Best Lexus ES 330 Car Insurance in 2025 (Compare the Top 10 Companies)

For as low as $35 per month, the best Lexus ES 330 car insurance is available from top providers Geico, State Farm, and Liberty Mutual. These companies offer exceptional coverage and competitive rates, ensuring the best value for your Lexus insurance cost. Keep reading to find out more about each option.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Feb 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Lexus ES 330

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Company Facts

Full Coverage for Lexus ES 330

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Lexus ES 330

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews

Geico, State Farm, and Liberty Mutual offer the best Lexus ES 330 car insurance rates starting at $35 per month. Geico emerges as the top pick overall for the most competitive Lexus ES insurance costs. Explore how these providers can deliver the coverage you need at a great price.

In addition to finding the best rates, the article also covers how to compare car insurance by coverage type. This comparison helps you understand the differences in protection levels, ensuring you select the right coverage for your Lexus ES 330. Make informed choices based on your specific needs and preferences.

Our Top 10 Company Picks: Best Lexus ES 330 Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Competitive Rates Geico

#2 20% B Customer Service State Farm

#3 25% A Broad Coverage Liberty Mutual

#4 25% A+ Trusted Brand Allstate

#5 20% A+ Wide Range Nationwide

#6 8% A++ Reliable Policies Travelers

#7 20% A Extensive Discounts Farmers

#8 10% A++ Personalized Service Auto-Owners

#9 20% A Family Oriented American Family

#10 25% A+ Specialized Options The Hartford

By entering your ZIP code above, you can get instant car insurance quotes from top providers.

- Lexus ES 330 insurance rates starts at $35 per month

- Geico offers the best rates and coverage

- Explore Insurance plans tailored for Lexus ES 330 owners

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Pick Overall

Pros

- Competitive Rates: Geico offers some of the most competitive rates for Lexus ES 330 car insurance, with an average monthly premium of $130. This makes it a cost-effective option for owners of the Lexus ES 330 who want to maintain comprehensive coverage without breaking the bank. Learn more in our Geico car insurance review.

- Extensive Discounts: Geico provides a range of discounts for Lexus ES 330 owners, including savings for having anti-theft devices and advanced safety features. This can significantly lower the cost of car insurance for the Lexus ES 330 by leveraging the vehicle’s built-in safety technologies.

- Strong Customer Satisfaction: Geico has a reputation for strong customer service and quick claims processing, which is valuable for Lexus ES 330 owners who might require efficient handling of their insurance claims. This high level of satisfaction is crucial for maintaining peace of mind.

Cons

- Limited Coverage Options: While Geico offers competitive rates, its coverage options for the Lexus ES 330 may not be as comprehensive as those offered by some competitors. This could mean fewer customization choices for owners looking for specialized coverage tailored to their Lexus ES 330.

- Higher Rates for Newer Models: Geico’s rates for newer Lexus ES 330 models might not be as competitive, with potential increases due to the higher repair costs and advanced features of newer vehicles. This can impact the affordability of insurance for those with recent model years.

#2 – State Farm: Best for Customer Service

Pros

- Wide Range of Coverage Options: State Farm offers a broad selection of coverage options for Lexus ES 330 owners, including comprehensive and collision coverage. This flexibility allows for tailored protection that meets the specific needs of Lexus ES 330 drivers. More information about their rates in our State Farm car insurance review.

- Discounts for Safe Driving: State Farm provides discounts for safe driving habits, which can benefit Lexus ES 330 owners who maintain a clean driving record. This can lead to lower premiums and enhanced savings on the best car insurance for Lexus ES 330.

- Extensive Network of Local Agents: State Farm has a wide network of local agents, making it easier for Lexus ES 330 owners to get personalized service and support. This accessibility ensures that policyholders can receive tailored advice and assistance from agents familiar with their specific insurance needs.

Cons

- Higher Average Premiums: State Farm’s average monthly premium of $145 for the Lexus ES 330 is higher compared to some other insurers. This could result in increased costs for those seeking affordable options for their Lexus ES 330 insurance.

