Best Jeep Compass Car Insurance in 2025 (See the Top 10 Companies Here!)

Progressive, Geico, and USAA are leading the market with the best Jeep Compass car insurance options available. Offering competitive rates starting at $62/month, these providers excel in customer service, innovative programs, and comprehensive coverage, ensuring Jeep Compass owners receive the best value.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Jan 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Jeep Compass

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Jeep Compass

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Jeep Compass

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

The best Jeep Compass car insurance is offered by Progressive, Geico, and USAA, also offering competitive rates and exceptional comprehensive car insurance coverage options.

These companies stand out for their innovative programs, customer service excellence, and tailored discounts, ensuring Jeep Compass owners receive optimal value, with minimum coverage rates starting at $62.

Our Top 10 Company Picks: Best Jeep Compass Car Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A+ | Innovative Programs | Progressive | |

| #2 | 25% | A++ | Competitive Rates | Geico | |

| #3 | 15% | A++ | Customer Service | USAA | |

| #4 | 20% | B | Reliable Claims | State Farm | |

| #5 | 10% | A | Customizable Policies | Liberty Mutual |

| #6 | 10% | A+ | Vanishing Deductible | Nationwide |

| #7 | 10% | A+ | Comprehensive Coverage | Allstate | |

| #8 | 8% | A++ | Extensive Coverage | Travelers | |

| #9 | 10% | A+ | Local Agents | Farmers | |

| #10 | 11% | A+ | Dividend Policies | Amica |

Compares safety features, driving record impact, and regional differences to help you choose the best insurance for your Jeep Compass. Explore each provider’s benefits to find optimal coverage and cost-effectiveness for your vehicle.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- Progressive leads for Jeep Compass car insurance start at $62/month

