Best Fiat 124 Spider Car Insurance in 2025 (Find the Top 10 Companies Here!)

Progressive, State Farm, and Geico offer the best Fiat 124 Spider car insurance, with rates starting as low as $22 per month. These top providers stand out due to their comprehensive coverage options, competitive pricing, and strong customer service. For the best Fiat 124 Spider insurance, consider these three.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Aug 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Fiat 124 Spider

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Fiat 124 Spider

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Fiat 124 Spider

A.M. Best Rating

Complaint Level

Pros & Cons

Progressive, State Farm, and Geico lead the way in providing the best Fiat 124 Spider car insurance. These top providers are renowned for their competitive rates, comprehensive coverage, and exceptional customer service.

Our Top 10 Company Picks: Best Fiat 124 Spider Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 20% A+ High-Risk Drivers Progressive

#2 20% B Complete Coverage State Farm

#3 25% A++ Affordable Rates Geico

#4 25% A+ New Car Allstate

#5 10% A++ Military Families USAA

#6 15% A Standard Coverage Farmers

#7 25% A+ Bundle Policies Nationwide

#8 10% A New Drivers Liberty Mutual

#9 20% A+ Claims Satisfaction Erie

#10 15% A+ Customer Loyalty Amica

Discover how these companies can offer the coverage and value you need for your vehicle.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool above to find the best policy for you.

Compare Quotes From Top Companies and Save Enter your ZIP code below to view companies that have cheap car insurance rates.Free Car Insurance Comparison

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Generous Policy Bundling Discount: Progressive provides a substantial 20% discount when combining insurance policies, a compelling advantage for those who cover multiple vehicles or properties, including the Fiat 124 Spider. Read up on the “Progressive Car Insurance Review” for more information.

- Robust Financial Strength: With an A+ rating from A.M. Best, Progressive showcases solid financial reliability, offering peace of mind for high-risk drivers.

- Adaptable Coverage Choices: Progressive delivers flexible coverage plans customized to the needs of high-risk drivers, ensuring thorough protection for vehicles like the Fiat 124 Spider.

Cons

- Potentially Elevated Premiums: Despite attractive bundling discounts, high-risk drivers might still face relatively high premiums, particularly for specialized vehicles such as the Fiat 124 Spider.

- Limited Savings on High-Risk Policies: Although Progressive excels in bundling, its discounts for high-risk policies may not be as extensive as those from some competitors, potentially impacting overall savings.

#2 – State Farm: Best for Complete Coverage

Pros

- Extensive Policy Bundling Options: State Farm’s 20% discount for combining various insurance policies makes it a prime choice for those seeking thorough coverage for their Fiat 124 Spider and other assets.

- Diverse Coverage Choices: State Farm offers a wide range of coverage options, addressing different needs, including customized plans for vehicles like the Fiat 124 Spider.

- Broad Network of Agents: With a large network of agents, State Farm ensures personalized service and support, enhancing the overall experience for Fiat 124 Spider owners. Check out insurance savings in our complete guide titled State farm car insurance review.

Cons

- Moderate Multi-Policy Discount: The multi-policy discount, while advantageous, may not be as significant compared to other insurers, potentially limiting savings for Fiat 124 Spider owners.

- Possibly Higher Premiums: Even with discounts, State Farm’s premiums might still be comparatively high, especially for comprehensive coverage of high-value vehicles like the Fiat 124 Spider.

#3 – Geico: Best for Affordable Rates

Pros

- Highest Policy Bundling Discount: Geico offers a notable 25% discount for bundling insurance policies, which can lead to considerable savings on coverage for your Fiat 124 Spider.

- Exceptional Financial Rating: Geico’s A++ rating from A.M. Best highlights its outstanding financial strength, providing reassurance for Fiat 124 Spider owners.

