Best Hyundai Excel Car Insurance in 2025 (We Suggest These 10 Companies)

The best Hyundai Excel car insurance providers are Progressive, State Farm, and Allstate, starting at just $65 a month. These companies are renowned for their competitive pricing and comprehensive coverage options, making them the best choices for Hyundai Excel owners.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Hyundai Excel

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Hyundai Excel

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews

Company Facts

Full Coverage for Hyundai Excel

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best Hyundai Excel car insurance are Progressive, State Farm, and Allstate, known for their exceptional coverage and customer service.

These top companies offer specialized policies that cater to the unique needs of Hyundai Excel owners, ensuring optimal protection and value. Learn more in our guide titled “Cheap Car Insurance.”

Our Top 10 Company Picks: Best Hyundai Excel Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 12% A+ Competitive Rates Progressive

#2 20% B Reliable Service State Farm

#3 25% A+ Comprehensive Coverage Allstate

#4 10% A++ Military Benefits USAA

#5 25% A Customizable Policies Liberty Mutual

#6 20% A+ Unique Discounts Nationwide

#7 20% A Flexible Options Farmers

#8 20% A Good Service American Family

#9 8% A++ Competitive Pricing Travelers

#10 25% A+ AARP Benefits The Hartford

When choosing the best Hyundai Excel car insurance, factors such as the vehicle’s safety features, driving history, and location play crucial roles in determining the final rates and benefits. By comparing these top insurers, you can secure a policy that perfectly matches your specific requirements and budget.

To compare Hyundai Excel car insurance quotes from top companies, enter your ZIP code above now. It’s fast and free.

- Progressive is the top choice for Hyundai Excel car insurance

- Hyundai Excel insurance factors in safety features and driving habits

- Coverage options vary based on the Hyundai Excel model specifics

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Economical Rates: Progressive provides Hyundai Excel owners with highly affordable rates, making it a prime choice for those mindful of their budgets. Learn more in our complete Progressive car insurance review.

- Usage-Based Discounts: Through Progressive’s Snapshot program, Hyundai Excel drivers can earn significant savings by showcasing safe driving behavior, allowing their premiums to reflect actual driving patterns.

- Flexible Payment Structures: Progressive offers Hyundai Excel owners adaptable payment plans, alleviating the financial strain of maintaining extensive insurance coverage.

Cons

- Discount Cap: The multi-car discount for Hyundai Excel coverage through Progressive is limited to 12%, which might not be as appealing to those looking to insure several vehicles.

- Claims Handling: Although competitively priced, Progressive’s claims process for Hyundai Excel owners may sometimes be slower compared to other providers, possibly resulting in delays in repair settlements.

#2 – State Farm: Best for Reliable Service

Pros

- Generous Multi-Car Discount: State Farm offers a sizable 20% discount for Hyundai Excel owners insuring multiple vehicles, making it an excellent option for families with more than one car.

- Top-Notch Customer Assistance: Hyundai Excel drivers benefit from State Farm’s exemplary customer support, ensuring that inquiries and concerns are addressed swiftly and efficiently. See more details in our guide titled, “State Farm Car Insurance Review.”

- Extensive Agent Presence: With a widespread network of agents, State Farm ensures Hyundai Excel owners have easy access to personalized guidance and advice, regardless of their location.

Cons

- Lower Financial Strength Rating: With a B rating from A.M. Best, Hyundai Excel owners might find State Farm’s financial standing less reassuring compared to top-rated insurers.

- Limited Policy Customization: While dependable, State Farm’s insurance options for Hyundai Excel drivers may lack the customization features that some drivers might prefer, potentially leading to gaps in coverage.

#3 – Allstate: Best for Comprehensive Coverage

Pros

- Expansive Coverage Options: Allstate offers Hyundai Excel owners an extensive range of comprehensive insurance choices, ensuring that all possible risks are covered.

- High Multi-Vehicle Discount: With a 25% discount for Hyundai Excel owners insuring more than one vehicle, Allstate makes it easier to save on premiums while maintaining full coverage.

