Several factors impact Chrysler Sebring insurance costs, including the model year, driving history, and coverage level. Newer models generally have higher rates due to their value. Location, credit score, and safety features also play a role, making it important to consider these when selecting coverage.

Best Chrysler Sebring Car Insurance in 2025 (Check Out the Top 10 Companies)

The best Chrysler Sebring car insurance providers, AAA, Allstate, and Erie, offer competitive rates from $36 per month. These companies excel in affordability, diverse coverage options, and strong customer satisfaction, making them ideal choices for Sebring owners seeking reliable and budget-friendly insurance.

UPDATED: Feb 26, 2025Fact Checked

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Feb 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

UPDATED: Feb 26, 2025Fact Checked

Top Pick for Chrysler Sebring: AAA 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Chrysler Sebring

$166/moA.M. Best Rating

AComplaint Level

LowPros & Cons

3,027 reviewsBest Add-On Coverage for Sebring: Allstate

3,027 reviewsBest Add-On Coverage for Sebring: Allstate

Company Facts

Full Coverage for Chrysler Sebring

$168/moA.M. Best Rating

A+Complaint Level

MedPros & Cons

Best 24/7 Support for Chrysler Sebring: Erie

Best 24/7 Support for Chrysler Sebring: Erie 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Chrysler Sebring

$187/moA.M. Best Rating

A+Complaint Level

HighPros & Cons

1,883 reviews

1,883 reviews

The best Chrysler Sebring car insurance providers, AAA, Allstate, and Erie, offer competitive rates starting at $60 a month and reliable coverage.

AAA excels in customer service and comprehensive options, while Allstate and Erie provide tailored coverage. Gain deeper insights by exploring our ” Best Chrysler 300 Car Insurance.”

Our Top 10 Company Picks: Best Chrysler Sebring Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 13% A Online App AAA

#2 15% A+ Add-on Coverages Allstate

#3 12% A+ 24/7 Support Erie

#4 18% A Local Agents Farmers

#5 16% B Many Discounts State Farm

#6 10% A++ Military Savings USAA

#7 14% A++ Custom Plan Geico

#8 17% A+ Usage Discount Nationwide

#9 19% A Customizable Polices Liberty Mutual

#10 11% A+ Innovative Programs Progressive

Compare RatesStart Now →

Each has been evaluated for customer satisfaction, financial strength, and coverage flexibility to ensure the best value. Find cheap car insurance quotes by entering your ZIP code.

Here's What You Need to Know

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – AAA: Top Overall Pick

Read More: Compare Chrysler Car Insurance Rates

Pros

- Discounts for Bundling: Offers significant discounts when bundling Chrysler Sebring insurance with other policies.

- Roadside Assistance: AAA provides excellent roadside assistance, a valuable perk for Sebring owners. Gain deeper insights by perusing our article named “AAA Car Insurance Review.”

- Comprehensive Coverage Options: Includes a variety of coverage options tailored to Chrysler Sebring’s needs.

Cons

- Membership Requirement: Requires AAA membership to access insurance benefits, adding an extra cost.

- Higher Premiums: Tends to have higher premiums compared to competitors for Chrysler Sebring insurance.

#2 – Allstate: Best for Extensive Options

Pros

- Accident Forgiveness: Allstate’s accident forgiveness can help keep your Chrysler Sebring insurance rates stable after an accident.

- Safe Driving Discounts: Offers substantial discounts for safe driving, ideal for responsible Sebring owners.

- Strong Claims Satisfaction: Allstate is known for reliable claims handling, providing peace of mind. Dive into the details with our article entitled “Allstate Car Insurance Review.”

Cons

- Higher Rates: Allstate’s premiums can be higher for Chrysler Sebring drivers compared to other insurers.

- Limited Coverage Options: Fewer customization options for coverage compared to competitors.

#3 – Erie: Best for Budget-Friendly Rates with Personal Touch

Pros

- Affordable Rates: Erie often provides lower rates for Chrysler Sebring insurance, making it budget-friendly. Explore further in our article titled “Erie Car Insurance Review.”