- Affordable Pricing: Known for its cost-effective rates, Geico delivers budget-friendly coverage options without sacrificing quality, ideal for protecting the Fiat 124 Spider. Discover more about offerings in our guide titled Geico car insurance review.

Cons

- Possibly Limited Coverage Choices: Although Geico’s rates are competitive, the range of coverage options may be narrower compared to other insurers, potentially limiting customization for the Fiat 124 Spider.

- Reduced Discounts for Specialized Vehicles: Geico’s discount structure might not be as beneficial for specialized or luxury vehicles like the Fiat 124 Spider, affecting overall savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for New Car

Pros

- Generous Policy Bundling Discount: Allstate provides a robust 25% discount for combining multiple insurance policies, advantageous for insuring new cars such as the Fiat 124 Spider.

- Strong Financial Stability: With an A+ rating from A.M. Best, Allstate ensures excellent financial reliability, crucial for covering your new Fiat 124 Spider. Access comprehensive insights into our article called “Allstate Car Insurance Review.”

- Thorough New Car Protection: Allstate’s coverage options are particularly suited for new vehicles, offering solid protection and added benefits for cars like the Fiat 124 Spider.

Cons

- Possibly Elevated Rates: While the bundling discount is appealing, Allstate’s rates for new car coverage might still be comparatively high, especially for specialized models like the Fiat 124 Spider.

- Discount Variability: The effectiveness of discounts might fluctuate based on location and individual circumstances, potentially affecting overall savings for Fiat 124 Spider owners.

#5 – USAA: Best for Military Families

Pros

- Exclusive Bundling Discounts: USAA offers a 10% discount for combining insurance policies, a valuable benefit for military families, including coverage for vehicles like the Fiat 124 Spider.

- Outstanding Financial Rating: Holding an A++ rating from A.M. Best, USAA demonstrates exceptional financial strength, providing reliable coverage for military families and their Fiat 124 Spider.

- Specialized Coverage for Military Needs: USAA focuses on policies designed for military families, ensuring comprehensive and relevant protection for vehicles like the Fiat 124 Spider. Check out insurance savings in our complete article called USAA car insurance review.

Cons

- Lower Bundling Discount: The 10% bundling discount, although beneficial, is less substantial compared to competitors, potentially limiting overall savings on insurance for the Fiat 124 Spider.

- Eligibility Restrictions: USAA’s services are exclusively available to military personnel and their families, possibly excluding other vehicle owners from accessing its benefits.

#6 – Farmers: Best for Standard Coverage

Pros

- Bundling Discounts for Fiat 124 Spider: Farmers provides a generous 15% discount when bundling multiple policies, making it a cost-effective choice for insuring your Fiat 124 Spider along with other assets.

- Comprehensive Coverage Options: Farmers offers extensive coverage options that cater well to the needs of Fiat 124 Spider owners, ensuring protection against a broad range of risks.

- A.M. Best Rating: With a solid ‘A’ rating, Farmers is a reliable choice for standard coverage, indicating strong financial stability and dependable claims handling. Unlock details in our article called Farmers car insurance review.

Cons

- Bundling Discount Limitation: Although Farmers offers a 15% bundling discount, it may not be as competitive as some other providers when it comes to insuring your Fiat 124 Spider.

- Premiums May Be Higher: Even with discounts, the overall premium costs for the Fiat 124 Spider may be relatively high compared to some competitors, potentially impacting your budget.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Bundle Policies

Pros

- Exceptional Bundling Discounts for Fiat 124 Spider: Nationwide stands out with a 25% discount for bundling policies, significantly reducing the cost of insuring your Fiat 124 Spider when combined with other policies.

- High A.M. Best Rating: Nationwide’s ‘A+’ rating reflects its superior financial strength and reliability, providing peace of mind for Fiat 124 Spider owners. Discover insights in our article called Nationwide car insurance discounts.

- Comprehensive Policy Options: The variety of coverage options offered by Nationwide ensures that you can tailor your policy to the specific needs of your Fiat 124 Spider.

