Best Buick Lucerne Car Insurance in 2025 (Find the Top 10 Companies Here)

Erie, Liberty Mutual, and American Family are the best Buick Lucerne car insurance, with Erie offering the lowest rate at $45 per month. Liberty Mutual is known for its comprehensive coverage options, while American Family provides reliable service and attractive multi-vehicle discounts for Buick Lucerne.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Oct 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Buick Lucerne

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Buick Lucerne

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 2,235 reviews

2,235 reviewsCompany Facts

Full Coverage Buick Lucerne

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsErie, Liberty Mutual, and American Family provide the best Buick Lucerne car insurance, with Erie offering rates as low as $45 per month.

Buick Lucerne insurance costs approximately $21 less per month than the average for other vehicles. To find the lowest car insurance quotes, read the article “Safeco Car Insurance Review.”

Our Top 10 Company Picks: Best Buick Lucerne Car Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Affordable Rates | Erie |

| #2 | 25% | A | Comprehensive Coverage | Liberty Mutual |

| #3 | 20% | A | Reliable Service | American Family | |

| #4 | 20% | A+ | Extensive Network | Nationwide |

| #5 | 8% | A++ | Customizable Policies | Travelers | |

| #6 | 10% | A++ | Excellent Discounts | Auto-Owners | |

| #7 | 20% | A | Superior Support | Farmers | |

| #8 | 25% | A+ | Senior Friendly | The Hartford |

| #9 | 12% | A+ | Innovative Options | Progressive | |

| #10 | 20% | B | Strong Reputation | State Farm |

Take a look through this comprehensive article to learn more about Buick Lucerne insurance rates. It will help you compare policies from different companies.

Our free online tool allows you to start entering your ZIP code to compare one of the best car insurance companies now.

- Full coverage for a Buick Lucerne costs $8/mo

- Liability-only policy is about $3/mo

- Teenage drivers face the highest rates at $31/mo

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Erie Insurance: Top Overall Pick

Pros

- Affordable Rates: Erie Insurance offers some of the most affordable rates for the best Buick Lucerne car insurance, ensuring you get value for your money.

- Multi-Vehicle Discount: Erie offers a 10% discount for insuring multiple vehicles, helping you secure the best Buick Lucerne car insurance at a lower overall cost.

- High A.M. Best Rating: Erie’s A+ rating for financial strength reinforces its reputation as a provider of reliable and stable Buick Lucerne car insurance. Read more at “Erie Car Insurance Review.”

Cons

- Limited Availability: Erie’s coverage is available in only 12 states, which might restrict some customers’ access to the best Buick Lucerne car insurance.

- Fewer Coverage Options: Erie may offer fewer specialized coverage options, which can make finding the best Buick Lucerne car insurance for specific needs more challenging.

#2 – Liberty Mutual: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Liberty Mutual provides a range of comprehensive coverage options, making it a strong contender for the best Buick Lucerne car insurance.

- High Multi-Vehicle Discount: The 25% discount for multiple vehicles ensures you receive competitive pricing for the best Buick Lucerne car insurance.

- Strong A.M. Best Rating: Rated A for financial stability, Liberty Mutual delivers dependable service in securing the best Buick Lucerne car insurance.

Cons

- Higher Rates for Younger Drivers: Liberty Mutual’s rates can be higher for younger drivers, which may impact the affordability of the best Buick Lucerne car insurance.

- Mixed Customer Service Reviews: Some customers report inconsistent service, which affects their experience. Delve more in our article entitled “Liberty Mutual Car Insurance Review.”

#3 – American Family: Best for Reliable Service

Pros

- Reliable Service: Known for its excellent customer service, American Family provides some of the best Buick Lucerne car insurance options with reliable support.

- Good Multi-Vehicle Discount: The 20% discount for multiple vehicles helps you secure cost-effective and competitive rates for the best Buick Lucerne car insurance.

- High A.M. Best Rating: With an A rating for financial strength, American Family ensures dependable service for the best Buick Lucerne car insurance.

Cons

- Higher Premiums for Certain Demographics: Premiums can be higher for some age groups, which may impact the overall affordability of the best Buick Lucerne car insurance.

