Best BMW Z3 Car Insurance in 2025 (Find the Top 10 Companies Here)

Discover why State Farm, Geico, and Allstate are the top picks for the best BMW Z3 car insurance, with rates beginning at just $25 monthly. This guide details why these companies are highly favored, offering exceptional coverage and value, ensuring optimal insurance solutions for BMW Z3 owners.

Read more

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jul 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for BMW Z3

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for BMW Z3

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for BMW Z3

A.M. Best Rating

Complaint Level

Pros & Cons

The best BMW Z3 car insurance picks are State Farm, Geico, and Allstate, known for their exceptional coverage options and customer service.

This article provides an in-depth look at why these providers stand out in the competitive market of luxury car insurance. See more details in our guide titled, “What is the best car insurance?”

Our Top 10 Company Picks: Best BMW Z3 Car Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 25% A++ Competitive Rates Geico

#3 10% A+ Comprehensive Coverage Allstate

#4 20% A+ Online Tools Progressive

#5 10% A++ Military Families USAA

#6 15% A Customizable Options Farmers

#7 20% A+ Coverage Options Nationwide

#8 12% A Flexible Policies Liberty Mutual

#9 15% A Teen Drivers American Family

#10 13% A++ Claims Process Travelers

We will explore the factors that affect insurance costs for the BMW Z3 and discuss ways to secure the most beneficial terms for your policy. By understanding what makes these companies the best choice, you can make an informed decision tailored to your specific needs. To see fast, free BMW Z3 insurance quotes right now, just enter your ZIP code above.

- State Farm leads as the top choice for the best BMW Z3 car insurance

- Tailored coverage options cater specifically to the needs of BMW Z3 owners

- Specialized policies address the unique aspects of insuring a luxury convertible

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for BMW Z3 owners who bundle their car insurance with other policies. Unlock details in our State Farm car insurance review.

- High Low-Mileage Discount: Owners of BMW Z3s benefit from substantial low-mileage discounts, ideal for luxury cars often used sparingly.

- Wide Coverage Options: BMW Z3 drivers can choose from a range of coverage options, tailored to the specific needs of luxury sports cars.

Cons

- Limited Multi-Policy Discount: Compared to competitors, State Farm’s multi-policy discount of 17% may be less appealing for BMW Z3 owners.

- Higher Premium Costs: Despite various discounts, State Farm’s premiums may still be relatively high for BMW Z3 owners seeking comprehensive coverage.

#2 – Geico: Best for Competitive Rates

Pros

- Aggressive Multi-Policy Discounts: Geico offers a 25% discount for BMW Z3 owners who bundle their policies, one of the highest in the industry.

- Excellent Financial Strength: With an A++ A.M. Best rating, Geico ensures reliable claims processing for BMW Z3 insurance. Learn more in our complete guide, “Geico Car Insurance Review.”

- Competitive Pricing: Geico is known for offering some of the most competitive rates for BMW Z3 car insurance, making it a cost-effective choice.

Cons

- Average Customer Service: Geico’s customer service ratings are not as high as those of some competitors, which might concern BMW Z3 owners.

- Less Personalized Service: Geico’s largely automated services may offer less personal attention compared to smaller insurers that might appeal to BMW Z3 car owners.

#3 – Allstate: Best for Comprehensive Coverage

Pros

- Broad Coverage: Allstate provides extensive coverage options that cater well to the comprehensive needs of BMW Z3 owners. Discover more about offerings in our Allstate car insurance review.

- Strong Financial Stability: With an A+ rating from A.M. Best, Allstate is a dependable choice for BMW Z3 owners requiring assured claim support.

- Tailored Insurance Solutions: Allstate offers specialized insurance solutions that can be customized for the unique requirements of BMW Z3 vehicles.

Cons

- Higher Premiums: Allstate’s premiums might be on the higher side, particularly for BMW Z3 owners looking for full coverage options.