- Limited Digital Tools: While State Farm offers robust coverage, its digital tools and online interface might not be as user-friendly or advanced as some competitors. This can be less convenient for Lexus ES 330 owners who prefer managing their policies online.

#3 – Liberty Mutual: Best for Broad Coverage

Pros

- Comprehensive Coverage: Liberty Mutual provides extensive coverage options for Lexus ES 330 owners, including add-ons for enhanced protection. This is beneficial for those who want full coverage that addresses various risks associated with their Lexus ES 330.

- Multiple Discount Opportunities: Liberty Mutual offers numerous discounts, such as for bundling policies and having safety features in the Lexus ES 330. These discounts can significantly reduce the overall cost of car insurance for the Lexus ES 330. Learn more in our Liberty Mutual car insurance review.

- 24/7 Customer Service: Liberty Mutual’s 24/7 customer service is advantageous for Lexus ES 330 owners needing assistance or claims support at any time. This round-the-clock availability ensures timely help and resolution of insurance-related issues.

Cons

- Higher Premium Costs: With an average monthly premium of $160, Liberty Mutual’s rates for the Lexus ES 330 can be higher compared to other insurers. This could make it a less attractive option for those seeking budget-friendly car insurance.

- Mixed Customer Reviews: Liberty Mutual has received mixed reviews regarding customer service and claims processing, which could be a concern for Lexus ES 330 owners who value high-quality customer support and efficient claim handling.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Trusted Brand

Pros

- Customizable Coverage Options: Allstate provides a variety of customizable coverage options for the Lexus ES 330, allowing owners to tailor their insurance to meet specific needs. This flexibility ensures that all aspects of the Lexus ES 330 are well-protected.

- Discounts for Safety Features: As mentioned in our Allstate car insurance review, Allstate offers discounts for Lexus ES 330 owners who have advanced safety features and anti-theft devices installed. These discounts can lower the cost of insurance while ensuring comprehensive protection for the vehicle.

- Robust Digital Tools: Allstate’s digital tools and mobile app provide easy management of policies and claims for Lexus ES 330 owners. These tools facilitate convenient access to account details, claims tracking, and policy adjustments.

Cons

- Higher Premiums for Luxury Vehicles: Allstate’s rates for the Lexus ES 330, averaging $170 monthly, can be higher due to the vehicle’s luxury status. This could result in elevated insurance costs compared to standard sedans.

- Customer Service Issues: Some customers report challenges with Allstate’s customer service and claims processing, which might affect the experience for Lexus ES 330 owners seeking efficient and reliable insurance support.

#5 – Nationwide: Best for Wide Range

Pros

- Competitive Premiums: Nationwide offers competitive rates for Lexus ES 330 insurance, with an average monthly premium of $150. This affordability is advantageous for owners looking for cost-effective coverage options for their Lexus ES 330. Check out their ratings in our complete Nationwide car insurance discount.

- Diverse Discount Programs: Nationwide provides a range of discount programs, including those for safe driving and vehicle safety features. These discounts help lower premiums and offer savings for Lexus ES 330 owners.

- Strong Claims Support: Nationwide is known for its effective claims support and customer service, providing reliable assistance for Lexus ES 330 owners in case of an accident or damage. This ensures timely and satisfactory resolution of claims.

Cons

- Limited Coverage Add-Ons: Nationwide’s coverage options may not include as many add-ons or specialized options as some competitors, potentially limiting customization for Lexus ES 330 insurance. This could be a drawback for those needing specific coverage enhancements.

- Mixed Customer Satisfaction: While generally reliable, Nationwide has received mixed reviews from customers regarding service quality and claims handling, which may impact the experience for Lexus ES 330 owners seeking optimal insurance service.

#6 – Travelers: Best for Reliable Policies

Pros

- Comprehensive Coverage Options: Travelers offers a wide range of coverage options for the Lexus ES 330, including customizable plans that can be tailored to individual needs. This flexibility allows Lexus ES 330 owners to choose coverage that best suits their requirements.

- Discounts for Safe Vehicles: Travelers provides discounts for vehicles with advanced safety features, such as those found in the Lexus ES 330. These discounts can help reduce insurance costs while ensuring robust protection for the vehicle. See more details on our Travelers car insurance review.