- Fewer Local Agents: The limited presence of local agents could affect personalized service. For additional insights, see the article “American Family Car Insurance Review.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Extensive Network

Pros

- Extensive Network: Nationwide’s broad network of agents and service centers contributes to its status as a top provider of the best Buick Lucerne car insurance.

- 20% Multi-Vehicle Discount: A 20% discount for multiple vehicles makes Nationwide a strong choice for cost-effective Buick Lucerne car insurance.

- High A.M. Best Rating: With an A+ rating for financial strength, Nationwide ensures stable and reliable coverage for the best Buick Lucerne car insurance.

Cons

- Higher Rates for Some Drivers: Premiums can be higher for specific demographics, which may affect the affordability of the best Buick Lucerne car insurance.

- Fewer Discounts for Younger Drivers: Nationwide offers limited discount options for younger drivers. Read our article entitled “What car insurance discounts does Nationwide offer?” to know more.

#5 – Travelers: Best for Customizable Policies

Pros

- Customizable Policies: Travelers offers a range of customizable policies, making it a leading option for finding the best Buick Lucerne car insurance.

- 8% Multi-Vehicle Discount: This discount is 8% for multiple vehicles, helping to lower costs for the best Buick Lucerne car insurance.

- A.M. Best Rating: Travelers have an A++ rating for financial strength and are reliable providers of the best Buick Lucerne car insurance.

Cons

- Variable Rates: Travelers’ rates can vary based on location and driver profile, which may impact your search for the best Buick Lucerne car insurance.

- Limited Discounts for Young Drivers: The range of discounts available for younger drivers may be more limited compared to other insurers. Discover “Travelers Car Insurance Review” to learn more.

#6 – Auto-Owners: Best for Excellent Discounts

Pros

- Excellent Discounts: Auto-Owners provides numerous discounts, including a 10% discount for multiple vehicles, making it a top choice for the best Buick Lucerne car insurance.

- Customizable Coverage: Offers extensive coverage options that can be tailored to fit your needs for the best Buick Lucerne car insurance.

- High A.M. Best Rating: With an A++ rating for financial strength, Auto-Owners is known for reliable service and stability in providing the best Buick Lucerne car insurance.

Cons

- Limited Regional Availability: Auto-Owners may not be available in all states, which can limit access to the best Buick Lucerne car insurance.

- Higher Rates for Certain Profiles: Premiums may be higher for high-risk drivers, impacting the overall affordability. Discover our article entitled “Auto-Owners Car Insurance Review.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Superior Support

Pros

- Superior Support: Farmers is known for providing excellent customer support, making it a top choice for the best Buick Lucerne car insurance.

- 20% Multi-Vehicle Discount: Farmers offers a 20% discount for insuring multiple vehicles, helping lower costs for the best Buick Lucerne car insurance.

- High A.M. Best Rating: Farmers’ A rating for financial strength supports its reputation as a reliable provider of the best Buick Lucerne car insurance.

Cons

- Higher Premiums: Premiums with Farmers can be higher compared to some competitors, which may affect the overall affordability of the best Buick Lucerne car insurance.

- Limited Availability: Farmers may not be available in all regions, potentially limiting access to the best Buick Lucerne car insurance. Delve deep into our article entitled “Farmers Car Insurance Review.”

#8 – The Hartford: Best for Senior Friendly

Pros

- Senior Friendly: The Hartford offers specialized coverage options and discounts for seniors, making it a strong option for the best Buick Lucerne car insurance.

- 25% Multi-Vehicle Discount: This program provides a significant 25% discount for insuring multiple vehicles, helping you get competitive rates for the best Buick Lucerne car insurance.

- High A.M. Best Rating: With an A+ rating for financial strength, The Hartford ensures reliable coverage for the best Buick Lucerne car insurance.

Cons

- Higher Premiums: The Hartford’s premiums can be higher than those of some other insurers, which might affect affordability for the best Buick Lucerne car insurance.

- Coverage Options May Vary: The availability of coverage options can vary by region. Visit “The Hartford Car Insurance Discounts” to gain new insights on coverage options.

