Best GMC Typhoon Car Insurance in 2025 (Your Guide to the Top 10 Companies)

The top providers for the best GMC Typhoon car insurance are State Farm for outstanding customer service, Geico for affordable rates starting at $38 per month, and Progressive for customizable plans. Benefit from these providers' specialized coverage designed to meet the needs of GMC Typhoon drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Aug 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for GMC Typhoon

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for GMC Typhoon

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for GMC Typhoon

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

State Farm, Geico, and Progressive are the leading companies for securing the best GMC Typhoon car insurance. Each of these top providers brings unique advantages to the table, ensuring you have access to exceptional coverage.

Our Top 10 Company Picks: Best GMC Typhoon Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 25% A++ Affordable Rates Geico

#3 15% A+ Customizable Plans Progressive

#4 20% A+ Digital Tools Allstate

#5 10% A++ Military Families USAA

#6 15% A Personal Service Farmers

#7 12% A Coverage Options Liberty Mutual

#8 20% A+ Policy Bundles Nationwide

#9 25% A Teen Drivers American Family

#10 10% A++ Claim Satisfaction Travelers

By comparing these options, you can find the ideal insurance policy that offers both comprehensive coverage and the best value for your GMC Typhoon.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

- State Farm offers top-rated customer service and competitive rates

- Compare the best GMC Typhoon car insurance for tailored coverage options

- Find affordable rates starting at $38 per month for GMC Typhoon insurance

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Excellent Customer Service: State Farm car insurance review promotes the company’s exceptional customer support, ensuring GMC Typhoon owners receive attentive and helpful service.

- Comprehensive Coverage Options: Offers a variety of coverage options tailored for GMC Typhoon drivers, addressing their specific insurance needs effectively.

- Strong Local Presence: With a wide network of agents, State Farm provides personalized service and local expertise, which is advantageous for GMC Typhoon owners seeking detailed advice.

Cons

- Higher Premiums for Some: While known for great customer service, State Farm’s premiums may be higher compared to other insurers, potentially affecting affordability for GMC Typhoon drivers.

- Limited Digital Tools: State Farm’s digital tools and app functionalities might not be as advanced as those of some competitors, impacting convenience for tech-savvy GMC Typhoon owners.

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico is recognized for offering some of the most competitive rates for GMC Typhoon insurance, making it a cost-effective choice for budget-conscious drivers.

- User-Friendly Online Experience: Geico car insurance review manifests the company’s intuitive online platform and mobile app for managing policies and claims, enhancing convenience for GMC Typhoon owners.

- Broad Discounts: Geico offers a variety of discounts that can be applied to GMC Typhoon insurance, further reducing overall costs.

Cons

- Basic Customer Service: Although rates are low, Geico’s customer service might not be as personalized or extensive as some other providers, which could affect support for GMC Typhoon owners.

- Limited Coverage Options: Geico may offer fewer options for customization compared to other insurers, which might not meet all the specific needs of GMC Typhoon drivers.

#3 – Progressive: Best for Customizable Plans

Pros

- Customizable Coverage Plans: Progressive excels in offering customizable insurance plans, allowing GMC Typhoon owners to tailor their coverage according to their specific needs.

- Competitive Rates for High-Risk Drivers: Progressive often provides favorable rates for drivers with less-than-perfect records, which can benefit some GMC Typhoon owners.

- Innovative Tools: Progressive company’s innovative tools like the Name Your Price tool, helping GMC Typhoon drivers find coverage that fits their budget. For additional details, explore our comprehensive resource titled “Progressive Car Insurance Review.”

Cons

- Mixed Customer Service Reviews: While offering customization, Progressive car insurance review unveil customer service may receive mixed reviews, potentially impacting the overall experience for GMC Typhoon owners.

- Potential for Higher Costs: Depending on the level of customization and risk factors, insurance costs with Progressive might be higher for some GMC Typhoon drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Digital Tools

Pros

- Extensive Digital Tools: Allstate introduces the company’s advanced digital tools and apps, which can be highly beneficial for GMC Typhoon owners managing their insurance online. To delve deeper, refer to our in-depth report titled “Allstate Car Insurance Review.”

