Best Chevrolet Tahoe Car Insurance in 2025 (Find the Top 10 Companies Here)

State Farm, Geico, and Progressive offer the best Chevrolet Tahoe car insurance. With rates starting at $140/month, State Farm provides 24/7 roadside assistance. Geico is known for affordability, and while Progressive offers flexible coverage options. These options deliver great value for Chevrolet Tahoe owners.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Sep 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Sep 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Chevrolet Tahoe

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Chevrolet Tahoe

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Chevrolet Tahoe

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, Geico, and Progressive are the top choices for the best Chevrolet Tahoe car insurance, each offering distinct advantages. State Farm excels with its broad range of coverage options and exceptional customer support, including 24/7 roadside assistance.

Geico stands out for its competitive pricing and efficient service, while Progressive is known for its customizable coverage plans and flexible options.

Our Top 10 Company Picks: Best Chevrolet Tahoe Car Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | B | Broad Network | State Farm | |

| #2 | 25% | A++ | Flexible Coverage | Geico | |

| #3 | 12% | A+ | Competitive Rates | Progressive | |

| #4 | 10% | A++ | Military Benefits | USAA | |

| #5 | 25% | A+ | Extensive Discounts | Allstate | |

| #6 | 25% | A | Customizable Policies | Liberty Mutual |

| #7 | 8% | A++ | Strong Service | Travelers | |

| #8 | 20% | A | Reliable Coverage | American Family | |

| #9 | 10% | A+ | Affordable Rates | Erie |

| #10 | 20% | A | Comprehensive Options | Farmers |

Together, these companies offer the most comprehensive protection and value for Chevrolet Tahoe owners, catering to various needs and preferences. For a thorough understanding, refer to our detailed analysis titled “Compare Car Insurance by Coverage Type.”

Ready to shop around for the best car insurance company? Enter your ZIP code above and see which one offers the coverage you need.

- State Farm provides the best Chevrolet Tahoe car insurance at competitive rates

- Geico and Progressive offer competitive pricing and versatile options

- Chevrolet Tahoe drivers benefit from strong protection and budget-friendly rates

