Best Hot Rod Car Insurance in 2025 (Find the Top 10 Companies Here!)

Hagerty, American Modern, and State Farm have the best hot rod car insurance. Hagerty's average minimum rates for hot rod insurance are $110/mo, and it also offers storage discounts. While some heavily modified hot rods will cost more to insure, these companies offer the best deals on hot rod insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

17 reviews

17 reviewsCompany Facts

Full Coverage for Hot Rod

A.M. Best Rating

Complaint Level

17 reviews

17 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Hot Rod

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Hot Rod

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsYou will find the best hot rod car insurance at Hagerty, American Modern, and State Farm.

Hot rod cars are fun to rebuild and even more fun to show off. However, how you insure them will likely come down to your vehicle and preferences.

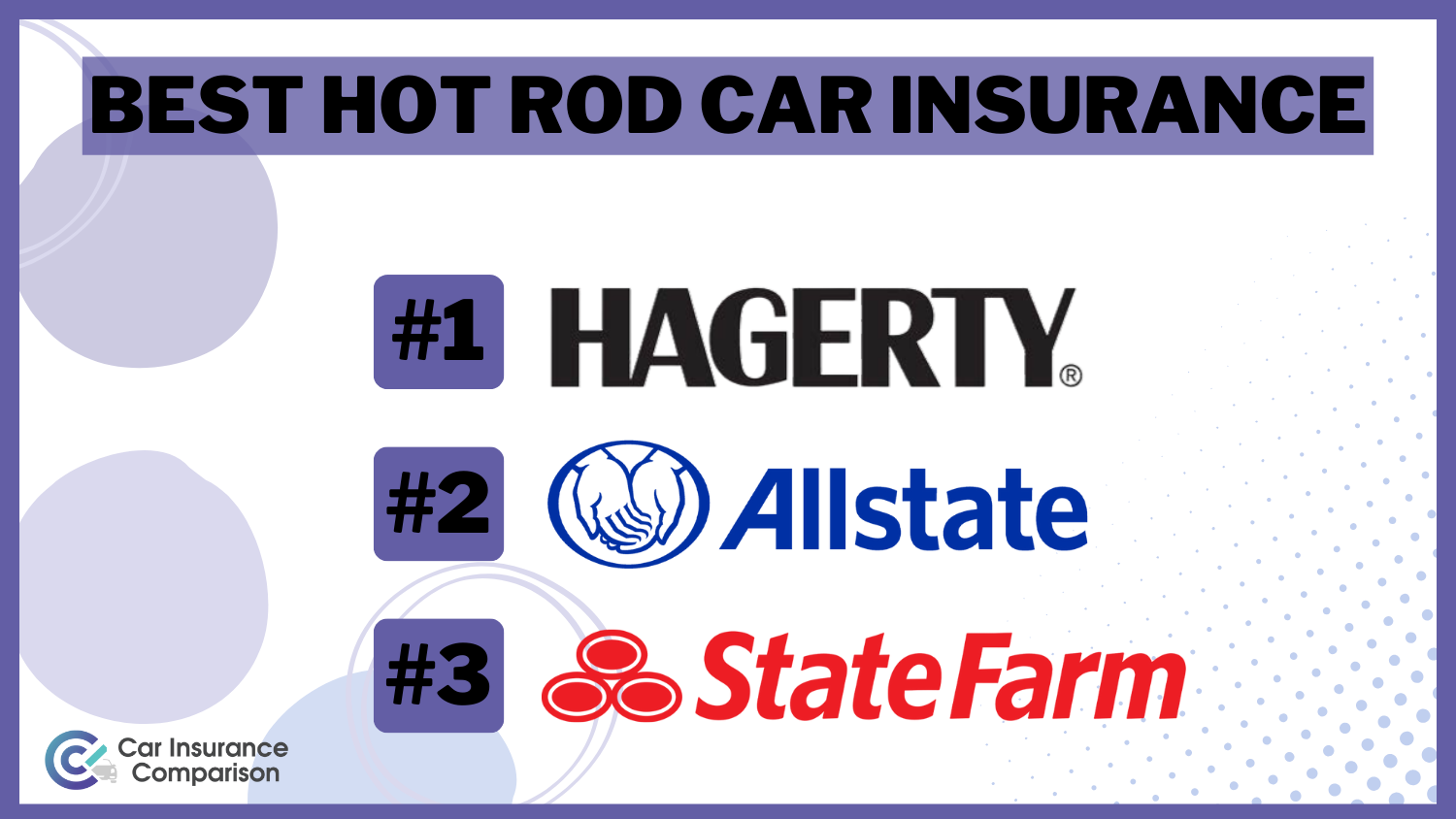

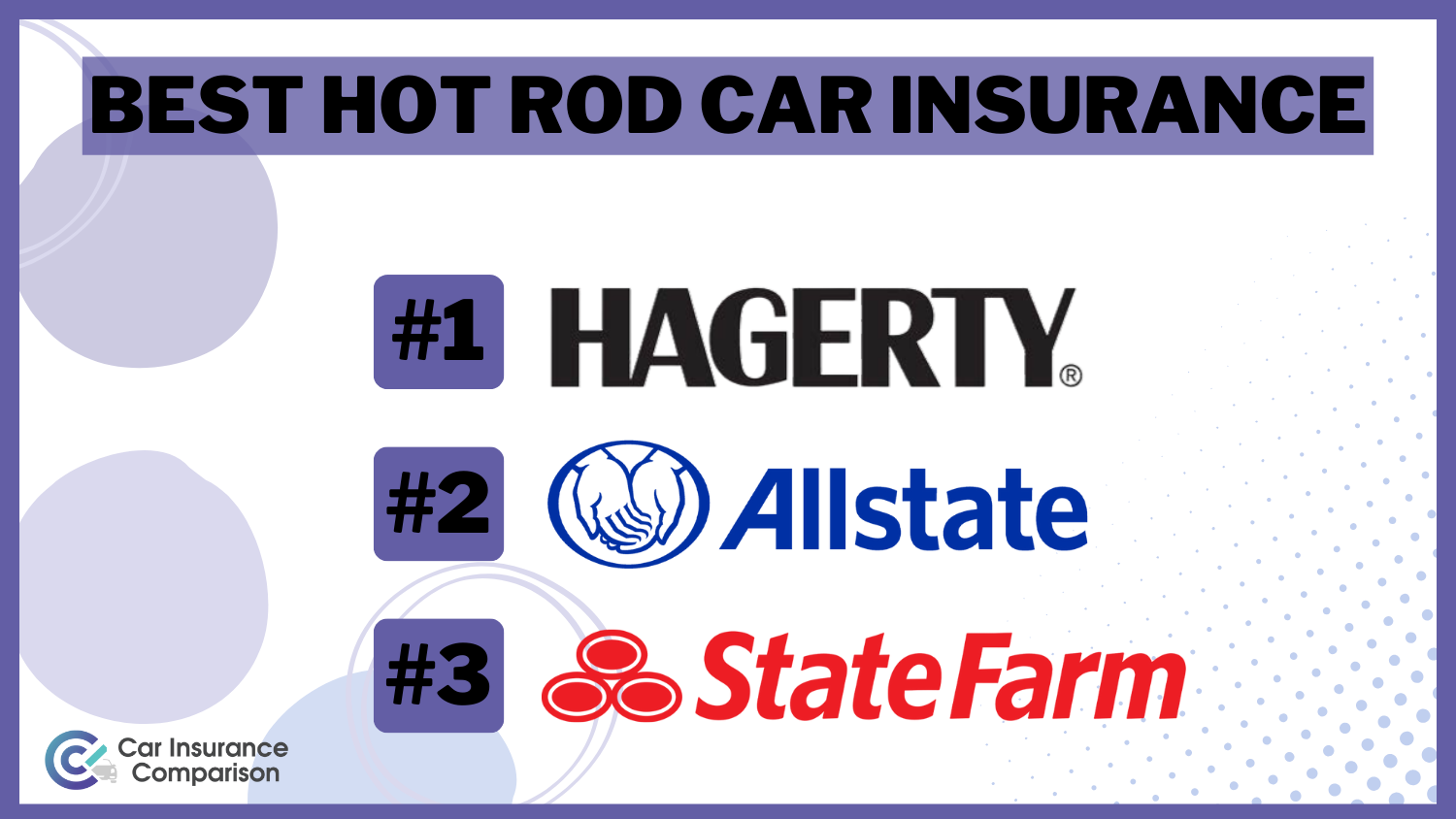

Our Top 10 Company Picks: Best Hot Rod Car Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A- | Classic Coverage | Hagerty |