Cons

- Bundling Focus May Limit Other Discounts: While Nationwide excels in bundling discounts, the focus on this area might mean fewer opportunities for other types of savings on your Fiat 124 Spider insurance.

- Potentially Higher Premiums: The cost of premiums, even with the bundling discount, may still be on the higher side for some policyholders, affecting overall affordability.

#8 – Liberty Mutual: Best for New Drivers

Pros

- Discounts for New Drivers with Fiat 124 Spider: Liberty Mutual offers tailored coverage for new drivers, with discounts that make insuring a Fiat 124 Spider more accessible for those just starting out.

- Decent A.M. Best Rating: With an ‘A’ rating, Liberty Mutual is a reliable option for new drivers, ensuring solid financial backing and trustworthy service. Discover more about offerings in our article called Liberty Mutual car insurance review.

- Targeted Coverage: The policies are designed with new drivers in mind, providing specific benefits that can be advantageous for those who are new to driving a Fiat 124 Spider.

Cons

- Limited Bundling Discounts: Liberty Mutual’s bundling discount of 10% might be less advantageous compared to other providers, potentially affecting overall savings.

- Less Comprehensive Discounts for Fiat 124 Spider: The focus on new drivers might not provide as extensive a range of discounts for other aspects of insuring a Fiat 124 Spider.

#9 – Erie: Best for Claims Satisfaction

Pros

- Top A.M. Best Rating: Erie’s ‘A+’ rating highlights its financial stability and excellent service, ensuring that your Fiat 124 Spider is covered by a trustworthy insurer.

- Attractive Bundling Discounts: With a 20% discount on bundled policies, Erie makes it easier to manage the costs of insuring your Fiat 124 Spider alongside other policies.

- Strong Claims Satisfaction for Fiat 124 Spider: Erie is renowned for its high claims satisfaction, offering reliable support and smooth processing for Fiat 124 Spider owners in the event of a claim. Unlock details in our guide titled “Erie Car Insurance Review.”

Cons

- Bundling Discount Cap: Despite the 20% discount for bundling, it may not reach the levels offered by some competitors, potentially limiting your savings on the Fiat 124 Spider.

- Premiums Could Be Higher: Even with discounts, the premiums for insuring a Fiat 124 Spider with Erie might still be higher compared to some other insurers, impacting overall affordability.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Amica: Best for Customer Loyalty

Pros

- Generous Discounts for Loyal Fiat 124 Spider Owners: Amica rewards customer loyalty with attractive discounts, making it an appealing choice for long-term Fiat 124 Spider owners who value consistent service.

- High A.M. Best Rating: With an ‘A+’ rating, Amica demonstrates strong financial health and reliability, providing excellent coverage for your Fiat 124 Spider.

- Personalized Service: Amica’s focus on customer loyalty often translates into personalized service and support, enhancing the overall insurance experience for Fiat 124 Spider drivers. If you want to learn more about the company, head to our article called “Amica vs. Progressive Car Insurance Comparison.”

Cons

- Bundling Discounts Not as Competitive: The 15% bundling discount offered by Amica may be less competitive compared to other insurers, potentially limiting savings on your Fiat 124 Spider insurance.

- Potentially Higher Premiums: Despite loyalty benefits, the premiums for a Fiat 124 Spider with Amica might be relatively high, which could affect the cost-effectiveness of your policy.

Monthly Insurance Rates for Fiat 124 Spider: Coverage Comparisons

Understanding the specific coverage rates for the Fiat 124 Spider can help you make an informed insurance decision. The table below outlines the monthly insurance costs for both minimum and full coverage across various providers.

