Best GMC Sierra 3500HD Car Insurance in 2025 (Your Guide to the Top 10 Companies)

Geico, Progressive, and Allstate lead the way for the best GMC Sierra 3500HD car insurance, offering top coverage and competitive rates starting around $115/month. These top-rated providers stand out for their comprehensive policies and impressive discounts, ensuring reliable protection for your GMC Sierra 3500HD.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for GMC Sierra 3500HD

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for GMC Sierra 3500HD

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for GMC Sierra 3500HD

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

These top providers excel in delivering comprehensive coverage and valuable discounts tailored to your needs. By comparing options from these leading insurers, you can find the best protection and savings for your GMC Sierra 3500HD.

Our Top 10 Company Picks: Best GMC Sierra 3500HD Car Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Numerous Discounts | Geico | |

| #2 | 12% | A+ | Usage-Based Program | Progressive | |

| #3 | 25% | A+ | Customer Service | Allstate | |

| #4 | 20% | B | Local Agents | State Farm | |

| #5 | 25% | A | Strong Stability | Liberty Mutual |

| #6 | 20% | A | Coverage Options | Farmers | |

| #7 | 20% | A+ | Good Service | Nationwide |

| #8 | 25% | A+ | Good Discounts | Amica | |

| #9 | 10% | A+ | Excellent Service | Erie |

| #10 | 8% | A++ | Strong Stability | Travelers |

Start exploring quotes now to secure the most cost-effective coverage. To compare GMC Sierra 3500 Classic auto insurance quotes from top companies, enter your ZIP code above now. It’s fast and free.

- Geico, Progressive, and Allstate offer the best GMC Sierra 3500HD car insurance

- Monthly rates for coverage start at approximately $115 with top discounts available

- Compare quotes to find the most affordable options for your GMC Sierra 3500HD

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Geico is renowned for offering some of the most competitive rates in the industry, which can be particularly beneficial for GMC Sierra 3500HD owners looking to save on their premiums, as highlighted in our Geico car insurance review.

- Extensive Discounts: Geico provides a variety of discounts for the GMC Sierra 3500HD, including those for safe driving, good student, multi-vehicle, and vehicle safety features, which can significantly reduce overall costs.

- User-Friendly Digital Tools: Geico’s mobile app and online portal are highly rated for their ease of use, allowing GMC Sierra 3500HD policyholders to manage their accounts, file claims, and access ID cards effortlessly.

Cons

- Limited Local Agents: Geico primarily operates online and over the phone, which might be a drawback for GMC Sierra 3500HD owners who prefer in-person interactions with their insurance agents.

- Repair Shop Limitations: Some GMC Sierra 3500HD policyholders have reported being limited to specific repair shops within Geico’s network, which might not always be convenient or preferred.

#2 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s innovative Snapshot program, a usage-based insurance initiative, can reward cautious driving with reduced premiums, potentially saving GMC Sierra 3500HD owners who exhibit safe driving habits.

- Expansive Coverage Choices: Progressive presents a robust selection of coverage options for the GMC Sierra 3500HD, including gap insurance, custom parts and equipment protection, and rideshare coverage, ensuring comprehensive, tailored protection for diverse needs.

- Bundling Benefits: GMC Sierra 3500HD owners can unlock substantial savings by bundling their auto insurance with other types of coverage, maximizing their discount potential, such as home or renters insurance, as highlighted our comprehensive guide titled “Progressive Car Insurance Discounts“.

Cons

- Rate Hikes: Certain GMC Sierra 3500HD owners may face rate hikes after their initial policy term, raising concerns about long-term affordability.

- Intricate Discount System: Progressive’s discount framework can be a labyrinth, potentially leaving GMC Sierra 3500HD policyholders grappling to decipher all the potential savings they might be eligible for.

#3 – Allstate: Best for Discount Opportunities

Pros

- Discount Opportunities: Allstate offers multiple discounts for GMC Sierra 3500HD owners, including those for new cars, safe driving, anti-theft devices, and bundling policies, which can help reduce premiums.