- Jeep Compass car insurance offers comprehensive coverage and discounts

- Safety features and driving record impact Jeep Compass car insurance rates

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

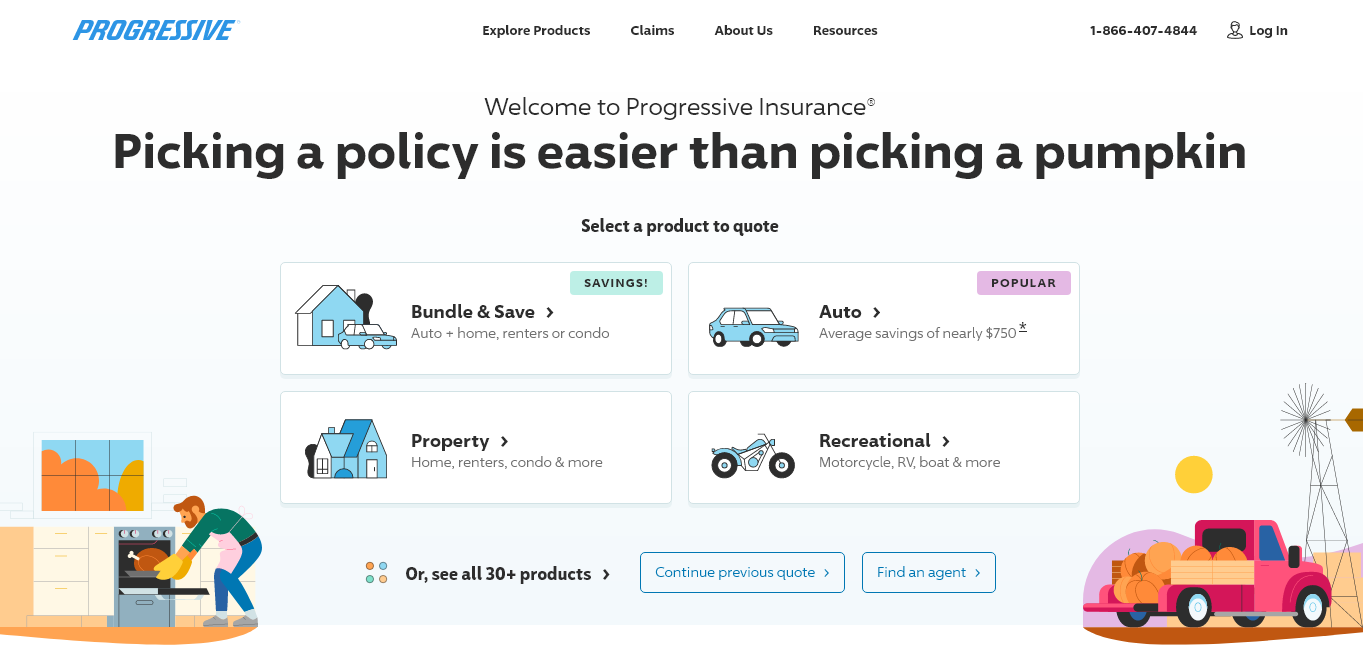

#1 – Progressive: Top Overall Pick

Pros

- Affordable Rates: Progressive offers some of the most competitive rates for Jeep Compass car insurance.

- Extensive Coverage: Comprehensive coverage options specifically designed for Jeep Compass car insurance.

- Unique Discounts: Discover our Progressive car insurance review for various innovative discounts for Jeep Compass car insurance.

Cons

- High-Risk Driver Rates: Higher premiums for Jeep Compass car insurance for high-risk drivers.

- Limited In-Person Support: Fewer local agents available for personalized Jeep Compass car insurance assistance.

#2 – Geico: Best for Competitive Rates

Pros

- Low Rates: View our Geico car insurance review to learn about the lowest rates available for Jeep Compass car insurance.

- Diverse Coverage Options: A variety of coverage plans tailored to Jeep Compass car insurance needs.

- Multiple Discounts: Geico provides extensive discount opportunities for Jeep Compass car insurance, such as safe driver and multi-policy discounts.

Cons

- Higher Rates for Young Drivers: Younger drivers may face higher premiums for Jeep Compass car insurance.

- Limited Specialized Programs: Fewer specialized programs for Jeep Compass car insurance compared to some competitors.

#3 – USAA: Best for Customer Service

Pros

- Exceptional Customer Service: USAA is known for its top-notch customer service for Jeep Compass car insurance.

- Competitive Rates: Offers competitive rates for Jeep Compass car insurance, especially for military families.

- Comprehensive Coverage: Explore our USAA car insurance review for extensive coverage options designed for Jeep Compass car insurance needs.

Cons

- Limited Availability: USAA has fewer physical locations for in-person Jeep Compass car insurance assistance.

- Premiums for Non-Military: Higher premiums for Jeep Compass car insurance for non-military members.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Reliable Claims

Pros

- Reliable Claims Process: In our State Farm car insurance review, we highlight the dependable claims process for Jeep Compass car insurance.

- Wide Network of Agents: Extensive network of local agents for personalized Jeep Compass car insurance assistance.

- Comprehensive Coverage Options: Offers a variety of coverage options tailored to Jeep Compass car insurance needs.

Cons

- Limited Discounts: Fewer discounts available for Jeep Compass car insurance compared to some competitors.

- Rates for High-Risk Drivers: Higher premiums for Jeep Compass car insurance for drivers with poor records.

#5 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Within our Liberty Mutual car insurance review, find out about highly customizable Jeep Compass car insurance policies.

- Exclusive Discounts: Provides unique discount options for Jeep Compass car insurance, including bundling and safety features.

- Comprehensive Coverage: Wide range of coverage options tailored to Jeep Compass car insurance needs.

Cons

- Mixed Customer Service Reviews: Customer service experiences for Jeep Compass car insurance can be inconsistent.

- Online Focus: Limited in-person support for Jeep Compass car insurance, focusing more on online services.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Unique vanishing deductible feature for Jeep Compass car insurance.

- Comprehensive Coverage Options: Offers a broad range of coverage options for Jeep Compass car insurance.

