Best Kia AMAnti Car Insurance in 2025 (Find the Top 10 Companies Here)

The best Kia AMAnti car insurance providers are State Farm, Geico, and USAA, offering rates starting at $35 per month. These companies stand out for their competitive pricing and comprehensive coverage. State Farm excels in customer support, Geico offers low premiums, and USAA provides specialized benefits for Kia AMAnti owners.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Kia Amanti

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Kia Amanti

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Kia Amanti

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

The best Kia AMAnti car insurance providers are State Farm, Geico, and USAA, with rates starting as low as $35 per month. State Farm offers the top pick overall due to its exceptional customer service and comprehensive coverage.

You’ll be able to buy your new Kia Amanti with confidence. For more information, read our article titled “Buying Car Insurance for Your New Car.”

Our Top 10 Company Picks: Best Kia Amanti Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 15% A++ Affordable Rates Geico

#3 10% A++ Military Savings USAA

#4 10% A+ New Drivers Allstate

#5 12% A+ Custom Policies Progressive

#6 12% A+ Bundling Discounts Nationwide

#7 10% A Personalized Service Farmers

#8 10% A Customizable Plans Liberty Mutual

#9 15% A Young Drivers American Family

#10 10% A++ Coverage Options Travelers

Read on to learn all about the Kia Amanti including MSRP, safety features and crash test ratings, and more. To see fast, free Kia Amanti insurance quotes right now, just enter your ZIP code above.

- Crash test ratings have an impact on Kia Amanti auto insurance rates

- Safety features of the Kia Amanti can earn you a car insurance discount

- The cost of insurance for a Kia Amanti depends on the trim level

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Competitive Pricing: State Farm offers a monthly premium starting at $120 for Kia Amanti coverage, which is reasonably priced compared to competitors. This cost-effective option makes State Farm a solid choice for Kia Amanti owners seeking affordable coverage. More information about their rates in our State Farm car insurance review.

- Extensive Coverage Options: With State Farm, Kia Amanti drivers can access a broad range of coverage options, including comprehensive and collision coverage. This ensures that you can customize your policy to fit your specific needs and protect your vehicle effectively.

- Wide Availability: State Farm provides coverage for Kia Amanti vehicles across various locations, making it accessible for many drivers. This widespread availability ensures that you can obtain insurance coverage no matter where you reside.

Cons

- Limited Discounts for Kia Amanti: State Farm does not offer extensive discounts specifically tailored for Kia Amanti vehicles. While they provide some standard discounts, there are fewer opportunities for savings based on the unique aspects of the Kia Amanti.

- Potentially Higher Rates for High-Risk Drivers: Kia Amanti owners with a history of accidents or traffic violations might face higher premiums with State Farm. This can make insurance more expensive for drivers considered high-risk, affecting overall affordability.

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Premiums: Geico offers competitive rates starting at $115 per month for Kia Amanti insurance. This makes Geico an excellent choice for budget-conscious Kia Amanti owners looking to minimize their monthly insurance costs. Learn more in our Geico car insurance review.

- Comprehensive Discounts: Geico provides various discounts that can lower premiums for Kia Amanti drivers. Discounts include those for safe driving, multiple policies, and vehicle safety features, allowing you to save more on your Kia Amanti insurance.

- User-Friendly Online Tools: Geico offers a range of online tools that make managing your Kia Amanti insurance policy easy. From quoting to claims management, their user-friendly interface simplifies the process for policyholders.

Cons

- Limited Coverage Customization: While Geico offers affordable rates, there may be limitations in customizing coverage specifically for Kia Amanti vehicles. This can restrict the options available for tailoring your policy to meet unique needs.

- Customer Service Challenges: Geico’s customer service has received mixed reviews, which may impact Kia Amanti owners who require frequent support. Some users report difficulties with getting timely assistance or resolving issues efficiently.