- First Accident Forgiveness: Offers accident forgiveness for your first at-fault accident, keeping premiums in check.

- Customizable Policies: Provides customizable policies tailored to Chrysler Sebring owners’ specific needs.

Cons

- Availability: Erie is not available in all states, limiting access for some Chrysler Sebring drivers.

- Limited Online Tools: Lacks comprehensive online tools and mobile apps for managing policies.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Farmers: Best for Personalized Service

Pros

- Discounts for Safe Drivers: Farmers offer discounts for safe driving, benefiting Chrysler Sebring owners. Delve into the specifics in our article called “Farmers Car Insurance Review.”

- Flexible Coverage Options: Provides flexible coverage options that can be tailored to fit the needs of a Chrysler Sebring.

- Strong Customer Service: Known for strong customer service, making the insurance experience smoother.

Cons

- Higher Premiums: Farmers may charge higher premiums for Chrysler Sebring insurance compared to other insurers.

- Complex Discounts: Discount qualification can be complex, requiring more effort from Chrysler Sebring owners.

#5 – State Farm: Best for Top-Rated for Customer Satisfaction

Pros

- Nationwide Availability: State Farm offers Chrysler Sebring insurance across the entire U.S., providing widespread access.

- Safe Driving Discounts: Significant discounts for safe drivers, helping reduce Chrysler Sebring insurance costs. For a comprehensive understanding, consult our article titled “State Farm Car Insurance Review.”

- Strong Financial Stability: Backed by strong financial stability, ensuring reliable coverage.

Cons

- Higher Rates for Some Drivers: State Farm may offer higher premiums for Chrysler Sebring owners with certain driving histories.

- Limited Coverage Customization: Offers fewer customization options compared to other insurers.

#6 – USAA: Best for Military Families

Pros

- Military-Focused Discounts: USAA offers excellent discounts for military members and their families, ideal for Chrysler Sebring owners with a military background.

- Top-Rated Customer Satisfaction: Consistently high customer satisfaction, providing peace of mind for Chrysler Sebring drivers.

- Low Premiums: USAA often provides low premiums for Chrysler Sebring insurance, making it a cost-effective option. Enhance your knowledge by reading our “USAA Car Insurance Review.”

Cons

- Membership Restriction: Only available to military members, veterans, and their families, limiting access.

- Limited Availability: Fewer local offices and agents available, potentially complicating in-person service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Best for Affordable Insurance with Easy Access

Pros

- Competitive Rates: Geico is known for offering competitive rates on Chrysler Sebring insurance, making it an affordable choice.

- Easy Online Tools: Provides robust online tools and mobile apps, making policy management convenient for Sebring owners.

- Strong Financial Stability: Backed by strong financial stability, ensuring reliable coverage. Uncover more by delving into our article entitled “Geico Car Insurance Review.”

Cons

- Mediocre Customer Service: Geico’s customer service may not be as strong as some competitors, potentially leading to frustrations.

- Limited Coverage Customization: Offers fewer customization options compared to other insurers.

#8 – Nationwide: Best for Flexible Coverage Tailored to You

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible can help reduce costs over time for Chrysler Sebring owners.

- On Your Side® Review: Offers an annual policy review to ensure you’re getting the best coverage for your Chrysler Sebring.

- Strong Financial Strength: Backed by strong financial stability, ensuring reliable coverage. Get a better grasp by checking out our article titled “Nationwide Car Insurance Discounts.”

Cons

- Higher Premiums: Nationwide may charge higher premiums for Chrysler Sebring insurance compared to other insurers.

- Mixed Customer Service Reviews: Customer service experiences can be inconsistent.

#9 – Liberty Mutual: Best for Customized Coverage for Your Needs

Pros

- Better Car Replacement: Liberty Mutual offers a better car replacement option, beneficial for Chrysler Sebring owners.

- Multi-Policy Discounts: Provides significant discounts when bundling Chrysler Sebring insurance with other policies. Expand your understanding with our article called “Liberty Mutual Car Insurance Discounts.”

