $48 $112

USAA $40 $90

The table above provides a detailed look at the monthly rates for both minimum and full coverage car insurance offered by various insurance companies for the Mazda MX-5 Miata. For instance, Progressive offers the lowest rate for minimum coverage at $32, making it an attractive option for those seeking basic protection.

On the other hand, Geico, despite being more expensive for full coverage at $127, might be considered by those looking for comprehensive protection due to its broader coverage benefits. Notably, prices can vary significantly, with Erie charging $42 for minimum coverage but jumping to $120 for full, indicating a substantial increase when opting for more comprehensive insurance.

This table serves as an essential tool for Mazda MX-5 Miata owners to evaluate and choose the right insurance plan based on their coverage needs and financial considerations.

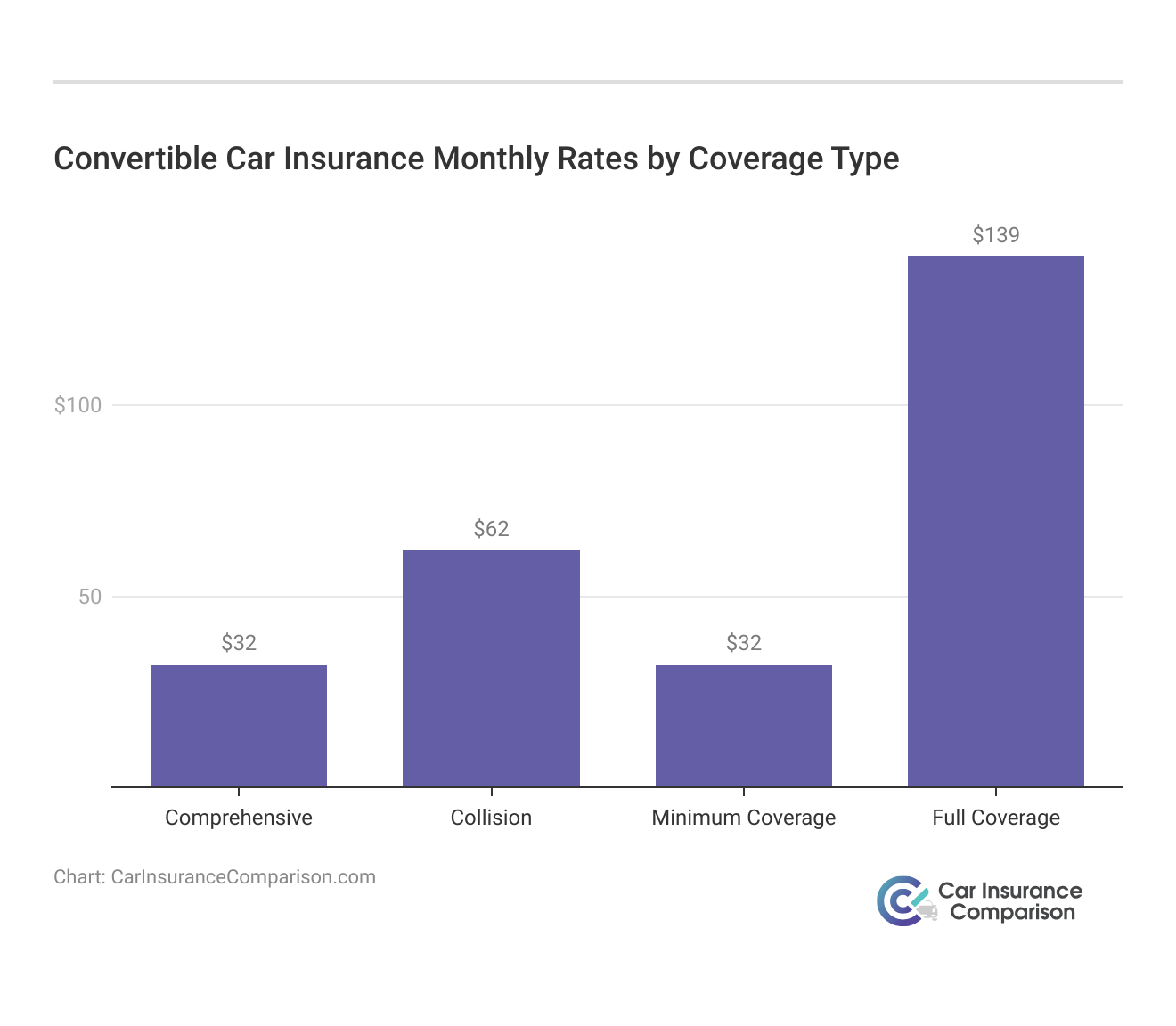

Assessing the Insurance Expenses of the Mazda MX-5 Miata

Understanding the insurance costs associated with convertible sports cars like the Mazda MX-5 Miata can help prospective buyers budget accordingly. This analysis compares the MX-5 Miata’s insurance rates with those of other popular convertibles such as the Nissan Murano CrossCabrio, Cadillac Eldorado, and Lexus SC 430.