#3 – USAA: Best for Military Savings

Pros

- Specialized Benefits for Kia Amanti: USAA provides specialized benefits for Kia Amanti owners, such as tailored coverage options and discounts based on military affiliation. These benefits enhance the overall value of insurance for Kia Amanti drivers.

- Low Premiums: USAA offers some of the lowest premiums starting at $110 per month for Kia Amanti insurance. This competitive pricing makes it an attractive option for those seeking cost-effective coverage for their Kia Amanti. Learn more in our USAA car insurance review.

- High-Quality Customer Service: USAA is renowned for its exceptional customer service, providing comprehensive support and assistance to Kia Amanti owners. This high level of service ensures that policyholders receive prompt and effective help when needed.

Cons

- Eligibility Restrictions: USAA insurance is only available to military members and their families. This restriction means that Kia Amanti owners outside of this group cannot benefit from USAA’s competitive rates and specialized coverage.

- Limited Local Agents: USAA operates primarily online, which can limit access to local agents for Kia Amanti owners who prefer face-to-face interactions. This may affect those who value in-person customer service and support.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for New Drivers

Pros

- Comprehensive Coverage Options: Allstate offers a wide range of coverage options for Kia Amanti owners, including accident forgiveness and roadside assistance. This extensive coverage ensures that all aspects of your Kia Amanti are protected.

- Multiple Discounts Available: As mentioned in our Allstate car insurance review, Allstate provides various discounts that can reduce premiums for Kia Amanti drivers. These include discounts for safe driving, anti-theft devices, and bundling multiple policies.

- Robust Claims Support: Allstate is known for its efficient claims processing and support, offering Kia Amanti owners reliable assistance in the event of a claim. This robust support system helps streamline the claims process.

Cons

- Higher Premiums: Allstate’s premiums start at $135 per month for Kia Amanti coverage, which is higher compared to other providers. This can make it a less economical option for budget-conscious Kia Amanti owners.

- Mixed Customer Reviews: Allstate has received mixed feedback regarding customer service, which may affect Kia Amanti owners who encounter issues or require assistance. Some users report dissatisfaction with service quality and resolution times.

#5 – Progressive: Best for Custom Policies

Pros

- Competitive Rates: Progressive offers Kia Amanti insurance at competitive rates starting at $130 per month. This makes it a viable option for drivers looking to save on insurance costs while maintaining adequate coverage.

- Flexible Coverage Options: Progressive provides flexible coverage options for Kia Amanti owners, allowing customization based on individual needs. This flexibility helps ensure that your insurance policy aligns with your specific requirements.

- Bundling Discounts: Progressive offers bundling discounts that can lower premiums for Kia Amanti drivers who combine their auto insurance with other policies, such as home or renters insurance. Learn more details in our Progressive car insurance review.

Cons

- Higher Rates for Younger Drivers: Progressive’s rates may be higher for younger drivers with a Kia Amanti, which could impact overall affordability. Younger drivers may face elevated premiums due to their risk profile.

- Limited Local Agent Availability: Progressive’s focus on online services means that some Kia Amanti owners may have limited access to local agents. This can be a drawback for those who prefer in-person interactions and personalized service.

#6 – Nationwide: Best for Bundling Discounts

Pros

- Comprehensive Coverage Choices: Nationwide provides a broad range of coverage options for Kia Amanti owners, including customizable policies and add-ons. This ensures that you can tailor your insurance to suit your specific needs.

- Discount Opportunities: Nationwide offers several discounts that can reduce premiums for Kia Amanti drivers. These discounts include safe driver perks, multi-policy savings, and discounts for vehicle safety features. Check out their ratings in our complete Nationwide car insurance discount.

- Reliable Claims Service: Nationwide is known for its reliable claims service, offering Kia Amanti owners efficient and supportive claims processing. This reliability helps ensure that claims are handled promptly and effectively.