Fiat 124 Spider Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $32 $125

Amica $26 $102

Erie $24 $95

Farmers $35 $130

Geico $25 $100

Liberty Mutual $30 $124

Nationwide $27 $110

Progressive $28 $115

State Farm $30 $120

USAA $22 $90

USAA offers the most affordable full coverage for the Fiat 124 Spider at $90 per month, closely followed by Erie at $95 and Geico at $100. For minimum coverage, USAA also leads with the lowest rate of $22 per month, while Erie and Amica provide competitive rates at $24 and $26, respectively.

Conversely, Farmers charges the highest rates, with $35 for minimum coverage and $130 for full coverage. Progressive and State Farm offer mid-range pricing, with Progressive at $28 for minimum and $115 for full coverage, and State Farm at $30 for minimum and $120 for full coverage.

By evaluating different providers, you can secure affordable premiums, uncover unique discounts, and tailor coverage to your specific needs. More information is available about this provider in our article called “Compare Car Insurance by Coverage Type.”

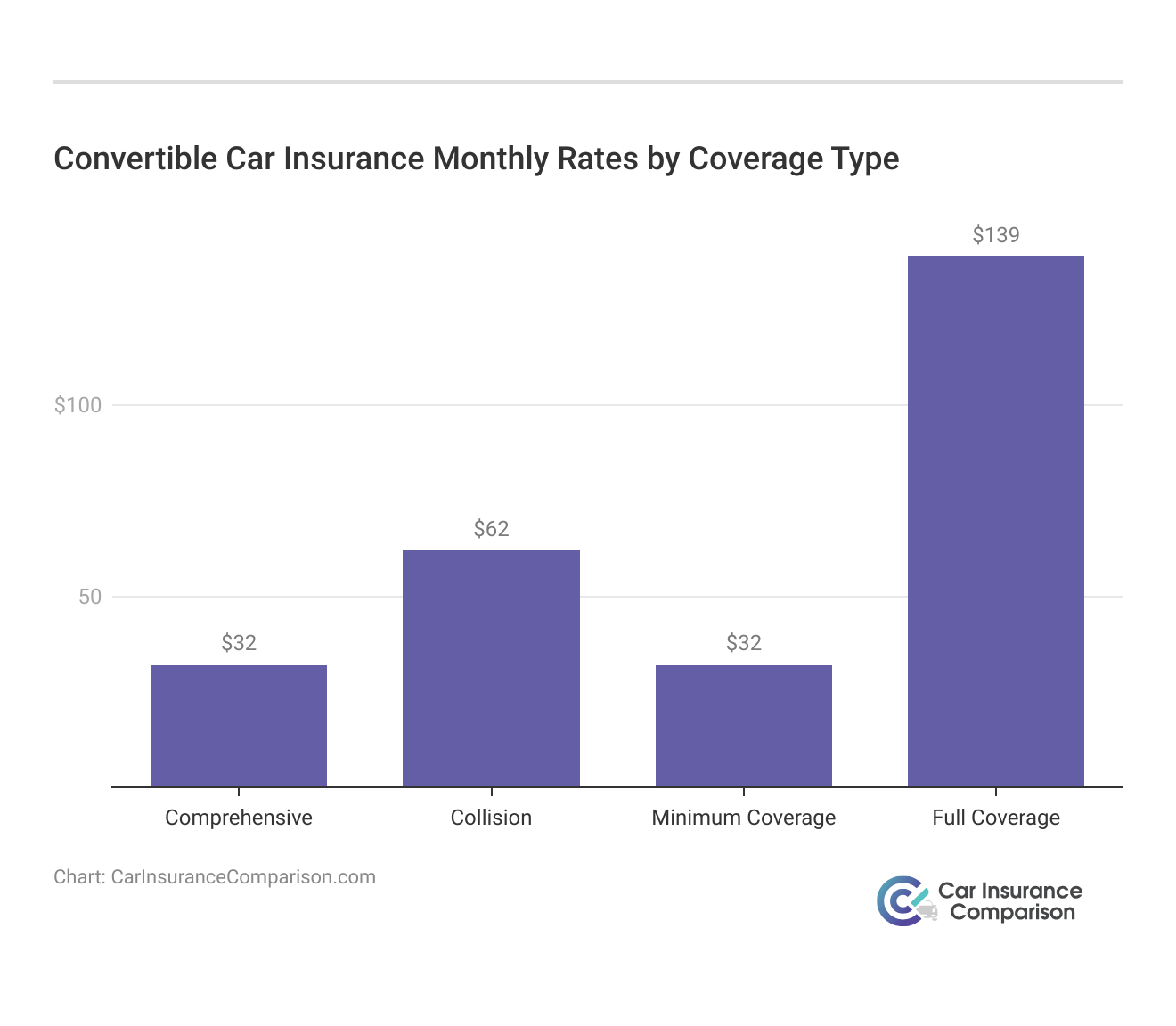