- Multiple Discounts: See our Nationwide car insurance discount options, including multi-policy and safe driver discounts for Jeep Compass car insurance.

Cons

- Customer Service Variability: Inconsistent customer service experiences for Jeep Compass car insurance.

- Limited Local Agents: Fewer local agents available for in-person Jeep Compass car insurance support.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Allstate: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Allstate provides a wide range of comprehensive coverage options for Jeep Compass car insurance.

- Strong Financial Stability: According to our Allstate car insurance review, the company is known for its financial strength and reliability in Jeep Compass car insurance.

- Exclusive Discounts: Offers various discounts tailored to Jeep Compass car insurance, such as multi-policy and safe driver discounts.

Cons

- Mixed Customer Service Reviews: Customer service experiences can be inconsistent for Jeep Compass car insurance.

- Limited Specialized Programs: Fewer specialized programs for Jeep Compass car insurance.

#8 – Travelers: Best for Extensive Coverage

Pros

- Comprehensive Coverage Options: Travelers offers extensive coverage options for Jeep Compass car insurance.

- Wide Range of Discounts: Multiple discount opportunities for Jeep Compass car insurance, including safe driver and multi-policy discounts.

- Strong Financial Ratings: Based on our Travelers car insurance review, the company is highly regarded for its financial stability and reliability in Jeep Compass car insurance.

Cons

- Limited Local Agents: Fewer local agents available for personalized Jeep Compass car insurance support.

- Customer Service Variability: Inconsistent customer service experiences for Jeep Compass car insurance.

#9 – Farmers: Best for Local Agents

Pros

- Extensive Agent Network: Delve into our Farmers car insurance review to discover a wide network of local agents for Jeep Compass car insurance.

- Comprehensive Coverage: Offers a variety of coverage options tailored to Jeep Compass car insurance needs.

- Good Discounts: Provides multiple discount opportunities for Jeep Compass car insurance, including safe driver and multi-policy discounts.

Cons

- Inconsistent Customer Service: Customer service experiences can vary for Jeep Compass car insurance.

- Limited Online Services: More focus on in-person services, with limited online support for Jeep Compass car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Amica: Best for Dividend Policies

Pros

- Dividend Policies: Amica offers dividend policies for Jeep Compass car insurance, potentially lowering costs.

- Excellent Customer Service: Known for exceptional customer service for Jeep Compass car insurance.

- Comprehensive Coverage: Provides extensive coverage options tailored to Jeep Compass car insurance. For more details, search “How do you get an Amica mutual car insurance quote online?“.

Cons

- Limited Discounts: Fewer discount opportunities for Jeep Compass car insurance.

- Fewer Local Agents: Limited availability of local agents for personalized Jeep Compass car insurance assistance.

Exploring Monthly Insurance Rates and Discounts for Jeep Compass Owners

Choosing the right insurance for your Jeep Compass involves comparing monthly rates from various providers and identifying discounts for Jeep Compass owners. Use this information to secure optimal coverage and cost-effectiveness. See our guide “Compare Car Insurance by Coverage Type” for detailed analysis.

Jeep Compass Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $73 | $155 |

| Amica | $67 | $145 |

| Farmers | $74 | $155 |

| Geico | $68 | $145 |

| Liberty Mutual | $75 | $160 |

| Nationwide | $70 | $150 |

| Progressive | $70 | $150 |

| State Farm | $72 | $155 |

| Travelers | $71 | $148 |

| USAA | $62 | $140 |

The table presents the monthly insurance rates for a Jeep Compass, with USAA offering the lowest rates at $62 for minimum coverage and $140 for full coverage. Liberty Mutual has the highest rates at $75 for minimum coverage and $160 for full coverage. Other providers, such as Geico and Allstate, offer competitive rates in between these extremes, providing various options based on your coverage needs.

Car insurance discounts from top providers like Allstate, Geico, and State Farm include multi-car policies, safe driver incentives, and good student discounts. These savings opportunities can lower your insurance costs while ensuring comprehensive coverage tailored to your needs. By exploring the provided rates and discounts, Jeep Compass owners can secure the best insurance coverage and optimize their costs.