Cons

- Premiums Can Be Higher: Nationwide’s premiums start at $128 per month for Kia Amanti coverage, which can be higher compared to some competitors. This might make it less appealing for cost-conscious Kia Amanti owners.

- Customer Service Variability: Nationwide has received varied reviews regarding customer service, which could affect Kia Amanti owners who need frequent support. Some customers report inconsistent experiences with service quality.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Personalized Service

Pros

- Broad Coverage Options: Farmers offers a range of coverage options for Kia Amanti owners, including comprehensive and collision coverage. This allows for a customizable insurance policy that meets the specific needs of Kia Amanti drivers. Learn more in our Farmers car insurance review.

- Discount Programs: Farmers provides multiple discount opportunities for Kia Amanti drivers, such as discounts for safe driving, anti-theft devices, and bundling policies. These discounts can help lower insurance premiums.

- Flexible Payment Plans: Farmers offers flexible payment plans, allowing Kia Amanti owners to choose payment schedules that best fit their financial situation. This flexibility helps manage insurance costs more effectively.

Cons

- Higher Premiums: Farmers’ premiums start at $125 per month for Kia Amanti coverage, which may be higher compared to some other insurers. This can affect affordability for those looking for lower insurance costs.

- Customer Service Issues: Some Kia Amanti owners have reported issues with Farmers’ customer service, including delays and difficulty resolving claims. This may impact overall satisfaction with the insurance provider.

#8 – Liberty Mutual: Best for Customizable Plans

Pros

- Extensive Coverage Options: Liberty Mutual offers a wide range of coverage options for Kia Amanti owners, including various add-ons and customization possibilities. This comprehensive approach ensures that all aspects of the Kia Amanti are covered.

- Discount Opportunities: Liberty Mutual provides various discounts, such as those for safe driving and vehicle safety features, which can help lower premiums for Kia Amanti drivers. These discounts can contribute to overall savings.

- Personalized Coverage: Liberty Mutual offers personalized coverage options for Kia Amanti drivers, allowing for adjustments based on individual needs and preferences. This customization helps ensure the policy fits your specific requirements. Learn more in our Liberty Mutual car insurance review.

Cons

- Higher Premiums: Liberty Mutual’s premiums start at $140 per month for Kia Amanti coverage, which is on the higher end compared to other insurers. This can make it a less economical choice for those seeking lower insurance costs.

- Mixed Reviews on Claims Processing: Liberty Mutual has received mixed reviews regarding claims processing, which could impact Kia Amanti owners who need to file claims. Some users report delays and issues with the efficiency of the claims process.

#9 – American Family: Best for Young Drivers

Pros

- Competitive Coverage Options: American Family provides a variety of coverage options for Kia Amanti owners, including comprehensive and collision coverage. This range of options ensures that you can find a policy that meets your specific needs. More information in our American Family car insurance review.

- Discounts for Vehicle Safety Features: American Family offers discounts for Kia Amanti vehicles equipped with advanced safety features. These discounts can reduce premiums and help make coverage more affordable.

- Flexible Policy Customization: American Family allows for flexible policy customization, enabling Kia Amanti drivers to tailor their insurance coverage according to personal preferences and requirements. This flexibility ensures a more personalized insurance experience.

Cons

- Premiums May Be Higher: American Family’s premiums start at $127 per month for Kia Amanti coverage, which may be higher compared to some other insurance providers. This could impact affordability for budget-conscious drivers.

- Customer Service Inconsistencies: Some Kia Amanti owners have reported inconsistencies in customer service with American Family, including delays in response times and challenges in resolving issues. This can affect overall satisfaction with the insurance provider.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Coverage Options

Pros

- Affordable Coverage Rates: Travelers offers competitive rates starting at $122 per month for Kia Amanti insurance. This affordability makes it a strong option for drivers looking to save on their insurance premiums while maintaining comprehensive coverage.

- Wide Range of Coverage Options: Travelers provides a broad array of coverage options for Kia Amanti owners, including customizable policies to fit individual needs. This ensures that you can get the right protection for your vehicle.