- Accident Forgiveness: Allstate’s accident forgiveness program swoops in to shield GMC Sierra 3500HD policyholders from rate hikes following their first mishap, delivering a comforting layer of financial stability and peace of mind.

- Comprehensive Coverage Options: Due to Allstate’s extensive selection of add-ons and coverage options, owners of GMC Sierra 3500HD vehicles can tailor their policies to meet their unique requirements.

Cons

- Higher Premiums: Allstate’s rates for GMC Sierra 3500HD insurance can be higher compared to some competitors, which might be a deterrent for price-sensitive customers, as noted in our Allstate car insurance review.

- Strict Qualification for Discounts: Some discounts for GMC Sierra 3500HD insurance may have stringent qualification criteria, making them less accessible for all policyholders.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Comprehensive Coverage Options

Pros

- Comprehensive Coverage Options: State Farm offers a vast array of coverage options for GMC Sierra 3500HD owners—ranging from liability and collision to comprehensive and beyond—empowering them to customize their policies to fit specific needs.

- Personalized Service: With a large network of local agents, State Farm provides personalized service and support, which can be especially beneficial for GMC Sierra 3500HD owners who prefer in-person interactions.

- Safe Driving Discounts: State Farm offers significant discounts for safe driving, including programs like Drive Safe & Save, which can lower premiums for careful GMC Sierra 3500HD drivers, as highlighted in our State Farm car insurance review.

Cons

- Higher Rates: Premiums for GMC Sierra 3500HD insurance may be higher compared to other insurers, which can be a drawback for budget-conscious customers.

- Limited Online Tools: State Farm’s digital tools and mobile app are not as advanced as some competitors, which might be a disadvantage for tech-savvy GMC Sierra 3500HD owners who prefer managing their policies online.

#5 – Liberty Mutual: Best for Customizable Coverage

Pros

- Customizable Coverage: Liberty Mutual offers a variety of coverage options and add-ons, allowing GMC Sierra 3500HD owners to tailor their policies to their specific needs and preferences, according to Liberty Mutual car insurance review.

- Discounts for Safety Features: The company provides discounts for GMC Sierra 3500HD vehicles equipped with advanced safety features, which can significantly reduce premiums for owners.

- Accident Forgiveness: Liberty Mutual’s optional accident forgiveness feature prevents premium increases after the first accident, offering peace of mind to GMC Sierra 3500HD policyholders.

Cons

- Price Variability: Rates for GMC Sierra 3500HD insurance can vary significantly depending on location and individual circumstances, making it difficult to predict premiums.

- Limited Local Agents: Liberty Mutual has fewer local agents compared to some larger insurers, which might be a drawback for GMC Sierra 3500HD owners who prefer in-person service.

#6 – Farmers: Best for Comprehensive Coverage Options

Pros

- Comprehensive Coverage Options: Farmers delivers an expansive selection of coverage options and add-ons, such as rideshare coverage, new car replacement, and custom parts protection, ensuring comprehensive safeguarding for GMC Sierra 3500HD owners.

- Discount Bonanza: With a plethora of discounts available—ranging from policy bundling and safe driving to good student and vehicle safety feature discounts—Farmers can substantially lower premiums for GMC Sierra 3500HD drivers.

- Accident Forgiveness: Farmers’ accident forgiveness feature ensures that rates remain steady after the first mishap, providing GMC Sierra 3500HD policyholders with reassuring financial stability.

Cons

- Elevated Premiums: Farmers’ insurance premiums for the GMC Sierra 3500HD frequently exceed those of other insurers, potentially deterring budget-conscious customers from choosing their coverage, as noted in our Farmers car insurance review.

- Digital Tools: Farmers’ digital tools and mobile app may lag behind those of some competitors, presenting a potential drawback for tech-savvy GMC Sierra 3500HD owners who prefer sleek, online policy management.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a vanishing deductible program for GMC Sierra 3500HD owners, which reduces your deductible over time as a reward for safe driving, providing savings and peace of mind.

- Bundling Discounts: Significant discounts are available for GMC Sierra 3500HD owners when bundling multiple policies, such as home, auto, and life insurance, which can help reduce overall costs, as highlighted in our Nationwide Car Insurance Discounts.

