Best Chrysler Town and Country Car Insurance in 2025 (Check Out These 10 Companies)

The best providers are State Farm, AAA, and Erie which offer the best Chrysler Town and Country car insurance starting at just $35 per month. State Farm, the top choice, excels with its tailored coverage options for Chrysler Town and Country owners, ensuring comprehensive and cost-effective protection.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Sep 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Sep 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Chrysler Country

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Chrysler Country

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Chrysler Country

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, AAA, and Erie emerge as the best Chrysler Town and Country car insurance providers, offering unparalleled coverage and benefits.

State Farm is the top pick overall for its comprehensive policies, while AAA stands out for exceptional customer service, and Erie provides competitive rates.

Our Top 10 Company Picks: Best Chrysler Town and Country Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 14% B Many Discounts State Farm

#2 12% A Online App AAA

#3 18% A+ 24/7 Support Erie

#4 10% A+ Add-on Coverages Allstate

#5 15% A++ Military Savings USAA

#6 16% A Local Agents Farmers

#7 19% A++ Custom Plan Geico

#8 11% A+ Innovative Programs Progressive

#9 13% A Customizable Polices Liberty Mutual

#10 17% A+ Usage Discount Nationwide

This article explores each provider’s strengths to help you choose the best Chrysler Town and Country car insurance. Learn more in our guide titled “Best Usage-Based Car Insurance Companies.”

Ready to shop around for the best car insurance company? Enter your ZIP code above and see which one offers the coverage you need.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm’s bundling options offer notable reductions for Chrysler Town and Country owners who consolidate their insurance needs. The company provides substantial savings when you combine auto coverage with additional policies such as home or life insurance, enhancing overall cost-effectiveness. This approach ensures that policyholders benefit from comprehensive protection while maximizing their savings.

- Discount for Low Mileage: For drivers of the Chrysler Town and Country who use their vehicles infrequently, State Farm provides a significant reduction specifically for low-mileage vehicles. This incentive not only lowers premiums but also highlights the insurer’s commitment to rewarding cautious and economical driving habits.

- Wide Range of Coverage: State Farm is recognized for its diverse coverage options. Whether you require basic liability or more extensive protection, the insurer offers customizable solutions suited to the specific needs of Chrysler Town and Country owners. This flexibility allows you to tailor your coverage to your precise requirements. To find out more, explore our guide titled State farm car insurance review.

Cons

- Limited Multi-Policy Discount: The multi-policy discount offered for a Chrysler Town and Country by State Farm is relatively lower compared to what some other insurance providers offer, potentially affecting savings.

- Premium Costs: Even with available discounts, the overall premium costs for Chrysler Town and Country coverage with State Farm might still be higher than those offered by some competitors.

#2 – AAA: Best for Online App

Pros

- Efficient Online App: AAA’s sophisticated online application is a major highlight, offering Chrysler Town and Country owners seamless access to policy management. The app makes it easy to perform tasks such as filing claims, reviewing coverage details, and monitoring policy status, all from the convenience of your device. This modern tool enhances user experience and operational efficiency. More information is available about this provider in our article called “AAA Car Insurance Review.”

- Attractive Multi-Vehicle Savings: AAA offers a competitive 12% discount for insuring multiple vehicles, including the Chrysler Town and Country. This discount can significantly reduce overall insurance costs, making it a practical choice for families or individuals with several vehicles.

- Comprehensive Digital Resources: Besides the app, AAA provides a range of digital tools that further simplify insurance management. These resources are designed to improve the experience for Chrysler Town and Country owners by offering easy access to information and services.

Cons

#3 – Erie: Best for 24/7 Support

Pros

- Around-the-Clock Assistance: Erie Insurance excels with its 24/7 customer support, ensuring that Chrysler Town and Country owners can access help any time, day or night. This comprehensive support system is crucial for addressing urgent issues and providing peace of mind.

- Generous Multi-Vehicle Discount: Erie offers a notable 18% discount for policies covering multiple vehicles, which is particularly advantageous for insuring several Chrysler Town and Country vehicles or combining with other types of coverage. This significant discount helps lower the overall insurance cost considerably.