- Comprehensive Coverage Options: Offers a wide range of coverage options tailored to Chrysler Sebring’s needs.

Cons

- Higher Premiums: Tends to have higher premiums for Chrysler Sebring insurance compared to competitors.

- Mixed Claims Experience: Some customers report mixed experiences with the claims process.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Progressive: Best for Discount-Driven Savings

Pros

- Snapshot® Program: Progressive’s Snapshot® program rewards safe Chrysler Sebring drivers with lower rates. For additional insights, refer to our “Progressive Car Insurance Review.”

- Affordable Rates: Offers competitive rates for Chrysler Sebring insurance, making it a budget-friendly option.

- Comprehensive Online Tools: Provides robust online tools and mobile apps, making policy management convenient.

Cons

- Rates May Vary: Premiums can vary significantly based on driving history and location, leading to potential rate increases for Chrysler Sebring owners.

- Customer Service: Progressive’s customer service may not be as strong as some competitors, leading to potential frustrations.

Chrysler Sebring Car Insurance Monthly Rates by Coverage Level & Provider

Chrysler Sebring Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $60 $166

Allstate $79 $168

Erie $56 $187

Farmers $36 $164

Geico $46 $223

Liberty Mutual $53 $137

Nationwide $65 $120

Progressive $63 $208

State Farm $51 $208

USAA $63 $182

Compare RatesStart Now →

It’s essential to compare rates from top insurers to ensure you’re getting the best value and coverage for your Chrysler Sebring. Factors like your driving history, location, and coverage preferences also influence the final cost. Gain deeper understanding through our article entitled “Compare Chrysler Grand Voyager Car Insurance Rates.”