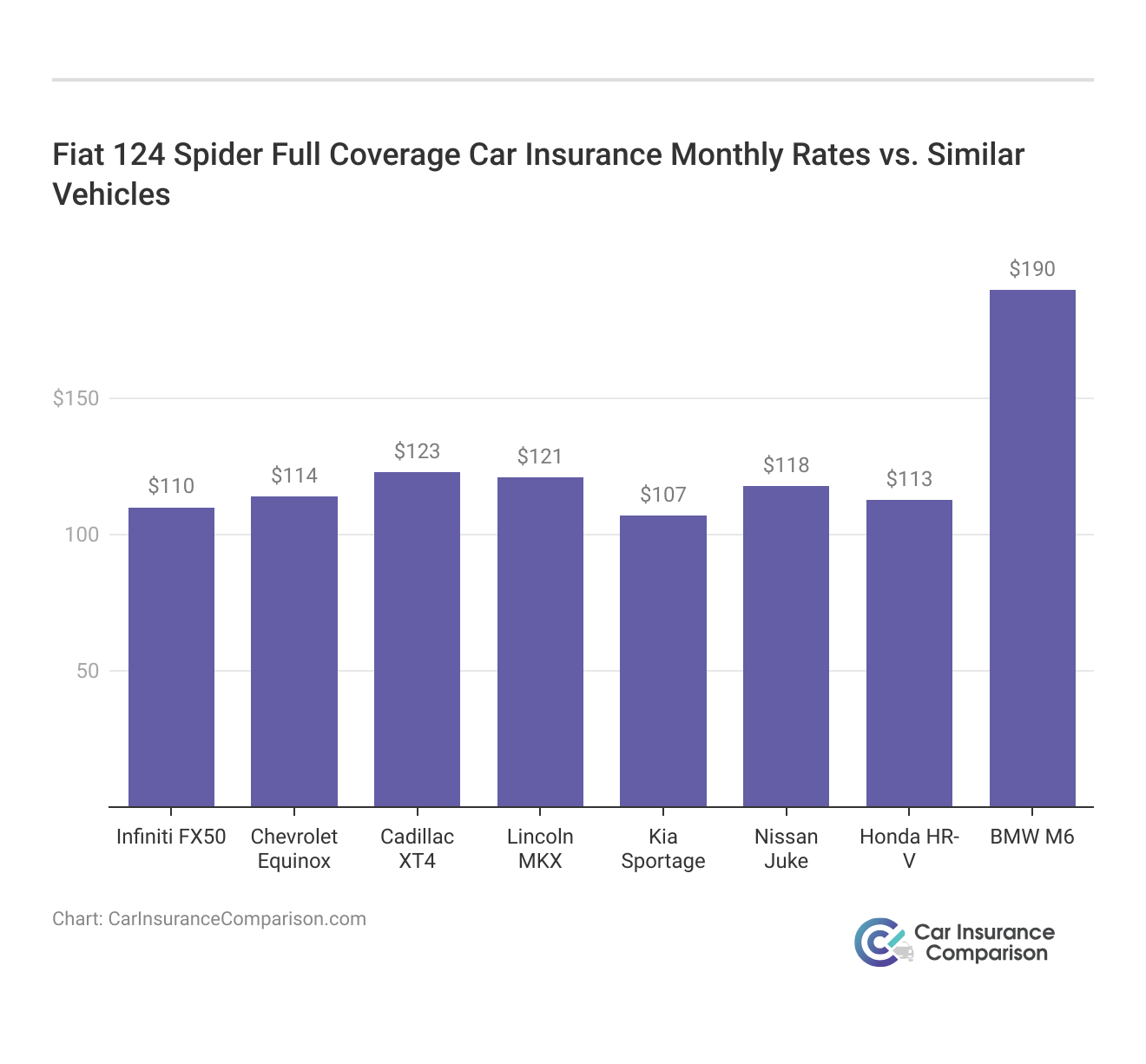

Are Vehicles Like the FIAT 124 Spider Expensive to Insure

Take a look at how insurance rates for similar models to the FIAT 124 Spider look.

These insurance rates for other convertibles like the Ford Mustang SVT Cobra, Tesla Roadster, and Lexus IS 250 C give you a good idea of what to expect.

This knowledge helps you find the most suitable insurance options, ensuring that you get the best value for your specific needs. For a deeper analysis, explore our detailed article, “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements,” where you’ll find comprehensive insights and comparisons.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of FIAT 124 Spider Insurance

The average annual rate for the FIAT 124 Spider is just that, an average. Your insurance rates for a FIAT 124 Spider can be higher or lower depending upon the trim level and personal factors.

Fiat 124 Spider Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

Vehicle Comprehensive Collision Minimum Coverage Full Coverage

Fiat 124 Spider $28 $51 $30 $120

Buick Cascada $28 $55 $33 $129

BMW M6 $43 $94 $38 $190

MINI Convertible $25 $45 $22 $100

Mercedes-Benz SL 450 $40 $77 $33 $163

Mercedes-Benz SLC 300 $36 $67 $33 $149

Volkswagen Eos $25 $44 $36 $118

Those factors include your age, home address, driving history, and the model year of your FIAT 124 Spider. Discover insights in our article called “Average Car Insurance Rates by Age and Gender.”

Ways to Save on FIAT 124 Spider Insurance

Save more on your FIAT 124 Spider car insurance rates. Take a look at the following five strategies that will get you the best FIAT 124 Spider auto insurance rates possible.

- Keep a close eye on teen drivers.

- Remove unnecessary insurance once your FIAT 124 Spider is paid off.

- Ask about loyalty discounts.

- Park your FIAT 124 Spider somewhere safe – like a garage or private driveway.

- Don’t assume your FIAT 124 Spider is cheaper to insure than another vehicle.

By following these tips, you can effectively lower your insurance premiums and ensure you’re getting the best rate for your FIAT 124 Spider. Discover more about offerings in our guide titled “What Is a Car Insurance Premium?”