- A+ Financial Rating: Erie’s A+ rating from A.M. Best reflects its strong financial stability and dependability. This rating assures Chrysler Town and Country owners that the insurer can meet its financial commitments and provide reliable coverage. Check out insurance savings in our complete guide title “Erie Car Insurance Review.”

Cons

- Limited Availability: Erie’s insurance coverage for the Chrysler Town and Country is not offered in every state, which means availability may be limited depending on your location.

- Digital Tools: Erie’s digital tools and online app are not as advanced as some competitors, potentially impacting convenience for Chrysler Town and Country owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Add-on Coverages

Pros

- Versatile Add-On Options: Allstate’s broad array of additional coverages allows Chrysler Town and Country owners to customize their policies with extra protections. Whether it’s roadside assistance, rental car coverage, or enhanced liability protection, these add-ons offer valuable flexibility and security.

- Competitive Multi-Vehicle Savings: Allstate provides a 10% discount for multi-vehicle insurance policies, which can help reduce costs for those insuring the Chrysler Town and Country alongside other vehicles. This discount is a practical option for managing multiple insurance needs.

- A+ Financial Rating: Allstate’s A+ rating from A.M. Best indicates its strong financial health and stability. This high rating assures Chrysler Town and Country owners of the insurer’s ability to meet its obligations and provide consistent coverage. Learn more in our article called “Allstate Car Insurance Review.”

Cons

- Less Competitive Discount Rate: The 10% discount for multi-vehicle policies may not be as competitive compared to discounts offered by other insurance companies. This could result in lower overall savings for Chrysler Town and Country owners.

- Complex Add-On Selection: While additional coverages provide valuable options, the variety and complexity might require more effort to fully understand and select the best protections for the Chrysler Town and Country. This could be a potential drawback for those seeking simpler, more straightforward insurance solutions.

#5 – USAA: Best for Military Savings

Pros

- Exceptional Military Savings: USAA is well-regarded for its substantial discounts for military personnel, including significant savings for insuring the Chrysler Town and Country. This pricing structure emphasizes USAA’s commitment to serving military families, offering exceptional value.

- Top A++ Rating: USAA’s A++ rating from A.M. Best signifies its superior financial strength and stability. This top-tier rating ensures that Chrysler Town and Country owners receive dependable coverage from a financially robust insurer.

- Customized Coverage Options: USAA offers extensive and tailored coverage options specifically designed for military families. This customized approach ensures that the Chrysler Town and Country is thoroughly protected, meeting the unique needs of its owners. Check out insurance savings in our complete article called USAA car insurance review.

Cons

- Eligibility Restrictions: USAA’s services are exclusively available to military members and their families, which means that Chrysler Town and Country owners outside this group are ineligible for the insurer’s benefits.

- Geographic Limitations: Certain services and coverage options provided by USAA might be limited based on location. This could affect Chrysler Town and Country owners residing outside major service areas, potentially impacting the availability and convenience of insurance services.

#6 – Farmers: Best for Local Agents

Pros

- Farmers excels in delivering bespoke service through its network of regional representatives, who offer expert counsel customized specifically for the Chrysler Town and Country. This localized strategy ensures that insurance choices are adjusted to meet the distinctive requirements of your vehicle and driving habits.

- Significant Multi-Vehicle Savings: Farmers provides a 16% discount for insuring multiple vehicles, resulting in substantial savings when including the Chrysler Town and Country. This concession is particularly beneficial for households with several cars, enhancing overall cost-efficiency.

- Robust A.M. Best Rating: With a solid A rating from A.M. Best, Farmers reflects a strong financial position and reliability. This rating highlights the company’s capability to honor its commitments, ensuring comprehensive protection for your Chrysler Town and Country. Delve into our evaluation of Farmers car insurance review.

Cons

- Discounts Not as Competitive: Although Farmers offers a 16% multi-vehicle reduction, it might not be as generous as the discounts from other insurers. This could lead to higher costs compared to competitors for the Chrysler Town and Country.

