Best Car Insurance for Japanese Imports in 2025 (Top 10 Companies)

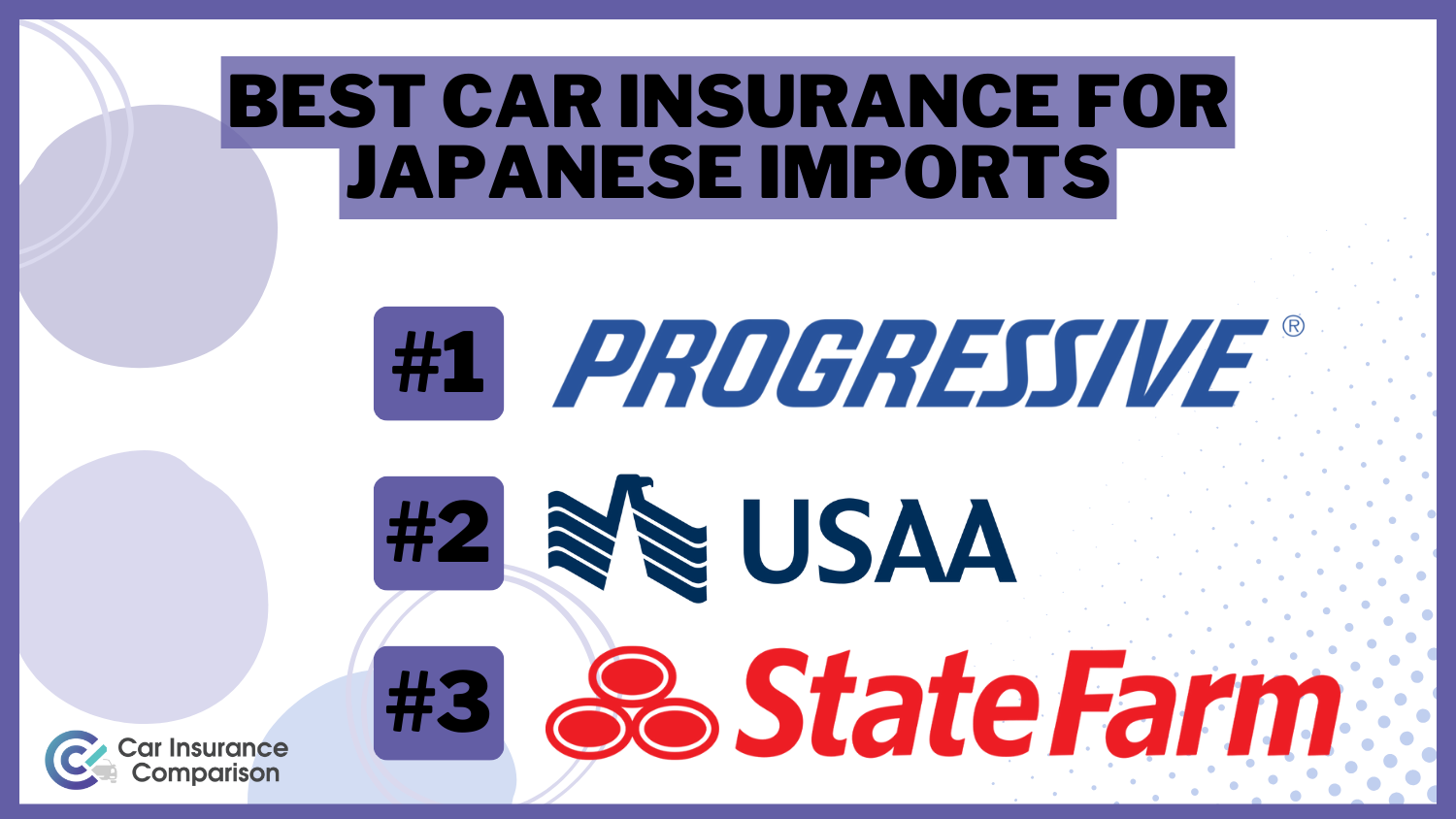

Progressive, USAA, and State Farm stand out as top choices for the best car insurance for Japanese imports. With competitive rates for as low as $70/month, these companies ensure comprehensive protection for your vehicle. these companies ensure comprehensive protection for your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Japanese Imports

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Japanese Imports

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Japanese Imports

A.M. Best Rating

Complaint Level

Pros & Cons

When it comes to finding the best car insurance for Japanese imports, three standout providers emerge: Progressive, USAA, and State Farm. Offering comprehensive coverage tailored specifically for Japanese imports.