- Safe Driver Incentive: Hyundai Excel drivers can benefit from Allstate’s Safe Driver Bonus, which reduces premiums for policyholders who maintain a clean driving record. More information about this provider is available in our Allstate car insurance review.

Cons

- Premium Costs: Despite the available discounts, Allstate’s premiums for Hyundai Excel insurance can be more expensive than those of some competitors, particularly for comprehensive plans.

- Inconsistent Customer Service: Hyundai Excel owners may experience variability in the quality of customer service, with some regions providing better support than others.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Military Benefits

Pros

- Exclusive Military Discounts: USAA offers Hyundai Excel insurance specifically tailored to military members, with unique discounts that aren’t available to the general public. Read up on the USAA car insurance review for more information.

- Superior Claims Processing: Hyundai Excel owners with USAA benefit from expedited claims service, thanks to the insurer’s top-tier A++ rating from A.M. Best and its dedicated service to military families.

- Emergency Roadside Assistance: USAA’s roadside assistance program provides Hyundai Excel drivers with peace of mind, offering rapid response and comprehensive support during breakdowns and emergencies.

Cons

- Restricted Eligibility: USAA’s insurance products are available only to military members and their families, limiting access for Hyundai Excel owners who do not qualify.

- Limited Local Representation: Hyundai Excel owners with USAA may find it challenging to obtain in-person support due to the insurer’s smaller network of local agents compared to other providers.

#5 – Liberty Mutual: Best for Customization Leader

Pros

- Highly Tailored Coverage: Liberty Mutual allows Hyundai Excel owners to extensively customize their insurance policies, ensuring that their specific needs are met without paying for unnecessary coverage.

- Accident Forgiveness: Hyundai Excel drivers can benefit from Liberty Mutual’s Accident Forgiveness program, which prevents premium hikes after a first accident, offering long-term savings. Check out insurance savings in our guide titled, “Liberty Mutual Car Insurance Review” for more information.

- New Vehicle Replacement: Liberty Mutual’s New Car Replacement feature ensures that Hyundai Excel owners can replace a totaled vehicle with a brand new one, providing additional financial protection.

Cons

- Elevated Base Premiums: The initial cost of Hyundai Excel insurance with Liberty Mutual can be higher, even before applying discounts, making it less appealing for price-sensitive drivers.

- Complex Discount System: While Liberty Mutual offers a 25% multi-vehicle discount, the variety and complexity of available discounts may make it difficult for Hyundai Excel owners to maximize their savings.

#6 – Nationwide: Best for Unique Discounts

Pros

- Specialized Hyundai Excel Plans: Nationwide customizes exclusive discount arrangements for Hyundai Excel owners, enabling considerable savings on both comprehensive and collision protection.

- SmartRide Initiative: Hyundai Excel motorists can capitalize on Nationwide’s SmartRide program, which provides up to a 40% reduction based on safe driving behaviors tracked via their application. Discover insights in our guide titled, “Nationwide Car Insurance Discount.”

- Diminishing Deductible: Hyundai Excel coverage through Nationwide includes an option for a diminishing deductible, rewarding claim-free driving by gradually lowering your deductible over time.

Cons

- Discount Requirements: Hyundai Excel owners may discover that Nationwide’s discounts are highly dependent on specific qualifications, potentially restricting availability.

- Rate Fluctuations: Despite the potential savings, Hyundai Excel premiums with Nationwide can vary widely based on regional factors, which might result in unexpected price increases.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Flexible Options

Pros

- Adaptable Hyundai Excel Coverage: Farmers offers a spectrum of adaptable coverage options for Hyundai Excel drivers, allowing for personalized policies that align with individual needs and financial constraints.

- New Vehicle Replacement: Hyundai Excel owners are eligible for Farmers’ New Vehicle Replacement option, which compensates the cost of a brand-new car if your Hyundai Excel is deemed a total loss within the first two model years.

- Signal App Incentives: Farmers provides the Signal app, awarding Hyundai Excel drivers up to a 15% discount for demonstrating safe driving, monitored through instant feedback and reports. Delve into our evaluation of Farmers car insurance review.