- Fewer Customization Opportunities: Despite its personalized service, Farmers might offer fewer options for customizing coverage compared to some rivals. This could limit flexibility in adapting the policy to specific needs of Chrysler Town and Country owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Best for Custom Plan

Pros

- Generous Multi-Vehicle Reduction: Geico’s 19% discount for multiple vehicles is notably competitive, providing significant savings for families covering multiple cars, including the Chrysler Town and Country. This benefit is especially advantageous for those with multiple vehicles.

- Exceptional Financial Strength: With an A++ rating from A.M. Best, Geico is recognized for its superior financial robustness and dependability. This top rating assures that Geico is well-equipped to manage claims and provide consistent coverage for your Chrysler Town and Country.

- Highly Adaptable Insurance Plans: Geico’s array of adaptable insurance plans allows for extensive personalization. This flexibility ensures that coverage for the Chrysler Town and Country can be precisely tailored to fit your specific needs and preferences. See more details on our guide titled Geico car insurance review.

Cons

- Variable Discount Effectiveness: While Geico offers a generous 19% discount, the actual impact on premiums can vary based on individual driving habits and vehicle usage. This variability might affect the overall savings for Chrysler Town and Country owners.

- Limited Face-to-Face Interaction: Geico’s focus on digital and remote services might lack the personal touch of in-person consultations with local agents. This could be a drawback for those who value direct, personalized assistance.

#8 – Progressive: Best for Innovative Programs

Pros

- dvanced Discount Mechanisms: Progressive’s 11% discount for the Chrysler Town and Country underscores its dedication to employing innovative discount programs. This includes usage-based insurance and other modern savings strategies tailored to individual driving patterns.

- Strong Financial Rating: With an A+ rating, Progressive demonstrates high financial reliability and stability. This rating assures that the company is capable of fulfilling its obligations and providing consistent coverage for the Chrysler Town and Country.

- Integration of Advanced Technology: Progressive’s insurance offerings are distinguished by their advanced technological features, such as the Snapshot program, which allows for personalized premium adjustments based on driving behavior. This innovation can be particularly beneficial for Chrysler Town and Country drivers. To learn more, explore our comprehensive resource on Progressive car insurance review.

Cons

- Lower Multi-Vehicle Savings: Progressive’s 11% multi-vehicle discount is less competitive compared to some other insurers. This could result in higher premiums for those covering multiple vehicles, including the Chrysler Town and Country.

- Complex Coverage Structure: The innovative programs provided by Progressive, while advantageous, may also be complex. Navigating these options might be challenging for those seeking straightforward coverage for their Chrysler Town and Country.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Extensive Policy Personalization: Liberty Mutual offers highly adjustable policies, allowing Chrysler Town and Country owners to select coverage options that exactly fit their needs. This level of customization ensures comprehensive protection tailored to individual preferences and driving habits.

- Competitive Multi-Vehicle Savings: With a 13% discount for insuring multiple vehicles, Liberty Mutual offers a solid savings opportunity for families with the Chrysler Town and Country, making it a cost-effective choice for multi-car households.

- Reliable Financial Position: Liberty Mutual holds an A rating from A.M. Best, reflecting strong financial stability. This rating provides confidence in the company’s ability to meet its commitments and offer reliable coverage for the Chrysler Town and Country. Discover more about offerings in our article called Liberty Mutual car insurance review.

Cons

- Moderate Discount Value: The 13% multi-vehicle discount, while beneficial, might not be as substantial as those offered by some other insurers. This could lead to relatively higher premiums for Chrysler Town and Country policyholders compared to more generous discount options.

- Complex Policy Selection: The broad range of customizable options might result in a more complicated policy selection process. This could be overwhelming for some customers, making it challenging to determine the optimal coverage for their Chrysler Town and Country.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Nationwide: Best for Usage Discount

Pros

- Significant Usage-Based Savings: Nationwide provides a 17% discount based on vehicle usage, which can be particularly advantageous for Chrysler Town and Country owners who drive less frequently. This usage-based approach helps lower premiums by aligning costs with actual driving patterns.

- Strong Financial Rating: With an A+ rating from A.M. Best, Nationwide showcases robust financial health and reliability. This rating assures policyholders of the company’s ability to handle claims effectively and offer dependable coverage for the Chrysler Town and Country.

