Best Car Insurance for Healthcare Workers in 2025 (Top 10 Companies)

State Farm, USAA, and Progressive offer the best car insurance for healthcare workers, with rates as low as $22. Their comprehensive coverage options and specialized discounts cater specifically to the needs of healthcare professionals, ensuring they're protected both on and off duty.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Healthcare Workers

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Healthcare Workers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Healthcare Workers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

When it comes to choosing the best car insurance for healthcare workers, factors like affordability, coverage options, and customer service are paramount.

Our Top 10 Company Picks: Best Car Insurance for Healthcare Workers

| Company | Rank | Healthcare Worker Discount | Multi-Vehicle Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 5% | Policy Options | State Farm | |

| #2 | 12% | 20% | Tailored Coverage | USAA | |

| #3 | 15% | 17% | Online Convenience | Progressive | |

| #4 | 13% | 18% | Big Discounts | Allstate | |

| #5 | 8% | 14% | 24/7 Support | Liberty Mutual |

| #6 | 11% | 16% | Vanishing Deductible | Farmers | |

| #7 | 9% | 13% | Accident Forgiveness | Nationwide |

| #8 | 10% | 15% | Bundle Discounts | Esurance | |

| #9 | 7% | 12% | Customer Service | Travelers | |

| #10 | 11% | 14% | Add-on Coverages | American Family |

State Farm emerges as a standout choice, offering a combination of competitive rates, comprehensive protection, and personalized policies tailored to the unique needs of healthcare professionals.

With State Farm, healthcare workers can drive with confidence knowing they have reliable coverage at an affordable price, allowing them to focus on their important work without worrying about their insurance needs.

Read on to see bad credit car insurance rates and discounts. Enter your ZIP code to compare free car insurance quotes from top companies.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Policy Options: State Farm stands out as the best for offering a variety of policy options, allowing healthcare workers to tailor their coverage to their specific needs.

- Healthcare Worker Discount: State Farm provides a competitive healthcare worker discount of up to 10%, helping to reduce insurance costs for individuals in the healthcare profession.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 15%, State Farm offers additional savings for healthcare workers insuring more than one vehicle.

Cons

- Discount Limitations: While State Farm offers a healthcare worker discount, it’s capped at 10%, which may be lower compared to some other providers.

- Online Convenience: State Farm may not be the top choice for those seeking a seamless online experience, as its emphasis on in-person agents may limit online convenience.

Read more: State Farm Car Insurance Review

#2 – USAA: Best for Tailored Coverage

Pros

- Tailored Coverage: USAA excels in providing tailored coverage, understanding the unique needs of healthcare workers and offering customized insurance solutions.

- Healthcare Worker Discount: With an impressive healthcare worker discount of up to 12%, USAA provides substantial savings for individuals in the healthcare field.

- Multi-Vehicle Discount: USAA offers a multi-vehicle discount of up to 20%, making it an attractive option for healthcare workers with more than one vehicle.

Cons

- Membership Eligibility: USAA membership is limited to military members and their families, excluding a significant portion of the healthcare worker population.

- Availability Constraints: USAA may not be available to everyone, as eligibility is restricted, potentially limiting choices for healthcare workers who don’t meet membership criteria.

Read more: USAA Car Insurance Review

#3 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Progressive is recognized for its online convenience, making it easy for healthcare workers to manage their policies, file claims, and access information from anywhere.

- Healthcare Worker Discount: Offering a healthcare worker discount of up to 15%, Progressive provides substantial savings for individuals in the healthcare profession.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 17%, Progressive caters to healthcare workers with multiple vehicles, ensuring cost-effective coverage.

Cons

- Coverage Limitations: While Progressive excels in online convenience, some healthcare workers may find that it lacks certain policy options or coverage depth compared to other providers.

- Customer Service: Progressive’s customer service may not be as highly rated as some competitors, potentially leading to a less satisfactory experience for healthcare workers seeking excellent support.