Considering an import like the MG RV8? You’ll need specialized Japanese import car insurance. Is it difficult to insure an imported car, and do foreign cars cost more? Surprisingly, imports often have lower premiums.

Our Top 10 Picks: Best Car Insurance for Japanese Imports

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A+ Competitive Rates Progressive

#2 10% A++ Exceptional Service USAA

#3 20% B Customer Satisfaction State Farm

#4 10% A+ Coverage Options Allstate

#5 25% A Roadside Assistance AAA

#6 20% A+ Policy Discounts Nationwide

#7 10% A Personalized Service Farmers

#8 12% A Customizable Policies Liberty Mutual

#9 10% A Generous discounts American Family

#10 8% A++ Quick Claims Travelers

Considering an import like the MG RV8? You’ll need specialized Japanese import car insurance. Is it difficult to insure an imported car, and do foreign cars cost more? Surprisingly, imports often have lower premiums. We’ll help you find the best coverage for your needs, so you can drive to your next car show worry-free.

Before finding out what is the best car insurance for an import car owner, be sure to enter your ZIP code above for free quotes on cheap car insurance for Japanese imports.

- Coverage for Japanese imports includes agreed value and spare parts

- Specialized insurance is needed to meet U.S. safety and emission standards

- Progressive is a top choice for insuring Japanese import cars

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Competitive Rates: Offers some of the most affordable rates for car insurance, making it a great choice for cost-conscious customers.

- Snapshot Program: Provides a usage-based insurance program that can result in additional savings based on driving habits. Learn more by reading our “Progressive car insurance review“

- Extensive Discounts: Offers a wide range of discounts, including multi-policy, multi-vehicle, and safe driver discounts.

Cons

- Customer Service: Some customers report mixed experiences with customer service, indicating room for improvement.

- Rate Increases: There can be significant rate increases upon policy renewal, particularly after filing a claim.

#2 – USAA: Best for Exceptional Service

Pros

- Exceptional Service: Known for top-notch customer service and high customer satisfaction ratings. To learn more, read our “USAA car insurance review“.

- Military-Focused Benefits: Offers specialized benefits and discounts for military members and their families.

- Comprehensive Coverage Options: Provides a wide range of coverage options tailored to various needs.

Cons

- Membership Restrictions: Only available to military members, veterans, and their families, limiting its availability to the general public.

- Digital Experience: Some users find the online and mobile platforms less intuitive compared to competitors.

#3 – State Farm: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Frequently ranks high in customer satisfaction surveys. For more information, read our “State Farm car insurance review“.

- Wide Agent Network: Extensive network of agents providing personalized service and support.

- Multi-Policy Discounts: Offers significant discounts for bundling multiple insurance policies.

Cons

- Premium Costs: Premiums can be higher compared to some competitors, particularly for certain coverage levels.

- Limited Discounts: Fewer discount options compared to other insurance providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Coverage Options

Pros

- Coverage Options: Provides a wide range of coverage options, including unique add-ons like new car replacement and accident forgiveness.

- Drivewise Program: Usage-based insurance program offering potential savings based on driving habits. Gain further insights by checking our “Allstate car insurance review“

- Strong Financial Stability: A+ rating from A.M. Best, indicating strong financial health.

Cons

- Higher Premiums: Generally higher premiums compared to some competitors, particularly for full coverage policies.

- Customer Service Variability: Mixed reviews on customer service experiences, with some customers reporting dissatisfaction.

#5 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: Renowned for its exceptional roadside assistance services. Check on our “AAA car insurance review” for more information.

- Member Discounts: Offers a variety of discounts for AAA members, including travel and retail discounts.

- Comprehensive Coverage: Provides extensive coverage options and add-ons tailored to individual needs.

Cons

- Membership Requirement: Requires AAA membership to access insurance services, adding an extra cost.

- Higher Rates: Insurance premiums can be higher compared to other providers, especially without bundling discounts.

#6 – Nationwide: Best for Policy Discounts

Pros

- Policy Discounts: Offers a wide range of discounts, including multi-policy, multi-vehicle, and safe driver discounts. Read on our “Nationwide car insurance discount” to gain further insights.

