Best Kia Seltos Car Insurance in 2025 (Your Guide to the Top 10 Companies)

Discover the best Kia Seltos car insurance with Geico, State Farm, and Progressive, starting as low as $32 a month. These providers offer top-notch coverage and competitive rates for your Kia Seltos, ensuring comprehensive protection and excellent customer service tailored to your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Aug 9, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 9, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Kia Seltos

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Kia Seltos

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Kia Seltos

A.M. Best Rating

Complaint Level

Pros & Cons

The best Kia Seltos car insurance providers are Geico, State Farm, and Progressive, renowned for their competitive coverage options and customer satisfaction.

When insuring your Kia Seltos, these companies stand out due to their comprehensive policies tailored specifically for SUVs like the Seltos. They offer a blend of affordability, extensive coverage, and exceptional customer service that sets them apart in the auto insurance landscape. Learn more in our article titled “Best Kia Car Insurance Rates.”

Our Top 10 Company Picks: Best Kia Seltos Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Affordable Rates Geico

#2 17% B Customer Service State Farm

#3 15% A+ Customizable Plans Progressive

#4 10% A+ New Drivers Allstate

#5 10% A++ Military Families USAA

#6 15% A Personalized Service Farmers

#7 12% A Coverage Options Liberty Mutual

#8 20% A+ Bundling Discounts Nationwide

#9 13% A++ Safe Drivers Travelers

#10 20% A Young Drivers American Family

Opting for one of these providers ensures your Kia Seltos is protected by the best in the business.

See if you’re getting the best deal on car insurance by entering your ZIP code above.

- Geico is the top pick for Kia Seltos car insurance, offering premier coverage

- Tailored insurance solutions cater specifically to the unique aspects of the Kia Seltos

- Policies are designed to maximize value and protection for Kia Seltos owners

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Competitive Pricing: Geico offers some of the most affordable rates for Kia Seltos car insurance, starting as low as $32 a month.

- High Multi-Policy Discount: Owners of Kia Seltos can enjoy up to 25% off when they bundle multiple policies with Geico. Learn more about Geico’s rates in our guide titled “Geico Car Insurance Review.”

- Top-Rated Financial Stability: Geico’s A++ A.M. Best rating ensures reliability in claims handling for Kia Seltos insurance.

Cons

- Coverage Limits: Some policyholders of Kia Seltos might find Geico’s coverage options less extensive compared to other insurers.

- Customer Service Variability: While generally positive, some Kia Seltos owners report mixed experiences with Geico’s customer service.

#2 – State Farm: Best for Customer Service

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies for Kia Seltos.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage of Kia Seltos.

- Wide Coverage: State Farm offers various options tailored to the insurance needs of Kia Seltos owners. See the reviews and rankings in our full article titled “State Farm Car Insurance Review.”

Cons

- Limited Multi-Policy Discount: The multi-policy discount for Kia Seltos owners at State Farm is lower compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain Kia Seltos coverage levels.

#3 – Progressive: Best for Customizable Plans

Pros

- Customization Options: Progressive offers highly customizable insurance plans, allowing Kia Seltos owners to tailor their coverage precisely.

- Loyalty Rewards: Progressive rewards Kia Seltos owners with discounts for loyalty and continuous insurance. Our complete “Progressive Car Insurance Review” goes over this in more detail.

- Strong Financial Rating: With an A+ A.M. Best rating, Progressive is a robust choice for Kia Seltos insurance.

Cons

- Complex Discount Structure: Some Kia Seltos owners may find Progressive’s discount structure complex and difficult to maximize.

- Rate Fluctuations: Progressive’s rates for Kia Seltos insurance may vary more significantly than those of competitors after the initial policy term.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for New Drivers

Pros

- Young Driver Support: Allstate offers tailored programs and discounts that benefit Kia Seltos owners who are new drivers.

- Educational Resources: Extensive resources and tools for Kia Seltos owners, helping them understand their coverage and manage risks effectively.

- Stable Financial Outlook: With an A+ rating from A.M. Best, Allstate ensures dependable service for Kia Seltos insurance. Find more information about Allstate’s rates in our article titled “Allstate Car Insurance Review.”

Cons

- Higher Premiums for Young Drivers: Despite support programs, young Kia Seltos owners might face higher initial premiums with Allstate.