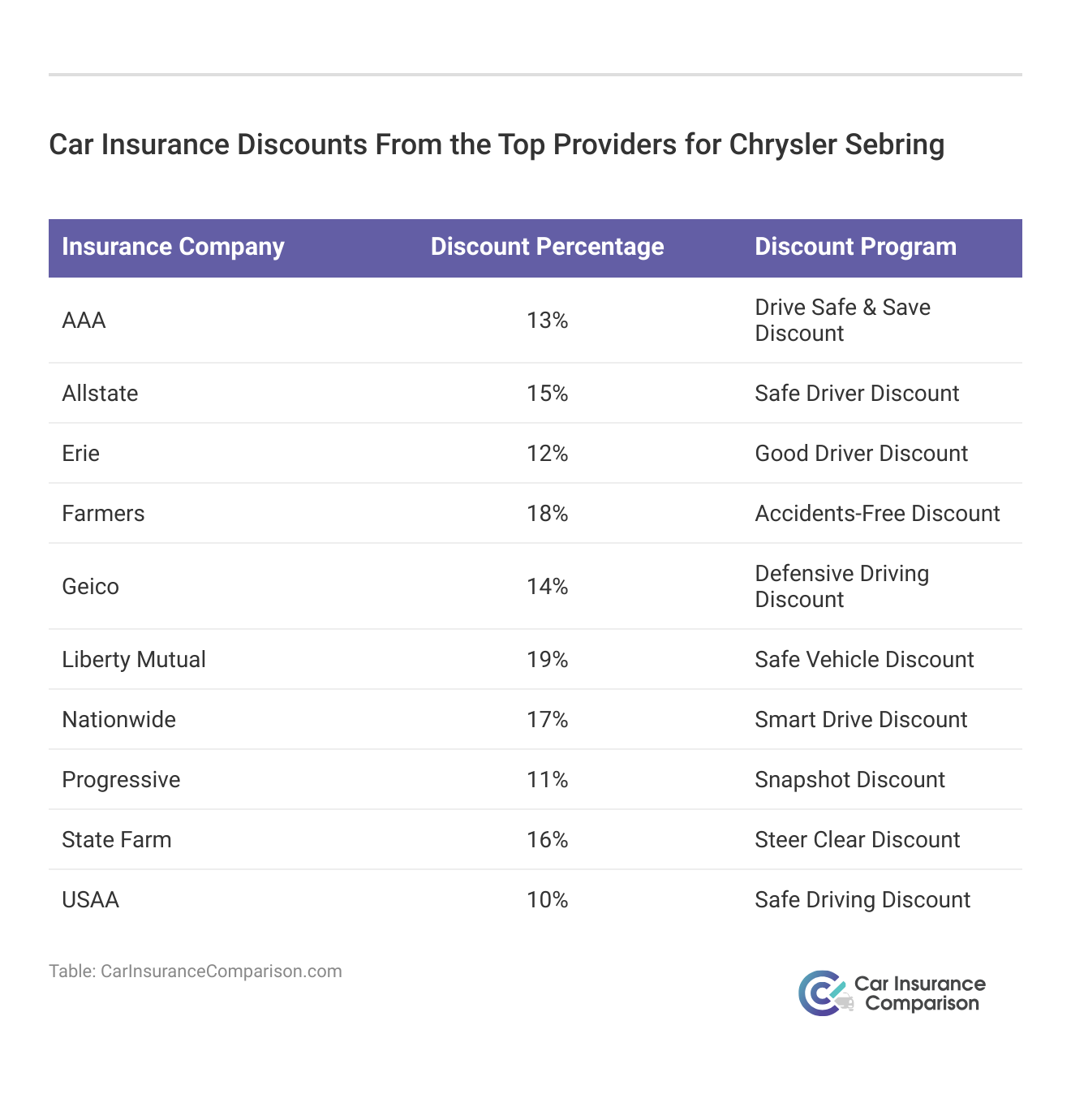

By taking advantage of these discounts, you can secure more affordable coverage without sacrificing quality. Comparing the available discounts from leading providers ensures you’re getting the most value for your insurance.

If you’re curious to know what it’s like to own one of Chrysler’s most celebrated models, the first question you have to ask yourself is, “How much would insurance cost for a Chrysler Sebring?” You don’t have time to do all the research or car insurance comparisons. We’re here to help.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Chrysler Sebring Insurance Cost

Additionally, understanding the specific discounts available from leading providers ensures you’re maximizing savings and getting the best deal for your needs. Find out more by reading our article titled “Chrysler Car Insurance.“

Understanding Chrysler Sebring Insurance: Key Factors Impacting Your Premiums

Age of the Vehicle

Driver Age

Driver Location

Your Driving Record

Chrysler Sebring Safety Ratings

There are several ways you can save even more on your Chrysler Sebring car insurance rates. Take a look at the following five tips:

- Inquire about Chrysler Sebring discounts if you were previously listed on someone else’s policy.

- Avoid assuming your Chrysler Sebring is cheaper to insure than other vehicles.

- Don’t automatically choose the cheapest Chrysler Sebring insurance policy.

- Consider paying your Chrysler Sebring insurance premium upfront.

- Relocate to an area with more favorable weather conditions.

Implementing these strategies can help you secure the most competitive rates for your Chrysler Sebring. Discover more by delving into our article entitled “Cheap Car Insurance for Minivans.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Safety features of the Chrysler Sebring

The type of seats in your vehicle, something that many people might consider minor, can significantly influence its safety rating. Additionally, the number of doors plays a crucial role in safety evaluations.

For instance, two-door Sebrings receive a much lower safety rating compared to their four-door counterparts, even if both models share some additional safety features.

While the Chrysler Sebring convertible generally boasts good safety ratings, it is more vulnerable to side-impact crashes, which are inherently more dangerous in any convertible vehicle. Uncover additional insights in our article called “What to Do if Your Car Keys Are Stolen.”

Compare RatesStart Now →

Theft Rates of the Chrysler Sebring

Automakers like Chrysler have come a long way when it comes to incorporating anti-theft technology with their newest vehicles. However, the last new Sebring model was made in 2010, and older models tend to be an easier target for car thieves.

AAA stands out as the top choice for Chrysler Sebring car insurance, offering unmatched value and competitive monthly rates.