- Vanishing Deductible: Unique feature that reduces your deductible over time for safe driving.

- On Your Side Review: Provides personalized insurance reviews to ensure customers get the best coverage for their needs.

Cons

- Premium Rates: Can have higher premium rates compared to some competitors, especially for comprehensive coverage.

- Digital Experience: Some customers report that the online and mobile platforms could be more user-friendly.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Known for providing tailored insurance solutions to meet individual customer needs.

- Extensive Coverage Options: Offers a wide range of coverage options and add-ons, including specialty policies.

- Strong Financial Stability: A rating from A.M. Best, indicating good financial health. Read our “Farmers car insurance review” to learn more.

Cons

- Higher Premiums: Generally higher premiums compared to some other providers, particularly for full coverage policies.

- Discount Availability: Fewer discount options compared to competitors, which can limit potential savings.

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Allows customers to tailor their coverage options to fit their specific needs. Check our comprehension guide titled “Liberty Mutual car insurance review” to learn more.

- Accident Forgiveness: Offers accident forgiveness, preventing rates from increasing after the first accident.

- Various Discounts: Provides numerous discounts, including multi-policy, multi-vehicle, and homeownership discounts.

Cons

- Premium Rates: Higher premium rates compared to some competitors, particularly for full coverage.

- Customer Service: Mixed reviews on customer service, with some customers reporting less satisfactory experiences.

#9 – American Family: Best for Generous Discounts

Pros

- Generous Discounts: Offers a wide range of discounts, including loyalty, multi-policy, and safe driver discounts. For more information, read our “American Family car insurance review“.

- Strong Customer Service: Known for good customer service and high customer satisfaction ratings.

- Comprehensive Coverage Options: Provides extensive coverage options and add-ons tailored to individual needs.

Cons

- Limited Availability: Coverage not available in all states, limiting accessibility for some customers.

- Premium Rates: Higher premium rates compared to some competitors, especially for comprehensive coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Quick Claims

Pros

- Quick Claims Processing: Known for fast and efficient claims processing, ensuring timely payouts. Click on our “Travelers car insurance review” to learn more.

- Strong Financial Stability: A++ rating from A.M. Best, indicating excellent financial health.

- Various Discounts: Offers numerous discounts, including multi-policy, safe driver, and homeownership discounts.

Cons

- Premium Rates: Can have higher premium rates compared to some competitors, particularly for full coverage.

- Digital Experience: Some customers report that the online and mobile platforms could be more user-friendly.

The Basics of Import Car Insurance

What’s special about import car insurance? There has to be something unique about it. Well, there are some things about import car insurance that set it apart from the standard coverage.

One of these things is that your vehicle will be assessed based upon what you and your insurer agree the value is, rather than the Kelley Blue Book value.

Car Insurance Monthly Rates for Japanese Imports by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $80 $130

Allstate $90 $150

American Family $85 $140

Farmers $95 $145

Liberty Mutual $100 $160

Nationwide $85 $135

Progressive $75 $120

State Farm $80 $130

Travelers $85 $140

USAA $70 $110

Import care insurance also factors in the additional cost of spare parts which may be harder to find and will maintain the value of the vehicle.

Read more: Compare Car Insurance Rates by Vehicle Make and Model

Necessary Car Insurance Coverage for Your Import Car

What is an imported car? If you own an import car, you may not be under the same constraints that you would be under if you’d purchased a vehicle from a dealer in the U.S.

Every state has its own liability insurance requirements. Search below to see what they are in your state. To gain further insights, read on our “Compare car insurance rates by state“.

Minimum Car Insurance Requirements by State & Limits

| State | Coverages | Limits |

|---|---|---|

| Alabama | Bodily injury & property damage liability | 25/50/25 |

| Alaska | Bodily injury & property damage liability | 50/100/25 |

| Arizona | Bodily injury & property damage liability | 25/50/15 |

| Arkansas | Bodily injury & property damage liability, personal injury protection | 25/50/25 |

| California | Bodily injury & property damage liability | 15/30/5 |

| Colorado | Bodily injury & property damage liability | 25/50/15 |

| Connecticut | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 25/50/25 |

| Delaware | Bodily injury & property damage liability, personal injury protection | 25/50/10 |