- Limited Customizability: Compared to others, Allstate offers fewer customization options for Kia Seltos insurance policies.

#5 – USAA: Best for Military Families

Pros

- Military Discounts: Exclusive discounts for Kia Seltos owners who are military personnel or their families. Check out insurance savings for military members and their families in our complete “USAA Car Insurance Review.”

- Superior Customer Support: Recognized for outstanding customer service tailored to the needs of military families with Kia Seltos.

- Exceptional Financial Strength: USAA’s A++ A.M. Best rating provides strong reassurance of reliability and trustworthiness for Kia Seltos insurance.

Cons

- Eligibility Restrictions: USAA services are only available to Kia Seltos owners who are members of the military community.

- Limited Physical Presence: Fewer local agents available for in-person support for Kia Seltos owners, relying more on online and phone services.

#6 – Farmers: Best for Personalized Service

Pros

- Personalized Policies: Farmers allows Kia Seltos owners to customize their policies extensively, ensuring a perfect fit for their needs.

- Dedicated Agents: Personalized service with dedicated agents who understand the specific requirements of Kia Seltos owners. Take a look at our article titled “Farmers Car Insurance Review.”

- Solid Financial Rating: An A rating from A.M. Best ensures that Farmers is a stable and reliable option for Kia Seltos insurance.

Cons

- Higher Cost for Customization: Customized plans for Kia Seltos at Farmers can come at a higher price point compared to standard options.

- Varied Customer Experiences: Some Kia Seltos owners report inconsistency in service quality across different regions.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Coverage Options

Pros

- Extensive Coverage Choices: Liberty Mutual offers a wide range of coverage options, providing comprehensive protection for Kia Seltos.

- Accident Forgiveness: Kia Seltos owners can benefit from programs like accident forgiveness, enhancing value over time. Learn more about this provider in our thorough article titled “Liberty Mutual Car Insurance Review.”

- Strong Global Presence: With an A rating from A.M. Best, Liberty Mutual is well-equipped to handle claims reliably for Kia Seltos owners worldwide.

Cons

- Premium Variability: Some Kia Seltos owners might experience rate increases at renewal, even with a clean driving record.

- Complex Policies: The wide array of options can be overwhelming and may require more time to understand for Kia Seltos owners.

#8 – Nationwide: Best for Bundling Discounts

Pros

- Generous Bundling Options: Nationwide offers substantial bundling discounts that benefit Kia Seltos owners who combine multiple policies.

- Flexible Payment Plans: Nationwide provides a range of payment options, making it easier to manage insurance costs for Kia Seltos owners.

- Strong Financial Stability: With an A+ rating from A.M. Best, Nationwide stands as a reliable insurer for Kia Seltos owners. Explore more discount options in our guide titled “Nationwide Car Insurance Discounts.”

Cons

- Discount Eligibility Criteria: Some Kia Seltos owners might find it challenging to qualify for Nationwide’s most attractive discounts.

- Customer Service Inconsistency: While generally positive, some Kia Seltos owners may experience variability in customer service quality.

#9 – Travelers: Best for Safe Drivers

Pros

- Incentives for Safe Driving: Travelers rewards Kia Seltos owners with significant discounts for maintaining a safe driving record. Read more about Travelers’ ratings in our article titled “Travelers Car Insurance Review.”

- Intuitive Online Tools: Travelers offers robust online tools that help Kia Seltos owners manage their policies and file claims efficiently.

- Excellent Financial Strength: With an A++ rating by A.M. Best, Travelers ensures dependable claims service for Kia Seltos insurance.

Cons

- Higher Rates for High-Risk Drivers: Kia Seltos owners with prior incidents may face higher premiums at Travelers.

- Policy Customization Limits: Although Travelers offers various discounts, some Kia Seltos owners might find the customization options for their policy limited.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Young Drivers

Pros

- Youthful Driver Focus: American Family provides specific programs and discounts designed to assist young Kia Seltos owners. Find out more about American Family in our article titled “American Family Car Insurance Review.”

- Proactive Claims Service: Fast and efficient claims handling ensures that young Kia Seltos owners receive quick support when needed.

- Reliable Financial Standing: With an A rating from A.M. Best, American Family offers solid reliability for Kia Seltos insurance coverage.

Cons

- Premium Sensitivity to Driving Habits: Premiums for Kia Seltos owners at American Family can fluctuate significantly based on driving behavior.