- Strong Customer Service: Travelers is known for its strong customer service and support, which benefits Lexus ES 330 owners seeking reliable assistance with their insurance policies. This high level of service contributes to overall customer satisfaction.

Cons

- Higher Premiums for High-Value Vehicles: Travelers’ rates for the Lexus ES 330 can be higher due to the vehicle’s value and advanced features, with an average monthly premium of $155. This might not be ideal for those seeking lower-cost insurance options.

- Limited Discount Availability: Some customers may find that Travelers’ discount options are less extensive compared to other insurers, potentially impacting savings for Lexus ES 330 owners who are looking for a range of discount opportunities.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Extensive Discounts

Pros

- Wide Coverage Options: Farmers offers extensive coverage options for the Lexus ES 330, including comprehensive and collision insurance. This ensures that all aspects of the vehicle’s protection are covered.

- Discounts for Multiple Policies: Farmers provides significant discounts for bundling multiple insurance policies, which can be beneficial for Lexus ES 330 owners who also need other types of coverage, such as homeowners or renters insurance.

- Flexible Payment Plans: Farmers offers flexible payment plans that can accommodate different budgeting needs for Lexus ES 330 owners. This flexibility helps in managing insurance costs effectively. Learn more in our Farmers car insurance review.

Cons

- Higher Average Premiums: Farmers’ average monthly premium of $165 for the Lexus ES 330 can be higher compared to some other insurers. This may result in increased insurance costs for those looking for budget-friendly options.

- Inconsistent Customer Service: Farmers has received mixed feedback regarding customer service and claims handling, which could affect the experience of Lexus ES 330 owners seeking reliable support and efficient resolution of insurance claims.

#8 – Auto-Owners: Best for Personalized Service

Pros

- Customizable Coverage: Auto-Owners offers customizable coverage options for the Lexus ES 330, allowing owners to tailor their insurance to their specific needs and preferences. This ensures comprehensive protection that matches the vehicle’s requirements.

- Discounts for Safety Features: As outlined in Auto-Owners car insurance review, Auto-Owners provides discounts for vehicles equipped with safety features, such as those found in the Lexus ES 330. This can lead to reduced premiums and savings for owners who invest in these safety technologies.

- Solid Customer Service: Auto-Owners is known for its strong customer service and support, which benefits Lexus ES 330 owners who require assistance with their insurance policies. This reliable service contributes to a positive customer experience.

Cons

- Higher Premiums for Certain Models: Auto-Owners’ premiums for the Lexus ES 330 can be higher compared to some other insurers, with an average monthly cost of $158. This might impact affordability for those seeking lower insurance rates.

- Limited Digital Tools: Auto-Owners’ digital tools and online resources may not be as advanced or user-friendly as those of some competitors, potentially affecting convenience for Lexus ES 330 owners who prefer managing their insurance online.

#9 – American Family: Best for Family Oriented

Pros

- Affordable Rates: American Family offers competitive rates for the Lexus ES 330, with an average monthly premium of $152. This affordability makes it a viable option for owners seeking cost-effective insurance coverage. More information in our American Family car insurance review.

- Discounts for Vehicle Safety: American Family provides discounts for vehicles with advanced safety features, such as the Lexus ES 330. These discounts can help reduce overall insurance costs while ensuring comprehensive coverage.

- Good Claims Service: American Family is known for its efficient claims handling and customer service, which is beneficial for Lexus ES 330 owners who need reliable support and timely resolution of insurance claims.

Cons

- Limited Customization: American Family’s coverage options may be less customizable compared to some competitors, potentially limiting choices for Lexus ES 330 owners who seek specialized coverage options.

- Mixed Customer Reviews: American Family has received mixed reviews from customers regarding service quality and claims processing, which may impact the overall experience for Lexus ES 330 owners seeking dependable insurance support.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – The Hartford: Best for Specialized Options

Pros

- Comprehensive Coverage Options: The Hartford offers a variety of comprehensive coverage options for the Lexus ES 330, including tailored plans that address specific needs. This ensures thorough protection for the vehicle.