The data reveals that insurance rates for convertibles vary significantly, with the Mazda MX-5 Miata positioned within a competitive range.

Knowing these costs is crucial for making an informed decision on whether the joy of driving a convertible like the MX-5 Miata aligns with financial expectations. Deepen your understanding by reading our guide, “How do you get competitive quotes for car insurance?“

Reviewing the insurance costs for vehicles similar to the Mazda MX-5 Miata provides valuable insight into what drivers might expect to pay for coverage. It illustrates the spectrum of insurance expenses associated with owning various types of convertibles, helping potential buyers make more informed decisions.

Insurance Rates for Vehicles Similar to the Mazda MX-5 Miata

When exploring insurance costs, it’s beneficial to compare the Mazda MX-5 Miata with similar vehicles to understand how rates are structured across different models. The following data provides a snapshot of comprehensive, collision, and liability insurance rates for a range of comparable cars.

Mazda MX-5 Miata Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Mazda MX-5 Miata | $32 | $62 | $32 | $139 |

| Mercedes-Benz SL 450 | $40 | $77 | $33 | $163 |

| Buick Cascada | $28 | $55 | $33 | $129 |

| BMW Z4 | $28 | $51 | $30 | $120 |

| Mercedes-Benz SLC 300 | $36 | $67 | $33 | $149 |

| Volkswagen Eos | $25 | $44 | $36 | $118 |

| MINI Convertible | $25 | $45 | $22 | $100 |

| BMW M6 | $43 | $94 | $38 | $190 |

This comparison highlights the variability in insurance costs among vehicles similar to the Mazda MX-5 Miata, reflecting differences in vehicle value, repair costs, and risk factors. Understanding these differences can help owners make informed decisions when selecting an insurance plan that best fits their vehicle and budgetary needs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Understanding What Affects Mazda MX-5 Miata Insurance Premiums

The Mazda MX-5 Miata trim and model you choose can impact the total price you will pay for Mazda MX-5 Miata insurance coverage.

When a #hurricane strikes, a generator can be a lifesaver. But if not used correctly, it can pose its own hazards. Follow these simple tips to stay safe while you keep the power going. pic.twitter.com/t634so9dkQ

— State Farm (@StateFarm) August 10, 2023

You can also expect your Mazda MX-5 Miata rates to be affected by where you live, your driving history, and in most states your age and gender. Access in-depth insights in our guide, “What affects a car insurance quote?”

Maximizing Savings on Mazda MX-5 Miata Insurance

Finding affordable insurance for your Mazda MX-5 Miata doesn’t have to be a challenge. By adopting strategic approaches, you can effectively manage costs while maintaining solid coverage.

- Don’t always pick the cheapest Mazda MX-5 Miata insurance policy.

- Ask for a higher deductible for your Mazda MX-5 Miata insurance policy.

- Buy your Mazda MX-5 Miata with cash, or get a shorter-term loan.

- Choose automatic payments or EFT for your Mazda MX-5 Miata insurance policy.

- Reduce modifications on your Mazda MX-5 Miata.

Implementing these strategies can lead to significant savings on your Mazda MX-5 Miata insurance. Carefully consider each option to determine the best balance between cost and coverage for your specific needs. Read more in our article titled, “What makes car insurance more expensive?“

Leading Insurance Providers for the Mazda MX-5 Miata

Choosing the right auto insurance for your Mazda MX-5 Miata involves considering various factors, including cost, coverage, and company reputation. This overview highlights the top insurance providers for the Mazda MX-5 Miata, ranked by market share and noted for their competitive rates and discounts for vehicle-specific safety features.

As the largest auto insurer, State Farm sets the industry standard for reliability and customer satisfaction.