- Limited Availability: American Family’s services for Kia Seltos owners are not available in all states, which may limit options for some drivers.

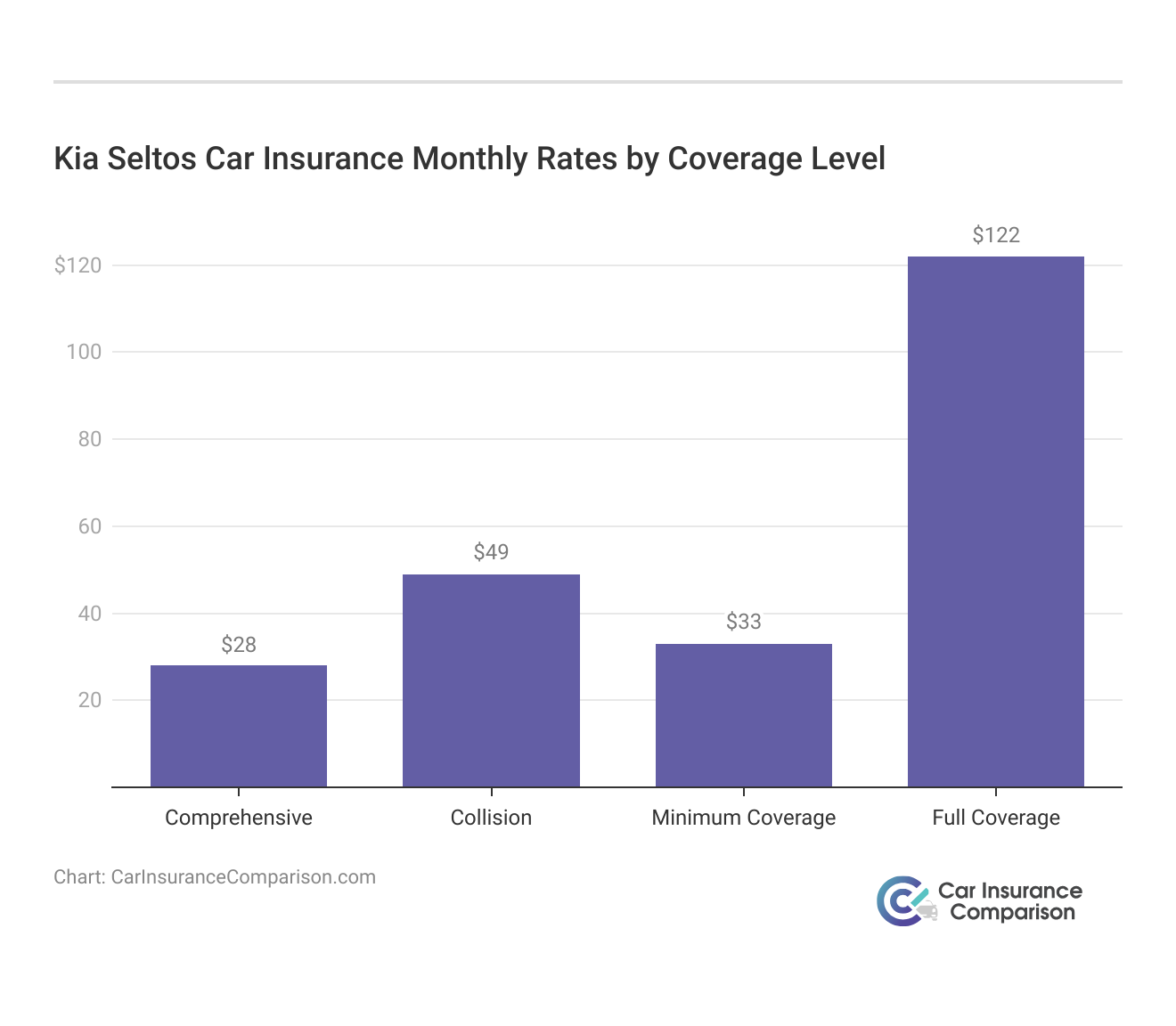

Comparative Monthly Insurance Rates for Kia Seltos

The monthly premiums for Kia Seltos car insurance vary significantly based on the level of coverage and the provider. This overview helps you understand what you might expect to pay for minimum versus full coverage.