Cons

- Increased Premiums: Hyundai Excel insurance through Farmers may carry higher premiums, particularly for full protection options, when compared to other providers.

- Restricted Availability: Farmers’ flexible options for Hyundai Excel might not be accessible in all regions, possibly limiting access to these advantages.

#8 – American Family: Best for Good Service

Pros

- Exclusive Hyundai Excel Assistance: American Family is recognized for its outstanding customer support, offering Hyundai Excel owners specialized assistance for claims and policy administration.

- Accident Forgiveness: Hyundai Excel drivers insured with American Family can benefit from accident forgiveness, ensuring that their first at-fault incident doesn’t lead to a rate increase.

- Loyalty Incentives: Long-time Hyundai Excel owners receive loyalty incentives, decreasing premiums for maintaining continuous coverage with American Family. Access comprehensive insights into our guide titled, “American Family Car Insurance Review.”

Cons

- Limited Digital Tools: Hyundai Excel policyholders might find American Family’s digital tools less robust, lacking comprehensive policy management features in comparison to other providers.

- Lower Discount Threshold: The discounts provided for Hyundai Excel insurance with American Family might have a lower threshold than other insurers, reducing the potential for significant savings.

#9 – Travelers: Best for Competitive Pricing

Pros

- Hyundai Excel Savings Programs: Travelers offers competitive pricing for Hyundai Excel insurance, with discounts up to 30% for safe driving and policy bundling. Discover more about offerings in our complete guide, “Travelers Car Insurance Review.”

- IntelliDrive System: Hyundai Excel drivers can save on costs by enrolling in Travelers’ IntelliDrive system, which monitors driving performance for 90 days and adjusts rates accordingly.

- Outstanding Financial Strength: With an A++ A.M. Best rating, Travelers provides Hyundai Excel owners with the assurance of insuring their vehicle with a financially strong and dependable company.

Cons

- Tracking App: Hyundai Excel drivers utilizing the IntelliDrive system might have concerns about privacy, as the app requires continuous monitoring of driving habits.

- Delayed Premium Adjustments: Changes in Hyundai Excel premiums through the IntelliDrive system might not be reflected immediately, causing a delay in realizing the benefits of safe driving.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – The Hartford: Best for AARP Benefits

Pros

- Exclusive AARP Hyundai Excel Discounts: The Hartford offers Hyundai Excel owners who are AARP members access to exclusive discounts, providing significant reductions on premiums.

- Lifetime Coverage Guarantee: Hyundai Excel insurance through The Hartford comes with a guarantee of lifetime coverage, as long as the premiums are paid on time. Find more information in our guide titled, “The Hartford Car Insurance Discounts.”

- Reducing Deductible: Hyundai Excel drivers can take advantage of The Hartford’s reducing deductible program, which decreases the deductible amount each year without an accident.

Cons

- AARP Membership Requirement: The discounts and privileges offered by The Hartford are primarily available to AARP members, potentially limiting access for non-members.

- Higher Starting Rates: Hyundai Excel insurance premiums through The Hartford might begin at a higher rate than average, particularly for those without AARP membership, possibly diminishing some of the potential savings.

Hyundai Excel Insurance Costs by Coverage

When selecting car insurance for a Hyundai Excel, understanding the difference between minimum and full coverage rates is crucial. This breakdown will help you decide which level of coverage suits your needs and budget.

Hyundai Excel Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $80 $170

American Family $78 $168

Farmers $82 $172

Liberty Mutual $85 $175

Nationwide $77 $167

Progressive $70 $160

State Farm $75 $165

The Hartford $76 $166

Travelers $79 $169

USAA $65 $155

The table below shows the monthly insurance rates for both minimum and full coverage across several providers. Progressive offers the most affordable full coverage at $160 per month, while USAA presents the lowest minimum coverage rate at $65.

On the higher end, Liberty Mutual charges $85 for minimum coverage and $175 for full. These figures highlight the variability in pricing between different insurers and coverage levels, providing a clear perspective on the potential costs for insuring a Hyundai Excel.