Kristine Lee Licensed Insurance Agent

The National Highway Traffic Safety Administration (NHTSA) reported that 250 out of 43,115 total Chrysler Sebring models were stolen for the 2006 model year. While that may seem high, the Chrysler Sebring has never made the National Insurance Crime Bureau’s list of most commonly stolen models.

Find out more by reading our “15 States with the Highest Vehicle Theft Rates.”

Theft Rates Impact Chrysler Sebring Insurance Costs

The theft rate of the Chrysler Sebring will be taken into consideration by insurance providers before they give you a quote. But another factor they will consider is your home address.

Insurance companies take your address into consideration because if you live in a low crime area, like the suburbs or a gated community, your car is less likely to be stolen. You’ll likely be issued a lower insurance rate as a result.

The opposite is true for high crime areas. For example, if you drive a 2006 Chrysler Sebring and live in an urban area that’s a hotbed for vehicle theft, you can expect to pay a higher comprehensive insurance rate.

If you’re unsure about the volume of vehicle theft in your community, you can review the U.S. Department of Justice’s motor vehicle theft report. Reading through this document will help you better understand how comprehensive insurance rates are determined based on where you live.

Explore further details in our “Cheap 4×4 Pickup Truck Insurance.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Claim Frequency on the Chrysler Sebring Affects Insurance Rates

Car insurance rates are determined by a number of factors. One of these is how often claims are made on the type of vehicle you drive. The Insurance Information Institute (III) has broken down how the frequency of claims filed on each vehicle class impacts car insurance rates.

As a midsize convertible or sedan, the Chrysler Sebring is part of the “passenger cars and minivans” category. Take a look at the following table to see the claim frequency and losses for this class as it compares to the average for all vehicle types.

The Chrysler Sebring has a claim frequency of 8.4 per 100 insured vehicle years. The average claim frequency for all vehicles is 7.3 for every year of insurance coverage. That means minimum liability rates are slightly higher than average for the Sebring.

Dive deeper into our “What is the difference between car make vs. model?” for a comprehensive understanding.

Chrysler Sebring Finance and Insurance Cost

Bodily Injury Car Insurance Losses for Midsize Four-Door Sedans

The following table shows the loss percentages for each model that belongs to the same class as the Chrysler Sebring. Knowing these figures will give you an understanding of how this car stacks up to similar cars from other brands.

Bodily Injury Car Insurance Losses for Midsize Four-Door Sedans (2008–2010)

| Vehicle | Bodily Injury Loss Percentage |

|---|---|

| Acura TSX | -29% |

| Volkswagen Passat CC | -14% |

| Volkswagen Passat | -12% |

| Honda Accord | -11% |

| Toyota Camry Hybrid | -10% |

| Nissan Altima Hybrid | -8% |

| Mercury Milan | -6% |

| Mazda 6 | -2% |

| Nissan Maxima | -2% |

| Nissan Altima | 0% |

| Saturn Aura | 2% |

| Toyota Camry | 2% |

| Chevrolet Malibu | 5% |

| Ford Fusion | 6% |

| Volkswagen Jetta | 8% |

| Hyundai Sonata | 14% |

| Kia Optima | 41% |

| Chrysler Sebring | 51% |

| Mitsubishi Galant | 54% |

| Dodge Avenger | 59% |

Compare RatesStart Now →

Using 0 percent as the median, each model that shows a negative loss percentage is considered to be favorable for the driver. Cars that show a positive loss percentage have a bodily injury liability rate that is unfavorable for the driver.

Access supplementary details in our “Cheap Car Insurance for High-Performance Vehicles.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Property Damage Car Insurance Losses for Midsize Four-Door Sedans

With a property damage loss percentage of 16 percent, the Chrysler Sebring is considered to be average for this class. So if you plan to get this policy as part of your car insurance, you can expect that your rate will be fair.