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

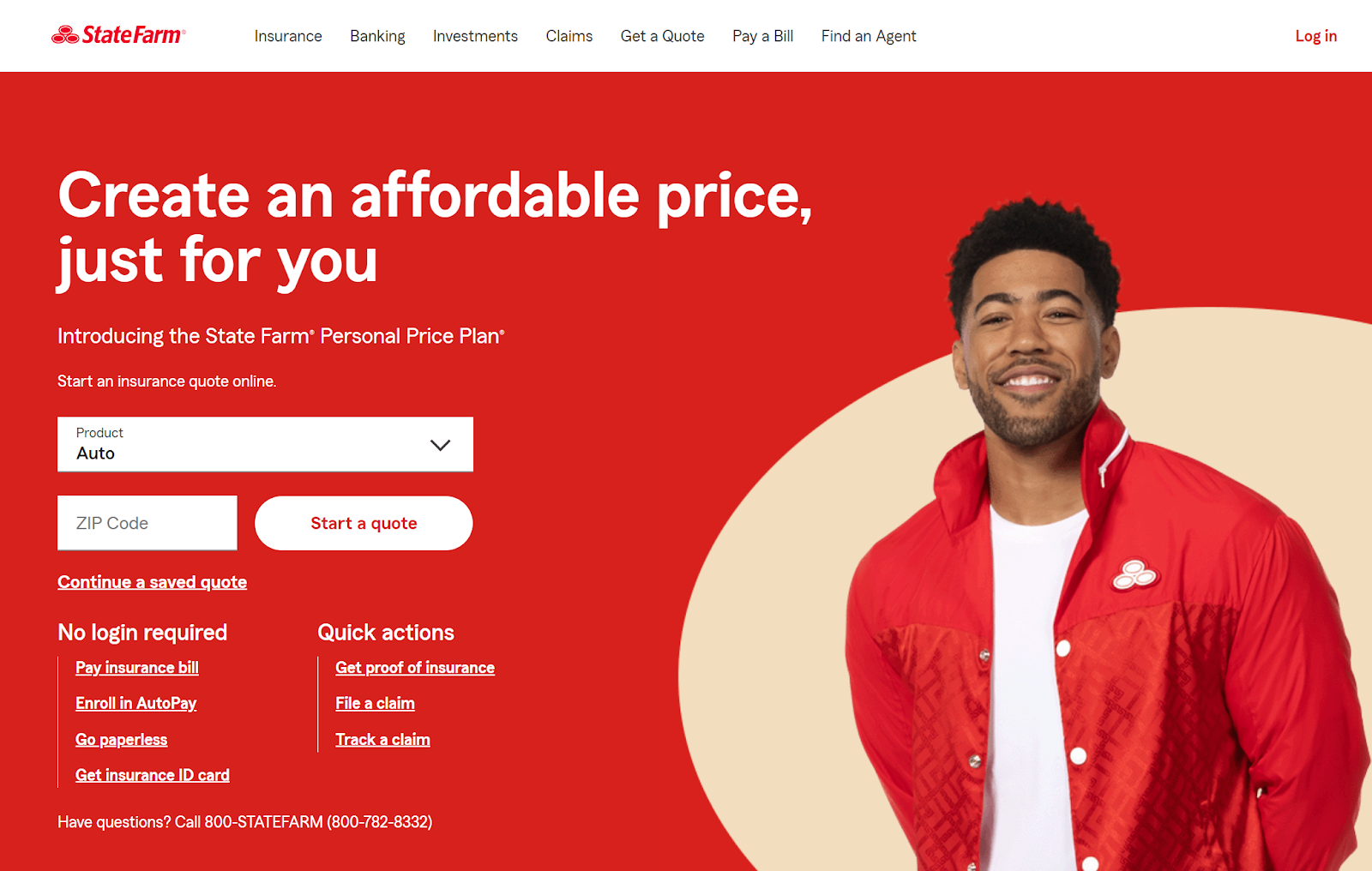

#1 – State Farm: Top Overall Pick

Pros

- Tailored Tahoe Coverage: State Farm offers specific coverage options for the Chevrolet Tahoe, including robust collision and comprehensive policies designed for the vehicle’s size and usage.

- Local Agent Expertise: Their network of local agents provides specialized advice and personalized service for Chevrolet Tahoe insurance, helping to tailor policies to the vehicle’s unique needs.

- Multi-Vehicle Discounts: According to our State Farm car insurance review, households with multiple Chevrolet Tahoes can benefit from significant savings, reducing overall insurance costs for Tahoe owners.

Cons

- Higher Premiums for Certain Drivers: State Farm may charge higher premiums for drivers with a history of claims or traffic violations, impacting cost for some Tahoe owners.

- Inconsistent Claims Processing: Some users report varying speeds in claims processing, which can affect how quickly Tahoe-related claims are handled.

#2 – Geico: Best for Flexible Coverage

Pros

- Competitive Tahoe Rates: Based on our Geico car insurance review, Geico provides affordable insurance rates specifically for Chevrolet Tahoe owners, helping to manage costs effectively.

- Efficient Online Tools: Their user-friendly app and website streamline managing Tahoe insurance policies and filing claims, enhancing convenience for Tahoe drivers.

- Relevant Discounts: Geico offers discounts relevant to Tahoe owners, including those for safe driving and anti-theft features, which can lower overall insurance costs.

Cons

- Limited Comprehensive Options: The coverage options may be more basic compared to other insurers, potentially missing out on specialized protections for the Tahoe.

- Less Personalized Service: While efficient, Geico’s customer service may lack the personal touch some Tahoe owners prefer.

#3 – Progressive: Best for Competitive Rates

Pros

- Customizable Tahoe Coverage: Progressive offers extensive policy choices that can be customized for Chevrolet Tahoe, including options for enhanced protection and additional coverage.

- Snapshot Program Savings: Their Snapshot program rewards safe driving habits with potential discounts, which can benefit Tahoe owners who practice good driving behavior.

- Advanced Online Tools: Within our Progressive car insurance review, Progressive’s online tools help compare quotes and manage policies effectively, providing a streamlined experience for Tahoe drivers.

Cons

- Variable Premiums: Premium rates can fluctuate based on individual driving history and risk factors, which might affect insurance costs for Tahoe owners unpredictably.

- Service Consistency: Customer service and claims handling can vary, potentially impacting the experience for Tahoe owners seeking consistent support.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Military Benefits

Pros

- Exceptional Claims Handling: USAA is known for excellent claims processing and support, providing reliable service for Chevrolet Tahoe owners.

- Military Discounts: In our USAA car insurance review, special discounts are available for military personnel and their families, making Tahoe insurance more affordable for eligible members.

- Tailored Coverage Options: USAA offers a range of coverage options specifically suited for the Chevrolet Tahoe, including comprehensive and collision coverage.

Cons

- Restricted Eligibility: Only available to military members and their families, excluding non-military Tahoe owners from accessing their services.

- Potentially Higher Costs: Some drivers may find USAA’s rates to be higher, especially if they have certain risk factors.

#5 – Allstate: Best for Extensive Discounts

Pros

- Comprehensive Tahoe Coverage: Allstate provides extensive coverage options that cater specifically to Chevrolet Tahoe drivers, including off-road and specialized equipment protection.

- Strong Financial Stability: With our Allstate car insurance review, you can see how Allstate ensures reliable coverage and support for Chevrolet Tahoe in case of a claim, thanks to their financial strength.