- Extensive Coverage Options: Nationwide provides a vast array of coverage choices and add-ons, enabling GMC Sierra 3500HD owners to tailor their insurance policies precisely to their needs.

Cons

- Elevated Base Rates: The starting premiums for GMC Sierra 3500HD insurance with Nationwide can be higher compared to competitors, potentially deterring those in search of the lowest rates.

- Discount Availability: Certain discounts for GMC Sierra 3500HD insurance might be restricted by state, potentially curbing savings for some policyholders.

#8 – Amica: Best for Dividend Policies

Pros

- Dividend Policies: Amica offers dividend policies for GMC Sierra 3500HD owners, which can return a portion of the premium at the end of the policy term, providing additional savings.

- Diverse Discounts: Amica dangles a plethora of discount opportunities for GMC Sierra 3500HD owners, ranging from multi-policy bundles and spotless driving records to loyalty perks and vehicle safety enhancements, all designed to trim those premiums., as mentioned in our Amica vs. Progressive Car Insurance Comparison.

- Comprehensive Coverage Options: Amica offers a wide range of coverage options for the GMC Sierra 3500HD, including gap insurance, new car replacement, and accident forgiveness, providing extensive protection.

Cons

- Sparse Local Representation: Amica boasts a scant number of local agents compared to its more expansive rivals, potentially posing a challenge for GMC Sierra 3500HD owners who crave that personal, face-to-face service.

- Basic Digital Features: While Amica offers digital tools and a mobile app, they may lag behind the cutting-edge capabilities found in some competitor offerings, which could frustrate the tech-savvy GMC Sierra 3500HD owners eager to manage their policies with ease and sophistication.

#9 – Erie: Best for Competitive Rates

Pros

- Competitive Rates: Erie is known for offering competitive rates and good value for coverage, making it an attractive option for GMC Sierra 3500HD owners.

- Comprehensive Coverage Options: Erie offers a range of coverage options for GMC Sierra 3500HD owners, including gap insurance, new car replacement, and pet injury coverage, providing extensive protection.

- Rate Lock: Erie offers a rate lock feature for GMC Sierra 3500HD owners, which guarantees that your premium won’t increase unless you make changes to your policy or add a vehicle or driver.

Cons

- Limited Digital Tools: Erie’s digital tools and online services may not be as advanced as those of larger competitors, which might be a disadvantage for tech-savvy GMC Sierra 3500HD owners.

- Fewer Discounts: Erie offers fewer discounts for GMC Sierra 3500HD insurance compared to some other insurers, which might limit potential savings, as detailed in our Erie car insurance review.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Diverse Coverage Options

Pros

- Diverse Coverage Options: Travelers presents an expansive selection of coverage possibilities and add-ons tailored for GMC Sierra 3500HD owners. This includes gap insurance, new car replacement, and rideshare coverage, ensuring comprehensive protection across various scenarios.

- Variety of Discounts: GMC Sierra 3500HD owners can tap into a multitude of discounts, such as those for safe driving, multi-policy bundles, vehicle safety features, and good student accolades, effectively slashing their premiums.

- New Car Replacement: If a GMC Sierra 3500HD is totaled within the first five years, Travelers will replace it with a brand new car, which can be a valuable benefit, according to Travelers car insurance review.

Cons

- Mixed Customer Service Experiences: Feedback regarding customer service for GMC Sierra 3500HD policyholders is a mixed bag; some clients express dissatisfaction with the support and claims handling, leaving room for improvement.

- Digital Tool Limitations: Travelers’ digital suite, including their mobile app, might not match the sophistication of competitors, posing a challenge for tech-savvy GMC Sierra 3500HD owners who prefer seamless online policy management.