Kia Seltos Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $45 $140

American Family $36 $120

Farmers $50 $145

Geico $35 $120

Liberty Mutual $55 $150

Nationwide $35 $125

Progressive $40 $130

State Farm $30 $115

Travelers $48 $135

USAA $32 $110

For Kia Seltos, the cost of minimum coverage ranges from as low as $30 with State Farm to $55 with Liberty Mutual. On the higher end, full coverage can cost from $110 with USAA, known for its competitive rates for military families, to $150 with Liberty Mutual. To see monthly premiums and honest rankings, read our guide titled “How do you get a Liberty Mutual car insurance quote online?”

This table highlights the diversity in pricing among top insurers, allowing Kia Seltos owners to make informed decisions based on their specific needs for protection and budget.

Such variability underscores the importance of comparing rates across different insurers to find the best fit for one’s personal circumstances and coverage requirements.

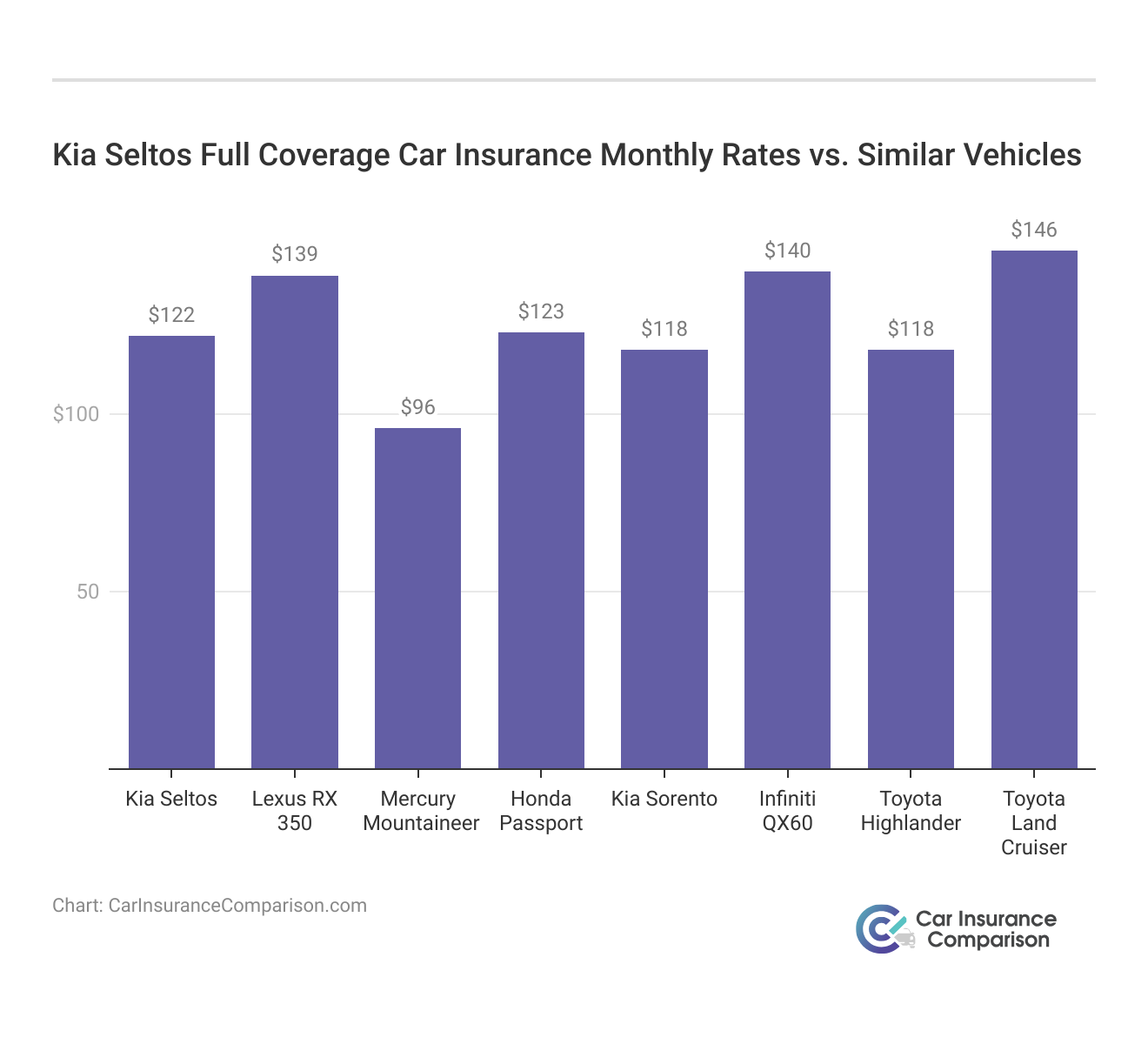

Are Vehicles Like the Kia Seltos Expensive to Insure

Take a look at how insurance rates for similar models to the Kia Seltos look. These insurance rates for other SUVs like the Mitsubishi Outlander, Jeep Cherokee, and Kia Sorento give you a good idea of what to expect.

Insurance rates for the Kia Seltos and similar SUVs like the Jeep Cherokee and Mitsubishi Outlander indicate that coverage costs can vary widely, often reflecting the vehicle’s value and repair costs.

Comparing these rates with other SUVs, such as the Lexus RX 350 and Honda Passport, highlights the importance of shopping around to find the best insurance policy tailored to your specific vehicle and driving needs. See more details on our guide titled “Compare Toyota vs. Honda Car Insurance Rates.”

Kia Seltos Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

Vehicle Comprehensive Collision Minimum Coverage Full Coverage

Kia Seltos $28 $49 $33 $122

Mazda Tribute $16 $28 $33 $87

Mazda CX-9 $29 $47 $31 $120

Chevrolet Traverse $28 $39 $26 $105

Honda Element $16 $26 $38 $94