Midsize 4-Door Sedan (2008-2010) Property Damage Loss Percentages

| Vehicle | Property Damage Loss Percentage |

|---|---|

| Subaru Legacy 4WD | -48% |

| Acura TSX | -27% |

| Ford Fusion 4WD | -27% |

| Volkswagen Passat CC | -27% |

| Nissan Maxima | -24% |

| Chevrolet Malibu Hybrid | -22% |

| Honda Accord | -21% |

| Chevrolet Malibu | -17% |

| Ford Fusion Hybrid 4dr | -16% |

| Ford Fusion | -15% |

| Mercury Milan | -14% |

| Mercury Milan 4WD | -13% |

| Volkswagen Passat | -13% |

| Nissan Altima | -11% |

| Nissan Altima Hybrid | -11% |

| Mazda 6 | -8% |

| Toyota Camry Hybrid | -7% |

| Hyundai Sonata | -5% |

| Saturn Aura | -3% |

| Volkswagen Jetta | -2% |

| Volvo S40 | -2% |

| Toyota Camry | -1% |

| Kia Optima | 15% |

| Chrysler Sebring | 16% |

| Mitsubishi Galant | 17% |

| Dodge Avenger | 35% |

Compare RatesStart Now →

Collision Car Insurance Losses for Midsize Four-Door Sedans

We can understand how affordable collision coverage is for the Chrysler Sebring by comparing loss percentages to similar models. The following table will list the loss percentages for each midsize car to give us the full picture.

Midsize 4-Door Sedan (2008-2010) Collision Loss Percentages

| Vehicle | Collision Loss Percentage |

|---|---|

| Subaru Legacy 4WD | -25% |

| Chevrolet Malibu Hybrid | -20% |

| Saturn Aura | -20% |

| Honda Accord | -18% |

| Mercury Milan Hybrid 4dr | -16% |

| Mazda 6 | -14% |

| Chrysler Sebring | -7% |

| Chevrolet Malibu | -6% |

| Ford Fusion | -2% |

| Ford Fusion 4WD | -2% |

| Volkswagen Passat | 1% |

| Mercury Milan | 2% |

| Hyundai Sonata | 3% |

| Mercury Milan 4WD | 7% |

| Volkswagen Jetta | 8% |

| Nissan Altima | 9% |

| Toyota Camry Hybrid | 9% |

| Volkswagen Passat CC 4WD | 9% |

| Nissan Altima Hybrid | 10% |

| Volvo S40 | 10% |

| Acura TSX | 11% |

| Dodge Avenger | 11% |

| Toyota Camry | 13% |

| Volkswagen Passat CC | 16% |

| Kia Optima | 18% |

| Mitsubishi Galant | 18% |

| Ford Fusion Hybrid 4dr | 21% |

| Nissan Maxima | 28% |

Compare RatesStart Now →

At -7 percent, the collision loss percentage for the Chrysler Sebring is slightly better than the average. Comparatively, the Subaru Legacy has the best loss percentage in the class at -25 percent. Gain a deeper understanding through our “Car Insurance Tier System: Explained Simply.”

Comprehensive Car Insurance Losses for Midsize Four-Door Sedans

If you’re curious to know how these rates stack up against vehicles that are similar to the Chrysler Sebring, the following table shows a breakdown of the loss percentages for each car in this class.

Midsize 4-Door Sedan (2008-2010) Comprehensive Loss Percentages

| Vehicle | Comprehensive Loss Percentage |

|---|---|

| Mercury Milan 4WD | -23% |

| Saturn Aura | -23% |

| Mercury Milan | -19% |

| Hyundai Sonata | -18% |

| Chrysler Sebring | -16% |

| Honda Accord | -14% |

| Volkswagen Jetta | -11% |

| Ford Fusion | -9% |

| Toyota Camry | -9% |

| Mazda 6 | -8% |

| Ford Fusion 4WD | -7% |

| Mitsubishi Galant | -5% |

| Nissan Altima | -3% |

| Chevrolet Malibu | -2% |

| Kia Optima | -2% |

| Nissan Altima Hybrid | -2% |

| Toyota Camry Hybrid | -1% |

| Dodge Avenger | 0% |

| Volkswagen Passat | 1% |

| Volkswagen Passat CC | 1% |

| Volvo S40 | 4% |

| Subaru Legacy 4WD | 5% |

| Ford Fusion Hybrid 4dr | 13% |

| Acura TSX | 16% |

| Volkswagen Passat CC 4WD | 17% |

| Nissan Maxima | 64% |

Compare RatesStart Now →

With a loss percentage of -16 percent, the Chrysler Sebring has a loss percentage that is considered favorable for its class. Look at our “Cheap Car Insurance for Supercars” for expanded insights.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Impact of Repair Costs on Collision and Comprehensive Car Insurance Rates

By now, you should know that you must carry the minimum amount of car insurance that the law requires in order to legally drive your Chrysler Sebring. But sometimes the minimum is simply not enough, especially if you get involved in a major accident.