#9 – Progressive: Best for Innovative Options

Pros

- Innovative Options: Progressive’s innovative coverage options, like the Snapshot program, make it a strong candidate for the best Buick Lucerne car insurance.

- 12% Multi-Vehicle Discount: A 12% discount for multiple vehicles helps you secure competitive pricing for the best Buick Lucerne car insurance.

- A.M. Best Rating: Progressive’s A+ rating for financial strength supports its reliability in providing the best Buick Lucerne car insurance.

Cons

- Inconsistent Rates: Progressive’s premiums can vary widely based on individual factors, which might affect your search for the best Buick Lucerne car insurance.

- Variable Customer Service: Customer service experiences can be inconsistent, impacting overall satisfaction. Find out more about customer service at Progressive Car Insurance Review.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – State Farm: Best for Strong Reputation

Pros

- Strong Reputation: State Farm’s longstanding reputation contributes to its status as a leading provider of the best Buick Lucerne car insurance.

- 20% Multi-Vehicle Discount: State Farm offers a 20% discount for multiple vehicles, making the best Buick Lucerne car insurance more affordable.

- A.M. Best Rating: With a B rating for financial strength, State Farm remains a reliable choice for securing the best Buick Lucerne car insurance.

Cons

- Higher Premiums in Some States: Premiums may be higher in certain states, affecting the affordability of the best Buick Lucerne car insurance.

- Limited Customization: State Farm offers fewer options for customizing policies. Read our article “State Farm Car Insurance Review” to gain insights on customization.

Find Out if Buick Lucerne is Expensive to Insure

The chart below details how Buick Lucerne insurance rates compare to those of other sedans, such as the Chevrolet Malibu, Ford Focus, and Audi A3. It highlights differences in premiums based on factors such as vehicle safety ratings and repair costs.

Buick Lucerne Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $50 | $140 | |

| $48 | $135 | |

| $45 | $125 |

| $58 | $155 | |

| $60 | $160 |

| $55 | $150 |

| $51 | $138 | |

| $47 | $130 | |

| $53 | $148 |

| $52 | $145 |

However, there are a few things you can do to find the cheapest Buick insurance rates online. If you are financing a Buick Lucerne, most lenders will require you to carry higher coverage options, including comprehensive coverage.

Additionally, understanding the process of filing a car insurance claim and maintaining a clean claims history can help in securing lower rates, as a history of frequent claims can lead to higher premiums.

Factors Affecting Buick Lucerne Insurance Costs

The Buick Lucerne trim and model you choose will affect the total price you pay for insurance coverage and how it aligns with the minimum car insurance required by the State.

Buick Lucerne Car Insurance Discounts by Provider

| Insurance Company | Available Discounts |

|---|---|

| Bundling, Steer into savings, Good student, Low mileage, Loyalty, Early bird, Safe driver | |

| Bundling, Payment history, Multi-car, Safety features, Student away at school, Teen driver monitoring | |

| Bundling, Safe driver, Payment frequency, Anti-theft device, Defensive driving, Reduced usage |

| Bundling, Good student, Safe driver, Homeowner, Hybrid/electric, Anti-theft | |

| Bundling, Multi-car, Good student, Anti-theft device, Alternative energy, Accident-free, Newly married |

| Bundling, SmartRide, SmartMiles, Accident-free, Good student, Defensive driving, Anti-theft device |

| Bundling, Multi-car, Snapshot, Good student, Homeowner, Continuous insurance, Teen driver | |

| Bundling, Good student, Safe driver, Accident-free, Driver training, Anti-theft device, Good driving habits | |

| Bundling, AARP member, Safe driver, Driver training, Vehicle fuel type, Anti-theft device |

| Bundling, Multi-car, Safe driver, Continuous insurance, Homeownership, New car, Hybrid/electric car |

Remember, driving without insurance can have severe legal and financial consequences, so ensure you have the right coverage in place. It’s crucial to shop around and compare Buick Lucerne auto insurance quotes from the best companies by using our free tool below. Enter your ZIP code now.