Jeep Compass $25 $42 $31 $110

Honda Passport $30 $55 $26 $123

Chevrolet Tahoe $28 $44 $31 $117

Mercedes-Benz GLA 250 $31 $60 $38 $143

Ultimately, understanding these variances helps Kia Seltos owners and potential buyers make informed decisions about their insurance investments, ensuring they receive the best possible coverage at a manageable cost.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of Kia Seltos Insurance

Insurance rates for the Kia Seltos are influenced by a variety of factors, making each policy unique to the driver. Key variables affecting the cost include the trim level of the vehicle, the owner’s age, and their specific home address. Additionally, the model year of the Kia Seltos plays a significant role in determining premiums.

Driving history is especially critical, with factors like at-fault accidents potentially raising rates more significantly. These elements combine to determine whether your annual insurance cost will be above or below the average rate for a Kia Seltos. Discover more about offerings in our article titled “Cheap Car Insurance After an At-Fault Accident.”

How much is the Kia Seltos

The starting price for a new Kia Seltos typically averages around $22,490. However, the final cost can vary significantly based on the selected trim level and additional options. The Kia Seltos is available in several trims, each offering varying features and upgrades such as enhanced safety technology, superior comfort elements, or advanced infotainment systems.

With a multi-policy discount of 25%, Geico offers substantial savings for Kia Seltos drivers who bundle their policies.

Michelle Robbins Licensed Insurance Agent

These selections not only personalize your driving experience but also influence the overall pricing. Therefore, when considering the purchase of a Kia Seltos, it’s important to account for the potential costs associated with different configurations to align with your preferences and budget. Access comprehensive insights into our article titled “Does driving less affect car insurance rates?”