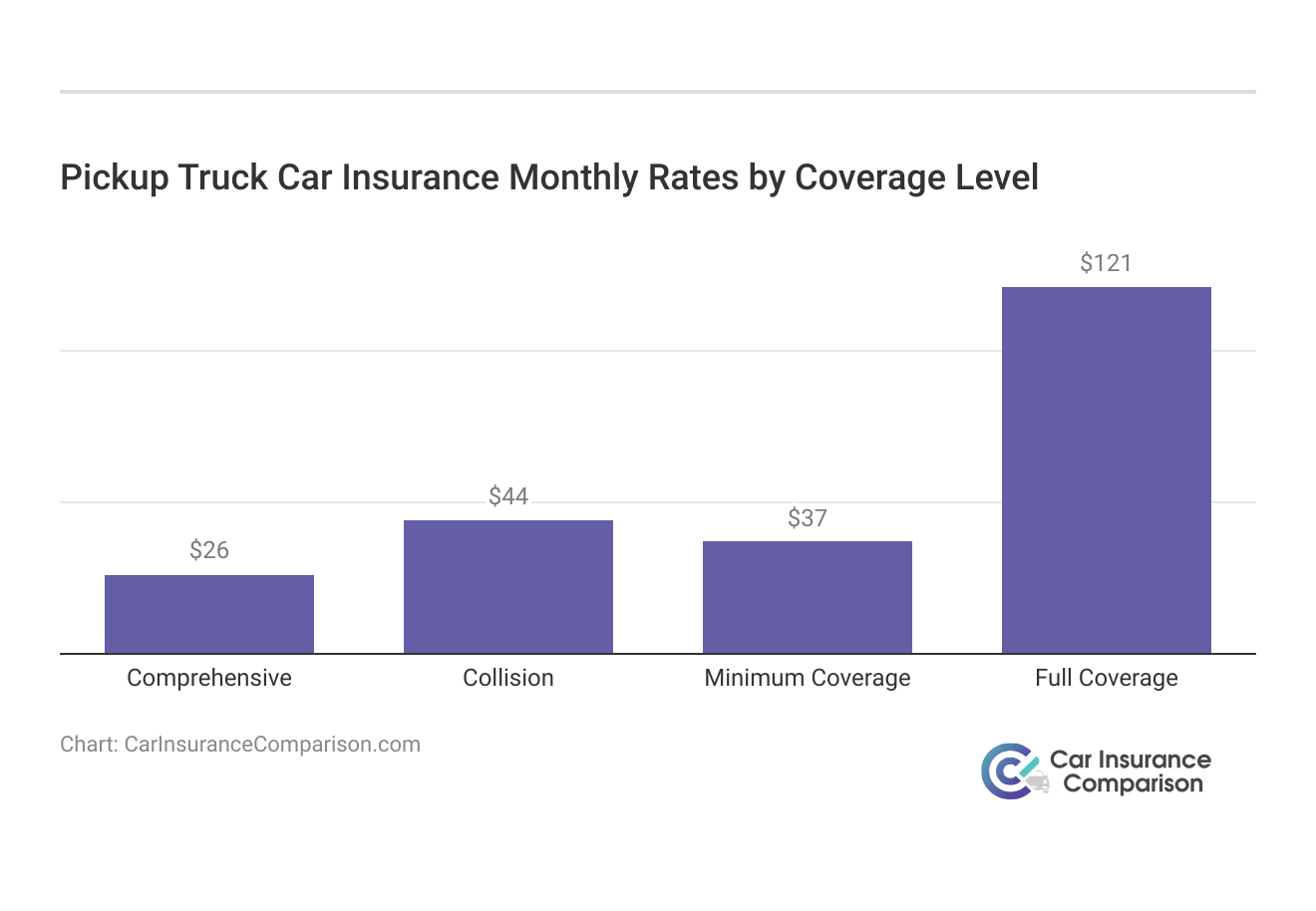

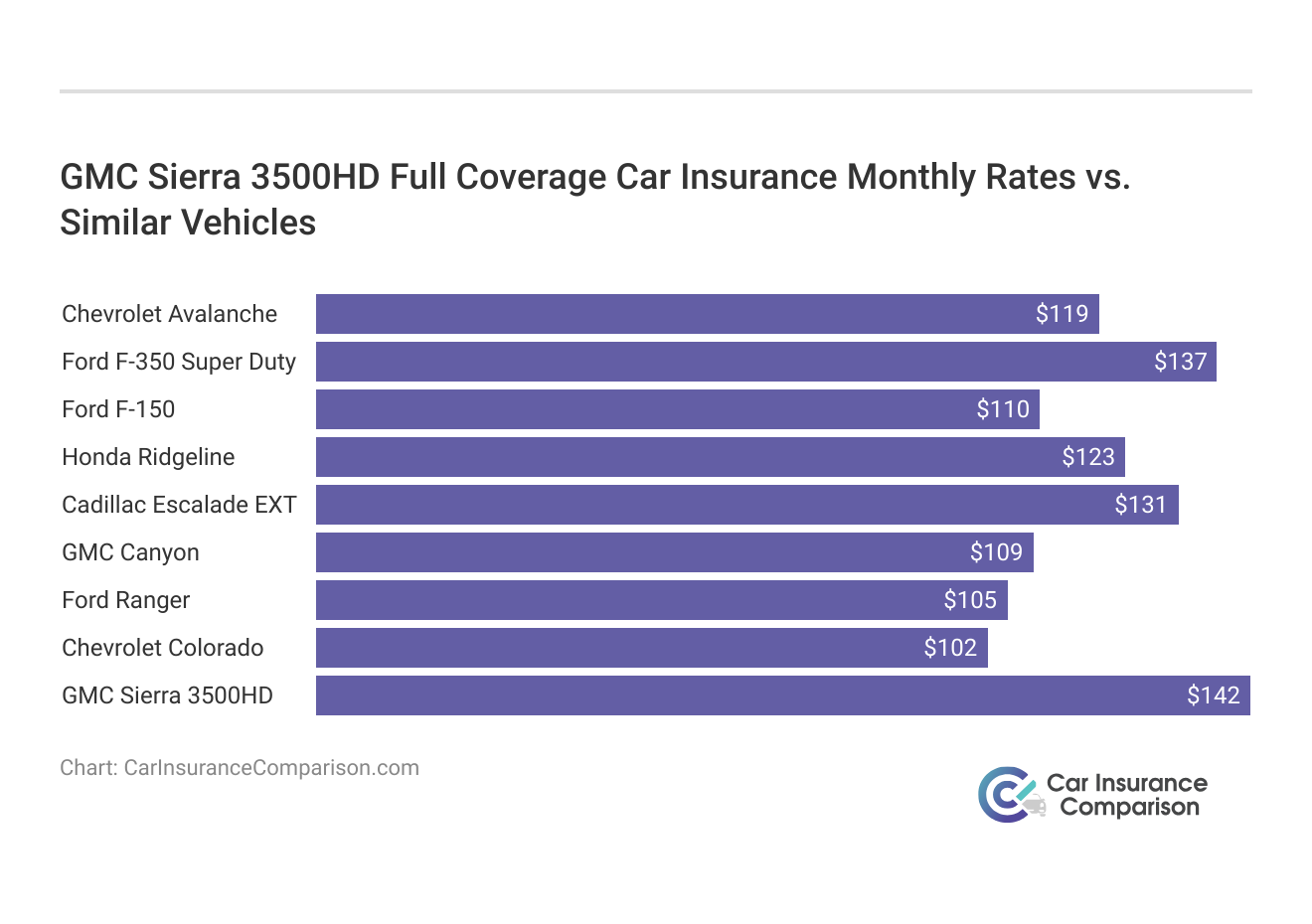

Insurance Costs for the GMC Sierra 3500 Classic

Vehicles similar to the GMC Sierra 3500 Classic often share insurance costs that reflect common attributes such as size, safety features, and repair expenses. These shared characteristics significantly influence how insurance premiums are calculated.

GMC Sierra 3500HD Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $145 | $255 |

| Amica | $132 | $170 |

| Erie | $123 | $160 |

| Farmers | $150 | $208 |

| Geico | $120 | $154 |

| Liberty Mutual | $115 | $145 |

| Nationwide | $140 | $157 |

| Progressive | $130 | $187 |

| State Farm | $125 | $125 |

| Travelers | $135 | $175 |

By examining the insurance rates for comparable models, you can gain a clearer understanding of what to expect for your GMC Sierra 3500 Classic. This comparison provides valuable insights into the factors that might affect your premium pricing.