| Florida | Property damage liability, personal injury protection | 10/20/10 |

| Georgia | Bodily injury & property damage liability | 25/50/25 |

| Hawaii | Bodily injury & property damage liability, personal injury protection | 20/40/10 |

| Idaho | Bodily injury & property damage liability | 25/50/15 |

| Illinois | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 25/50/20 |

| Indiana | Bodily injury & property damage liability | 25/50/25 |

| Iowa | Bodily injury & property damage liability | 20/40/15 |

| Kansas | Bodily injury & property damage liability, personal injury protection | 25/50/25 |

| Kentucky | Bodily injury & property damage liability, personal injury protection, uninsured motorist, underinsured motorist | 25/50/25 |

| Louisiana | Bodily injury & property damage liability | 15/30/25 |

| Maine | Bodily injury & property damage liability, uninsured motorist, underinsured motorist, medical payments | 50/100/25 |

| Maryland | Bodily injury & property damage liability, personal injury protection, uninsured motorist, underinsured motorist | 30/60/15 |

| Massachusetts | Bodily injury & property damage liability, personal injury protection | 20/40/5 |

| Michigan | Bodily injury & property damage liability, personal injury protection | 20/40/10 |

| Minnesota | Bodily injury & property damage liability, personal injury protection, uninsured motorist, underinsured motorist | 30/60/10 |

| Mississippi | Bodily injury & property damage liability | 25/50/25 |

| Missouri | Bodily injury & property damage liability, uninsured motorist | 25/50/25 |

| Montana | Bodily injury & property damage liability | 25/50/20 |

| Nebraska | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 25/50/25 |

| Nevada | Bodily injury & property damage liability | 25/50/20 |

| New Hampshire | Financial responsibility only | 25/50/25 |

| New Jersey | Bodily injury & property damage liability, personal injury protection, uninsured motorist, underinsured motorist | 15/30/5 |

| New Mexico | Bodily injury & property damage liability | 25/50/10 |

| New York | Bodily injury & property damage liability, personal injury protection, uninsured motorist, underinsured motorist | 25/50/10 |

| North Carolina | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 30/60/25 |

| North Dakota | Bodily injury & property damage liability, personal injury protection, uninsured motorist, underinsured motorist | 25/50/25 |

| Ohio | Bodily injury & property damage liability | 25/50/25 |

| Oklahoma | Bodily injury & property damage liability | 25/50/25 |

| Oregon | Bodily injury & property damage liability, personal injury protection, uninsured motorist, underinsured motorist | 25/50/20 |

| Pennsylvania | Bodily injury & property damage liability, personal injury protection | 15/30/5 |

| Rhode Island | Bodily injury & property damage liability | 25/50/25 |

| South Carolina | Bodily injury & property damage liability, uninsured motorist | 25/50/25 |

| South Dakota | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 25/50/25 |

| State | Insurance required | Minimum Liability Limits |

| Tennessee | Bodily injury & property damage liability | 25/50/15 |

| Texas | Bodily injury & property damage liability, personal injury protection | 30/60/25 |

| Utah | Bodily injury & property damage liability, personal injury protection | 25/65/15 |

| Vermont | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 25/50/10 |

| Virginia | Bodily injury & property damage liability (8), uninsured motorist, underinsured motorist | 25/50/20 |

| Washington | Bodily injury & property damage liability | 25/50/10 |

| Washington, D.C. | Bodily injury & property damage liability, uninsured motorist | 25/50/10 |

| West Virginia | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 25/50/25 |

| Wisconsin | Bodily injury & property damage liability, uninsured motorist, medical payments | 25/50/10 |

| Wyoming | Bodily injury & property damage liability | 25/50/20 |

However, if you went through the time and trouble to import your vehicle, you probably want more than just the basics. You didn’t get here because you want the bland, humdrum, run-of-the-mill normal for your ride. So don’t leave it unprotected.

You’re going to want to carry comprehensive and collision coverage for your vehicle. If you leased your vehicle, this is probably going to be required.

If you purchased a vehicle from overseas, however, you may have either gotten a personal loan (rather than a vehicle loan) or you may not have needed a loan at all.

So, what type of insurance do you need for your vehicle if you aren’t under a lender’s constraints? Well, first of all, you’re going to have to purchase your state’s minimums, just as you would with any other vehicle.