| #2 | 25% | A+ | Agreed Value | Allstate | |

| #3 | 20% | A++ | Agency Network | State Farm | |

| #4 | 10% | A+ | Military Savings | American Modern | |

| #5 | 10% | A+ | Flexible Options | Progressive | |

| #6 | 10% | A++ | Classic Cars | Grundy |

| #7 | 20% | A+ | Comprehensive Coverage | Nationwide |

| #8 | 15% | A++ | Value Vehicles | Chubb | |

| #9 | 10% | A | First-Responder Discount | Farmers | |

| #10 | 12% | A | 24/7 Support | Liberty Mutual |

Understanding your car insurance policy and what it allows will help you get the best classic car insurance for your hot rod.

Curious about rates for hot rod car insurance? Enter your ZIP code into our free quote tool to see what you could pay for hot rod auto insurance.

- Hagerty is one of the best hot rod insurance companies

- Classic, agreed value, and custom parts car insurance are all hot rod options

- Discuss your vehicle and policy options with an agent to help you narrow it down

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Hagerty: Top Pick Overall

Pros

- Classic Coverage: Hagerty is known for its specialized collector and classic car insurance policies.

- Agreed Value Coverage: If your hot rod is totaled, you will receive the previously agreed-upon value.

- Repair Shop Network: Hagerty offers a network of repair shops that are experienced with hot rod repairs.

Cons

- Availability: Hagerty hot rod insurance is not available in all states. Learn more in our Hagerty insurance review.

- Mileage Restrictions: Some coverages for hot rods may have mileage restrictions.

#2 – Allstate: Best for Agreed Value

Pros

- Agreed Value: Allstate bases its classic car insurance on agreed value.

- 24/7 Support: Allstate offers support for hot rod owners around the clock.

- Good Driver Discounts: Save with Allstate’s good driver discounts. Learn more in our Allstate review.

Cons

- Fewer Classic Discounts: Hot rod owners may not have as many discounts for their non-standard policies.

- Local Agent Availability: There may not be a local agent available in most locations.

#3 – State Farm: Best for Agency Network

Pros

- Agency Network: Most hot rod owners will have access to a local agent. Learn more in our State Farm review.

- Multi-Policy Discounts: Drivers can bundle hot rod insurance with other insurance types.

- Competitive Rates: State Farm offers some of the cheapest rates for good drivers.

Cons

- Coverage Options: State Farm’s coverage options for classic hot rods may be more limited.

- Additional Underwriting: Some specialized coverages may require additional underwriting.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – American Modern: Best for Military Savings

Pros

- Military Savings: American Modern offers a military discount if you are an active military personnel (read more: Compare Military Personnel Car Insurance Rates).

- Flexible Usage: You can purchase a flexible usage policy to drive your hot rod to shows.

- Garage Insurance: You can purchase a specialized policy in case of damages while your car is stored.

Cons

- Availability: American Modern has limited availability, so it may not be in your state.

- Underwriting: A few specialty coverages may need additional underwriting from American Modern.

#5 – Progressive: Best for Flexible Options

Pros

- Flexible Options: Progressive offers flexible coverage options for hot rod coverage. Read more in our Progressive car insurance review.

- Multi-Policy Discounts: Bundle hot rod insurance with another insurance for a discount.

- Name Your Price Tool: Use Progressive’s tool to see which customization coverage you can afford.

Cons

- Additional Underwriting: Some coverages sold by Progressive may need additional underwriting.

- Discount Availability: Discounts may be more limited for specialized car insurance.

#6 – Grundy: Best for Classic Cars

Pros

- Classic Cars: Grundy offers great coverage options for classic hot rod cars.

- No Mileage Caps: Grundy doesn’t have mileage restrictions when driving classic cars to events.

- Agreed Value: Get full reimbursement for a covered loss of your hot rod with agreed value car insurance.

Cons

- Availability: Grundy may have limited coverage options in some states.

- Customer Reviews: Some Grundy customers left negative reviews about its customer service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Nationwide offers great comprehensive coverage for hot rods.

- Online Quotes: You can easily and quickly get an online quote for your hot rod.

- Multi-Policy Discount: Bundle hot rod insurance with other insurance for a substantial discount. Read more in our article on Nationwide car insurance discounts.