- Strong Coverage Options: Offers a wide range of coverage options, ensuring GMC Typhoon drivers can find plans that meet their specific needs.

- Good Claim Satisfaction: Allstate has a reputation for effective claims handling, which can provide peace of mind for GMC Typhoon owners in case of an accident.

Cons

- Higher Premiums: The comprehensive coverage and digital tools come with potentially higher premiums, which may affect affordability for some GMC Typhoon drivers.

- Inconsistent Customer Service: While digital tools are strong, customer service experiences can vary, possibly impacting support for GMC Typhoon owners.

#5 – USAA: Best for Military Families

Pros

- Excellent for Military Families: USAA offers tailored insurance solutions for military families, including GMC Typhoon drivers with military affiliations.

- Highly Rated Customer Service: USAA car insurance review broadcast the company’s outstanding customer service, which benefits GMC Typhoon owners who value personalized support.

- Comprehensive Coverage: Provides robust coverage options that can be customized to meet the needs of GMC Typhoon drivers.

Cons

- Limited Eligibility: USAA’s services are available only to military members and their families, which limits access for non-military GMC Typhoon owners.

- Potentially Higher Costs: Rates might be higher for some, depending on the level of coverage and individual circumstances for GMC Typhoon drivers.

#6 – Farmers: Best for Personal Service

Pros

- Personal Service: Farmers offers personalized insurance services, which can be advantageous for GMC Typhoon drivers seeking tailored advice and support.

- Broad Coverage Options: Provides a range of coverage options, ensuring GMC Typhoon owners can find suitable policies for their needs.

- Flexible Policies: Farmers car insurance review publicize the company’s flexible policy options that can be customized based on the specific requirements of GMC Typhoon drivers.

Cons

- Higher Premiums: The personalized service and extensive options may come with higher premiums, impacting affordability for GMC Typhoon drivers.

- Variable Customer Service: Service quality can vary by agent and location, potentially affecting the consistency of support for GMC Typhoon owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Coverage Options

Pros

- Wide Coverage Options: Liberty Mutual offers a broad selection of coverage options, catering to the needs of GMC Typhoon drivers.

- Flexible Discounts: Liberty Mutual car insurance review promotes the company’s various discounts that can reduce insurance costs for GMC Typhoon owners.

- Good Customer Support: Offers solid customer support and resources for managing your GMC Typhoon insurance.

Cons

- Inconsistent Rates: Insurance rates can vary significantly based on location and other factors, which might affect the cost for GMC Typhoon drivers.

- Limited Digital Features: The digital tools and app functionality might not be as advanced compared to some competitors, impacting convenience.

#8 – Nationwide: Best for Policy Bundles

Pros

- Comprehensive Policy Bundles: Nationwide offers valuable policy bundles that can be beneficial for GMC Typhoon drivers looking for combined insurance options.

- Variety of Discounts: Provides various discounts that can help lower insurance costs for GMC Typhoon owners.

- Strong Coverage Options: Nationwide car insurance review illustrates the company’s robust coverage options tailored to the needs of GMC Typhoon drivers.

Cons

- Premium Variability: Premiums can be higher depending on the bundle and coverage options selected, which might affect affordability for some GMC Typhoon drivers.

- Mixed Customer Service: Customer service experiences can vary, potentially impacting the support for GMC Typhoon owners.

#9 – American Family: Best for Teen Drivers

Pros

- Excellent for Teen Drivers: American Family offers specialized insurance options for teen drivers, which can be beneficial for families with young GMC Typhoon drivers.

- Strong Coverage Options: Provides a range of coverage options suitable for GMC Typhoon owners.

- Good Discount Programs: GMC Typhoon drivers can lower their insurance costs by participating in American Family, one of the company’s many discount programs. For additional details, explore our comprehensive resource titled “American Family Car Insurance Review.”

Cons

- Higher Premiums for Some: Premiums may be higher, especially for younger drivers, which can impact affordability for GMC Typhoon owners.

- Customer Service Variability: Service quality can vary by location and agent, potentially affecting the overall experience for GMC Typhoon drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Claim Satisfaction

Pros

- High Claim Satisfaction: Travelers car insurance review emphasize the company’s strong track record for claim satisfaction, which can provide reassurance for GMC Typhoon owners.

