Best GMC Savana Car Insurance in 2025 (Check Out the Top 10 Companies)

For the best GMC Savana car insurance, State Farm, Farmers, and Allstate are top choices. With State Farm offering rates as low as $28 per month, these providers deliver great value. Known for their extensive coverage and competitive pricing, they are ideal for GMC Savana owners seeking reliable insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Aug 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for GMC Savana

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews

Company Facts

Full Coverage for GMC Savana

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for GMC Savana

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

When searching for the best GMC Savana car insurance, our top pick overall is State Farm, known for its comprehensive coverage and competitive rates. State Farm, Farmers, and Allstate offer affordable rates and excellent customer service.

This article explores their standout features to help you choose the best insurance for your GMC Savana, ensuring you get the best value and coverage for your needs. See more details on our article called “How much car insurance coverage do I need for a new car?”

Our Top 10 Company Picks: Best GMC Savana Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 15% A Customer Support Farmers

#3 10% A+ Comprehensive Coverage Allstate

#4 12% A+ Online Tools Progressive

#5 12% A New Drivers Liberty Mutual

#6 13% A++ Hybrid Cars Travelers

#7 20% A+ Policy Bundles Nationwide

#8 17% A Teen Drivers American Family

#9 25% A++ Affordable Rates Geico

#10 10% A++ Military Families USAA

Need the cheapest car insurance possible? Enter your ZIP code above into our free comparison tool to find the most affordable rates for your vehicle.

- State Farm is the top pick for GMC Savana car insurance

- Our guide highlights top features and benefits for your GMC Savana

- Top providers provide excellent value with competitive pricing and reliable service

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Comprehensive Coverage Options: State Farm offers a wide range of coverage options for the GMC Savana Cargo, including collision, comprehensive, and liability, ensuring you get the protection you need. More information about their rates in our State Farm car insurance review.

- Customer Service: Known for its excellent customer service, State Farm provides a strong network of agents who can assist with any GMC Savana Cargo insurance questions or claims.

- Rental Car Reimbursement: State Farm provides rental car reimbursement coverage for GMC Savana Cargo owners, which can be very useful when your vehicle is being repaired after a covered incident.

Cons

- Pricing: At $105 per month, State Farm’s rates for GMC Savana Cargo insurance are higher compared to some competitors, which may not be ideal for budget-conscious drivers.

- Limited Discounts: State Farm may not offer as many significant discounts for GMC Savana Cargo insurance as other insurers, potentially leading to higher overall costs.

#2 – Farmers: Best for Customer Support

Pros

- Customizable Policies: Farmers provides highly customizable insurance policies for GMC Savana Cargo, allowing you to tailor your coverage to fit your specific needs and preferences.

- Local Agents: With a strong network of local agents, Farmers ensures personalized service and support for GMC Savana Cargo insurance policyholders. Learn more in our Farmers car insurance review.

- Discount Opportunities: Farmers offers various discounts that can help reduce the cost of GMC Savana Cargo insurance, such as multi-policy and good driver discounts.

Cons

- Higher Rates: At $107 per month, Farmers’ insurance rates for GMC Savana Cargo are higher than many other providers, which might not be the best option for those seeking lower premiums.

- Digital Tools: Farmers’ online tools and mobile app for managing GMC Savana Cargo insurance policies may not be as advanced or user-friendly as those offered by other insurers.

#3 – Allstate: Best for Comprehensive Coverage

Pros

- Discounts: Allstate offers numerous discounts on GMC Savana Cargo insurance, including good driver and multiple policy discounts, which can help lower your premiums.

- Claims Satisfaction: As mentioned in our Allstate car insurance review, Allstate is known for its high customer satisfaction with the claims process, ensuring GMC Savana Cargo owners receive prompt and fair settlements.

- Comprehensive Coverage: Allstate provides extensive coverage options for GMC Savana Cargo, including liability, collision, and comprehensive, offering peace of mind and protection.

Cons

- Higher Premiums: At $110 per month, Allstate’s insurance rates for GMC Savana Cargo are among the highest, which may not be suitable for cost-conscious drivers.

- Coverage Limitations: Some GMC Savana Cargo owners report limitations in Allstate’s coverage options, which may not meet all their specific insurance needs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Online Tools

Pros

- Competitive Rates: At $98 per month, Progressive offers some of the most competitive rates for GMC Savana Cargo insurance, making it an affordable option for many drivers.