- Broad Discount Opportunities: Offers a range of discounts that can reduce insurance costs for Tahoe owners, including those for safe driving and vehicle safety features.

Cons

- Higher Premiums: Some drivers might face higher premiums compared to other insurers, which can impact affordability for Tahoe insurance.

- Limited Local Agent Availability: In some regions, there may be fewer local agents, potentially affecting the level of personalized service for Tahoe owners.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Tahoe Coverage: Liberty Mutual allows for extensive customization of insurance policies, catering to the specific needs of Chevrolet Tahoe drivers, including modifications and specialized coverage.

- Reliable Claims Support: Known for dependable claims handling, ensuring that Chevrolet Tahoe owners receive effective support when needed.

- Discount Options: Explore our Liberty Mutual car insurance review to learn about the various discounts that can lower insurance costs for Tahoe owners, including for bundling and safe driving.

Cons

- Higher Premiums: Premiums may be higher compared to some competitors, which could impact overall cost-effectiveness for Tahoe drivers.

- Limited Local Agent Presence: Fewer local agents in certain areas might affect the availability of personalized service for Tahoe insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Strong Service

Pros

- Versatile Tahoe Coverage: Discover our Travelers car insurance review to find out how Travelers offers a broad range of coverage options tailored for Chevrolet Tahoe owners, including comprehensive and collision policies.

- Discount Programs: Provides discounts for safe driving, multi-car policies, and bundling, which can help lower insurance premiums for Tahoe owners.

- User-Friendly Online Tools: Offers an easy-to-use online platform for managing policies and filing claims, enhancing the experience for Tahoe drivers.

Cons

- Higher Premiums: Rates may be higher for some drivers, particularly those with specific risk factors or requiring extensive coverage.

- Inconsistent Service: Customer service experiences can vary, which may affect the support Tahoe owners receive.

#8 – American Family: Best for Reliable Coverage

Pros

- Extensive Tahoe Coverage Options: American Family provides a wide range of coverage options specifically designed for Chevrolet Tahoe drivers, including optional add-ons for specialized needs.

- Discount Opportunities: Offers discounts for safe driving and policy bundling, which can help reduce insurance costs for Tahoe owners.

- Local Agent Support: View our American Family car insurance review to see how they provide access to local agents who can offer personalized insurance solutions for Chevrolet Tahoe drivers.

Cons

- Higher Premiums: Premiums may be higher compared to other insurers, which could impact affordability for some Tahoe drivers.

- Slower Claims Processing: Some users report slower processing times for claims, which can affect the experience for Tahoe owners.

#9 – Erie: Best for Affordable Rates

Pros

- Comprehensive Coverage Choices: Erie offers thorough coverage options tailored for Chevrolet Tahoe, including enhanced protection and optional add-ons.

- Affordable Premiums: Known for competitive rates, Erie provides a cost-effective option for Tahoe insurance, especially with available discounts.

- Responsive Customer Service: Delve into our Erie car insurance review, which highlights how Erie is highly rated for its customer service, ensuring reliable support for Chevrolet Tahoe drivers.

Cons

- Limited Availability: Erie’s services are not available in all states, which may limit options for some Chevrolet Tahoe owners.

- Fewer Discount Opportunities: Offers fewer discounts compared to some other major insurers, potentially affecting overall savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Comprehensive Options

Pros

- Wide Range of Tahoe Coverage Options: Farmers provides diverse coverage options that cater to the specific needs of Chevrolet Tahoe owners, including modifications and specialized protections.

- Discount Programs: See our Farmers car insurance review for details on how Farmers offers discounts for safe driving, insuring multiple vehicles, and bundling, which can help lower insurance premiums for Tahoe drivers.

- Local Agent Network: Provides access to local agents who can offer personalized service and tailored insurance solutions for Chevrolet Tahoe owners.

Cons

- Higher Premiums: Premiums may be higher than some competitors, which could affect cost-effectiveness for some Tahoe drivers.

- Service Consistency: Some customers report inconsistent experiences with customer service and claims handling, which might impact the experience for Tahoe owners.

Chevrolet Tahoe Car Insurance Cost

When evaluating the best Chevrolet Tahoe car insurance options, it’s essential to consider both the cost and coverage provided by different insurers. The table below compares monthly rates for minimum and full coverage across several prominent insurance companies, highlighting their pricing and value propositions.

Chevrolet Tahoe Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $155 | $360 |

| American Family | $140 | $340 |

| Erie | $135 | $325 |

| Farmers | $150 | $360 |

| Geico | $130 | $320 |

| Liberty Mutual | $150 | $355 |

| Progressive | $145 | $350 |

| State Farm | $140 | $340 |

| Travelers | $160 | $365 |

| USAA | $125 | $310 |

State Farm emerges as a top pick due to its extensive network of agents and excellent customer service. Progressive is recognized for its quote comparison tools, helping you find the best price. While Geico provides good value with competitive rates and a user-friendly online platform.