- Discounts for Bundling Policies: The Hartford provides discounts for bundling multiple insurance policies, which can be advantageous for Lexus ES 330 owners who need other types of coverage, such as home or renters insurance. Learn more in The Hartford car insurance discounts.

- 24/7 Claims Support: The Hartford’s 24/7 claims support is beneficial for Lexus ES 330 owners who may need assistance or claim processing outside of regular business hours. This round-the-clock support ensures timely help.

Cons

- Higher Premiums for Luxury Vehicles: The Hartford’s average monthly premium of $162 for the Lexus ES 330 can be higher due to the vehicle’s luxury status. This could make it less appealing for those seeking more affordable insurance options.

- Variable Customer Service Experience: The Hartford has received variable feedback regarding customer service, which may impact the experience for Lexus ES 330 owners who value consistent and high-quality support.

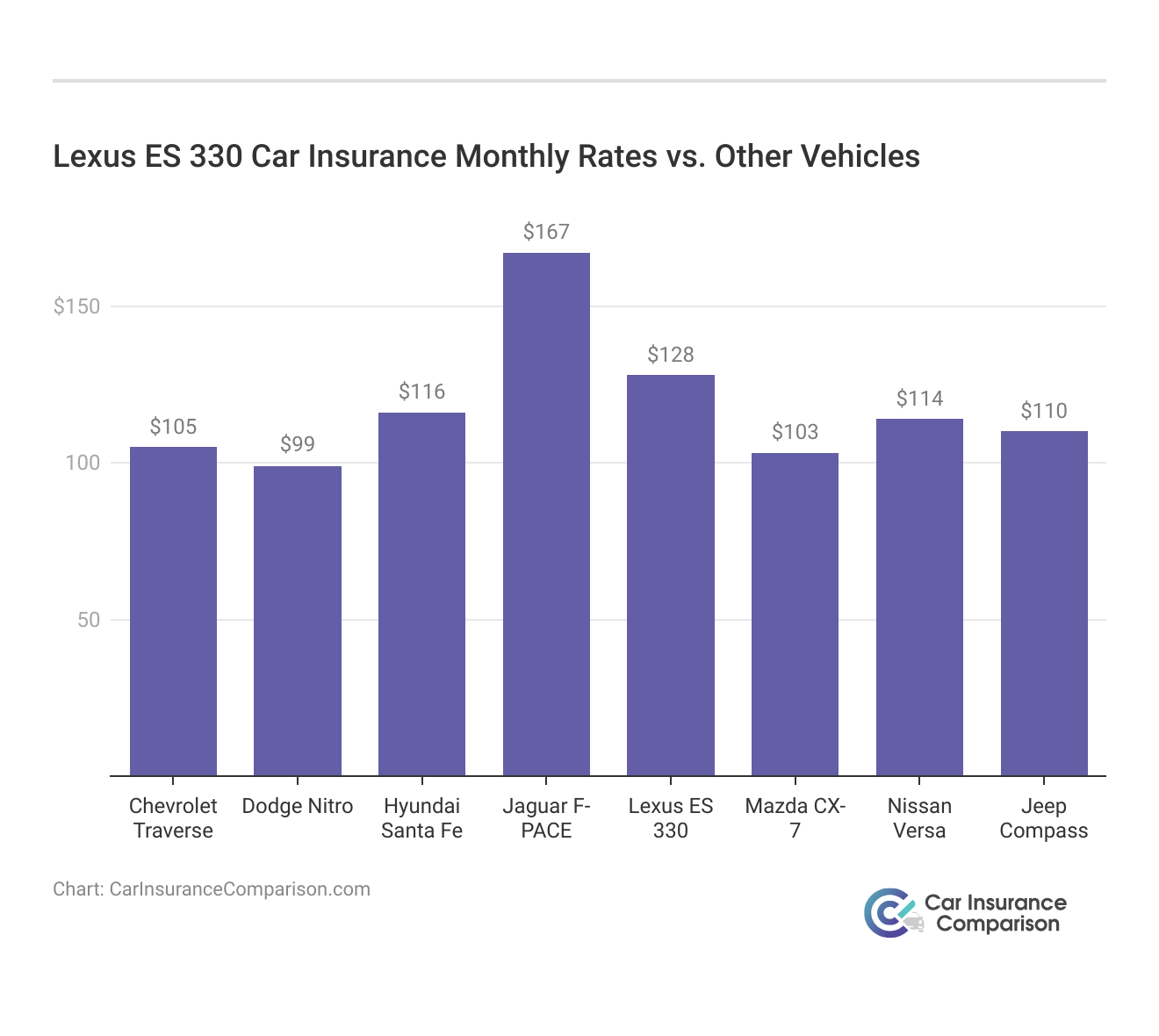

The Expensive Cost of Lexus ES 330 Insurance

Check out this comparison of monthly rates for minimum and full coverage car insurance on a Lexus ES 330 from various providers.

Lexus ES 330 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $55 $170

American Family $46 $152

Auto-Owners $48 $158

Farmers $50 $165

Geico $35 $130

Liberty Mutual $45 $160

Nationwide $42 $150

State Farm $40 $145

The Hartford $49 $162

Travelers $47 $155

Comparing insurance rates for similar vehicles like the Audi A4 and Nissan Versa can help you find competitive pricing for your Lexus ES 330. By evaluating these rates, you can identify cost-effective insurance options tailored to your needs.

Comparing insurance rates for similar vehicles like the Audi A4 and Nissan Versa can help you find competitive pricing for your Lexus ES 330. Reviewing the comprehensive, collision, and liability costs for various vehicles like the Lexus ES 350 and Audi S8 can guide you in finding the best insurance options.

Read More: Compare Hyundai Sonata Car Insurance Rates

Lexus ES 330 Insurance Saving Hacks

There are several ways you can save even more on your Lexus ES 330 car insurance rates. Take a look at the following five tips:

- Buy your Lexus ES 330 with cash, or get a shorter-term loan.

- Ask about loyalty discounts.

- Ask for a Lexus ES 330 discount if you have a college degree.

- Compare insurance companies after moving.

- Pay your bills on time — especially Lexus ES 330 payments and insurance.

By implementing these tips, you can significantly reduce your Lexus ES 330 insurance costs. Start exploring these options today to maximize your savings on car insurance.