- Snapshot Program: Progressive’s usage-based insurance program, Snapshot, can lead to significant discounts for safe GMC Savana Cargo drivers who demonstrate good driving habits.

- Diverse Coverage Options: As mentioned in our Progressive car insurance review, Progressive provides a variety of coverage options for GMC Savana Cargo, including custom parts coverage and pet injury protection, enhancing overall protection.

Cons

- Rate Increases: Progressive may increase rates more significantly for GMC Savana Cargo insurance after an accident compared to other insurers, potentially leading to higher premiums.

- Customer Complaints: There have been higher than average customer complaints regarding Progressive’s service and claims handling for GMC Savana Cargo insurance.

#5 – Liberty Mutual: Best for New Drivers

Pros

- Extensive Coverage Options: Liberty Mutual offers a wide range of coverage options for GMC Savana Cargo, including new car replacement and better car replacement, providing comprehensive protection.

- Discounts: Liberty Mutual provides numerous discounts on GMC Savana Cargo insurance, such as for new customers and safe drivers, which can help reduce overall costs.

- Customer Support: Known for reliable customer support, Liberty Mutual ensures GMC Savana Cargo policyholders have access to assistance when needed. Learn more in our Liberty Mutual car insurance review.

Cons

- Higher Rates: At $108 per month, Liberty Mutual’s rates for GMC Savana Cargo insurance are higher than the average, which might not be ideal for budget-conscious individuals.

- Customer Service: Mixed reviews on customer service experiences for Liberty Mutual’s GMC Savana Cargo insurance indicate that some policyholders may face challenges in getting satisfactory support.

#6 – Travelers: Best for Hybrid Cars

Pros

- Affordable Rates: At $97 per month, Travelers offers affordable insurance rates for GMC Savana Cargo, making it a cost-effective option for many drivers. See more details on our Travelers car insurance review.

- Comprehensive Coverage: Travelers provides extensive coverage options for GMC Savana Cargo, including liability, collision, and comprehensive, ensuring well-rounded protection.

- Financial Stability: Travelers is known for its strong financial stability, offering peace of mind that claims for GMC Savana Cargo insurance will be paid promptly and fairly.

Cons

- Digital Experience: Travelers’ online tools and mobile app for managing GMC Savana Cargo insurance may not be as advanced or user-friendly as those offered by other insurers.

- Discount Limitations: Travelers may offer fewer discounts for GMC Savana Cargo insurance compared to other insurers, which could lead to higher overall costs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Policy Bundles

Pros

- Vanishing Deductible: Nationwide’s unique Vanishing Deductible feature can reduce your deductible over time for safe GMC Savana Cargo driving, potentially lowering out-of-pocket costs in case of a claim. Check out their ratings in our complete Nationwide car insurance discount.

- Comprehensive Coverage: Nationwide offers a broad range of coverage options for GMC Savana Cargo, including liability, collision, and comprehensive, providing thorough protection.

- Financial Strength: Nationwide is known for its strong financial strength, ensuring that GMC Savana Cargo insurance claims are handled efficiently and reliably.

Cons

- Pricing: At $100 per month, Nationwide’s rates for GMC Savana Cargo insurance may be higher than some competitors, which might not be the best option for budget-conscious drivers.

- Claim Handling: Some GMC Savana Cargo policyholders have reported mixed experiences with Nationwide’s claims handling process, indicating potential challenges in getting claims resolved.

#8 – American Family: Best for Teen Drivers

Pros

- Personalized Service: American Family offers personalized service for GMC Savana Cargo insurance policyholders, ensuring you receive tailored support and assistance.

- Discounts: American Family provides various discounts on GMC Savana Cargo insurance, such as multi-policy and safe driver discounts, helping to lower overall costs. More information in our American Family car insurance review.

- Customizable Policies: American Family allows for highly customizable insurance policies for GMC Savana Cargo, enabling you to select coverage that fits your specific needs.

Cons

- Pricing: At $102 per month, American Family’s rates for GMC Savana Cargo insurance may be higher compared to some other insurers, potentially impacting affordability.

- Availability: American Family may not be available in all regions, limiting access to their GMC Savana Cargo insurance policies for some drivers.