Read more: Progressive Car Insurance Review

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Big Discounts

Pros

- Big Discounts: Allstate is recognized for offering substantial discounts, with healthcare workers benefiting from up to 13% off, making it an attractive option for cost-conscious individuals.

- Multi-Vehicle Discount: Allstate provides a significant multi-vehicle discount of up to 18%, appealing to healthcare workers with more than one vehicle and offering additional savings.

- Coverage Options: Allstate is known for providing a wide range of coverage options, allowing healthcare workers to customize their policies to meet specific needs.

Cons

- Healthcare Worker Discount Limit: While Allstate offers a healthcare worker discount, it may not be as high as some competitors, potentially limiting the extent of savings for healthcare professionals.

- Customer Service: Some customers have reported less-than-optimal experiences with Allstate’s customer service, which may be a consideration for healthcare workers seeking excellent support.

Read more: Allstate Car Insurance Review

#5 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Liberty Mutual stands out for its commitment to customer support, providing 24/7 assistance, which can be valuable for healthcare workers with non-traditional work hours.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 14%, Liberty Mutual offers additional savings for healthcare workers insuring more than one vehicle.

- Coverage Options: Liberty Mutual provides a variety of coverage options, allowing healthcare workers to tailor their insurance policies to their unique needs.

Cons

- Healthcare Worker Discount: The healthcare worker discount offered by Liberty Mutual is up to 8%, which may be comparatively lower than some competitors.

- Online Experience: Liberty Mutual’s online experience may not be as user-friendly or seamless as some other providers, potentially impacting the convenience for tech-savvy healthcare workers.

Read more: Liberty Mutual Car Insurance Review

#6 – Farmers: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Farmers Insurance offers a vanishing deductible program, allowing healthcare workers to lower their deductible over time with safe driving habits.

- Healthcare Worker Discount: With a healthcare worker discount of up to 11%, Farmers provides a competitive option for professionals in the healthcare industry.

- Multi-Vehicle Discount: Farmers offers a multi-vehicle discount of up to 16%, making it an attractive choice for healthcare workers with multiple vehicles.

Cons

- Limited Online Presence: Farmers may not have as strong an online presence as some competitors, potentially impacting the convenience for healthcare workers who prefer online interactions.

- Coverage Options: While Farmers offers a range of coverage options, some healthcare workers may find that it lacks certain specialized coverage options offered by other providers.

Read more: Farmers Car Insurance Review

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide stands out for offering accident forgiveness, providing a valuable benefit for healthcare workers concerned about potential increases in premiums after an accident.

- Healthcare Worker Discount: Nationwide provides a healthcare worker discount of up to 9%, contributing to potential savings for professionals in the healthcare industry.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 13%, Nationwide offers additional savings for healthcare workers insuring more than one vehicle.

Cons

- Coverage Options: Some healthcare workers may find that Nationwide’s coverage options are not as extensive or customizable as those offered by other providers.

- Online Experience: Nationwide’s online experience may not be as advanced or user-friendly as some competitors, potentially affecting the convenience for healthcare workers who prefer online interactions.

#8 – Esurance: Best for Bundle Discounts

Pros

- Bundle Discounts: Esurance is known for offering bundle discounts, allowing healthcare workers to combine multiple insurance policies for additional savings.

- Healthcare Worker Discount: With a healthcare worker discount of up to 10%, Esurance provides a competitive option for professionals in the healthcare industry.

- Multi-Vehicle Discount: Esurance offers a multi-vehicle discount of up to 15%, making it an appealing choice for healthcare workers with multiple vehicles.

Cons

- Customer Service: Some customers have reported less-than-optimal experiences with Esurance’s customer service, which may be a consideration for healthcare workers seeking excellent support.

- Add-On Coverages: While Esurance offers various add-on coverages, some healthcare workers may find that it lacks certain specialized coverage options offered by other providers.

#9 – Travelers: Best for Customer Service

Pros

- Customer Service: Travelers Insurance is recognized for its strong emphasis on customer service, providing a positive experience for healthcare workers seeking reliable support.