Cons

- Additional Underwriting: Some coverages, like agreed value, may need additional underwriting.

- Discount Availability: Some discounts may be absent for custom car insurance.

#8 – Chubb: Best for Value Vehicles

Pros

- Value Vehicles: Chubb has great coverage for high-value vehicles.

- Agent Support: Chubb has experienced agents who can help you compare car insurance by coverage type and offer advice on custom car insurance rates.

- Worldwide Coverage: Chubb offers worldwide auto liability insurance for hot rod cars traveling to shows.

Cons

- Higher Rates: Chubb’s rates for hot rod insurance are more expensive.

- State Options: Some states may have limited coverage and discount options.

#9 – Farmers: Best for First-Responder Discount

Pros

- First-Responder Discount: Get a discount if you are a first-responder. Learn more in our Farmers review.

- Agent Support: Farmers has agents for personalized assistance.

- Multi-Vehicle Discount: Save up to 10% when you insure more than one vehicle.

Cons

- Additional Underwriting: You may need additional underwriting for agreed value coverage.

- Discount Limitations: Some standard car insurance discounts may not be offered to hot rod owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Hot rod owners have access to help at any time of day.

- Bundling Discount: Liberty Mutual offers a multi-policy discount. Learn more in our article on Liberty Mutual discounts.

- Custom Part Coverage: Get insurance for modifications and custom parts.

Cons

- Additional Underwriting: You may need underwriting for agreed value insurance.

- Discount Limitations: Some discounts may be less for hot rod insurance.

Classic Hot Rod Insurance Providers

A classic car is a piece of American history that we can still see and drive around today. Ensuring these vehicles with the right policy can even be affordable if the car meets the policy’s requirements. Some of the most popular insurance companies that offer classic car insurance for hot rods are:

- Hagerty

- American Modern

- State Farm

When it comes to getting custom or classic car insurance, you’ll want to make sure that the insurer offers the right deals for your policy. You can get quotes directly from providers like Hagerty.

Some insurance companies, like Hagerty, offer coverage for remodeling, while others, like State Farm, have mile restrictions for some policies. Because the cost of insurance is based on risk and value, you should ensure that your policy fits your situation and you are getting the best quotes possible.

Read More: Cheap Car Insurance Companies That Beat Quotes

Hot Rod Classification

According to the National Street Rod Association, a hot rod is a vehicle that:

- Was created in 1948 or earlier

- Has undergone modernization in some form

- Does not have standard factory equipment

Since there are no policies specifically designed for hot rods, you’ll likely have to consider other options for cheap hot rod car insurance. For instance, if you’ve taken pride in restoring your car to its factory build, you can probably still get classic car insurance.

However, if you’ve been doing some of your mechanical work and replaced parts in the vehicle, you’ll need to get some special coverage.

How To Know if Your Car Qualifies for Classic Car Insurance

If you’re looking to get classic car insurance, there are a few requirements that your vehicle will need to meet. According to the Insurance Information Institute, there are many factors that the insurer will look at besides the car’s age.

To get classic car insurance, you will need to ensure:

- Your vehicle meets the minimum age requirement

- You aren’t driving the car regularly

- That your vehicle is in secure storage

- You don’t have a bad driving record

You may also wish to ask your insurer if you have coverage for car shows.

If you can pass all of the above benchmarks, you shouldn’t have any problem getting a suitable classic car insurance policy.

Cost of Hot Rod Car Insurance

Hot rods with expensive modifications may cost more to insure than a traditional car, even if you get competitive quotes (learn more: How do you get competitive quotes for car insurance?).

Hot Rod Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $120 | $230 |

| American Modern | $140 | $250 |

| Chubb | $200 | $350 |

| Farmers | $150 | $270 |

| Grundy | $130 | $240 |

| Hagerty | $110 | $220 |

| Liberty Mutual | $160 | $280 |

| Nationwide | $130 | $240 |

| Progressive | $140 | $260 |

| State Farm | $125 | $235 |

However, if you have a hot rod you rarely drive, it may be able to qualify for classic car insurance, which is cheaper than a traditional policy.

View this post on Instagram

Read on to learn about how much classic car insurance costs.

Cost of Classic Car Insurance

According to Progressive, classic car insurance rates can often be at least 34% less than traditional insurance. That doesn’t mean you can’t drive the car; you’ll just have to be selective about when you start the engine.