- Flexible Coverage Solutions: Nationwide’s policies are designed to accommodate various usage scenarios, offering tailored coverage solutions that fit the specific needs of Chrysler Town and Country drivers. Access comprehensive insights into our article called Nationwide car insurance discounts.

Cons

- Usage Discount Limitations: The impact of the 17% usage-based discount might be less significant for high-mileage drivers, potentially reducing its attractiveness for those with frequent driving needs.

- Policy Complexity: The detailed structure of usage-based discounts and coverage options might be intricate to navigate, which could be a disadvantage for those seeking straightforward insurance solutions for their Chrysler Town and Country.

Monthly Rates for Chrysler Town and Country Car Insurance by Provider

The following table provides an overview of monthly rates for insuring a Chrysler Town and Country with minimum and full coverage from various insurance providers. Understanding these rates can help you make an informed decision when selecting the best insurance option for your vehicle.

Chrysler Town and Country Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $72 $151

Allstate $35 $148

Erie $50 $168

Farmers $50 $164

Geico $45 $201

Liberty Mutual $49 $123

Nationwide $59 $187

Progressive $60 $108

State Farm $56 $149

USAA $48 $187

When evaluating the best insurance options for a Chrysler Town and Country, it is essential to compare both minimum and full coverage rates across different providers. Allstate offers the most affordable minimum coverage at $35 per month, making it a strong contender for budget-conscious drivers.

However, if you are looking for comprehensive protection, Progressive provides the lowest full coverage rate at $108 per month. On the other hand, Geico’s full coverage rate is the highest at $201, indicating a significant variation in costs depending on the level of coverage you choose.

Understanding these differences can help you select the right insurance plan that balances cost with the coverage needs of your Chrysler Town and Country. More information is available about this provider in our article called “Compare Car Insurance by Coverage Type.”

What Impacts the Cost of Chrysler Town and Country Insurance

The Chrysler Town and Country trim and model you choose will affect the total price you will pay for Chrysler Town and Country insurance coverage. See more details on our article called “Compare Car Insurance by Coverage Type.”

Age of the Vehicle

Insurance rates for older cars generally differ from those of newer models, and understanding these variations helps car owners make informed financial decisions. A comparative look at the monthly insurance costs for the Chrysler Town and Country alongside similar vehicles provides insight into how rates fluctuate based on coverage type.

Chrysler Town and Country Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Chrysler Town and Country | $25 | $44 | $31 | $113 |

| Kia Sedona | $24 | $37 | $28 | $100 |

| Dodge Grand Caravan | $26 | $37 | $31 | $106 |

| Honda Odyssey | $23 | $44 | $31 | $112 |

| Chrysler Pacifica | $29 | $44 | $26 | $111 |

The Kia Sedona offers the lowest overall rates across most categories, while the Chrysler Town and Country and Chrysler Pacifica exhibit higher premiums. Understanding these variations allows vehicle owners to tailor their insurance plans more effectively, ensuring they balance adequate coverage with affordable pricing.

Driver Age

Insurance companies assess the risk associated with different age groups and adjust their rates accordingly. Younger drivers often face higher premiums due to perceived higher risk, while more experienced drivers typically enjoy lower costs. Let’s take a closer look at the monthly insurance rates for drivers of various ages.

Chrysler Town and Country Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $600 |

| Age: 18 | $381 |

| Age: 20 | $237 |

| Age: 30 | $109 |

| Age: 40 | $104 |

| Age: 45 | $100 |

| Age: 50 | $95 |

| Age: 60 | $93 |

Based on the figures provided, insurance costs for the Chrysler Town and Country gradually decrease as motorists age and accumulate more experience on the road. Younger, less seasoned drivers face the steepest fees, while individuals in their 30s and older enjoy more advantageous pricing.

Recognizing the effect age has on car insurance can assist motorists in making more informed financial decisions and possibly lowering their payments as they get older.

