Best Hyundai Santa Cruz Car Insurance in 2025 (Compare the Top 10 Companies)

Discover the best Hyundai Santa Cruz car insurance from State Farm, Geico, and Progressive as our top choices. With State Farm offering rates as low as $70/mo, these picks deliver great value. Known for their coverage and competitive pricing, they are ideal for Hyundai Santa Cruz owners seeking reliable insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Aug 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Hyundai Santa Cruz

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Hyundai Santa Cruz

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Hyundai Santa Cruz

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

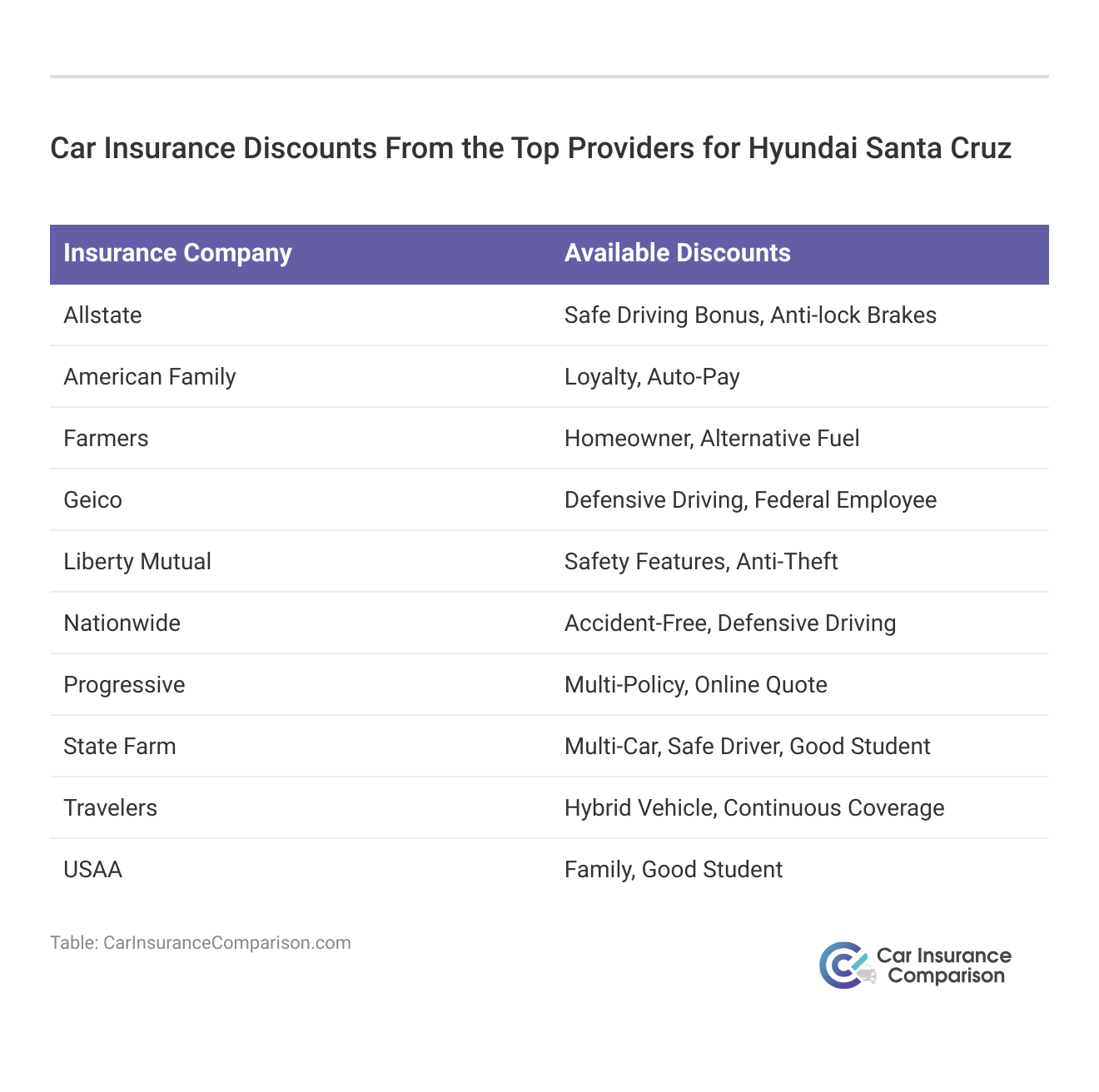

When searching for the best Hyundai Santa Cruz car insurance, our top pick overall is State Farm, known for its comprehensive coverage and competitive rates.