Then you need to consider two things:

- The value of the vehicle that you’ve imported

- The cost of the work to manufacture your vehicle

Are imported cars more expensive to insure? Why might it cost more to insure a Japanese import car? That definitely depends on what kind of car you imported.

If you’re moving to the U.S. from another country and want to bring your vehicle, you may want to carry simply the state requirements (or something a little higher) for basic protection.

How much does it cost to insure a classic car and can you get full coverage on a classic car? If you’re buying a classic imported car, your classic car insurance rates will look a little different.

We’ve compiled the average rates per state below for classic cars. Keep in mind that if you’re interested in learning more about classic car insurance you can learn more in our classic car insurance guide.

Classic Car Insurance Monthly Rates by Coverage Level & State

| States | Minimum Coverage | Full Coverage |

|---|---|---|

| Alabama | $237 | $521 |

| Alaska | $324 | $617 |

| Arizona | $305 | $584 |

| Arkansas | $236 | $544 |

| California | $294 | $592 |

| Colorado | $312 | $589 |

| Connecticut | $391 | $691 |

| Delaware | $480 | $744 |

| Florida | $515 | $754 |

| Georgia | $334 | $629 |

| Hawaii | $275 | $524 |

| Idaho | $207 | $408 |

| Illinois | $268 | $531 |

| Indiana | $230 | $453 |

| Iowa | $180 | $421 |

| Kansas | $215 | $518 |

| Kentucky | $318 | $563 |

| Louisiana | $466 | $843 |

| Maine | $203 | $422 |

| Maryland | $366 | $670 |

| Massachusetts | $364 | $678 |

| Michigan | $477 | $818 |

| Minnesota | $274 | $525 |

| Mississippi | $276 | $596 |

| Missouri | $250 | $523 |

| Montana | $232 | $518 |

| Nebraska | $219 | $499 |

| Nevada | $409 | $662 |

| New Hampshire | $240 | $491 |

| New Jersey | $522 | $830 |

| New Mexico | $293 | $563 |

| New York | $483 | $816 |

| North Carolina | $216 | $473 |

| North Dakota | $179 | $464 |

| Ohio | $238 | $473 |

| Oklahoma | $277 | $603 |

| Oregon | $350 | $543 |

| Pennsylvania | $299 | $582 |

| Rhode Island | $456 | $782 |

| South Carolina | $316 | $584 |

| South Dakota | $180 | $460 |

| Tennessee | $248 | $523 |

| Texas | $317 | $666 |

| Utah | $299 | $524 |

| Vermont | $206 | $458 |

| Virginia | $255 | $506 |

| Washington | $358 | $581 |

| Washington, D.C. | $377 | $798 |

| West Virginia | $295 | $615 |

| Wisconsin | $225 | $442 |

| Wyoming | $193 | $508 |

| U.S. Average | $323 | $606 |

Most car insurance companies cover older models, but classic cars need special insurance, offered by major insurers like State Farm and Progressive. The cheapest classic car insurance is in Idaho, while rates in Louisiana can be double.

Insurance premiums depend on your location, with higher rates in high-risk areas, especially cities with elevated crime rates.

Insurers will also look at the value of your car when pricing your coverage.

You have an import, so what does that mean? Insurance companies might not have easily accessible information about your exact car, so they may end up looking at something that seems similar but is in fact much cheaper than your import. At first glance, that seems cool. Your insurance rates will be lower if the value is priced lower, right?

Yes, but the insurance company will only pay out what they think your car is worth if you’re in an accident. That’s bad news if you have a $50,000 car that they thought was only worth $5,000. You’d only get $5,000 worth of repairs or cash toward a new vehicle.

Classic and antique cars often appreciate in value, unlike regular sedans, and require special insurance to protect that investment. Spare parts can be hard to find and costly, so comprehensive and collision coverage is essential for expensive vehicles.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Insuring Your Japanese Import Car

What is import car insurance? Let’s take a closer look at import vehicles and car insurance laws.

Import Vehicles & Car Insurance Laws

Between 2015 and 2019, the U.S. imported 45,000 to 61,000 used passenger vehicles annually. Most imported cars fall under “used” in the table below, as new vehicles are typically dealership imports, though there are exceptions. The International Trade Administration highlights these significant import numbers due to specific import regulations.