Driver Location

The expense of auto insurance can differ greatly depending on your location, even for the same vehicle model. For Chrysler Town and Country drivers, monthly premiums shift based on the city where they reside. Factors like traffic volume, crime statistics, and local laws all play a role in influencing insurance prices, making it crucial for motorists to recognize how location can affect their costs.

Chrysler Town and Country Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $178 |

| New York, NY | $165 |

| Houston, TX | $164 |

| Jacksonville, FL | $151 |

| Philadelphia, PA | $140 |

| Chicago, IL | $138 |

| Phoenix, AZ | $121 |

| Seattle, WA | $101 |

| Indianapolis, IN | $89 |

| Columbus, OH | $87 |

Geography significantly impacts insurance premiums for the Chrysler Town and Country, as illustrated by the varying expenses across different U.S. cities. Major metropolitan areas like Los Angeles and New York see much higher premiums in comparison to locations such as Columbus and Indianapolis, where insurance tends to be more reasonably priced.

Your Driving Record

Your driving record can have an impact on the cost of Chrysler Town and Country auto insurance.

Chrysler Town and Country Car Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $600 | $800 | $1,150 | $760 |

| Age: 18 | $381 | $590 | $820 | $510 |

| Age: 20 | $237 | $400 | $620 | $330 |

| Age: 30 | $109 | $170 | $270 | $150 |

| Age: 40 | $104 | $160 | $260 | $140 |

| Age: 45 | $100 | $155 | $255 | $135 |

| Age: 50 | $95 | $150 | $250 | $130 |

| Age: 60 | $93 | $145 | $240 | $125 |

Teens and drivers in their 20’s see the highest jump in their Chrysler Town and Country car insurance with violations on their driving record.

Chrysler Town and Country Safety Ratings

Your Chrysler Town and Country car insurance rates are influenced by the safety ratings of the Chrysler Town and Country. See the breakdown below.

Chrysler Town and Country Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Poor |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

Understanding the safety ratings of the Chrysler Town and Country is crucial for determining your car insurance rates. Insurance companies often consider these ratings when setting premiums, as higher safety ratings generally lead to lower insurance costs.

Chrysler Town and Country Crash Test Ratings

Chrysler Town and Country crash test ratings can impact the cost of your Chrysler Town and Country car insurance. See Chrysler Town and Country crash test results below:

Chrysler Town and Country Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Chrysler Town and Country | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2023 Chrysler Town and Country | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2022 Chrysler Town and Country | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2021 Chrysler Town and Country | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2020 Chrysler Town and Country | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2019 Chrysler Town and Country | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2018 Chrysler Town and Country | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2017 Chrysler Town and Country | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2016 Chrysler Town and Country | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

These ratings directly influence the cost of car insurance for the Chrysler Town and Country, as higher safety ratings generally lead to lower premiums due to reduced risk for insurers.

Chrysler Town and Country Safety Features

The more safety features you have on your Chrysler Town and Country, the more likely it is that you can earn a discount. The Chrysler Town and Country’s safety features include:

- Electronic Stability Control (ESC)

- ABS And Driveline Traction Control

- Side Impact Beams

- Dual Stage Driver And Passenger Seat-Mounted Side Airbags

- Low Tire Pressure Warning

Prioritizing these features is essential for both safety and cost savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Chrysler Town and Country Finance and Insurance Cost

If you are financing a Chrysler Town and Country, most lenders will require your carry higher Chrysler Town and Country coverage options including comprehensive coverage, so be sure to shop around and compare Chrysler Town and Country car insurance quotes from the best companies using our FREE tool below.

Check out insurance savings in our complete article called “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

Ways to Save on Chrysler Town and Country Insurance

You have more options at your disposal to save money on your Chrysler Town and Country auto insurance costs. For example, try taking advantage of the following five strategies to reduce your Chrysler Town and Country car insurance rates

- Ask about mature driver discounts for drivers over 50.

- Reduce modifications on your Chrysler Town and Country.

- Ask about seasonal insurance for your Chrysler Town and Country.

- Compare apples to apples when comparing Chrysler Town and Country insurance quotes and policies.

- Remove unnecessary insurance once your Chrysler Town and Country is paid off.