Understanding these similarities allows you to estimate your insurance costs more accurately, giving you a better idea of what to anticipate. The impact of size, safety, and repair costs on premiums is substantial, so it’s important to consider these elements when comparing different vehicles. By looking at how similar models are priced, you can better prepare yourself for the costs associated with insuring your GMC Sierra 3500 Classic.

To find the best insurance coverage that fits your budget, it’s crucial to compare quotes from a variety of providers. Actively seeking out available discounts can further reduce your overall insurance expenses.

GMC Sierra 3500HD Insurance Monthly Rates vs. Other Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Chevrolet Colorado | $21 | $37 | $31 | $102 |

| Dodge Dakota | $17 | $26 | $44 | $102 |

| Cadillac Escalade EXT | $29 | $51 | $38 | $131 |

| Chevrolet Silverado | $27 | $47 | $35 | $124 |

| Dodge Ram | $30 | $47 | $35 | $127 |

| GMC Canyon | $23 | $40 | $33 | $109 |

| Honda Ridgeline | $26 | $45 | $38 | $123 |

| Chevrolet Silverado 2500HD | $30 | $57 | $35 | $138 |

| GMC Sierra 3500HD | $32 | $60 | $36 | $142 |

By taking the time to evaluate different options and considering specific factors related to your vehicle and driving history, you can make an informed decision. This approach will help you secure a policy that offers comprehensive protection while remaining affordable and tailored to your unique needs. Discover our comprehensive guide to “Calculating Car Insurance Cost” for additional insights.

Factors Affecting the Cost of GMC Sierra 3500 Classic Insurance

As with any car, your GMC Sierra 3500 Classic car insurance costs will be affected by personal factors like where you live, your driving record, and your driving habits. The GMC Sierra 3500 Classic trim level you buy will also have an impact on the total price you will pay for GMC Sierra 3500 Classic insurance coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Strategies for Reducing GMC Sierra 3500 Classic Insurance Costs

Finding ways to lower your insurance premiums for the GMC Sierra 3500 Classic can make a significant difference in your overall expenses. By implementing effective strategies, you can reduce your insurance costs while maintaining the coverage you need.

Here are key approaches to help you save on your GMC Sierra 3500 Classic insurance. Learn more by visiting our detailed “Where can I find the lowest car insurance quotes?” section.

Save more on your GMC Sierra 3500 Classic car insurance rates. Take a look at the following five strategies that will get you the best GMC Sierra 3500 Classic auto insurance rates possible.

- Choose automatic payments or EFT for your GMC Sierra 3500 Classic insurance policy.

- Ask for a new GMC Sierra 3500 Classic auto insurance rate based on your improved credit score.

- Bundle your GMC Sierra 3500 Classic auto insurance with home insurance.

- Wait six years for accidents to disappear from your record.

- Understand the different types of auto insurance for your GMC Sierra 3500 Classic.

By applying these strategies, you can potentially lower your insurance costs and enjoy greater savings on your GMC Sierra 3500 Classic coverage. Regularly reviewing your policy, seeking discounts, and comparing quotes are essential steps in optimizing your insurance expenses. Start exploring these methods today to find the most cost-effective insurance solution for your vehicle.