- Discount Opportunities: Travelers offers various discounts that can help reduce premiums for Kia Amanti drivers, such as safe driver discounts and multi-policy savings. These discounts contribute to overall cost savings. See more details on our Travelers car insurance review.

Cons

- Potential for Higher Rates in Certain Areas: Travelers’ premiums may be higher in specific regions or for certain demographics, which could affect the overall cost of Kia Amanti insurance. This variability can impact affordability for some drivers.

- Mixed Customer Service Feedback: Travelers has received mixed reviews regarding customer service, which may impact Kia Amanti owners who require frequent support. Some users report dissatisfaction with service quality and claim resolution times.

Cost of Insuring Your Kia Amanti Insurance

If you’re looking to buy a Kia Amanti, you will want to know the details first. We’ve put together information on insurance for the Kia Amanti to help you get an idea of costs. We’ve also gathered other cost information, including how much a Kia Amanti will run you.

Kia Amanti Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $55 $135

American Family $49 $127

Farmers $48 $125

Geico $40 $115

Liberty Mutual $60 $140

Nationwide $52 $128

Progressive $50 $130

State Farm $45 $120

Travelers $47 $122

USAA $35 $110

Take a look at how insurance rates for similar models to the Kia Amanti look. These insurance rates for other sedans like the Chevrolet Caprice, Chevrolet Cobalt, and Audi 80 give you a good idea of what to expect.

Kia Amanti Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Liability | Collision | Comprehensive | Full Coverage |

|---|---|---|---|---|

| Chevrolet Express | $29 | $42 | $28 | $108 |

| Chrysler Pacifica | $26 | $44 | $29 | $111 |

| Dodge Grand Caravan | $31 | $37 | $26 | $106 |

| Honda Odyssey | $31 | $44 | $23 | $112 |

| Kia Amanti | $26 | $37 | $24 | $100 |

| Toyota Sienna | $31 | $44 | $25 | $113 |

To give you a broader perspective on how insurance rates for the Kia Amanti compare to similar vehicles, This table outlines the insurance costs for a selection of comparable cars. This includes comprehensive, collision, and liability coverage rates, as well as the total cost of full coverage.

State Farm offers the top pick overall due to its exceptional customer service and comprehensive coverage.

Brad Larson LICENSED INSURANCE AGENT

Understanding these comparisons can help you assess where the Kia Amanti stands in relation to other vehicles in its category. Gain deeper insights by exploring our “Average Car Insurance Rates by Age and Gender.”

Best Kia Amanti Providers

Several insurance companies offer competitive rates for the Kia Amanti based on factors like discounts for safety features. Take a look at these top car insurance companies that are popular with Kia Amanti drivers organized by market share.

Top Kia Amanti Car Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9% |

| #2 | Geico | $46.3 million | 6% |

| #3 | Progressive | $41.7 million | 5% |

| #4 | Allstate | $39.2 million | 5% |

| #5 | Liberty Mutual | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3% |

| #8 | Chubb | $24.1 million | 3% |

| #9 | Farmers | $20 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

This overview of the largest auto insurers by market share provides insight into the major players in the insurance industry. Save money by comparing Kia Amanti insurance rates with free quotes online now.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