- Healthcare Worker Discount: Travelers offers a healthcare worker discount of up to 7%, contributing to potential savings for professionals in the healthcare industry.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 12%, Travelers caters to healthcare workers with multiple vehicles, ensuring cost-effective coverage.

Cons

- Limited Online Presence: Travelers may not have as strong an online presence as some competitors, potentially impacting the convenience for healthcare workers who prefer online interactions.

- Coverage Options: While Travelers offers a range of coverage options, some healthcare workers may find that it lacks certain specialized coverage options offered by other providers.

Read more: Travelers Car Insurance Review

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Add-On Coverages

Pros

- Add-On Coverages: American Family Insurance excels in providing various add-on coverages, allowing healthcare workers to tailor their policies with additional protections.

- Healthcare Worker Discount: With a healthcare worker discount of up to 11%, American Family provides a competitive option for professionals in the healthcare industry.

- Multi-Vehicle Discount: American Family offers a multi-vehicle discount of up to 14%, making it an appealing choice for healthcare workers with multiple vehicles.

Cons

- Customer Service: American Family’s customer service may not be as highly rated as some competitors, potentially leading to a less satisfactory experience for healthcare workers seeking excellent support.

- Online Experience: American Family’s online experience may not be as advanced or user-friendly as some competitors, potentially affecting the convenience for healthcare workers who prefer online interactions.

Read more: American Family Car Insurance Review

The Practice of Occupational Markers

responsibilities associated with the profession influence premiums. Delving into the average monthly rates for various providers reveals key insights.