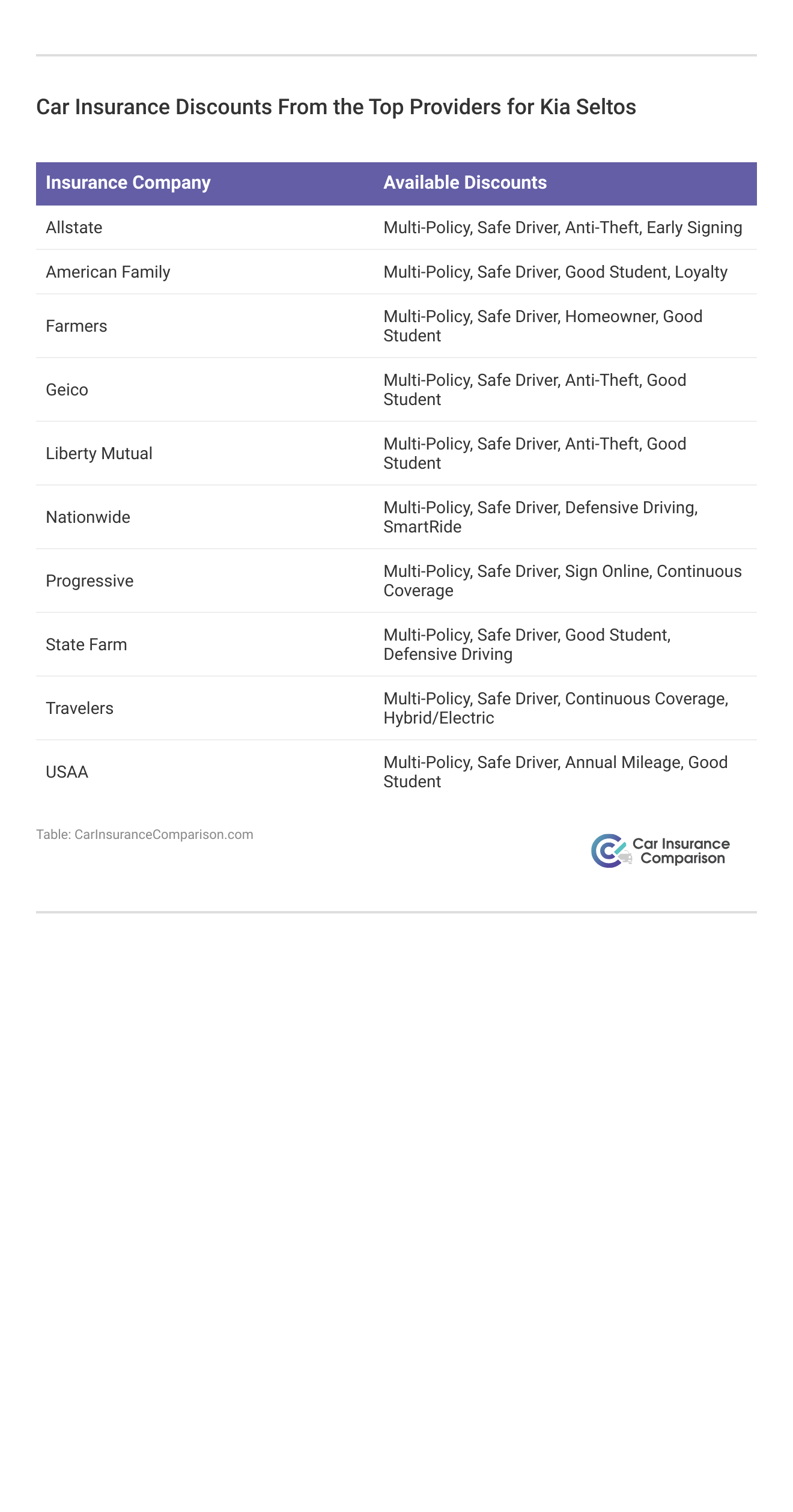

Ways to Save on Kia Seltos Insurance

Save more on your Kia Seltos car insurance rates. Take a look at the following five strategies that will get you the best Kia Seltos auto insurance rates possible.

- Check for organization-based discounts, like alumni or employer discounts.

- Move to the countryside.

- Consider using a tracking device on your Kia Seltos.

- Pay your bills on time — especially Kia Seltos payments and insurance.

- Buy a Kia Seltos with an anti-theft device.

Implementing these strategies can significantly reduce your Kia Seltos insurance costs, ensuring you enjoy both enhanced security and financial savings. Unlock details in our guide titled “Is it safe to buy car insurance online?”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