As we touched on earlier, collision will pay for the cost of repairs on your vehicle after it gets damaged from colliding with another vehicle or object. Comprehensive coverage provides even more protection by paying for damages to your vehicle that are outside of your control, such as an object falling onto your car.

In these cases, it’s beneficial to have a policy with collision or comprehensive coverage (or both).

Your insurance provider will be aware of how much repairs cost on your Chrysler Sebring. They will then foot the bill on any repairs as long as they’re covered under your policy. Rate increases will only happen at the discretion of your provider.

Dive into the details with our article entitled “Best Car Insurance for Sports Cars.”

Other Car Insurance Coverage Rates for the Chrysler Sebring

When you purchase a new car, it’s important to figure in the monthly cost of your insurance to see if you can afford the vehicle you’re planning to buy. This is called the cost of ownership.

When you determine the cost of ownership, you have to figure in:

- Your insurance rates

- Financing

- State property taxes

- Fuel costs

- Repairs

The Safety Comparison of the Chrysler Sebring to Other Vehicles in the Same Size and Class

The Chrysler Sebring scored very well in the safety tests administered by the IIHS, but if you’re thinking of buying one, you might be curious to know if other models in the same class are equally as safe. The fatality rate for drivers who own a midsize car is 41 per million registered vehicles.

That is slightly higher than the average of 37 deaths per million for all registered vehicles. Since the fatality rate for midsize cars is above average, we can reasonably conclude that there are several vehicles similar to the Sebring that aren’t as safe.

Take a look at this crash test video of a Sebring.

Though the Chrysler Sebring has positive crash test scores, that doesn’t mean the car is invincible. Certain parts of the car are more vulnerable than others. Delve into the specifics in our article called “Car Subscription Services: A Comprehensive Guide.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Effect of the Chrysler Sebring’s Safety Ratings on Med Pay Car Insurance Rates

Medical Payment (Med Pay) insurance is reserved for covering expenses like medical bills for you and any passengers in your vehicle that were incurred as a result of an accident. The following table shows how the safety ratings of the Chrysler Sebring translate to Med Pay loss percentages in comparison to all other midsize cars.

Midsize 4-Door Sedan (2008-2010) Med Pay Loss Percentages

| Vehicle | Med Pay Loss Percentage |

|---|---|

| Volkswagen Passat | -11% |

| Acura TSX | -7% |

| Toyota Camry Hybrid | -7% |

| Volkswagen Passat CC | -3% |

| Honda Accord | -1% |

| Mazda 6 | 2% |

| Volkswagen Jetta | 3% |

| Saturn Aura | 7% |

| Nissan Maxima | 8% |

| Mercury Milan | 11% |

| Chevrolet Malibu | 12% |

| Ford Fusion | 25% |

| Hyundai Sonata | 30% |

| Toyota Camry | 32% |

| Nissan Altima | 35% |

| Chrysler Sebring | 46% |

| Kia Optima | 65% |

| Mitsubishi Galant | 66% |

| Dodge Avenger | 70% |

Compare RatesStart Now →

At 46 percent, the Med Pay loss percentage for the Chrysler Sebring is above average for this size and class. Uncover more by delving into our article entitled “Best Car Insurance Companies That Don’t Report to the DMV.”

History of the Chrysler Sebring

The Chrysler Sebring was manufactured from 1995-2010. As a midsize car, the Sebring was made available as both a two-door convertible and a four-door sedan. With two contrasting body styles, drivers are given the option to decide between the sporty look of the coupe or the more conservative look of the sedan.