Implementing these approaches can help you secure the best rates and maximize your savings. Discover more about offerings in our guide titled “Finding Free Car Insurance Quotes Online.”

Chrysler Town and Country Insurance Cost

The average Chrysler Town and Country auto insurance rates is $104 a month. However, insurance rates can fluctuate significantly based on various factors, making it essential to understand how these variables influence your premiums.

Chrysler Town and Country Car Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $104 |

| Discount Rate | $61 |

| High Deductibles | $90 |

| High Risk Driver | $222 |

| Low Deductibles | $131 |

| Teen Driver | $381 |

Evaluating and understanding the intricacies of Chrysler Town and Country insurance costs can lead to better financial decisions and enhanced protection. With varying rates based on coverage types and individual driver profiles, it’s crucial to assess your needs and choose a plan that balances cost with adequate coverage.Discover more about offerings in our Chrysler Town and Country article called “Minimum Car Insurance Requirements by State.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

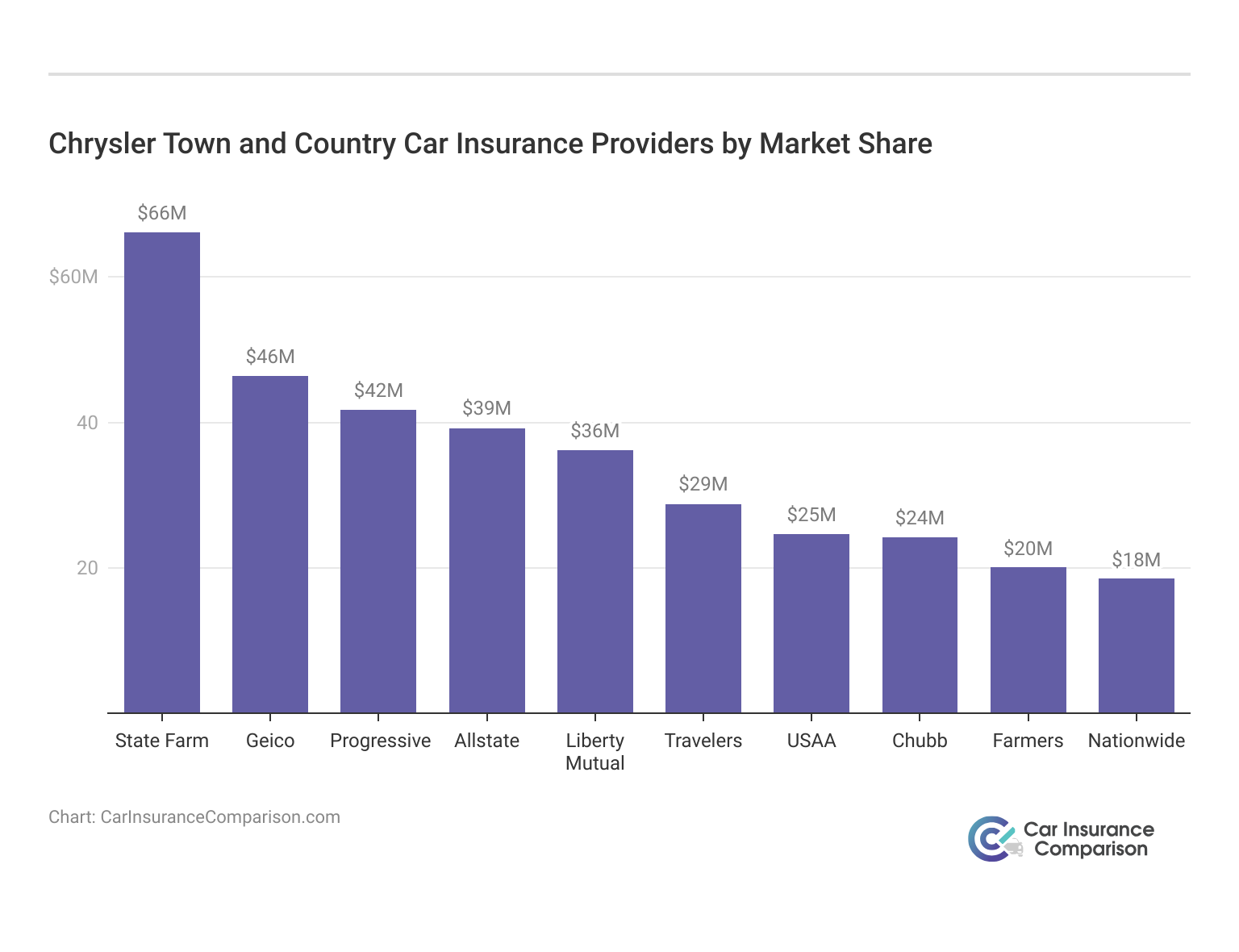

Top Chrysler Town and Country Insurance Companies

Although your specific rates will vary based on several factors, here are some leading companies that provide auto insurance for the Chrysler Town and Country, listed by market share.

Listing top companies by market share assists consumers in finding trustworthy options and making well-informed choices, despite the fact that individual rates may differ depending on personal circumstances.

Top Chrysler Town and Country Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Many of these companies offer discounts for security systems and other safety features that the Chrysler Town and Country offers. Access comprehensive insights into our article called “Online Car Insurance Quotes Without Personal Information.”

Are Chrysler Town and Countrys Expensive to Insure

The chart below details how Chrysler Town and Country insurance rates compare to other vans like the Toyota Sienna, Kia Sedona, and Dodge Grand Caravan.

Chrysler Town and Country Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Chrysler Town and Country | $25 | $44 | $31 | $113 |

| Kia Sedona | $24 | $37 | $28 | $100 |

| Dodge Grand Caravan | $26 | $37 | $31 | $106 |

| Honda Odyssey | $23 | $44 | $31 | $112 |

| Chrysler Pacifica | $29 | $44 | $26 | $111 |

Read more: Compare Kia Car Insurance Rates

However, there are several strategies you can employ to discover the most affordable Chrysler insurance rates available online.

Compare Free Chrysler Town and Country Insurance Quotes Online