Best Coverage Options for GMC Sierra 3500 Classic

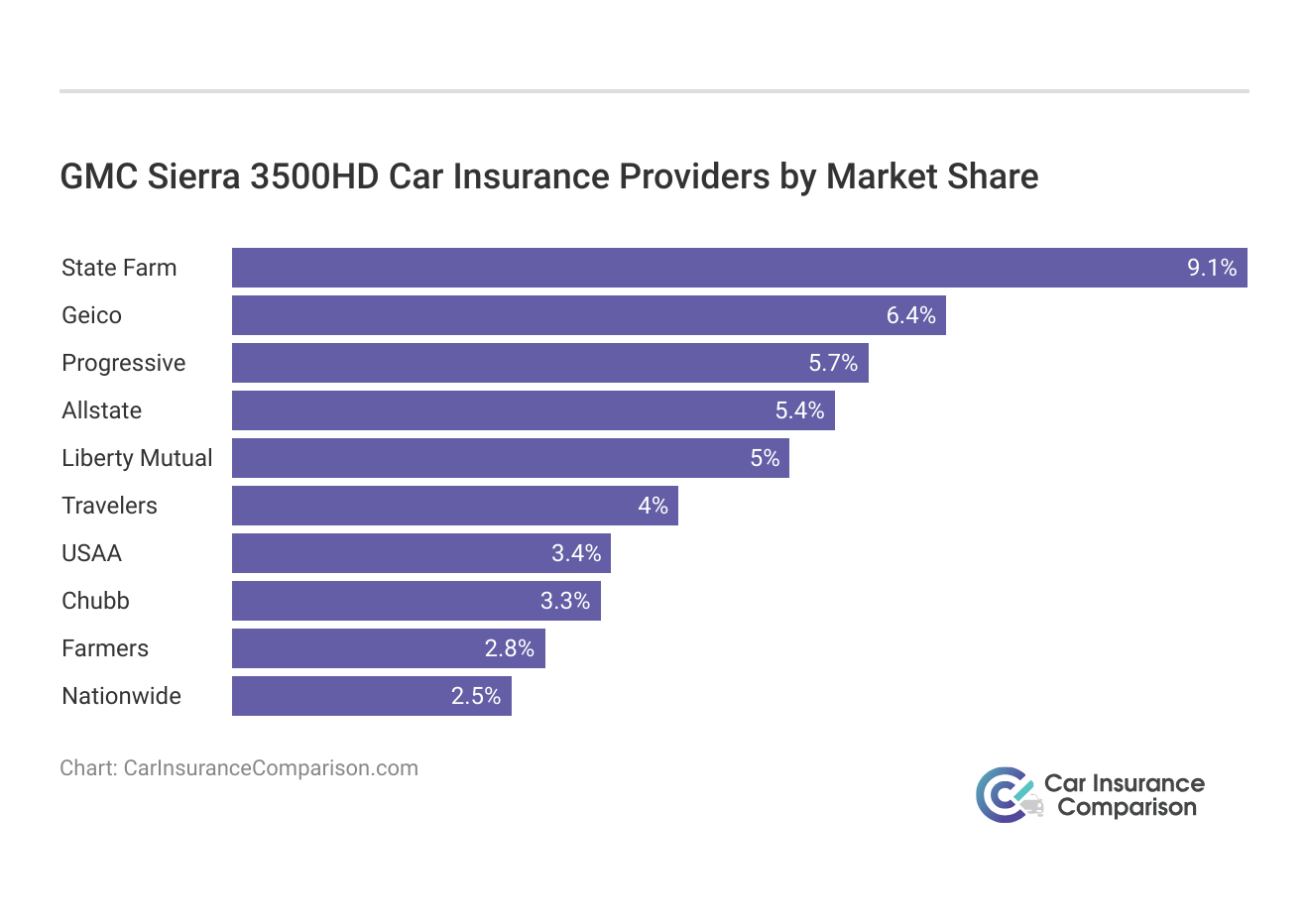

What is the best company for affordable GMC Sierra 3500 Classic insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering GMC Sierra 3500 Classic insurance coverage (ordered by market share).

Many of these companies offer discounts for security systems and other safety features found on the GMC Sierra 3500 Classic. In summary, choosing the right insurance company for your GMC Sierra 3500 Classic is crucial for securing the best coverage at competitive rates.

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9.1% |

| #2 | Geico | $46.3 million | 6.4% |

| #3 | Progressive | $41.7 million | 5.7% |

| #4 | Allstate | $39.2 million | 5.4% |

| #5 | Liberty Mutual | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3.4% |

| #8 | Chubb | $24.1 million | 3.3% |

| #9 | Farmers | $20 million | 2.8% |

| #10 | Nationwide | $18.4 million | 2.5% |

No-Cost Online Comparison for GMC Sierra 3500 Classic Insurance

Comparing GMC Sierra 3500 Classic insurance quotes online for free is a straightforward way to find the best coverage and rates. By utilizing online tools, you can easily gather quotes from various insurers, ensuring you get the most competitive offers available. Here’s how to make the most of your comparison process.