The following walk-around video from Woody’s Automotive Group is going to explore the latter so you can see what the 2010 model has to offer. Even though 2010 was the last model year for the Sebring, the car lives on in a new form.

Today, the Chrysler 200 is a rebadged version of the Sebring. In short, that means that the 200 has the same platform and body shell as the Sebring. Get a better grasp by checking out our article titled “Top 10 Most Popular Cars.”

Frequently Asked Questions

What factors influence Chrysler Sebring’s car insurance rates?

Factors include the model year, trim level, driving history, and location. Get the full story by checking out our “How Car Insurance Companies Determine Salvage Value.”

Is comprehensive coverage recommended for a Chrysler Sebring?

Comprehensive coverage is recommended to protect against non-collision-related damage like theft or weather events.

How does the model year of my Chrysler Sebring affect insurance costs?

Newer models typically have higher insurance costs due to their higher value and repair costs. Find cheap car insurance quotes by entering your ZIP code.

Are there discounts available for Chrysler Sebring owners?

Yes, discounts may be available for safe driving, multiple policies, or vehicle safety features. Elevate your knowledge with our “What vehicles are exempt from car insurance requirements?“

What is collision coverage, and is it necessary for a Chrysler Sebring?

Collision coverage pays for repairs after a collision. It is optional but beneficial for protecting your vehicle.

How can I reduce my Chrysler Sebring insurance premiums?

Consider raising your deductible, taking advantage of discounts, or maintaining a clean driving record.

Do insurance rates differ between the Chrysler Sebring’s trim levels?

Yes, different trim levels can affect insurance rates due to varying repair costs and safety features. Learn more about our “Top 10 Deadliest Vehicles in History” for a broader perspective.

Is it worth getting higher coverage limits for my Chrysler Sebring?

Higher coverage limits offer more protection but may come with higher premiums. Assess your needs and budget.

How does the Chrysler Sebring’s safety rating affect insurance costs?

Higher safety ratings can lead to lower insurance premiums due to reduced risk of injury and damage. By entering your ZIP code, you can get instant car insurance quotes from top providers.

What should I do if my Chrysler Sebring is totaled?

Contact your insurance provider to file a claim and follow their instructions for the next steps. Gain deeper insights by exploring our “10 Best Usage-Based Car Insurance Companies.”

Does the location where I live impact my Chrysler Sebring insurance rates?

Yes, insurance rates can vary based on your location due to factors like crime rates and local traffic conditions.

Can I get insurance for a Chrysler Sebring if it has a salvage title?

Yes, but you may face higher premiums and limited coverage options.

How often should I review my Chrysler Sebring’s insurance policy?

It’s a good idea to review your policy annually or after major life changes, like moving or getting a new vehicle. Expand your understanding with our “Cheap Car Insurance for Convertibles.”

What types of coverage are available for a Chrysler Sebring?

Coverage options include liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments.

Are there any common misconceptions about insuring a Chrysler Sebring?

Common misconceptions include that older models are always cheaper to insure or that higher trims are always more expensive.

How can I determine if I’m getting a good deal on my Chrysler Sebring insurance?

Compare quotes from multiple insurers and review coverage limits and discounts to ensure you’re getting a good deal. Discover a wealth of knowledge in our “Cheap Car Insurance for Occasional Drivers.”

Does having a good driving record affect my Chrysler Sebring insurance rates?

Yes, a clean driving record typically leads to lower insurance premiums.

What should I do if I need to claim my Chrysler Sebring insurance?

Report the claim to your insurer as soon as possible and provide all necessary documentation and details. Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

Can adding a Chrysler Sebring to a multi-car policy save money?

Yes, bundling multiple vehicles on one policy often results in discounts. Uncover more about our “Best Car Insurance for 16-Year-Olds” by reading further.

How do insurance rates for a Chrysler Sebring compare to other vehicles?

Insurance rates for the Chrysler Sebring can vary based on its model year, trim, and other factors, so it’s helpful to compare it with similar vehicles.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.