- Customizable Coverage: Offers flexible coverage options that can be tailored to the specific needs of GMC Typhoon drivers.

- Comprehensive Discounts: Provides various discounts that can help lower the cost of insurance for GMC Typhoon owners.

Cons

- Potentially Higher Costs: Depending on the coverage options and risk factors, premiums might be higher for some GMC Typhoon drivers.

- Mixed Customer Service Reviews: Customer service experiences can be inconsistent, which might impact the support for GMC Typhoon owners.

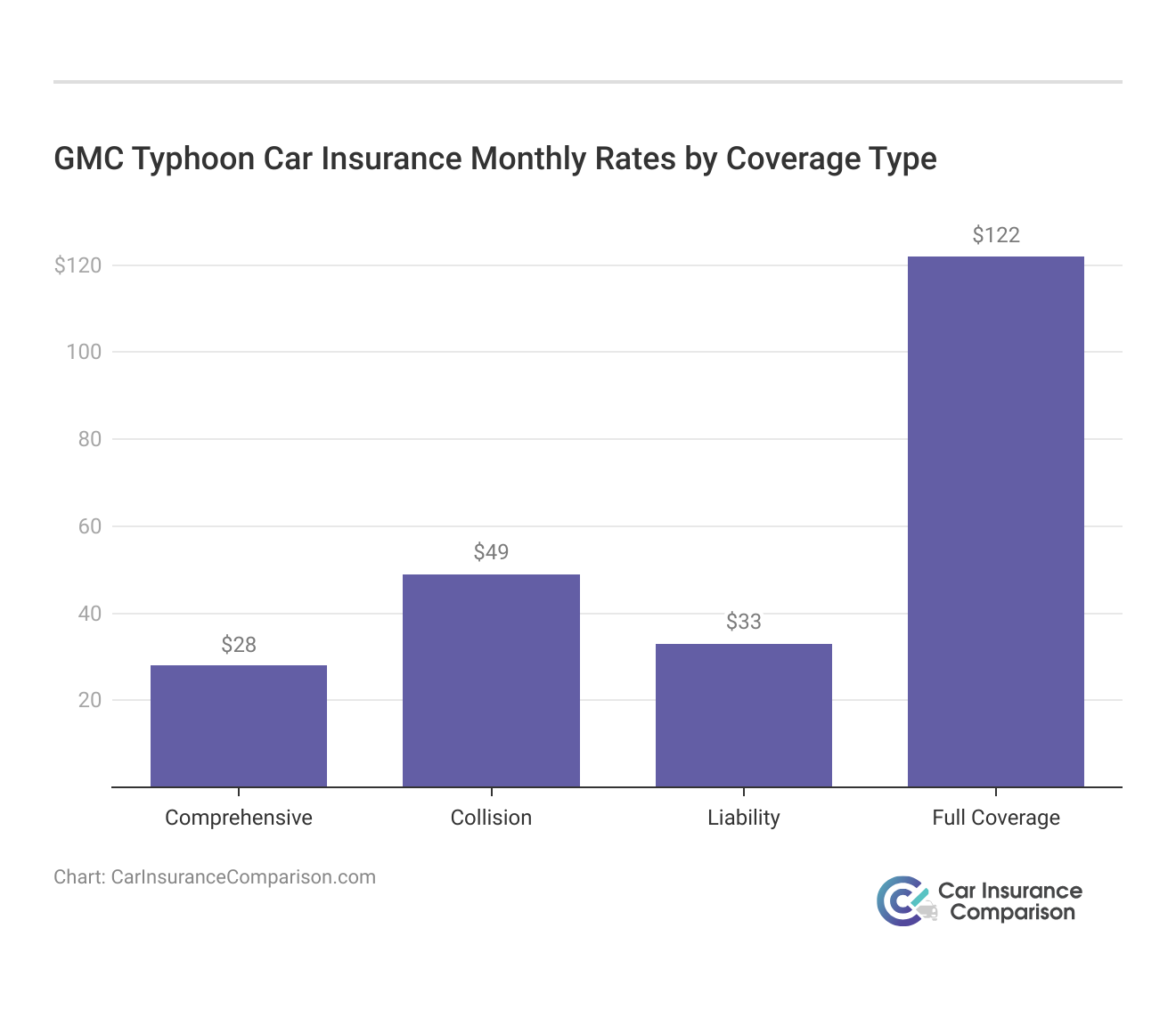

Factors Affecting the Cost of GMC Typhoon Insurance

The GMC Typhoon trim and model you choose can impact the total price you will pay for GMC Typhoon insurance coverage. These factors include the vehicle’s safety features, your driving history, and your location. Insurance companies assess the risk associated with insuring a GMC Typhoon based on its safety ratings, repair costs, and overall performance.

GMC Typhoon Car Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $47 $125

American Family $39 $109

Farmers $43 $118

Geico $40 $110

Liberty Mutual $41 $112

Nationwide $44 $117

Progressive $42 $115

State Farm $45 $120

Travelers $46 $122

USAA $38 $105

You can also expect your GMC Typhoon rates to be affected by where you live, your driving history, and in most states your age and gender. Additionally, your personal driving record, including any accidents or violations, plays a significant role in determining your rates. For additional details, explore our comprehensive resource titled “Do car accidents where you live affect car insurance rates?”

The area where you live also affects insurance costs, as factors like local crime rates and traffic conditions can impact the likelihood of claims. By evaluating these factors, you can better understand how to manage and potentially reduce your GMC Typhoon insurance premiums.