This comparison is essential for owners to pinpoint the insurance that offers the best value for their specific circumstances. To find out more, explore our guide titled “Minimum Car Insurance Requirements by State.”

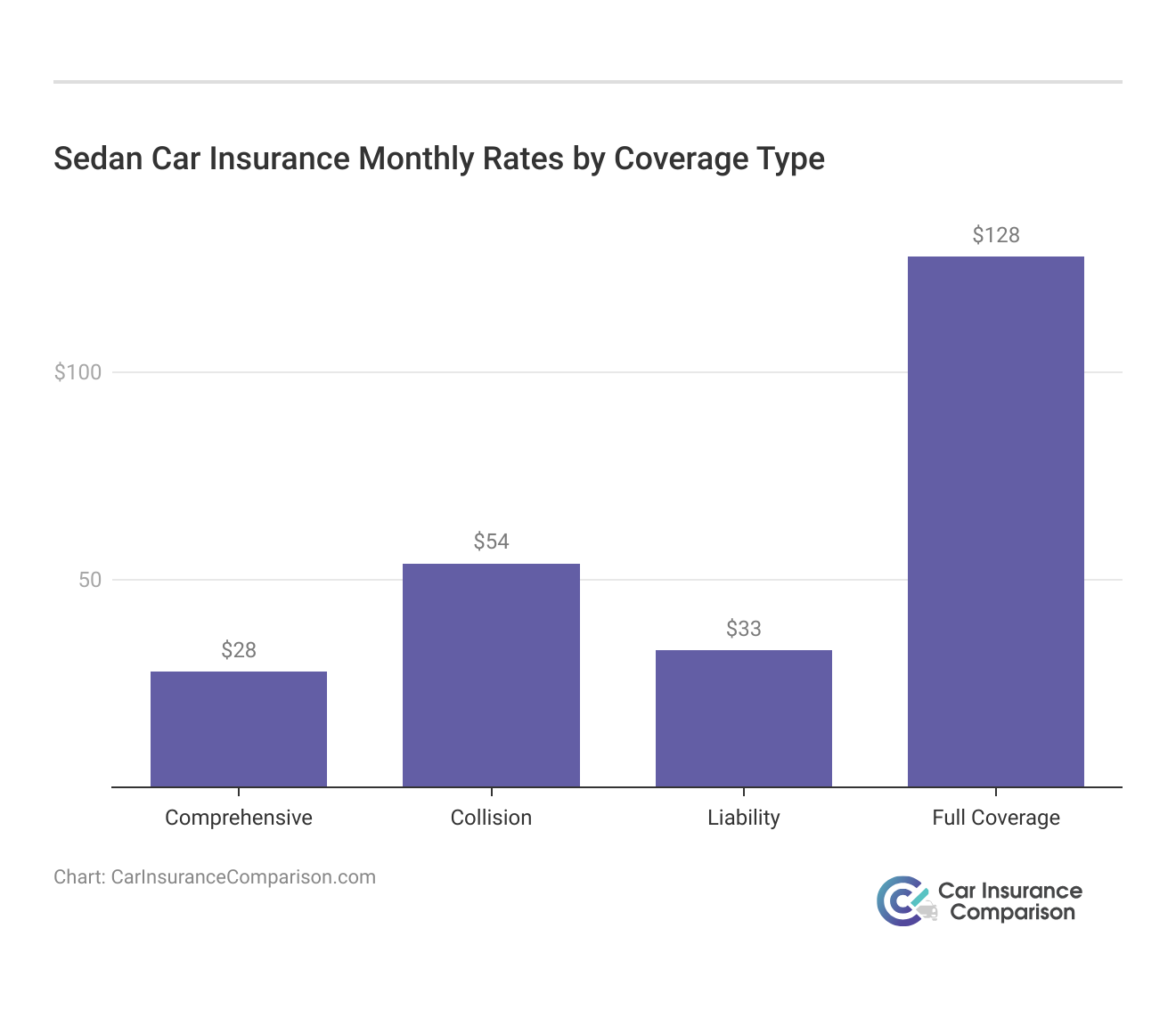