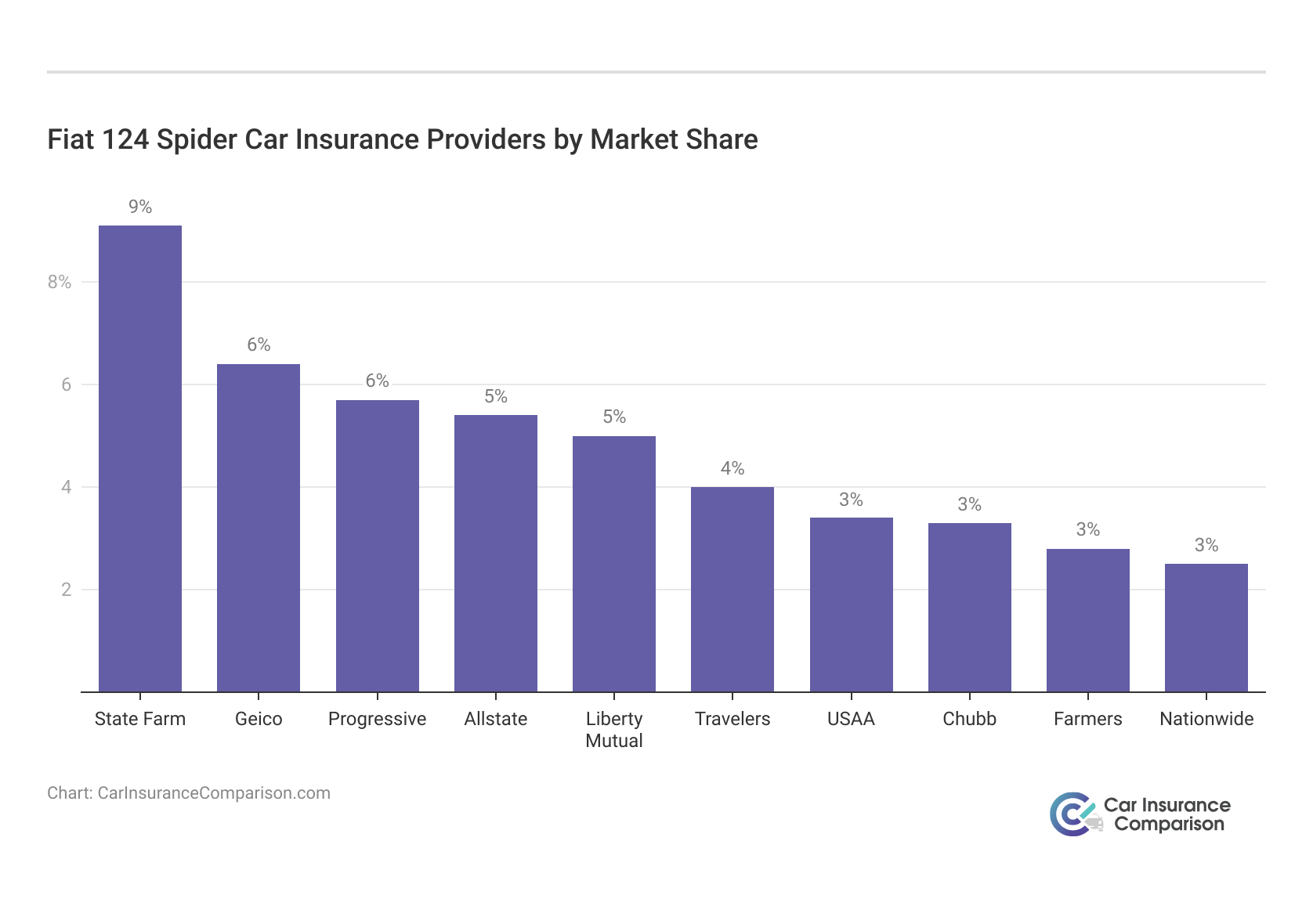

Top FIAT 124 Spider Insurance Companies

What is the best company for affordable FIAT 124 Spider insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering FIAT 124 Spider insurance coverage (ordered by market share).

However, here are some of the top insurance companies with a strong market share offering reliable coverage options tailored for the FIAT 124 Spider.

Top Fiat 124 Spider Car Insurance Providers by Market Share

Rank Insurance Company Premiums Written Market Share

#1 State Farm $65.6 million 9%

#2 Geico $46.1 million 6%

#3 Progressive $39.2 million 6%

#4 Allstate $35.6 million 5%

#5 Liberty Mutual $35 million 5%

#6 Travelers $28 million 4%

#7 USAA $23.5 million 3%

#8 Chubb $23.4 million 3%

#9 Farmers $20.6 million 3%

#10 Nationwide $18.4 million 3%

Many of these companies offer discounts for security systems and other safety features found on the FIAT 124 Spider. Discover insights in our article called “Safety Features Car Insurance Discounts.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Comparing Free FIAT 124 Spider Insurance Quotes Online

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Frequently Asked Questions

How can crash test ratings impact FIAT 124 Spider auto insurance rates?