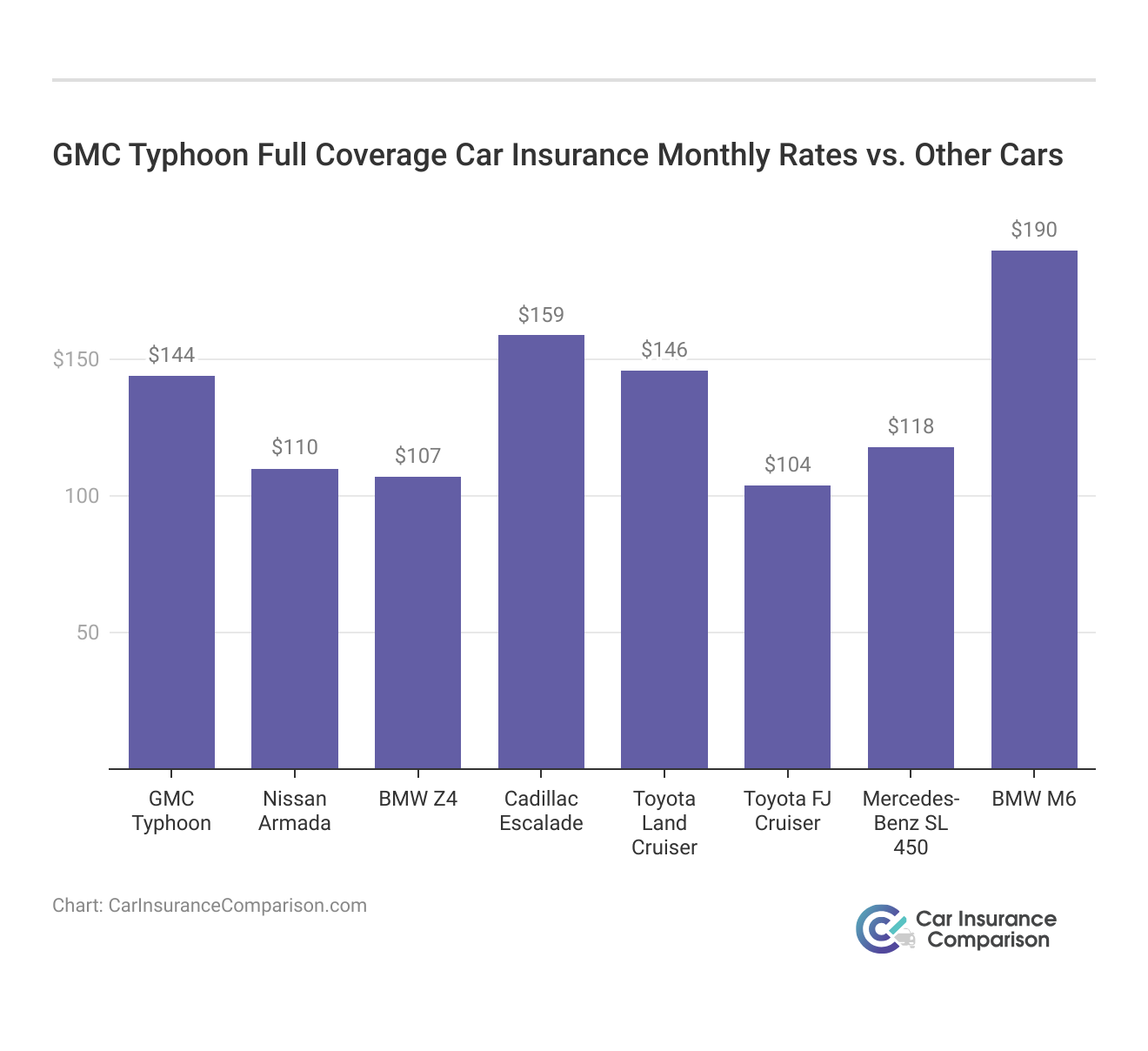

Insurance Costs for GMC Typhoon and Similar Vehicles

When evaluating insurance costs for the GMC Typhoon, it’s useful to compare rates with similar SUVs to understand what you might expect. By examining the insurance rates for vehicles like the Tesla Model X, Kia Telluride, and Mazda Navajo, you can gain insights into how coverage costs for the GMC Typhoon might measure up.

Understanding the insurance rates for comparable SUVs provides valuable context for budgeting your GMC Typhoon insurance.

By comparing these rates, you can make more informed decisions and potentially find ways to manage your insurance costs effectively. To learn more, explore our comprehensive resource on commercial auto insurance titled “How do you get competitive quotes for car insurance?”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Effective Strategies to Save on GMC Typhoon Insurance

Save more on your GMC Typhoon car insurance rates. Take a look at the following five strategies that will get you the best GMC Typhoon auto insurance rates possible.

To save on your GMC Typhoon insurance, consider several strategies. First, ask about seasonal insurance options, which can offer lower rates during times when you drive less. Ensure that you maintain a safe driving record, as this can help reduce your premiums.

Utilizing ride-sharing services to lower your mileage can also lead to cost savings. Additionally, if you move to a new location, compare insurance companies to find the best rates for your new area. Finally, providing your GMC Typhoon’s VIN when requesting quotes can help insurers offer more accurate and potentially lower premiums.

View this post on Instagram

Comparing quotes and updating your information with insurers will ensure you’re always getting the best deal for your GMC Typhoon insurance. By implementing these strategies, you can significantly reduce your GMC Typhoon insurance costs.

Whether it’s exploring seasonal coverage, maintaining a clean driving record, or taking advantage of mileage-based discounts, each approach can help you secure more affordable rates. To delve deeper, refer to our in-depth report titled “How much does mileage affect car insurance rates?”