Geico stands out for its affordability and extensive discounts, making it a top choice for those seeking budget-friendly car insurance for their GMC Sierra 3500HD.

Brad Larson Licensed Insurance Agent

By comparing GMC Sierra 3500 Classic insurance quotes online for free, you can quickly identify the most affordable and comprehensive coverage options. This process helps you make an informed decision and secure the best insurance deal for your vehicle. Read our extensive guide on “How do you get competitive quotes for car insurance?” for more knowledge.

Start your comparison today to find the ideal policy that fits your needs and budget. Save money by comparing GMC Sierra 3500 Classic insurance rates with free quotes online now.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is the best insurance company for GMC Sierra 3500HD?

Geico is often considered the best insurance company for GMC Sierra 3500HD due to its competitive rates and extensive coverage options.

What are the GMC Sierra 3500HD insurance needs in California?

In California, GMC Sierra 3500HD insurance needs include meeting state minimum liability requirements and considering additional coverage like comprehensive and collision due to high vehicle values and repair costs.

What is the cheapest level of GMC Sierra 3500HD insurance?

The cheapest level of GMC Sierra 3500HD insurance is usually basic liability coverage, which meets minimum state requirements.

Explore our detailed analysis on “Compare Liability Car Insurance” for additional information.

What is the cheapest category for GMC Sierra 3500HD insurance?

The cheapest category for GMC Sierra 3500HD insurance typically includes minimum liability coverage and excludes comprehensive and collision protections.

Why is there difficulty in getting GMC Sierra 3500HD insurance in California?

Difficulty in getting GMC Sierra 3500HD insurance in California may arise due to high vehicle values, stringent state regulations, and the higher cost of repairs and replacement parts.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

What is the most expensive GMC Sierra 3500HD insurance?

The most expensive GMC Sierra 3500HD insurance usually includes full coverage with high liability limits and additional protections, especially in high-risk areas.

Get more insights by reading our expert “Best Full Coverage Car Insurance” advice.

What does full coverage GMC Sierra 3500HD insurance include?

Full coverage GMC Sierra 3500HD insurance includes liability, collision, comprehensive, uninsured motorist coverage, and often additional options like roadside assistance.

What are the reasons for high GMC Sierra 3500HD insurance in the USA?

High GMC Sierra 3500HD insurance costs in the USA are due to the vehicle’s high repair costs, value, and potential for theft, along with general risk factors.

What is the best GMC Sierra 3500HD insurance currently available?

Currently, Geico and Progressive offer the best GMC Sierra 3500HD insurance options, providing competitive rates and comprehensive coverage.

Continue reading our full “Compare Collision Car Insurance” guide for extra tips.

What is the best insurance for a GMC Sierra 3500HD after 5 years?

After five years, the best insurance for a GMC Sierra 3500HD includes companies that offer affordable rates and comprehensive coverage, such as Geico and State Farm.

What are the recommended types of GMC Sierra 3500HD insurance?

Recommended types of GMC Sierra 3500HD insurance include liability, collision, comprehensive, and uninsured motorist coverage to ensure full protection.

What are the top 5 GMC Sierra 3500HD insurance companies in Illinois?

The top 5 GMC Sierra 3500HD insurance companies in Illinois are Geico, Progressive, Allstate, State Farm, and Liberty Mutual.

For more information, explore our informative “Compare Car Insurance Rates by State” page.

Which is the most trusted GMC Sierra 3500HD insurance company?

Geico is frequently recognized as the most trusted GMC Sierra 3500HD insurance company due to its strong customer service and reliability.

Who are the top GMC Sierra 3500HD car insurance companies?

The top GMC Sierra 3500HD car insurance companies include Geico, Progressive, and Allstate, known for their excellent coverage and competitive rates.

Who are the cheapest GMC Sierra 3500HD insurance providers?

The cheapest GMC Sierra 3500HD insurance providers are generally Geico, Progressive, and State Farm, offering affordable rates and good coverage.

Expand your understanding with our thorough “Cheap Car Insurance” overview.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.