If you’re looking to buy a Hyundai Santa Cruz, you will want to know the details first. We’ve put together information on insurance for the Hyundai Santa Cruz to help you get an idea of costs. See more details on our article called “How much car insurance coverage do I need for a new car?”

Our Top 10 Company Picks: Cheap Hyundai Santa Cruz Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 25% A++ Online Service Geico

#3 12% A+ Customizable Plans Progressive

#4 10% A+ New Drivers Allstate

#5 15% A Multiple Discounts Farmers

#6 25% A Custom Coverage Liberty Mutual

#7 10% A++ Military Families USAA

#8 20% A+ Claims Satisfaction Nationwide

#9 15% A Coverage Options American Family

#10 13% A++ Low Mileage Travelers

To see fast, free Hyundai Santa Cruz insurance quotes right now, just enter your ZIP code above. We’ll provide you with personal Hyundai Santa Cruz insurance rate from top companies right away.

- The starting price for Hyundai Santa Cruz insurance is $70

- The Hyundai Santa Cruz’s safety features can qualify you for a discount

- Crash test ratings influence the auto insurance rates for the Hyundai Santa Cruz

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: State Farm offers rates as low as $70 per month for Hyundai Santa Cruz insurance, providing excellent value. The 17% multi-policy discount can further reduce costs when bundling with other insurance policies, making it one of the best Hyundai Santa Cruz car insurance options for budget-conscious drivers.

- Extensive Network: With a large network of agents, State Farm ensures personalized support and assistance, which is crucial for those seeking the best Hyundai Santa Cruz car insurance experience. Their solid B rating from A.M. Best reflects reliable service, adding to the overall value.

- High Customer Satisfaction: Known for strong customer service and high satisfaction ratings, State Farm excels in delivering the best Hyundai Santa Cruz car insurance with a focus on excellent support for drivers. More information about their rates in our State Farm car insurance review.

Cons

- Limited Online Resources: Compared to competitors like Geico, State Farm’s online tools and resources may be less comprehensive, which could impact the convenience of managing your Hyundai Santa Cruz insurance online.

- Regional Rate Variability: Insurance premiums can vary significantly based on location, potentially making it less predictable for those seeking consistent rates for the best Hyundai Santa Cruz car insurance.

#2 – Geico: Best for Online Service

Pros

- Excellent Online Tools: Geico provides user-friendly digital tools for easy policy management and claims processing, which is ideal for those looking for the best Hyundai Santa Cruz car insurance with excellent online features. Their A++ rating from A.M. Best highlights their financial stability and reliability.

- Competitive Pricing: Known for low rates and various discount opportunities, including a 25% multi-policy discount, Geico offers one of the best Hyundai Santa Cruz car insurance deals. This can significantly lower overall costs while providing high-quality coverage.

- 24/7 Customer Service: Geico offers round-the-clock support for claims and customer inquiries, ensuring assistance whenever needed. This level of availability is a key factor in achieving the best Hyundai Santa Cruz car insurance experience. Learn more in our Geico car insurance review.

Cons

- Less Personalized Service: Due to its large scale, customer service may feel less personal compared to smaller insurers, potentially affecting the individual experience for those seeking the best Hyundai Santa Cruz car insurance.

- Higher Rates for Poor Driving Records: Geico may not offer the best rates for those with a history of accidents or violations, which could be a drawback for some drivers looking for the most affordable Hyundai Santa Cruz car insurance.

#3 – Progressive: Best for Customizable Plans

Pros

- Customizable Plans: Progressive’s insurance plans are highly customizable to meet individual needs, including various options for different coverage levels. Their A+ rating from A.M. Best reflects strong financial stability, making Progressive a great option for the best Hyundai Santa Cruz car insurance.

- Innovative Tools: Features like the Name Your Price® tool help find coverage that fits your budget, which is crucial for managing costs effectively and securing the best Hyundai Santa Cruz car insurance.

- Competitive Rates: Provides good rates, especially for high-risk drivers, with a 12% multi-policy discount that can lower premiums further. This makes Progressive a competitive choice for those seeking the best Hyundai Santa Cruz car insurance. Read more through our Progressive insurance review.

Cons

- Complex Policy Options: The variety of options and features can be overwhelming for some customers, which might complicate finding the best Hyundai Santa Cruz car insurance.