In assessing the best Chevrolet Tahoe car insurance costs, various elements contribute to the overall expense. The average insurance cost provides a general reference, but individual rates can fluctuate based on several key factors.

The table demonstrates that opting for higher deductibles generally leads to reduced premiums, as policyholders take on more financial responsibility in the event of a claim.

Chevrolet Tahoe Car Insurance Monthly Rates by Driver Profile

| Type | Rates |

|---|---|

| Discount Rate | $69 |

| High Deductibles | $100 |

| Average Rate | $117 |

| Low Deductibles | $147 |

| High Risk Driver | $248 |

| Teen Driver | $426 |

Insurance costs also vary for high-risk drivers, such as those with a history of accidents or driving violations, and for teen drivers, who face higher rates due to their lack of experience and higher risk.

State Farm stands out as the best provider for Chevrolet Tahoe car insurance with unbeatable coverage options.

Justin Wright Licensed Insurance Agent

These factors that affect car insurance rates insurance rate, highlighting the importance of considering your coverage choices and risk profile to manage your insurance costs effectively.

Factors Affecting Chevrolet Tahoe Car Insurance Costs

The cost of insuring a Chevrolet Tahoe is influenced by several key factors. These include your age, location, driving history, and the vehicle’s model year. Each element affects your premiums differently, shaping the overall expense of your insurance policy.

Age of the Vehicle

When evaluating the impact of vehicle age on insurance costs, it’s clear that the model year of your Chevrolet Tahoe plays a significant role. The insurance premiums for a Chevrolet Tahoe vary notably between newer and older models. To illustrate this, the following table outlines how insurance rates change with the model year of the Chevrolet Tahoe.

Chevrolet Tahoe Car Insurance Monthly Rates by Model Year & Coverage Type

| Model Year | Liability | Comprehensive | Collision | Full Coverage |

|---|---|---|---|---|

| 2024 Chevrolet Tahoe | $29 | $32 | $48 | $122 |

| 2023 Chevrolet Tahoe | $30 | $31 | $47 | $121 |

| 2022 Chevrolet Tahoe | $31 | $30 | $46 | $119 |

| 2021 Chevrolet Tahoe | $31 | $29 | $45 | $118 |

| 2020 Chevrolet Tahoe | $31 | $28 | $44 | $117 |

| 2019 Chevrolet Tahoe | $33 | $27 | $43 | $115 |

| 2018 Chevrolet Tahoe | $33 | $26 | $42 | $114 |

| 2017 Chevrolet Tahoe | $35 | $25 | $41 | $114 |

| 2016 Chevrolet Tahoe | $36 | $24 | $40 | $112 |

| 2015 Chevrolet Tahoe | $37 | $23 | $38 | $111 |

| 2014 Chevrolet Tahoe | $38 | $22 | $35 | $108 |

| 2013 Chevrolet Tahoe | $38 | $21 | $33 | $105 |

| 2012 Chevrolet Tahoe | $38 | $20 | $30 | $101 |

| 2011 Chevrolet Tahoe | $38 | $19 | $28 | $98 |

| 2010 Chevrolet Tahoe | $39 | $18 | $26 | $96 |

As vehicles age, insurance premiums typically decrease. Newer models have higher rates due to higher repair and replacement costs and advanced technology. Older models have lower premiums because of their reduced market value and lower repair expenses, and may lack the latest safety features, further lowering costs.

The age of your Chevrolet Tahoe is a key factor in determining your insurance premiums this can help you better manage your insurance expenses and choose coverage that fits your vehicle’s age and value. For additional details, explore our comprehensive resource titled “Car Insurance Market Value: Explained Simply”

Driver Age

When seeking the best Chevrolet Tahoe car insurance, driver age is a key factor that can influence your premiums. Understanding how age impacts insurance rates is essential for finding the most cost-effective coverage. The following table illustrates how insurance rates vary by driver age.

Chevrolet Tahoe Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $426 |

| Age: 18 | $370 |

| Age: 20 | $264 |

| Age: 30 | $122 |

| Age: 40 | $117 |

| Age: 45 | $112 |

| Age: 50 | $106 |

| Age: 60 | $104 |

For instance, teenagers and drivers in their early twenties often face significantly higher premiums due to their higher likelihood of being involved in accidents. In contrast, drivers in their forties or fifties generally benefit from lower rates, as their experience and mature driving habits reduce their risk profile.

By considering these age-related factors, you can better navigate your options and select the best Chevrolet Tahoe car insurance to suit your needs and budget. To delve deeper, refer to our in-depth report titled “Compare Teen Driver Car Insurance Rates in 2024.”

Driver Location

When selecting the best Chevrolet Tahoe car insurance, your location plays a key role in determining your premiums. Insurance costs can vary significantly from one city to another. The following table shows how insurance rates for a Chevrolet Tahoe differ across various U.S. cities.