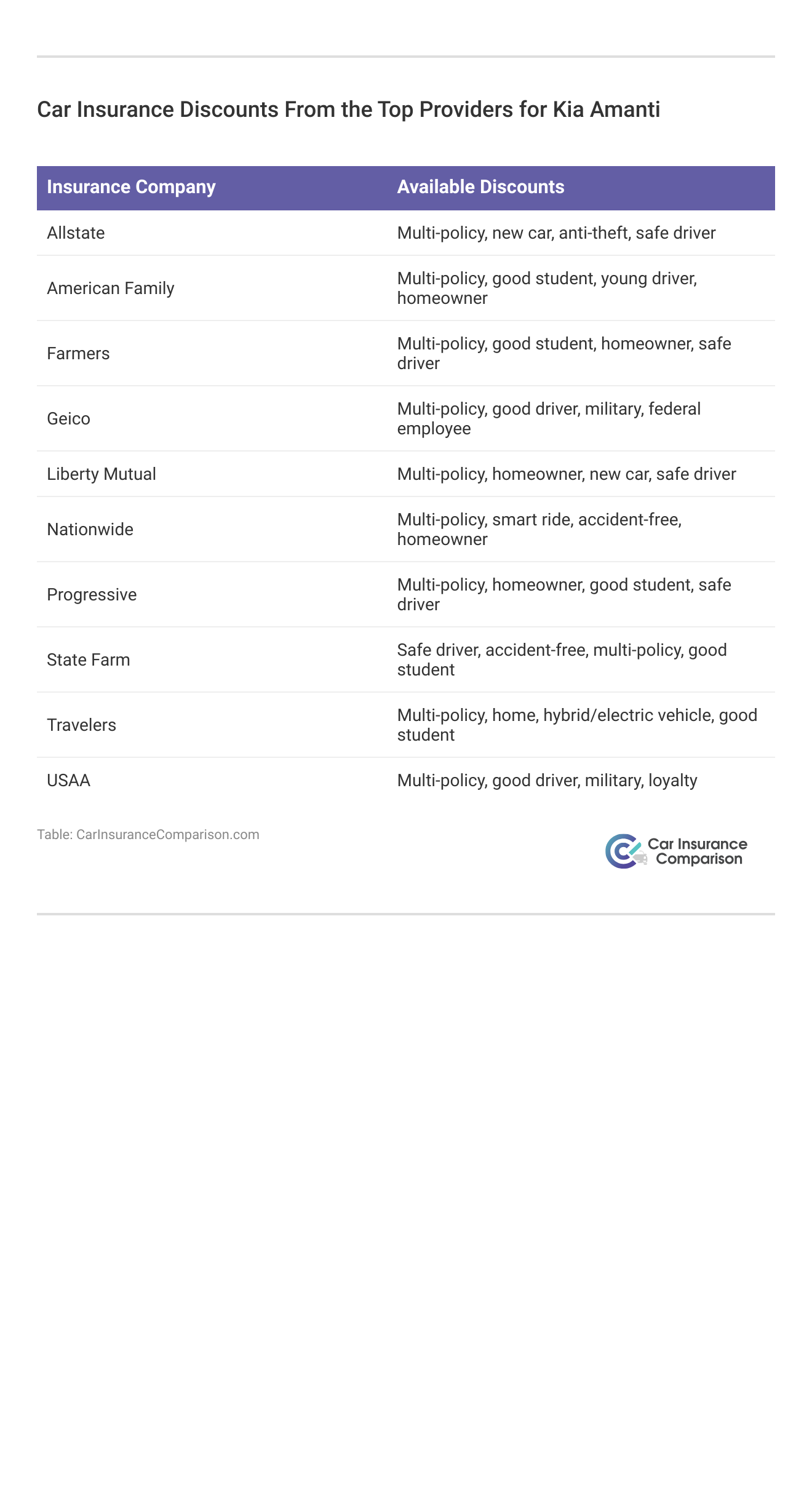

Kia Amanti Costs Reducing Tips

Explore the available discounts from different insurance providers, you can find ways to reduce your Kia Amanti insurance premiums. If you want to reduce the cost of your Kia Amanti car insurance rates, follow these five strategies below:

- If you’re recently married, ask about discounts.

- Check for organization-based discounts, like alumni or employer discounts.

- Audit your Kia Amanti driving when you move to a new location or start a new job.

- Use an accurate job title when requesting Kia Amanti auto insurance.

- Ask for a new Kia Amanti auto insurance rate based on your improved credit score.