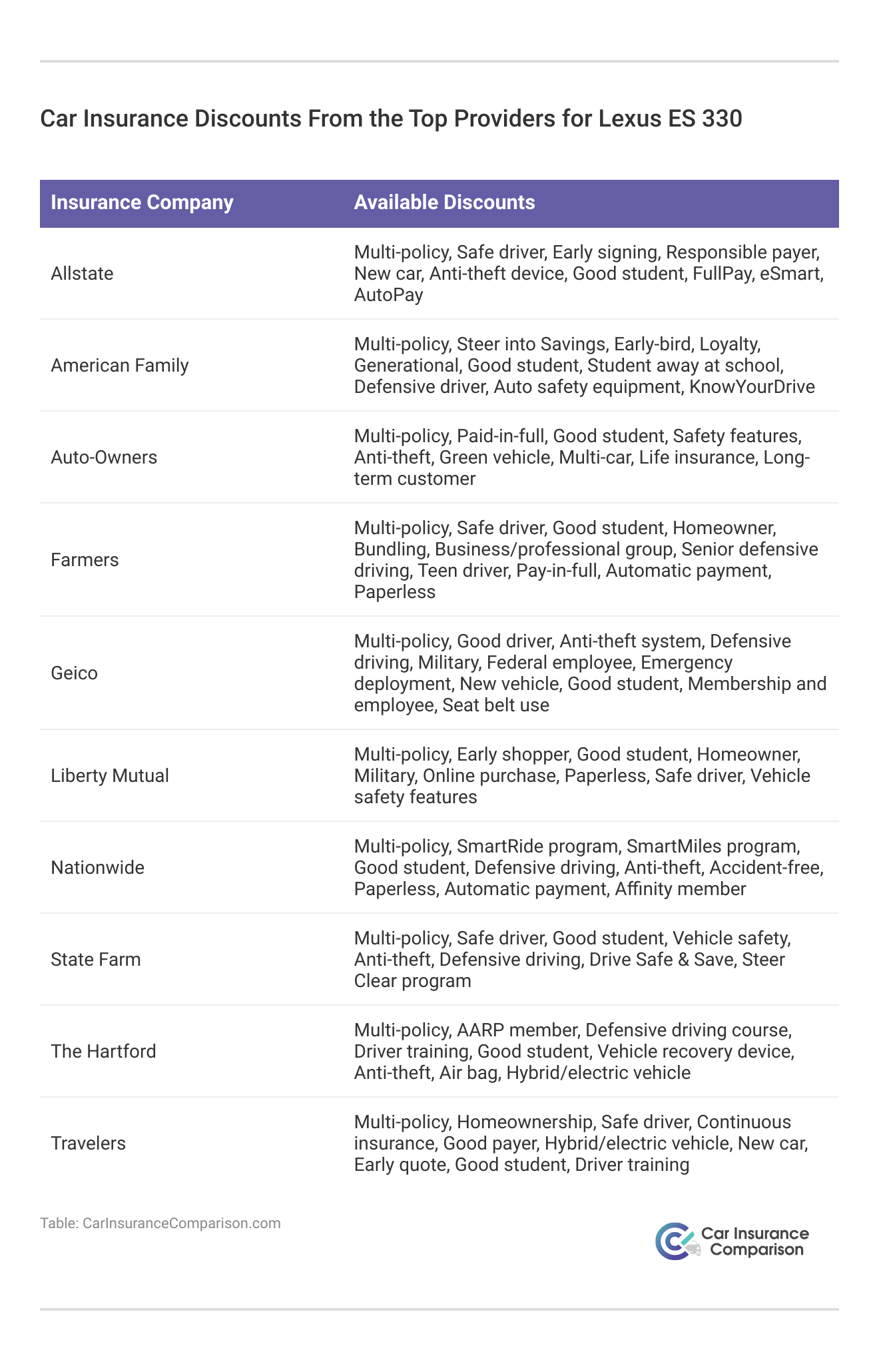

Exploring car insurance discounts from top providers can help you find significant savings on your Lexus ES 330. Companies offer a variety of discounts, such as multi-policy, good student, and vehicle safety features.

Additionally, taking advantage of the bundling car insurance discount can further reduce your premiums. Compare offers from different insurers to ensure you get the best rate possible.

Read More: Best Companies for Bundling Home and Car Insurance

Lexus ES 330 Insurance Cost Factors

The average annual rate for the Lexus ES 330 is just that, an average. Your insurance rates for a Lexus ES 330 can be higher or lower depending on factors such as the trim level and personal details.

The insurance cost factors include your age, home address, driving history, and the model year of your Lexus ES 330.

Scott W. Johnson LICENSED INSURANCE AGENT

Additionally, the age of a car can affect car insurance rates, with older models sometimes costing more to insure due to potential repair costs and safety features. Insurance rates can vary widely based on individual circumstances and vehicle specifics. For the most accurate estimate, consider getting personalized quotes from multiple insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Leading Lexus ES 330 Insurance Companies

What is the best auto insurance company for Lexus ES 330 insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Lexus ES 330 auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features found on the Lexus ES 330.

Lexus LC 500 Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Lexus LC 500h 2 DR RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2024 Lexus LC 500 2 DR RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Lexus LC 500h 2 DR RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Lexus LC 500 2 DR RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Lexus LC 500h 2 DR RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Lexus LC 500 2 DR RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Lexus LC 500h 2 DR RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Lexus LC 500 2 DR RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Lexus LC 500h 2 DR RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Lexus LC 500 2 DR RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Lexus LC 500H 2 DR RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Lexus LC 500 2 DR RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Lexus LC 500H 2 DR RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Lexus LC 500 2 DR RWD | 5 stars | 5 stars | 5 stars | 4 stars |

When choosing the best auto insurance for your Lexus ES 330, consider the top insurers by market share, such as State Farm, Geico, and Progressive. Comparing quotes from these leading companies can help you find the most competitive rates and suitable coverage options.

