Best Infiniti Car Insurance Rates in 2025 (Top 10 Companies Ranked)

The best Infiniti car insurance rates are offered by Farmers, State Farm, and Allstate, with potential discounts up to 25%. Farmers provides comprehensive options, State Farm offers personalized policies, and Allstate excels in customer service. These companies help car owners with reliable coverage and support.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jul 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,072 reviews

3,072 reviewsCompany Facts

Full Coverage Infiniti

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage Infiniti

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage Infiniti

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

The best Infiniti car insurance rates are offered by Farmers, State Farm, and Allstate, with potential discounts up to 25%. These companies provide affordable rates and excellent service, including quick claims and benefits like roadside assistance. Compare today to find the best coverage for your needs.

Infiniti car insurance rates average $163 monthly, about 37% higher than the national average due to the luxury vehicle’s higher cost.

Our Top 10 Company Picks: Best Infiniti Car Insurance Rates

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 22% | A | Safe Drivers | Farmers | |

| #2 | 25% | B | Personalized Policies | State Farm | |

| #3 | 20% | A+ | Customer Service | Allstate | |

| #4 | 18% | A+ | Vanishing Deductible | Nationwide |

| #5 | 18% | A++ | Military Benefits | USAA | |

| #6 | 22% | A++ | Online Convenience | Geico | |

| #7 | 20% | A+ | Loyalty Rewards | Progressive | |

| #8 | 22% | A | Quick Claims | Liberty Mutual |

| #9 | 19% | A++ | Low-Mileage Drivers | Travelers | |

| #10 | 20% | A+ | Youth Discounts | Erie |

How do you get competitive quotes for car insurance? To find affordable Infiniti car insurance rates, compare several options.

Make sure to select a policy that not only fits your budget but also provides adequate coverage for your Infiniti. Find cheap car insurance quotes by entering your ZIP code above.

- Farmers, State Farm, and Allstate offer best Infiniti car insurance rates

- Infiniti drivers benefit from comprehensive coverage options

- Farmers, the top pick, provides tailored solutions and excellent service

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Farmers: Top Overall Pick

Pros

- Top Overall Pick: Farmers is highlighted as a top overall pick for Infiniti car insurance.

- Customizable Policies: Offers personalized policies to fit individual needs.

- Wide Range of Coverage Options: As mentioned in our Farmers car insurance review, they provide comprehensive coverage options.

Cons

- Potentially Higher Premiums: Rates may be higher compared to some competitors.

- Mixed Customer Reviews: Some customers report dissatisfaction with claims processing.

#2 – State Farm: Best for Personalized Policies

Pros

- Best for Personalized Policies: State Farm is recognized for offering personalized policies.

- Strong Financial Stability: State Farm has strong financial ratings. Learn more in our State Farm car insurance review.

- Extensive Agent Network: Provides access to a large network of agents for personalized service.

Cons

- Higher Premiums: Premiums may be higher compared to other insurers.

- Mixed Customer Service Reviews: Some customers report dissatisfaction with claims handling.

#3 – Allstate: Best for Customer Service

Pros

- Best for Customer Service: Allstate is known for its customer service.

- Innovative Tools: Offers tools like Drivewise for safe drivers.

- Variety of Discounts: Provides numerous discounts to lower premiums. Learn more in our Allstate car insurance review.

Cons

- Higher Premiums: Allstate tends to be more expensive compared to some competitors.

- Claims Process May Be Lengthy: Some customers report longer claims processing times.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Vanishing Deductible

Pros

- Best for Vanishing Deductible: Offers the Vanishing Deductible program.

- Local Agents: Provides access to local agents for personalized service.

- Wide Range of Products: Offers various insurance products beyond auto insurance. Learn more about their products in our Nationwide car insurance discounts article.

Cons

- Higher Premiums: Nationwide can be more expensive compared to other insurers.

- Claims Handling: Some customers report delays and issues with claims processing.

#5 – USAA: Best for Military Benefits

Pros

- Best for Military Benefits: USAA offers exclusive benefits for military members.

- Excellent Customer Service: Known for exceptional customer service.

- Strong Financial Ratings: Has top ratings for financial stability.

Cons

- Limited Membership: As mentioned in our USAA car insurance review, they are only available to military members, veterans, and their families.

- Availability of Services: Limited physical locations may not be convenient for all customers.

#6 – Geico: Best for Online Convenience

Pros

- Best for Online Convenience: Geico is praised for its user-friendly online platform. Learn more in our Geico car insurance review.

- Affordable Rates: Offers competitive pricing and discounts.

- High Customer Satisfaction: Generally receives positive feedback for customer service.

Cons

- Limited Personalized Service: Geico is primarily online, which may not appeal to customers preferring in-person interactions.