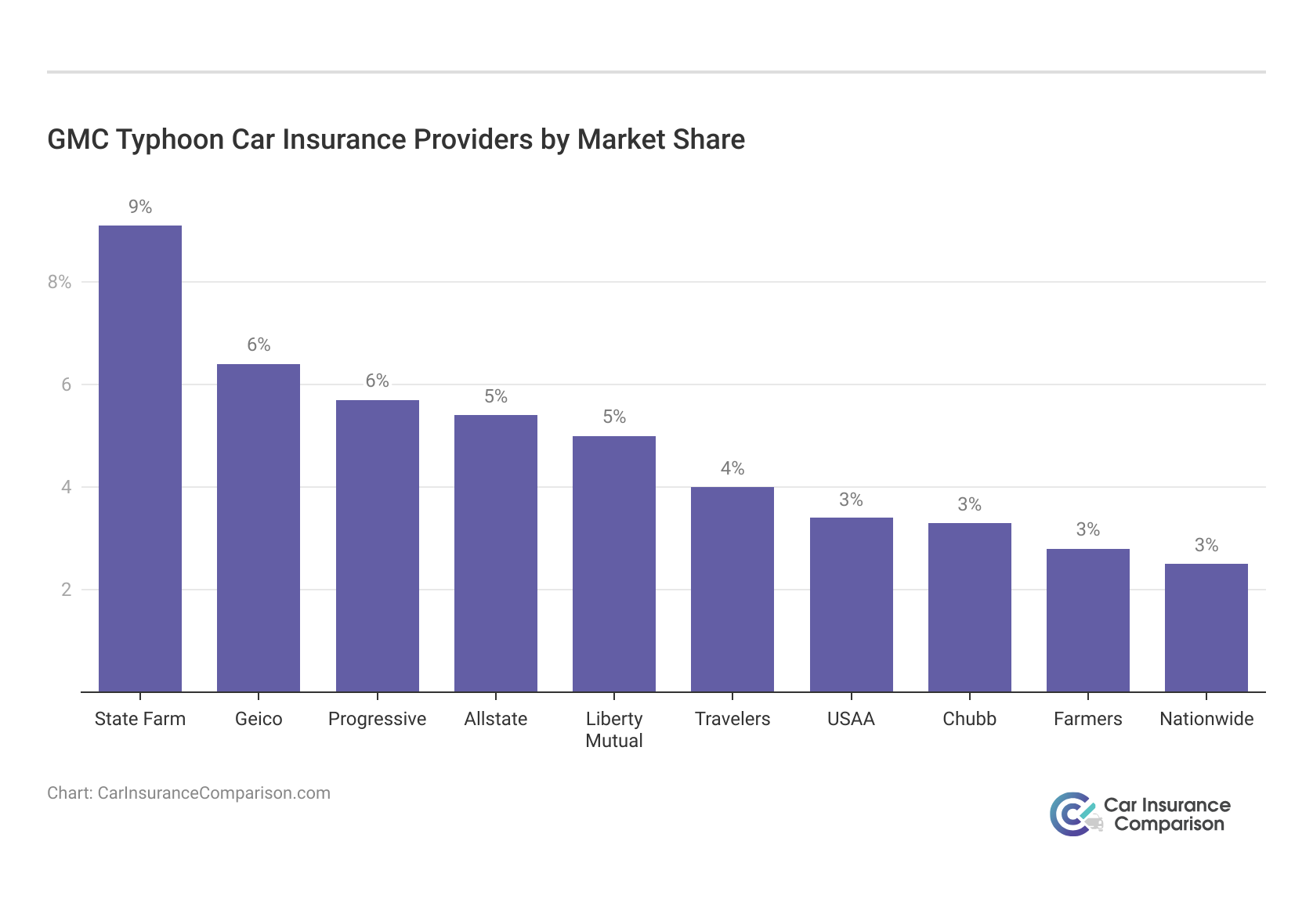

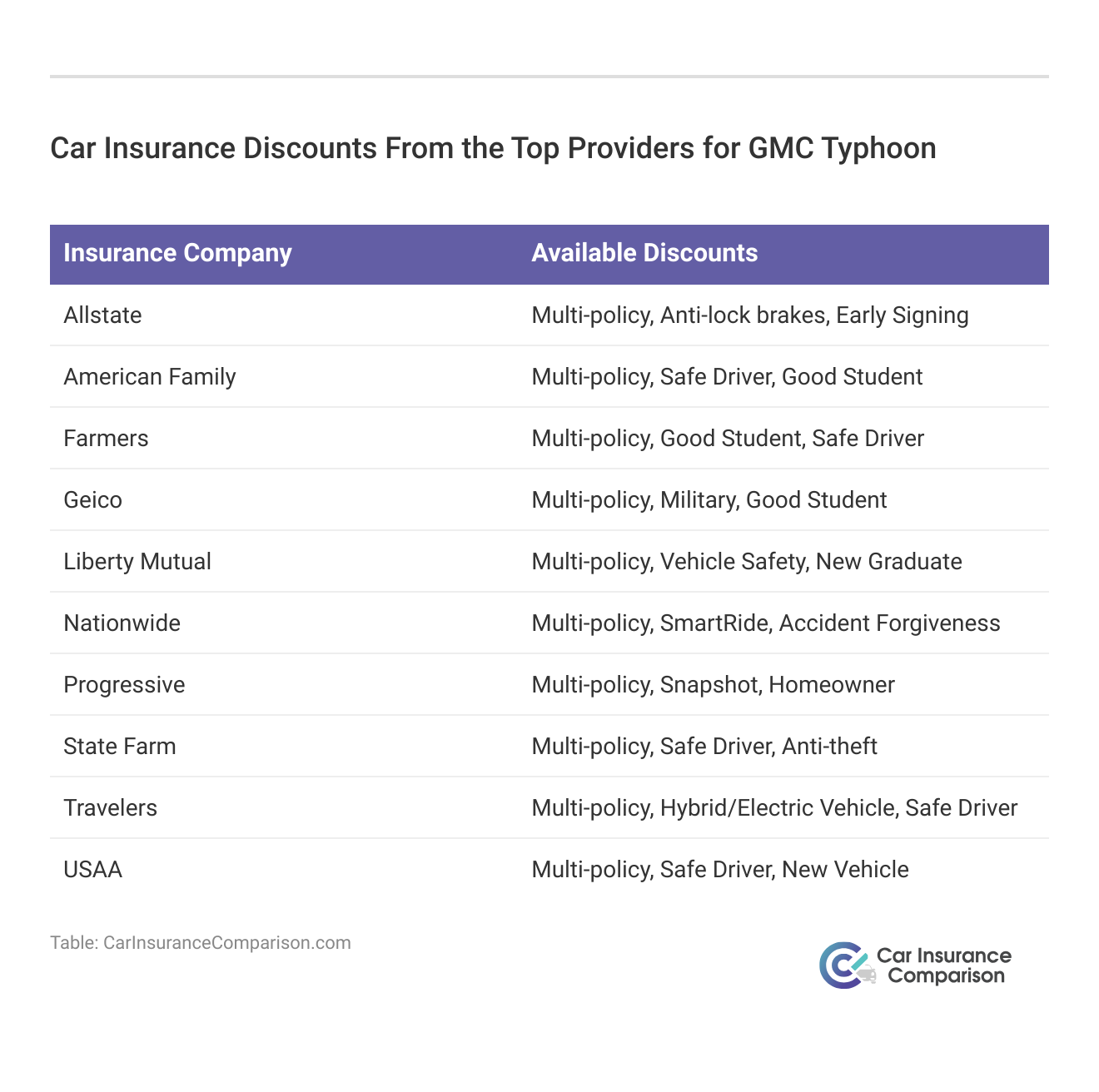

Top GMC Typhoon Insurance Companies

Several insurance companies offer competitive rates for the GMC Typhoon based on factors like discounts for safety features. Take a look at these top car insurance companies that are popular with GMC Typhoon drivers organized by market share.

Top GMC Typhoon Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 million | 9% |

| #2 | Geico | $46.1 million | 6% |

| #3 | Progressive | $39.2 million | 6% |

| #4 | Allstate | $35.6 million | 5% |

| #5 | Liberty Mutual | $35 million | 5% |

| #6 | Travelers | $28 million | 4% |

| #7 | USAA | $23.5 million | 3% |

| #8 | Chubb | $23.4 million | 3% |

| #9 | Farmers | $20.6 million | 3% |

| #10 | Nationwide | $18.4 million | 3% |

When selecting insurance for your GMC Typhoon, considering top companies known for competitive rates and comprehensive coverage options is crucial. For a thorough understanding, refer to our detailed analysis titled “Compare Car Insurance by Coverage Type.”

By exploring the largest auto insurers by market share, you can find providers that offer valuable discounts and benefits tailored to GMC Typhoon drivers. Evaluating these top insurers helps ensure you choose a company that meets your needs while providing excellent coverage and service.

Smart Strategies for GMC Typhoon Insurance

To effectively manage the cost of your GMC Typhoon insurance, consider several smart strategies. Maintaining a clean driving record is crucial, as it often results in lower rates and avoids increases in your premium. Utilize seasonal coverage options to adjust your policy based on your driving habits and seasonal needs, which can help reduce premiums.