- Potentially Higher Premiums: Certain high-risk drivers may face higher premiums compared to other providers, potentially impacting the affordability of the best Hyundai Santa Cruz car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for New Drivers

Pros

- New Driver Resources: Offers extensive resources and discounts for new drivers, which is beneficial for those seeking the best Hyundai Santa Cruz car insurance as a new driver. The 10% multi-policy discount also contributes to overall savings.

- Wide Range of Coverage: Provides numerous coverage options and add-ons, catering to diverse needs. This comprehensive approach ensures that Allstate remains a top contender for the best Hyundai Santa Cruz car insurance.

- Various Discounts: Includes discounts for safe driving, bundling, and more, making it easier to find savings. These opportunities contribute to Allstate’s reputation as a leading choice for the best Hyundai Santa Cruz car insurance. Learn more through our Allstate insurance review.

Cons

- Higher Premiums: Generally, premiums might be higher compared to some competitors, which could affect the affordability of the best Hyundai Santa Cruz car insurance.

- Inconsistent Service: Service quality can vary depending on the region and agent, which may lead to inconsistent experiences for those seeking the best Hyundai Santa Cruz car insurance.

#5 – Farmers: Best for Multiple Discounts

Pros

- Multiple Discounts: Offers various discounts, including a 15% multi-policy discount, which helps to reduce overall insurance costs. This makes Farmers a competitive option for the best Hyundai Santa Cruz car insurance.

- Customizable Coverage: Provides a range of coverage options tailored to individual needs, supported by their A rating from A.M. Best for financial strength. Farmers’ flexibility contributes to securing the best Hyundai Santa Cruz car insurance.

- Strong Agent Network: Extensive network of agents for personalized support ensures dedicated service, which is essential for finding the best Hyundai Santa Cruz car insurance experience. Learn more in our Farmers car insurance review.

Cons

- Rate Variability: Insurance rates can differ significantly based on location and driving history, which may impact predictability and affordability for the best Hyundai Santa Cruz car insurance.

- Complex Policies: Policy options can be complex and might be difficult to navigate for some customers, potentially causing confusion when seeking the best Hyundai Santa Cruz car insurance.

#6 – Liberty Mutual: Best for Custom Coverage

Pros

- Customizable Coverage: Offers flexible coverage options to meet specific needs, including a 25% multi-policy discount for bundling multiple policies. This customization helps ensure Liberty Mutual provides one of the best Hyundai Santa Cruz car insurance solutions.

- Discount Opportunities: Various discounts available, including those for hybrid or electric vehicles, enhance cost savings. Liberty Mutual’s discount programs make it a strong contender for the best Hyundai Santa Cruz car insurance.

- Strong Customer Service: Reliable customer service and support, bolstered by their A rating from A.M. Best for financial strength. This reliability is crucial for finding the best Hyundai Santa Cruz car insurance. Learn more in our Liberty Mutual car insurance review.

Cons

- Higher Premiums: Rates might be higher compared to some other insurers, which could impact affordability for the best Hyundai Santa Cruz car insurance.

- Limited Online Tools: Less extensive online resources compared to competitors like Geico, potentially reducing convenience for those seeking the best Hyundai Santa Cruz car insurance digitally.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – USAA: Best for Military Families

Pros

- Exceptional Service: Highly rated customer service and support, particularly for military families, with a strong A++ rating from A.M. Best. USAA’s exceptional service is ideal for those seeking the best Hyundai Santa Cruz car insurance.

- Competitive Rates: Provides good rates and comprehensive coverage options, with a 10% multi-policy discount for bundling. This makes USAA one of the best choices for affordable Hyundai Santa Cruz car insurance.

- High Satisfaction: Strong customer satisfaction and claims handling, reflecting their commitment to quality service. This high level of satisfaction is a key factor in achieving the best Hyundai Santa Cruz car insurance experience. Learn more in our USAA car insurance review.

Cons

- Limited Eligibility: Only available to selected family members, which limits chances for the general public seeking the best car insurance for their vehicle Hyundai Santa Cruz.

- Limited Coverage Options: Fewer options for non-military customers who may not qualify for their specialized services, potentially limiting choices for the best Hyundai Santa Cruz car insurance.

#8 – Nationwide: Best for Claims Satisfaction

Pros

- Vanishing Deductible: Reduces your deductible over time for safe driving, potentially lowering out-of-pocket costs. Nationwide highlights their reliability, making them a great option for the best Hyundai Santa Cruz car insurance.