- Claims Satisfaction: Some customers report issues with the claims process.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best for Loyalty Rewards

Pros

- Best for Loyalty Rewards: Offers loyalty rewards and usage-based insurance programs.

- Innovative Tools: Provides tools like Name Your Price® and online quote comparison.

- Wide Range of Coverages: Offers a variety of insurance products beyond auto insurance.

Cons

- Rate Increases: In our Progressive car insurance review, some customers experience rate increases over time.

- Complex Claims Process: Claims processing can be more complicated compared to other insurers.

#8 – Liberty Mutual: Best for Quick Claims

Pros

- Best for Quick Claims: Liberty Mutual is recognized for quick claims processing.

- Customizable Policies: Offers options for tailoring policies to individual needs.

- Financial Strength: Liberty Mutual has strong financial stability and ratings.

Cons

- Higher Premiums: Liberty Mutual can be more expensive compared to some competitors. For more information, read our Liberty Mutual car insurance review.

- Mixed Customer Reviews: Some customers report dissatisfaction with claims handling.

#9 – Travelers: Best for Low-Mileage Drivers

Pros

- Best for Low-Mileage Drivers: Offers discounts for low-mileage drivers.

- Strong Financial Stability: Travelers has strong financial ratings and stability.

- Innovative Products: Provides innovative insurance products and coverage options.

Cons

- Higher Premiums: Travelers tends to be more expensive compared to some competitors. Learn more about their rates in our Travelers car insurance review.

- Customer Service: Mixed customer reviews regarding claims handling and customer service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Erie: Best for Youth Discounts

Pros

- Best for Youth Discounts: Offers discounts specifically for young drivers.

- Excellent Customer Service: Known for exceptional customer service.

- Affordable Rates: Generally offers competitive pricing.

Cons

- Potentially Higher Premiums: Premiums may be higher compared to some competitors. Learn more about their rates in our Erie car insurance review.

- Limited Availability: Erie may not be available in all states, limiting accessibility.

Infiniti Car Insurance Rates

While you can find a cheaper model, most new Infinitis cost between $50,000 and $100,000. By no means are Infinitis cheap, but the brand promises you’ll be getting quite the bargain in your car.

Many luxury cars have extremely high insurance rates, but that’s not the case for Infiniti. While Infiniti car insurance rates are still above the national average, they’re much more affordable than many other luxury brands. The average Infiniti driver pays about $163 a month for car insurance.

Infiniti Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $72 | $188 |

| Erie | $33 | $95 |

| Farmers | $66 | $160 |

| Geico | $39 | $106 |

| Liberty Mutual | $81 | $212 |

| Nationwide | $53 | $137 |

| Progressive | $52 | $140 |

| State Farm | $44 | $110 |

| Travelers | $51 | $134 |

| USAA | $35 | $90 |

However, you’ll see many different rates based on the model you buy. Generally speaking, higher-priced models come with more expensive car insurance. Check out the table below to compare Infiniti car insurance cost by model:

Infiniti Car Insurance Monthly Rates by Coverage Type & Model

Infiniti Model Comprehensive Collision Minimum Coverage Full Coverage

Infiniti Q50 $33 $67 $42 $157

Infiniti Q50S $38 $72 $43 $165

Infiniti Q60 $37 $73 $42 $167

Infiniti Q70 $36 $76 $35 $160

Infiniti QX30 $33 $67 $42 $157

Infiniti QX50 $34 $67 $42 $159

Infiniti QX55 $35 $70 $41 $160

Infiniti QX60 $40 $75 $37 $168

Infiniti QX70 $37 $76 $42 $170

Infiniti QX80 $41 $78 $45 $172

Although the QX70 is the most expensive model to insure, there’s not very much variation between models. There’s only a $13 difference between QX70 rates and the least expensive models, QX30 and Q50.

Aside from the model of your car, several other factors will affect your car insurance rates. You can learn more about factors that affect your car insurance rates below. It helps to understand these factors while you’re looking for cheap Infiniti car insurance because some companies are more forgiving of specific situations than others.

It’s almost impossible to guess which company will have the cheapest rates for you without getting a personalized Infiniti car insurance quote. Learn how to find cheap car insurance.

Infiniti Car Insurance Coverage Options

While several factors affect your Infiniti car insurance rates, one of the most important is how much coverage you want to buy. Since Infinitis are luxury, high-end cars, most drivers choose a full coverage policy.

When you purchase full coverage, you’ll get the following Infiniti car insurance coverage options:

- Liability: Liability auto insurance coverage pays for the damages and injuries you cause in an at-fault accident. Most states require it, but it doesn’t cover your car.

- Collision: If you want help paying for your car repairs after an at-fault accident, you need collision insurance. Collision car insurance also covers you if you hit a stationary object, like a tree. Learn more about what is collision coverage on car insurance.