Reducing your car insurance premiums for the Kia Amanti can be achieved through various discounts offered by insurance providers as well as following the five strategies mentioned above.

Understanding these discounts can help you lower your insurance costs effectively. This table outlines the discounts available from top insurers, including multi-policy discounts, safe driver perks, and more.

Be sure to check with your insurer to ensure you’re taking advantage of all applicable discounts to maximize your savings for your Kia Amanti Car Insurance. Dive deeper into “Safe Driver Car Insurance Discounts” with our complete resource.

Kia Amanti What Influences the Cost

As with any car, your Kia Amanti car insurance costs will be affected by personal factors like where you live, your driving record, and your driving habits.

The Kia Amanti trim level you buy will also have an impact on the total price you will pay for Kia Amanti insurance coverage. Learn more by visiting our detailed “Understanding Your Car Insurance Policy” section.

Frequently Asked Questions

How can I compare car insurance rates for a Kia Amanti?

To compare car insurance rates for a Kia Amanti, you should start by gathering quotes from multiple insurance companies. Use online comparison tools by entering your ZIP code to receive personalized quotes. Read up on the “How do you get competitive quotes for car insurance?” for more information.

What factors can influence car insurance rates for a Kia Amanti?

Several factors can influence car insurance rates for a Kia Amanti. These include your driving history, the amount of coverage you choose, your location, and the specific trim level of your Kia Amanti. Additionally, factors such as your age, credit score, and annual mileage can also impact your insurance rates.

Are there any discounts available to reduce car insurance rates for a Kia Amanti?

Yes, there are various discounts that might be available to reduce car insurance rates for a Kia Amanti. Common discounts include those for having safety features on your vehicle, maintaining a clean driving record, bundling multiple insurance policies, and completing defensive driving courses.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Do car insurance rates vary among insurance companies for a Kia Amanti?

Car insurance rates can vary significantly among different insurance companies for a Kia Amanti. Each insurer uses its own criteria to assess risk and set rates, which means that comparing quotes from multiple companies is essential to finding the most affordable and suitable coverage for your vehicle.

Can I change my car insurance policy for a Kia Amanti if I find a better rate?

Yes, you can change your car insurance policy for a Kia Amanti if you find a better rate with another insurer. However, it’s important to review the terms of your current policy and understand any potential cancellation fees or penalties before making the switch.

Read More: Can I change my car insurance company mid-policy?

What is the average cost of car insurance for a Kia Amanti?

The average cost of car insurance for a Kia Amanti can vary widely based on several factors, including your location, driving record, and the level of coverage you choose. Typically, you can expect to see variations in cost from one insurer to another, so it’s beneficial to compare quotes to get an accurate estimate.

How does the trim level of my Kia Amanti affect insurance rates?

The trim level of your Kia Amanti can affect insurance rates because different trims may have varying levels of safety features and repair costs. Higher trims with more advanced features might qualify for discounts, but they could also be more expensive to repair or replace, influencing overall insurance costs.

Can installing additional safety features lower my insurance rates for a Kia Amanti?

Yes, installing additional safety features on your Kia Amanti can potentially lower your insurance rates. Features such as anti-theft systems, advanced driver-assistance systems, and upgraded safety packages can qualify you for discounts with some insurance companies.

Read More: Safety Features Car Insurance Discounts

What should I look for when choosing car insurance for my Kia Amanti?

When choosing car insurance for your Kia Amanti, consider factors such as coverage options, deductible amounts, customer service reviews, and the insurer’s financial stability. Ensure that the policy provides adequate coverage for your needs and offers competitive rates.

How often should I review my Kia Amanti insurance policy?

It’s a good practice to review your Kia Amanti insurance policy at least once a year or whenever significant changes occur, such as a move, a change in driving habits, or a modification to your vehicle. Regular reviews help ensure that your coverage remains appropriate and that you’re taking advantage of any new discounts or changes in rates.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.