Jeep Compass Car Insurance Monthly Rates Breakdown

When considering car insurance for your Jeep Compass, it’s essential to understand the various factors influencing your monthly premiums. The average monthly insurance rate for a Jeep Compass stands at $110. However, opting for a discount rate can reduce this to $65, while choosing high deductibles brings it to $95.

Jeep Compass Car Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $110 |

| Discount Rate | $65 |

| High Deductibles | $95 |

| High Risk Driver | $235 |

| Low Deductibles | $139 |

| Teen Driver | $403 |

Conversely, if you’re a high-risk driver, you can expect to pay around $235 monthly. Low deductibles set your rate at $139, and for teen drivers, the rate significantly increases to $403 per month. By comparing these rates and choosing the right coverage type, you can find the most cost-effective insurance for your Jeep Compass. For more details, see our guide on “Car Insurance for High-Risk Drivers.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeep Compass Insurance Costs: Competitive and Affordable

The chart below compares the monthly insurance rates for the Jeep Compass against other SUVs like the Kia Sorento, Acura RDX, and Cadillac Escalade. For the Jeep Compass, the rates are $25 for comprehensive, $42 for collision, $31 for minimum coverage, and $110 for full coverage.

Jeep Compass Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Jeep Compass | $25 | $42 | $31 | $110 |

| Kia Sorento | $27 | $47 | $31 | $118 |

| Acura RDX | $26 | $44 | $26 | $108 |

| Cadillac Escalade | $38 | $65 | $39 | $159 |

| Ford Flex | $28 | $47 | $33 | $121 |

| Audi Q7 | $33 | $60 | $33 | $139 |

| Toyota Sequoia | $28 | $47 | $33 | $121 |

This positions the Jeep Compass as a competitively priced option, with the Cadillac Escalade being notably higher at $159 for full coverage. By examining these rates, you can better understand the insurance costs associated with different SUVs and make a more informed decision.

Read more: Compare Kia Car Insurance Rates

Key Factors Affecting Jeep Compass Car Insurance Rates

Several factors influence Jeep Compass insurance costs, including vehicle age, driver age, and location. Newer models typically attract higher premiums, and younger drivers face higher rates. Regional risks and accident statistics also affect costs. For more details, see our guide on “Factors That Affect Car Insurance Rates.”

Progressive is the best choice for Jeep Compass car insurance, offering a perfect blend of competitive rates, innovative programs, and exceptional coverage.

Dani Best Licensed Insurance Producer

Your driving record impacts your premium; a clean record usually results in lower rates, while violations can significantly increase costs. The Jeep Compass’s safety ratings and features, such as crash test results and built-in safety mechanisms, also affect insurance pricing. Understanding these factors can help you make informed decisions to optimize your insurance coverage and costs.

Determine the Vehicle’s Age

Older Jeep Compass models generally cost less to insure. The costs for comprehensive, collision, minimum, and full coverage change depending on the vehicle’s age and the type of protection selected. For a more detailed comparison, see our guide on “Compare Car Insurance Rates by Vehicle Make and Model.”

Jeep Compass Car Insurance Monthly Rates by Model Year and Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Jeep Compass | $26 | $45 | $33 | $112 |