Insurance Costs for Hyundai Excel: What to Expect

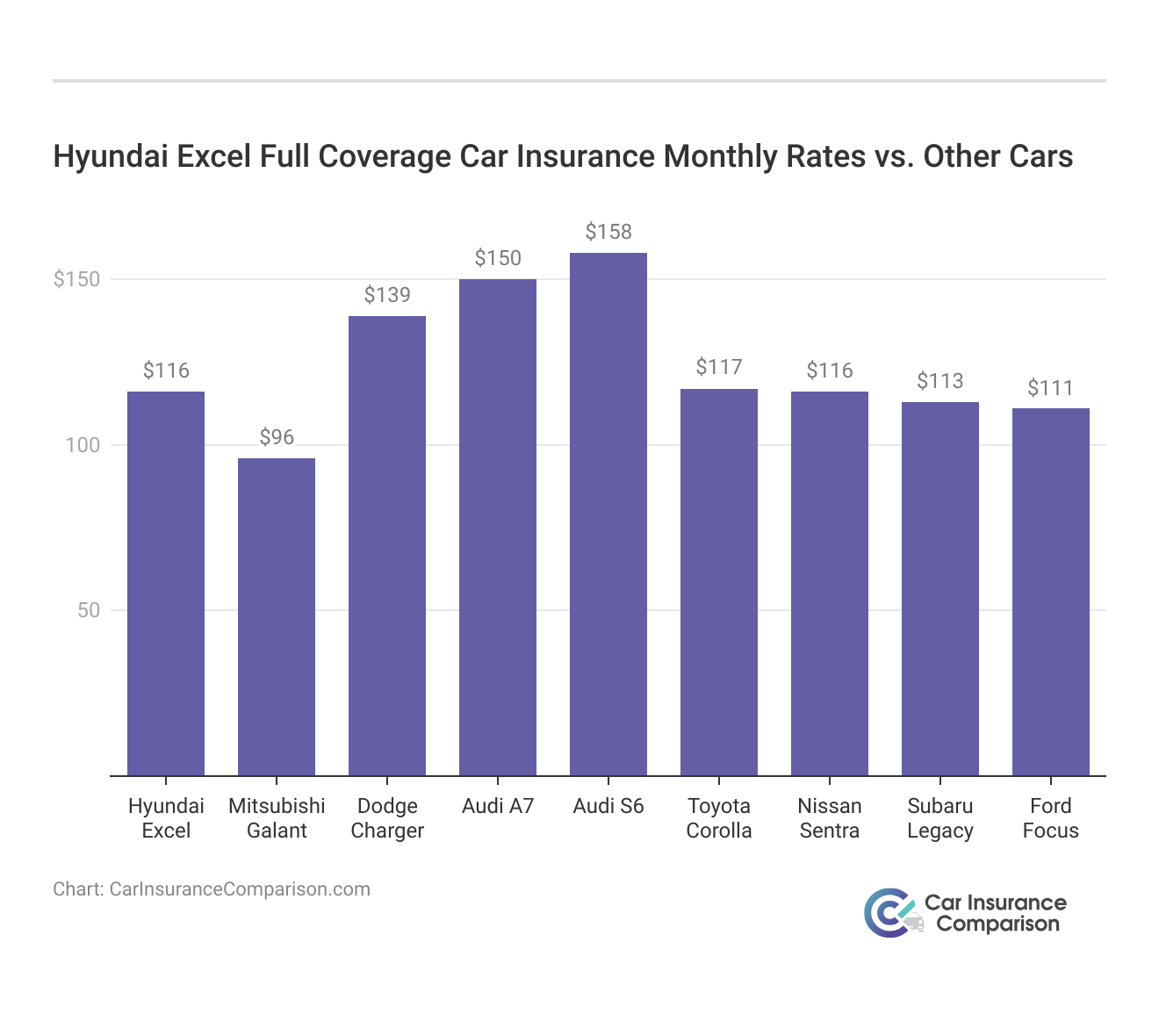

Exploring insurance rates for vehicles comparable to the Hyundai Excel, such as the Dodge Neon, Buick Roadmaster, and Ford Taurus, can provide insight into what you might pay for similar models.