To determine how do you get cheaper car insurance quotes, explore the discounts and offers available from each provider. By comparing free Lexus ES 330 insurance quotes online, you can find the best rates and coverage options tailored to your specific needs.

This process helps Lexus owners identify potential savings by evaluating offers from multiple insurance providers, ensuring they get the most competitive pricing. It also allows you to assess different coverage levels and discounts, such as those for safety features and bundling, leading to more informed and cost-effective insurance decisions.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Frequently Asked Questions

What factors affect the car insurance rates for a Lexus ES 330?

Several factors can influence the car insurance rates for a Lexus ES 330, including the driver’s age and driving history, the location where the vehicle will be primarily used, the level of coverage desired, the deductible amount chosen, the vehicle’s value, safety features, and the insurer’s own underwriting criteria.

What type of liability coverage is recommended for a Lexus ES 330?

For a Lexus ES 330, it’s recommended to have higher liability coverage limits due to the vehicle’s luxury status and potential repair costs. Compare liability car insurance to see how different policies stack up. Minimum liability coverage may not be sufficient in case of serious accidents or claims. Opting for higher limits can provide better protection and peace of mind.

How can I compare car insurance rates for a Lexus ES 330?

To compare car insurance rates for a Lexus ES 330, research reputable providers, gather details about your vehicle, and request quotes. Then, review and compare the rates, coverage options, and any available discounts to make an informed decision.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Are Lexus ES 330 car insurance rates higher than average?

Car insurance rates for a Lexus ES 330 can vary depending on multiple factors, including the driver’s profile, location, and the insurance company’s underwriting criteria. While the Lexus ES 330 is considered a luxury vehicle, insurance rates can be influenced by factors beyond the car itself, such as the driver’s history and the chosen coverage levels.

It’s advisable to obtain personalized quotes from insurance providers to get an accurate assessment of the rates.

What can I do to lower my car insurance rates for a Lexus ES 330?

There are different ways to lower car insurance rates, maintain a good driving record and choose a higher deductible. Also, seek out discounts and compare quotes from various insurers for the best rates.

Are there any specific safety features on the Lexus ES 330 that can impact insurance rates?

The presence of certain safety features in a Lexus ES 330 can potentially influence car insurance rates. Safety features such as anti-lock brakes, traction control, stability control, airbags, anti-theft devices, and advanced driver assistance systems (ADAS) may help reduce the risk of accidents or theft. Insurance companies often offer discounts for vehicles equipped with these safety features, as they can lead to fewer claims and lower risk.

Is full coverage necessary for a Lexus ES 330?

Full coverage is often recommended for a Lexus ES 330, especially if the vehicle is relatively new or has a high value. Full coverage typically includes comprehensive and collision insurance, which protects against a wide range of risks including theft, vandalism, and accidents. It ensures that you are fully protected in various scenarios.

How do insurance rates for the Lexus ES 330 compare to other luxury sedans?

Insurance rates for the Lexus ES 330 are often comparable to other luxury sedans but can vary based on factors such as the vehicle’s age, trim level, and safety features. Comparing rates with similar models like the BMW 5 Series or Audi A6 can provide a benchmark for evaluating insurance costs for the ES 330.

For those seeking the best insurance for luxury cars, it’s crucial to consider these comparisons to ensure optimal coverage and value.

Are there specific insurance discounts available for Lexus ES 330 owners?

Yes, Lexus ES 330 owners may qualify for specific insurance discounts. These can include discounts for vehicle safety features, anti-theft devices, and good driving records. Additionally, many insurers offer multi-policy discounts if you bundle your car insurance with other types of coverage, such as homeowners or renters insurance.

How does paying bills on time affect my Lexus ES 330 insurance rates?

Paying your insurance bills on time can positively impact your Lexus ES 330 insurance rates. Many insurers offer discounts for timely payments and a consistent payment history. On the other hand, missed payments can lead to penalties or even policy cancellation, which can increase your rates or make it harder to find affordable coverage.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.