| 2023 Jeep Compass | $25 | $45 | $32 | $111 |

| 2022 Jeep Compass | $25 | $44 | $32 | $111 |

| 2021 Jeep Compass | $25 | $44 | $32 | $110 |

| 2020 Jeep Compass | $25 | $42 | $31 | $110 |

| 2019 Jeep Compass | $23 | $40 | $33 | $109 |

| 2018 Jeep Compass | $23 | $40 | $33 | $109 |

| 2017 Jeep Compass | $22 | $39 | $35 | $108 |

| 2016 Jeep Compass | $21 | $37 | $36 | $107 |

| 2015 Jeep Compass | $20 | $36 | $37 | $106 |

| 2014 Jeep Compass | $19 | $33 | $38 | $103 |

| 2013 Jeep Compass | $18 | $31 | $38 | $101 |

| 2012 Jeep Compass | $18 | $28 | $38 | $97 |

| 2011 Jeep Compass | $16 | $26 | $38 | $94 |

| 2010 Jeep Compass | $16 | $24 | $39 | $92 |

Jeep Compass insurance rates vary by model year and coverage type. Comprehensive coverage ranges from $20/month to $26/month. Collision coverage costs between $36 and $45 monthly. Minimum coverage starts at $31, while full coverage ranges from $106 to $112 monthly.

Driver Age

Driver age can significantly affect Jeep Compass auto insurance rates. The table below illustrates how monthly rates vary by age group. For a 16-year-old driver, the rate is $610 per month, while an 18-year-old pays $403. At age 20, the rate decreases to $250.

Jeep Compass Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $610 |

| Age: 18 | $403 |

| Age: 20 | $250 |

| Age: 30 | $115 |

| Age: 40 | $110 |

| Age: 45 | $105 |

| Age: 50 | $100 |

| Age: 60 | $99 |

Rates continue to decline with age, with 30-year-olds paying $115 and 40-year-olds $110. By age 60, the monthly rate drops to $99. Understanding these variations can help drivers anticipate their insurance costs based on age. For more insights, see our guide on “Average Car Insurance Rates by Age and Gender.”

Driver Location

Where you live can have a significant impact on Jeep Compass insurance rates. The table below shows how monthly insurance rates vary by city. For example, drivers in Los Angeles, CA, pay the highest rate at $189 per month, while those in Columbus, OH, enjoy the lowest rate at $92 per month.

Jeep Compass Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $189 |

| New York, NY | $174 |

| Houston, TX | $173 |

| Jacksonville, FL | $160 |

| Philadelphia, PA | $148 |

| Chicago, IL | $146 |

| Phoenix, AZ | $128 |

| Seattle, WA | $107 |

| Indianapolis, IN | $94 |

| Columbus, OH | $92 |

Other cities like New York, NY, and Houston, TX, have car insurance rates by city of $174 and $173 respectively. This variation highlights the importance of location in determining insurance costs.

Your Driving Record

Your driving record can significantly impact the cost of Jeep Compass auto insurance. The table below illustrates how monthly insurance rates vary by age and driving history. For a 16-year-old with a clean record, the rate is $610, but it increases to $790 with one accident, $1,100 with one DUI, and $760 with one ticket.

Jeep Compass Car Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $610 | $790 | $1,100.00 | $760 |

| Age: 18 | $403 | $610 | $830.00 | $530 |

| Age: 20 | $250 | $410 | $620.00 | $350 |

| Age: 30 | $115 | $180 | $290.00 | $160 |

| Age: 40 | $110 | $170 | $280.00 | $150 |

| Age: 45 | $105 | $165 | $275.00 | $145 |

| Age: 50 | $100 | $160 | $270.00 | $140 |

| Age: 60 | $99 | $155 | $260.00 | $135 |

For a 40-year-old, the rates are $110 with a clean record, $170 with one accident, $280 with one DUI, and $150 with one ticket. These variations highlight the importance of maintaining a clean driving record to minimize insurance costs. When considering whether all car insurance companies check your driving records, it’s evident that a clean record significantly impacts your rates.

Jeep Compass Safety Ratings and Insurance Impact

Your Jeep Compass auto insurance rates are influenced by its safety ratings, which are provided by the Insurance Institute for Highway Safety (IIHS). The table below shows that the Jeep Compass has received “Good” ratings across various safety categories, including small overlap front (driver and passenger side), moderate overlap front, side impact, roof strength, and head restraints and seats.