Reviewing the insurance costs for models like the Hyundai Excel and its peers helps you understand the potential expenses involved, ensuring you make an informed decision when choosing your next vehicle’s insurance.

The data highlights that while insurance costs for the Hyundai Excel are competitive, rates can vary greatly among similar models, impacting overall ownership expenses. Such comparisons are crucial for making informed decisions on which car to buy based on potential long-term costs.

Insurance Rates for Vehicles Similar to the Hyundai Excel

Comparing car insurance rates for vehicles similar to the Hyundai Excel can provide insights into the potential costs associated with various models.

This comparison covers comprehensive, collision, minimum, and full coverage costs for several cars ranging from luxury sedans to compact models. Access comprehensive insights into our guide titled, “What makes car insurance more expensive?“

Hyundai Excel Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Hyundai Excel | $23 | $62 | $35 | $111 |

| Lexus LS 460 | $34 | $68 | $30 | $143 |

| Mercedes-Benz S450 | $41 | $82 | $33 | $169 |

| Audi S8 | $55 | $114 | $33 | $215 |

| Hyundai Accent | $20 | $44 | $35 | $111 |

| Audi S3 | $30 | $62 | $22 | $123 |

| BMW M5 | $37 | $74 | $36 | $160 |

| Honda Civic | $23 | $55 | $35 | $128 |

| Mazda 3 | $26 | $47 | $31 | $117 |

The data illustrates the diversity in insurance costs among different vehicle types, highlighting how factors like vehicle value and repair costs impact premiums. Understanding these differences helps Hyundai Excel owners gauge where their car stands in terms of insurance affordability relative to other models.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Key Elements Affecting the Cost of Insuring a Hyundai Excel

Personal factors like where you live, your driving history, and your driving habits will have an impact on the cost of your Hyundai Excel car insurance, just like they would with any other car. The Hyundai Excel trim level you buy will also have an impact on the total price you will pay for Hyundai Excel insurance coverage. Explore our comprehensive resource titled “Does the age of a car affect car insurance rates?“