Michelle Robbins Licensed Insurance Agent

Selecting the best car insurance companies for your Mazda MX-5 Miata can significantly impact your coverage quality and cost-effectiveness.

Largest Auto Insurers by Market Share

Understanding the landscape of the auto insurance market can be crucial for consumers looking to choose a provider. The list below ranks the largest auto insurers in the U.S. by market share, offering insight into their dominance and reach in the industry.

Top Mazda MX-5 Miata Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

This ranking highlights the top players in the auto insurance sector, showcasing their influence based on market share. For individuals seeking insurance, these statistics provide a foundation for comparing the scale and potential reliability of each insurer. Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool below to see affordable car insurance quotes.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What factors influence car insurance rates for the Mazda MX-5 Miata?

Car insurance rates for the Mazda MX-5 Miata are affected by the driver’s age and driving record, the car’s trim level and safety features, as well as geographic location and frequency of use. For additional details, explore our comprehensive resource titled, “Average Car Insurance Rates by Age and Gender.”

What coverage options are recommended for Mazda MX-5 Miata car insurance?

For Mazda MX-5 Miata car insurance, it is recommended to consider comprehensive and collision coverage along with liability insurance to ensure full protection against a variety of incidents. Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

How can I secure affordable car insurance for my Mazda MX-5 Miata?

To secure affordable car insurance for your Mazda MX-5 Miata, compare rates from multiple insurers, maximize discounts for which you qualify, and adjust your coverage levels and deductibles to fit your budget.

How much does Mazda MX 5 car insurance typically cost?

Mazda MX 5 car insurance costs can vary widely; however, typical monthly rates range from about $38 for minimum coverage to $127 for full coverage, influenced by factors like the driver’s age, driving history, and chosen insurance company.

What specific safety features of the Mazda MX-5 Miata can reduce insurance rates?

Safety features in the Mazda MX-5 Miata, such as advanced airbag systems, anti-lock braking systems, and stability control, can potentially lower insurance rates by reducing risk. Access comprehensive insights into our guide titled, “Safe Driver Car Insurance Discounts.”

Does the trim level of the Mazda MX-5 Miata influence its insurance rates?

Yes, the trim level of the Mazda MX-5 Miata can impact insurance rates; higher trim levels with additional features may lead to higher premiums due to increased value and repair costs.

What is the best insurance for Mazda Miata?

The best insurance for Mazda Miata typically comes from providers like State Farm, Geico, and Progressive, offering a balance of comprehensive coverage and competitive rates.

How do I find affordable Mazda Miata insurance?

To find affordable Mazda Miata insurance, compare quotes from multiple insurers, take advantage of discounts, and choose coverage that matches your driving habits and needs.

What is the average Mazda Miata insurance cost?

The average Mazda Miata insurance cost varies, but generally, monthly premiums can range from $32 for basic coverage to over $100 for full coverage, depending on various factors. To find out more, explore our guide titled, “Finding Free Car Insurance Quotes Online.”

Are Mazda MX-5 Miatas high maintenance in terms of insurance?

Mazda MX-5 Miatas are generally not high maintenance regarding insurance; they typically feature lower insurance costs due to their reliability and reasonable repair expenses.

Why is the Mazda MX-5 Miata considered a good choice for insurance?

The Mazda MX-5 Miata is considered a good choice for insurance due to its affordable coverage rates, enhanced by the car’s safety features and low theft rates, making it a cost-effective option for enthusiasts.

Are Mazda MX-5 Miatas reliable for maintaining low insurance costs?

Yes, Mazda MX-5 Miatas are reliable for maintaining low insurance costs. Their long-standing reputation for durability and low repair costs contributes to generally favorable insurance premiums.

Are insurance values for Mazda MX-5 Miatas going up?

Insurance values for Mazda MX-5 Miatas can increase for well-maintained or classic models, reflecting their potential status as collectibles which may influence their insured value. To find out more, explore our guide titled “The Top 5 Car Insurance Companies.”

Is the Mazda MX-5 Miata a good choice for long-drive coverage?

The Mazda MX-5 Miata is a good choice for long-drive coverage, given its reliability. However, policyholders should consider comprehensive coverage to protect against road trip-related risks like theft and roadside emergencies.

What is the most common insurance claim with the Mazda MX-5 Miata?

The most common insurance claim for the Mazda MX-5 Miata often involves its convertible top, where damage can occur due to weather, accidental misuse, or mechanical failures. Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.