Jeep Compass Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

These strong safety ratings contribute to better insurance rates, as they indicate a lower risk of severe injury in the event of an accident. Understanding how car insurance table ratings affect car insurance rates is crucial, as these ratings directly impact the premiums you pay.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeep Compass Crash Test Ratings

The Jeep Compass demonstrates reliable safety performance in crash tests, consistently achieving strong ratings across various categories. This makes it a dependable choice for safety-conscious drivers. For those interested in understanding car accidents, the Jeep Compass’s strong safety ratings provide reassurance of its protective capabilities.

Jeep Compass Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Jeep Compass SUV FWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2024 Jeep Compass SUV AWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2023 Jeep Compass SUV FWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2023 Jeep Compass SUV AWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2022 Jeep Compass SUV FWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2022 Jeep Compass SUV AWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2021 Jeep Compass SUV FWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2021 Jeep Compass SUV AWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2020 Jeep Compass SUV FWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2020 Jeep Compass SUV AWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2019 Jeep Compass SUV FWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2019 Jeep Compass SUV AWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2018 Jeep Compass SUV FWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2018 Jeep Compass SUV AWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2017 Jeep Compass SUV FWD | 4 stars | 3 stars | 5 stars | 4 stars |

| 2017 Jeep Compass SUV 4WD | 4 stars | 3 stars | 5 stars | 4 stars |

| 2016 Jeep Compass SUV 4WD | 4 stars | 3 stars | 5 stars | 4 stars |

| 2016 Jeep Compass SUV 2WD | 4 stars | 3 stars | 5 stars | 4 stars |

The Jeep Compass models between 2020 and 2024 have maintained an average of 4-star crash ratings, showcasing consistent safety and reliability. These positive safety ratings can contribute to more favorable insurance rates for Jeep Compass owners.

Jeep Compass Safety Features and Insurance Benefits

The Jeep Compass is equipped with a variety of safety features that can positively impact your car insurance rates. Key safety components include safety features like car insurance discounts, which can lead to significant savings on your premiums.

- Driver and Passenger Air Bags

- 4-Wheel ABS and Disc Brakes

- Electronic Stability Control

- Blind Spot Monitor

- Lane Departure Warning

These advanced safety features not only enhance driver and passenger protection but may also qualify you for insurance discounts.

By investing in a Jeep Compass with such comprehensive safety measures, you’re not only ensuring greater security on the road but also potentially reducing your insurance costs. Consult with a licensed insurance agent to explore all the discounts you may be eligible for.

Understanding Jeep Compass Insurance Loss Probability

Insurance loss probability for the Jeep Compass varies across different coverage types. The table below highlights these variations, with collision coverage showing a loss rate of -13% and comprehensive coverage at -42%, indicating lower than average claims.

Jeep Compass Car Insurance Loss Probability by Coverage Type

| Insurance Coverage Category | Loss Rate |

|---|---|

| Collision | -13% |

| Property Damage | 35% |

| Comprehensive | -42% |

| Personal Injury | 28% |

| Medical Payment | 24% |

| Bodily Injury | 42% |

In contrast, bodily injury has the highest loss rate at 42%, followed by property damage at 35%. These percentages reflect the likelihood of claims being made under each coverage type, impacting the overall insurance rates. When considering “How do you calculate total loss for car insurance?” it’s important to understand how these loss rates contribute to the determination of total loss and influence insurance premiums.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Smart Tips for Reducing Jeep Compass Insurance Costs

Save more on your Jeep Compass car insurance rates. Take a look at the following five strategies that will get you the best Jeep Compass auto insurance rates possible.

- Don’t skimp on Jeep Compass liability coverage

- Spy on your teen driver

- Consider renting a car instead of buying a second Jeep Compass

- Get married and ask for a discount

- Make sure you use an accredited driver safety program

Save more on your Jeep Compass car insurance rates. Take a look at the following five strategies that will get you the best Jeep Compass auto insurance rates possible, including understanding “Best Smart Car Insurance Rates” to make informed decisions and maximize savings.

Top Insurance Providers for Jeep Compass Owners

Several insurance companies offer competitive rates for the Jeep Compass based on factors like discounts for safety features. Take a look at these best car insurance companies that are popular with Jeep Compass drivers, organized by market share.