Save money by comparing Chrysler Town and Country insurance rates with free quotes online now.

The auto insurance premiums for a Chrysler Town & Country are, approximately, $106 per month. These figures are estimates.

Additionally, you should expect a slight decrease in your auto insurance premium each year that you own your vehicle. This is due to depreciation on the vehicle.

Safety is highly important, so be certain that you research the Chrysler Town & Country’s safety ratings.

The official NHTSA safety ratings, as well as the Town & Country safety features, are explained below. Although no one likes to think about getting into an accident it’s good to plan for one just in case. Unlock details in our article called “Safety Features Car Insurance Discounts.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Is the Cost of Ownership for a Chrysler Town & Country

The cost of ownership is the amount of money it costs to operate and purchase the vehicle over an extended period of time.

By understanding such costs you can save money in the long run thereby making a wiser financial decision when it comes to selecting the vehicle that’s right for you.

Determining how much a Chrysler Town & Country costs over the lifetime of ownership is as important as actually purchasing it. Within an MSRP of $29,995, the Chrysler Town & Country is comparable to other vehicles in its class.

Chrysler Town and Country owners can leverage State Farm’s bundling discounts to significantly reduce their monthly insurance costs.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

It has a fuel economy of 23 miles per gallon. The total cost of ownership for a Chrysler Town & Country minivan includes premiums set by the car insurance providers. Discover insights in our article called “What is a car insurance premium?”

A vehicle’s economic value is based on how much it will cost you to operate the vehicle as well as own it compared to the actual purchase price of the vehicle.

You are comparing what you pay (the purchase price) to what you actually get (the ownership costs); and obviously, the less difference, the better off you actually are.

What Do Ownership Costs for a Chrysler Town & Country Include

Ownership costs can vary significantly. The cost of owning and operating two completely different vehicles can actually differ by thousands of dollars. Check out insurance savings in our complete guide titled “How do you find competitive car insurance rates?”

Obviously, you do want to compare similar types of vehicles. For example, compare trucks with trucks, compare used cars with used cars, compare the same year of vehicles, etc. to get an accurate and complete picture.