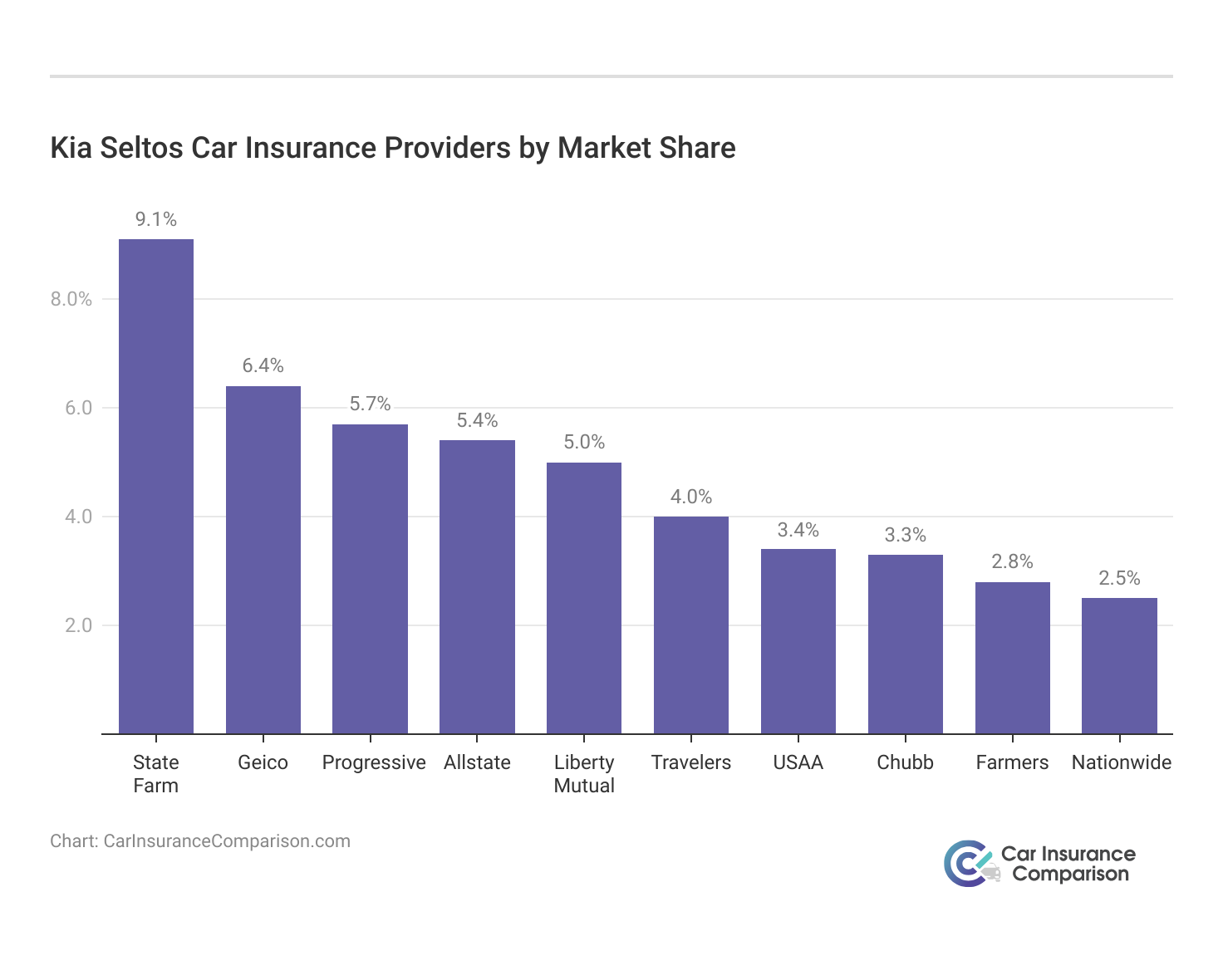

Top Kia Seltos Insurance Companies

What is the best company for affordable Kia Seltos insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Kia Seltos insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features found on the Kia Seltos.

Choosing the right insurer for your Kia Seltos involves considering both market share and the specific discounts offered by these top companies.

Top Kia Seltos Car Insurance Providers by Market Share

Rank Insurance Company Premiums Written Market Share

#1 State Farm $66,153,063 9%

#2 Geico $46,358,896 6%

#3 Progressive $41,737,283 6%

#4 Allstate $39,210,020 5%

#5 Liberty Mutual $36,172,570 5%

#6 Travelers $28,786,741 4%

#7 USAA $24,621,246 3%

#8 Chubb $24,199,582 3%

#9 Farmers $20,083,339 3%

#10 Nationwide $18,499,967 3%

Comparing Free Kia Seltos Insurance Quotes Online

When shopping for Kia Seltos car insurance, using online comparison tools is crucial for finding affordable and comprehensive coverage. These tools help you quickly collect and compare quotes from multiple insurers, allowing you to see differences in premiums and coverage levels side-by-side. Delve into our evaluation of our guide titled “How To Combine Car Insurance Coverage With the Right Deductible.”