Chevrolet Tahoe Car Insurance Monthly Rates by City

| State | Rates |

|---|---|

| Los Angeles, CA | $199 |

| New York, NY | $184 |

| Houston, TX | $183 |

| Jacksonville, FL | $169 |

| Philadelphia, PA | $156 |

| Chicago, IL | $154 |

| Phoenix, AZ | $135 |

| Seattle, WA | $113 |

| Indianapolis, IN | $99 |

| Columbus, OH | $97 |

For instance, drivers in Los Angeles often encounter higher premiums due to the city’s high traffic congestion and elevated theft rates. Conversely, cities like Indianapolis and Columbus typically offer more affordable insurance due to lower traffic and reduced crime rates.

Recognizing these regional variations can help you secure the best Chevrolet Tahoe car insurance. By comparing car insurance rates by state, you can see how providers like State Farm and Geico adjust their rates based on local risks and offer discounts that reflect these factors, allowing you to find more competitive and suitable coverage for your location.

Your Driving Record

As you determine the best Chevrolet Tahoe car insurance, your driving record has a major impact on the cost of your coverage. Insurance providers assess your driving history to gauge the level of risk you represent. The following table illustrates how different aspects of your driving history can impact insurance costs:

Chevrolet Tahoe Car Insurance Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $426 | $495 | $520 | $570 |

| Age: 18 | $370 | $432 | $455 | $510 |

| Age: 20 | $264 | $287 | $310 | $340 |

| Age: 30 | $122 | $132 | $154 | $180 |

| Age: 40 | $117 | $127 | $150 | $170 |

| Age: 45 | $112 | $122 | $145 | $165 |

| Age: 50 | $106 | $116 | $140 | $160 |

| Age: 60 | $104 | $113 | $137 | $155 |

For example, drivers with multiple speeding tickets or a history of accidents typically face higher premiums due to their increased risk. Conversely, those with a clean driving record often benefit from lower rates.

Insurance providers like Progressive and Allstate may offer discounts for maintaining a clean record, helping to reduce overall costs. By focusing on safe driving practices, you can secure more affordable coverage for your Chevrolet Tahoe. For a comprehensive analysis, refer to our detailed guide titled “Do all car insurance companies check your driving records?”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Cost-Effective Chevrolet Tahoe Coverage

Analyzing the best Chevrolet Tahoe car insurance involves assessing how its insurance costs compare to those of other SUVs. Understanding how the Tahoe measures up against similar vehicles helps determine whether its premiums are competitive or higher than average.

The table below provides a comparison of insurance rates for the Chevrolet Tahoe and several similar models.

Chevrolet Tahoe Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Liability | Comprehensive | Collision | Full Coverage |

|---|---|---|---|---|

| BMW X5 | $31 | $37 | $63 | $144 |

| Chevrolet Tahoe | $31 | $28 | $44 | $117 |

| Honda Passport | $26 | $30 | $55 | $123 |

| Infiniti QX60 | $31 | $34 | $63 | $140 |

| Nissan Pathfinder | $33 | $25 | $38 | $108 |

| Toyota 4Runner | $28 | $28 | $43 | $109 |

| Volvo XC90 | $33 | $29 | $50 | $125 |

However, there are a few things you can do to find the cheapest Chevrolet insurance rates online.

Read more:

The Chevrolet Tahoe has insurance costs that are competitive with other popular SUVs. For example, its total insurance cost is comparable to the Nissan Pathfinder and slightly higher than the Toyota 4Runner. However, it is less expensive to insure than models like the Honda Passport, Infiniti QX60, and BMW X5.

Companies like State Farm and Geico offer lower premiums based on your driving record and other factors, helping you find the best Chevrolet Tahoe car insurance.

They provide benefits such as multi-policy discounts, safe driver car insurance discounts, accident forgiveness, and usage-based insurance. Exploring these options and comparing quotes can help you find the most cost-effective coverage for your Chevrolet Tahoe.