Number of Units and Value of U.S. Imports by Vehicle Type

| Year | Used Car Units/Value | New Car & Light Truck Units/Value | Medium & Heavy-Duty Truck Units/Value | |

|---|---|---|---|---|

| 2024 | 55,000 units / $1,050,000,000 | 8,500,000 units / $200,000,000,000 | 240,000 units / $18,500,000,000 | |

| 2023 | 54,000 units / $1,030,000,000 | 8,400,000 units / $198,000,000,000 | 235,000 units / $18,000,000,000 | |

| 2022 | 53,500 units / $1,020,000,000 | 8,350,000 units / $196,000,000,000 | 233,000 units / $17,500,000,000 | |

| 2021 | 53,000 units / $1,010,000,000 | 8,300,000 units / $194,000,000,000 | 230,000 units / $17,000,000,000 | |

| 2020 | 52,000 units / $1,000,000,000 | 8,250,000 units / $192,000,000,000 | 225,000 units / $16,500,000,000 | |

| 2019 | 53,652 units / $991,661,288 | 8,262,039 units / $197,279,927,226 | 221,113 units / $17,250,601,585 | |

| 2018 | 49,055 units / $987,766,241 | 8,218,741 units / $191,753,771,717 | 230,717 units / $16,188,074,170 | |

| 2017 | 45,361 units / $1,009,384,769 | 8,273,315 units / $191,765,678,137 | 231,949 units / $14,403,869,708 | |

| 2016 | 61,171 units / $1,256,438,899 | 8,153,290 units / $186,356,026,335 | 198,547 units / $12,029,293,837 | |

| 2015 | 45,245 units / $1,131,730,890 | 8,003,550 units / $179,819,603,360 | 240,638 units / $15,690,482,306 |

Check out this helpful how-to video from the U.S. Customs and Border Protection on importing your vehicle to the U.S.

Import vehicles, much like any other vehicle in the U.S., are subject to insurance laws that vary by state. Before you can purchase insurance for your import vehicle, however, you have to ensure that it is compliant with U.S. safety laws.

The vehicle you’re importing also has to meet certain emissions standards, as defined by the Environmental Protection Agency.

To import a car to the U.S., it must be over 25 years old or similar to models already sold in the country, as stated by Bill H.R.2628. It must also comply with Federal Motor Vehicle Safety Standards set by the National Highway Traffic Safety Administration. Vehicles made outside the U.S. often don’t meet these standards, and you can’t insure the car until it does.

If your vehicle doesn’t meet U.S. standards within 90 days of import, you must export or destroy it, as imported car insurance isn’t available in the U.S. For more information, read our “Export car insurance: rates, discounts, & requirements“.

Progressive is the top overall pick for Japanese import car insurance, offering comprehensive coverage with rates starting as low as $74/month.

Melanie Musson Published Insurance Expert

There is no specially designated car insurance for imported cars, Japanese or otherwise, but there are requirements that must be addressed before you can insure one at all.

The best car insurance for an import car owner will be different in every state. Also, don’t forget to title your import vehicle as soon as you can.

The Best Car Insurance Company For an Import Car

If you’re looking for an insurance company that specializes in insuring import vehicles, you’re going to be disappointed.

There are no insurance companies that are import car insurance specialists, or those that offer policies insuring any imported car in the USA. Naturally, this includes companies that provide insurance for Japanese imported cars. Though some providers do specialize in classic cars, including:

- Hagerty Insurance

- Grundy Classic Car Insurance

- American Modern Classic Car Insurance

- American Collectors Insurance

- JDM Imports insurance for JDM cars

Is Hagerty Insurance any good, or should you stick with a better-known name like Safeco classic car insurance? It really depends on your needs, which will help you identify the best car insurance company for your exotic car.

Once your vehicle meets U.S. standards, you can purchase quality coverage from dozens of insurance companies.

Interestingly enough, many other countries offer specialty insurance for import and classic cars, this just isn’t the case in the U.S. Rather than having specialty companies, most insurance companies simply offer car insurance on Japanese imported vehicles and regular vehicles as well.

This makes it easy to talk to an agent and determine the difference between classic car insurance vs. regular and determine which you need.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Determining Sufficient Insurance Coverage for Your Imported Vehicle

You’ll want to make sure to choose the right company for you. To that end, let’s take a look at the financial standings of some of the most popular car insurance companies.