Age of the Vehicle

The average Buick Lucerne auto insurance rates are higher for newer models due to increased vehicle value and repair costs. For example, auto insurance rates for a 2011 Buick Lucerne cost $1,258, while rates for a 2010 Buick Lucerne are $1,228, a difference of $30.

Buick Lucerne Car Insurance Monthly Rates vs. Model Year by Coverage Type

| Vehicle | Liability | Comprehensive | Collision | Full Coverage |

|---|---|---|---|---|

| 2024 Buick Lucerne | $38 | $19 | $34 | $105 |

| 2023 Buick Lucerne | $39 | $19 | $32 | $102 |

| 2022 Buick Lucerne | $38 | $18 | $30 | $101 |

| 2021 Buick Lucerne | $36 | $18 | $29 | $99 |

Over time, this slight increase can add up, making older models more appealing for those looking to save on insurance, especially when considering the overall cost of vehicle ownership.

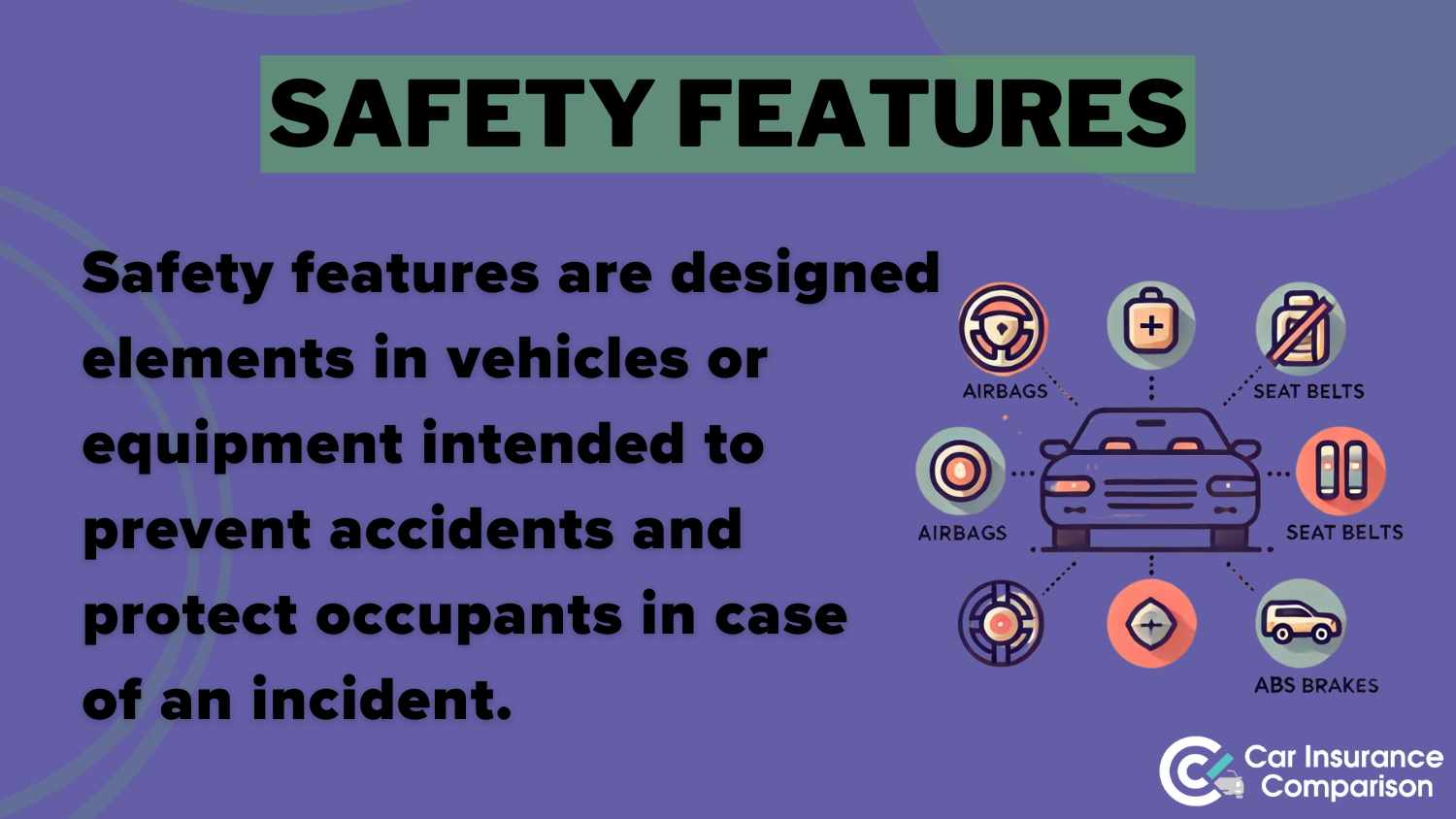

Buick Lucerne Safety Features

Most drivers don’t realize that not only do Buick Lucerne safety features play a vital role in keeping passengers safe in crashes, but they can also help lower Buick Lucerne auto insurance rates.

The Buick Lucerne’s safety features include: The vehicle is equipped with advanced safety features, including driver and passenger airbags, front and rear head airbags, front side airbags, 4-wheel ABS, 4-wheel disc brakes, brake assist, electronic stability control, daytime running lights, child safety locks, and traction control.

These features enhance the vehicle’s safety and can reduce insurance premiums. Additionally, having such comprehensive safety equipment can minimize the risk of severe accidents, further contributing to cost savings on your insurance policy.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Top Buick Lucerne Insurance Companies

Who is the best auto insurance company for Buick Lucerne insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Buick Lucerne auto insurance coverage (ordered by market share).

Whether you are buying car insurance for your new car or renewing an existing policy, many of these companies offer discounts for security systems and other safety features that the Buick Lucerne offers, which can help lower your Buick Lucerne car insurance rates.

Buick Lucerne Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | $66,153,063 | 9% | |

| #2 | $46,358,896 | 6% | |

| #3 | $41,737,283 | 6% | |

| #4 | $39,210,020 | 5% | |

| #5 |  | $36,172,570 | 5% |

| #6 | $28,786,741 | 4% | |