- Comprehensive Coverage: Offers a broad range of coverage options including liability, collision, and comprehensive, ensuring thorough protection for your Hyundai Santa Cruz. This makes Nationwide a strong choice for the best Hyundai Santa Cruz car insurance.

- Financial Strength: Known for strong financial stability, ensuring that claims are handled efficiently and reliably. Nationwide’s financial strength contributes to their status as a top provider for the best Hyundai Santa Cruz car insurance. Check out other details in our complete Nationwide car insurance discount.

Cons

- Pricing: Rates may be higher compared to some competitors, potentially affecting the affordability of the best Hyundai Santa Cruz car insurance.

- Claims Handling: Some customers report mixed experiences with the claims process, which could be a concern for those needing prompt resolution for the best Hyundai Santa Cruz car insurance.

#9 – American Family: Best for Coverage Options

Pros

- Broad Coverage: Offers a wide range of coverage and customizable plans, supported by their A rating for financial strength. This comprehensive approach helps American Family secure a spot among the best Hyundai Santa Cruz car insurance providers.

- Strong Customer Support: Known for good customer service and effective claims handling, ensuring a positive experience. This level of support is essential for finding the best Hyundai Santa Cruz car insurance.

- Discounts Available: Various discounts for safe driving, bundling, and more, helping to reduce overall costs. These discount opportunities make American Family a competitive choice for the best Hyundai Santa Cruz car insurance. Browse for more details in our American Family car insurance review.

Cons

- Higher Rates: Premiums may be higher compared to some other providers, which could impact affordability for the best Hyundai Santa Cruz car insurance.

- Complex Pricing: Pricing and policy structures can be complex and difficult to understand, potentially causing confusion when seeking the best Hyundai Santa Cruz car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Low Mileage

Pros

- Low-Mileage Rates: Offers competitive rates for low-mileage drivers, with a 13% multi-policy discount that can further reduce costs. This makes Travelers a strong contender for the best Hyundai Santa Cruz car insurance for those with low mileage.

- Coverage Options: Provides a range of coverage options and discounts, including innovative features like usage-based insurance. Travelers’ flexible options help secure the best Hyundai Santa Cruz car insurance tailored to individual needs.

- Good Customer Support: Reliable customer service and claims processing contribute to a positive customer experience. This support is a key factor in achieving the best Hyundai Santa Cruz car insurance. See more details on our Travelers car insurance review.

Cons

- Limited Options for High-Risk Drivers: Fewer options available for drivers with poor records, which could limit coverage choices for those seeking the best Hyundai Santa Cruz car insurance.

- Higher Rates for High-Mileage: Rates might not be as competitive for drivers with high mileage or poor driving records, potentially affecting the affordability of the best Hyundai Santa Cruz car insurance.

Insuring Vehicles Like Hyundai Santa Cruz

Hyundai Santa Cruz Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $85 $160

American Family $67 $159

Farmers $90 $176

Geico $70 $132

Liberty Mutual $95 $180

Nationwide $64 $166

Progressive $75 $140

State Farm $80 $150

Travelers $78 $145

USAA $60 $120

The Jeep Gladiator, which combines the rugged off-road capability of the Jeep brand with the utility of a pickup truck, may have higher insurance rates influenced by its off-road potential, although its strong safety ratings and modern technology features can help balance the costs.

Meanwhile, the Toyota Tacoma, a popular mid-size pickup known for its reliability and versatility, often enjoys competitive insurance premiums due to its reputation for durability and comprehensive suite of safety features, with its strong resale value also playing a role in keeping insurance costs reasonable.

When seeking the best full coverage car insurance for your Hyundai Santa Cruz, comparing these models can provide valuable insights into what to expect for insuring your vehicle.

Hyundai Santa Cruz Cost

The starting price (MSRP) for a Hyundai Santa Cruz is $23,990. However, this base price can vary significantly depending on several factors. The trim level you select will have a major impact on the final cost, as higher trims come with additional features and enhancements that can increase the price.

Ty Stewart

Licensed Insurance Agent

Additionally, check for dealer incentives and promotions that can affect the overall cost. For example, installing anti-theft devices in your Hyundai Santa Cruz may qualify you for insurance discounts, helping to reduce your premiums.

Additionally, any dealer incentives, promotions, or discounts available at the time of purchase can further affect the overall cost. For instance, installing anti-theft devices in your Hyundai Santa Cruz may qualify you for anti-theft car insurance discounts, which could help reduce your insurance premiums.