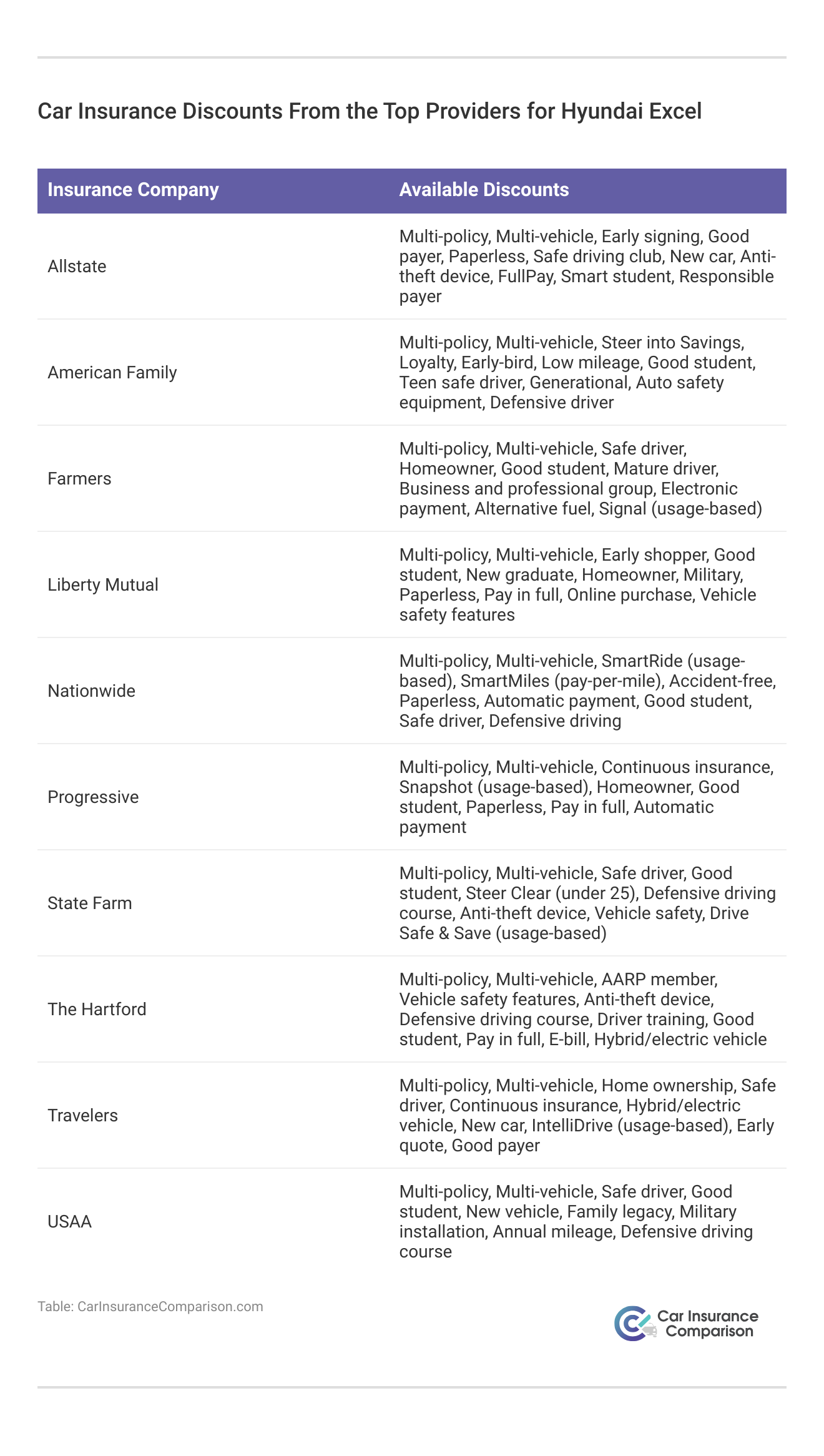

Money-Saving Tips for Hyundai Excel Insurance

Save more on your Hyundai Excel car insurance rates. Take a look at the following five strategies that will get you the best Hyundai Excel auto insurance rates possible.

- Renew your Hyundai Excel insurance coverage to avoid lapses.

- Ask about Hyundai Excel safety discounts.

- Check for organization-based discounts, like alumni or employer discounts.

- Work with a direct insurer instead of an insurance broker for your Hyundai Excel.

- Ask about welcome discounts.

By implementing these strategies, you can potentially lower your car insurance premiums and enjoy more affordable coverage for your Hyundai Excel.

Always compare multiple insurers and explore all available discounts to ensure you are getting the best possible deal. Find out more information in our guide titled, “Factors That Affect Car Insurance Rates.”

Best-Rated Hyundai Excel Insurance Companies

Choosing the right auto insurance for your Hyundai Excel is crucial, as rates can vary significantly based on a variety of factors. Here’s a look at the top insurers, ranked by market share, that offer competitive rates and discounts for this model.

Largest Auto Insurers by Market Share

When choosing the best car insurance for a Hyundai Excel, it’s helpful to consider the largest auto insurers by market share. This list reflects the top providers in terms of premiums written, indicating their popularity and trustworthiness among consumers. To find out more, explore our guide titled, “Finding Free Car Insurance Quotes Online.”

Top Hyundai Excel Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

The rankings above showcase the leading auto insurance companies for Hyundai Excel by market share, helping you identify which insurers are the most favored in the industry.

With Progressive, you’re choosing the market leader in value and reliability for your Hyundai Excel insurance.

Brad Larson Licensed Insurance Agent

Understanding these market dynamics can guide you in making a more informed decision when selecting your car insurance provider. You can start comparing quotes for Hyundai Excel insurance from some of the top car insurance companies by using our free online tool below today.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Are vehicles like the Hyundai Excel expensive to insure?