Additionally, bundling your GMC Typhoon insurance with other policies, such as home or renters insurance, can lead to significant savings. For a comprehensive overview, explore our detailed resource titled “Best Companies for Bundling Home and Car Insurance.” By implementing these strategies, you can secure comprehensive full coverage insurance while optimizing your overall costs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Essential Guide to GMC Typhoon Insurance

Finding the right insurance for your GMC Typhoon requires careful consideration of several key factors. By comparing quotes, exploring discounts, and choosing the best policy, you can ensure comprehensive protection while managing costs effectively.

- Compare Quotes: Evaluate offers from multiple insurers to find the best rates and coverage for your GMC Typhoon.

- Explore Discounts: Inquire about savings for safety features, bundling policies, and maintaining a clean driving record.

- Choose the Right Policy: Select comprehensive coverage tailored to your GMC Typhoon’s specific needs and driving conditions. To gain profound insights, consult our extensive guide titled “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

By following this essential guide, you can confidently navigate your GMC Typhoon insurance options. Make informed choices to secure optimal coverage and take advantage of savings tailored to your needs.

Frequently Asked Questions

What is the most trusted car insurance company for a GMC Typhoon and which insurance company is best for car insurance?

The most trusted car insurance companies for a GMC Typhoon include State Farm and Geico. These companies are considered the best for car insurance due to their comprehensive coverage options and customer service.

Which car insurance cover is best for a GMC Typhoon and who is the top 5 insurance company?

Full coverage car insurance is best for a GMC Typhoon, offering protection against various risks. Top insurance companies providing this coverage include State Farm, Geico, Progressive, USAA, and Allstate.

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

Who is the cheapest car insurance provider for a GMC Typhoon and what type of insurance is best for a car?

Companies like Geico and Progressive are known for offering affordable car insurance for a GMC Typhoon. The best type of insurance includes liability, collision, and comprehensive coverage for complete protection.

For an in-depth examination, consult our thorough guide entitled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

Which one is the best insurance for a GMC Typhoon and what is the most important car insurance?

The best insurance for a GMC Typhoon often includes comprehensive coverage. The most important car insurance generally consists of liability coverage, which protects against damage to others, along with comprehensive coverage for your vehicle.

What are the 3 most important insurance types for a GMC Typhoon and what is the cheapest car insurance in the USA?

The three most important insurance types for a GMC Typhoon are liability, collision, and comprehensive coverage. The cheapest car insurance in the USA is often provided by companies like Geico and Progressive.

What is fully comprehensive car insurance for a GMC Typhoon and who is the most popular car insurance company?

Fully comprehensive car insurance for a GMC Typhoon covers all types of damage, including theft and vandalism. Popular insurance companies offering this coverage include State Farm, Geico, and Progressive.

For a thorough exploration, delve into our extensive guide titled “Anti-Theft Car Insurance Discounts.”

At what age is car insurance cheapest for a GMC Typhoon and what is the highest price for car insurance?

Car insurance for a GMC Typhoon is typically cheapest for drivers aged 25-65. The highest price for car insurance can vary widely but may exceed several thousand dollars annually, depending on coverage and other factors.

What insurance provider is the best for a GMC Typhoon and what is the most expensive type of insurance?

The best insurance provider for a GMC Typhoon depends on your needs, but State Farm and Progressive are often recommended. The most expensive type of insurance is usually full coverage with high limits and additional endorsements.

Which insurance company is most expensive for a GMC Typhoon and which insurance company is best for car insurance and injury coverage?

High-end insurance providers with extensive coverage options may be more expensive for a GMC Typhoon. However, companies like State Farm and Progressive are considered the best overall for car insurance and injury coverage.

For a detailed breakdown, consult our comprehensive guide named “Best Personal Injury Protection (PIP) Car Insurance.”

What is the cheapest car insurance for a GMC Typhoon and which car insurance group is the cheapest?

The cheapest car insurance for a GMC Typhoon is often provided by Geico and Progressive. These companies are part of the car insurance groups that offer the most affordable rates for comprehensive coverage options.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.