In other words, you would not want to compare a brand-new Chrysler Town & Country minivan to a ten-year-old Honda Civic.

How Chrysler Town & Country Safety Features Impact Insurance Costs

There are many safety features on the Chrysler Town & Country minivan that will significantly affect your auto insurance premiums. These include:

- Electronic stability control

- Adjustable upper belt for both rear and head air bags

- Four-wheel anti-lock braking system

- Pretensioner

- Trunk release

The independent company, Intellichoice, analyzes vehicles for the current model year each January. To obtain additional information for the Chrysler Town & Country, the near-luxury category is one which you should visit.

Ownership costs are released every year and are estimated. The overall winners for each category are not made available until all the data is gathered and compiled. See more details on our guide titled “Why is my car insurance so expensive?”

Intellichoice updates its Best Deals results monthly so that it includes any ongoing programs, market conditions, current pricing, and expiring rebates, which gives the buyer the most up-to-date information.

It is important to remember that there are many factors to consider when purchasing any vehicle. By considering the safety features, you can make a more informed decision.

Fortunately, it is the Town & Country safety features which affect the insurance rate in a positive manner. Combine its safety with its good gas mileage, and its good crash rating, and you get a vehicle that is not only worth researching but is also worth purchasing.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How much does car insurance cost for a Chrysler Town and Country?

The cost of car insurance for a Chrysler Town and Country can vary depending on several factors, including your location, driving history, age, coverage options, and the insurance provider you choose. Additionally, factors such as the model year of the vehicle, its safety features, and the cost of repairs can influence insurance rates. To get an accurate estimate, it’s recommended to request quotes from multiple insurance companies.

For additional details, explore our comprehensive resource titled “Safe Driver Car Insurance Discounts.”

What are the factors that affect Chrysler Town and Country car insurance rates?

Several factors can impact the cost of car insurance for a Chrysler Town and Country. These factors include your age, driving record, location, mileage, coverage options, deductibles, and the level of coverage you choose. Insurance providers also consider the theft rate of the vehicle, its safety features, and the cost of repairs. Additionally, the state you live in and local insurance regulations can influence rates.

What type of coverage do I need for my Chrysler Town and Country?

The type of coverage you need for your Chrysler Town and Country depends on your personal circumstances and preferences. However, the most common types of coverage for a Chrysler Town and Country include liability coverage, which is typically required by law, and comprehensive and collision coverage to protect against damage to your vehicle.

It’s also advisable to consider uninsured/underinsured motorist coverage and additional optional coverages based on your needs.

How can I find affordable car insurance for my Chrysler Town and Country?

To find affordable car insurance for your Chrysler Town and Country, it’s recommended to shop around and compare quotes from different insurance providers. You can also inquire about available discounts, such as multi-car discounts, safe driver discounts, and discounts for safety features in your vehicle.

Maintaining a clean driving record and choosing higher deductibles can also help lower your premiums. Working with an independent insurance agent can simplify the process and help you find the best coverage options at competitive rates.

Are there any specific considerations for insuring a Chrysler Town and Country?

When insuring a Chrysler Town and Country, it’s important to consider factors such as the vehicle’s value, safety features, and potential repair costs. The specific model year of your Chrysler Town and Country may also impact insurance rates.

Additionally, factors like your location and driving habits can affect rates. It’s advisable to review your policy and discuss any specific concerns or questions with your insurance provider to ensure you have adequate coverage for your Chrysler Town and Country.

To find out more, explore our guide titled “Do I have to repair my car with the insurance money?”

What are the best car insurance rates for a Town and Country?

The best car insurance rates for a Town ‘n’ Country can vary based on factors like coverage level and discounts. Companies like State Farm, AAA, and Erie offer competitive rates.

Which car insurance companies offer coverage for Town and Country?

Top car insurance companies for Town ‘n’ Country include State Farm, AAA, and Erie, each providing various coverage options tailored to your needs.

Where can I find cheap car insurance for a Town and Country?

For cheap car insurance on a Town ‘n’ Country, consider companies such as Allstate, Geico, and Liberty Mutual, which offer affordable rates and coverage options.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.