#9 – Geico: Best for Affordable Rates

Pros

- Competitive Rates: At $92 per month, Geico offers some of the lowest rates for GMC Savana Cargo insurance, making it an affordable choice for many drivers. Learn more in our Geico car insurance review.

- User-Friendly Tools: Geico provides a highly user-friendly website and mobile app for managing GMC Savana Cargo insurance policies, enhancing convenience and accessibility.

- Discount Opportunities: Geico offers numerous discounts for GMC Savana Cargo insurance, including for good drivers and safety features, helping to reduce overall premiums.

Cons

- Customer Service: Some GMC Savana Cargo policyholders report less personalized service with Geico due to its online-focused business model, potentially impacting customer satisfaction.

- Coverage Limitations: Geico may offer fewer customization options for GMC Savana Cargo insurance policies compared to some other insurers, which might not meet all specific needs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 –USAA: Best for Military Families

Pros

- Excellent Rates: At $85 per month, USAA offers the best rates for GMC Savana Cargo insurance, providing significant savings for eligible policyholders. Learn more in our USAA car insurance review.

- Superior Customer Service: USAA is known for its exceptional customer service and claims satisfaction ratings, ensuring GMC Savana Cargo owners receive prompt and reliable support.

- Comprehensive Coverage Options: USAA provides extensive coverage options for GMC Savana Cargo, including liability, collision, and comprehensive, offering thorough protection.

Cons

- Eligibility: USAA is only available to military members and their families, limiting access to its GMC Savana Cargo insurance policies for other drivers.

- Limited Physical Locations: USAA has fewer physical locations for in-person assistance with GMC Savana Cargo insurance, which may be inconvenient for some policyholders.

Why GMC Savana Cargo Insurance are Expensive

The table below compares monthly rates for minimum and full coverage car insurance for a GMC Savana Cargo from various providers. More information is available in our article titled “Best Full Coverage Car Insurance.”

GMC Savana Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $36 $110

American Family $33 $102

Farmers $41 $107

Geico $28 $92

Liberty Mutual $44 $108

Nationwide $30 $100

Progressive $37 $98

State Farm $34 $105

Travelers $31 $97

USAA $46 $85

Take a look at how insurance rates for similar models to the GMC Savana Cargo look. These insurance rates for other vans like the Dodge Caravan, Toyota Sienna, and Dodge Grand Caravan give you a good idea of what to expect.

GMC Savana Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Liability | Collision | Comprehensive | Full Coverage |

|---|---|---|---|---|

| Chrysler Pacifica | $26 | $44 | $29 | $111 |

| Chrysler Pacifica Hybrid | $28 | $55 | $31 | $125 |

| Chrysler Town and Country | $30 | $39 | $25 | $104 |

| Dodge Grand Caravan | $31 | $37 | $26 | $106 |

| GMC Savana | $30 | $48 | $28 | $120 |

| Honda Odyssey | $31 | $44 | $23 | $112 |

| Kia Sedona | $28 | $37 | $24 | $100 |

| Mazda 5 | $31 | $34 | $19 | $95 |

| Toyota Sienna | $31 | $44 | $25 | $113 |

The insurance rates for the GMC Savana Cargo are competitive but vary significantly based on the provider and coverage level. Comparing these rates with similar vehicles helps highlight the best options for comprehensive, collision, and liability coverage, ensuring you get the best value for your insurance needs.