| #7 | $24,621,246 | 3% | |

| #8 | $24,199,582 | 3% | |

| #9 | $20,083,339 | 3% | |

| #10 |  | $18,499,967 | 3% |

Additionally, features like anti-lock brakes and airbags may qualify you for further savings, making your insurance costs more manageable. Always check with your provider to ensure you’re taking full advantage of available discounts for your Buick Lucerne.

Compare Free Buick Lucerne Insurance Quotes Online

Read on to learn about the various aspects of car insurance that affect the Buick Lucerne cost. The first thing a car insurance company looks at is the make and model of the car being insured.

Additionally, they consider factors such as previous car insurance claims, which can impact the overall cost of coverage. If the vehicle has a history of frequent claims, it may result in higher premiums.

Every insurance company must determine the market value of the car at the time it is being insured. Some use the Kelley Blue Book along with other well-known resources.

Your insurance premium does not decrease proportionally with your vehicle’s retail value; it is based on the value when the car was first insured.

The Buick Lucerne is considered an entry-level luxury car, with repair costs slightly higher than those of less expensive models. Enter your ZIP code now to find out the prices and save money.

Safety Ratings for a Buick Lucerne

Safety ratings play an important part in insurance costs for any vehicle. The insurance company must weigh the risk of bodily injury that could result in a claim against it.

To find the best rates, it’s crucial to know the average monthly car insurance payment from different providers. Those with higher safety ratings often benefit from lower premiums due to reduced risk.

Schimri Yoyo Licensed Agent & Financial Advisor

Owners of the Buick Lucerne can take comfort in knowing it has very high safety ratings, which not only provide peace of mind but can also lower insurance premiums.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How can I compare insurance rates for a Buick Lucerne?

To compare insurance rates for a Buick Lucerne, you can follow these steps:

- Gather details about your Buick Lucerne, including its make, model, and features.

- Research and select reputable insurance providers in your area.

- Obtain and compare quotes using online tools or by contacting insurers directly.

- Review coverage options, deductibles, and limits from different providers.