Optimizing Savings on Chevrolet Tahoe Insurance

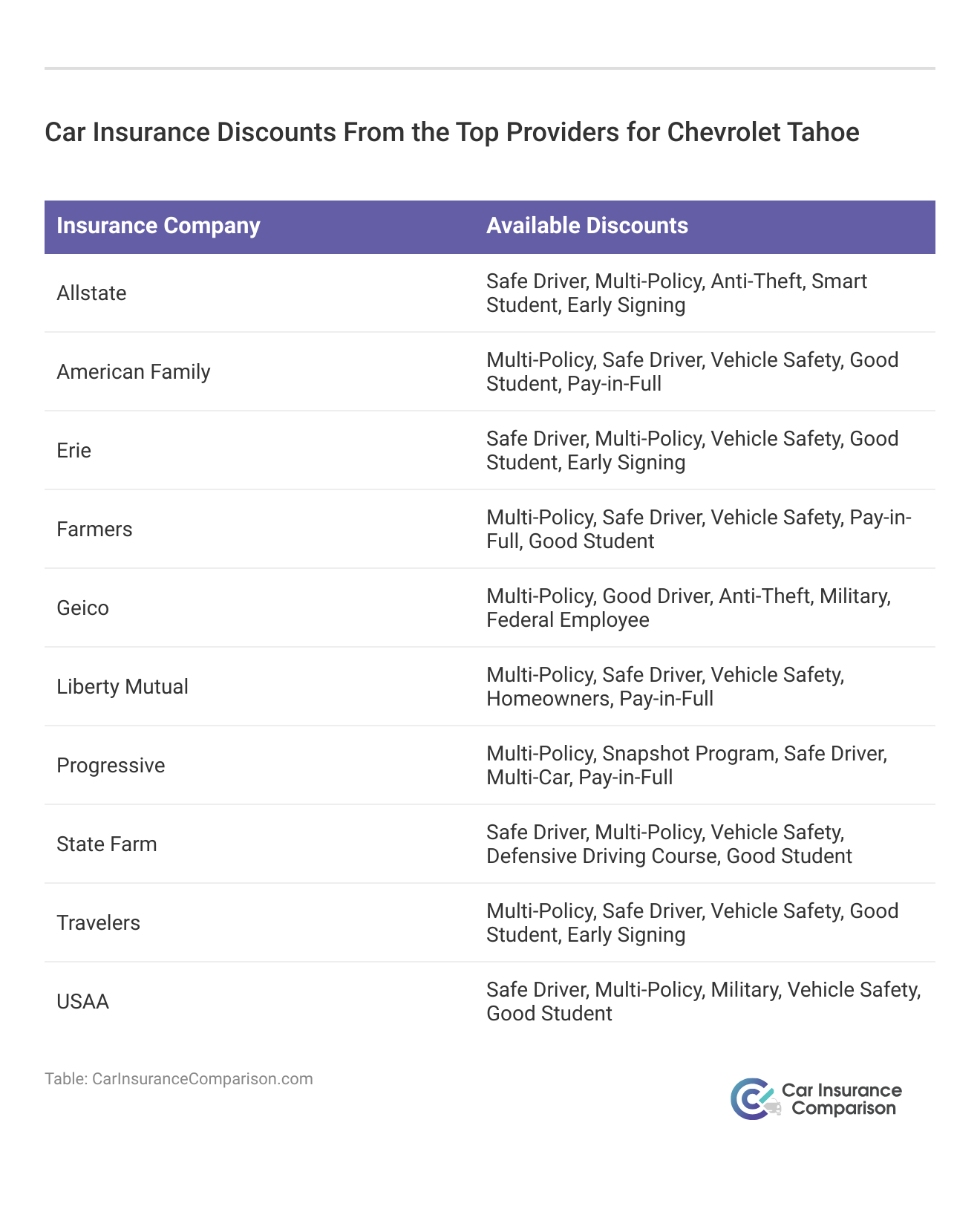

Searching for the best Chevrolet Tahoe car insurance involves more than just comparing rates; it’s also about maximizing available discounts. By leveraging discounts from top providers, you can significantly lower your premiums and find cost-effective coverage that meets your needs.

The table below highlights some of the key discounts offered by leading insurance companies for Chevrolet Tahoe owners.

State Farm offers discounts like Safe Driver, Multi-Policy, Vehicle Safety, Defensive Driving Course, and Good Student, benefiting those with a clean record or multiple policies. Geico provides Multi-Policy, Good Driver, Anti-Theft, and discounts for military and federal employees.

Progressive and Allstate also offer Multi-Policy and Safe Driver discounts, with Progressive’s Snapshot Program rewarding safe driving. To get the best Chevrolet Tahoe car insurance at a lower cost, consider these top five ways to secure a discount:

- Maintain a Clean Driving Record: Qualify for Safe Driver discounts with providers like State Farm and Geico.

- Bundle Policies: Save with Multi-Policy discounts by combining your Tahoe insurance with other coverage, such as home or renters insurance.

- Install Anti-Theft Devices: Earn anti-theft car insurance discounts by adding security features to your Tahoe, available through insurers like Geico and Allstate.

- Pay in Full: Reduce your premium by paying the entire annual amount upfront, an option offered by companies like Progressive and Liberty Mutual.

Maximizing these discounts can make a significant difference in reducing your Chevrolet Tahoe insurance costs. By choosing the right provider and taking advantage of available savings, you can secure comprehensive coverage at the best possible rate.