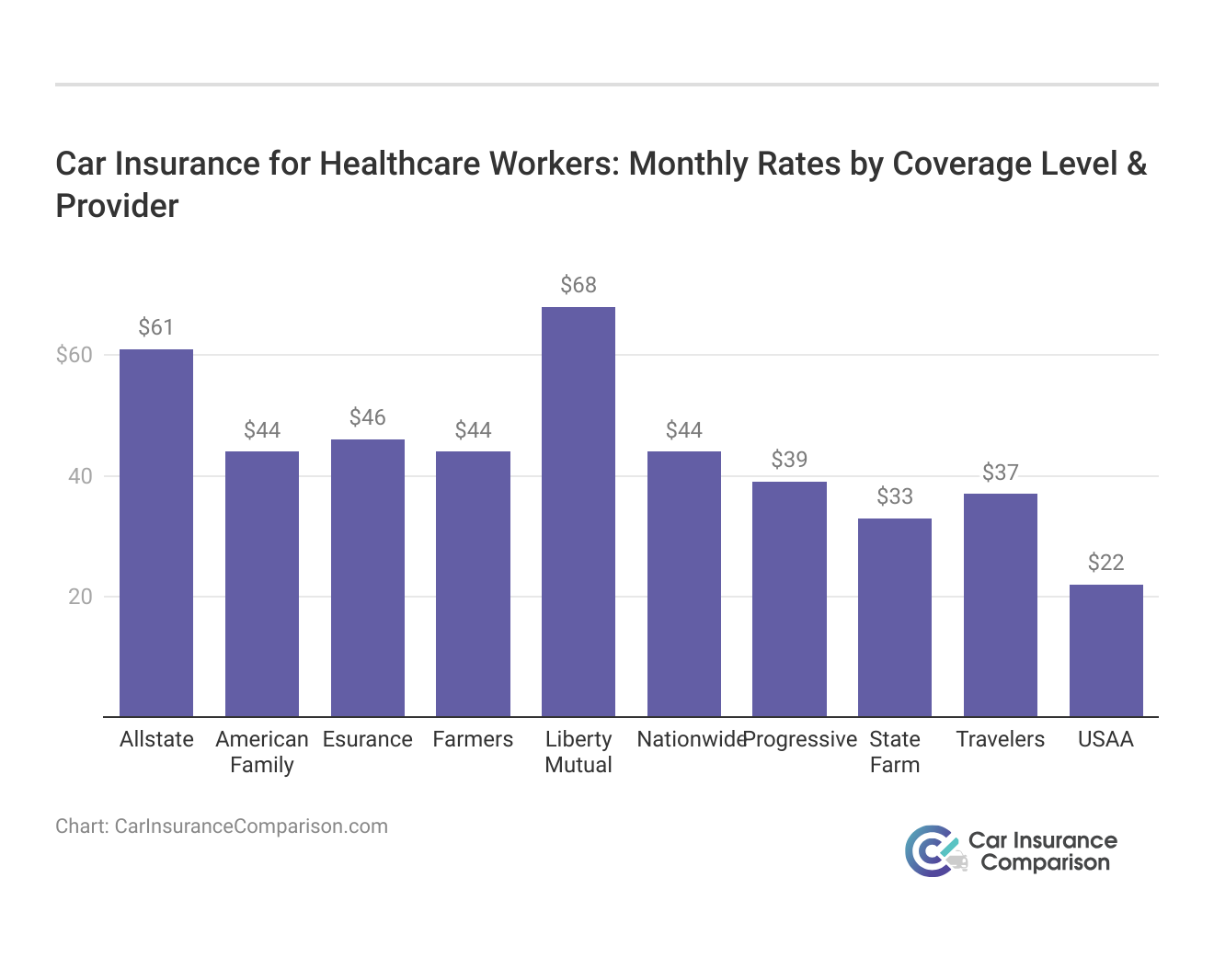

Car Insurance for Healthcare Workers: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Esurance | $46 | $114 |

| Farmers | $44 | $139 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

| USAA | $22 | $59 |

USAA emerges as a cost-efficient option, boasting the lowest average monthly rates for both full and minimum coverage at $59 and $22, respectively. State Farm car insurance review strikes a balance between affordability and comprehensive coverage, offering competitive rates of $86 for full coverage and $33 for minimum coverage. Liberty Mutual reflects a higher cost with rates of $174 for full coverage and $68 for minimum coverage.

For healthcare professionals seeking budget-friendly options without compromising coverage, USAA and State Farm stand out as top choices, while Liberty Mutual emphasizes the importance of exploring different providers for potential savings. Ultimately, these insights empower healthcare workers to make informed decisions based on their unique preferences, coverage requirements, and budget constraints.

Risk factors are determined by groups, not by individuals; that is because there are far too many people on the road these days for the insurance companies to risk providing a clean slate, so to speak, for every driver.

What this means is that your risk factors are based on what other drivers in your situation do while they are on the road.

It is becoming more common for insurance companies to use your occupation as a factor in determining your auto insurance rates.

As a healthcare worker, your job is considered, by the insurance companies, to be one that causes you enough stress that you will not be the safest driver on the road.

Read more: Compare Doctor & Dentist Car Insurance Rates

No Dividing Factors

There is a major downside to this practice by auto insurance companies and that is the fact that your job may not be stressful as someone’s who works in the same field that you do.

Sure, you can qualify for some discounts to help save you money, but your job, in itself, cannot be changed — unless your career changes. To learn more insight, check out this comprehensive guide titled “Car Insurance Discounts: Compare the Best Discounts“.

It is for this reason that it is very important that you find all of the discounts that you can so that you can negate some of the costs associated with your career.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Obtaining Online Quotes for Healthcare Workers

For healthcare professionals who are often pressed for time, obtaining car insurance quotes online offers a speedy and convenient solution. Start by gathering necessary details such as your vehicle information and driving history. Visit reputable insurance comparison sites or individual insurer websites, where you can input your data, specify your insurance needs, and ensure to indicate your profession to access potential healthcare worker discounts.

After submitting your information, you’ll receive a variety of quotes. It’s important to compare car insurance quotes carefully, considering factors such as coverage options, costs, and the insurer’s customer service reputation. If you use your vehicle for professional purposes, such as visiting patients, consider quotes for commercial insurance as well. Once you find a suitable offer, you can usually purchase the policy directly online.

To ensure continued adequacy of coverage, regularly reassess your insurance needs, especially if your professional or personal circumstances change. This approach allows healthcare workers to efficiently secure car insurance that aligns with their professional demands and provides peace of mind.