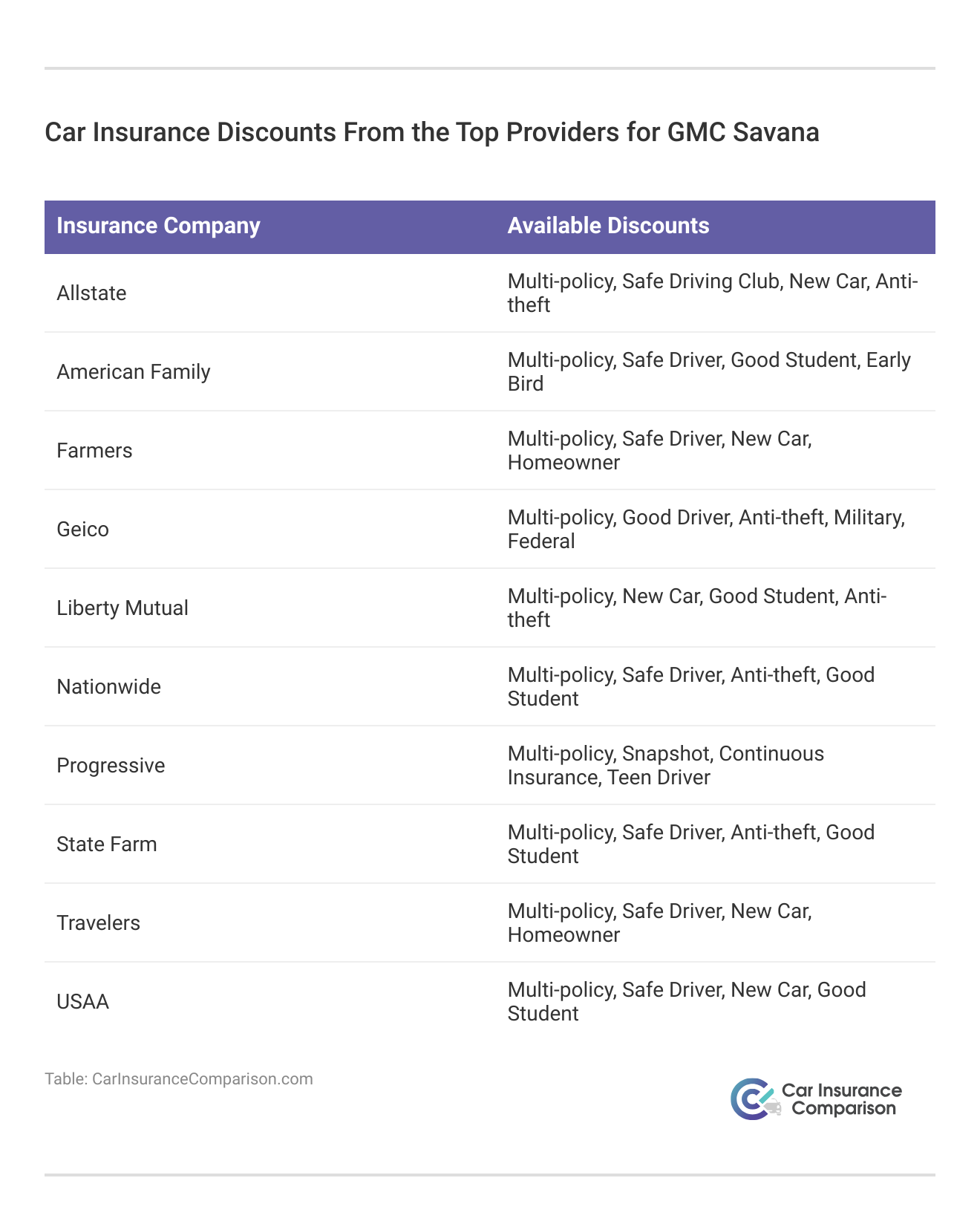

GMC Savana Cargo Insurance Saving Hacks

Save more on your GMC Savana Cargo car insurance rates. Take a look at the following five strategies that will get you the best GMC Savana Cargo auto insurance rates possible.

- Buy a GMC Savana Cargo with an anti-theft device. Learn more in our article titled “Anti-Theft Car Insurance Discounts.”

- Make sure you use an accredited driver safety program.

- Take a refresher course as an older driver.

- Ask for a GMC Savana Cargo discount if you have a college degree.

- Ask about GMC Savana Cargo low mileage discounts.

Utilizing these tips can help you decrease your GMC Savana Cargo insurance expenses while keeping optimal coverage. Don’t forget to consult with your insurer about your policy to ensure you’re benefiting from the best rates.

Each provider offers unique savings opportunities, so be sure to inquire about all available discounts. With these strategies and discounts, you can make informed decisions and maximize your savings.

What Impacts the Cost of GMC Savana Cargo insurance

As with any car, your GMC Savana Cargo car insurance costs will be affected by personal factors like where you live, your driving record, and your driving habits. The GMC Savana Cargo trim level you buy will also have an impact on the total price you will pay for GMC Savana Cargo insurance coverage.

State Farm stands out with its comprehensive coverage and competitive rates.

Scott W. Johnson LICENSED INSURANCE AGENT

The vehicle’s safety features, age, and overall value can influence the premium. High-risk areas with higher theft or accident rates may lead to increased insurance costs.