Top 10 Car Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share | A.M. Best | Loss Ratio |

|---|---|---|---|---|---|

| #1 | State Farm | $41.9 billion | 17.01% | B (Fair) | 63% |

| #2 | Geico | $33.1 billion | 13.41% | A++ (Superior) | 71% |

| #3 | Progressive | $27.1 billion | 10.97% | A+ (Superior) | 62% |

| #4 | Allstate | $22.7 billion | 9.19% | A+ (Superior) | 56% |

| #5 | USAA | $14.5 billion | 5.87% | A++ (Superior) | 77% |

| #6 | Liberty Mutual | $11.8 billion | 4.77% | A (Excellent) | 62% |

| #7 | Farmers | $10.5 billion | 4.26% | A (Excellent) | 61% |

| #8 | Nationwide | $6.7 billion | 2.73% | A+ (Superior) | 58% |

| #9 | American Family | $4.7 billion | 1.90% | A (Excellent) | 69% |

| #10 | Travelers | $4.7 billion | 1.90% | A++ (Superior) | 60% |

What is a loss ratio?

A loss ratio is a measure of the financial strength of an insurance company that compares how much it’s bringing in from customer payments versus how much it’s paying out in claims.

The ideal range for a loss ratio is between 45 and 75 percent. If a company’s loss ratio goes too high, that means it’s probably paying out too many claims. If it’s over 100, a rate hike is probably coming. A very low loss ratio means the company is not paying out on many claims, so that’s a red flag to look out for.

The bottom line is that the amount of coverage that you should purchase is dependent on your specific situation. First of all, you’ll want to consider the value of your vehicle. Remember, liability insurance doesn’t cover losses to your vehicle in an accident you caused, only the losses of the other driver.

If you have plenty of money in the bank to cover your own losses, then you may not need to purchase any sort of additional insurance.

What you owe if the vehicle is financed and the value of the vehicle are two different things. Your insurance company will only pay for the value of your car.

With the average used import from 2019 valued at $18,483, they’re not clunkers. And remember, that’s just an average; there are a lot of imports that are worth far more than that.

Progressive stands out as the top choice for Japanese import car insurance, boasting competitive rates starting at just $74 per month.

Jeffrey Manola Licensed Insurance Agent

The second thing that you need to consider is self-preservation. When you get behind the wheel of a vehicle, you become responsible for everything that vehicle does. If you cause an accident, you’re responsible for every cost associated with that accident. If you don’t have enough insurance, you’ll be financially responsible for the difference in cost.

Many people will purchase more than the state’s minimum requirements for their vehicle for just this reason.

You likely imported your car for its unique appeal, but remember, insurance costs can vary based on the vehicle’s value and your driving record; so, drive responsibly to avoid higher premiums. To gain further insights, read our “What is a car insurance premium“.

Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One DUI | One Accident |

|---|---|---|---|---|

| Allstate | $318 | $374 | $500 | $450 |

| American Family | $224 | $252 | $370 | $320 |

| Farmers | $288 | $340 | $480 | $420 |

| Geico | $179 | $220 | $350 | $280 |

| Liberty Mutual | $398 | $475 | $600 | $520 |

| Nationwide | $229 | $259 | $380 | $330 |

| Progressive | $283 | $334 | $460 | $400 |

| State Farm | $235 | $266 | $390 | $340 |

| Travelers | $287 | $355 | $470 | $410 |

| USAA | $161 | $183 | $300 | $250 |

As you can see, your rates will go up with just one speeding ticket, anywhere from 12 to 24 percent with these major insurers.

Case Studies: Real-World Insights: Top Insurance Providers in Action

Three major contenders in the insurance industry are Progressive, USAA, and State Farm. These companies have gained recognition for their unique methods of serving clients, whether by offering competitive rates, providing exceptional service, or demonstrating an unwavering commitment to customer satisfaction.

Through fictional scenarios, we’ll explore how these companies effectively leverage their strengths to deliver tangible benefits for consumers.

- Case Study #1 – Progressive’s Competitive Rates: Mark and Sarah, a young couple on a budget, are shopping for car insurance. They discover Progressive, known for its competitive rates. With premiums 10% lower than competitors, they find comprehensive coverage without overspending.

- Case Study #2 – USAA’s Exceptional Service: John, a retired veteran, values reliability and personalized service. He chooses USAA for its exceptional service tailored to military families. USAA’s A++ satisfaction rating ensures John’s family is well taken care of.