Classic car insurance savings come from the lowered risk of not driving the car regularly, as classic cars are often just driven to events or on a weekend pleasure drive.

Dani Best Licensed Insurance Producer

According to our classic auto insurance guide, which looks at classic car rates state by state, most insurance policies range from $400 to $800 a year for full coverage. That’s much cheaper than traditional car insurance policies for newer vehicles.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How to Save on Car Insurance for Hot Rods

If you need to get more affordable hot rod insurance quotes, there are a few things you can do, including:

- Improving Your Driving Record: This will show the insurer that you’re a responsible driver and less of a risk.

- Raising Your Deductible: You’ll be paying more for repairs before the insurance kicks in, but your rates will be lower.

- Consider Your Options: Looking at multiple policy options will ensure that you find the best price.

Drivers with few or no accidents and infractions on their records will always get the best hot rod insurance rates, as they qualify for more car insurance discounts.

Shopping around with multiple insurance companies can also help you save money on your hot rod car insurance rates.

Hot Rod Car Insurance: The Bottom Line

If you need hot rod car insurance, there are more than a few companies that will be happy to provide that to you. First, however, you’ll need to decide what kind of coverage your car needs and compare monthly car insurance rates. Some of the best hot rod auto insurance companies even offer added benefits when you’re rebuilding a classic car.

Are you looking for quotes for hot rod car insurance? Enter your ZIP code into our free quote tool to see what you could pay at different hot rod car insurance companies.

Frequently Asked Questions

What companies offer hot rod car insurance?

Some popular insurance companies that offer classic car insurance for hot rods are Hagerty, Safeco, and Progressive.

How much does classic car insurance cost?

Classic car insurance rates can range from $400 to $800 a year for full coverage, which is often at least 34% less than traditional insurance. Using a car insurance calculator can help you find the best deal.

What counts as a hot rod to car insurance companies?

According to the National Street Rod Association, a hot rod is a vehicle that has been modified for speed and performance.

How do I know if my car can get hot rod insurance?

To qualify for classic car insurance, your vehicle will need to meet certain requirements such as being a certain age, in good condition, and not driven as a primary vehicle.

How do I know if I need rat rod insurance?

Rat rods, highly customized vehicles, may not qualify for classic car insurance. Some hot rod cars may not qualify for classic car insurance if they’ve been heavily modernized or customized. An agreed value car insurance policy may be more suitable in such cases (learn more: How to Get Car Insurance).

Can I get hot rod insurance while modifying a car?

Some insurance companies, like Hagerty, allow you to ensure your classic car in all steps of the remodeling process. As an example, Hagerty’s vehicle under construction coverage includes:

- Guaranteed value

- $250 in coverage for tools

- A network of towing specialists to get your vehicle to the shop

Hagerty will guarantee to insure your classic car for up to $25,000 and give you coverage for any lost or damaged tools. With an insurance policy like that, you’d have a helping hand getting your vehicle in proper shape.

Are there additional coverage options for hot rods?

Another option to consider for hot rods with custom parts is a custom parts and equipment policy. This primarily covers vehicles with custom equipment, but may not offer enough value for a full classic car.

Most insurance companies insure vehicles for what they came out of the factory with, so adding supplemental coverage to your classic car may be a good idea.

What policy features are important for hot rod insurance?

When you get a classic car insurance policy, you should ensure that it meets all of your needs. This can be everything from including showroom coverage to allowing you to drive the car on short trips.

When you apply for a classic car insurance policy, you should verify that you’ll be covered for the situations your vehicle will be in. Nothing would be worse than having your car dinged up on the showroom floor and finding out you don’t have the right coverage to pay for repairs (learn more: Understanding Your Car Insurance Policy).

What is agreed value car insurance?

Just like it sounds, agreed value car insurance is a policy where you and the insurer agree on the vehicle’s value. This type of policy is suitable for vehicles that:

- Are missing components

- Have custom equipment

- Are made to look worse than they are

With agreed value car insurance, you can go over the vehicle with an agent and discuss what you think the appropriate value is. Then, your insurer will estimate your car insurance rates from there.

Who has the best street rod insurance?

Hagerty has the best street rod car insurance. Other good companies for street rods insurance include American Modern and State Farm.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.