- Comprehensive: There’s a lot more than accidents that can damage your Infiniti. Comprehensive car insurance covers damage from fire, floods, extreme weather, animals, vandalism, and theft.

- Uninsured/Underinsured Motorist: While most states require car insurance, not everyone follows the law. Uninsured/underinsured motorist insurance protects you from drivers with inadequate coverage.

- Medical Payment/Personal Injury Protection: Medical payments and personal injury protection insurance covers your health care costs after an accident. It also covers your passengers and might protect you when you’re a passenger in someone else’s car.

Aside from these basic types of insurance, many Infiniti owners choose to add extra coverage. Popular add-ons for Infiniti owners include gap insurance, new car replacement coverage, roadside assistance, and rental car reimbursement. For more information, read our “How do I find out if gap insurance is included in my car lease?”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How to Save on Infiniti Car Insurance Rates

Luxury car insurance always costs more than standard policies, but Infiniti generally has affordable prices. As far as luxury cars go, Infinitis don’t have the largest price tags. Their affordability helps keep their car insurance rates low.

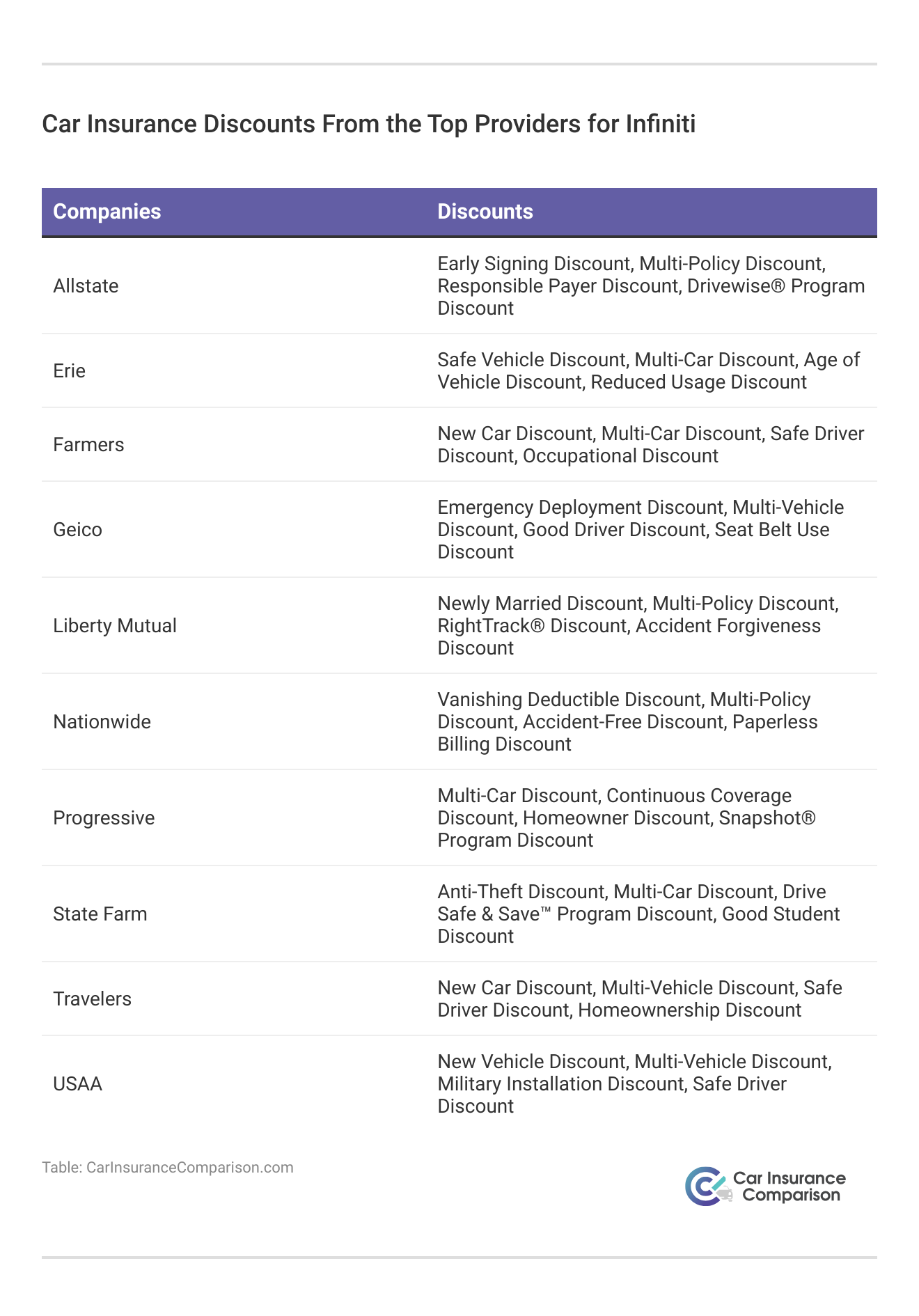

Although Infiniti cars have relatively low insurance rates, there are always more ways to save. You can look for discounts, as taking advantage of Infiniti car insurance discounts, such as bundling policies, having multiple cars, and remaining claims-free, is one of the best ways to keep your rates low.