- Case Study #3 – State Farm’s Customer Satisfaction: Lisa, a small business owner, seeks reliable insurance. She chooses State Farm car insurance for its outstanding customer satisfaction and tailored solutions. With State Farm’s support, Lisa focuses on growing her business with confidence.

Through our exploration of Progressive, USAA, and State Farm, we’ve witnessed the power of strategic positioning and customer-centricity in the insurance industry.

From offering competitive rates to providing exceptional service and prioritizing customer satisfaction, each company has demonstrated a unique formula for success. These scenarios serve as a reminder of the importance of understanding and leveraging strengths to meet the diverse needs of customers in an ever-evolving market.

Obtaining a Car Insurance Quote for Your Imported Vehicle

Consider your finances when pursuing insurance for import cars. If you don’t have the funds to pay for extra insurance, then you have a problem. If you need to get full coverage and save money, then there are two things you can do:

- Raise your deductible

- Get car insurance quotes

Raising your deductible does require that you have more out-of-pocket money if an accident occurs; however, this often makes it possible for people to purchase more insurance at a reasonable monthly premium. To learn more, read our “Car insurance deductible“.

Getting car insurance quotes from multiple companies ensures that you get the lowest rate possible for the insurance coverage that you want to purchase.

Using our link at the bottom of the page will take you to our free, no-obligation, car insurance rate quote tool for collector car insurance.

What kind of car insurance should you get? Enter your ZIP code to get Japanese import car insurance quotes and get started insuring your imported cars from Japan.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is a Japanese import car?

A Japanese import car refers to a vehicle that was originally manufactured in Japan and subsequently imported into another country. These vehicles often have unique features, specifications, and are typically right-hand drive.

Are Japanese import cars more expensive to insure?

The cost of insurance for Japanese import cars can vary depending on several factors, including the model, age, and modifications. In general, Japanese import cars may have higher insurance rates due to factors such as parts availability and repair costs.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

Why do Japanese import cars have higher insurance rates?

Japanese import cars may have higher insurance rates for several reasons. First, the availability and cost of parts for these vehicles can be more expensive, which can impact repair costs. Additionally, right-hand drive cars may require specialized maintenance and repairs, leading to higher premiums.

Can I insure a Japanese import car with any insurance company?

Not all insurance companies provide coverage for Japanese import cars. It’s essential to check with different insurance providers to find out if they offer specific policies for these vehicles. Some insurers specialize in providing coverage for imported cars and may have competitive rates.

To gain further insights, read our “How do you get competitive quotes for car insurance?“.

How can I find affordable insurance rates for my Japanese import car?

To find affordable insurance rates for your Japanese import car, consider the following tips:

- Shop around and obtain quotes from multiple insurance providers.

- Maintain a clean driving record to qualify for better rates.

- Install safety features and anti-theft devices in your vehicle.

- Consider higher deductibles, but ensure they are manageable for your budget.

- Bundle your car insurance with other policies to potentially receive discounts.

Are there any specific requirements for insuring a Japanese import car?

Specific requirements for insuring a Japanese import car can vary among insurance companies. However, common requirements may include:

- A valid import certificate or registration documents.

- Vehicle inspections and compliance with local safety standards.

- Documentation of modifications or changes made to the car.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

What factors contribute to the higher insurance rates for Japanese import cars?

Insurance rates for Japanese import cars can be influenced by several factors, including the availability and cost of parts, repair costs, and potential maintenance requirements for right-hand drive vehicles.

Read our “Can my car insurance company make me use a specific car repair shop?” to gain further insights.

Are there specific insurance companies that specialize in providing coverage for Japanese import cars?

While not all insurance companies offer specialized coverage for Japanese imports, some may have policies tailored to these vehicles. It’s essential to research and compare quotes from different insurers to find the best coverage options.

What types of coverage are typically recommended for Japanese import cars?

Comprehensive and collision coverage are often recommended for Japanese import cars to ensure protection against various risks, including accidents, theft, and damage.

Do Japanese import cars require any modifications to meet U.S. safety and emissions standards for insurance purposes?

Yes, Japanese import cars must meet U.S. safety and emissions standards before they can be insured. Failure to comply with these standards may result in limitations or restrictions on insurance coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.