- Case Study #1– Affordable Customization for Nurses: Emily, a nurse, found a perfect fit with State Farm. For $86 monthly, she got full coverage tailored to her busy schedule and unique needs, appreciating the balance between affordability and comprehensive protection.

- Case Study #2– Budget-Friendly Military Coverage: David, a military healthcare worker, opted for USAA’s $59 full coverage plan, which included a 12% healthcare worker discount. USAA’s tailored coverage options provided him with the financial flexibility he needed without compromising on protection.

- Case Study #3– Premium Support for Healthcare Administrators: Sarah, a healthcare administrator, valued Liberty Mutual’s comprehensive coverage and 24/7 support, despite the higher costs. For $174 monthly, she received extensive protection and reliable assistance, reflecting the trade-off between premium costs and peace of mind.

This illustrate the importance of considering factors such as cost, coverage options, and insurer reputation when choosing car insurance, especially for healthcare professionals who may have unique needs and preferences. Read thoroughly to gain more insights about “How Occupation Affects Car Insurance Rates (Education, Discounts, & Rates)“.

State Farm stands out as a top choice for healthcare workers with its balanced combination of affordability, comprehensive coverage, and customizable policy options

Brad Larson Licensed Insurance Agent

Each provider offers distinct advantages, allowing individuals to select the option that best aligns with their priorities and requirements.

Bottom Line: Navigating Car Insurance for Healthcare Workers

A detailed overview of the top car insurance choices tailored for healthcare workers. Highlighting State Farm, USAA, and Progressive as standout options, the piece emphasizes their competitive rates, specialized discounts, and comprehensive coverage designed to meet the specific needs of healthcare professionals.

Through case studies, it illustrates how these insurers cater to diverse preferences, ranging from affordability to extensive protection. Additionally, it addresses common inquiries regarding the impact of occupation on insurance rates and the importance of selecting the appropriate policy type, particularly for healthcare workers who transport medical supplies or work in patients’ homes.

Overall, the article serves as a valuable resource for healthcare professionals navigating car insurance decisions. When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What are the average car insurance rates for healthcare workers in the US?

The average monthly car insurance rate for a healthcare worker in the US is $101.

Learn more information about rates in this comprehensive guide “Compare Monthly Car Insurance: Rates, Discounts, & Requirements“

Can I save on car insurance as a healthcare worker?

Yes, comparing quotes online can help you save up to 20% on your car insurance policy.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Does having a college education affect car insurance rates for healthcare workers?

Yes, having a college degree may lead to lower insurance rates for healthcare workers.

How does my occupation impact car insurance rates as a healthcare worker?

Insurance companies may view healthcare workers as having higher stress levels, which can influence auto insurance rates.

What type of car insurance policy should healthcare workers consider?

Healthcare workers who transport medical supplies or work in patients’ homes should consider commercial or business insurance.

Explore our guide to the “Best Car Insurance Companies” and make informed decisions to secure reliable coverage for your needs.

Are there specific discounts available for healthcare workers?

Some insurance companies offer discounts tailored for healthcare professionals, such as reduced rates for those with certain healthcare certifications or memberships.

Does my driving record affect car insurance rates as a healthcare worker?

Like any other driver, your driving record plays a significant role in determining your car insurance rates. A clean driving record typically results in lower premiums.

To gain further insights, read our guide “What is a car insurance premium?“

Do I need additional coverage if I use my car for work-related purposes as a healthcare worker?

If you use your car for work-related tasks, such as transporting medical equipment or making home visits, you may need commercial or business insurance to ensure adequate coverage.

How can I lower my car insurance premiums as a healthcare worker?

You can lower your premiums by maintaining a clean driving record, taking advantage of available discounts, comparing quotes from multiple insurance providers, and choosing a policy that aligns with your coverage needs.

What should I consider when selecting a car insurance provider as a healthcare worker?

Factors to consider include the provider’s reputation for customer service, coverage options tailored to healthcare professionals, discounts offered, financial stability, and ease of claims process.

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.