Crash test ratings can have an impact on FIAT 124 Spider auto insurance rates. Vehicles with higher safety ratings tend to have lower insurance rates.

For additional details, explore our comprehensive resource titled “The Best Small Car Safety Ratings.”

Can safety features of the FIAT 124 Spider earn me a car insurance discount?

Yes, safety features of the FIAT 124 Spider can potentially earn you a car insurance discount. Features such as anti-lock brakes, airbags, and anti-theft systems may qualify for discounts with certain insurance providers.

Does the cost of insurance for a FIAT 124 Spider depend on the trim level?

Yes, the cost of insurance for a FIAT 124 Spider can depend on the trim level. Higher trim levels with more features and a higher purchase price may result in higher insurance rates.

Which companies offer affordable FIAT 124 Spider insurance rates?

Some of the top companies offering FIAT 124 Spider insurance coverage include State Farm, Geico, Progressive, Allstate, Liberty Mutual, Travelers, USAA, Chubb, Farmers, and Nationwide.

What are some ways to save on FIAT 124 Spider insurance?

You can save on FIAT 124 Spider insurance rates by keeping an eye on teen drivers, removing unnecessary insurance once the vehicle is paid off, asking about loyalty discounts, parking the car in a safe location, and comparing quotes from different insurance companies.

To find out more, explore our guide titled “Does hitting a parked car affect car insurance rates?”

Is the Fiat 124 Spider expensive to insure?

The average monthly repair cost for a Fiat 124 Spider is approximately $44.83, indicating above-average ownership costs, which can contribute to higher insurance premiums.

Does the Fiat 124 Spider need premium gas, and does it affect insurance?

The Fiat 124 Spider requires unleaded gasoline with a recommended rating of 91 octane, and using premium gas can sometimes lower insurance costs due to better engine performance and longevity.

Is the Fiat 124 Spider a good car for insurance purposes?

The Fiat 124 Spider’s reliable performance and relatively low repair frequency can lead to more favorable insurance rates.

What factors affect the insurance cost of the Fiat 124 Spider?

Factors affecting insurance costs include the car’s repair costs, average number of repair visits, the likelihood of severe repairs, and the car’s performance specifications.

To learn more, explore our comprehensive resource on “Do I have to repair my car with the insurance money?”

Does the Fiat 124 Spider have a high insurance premium?

The insurance premium for the Fiat 124 Spider can be higher due to its above-average ownership costs and the necessity for premium fuel.

What is the cost of insurance for a Fiat 124 Spider?

The cost of insurance for a Fiat 124 Spider can vary, but factors like its repair costs, reliability, and performance features contribute to the overall premium.

Find cheap car insurance quotes by entering your ZIP code below.

What types of insurance are recommended for a Fiat 124 Spider?

Comprehensive insurance is recommended for a Fiat 124 Spider to cover third-party injuries, death, property damage, and personal injuries or vehicle damage.

How does the Fiat 124 Spider’s turbo engine affect insurance?

The turbo engine in the Fiat 124 Spider Abarth can lead to higher insurance premiums due to increased performance capabilities and potential repair costs.

Learn more by reading our guide titled “Does car insurance cover a bad engine?”

Is the Fiat 124 Spider considered a luxury car for insurance purposes?

While the Fiat 124 Spider Abarth offers a luxury experience, its insurance premiums are generally based on repair costs, performance, and reliability rather than luxury status alone.

What should I consider when insuring an older Fiat 124 Spider?

When insuring an older Fiat 124 Spider, consider its maintenance history, particularly the timing belt replacement, as deferred maintenance can affect both reliability and insurance costs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.