Lastly, the frequency and type of use, such as commercial versus personal use, will also play a role in determining your insurance rates. Learn more in our article titled “Compare Commercial Car Insurance: Rates, Discounts, & Requirements.”

Crash Test Ratings

GMC Savana Cargo crash test ratings can impact the cost of your GMC Savana Cargo car insurance. See GMC Savana Cargo crash test results here.

GMC Savana Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 GMC Savana Cargo 3500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2024 GMC Savana Cargo 2500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2023 GMC Savana Cargo 3500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2023 GMC Savana Cargo 2500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2022 GMC Savana Cargo 3500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2022 GMC Savana Cargo 2500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2021 GMC Savana Cargo 3500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2021 GMC Savana Cargo 2500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2020 GMC Savana Cargo 3500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2020 GMC Savana Cargo 2500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2019 GMC Savana Cargo G3500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2019 GMC Savana Cargo G2500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2018 GMC Savana Cargo G3500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2018 GMC Savana Cargo G2500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2017 GMC Savana Cargo G3500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2017 GMC Savana Cargo G2500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2016 GMC Savana Cargo G3500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

| 2016 GMC Savana Cargo G2500 VAN RWD | 4 stars | 5 stars | 4 stars | 5 stars |

Higher crash test ratings typically result in lower insurance premiums as they indicate better safety performance. However, lower ratings in side and rollover tests might still impact the premiums, making it essential to weigh all factors.

The GMC Savana Cargo’s solid ratings in frontal and overall categories can help reduce your car insurance premiums.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

GMC Savana Cargo Insurance Leaders

What is the best auto insurance company for GMC Savana Cargo insurance rates? Here are a few of the top providers of GMC Savana Cargo auto insurance coverage, listed in order of market share. Explore fleet car insurance in our article titled “Fleet Car Insurance Explained.”

Top GMC Savana Car Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9% |

| #2 | Geico | $46.3 million | 6% |

| #3 | Progressive | $41.7 million | 5% |

| #4 | Liberty Mutual | $39.2 million | 5% |

| #5 | Allstate | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3% |

| #8 | Chubb | $24.1 million | 3% |

| #9 | Farmers | $20 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

Frequently Asked Questions

Are GMC Savana Cargo vehicles expensive to insure?

Insurance costs for GMC Savana Cargo vehicles vary based on factors such as driving history and location. Generally, the size and type of vehicle can influence the cost, but comparing quotes can help find the best rate. Do you have a GMC Savana cargo that you are using for commercial, read our article titled “Best Commercial Car Insurance Companies.”

What affects the cost of GMC Savana Cargo insurance?

Factors include where you live, your driving record, driving habits, and the vehicle’s trim level. Insurance companies also consider the vehicle’s safety features and repair costs.

How can I save on GMC Savana Cargo insurance?

Compare quotes, maintain a good driving record, increase deductibles, utilize available discounts, and install safety features to potentially lower your insurance costs.

How can I compare free GMC Savana Cargo insurance quotes online?

Use our free online tool below and enter your ZIP code to compare quotes from top insurers. This tool provides a quick way to see rates from multiple companies.

How can I find the best GMC Savana Cargo auto insurance rates?

To find the best rates, it’s recommended to compare insurance quotes from different companies and consider factors like coverage options and discounts.

What coverage options are recommended for a GMC Savana Cargo?

Comprehensive and collision coverage are recommended for optimal protection, especially if you have a new or valuable vehicle. Liability insurance is also essential.

Read More: Understanding Your Car Insurance Policy

Does my driving record impact my GMC Savana Cargo insurance rates?

Yes, a clean driving record typically results in lower insurance rates, while a history of accidents or traffic violations may increase your premiums.

Are there any discounts available for GMC Savana Cargo insurance?

Many insurers offer discounts for features like anti-theft devices, safety systems, or bundling multiple policies. It’s worth asking your insurer about available discounts.

How does my location affect GMC Savana Cargo insurance rates?

Insurance rates can vary by location due to factors such as local crime rates, traffic conditions, and weather. Urban areas with higher traffic and accident rates often have higher premiums.

Read More: Can I use a P.O. Box for my car insurance?

Is it possible to get temporary insurance for a GMC Savana Cargo?

Yes, some insurance companies offer temporary or short-term coverage options. This can be useful for temporary use or while you’re shopping for a longer-term policy.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.