Jeep Compass Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Here are the top insurance providers for Jeep Compass owners by market share. State Farm leads with $66.2 million in premiums and a 9% market share, followed by Geico and Progressive. Liberty Mutual, Allstate, and Travelers round out the top five. These rankings highlight the leading companies in the market and their respective share of Jeep Compass insurance premiums.

This chart shows the market share of various car insurance providers for the Jeep Compass. State Farm leads with $66.2 million, followed by Geico and Progressive with $46.4 million and $41.7 million, respectively. Other notable providers include Liberty Mutual, Allstate, and Travelers. This data helps illustrate the distribution of market share among top insurers for the Jeep Compass.

Easily Compare Jeep Compass Insurance Quotes Online

Progressive is the top-rated choice for Jeep Compass car insurance, with 95% customer satisfaction, competitive rates, and exceptional coverage options.

Michelle Robbins Licensed Insurance Agent

Understanding these details will help you make an informed decision about your coverage needs. Explore the different types of insurance available to ensure you’re well-prepared for purchasing Jeep Compass yearly insurance. By knowing more about the vehicle and its insurance requirements, you can find the best rates and coverage options tailored to your needs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Choosing the Right Car Insurance for Your Jeep Compass

Selecting the appropriate car insurance for your Jeep Compass involves understanding the various coverage options available and determining which ones best suit your needs. Here’s a streamlined guide to help you make an informed decision:

- Liability Coverage: This is often the minimum required by states and covers damages to others caused by you in an accident.

- Comprehensive Physical Damage Coverage: Protects your Jeep Compass from non-accident damage like theft, weather, and vandalism.

- Collision Coverage: Covers damages to your vehicle in the event of an accident.

- Uninsured Motorist Coverage: Provides coverage if the other driver is at fault and does not have insurance.

- Personal Injury Protection: May include medical and funeral costs for you and your passengers, depending on the state.

These insurance types vary from one company to the next, with policies determined by each company’s contract.

Insurers set their own prices for different types of coverage, so it’s advisable to compare quotes from many car insurance companies by coverage type before choosing one.

Evolution of the Jeep Compass

The Jeep Compass has seen significant improvements over the years. Earlier models, despite their affordability and fuel efficiency, lacked the off-road capability and robust features expected from a Jeep. They were priced between $18,000 and $24,000 and offered good fuel economy, but their design and interior quality were subpar.

data-media-max-width=”560″>

Teen driving can be a wild ride. But if you cover them with Progressive, you could at least get a discount. And maybe some sleep. pic.twitter.com/yXv7l8LOOd

— Progressive (@progressive) June 26, 2024

The base model had minimal features, and upgrading required substantial extra cost. The 2011 Jeep Compass brought dramatic changes with a sleek exterior, high-quality interior, and enhanced performance for off-road driving. These improvements increased the base price to $23,295, with additional options pushing the average cost over $26,000.

Jeep Compass Safety Ratings and Features

The Jeep Compass has received solid safety ratings from the National Highway Traffic Safety Administration (NHTSA), earning four out of five stars for rollover safety and three stars for front impact collision, with an overall rating of four stars. These ratings can help lower costs with the best auto insurance companies, as a safer vehicle poses less risk.

There are numerous car insurance discounts available for the Compass’s safety features. Key safety features include Brake Assist, Electronic Roll Mitigation, Electronic Stability Control, and Hill Start Assist. While front and rear airbags are standard, side airbags can be added for an additional $250, further enhancing safety and potential insurance savings with the best auto insurance companies.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How Jeep Compass Depreciation Affects Insurance Costs

The depreciation rate of your Jeep Compass can significantly impact your insurance costs. Initially, you will pay higher insurance premiums based on the vehicle’s full purchase price. However, as your Jeep Compass depreciates, particularly in the first year where depreciation can be as much as $5,706, your insurance rates will start to decrease.