Raise your deductible to help keep your insurance rates low, but be cautious since you’ll have to pay more out of pocket if you need to make a claim.

Brad Larson Licensed Insurance Agent

Enroll in telematics programs offered by most companies to help safe drivers save money; depending on the company you choose, you can save up to 40% on your insurance.

Keep your car safe by utilizing the excellent safety features that come with Infinitis and increase your savings by parking in a secured spot every night.

Drive safely, as drivers with incidents like speeding tickets, at-fault accidents, and DUIs will pay much higher rates than people with clean records.

Lastly, choose the right coverage; while it’s tempting to add as many Infiniti car insurance coverage options as possible for a luxury car, these add-ons will significantly increase your rates, so you should only buy what you need.

Many drivers opt to lower their Infiniti car insurance coverage as their car gets older. Insurance experts recommend lowering your coverage when your car is only worth a few thousand dollars. Since Infinitis are high-value cars, many drivers choose to keep full coverage even when their vehicle is a few years old.

While all the tips listed above are excellent ways to save on your car insurance, comparing Infiniti car insurance quotes is the best way to find affordable Infiniti car insurance. Companies use unique formulas to determine your rates, so knowing which company will have the lowest rates for you is impossible to guess.

Find the Best Infiniti Car Insurance Rates Today

With built-in safety features, affordable price tags, and a gas tank that won’t drain the bank, Infiniti is a good choice for anyone who wants a car that matches practicality with luxury. Affordable car insurance rates are just another bonus that comes with buying an Infiniti.

Although Infiniti car insurance rates are usually affordable, there are different ways to lower your car insurance rates even more. Before you buy a policy, make sure you research your Infiniti car insurance coverage options and discounts. Comparing Infiniti car insurance quotes not only helps you find the lowest rates, but also helps you pick a policy with the best car insurance coverage for your Infiniti.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Frequently Asked Questions

How can I compare Infiniti car insurance rates?

Can I save money on Infiniti car insurance?

Yes. There are several ways to save on Infiniti car insurance and some insurance companies offer multi-policy discounts. Compare quotes from multiple companies to get the best rate. Choose higher deductibles to lower premiums, maintain a clean driving record, and take advantage of discounts like safe driver and multi-policy discounts.

Are Infinitis more expensive to insure?

Infiniti car insurance rates vary depending on several factors, such as the model, year, location, driver’s age and history, and the insurance provider’s underwriting guidelines.

While it’s difficult to make a general comparison to other brands, some factors might contribute to higher insurance rates for Infiniti vehicles. These include higher repair costs, theft rates, or the perceived risk associated with certain Infiniti models. It’s important to compare rates from multiple insurers to find the best coverage and pricing for your specific Infiniti car.

What factors can affect Infiniti car insurance rates?

Several factors influence Infiniti car insurance rates. The specific make and model of your Infiniti can impact premiums due to varying repair costs. Younger, less experienced drivers generally face higher rates, while a clean driving record and low annual mileage can help lower premiums.

Is insurance expensive on an Infiniti Q50?

Infiniti Q50 insurance costs $157 monthly on average, a few dollars cheaper than the overall Infiniti average. You should always compare Infiniti car insurance cost by model to find the best car insurance coverage for your Infiniti.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

How can I find the best Infiniti car insurance rates?

To find the best Infiniti car insurance rates, compare quotes from multiple insurers like Farmers, State Farm, and Allstate. Each offers competitive rates and discounts up to 25%.

Which company offers the best Infiniti car insurance coverage?

Farmers is our top pick for Infiniti car insurance due to its comprehensive options and excellent customer service. State Farm and Allstate also provide collision and comprehensive coverages tailored to your needs.

Are there specific discounts available for Infiniti car insurance?

Yes, you can save on Infiniti car insurance with discounts for bundling policies, having multiple vehicles, remaining claims-free, and utilizing safety features on your Infiniti.

How can I lower my Infiniti car insurance rates?

To lower your Infiniti car insurance rates, consider raising your deductible, enrolling in telematics programs, and comparing quotes regularly. Choosing the right coverage for your needs can also help reduce costs.

Can I get specialized insurance coverage for my Infiniti car?

Yes, you can get specialized insurance coverage for your Infiniti car. Many insurers offer specific options tailored to luxury or high-performance vehicles, such as comprehensive coverage, new car replacement, roadside assistance, and rental car reimbursement.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.