Chevrolet Tahoe Crash Test and Safety Features

Crash test ratings can greatly influence the cost of the best Chevrolet Tahoe car insurance. The Chevrolet Tahoe has consistently earned favorable ratings, with recent models achieving high marks for side impact protection. Vehicles that perform well in crash tests are often seen as less risky by insurance providers, leading to potentially lower premiums.

For example, the 2020 Chevrolet Tahoe received a 4-star overall rating and 5 stars for side impacts in both RWD and 4WD configurations. The following table provides detailed crash test ratings for various Chevrolet Tahoe models.

Chevrolet Tahoe Crash Test Ratings by Model Year

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Chevrolet Tahoe SUV RWD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2024 Chevrolet Tahoe SUV 4WD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2023 Chevrolet Tahoe SUV RWD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2023 Chevrolet Tahoe SUV 4WD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2022 Chevrolet Tahoe SUV RWD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2022 Chevrolet Tahoe SUV 4WD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2021 Chevrolet Tahoe SUV RWD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2021 Chevrolet Tahoe SUV 4WD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2020 Chevrolet Tahoe SUV RWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2020 Chevrolet Tahoe SUV 4WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2019 Chevrolet Tahoe SUV RWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2019 Chevrolet Tahoe SUV 4WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2018 Chevrolet Tahoe SUV RWD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2018 Chevrolet Tahoe SUV 4WD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2017 Chevrolet Tahoe SUV RWD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2017 Chevrolet Tahoe SUV 4WD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2016 Chevrolet Tahoe SUV RWD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2016 Chevrolet Tahoe SUV 4WD | 4 stars | 5 stars | 5 stars | 3 stars |

These strong safety ratings can positively impact your insurance costs, as insurers may offer better rates for vehicles that demonstrate enhanced protection in crashes. Insurance providers like State Farm, Geico, and Progressive may consider these ratings when setting premiums, potentially offering discounts for the Tahoe’s advanced safety features.

The safety features of the Chevrolet Tahoe significantly influence the best Chevrolet Tahoe car insurance rates. Comprehensive safety technologies not only enhance driver and passenger protection but also affect insurance premiums.

For the best Chevrolet Tahoe car insurance, State Farm is the top pick with comprehensive coverage and reliable service

Brad Larson Licensed Insurance Agent

The Tahoe is equipped with an array of advanced safety features, including multiple airbags, 4-wheel ABS, electronic stability control, and lane departure warning, which contribute to its strong crash test ratings.

Opting for a Chevrolet Tahoe with high crash test ratings and advanced safety features not only enhances your driving safety but also helps you secure the best Chevrolet Tahoe car insurance at lower premiums. To gain profound insights, consult our extensive guide titled “Passive Restraint Car Insurance Discounts“

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Loss Probability of Chevrolet Tahoe Car Insurance

The Chevrolet Tahoe’s insurance loss probability can significantly affect your quest for the best Chevrolet Tahoe car insurance. This metric reflects the likelihood of filing car insurance claim investigation across various coverage types, impacting your premium rates.

Lower loss probabilities generally correlate with reduced insurance costs. The following table illustrates the Chevrolet Tahoe’s insurance loss probabilities across various coverage categories:

Chevrolet Tahoe car Insurance Loss Probability by Coverage Type

| Coverage | Rates |

|---|---|

| Collision | -18% |

| Property Damage | -10% |

| Comprehensive | 5% |

| Personal Injury | -30% |

| Medical Payment | -37% |

| Bodily Injury | -12% |

For example, the Tahoe’s lower loss probabilities in Personal Injury and Medical Payments suggest fewer claims in these areas, potentially leading to lower insurance premiums. Conversely, higher loss probabilities in Comprehensive and Collision coverage may result in increased insurance costs.

Providers such as State Farm, Geico, and Progressive use these loss probability figures to assess risk and set premiums. By choosing a Tahoe model with lower loss probabilities, you can enhance your chances of securing the best Chevrolet Tahoe car insurance at a lower rate, benefiting from reduced premium costs and comprehensive coverage.

GAP for Best Chevrolet Tahoe Car Insurance

When selecting the best Chevrolet Tahoe car insurance, it’s important to consider additional coverage options like Guaranteed Auto Protection (GAP) insurance.

GAP insurance can be especially beneficial if you’re purchasing or leasing a new Tahoe, as it helps cover the difference between your car’s loan or lease balance and the payout from your standard car insurance if the vehicle is totaled.

State Farm provides flexible GAP insurance tailored to protect your financial investment. Geico offers a cost-effective GAP option that integrates well with its standard policies. Progressive includes GAP insurance as part of its comprehensive coverage suite, offering extensive benefits for peace of mind.

Compare GAP insurance from any of these top providers ensures you have robust protection for your Chevrolet Tahoe, helping you avoid unexpected financial burdens and securing your investment.

Top Chevrolet Tahoe Insurance Companies

Choosing the best Chevrolet Tahoe car insurance requires examining options from leading insurance companies that offer tailored coverage for your vehicle.