The cost of insurance for vehicles like the Hyundai Excel can vary. To get an idea of what to expect, you can look at insurance rates for similar models like the Dodge Neon, Buick Roadmaster, and Ford Taurus. To learn more, explore our comprehensive resource on “Compare Car Insurance by Coverage Type.”

What impacts the cost of Hyundai Excel insurance?

The cost of Hyundai Excel insurance is influenced by personal factors such as your location, driving record, driving habits, and the specific trim level of the Hyundai Excel you own.

What are some ways to save on Hyundai Excel insurance?

Here are five strategies to help you save on Hyundai Excel insurance rates:

- Compare quotes from multiple insurance companies.

- Maintain a good driving record.

- Take advantage of available discounts and safety features.

- Opt for a higher deductible.

- Bundle your auto insurance with other policies.

By implementing these strategies, you can achieve more affordable insurance premiums for your Hyundai Excel. Regularly reviewing your policy options and staying informed about potential savings will ensure you get the best value for your car insurance.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

How can I compare free Hyundai Excel insurance quotes online?

You can compare quotes for Hyundai Excel insurance from top insurance companies by using our free online tool. Simply enter your ZIP code to get started and view the available options.

What safety features does the Hyundai Excel have that can potentially reduce car insurance rates?

The Hyundai Excel comes equipped with numerous safety features that can help lower car insurance rates. Some of these features may include anti-lock brakes, air bags, traction control, electronic stability control, and a security system.

These safety features can contribute to safer driving and may result in potential discounts from insurance companies. To know the specific safety features of a particular model, it’s best to consult with the Hyundai dealership or refer to the vehicle’s specifications. Learn more by reading our guide titled, “Does car insurance cover performance parts?“

Is insurance higher on Hyundai Excel?

The insurance cost for a Hyundai Excel is typically lower than for newer models, due to its age and lower market value. Monthly premiums are usually quite affordable.

What is the best car insurance right now for a Hyundai Excel?

Progressive currently offers the best car insurance for a Hyundai Excel, with competitive monthly rates and comprehensive coverage options tailored for older cars.

Which insurance company is best for Hyundai Excel car insurance?

Progressive is highly recommended for Hyundai Excel car insurance due to its expertise in providing policies for older vehicles at competitive rates.

How does the reliability of the Hyundai Excel affect its insurance rates?

The moderate reliability of the Hyundai Excel can influence insurance rates slightly higher, as older and less reliable vehicles may pose a higher risk for claims related to mechanical failures.

Learn more by reading our guide: 16 Ways to Lower the Cost of Your Insurance

Why might older Hyundai Excels be considered a higher risk for insurers?

Older Hyundai Excels can be considered higher risk by insurers due to the increased likelihood of needing repairs as the vehicle ages, potentially leading to higher insurance premiums.

Which insurance is best for a Hyundai Excel after 5 years?

Allstate offers specialized insurance for Hyundai Excels that are more than 5 years old, focusing on balancing affordable coverage with the needs of an older vehicle.

What impact did the replacement of the Hyundai Excel by the Hyundai Accent have on insurance?

The replacement of the Hyundai Excel with the Hyundai Accent generally led to slightly higher insurance rates for the Accent due to newer technology and higher replacement costs.

What is the lifespan of a Hyundai Excel in terms of insurance coverage?

Insurance companies typically cover Hyundai Excel models up to a significant age as long as the vehicle is in good working condition, though rates may increase as the car ages beyond 150,000 miles. For additional details, explore our comprehensive resource titled, “How do you get competitive quotes for car insurance?“

What are the insurance implications of the disadvantages of Hyundai Excel cars?

The basic features and older technology of Hyundai Excel cars can lead to higher insurance costs, as these cars may require more frequent repairs and are less secure against theft.

Which insurance is best for a second-hand Hyundai Excel?

AAA is a good choice for insuring a second-hand Hyundai Excel, offering policies that are tailored for older, used vehicles at competitive monthly rates. Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.