- Check for available discounts and assess customer reviews before making a decision.

By carefully comparing quotes and coverage options, you can find the ideal insurance provider for your Buick Lucerne.

What factors can affect Buick Lucerne’s car insurance rates?

Several factors can influence the cost of car insurance for a Buick Lucerne, including:

- Age, driving experience, and driving record of the primary driver

- Location, parking situation, and annual mileage

- Vehicle make, model, year, and installed safety features

- Insurance coverage limits, deductibles, and repair costs

- Credit history and overall claims history of the insurance company

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Are there any specific discounts available to ensure a Buick Lucerne?

Yes, insurance companies may offer various discounts that can help reduce the cost of insuring a Buick Lucerne. Common discounts include:

- Safe driver discount for a clean driving record

- Multi-policy discount for bundling with other insurance policies

- Anti-theft device discount for installed security features

- Good student discount for students with high grades

- Low mileage discount for infrequent driving

Understanding the difference between collision vs. comprehensive coverage can also help you choose the best policy and maximize your savings.

Are Buick Lucerne car insurance rates generally high or low?

The cost of insurance for a Buick Lucerne can vary depending on multiple factors, including the ones mentioned earlier.

The Buick Lucerne is generally a midsize sedan known for its safety features and comfort, which can potentially lower insurance rates.

However, the specific insurance rates will depend on factors such as the driver’s profile, location, coverage options, and the insurance company’s individual pricing algorithms.

To get accurate insurance rates, it’s recommended to obtain quotes from multiple insurance providers.

Can I get insurance coverage for a leased or financed Buick Lucerne?

Yes, insurance coverage is generally required for a leased or financed Buick Lucerne. Leasing companies and lenders typically require comprehensive collision coverage to protect their investment in the vehicle.

Check the specific insurance requirements outlined in your lease or financing agreement to ensure you have the necessary coverage. Enter your ZIP code now to receive a personalized quote and find the best insurance options for you.

How can I reduce my Buick Lucerne insurance premiums?

To reduce your Buick Lucerne insurance premiums, you can take advantage of discounts for multi-vehicle policies, safe driving records, and anti-theft devices.

Increasing your deductible can also lower your monthly premium, and bundling your auto insurance with other types of insurance through the same provider may result in savings.

Additionally, improving your credit score and regularly comparing quotes from different insurers can help you find the best rates, including competitive options for liability car insurance coverage.

What factors affect the cost of insurance for a Buick Lucerne?

Several factors affect the cost of insurance for a Buick Lucerne, including the driver’s age and driving history, location, coverage options, vehicle safety features, and annual mileage.

Younger drivers or those with a history of accidents may face higher premiums, while insurance rates can vary based on where you live.

Your insurance costs will also be influenced by the type and amount of coverage you choose, the safety features of your vehicle, and how much you drive.

Is it worth adding comprehensive coverage for a Buick Lucerne?

Adding comprehensive coverage to your Buick Lucerne policy can be worthwhile, mainly if the vehicle’s value justifies it or if you want peace of mind with additional protection.

Comprehensive coverage is beneficial if your vehicle is relatively new or valuable. It provides protection against theft, vandalism, and natural disasters.

It’s also worth considering if you live in a high-risk area prone to severe weather or high theft rates. Enter your ZIP code now to get tailored insurance quotes and discover the best coverage options available to you.

Can I get insurance for a Buick Lucerne if I have a bad driving record?

Yes, you can still get insurance for a Buick Lucerne with a bad driving record, but you should expect to pay higher premiums due to the increased risk.

Insurance options may be limited, and some insurers might offer only basic coverage or impose higher car insurance deductibles. It may also be helpful to seek out insurers that specialize in high-risk drivers or offer non-standard policies.

What should I do if my Buick Lucerne is involved in an accident?

If your Buick Lucerne is involved in an accident, ensure everyone’s safety first. If possible, move to a safe location. Contact the police to report the accident and obtain an official report.

Exchange contact and insurance information with the other party involved, document the scene by taking photos of the damage and accident scene and notify your insurance company as soon as possible to start the claims process.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.