By entering basic information about your Kia Seltos, such as the model year and any safety features it may have, along with your driving history and location, these tools can provide accurate estimates tailored to your specific needs. Moreover, comparing online is convenient, allowing you to explore options from the comfort of your home without the need to visit multiple agencies or spend time on the phone.

This proactive approach ensures that you get a competitive rate and the best possible protection for your Kia Seltos, ultimately saving you money and providing peace of mind.

Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

Frequently Asked Questions

How much does car insurance cost for a Kia Seltos?

The cost of car insurance for a Kia Seltos can vary based on several factors. These include your location, driving history, age, gender, credit score, coverage options, and the insurance company you choose. To get an accurate estimate, it’s recommended to request quotes from different insurance providers and compare their rates and coverage options.

Access comprehensive insights into our guide titled “Best Car Insurance for New Drivers Over 21.”

What are the common coverage options for Kia Seltos Car Insurance?

Kia Seltos car insurance typically includes liability coverage for accident-related damages, collision coverage for vehicle repairs, and comprehensive coverage for non-collision damages like theft or weather. Additionally, uninsured motorist coverage protects against accidents with underinsured drivers, while medical payments coverage helps with medical expenses after an accident, regardless of fault.

What factors can affect the cost of Kia Seltos Car Insurance?

The cost of Kia Seltos car insurance is influenced by factors such as the driver’s age and experience, driving record, and location. Premiums also vary with the level of coverage and deductibles selected, and installing safety features in the vehicle can reduce rates.

Are there any discounts available for Kia Seltos Car Insurance?

Insurance providers offer various discounts that can lower Kia Seltos car insurance costs, such as multi-policy, good driver, and safety feature discounts. Additionally, good student and loyalty discounts are also available.

Learn more by reading our guide titled “Multiple Policy Car Insurance Discounts.”

How can I find affordable Kia Seltos car insurance?

To secure affordable Kia Seltos car insurance, compare quotes from different insurers, consider higher deductibles to reduce premiums, maintain a clean driving record, and explore available discounts. Regularly review and adjust your coverage to avoid paying for unnecessary features.

Is Kia Seltos expensive to insure?

Kia Seltos insurance costs vary but are generally moderate compared to other SUVs, depending on factors like location, driving history, and chosen coverage levels.

Why is my Kia insurance so high?

Your Kia insurance may be high due to factors such as a poor driving record, high claims rates in your area, younger driver age, or higher coverage options.

To learn more, explore our comprehensive resource on “Best Car Insurance Rates for Young Drivers With Points.”

How can I lower my Kia Seltos car insurance rate?

Lower your Kia Seltos car insurance rate by qualifying for discounts, increasing deductibles, maintaining a clean driving record, and regularly comparing insurance quotes.

What Kia models are uninsurable?

No Kia models are inherently uninsurable; however, models with high theft rates, poor safety records, or extensive modifications might face insurance challenges.

Who typically has the cheapest Kia Seltos insurance?

Typically, companies like Geico and State Farm offer the cheapest Kia Seltos insurance, depending on your location and eligibility for discounts.

Avoid overpaying for your car insurance by entering your ZIP code below in our free comparison tool to find which company has the lowest rates.

What color cars are more expensive to insure for Kia Seltos?

Car color generally does not impact insurance costs for a Kia Seltos; rates are more influenced by safety features, model, and driver history.

Does Kia Seltos insurance go down after paying off a car?

Paying off a Kia Seltos might not directly lower insurance rates, but you could reduce coverage that lenders require, like collision or comprehensive, thus decreasing costs.

Is Allstate cheaper than Geico for Kia Seltos?

Whether Allstate or Geico is cheaper for Kia Seltos insurance can vary by individual circumstances; comparing quotes is the best way to determine the cheaper option for you.

To find out more, explore our guide titled “Geico vs. Allstate Car Insurance Comparison.”

What state has the worst Kia Seltos insurance rates?

States like Michigan and Louisiana typically have higher Kia Seltos insurance rates due to high accident rates, insurance fraud, and state-specific insurance laws.

Which insurance is best for a Kia Seltos car after 5 years?

After 5 years, companies offering competitive renewal discounts and maintaining strong customer service ratings, like USAA or State Farm, might be best for Kia Seltos insurance.

At what age is Kia Seltos car insurance cheapest?

Kia Seltos car insurance is usually cheapest for drivers in their 50s and 60s, as they are considered less risky due to more driving experience and typically fewer claims.

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.