The market is populated with several reputable companies that offer comprehensive car insurance coverage options, competitive rates, and potential discounts based on the vehicle’s safety features. The following table highlights the leading insurance companies based on their market share:

Top Chevrolet Tahoe Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 million | 9.3% |

| #2 | Geico | $46.1 million | 6.6% |

| #3 | Progressive | $39.2 million | 5.6% |

| #4 | Liberty Mutual | $35.6 million | 5.1% |

| #5 | Allstate | $35.0 million | 5.0% |

| #6 | Travelers | $28.0 million | 4.0% |

| #7 | USAA | $23.4 million | 3.3% |

| #8 | Chubb | $23.3 million | 3.3% |

| #9 | Farmers | $20.6 million | 2.9% |

| #10 | Nationwide | $18.4 million | 2.6% |

According to market share data, State Farm stands out as the leading provider with the largest share, offering extensive coverage options and potential discounts for the Tahoe’s advanced safety features.

Geico and Progressive also rank highly, providing competitive rates and additional savings opportunities through their safety feature discounts. Liberty Mutual and Allstate follow closely, with comprehensive policies that may benefit from the Tahoe’s security features.

By evaluating the leading insurers, you can secure the most suitable policy for your Chevrolet Tahoe, ensuring you get the best coverage and value for your investment.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Finding the Best Chevrolet Tahoe Car Insurance

Opting for car insurance for your Chevrolet Tahoe requires careful consideration of providers that deliver the best coverage, pricing, and customer service. State Farm, Progressive, and Geico are top options, each with their own distinct advantages.

State Farm provides a range of coverage options, competitive rates, and various discounts, including those for safe driving and multiple vehicles, along with additional benefits like rental car coverage and accident forgiveness.

State Farm delivers outstanding Chevrolet Tahoe car insurance with tailored coverage that perfectly fits your Tahoe’s needs.

Jeffrey Manola Licensed Insurance Agent

Progressive stands out with its flexible policies, tools like Progressive Name Your Price tool review and Snapshot® for rewarding safe driving, and potential discounts for multiple policies. Geico offers competitive pricing, a broad range of discounts, and an efficient claims process.

All three companies excel in customer service and claims handling, with State Farm’s local agents and repair shops, Progressive’s fast claims processing, and Geico’s accessible online support.

Ultimately, the best choice for your Chevrolet Tahoe insurance will depend on your individual requirements for coverage, cost, and customer service. Consider factors such as the types of coverage you need, your budget, and the level of support you expect from your insurer.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Frequently Asked Questions

Which category is cheapest to insure for the best Chevrolet Tahoe car insurance?

Standard liability car insurance coverage is typically the cheapest category for insuring the best Chevrolet Tahoe car insurance, compared to more extensive coverage options.

Is insurance high for the best Chevrolet Tahoe car insurance?

Insurance for a Chevrolet Tahoe can be relatively high due to its size and value. However, choosing top providers like State Farm, Progressive, or Geico can help find competitive rates and potentially lower costs.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

What type of car insurance is the cheapest for the best Chevrolet Tahoe car insurance?

Liability coverage is usually the cheapest option for the best Chevrolet Tahoe car insurance, though comprehensive and collision coverage are recommended for full protection.

Is the best Chevrolet Tahoe car insurance cheap to maintain?

Insurance for the best Chevrolet Tahoe car insurance may not be cheap due to the vehicle’s value and size, but choosing the right provider and coverage options can help manage costs.

What is the best side of the best Chevrolet Tahoe car insurance?

The best side of the best Chevrolet Tahoe car insurance is finding a policy with comprehensive coverage, competitive rates, and excellent customer service from providers like State Farm, Progressive, and Geico.

What age is best Chevrolet Tahoe car insurance most expensive?

Insurance for the best Chevrolet Tahoe is generally most expensive for drivers under 25 due to higher risk factors. However, costs can decrease with more driving experience, and learning about high-risk car insurance can help manage these expenses.

Which one is the best car insurance for the best Chevrolet Tahoe car insurance?

State Farm, Progressive, and Geico are among the best car insurance options for the best Chevrolet Tahoe car insurance, offering competitive rates and strong coverage.

What is the most important car insurance for the best Chevrolet Tahoe car insurance?

Comprehensive coverage is crucial for the best Chevrolet Tahoe car insurance as it protects against a range of risks beyond just liability and collision.

Which category of best Chevrolet Tahoe car insurance is the best?

Comprehensive coverage is the best category of insurance for the Chevrolet Tahoe, providing extensive protection against various risks beyond basic liability or collision car insurance coverage.

Do the best Chevrolet Tahoe car insurance hold their value?

Insurance policies for the best Chevrolet Tahoe car insurance typically protect the vehicle’s value with comprehensive coverage, though maintaining the vehicle in good condition is also important.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.