Therefore, while the MSRP provides a baseline, the actual price you pay for a Hyundai Santa Cruz will depend on these variables and potential savings from insurance discounts. Enter your ZIP code now to begin.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Saving on Hyundai Santa Cruz Insurance

Impacts of the Cost of Hyundai Santa Cruz Insurance

When insuring your Hyundai Santa Cruz, various elements come into play that can significantly affect the overall cost. Like with any vehicle, your personal circumstances will heavily influence the insurance premiums. Key factors include your location, as areas with higher traffic or crime rates generally lead to higher insurance costs.

Your driving record also plays a crucial role; a clean record can lower your premiums, while a history of accidents or traffic violations will likely increase them. Additionally, your driving habits, such as the frequency and distance you drive, can impact the cost, with more extensive driving typically leading to higher premiums.

For those using the Hyundai Santa Cruz for business purposes, it’s essential to compare commercial car insurance: rates, discounts, & requirements, as commercial policies have different criteria and can offer tailored coverage and discounts that might benefit your specific needs.

The specific trim level of the Hyundai Santa Cruz you choose also affects insurance costs. Higher trims often come with more advanced features and higher price tags, which can lead to increased insurance rates.

Features such as enhanced safety systems might mitigate some of the costs by qualifying you for discounts, but generally, the overall cost of coverage will be higher for more expensive trim levels. By understanding these factors, you can better anticipate and manage the insurance costs associated with your Hyundai Santa Cruz. Enter your ZIP code now.

Frequently Asked Questions

What impacts the cost of Hyundai Santa Cruz insurance?

Factors such as location, driving record, habits, and trim level impact insurance costs. Enter your ZIP code now.

How much does a Hyundai Santa Cruz cost?

When considering the best commercial car insurance companies for a vehicle with a starting price of $23,990, it’s important to factor in how different trim levels and dealer incentives might impact your insurance needs.

The cost of insurance can vary depending on the specific trim and features of the vehicle, as well as any additional discounts or incentives that may apply.

To ensure you get the best coverage at a competitive rate, it’s advisable to compare quotes from top-rated commercial insurance providers and select one that offers the best value for the vehicle’s price and its associated risks.

How can I save on Hyundai Santa Cruz insurance?

Compare quotes, maintain a clean record, use discounts, consider higher deductibles, and bundle policies.

How can I compare Hyundai Santa Cruz insurance quotes online?

Use our free tool and enter your ZIP code to compare quotes from top insurance companies. Enter your ZIP code now to begin.

Which insurance provider offers the highest multi-policy discount for Hyundai Santa Cruz insurance?

Geico offers the highest multi-policy discount at 25%, making it a strong choice for those looking to bundle multiple policies. This significant discount can help reduce overall insurance costs for Hyundai Santa Cruz owners.

Read More: Understanding Your Car Insurance Policy

What is the A.M. Best rating for Geico, and how does it reflect on its Hyundai Santa Cruz insurance offerings?

Geico has an A++ rating from A.M. Best, indicating superior financial strength and reliability. This rating reflects Geico’s ability to provide robust and dependable coverage for Hyundai Santa Cruz owners.

How does Progressive’s customizable plan feature benefit Hyundai Santa Cruz owners seeking the best insurance?

Progressive’s customizable plans allow Hyundai Santa Cruz owners to tailor coverage to their specific needs, potentially lowering premiums and enhancing protection. This flexibility is ideal for finding the best insurance solution. Enter your ZIP code now to begin.

What unique feature does Nationwide offer that could lower out-of-pocket costs for Hyundai Santa Cruz drivers?

Nationwide’s Vanishing Deductible feature can reduce your deductible over time for safe driving, helping to lower out-of-pocket costs if a claim is filed. This benefit makes Nationwide a compelling option for cost-conscious Hyundai Santa Cruz drivers.

Read More: Can I use a P.O. Box for my car insurance?

Which insurance provider provides special discounts for military families, and how does this impact Hyundai Santa Cruz insurance rates?

USAA offers discounts specifically for military families, which can significantly reduce insurance rates for Hyundai Santa Cruz owners who qualify. This targeted discount helps make USAA a top choice for military personnel seeking affordable insurance.

How expensive is Hyundai Santa Cruz car insurance?

Insurance rates for similar pickup trucks can give you an idea of the cost.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.