After the first year, depreciation slows to about $2,000 annually, which continues to lower your insurance premiums over time. Regularly checking the vehicle’s value with resources like Kelley Blue Book can help you stay informed about how depreciation and modifications like lowering a car affect car insurance rates.

Getting Car Insurance Quotes for a Jeep Compass

Obtaining car insurance quotes for your Jeep Compass is a straightforward process. The average monthly cost is about $110, but this can vary based on your specific needs and provider. Most insurance companies offer free quotes on their websites; simply fill out a form with details about you and your car.

Alternatively, use comparison websites to fill out one form and receive multiple quotes, making it easier to compare prices. To ensure you get the best deal and answer how often should you check car insurance quotes, it’s recommended to obtain at least three quotes when shopping for insurance.

Key Takeaways for Jeep Compass Car Insurance

When purchasing a Jeep Compass, consider several factors including how do you get competitive quotes for car insurance to ensure affordability. The average monthly cost to insure a Jeep Compass is around $108, and as your vehicle depreciates, your insurance costs will decrease.

Adding safety features and anti-theft devices can help lower your premiums even further. To ensure you’re getting the best rate, it’s crucial to compare prices by obtaining at least three different quotes from various insurance providers. By taking these steps, you can find the most cost-effective and comprehensive coverage for your Jeep Compass.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How much is insurance on a 2012 Jeep Compass?

The average monthly insurance cost for a 2012 Jeep Compass typically ranges from approximately $90 to $110, depending on factors such as your driving history, location, and coverage level.

For more information, refer to our detailed guide titled “Do all car insurance companies check your driving records?” to ensure accuracy.

Is Jeep Compass considered a safe car for insurance purposes?

The Jeep Compass is considered safe for insurance purposes, particularly newer models equipped with advanced safety features, which can enhance safety ratings and potentially lower insurance costs.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What is the best level of car insurance for a Jeep Compass?

Comprehensive insurance with collision and liability coverage is generally recommended for a Jeep Compass, providing broad protection suitable for its on and off-road capabilities.

For more information, explore our detailed guide titled “Compare Four-Wheel Drive vs. Two-Wheel Drive Car Insurance Rates,” and discover key differences.

Are repairs expensive on a Jeep Compass, and how does this impact insurance costs?

Repair costs for the Jeep Compass can be moderate, potentially leading to higher insurance premiums to cover these costs over time.

What is the life expectancy of a Jeep Compass, and how does this affect its insurance?

A well-maintained Jeep Compass can last around 200,000 miles. Vehicles with longer life expectancies can sometimes enjoy lower insurance rates due to their proven durability.

What are the downsides to a Jeep Compass that might affect insurance rates?

Downsides such as average reliability ratings and known mechanical issues may lead to higher insurance premiums due to increased risk of claims.

For an in-depth look, consult our detailed analysis titled “Factors That Affect Car Insurance Rates,” which covers essential insights.

Are Jeep Compasses considered reliable vehicles by insurance companies?

While considered moderately reliable, any reliability concerns might slightly increase insurance premiums, reflecting the potential for more frequent claims.

How does the safety rating of a Jeep Compass influence car insurance rates?

Good safety ratings for the Jeep Compass can reduce insurance costs. Newer models with enhanced safety features typically attract lower premiums due to reduced risk.

Enter your ZIP code below into our free comparison tool to see how much car insurance costs in your area.

Is the Jeep Compass fuel efficient, and does this affect its insurance premiums?

The Jeep Compass offers moderate fuel efficiency, which generally does not significantly impact insurance premiums. However, insurers might consider fuel efficiency indirectly when assessing the vehicle’s overall cost of ownership and usage.

To broaden your understanding, see our comprehensive handbook titled “The Most Fuel-Efficient Cars,” which provides further information.

What common problems with a Jeep Compass could lead to higher insurance claims?

Issues such as transmission glitches, electrical malfunctions, and suspension problems are known in some models, possibly leading to higher claims and thus influencing insurance rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.