- Lower Multi-Policy Discount: The 10% multi-policy discount might be less attractive to BMW Z3 owners compared to other providers with higher discounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Online Tools

Pros

- Innovative Online Resources: Progressive offers advanced online tools that simplify the insurance process for BMW Z3 owners.

- Generous Multi-Policy Discount: With a 20% discount for bundling, BMW Z3 drivers can significantly reduce their insurance costs.

- Strong Online Claims Process: Progressive excels in an efficient online claims process, suitable for tech-savvy BMW Z3 owners. Delve into our evaluation of Progressive car insurance review.

Cons

- Variable Premiums: BMW Z3 owners might find Progressive’s premiums fluctuate more than those of insurers with more stable pricing.

- Less Tailored Coverage: While Progressive is strong online, its coverage options might not be as customized for the specific needs of luxury cars like the BMW Z3.

#5 – USAA: Best for Military Families

Pros

- Exceptional Rates for Military: USAA offers outstanding rates and discounts for BMW Z3 owners who are military personnel or their families.

- Highest Financial Rating: With an A++ rating from A.M. Best, USAA promises excellent reliability and claims service for BMW Z3 insurance. Unlock details in our USAA car insurance review.

- Dedicated Military Benefits: Specialized services and benefits are available for BMW Z3 owning military families, adding value beyond standard policies.

Cons

- Limited Eligibility: USAA’s services are only available to military members and their families, and not accessible to the BMW Z3 car owners.

- Specific Focus: While highly beneficial for its niche market, USAA’s tailored approach might not meet the broader needs of non-military BMW Z3 owners.

#6 – Farmers: Best for Customizable Options

Pros

- Highly Customizable Policies: Farmers offers a wide range of customization options that appeal to BMW Z3 owners who desire tailored coverage.

- Dedicated Agents: Personal service through dedicated agents helps BMW Z3 owners find the perfect match for their insurance needs.

- Competitive Multi-Policy Discounts: At 15%, Farmers’ multi-policy discounts can provide substantial savings for BMW Z3 drivers. Learn more in our Farmers car insurance review.

Cons

- Higher Cost for Custom Features: Customizing insurance policies with Farmers can lead to higher costs, potentially offsetting the benefits of multi-policy discounts for BMW Z3 drivers.

- Average Financial Rating: Farmers’ A rating from A.M. Best is solid, but BMW Z3 owners might prefer insurers with higher financial stability.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Coverage Options

Pros

- Extensive Coverage Selection: Nationwide offers a diverse array of coverage options, meeting the varied needs of BMW Z3 owners.

- Strong Multi-Policy Discounts: A 20% discount for bundling policies makes Nationwide a financially appealing option for BMW Z3 insurance. Check out insurance savings in our complete Nationwide car insurance discount.

- Dedicated Claims Service: Nationwide provides dedicated claims service, ensuring BMW Z3 owners receive focused and efficient support.

Cons

- Inconsistent Pricing: Some BMW Z3 owners may find Nationwide’s pricing less predictable than other insurers.

- Complex Policy Options: The wide range of options can be overwhelming and may require more time for BMW Z3 owners to find the ideal coverage.

#8 – Liberty Mutual: Best for Flexible Policies

Pros

- Flexible Policy Options: Liberty Mutual offers a variety of flexible policies that can be tailored to the specific needs of BMW Z3 owners.

- Dedicated Support: Personalized customer service ensures that BMW Z3 owners receive guidance that’s as premium as their vehicle. Read up on the Liberty Mutual car insurance review for more information.

- Adaptive Discounts: Liberty Mutual provides adaptable discounts that can benefit BMW Z3 owners based on driving habits and safety features.

Cons

- Variable Rate Consistency: Some BMW Z3 owners may find that Liberty Mutual’s rates vary more than those of other insurers.

- Premiums on the Higher End: While flexible, the coverage options can come with higher premiums, which might be a concern for budget-conscious BMW Z3 owners.

#9 – American Family: Best for Teen Drivers

Pros

- Teen-Friendly Policies: American Family offers specific benefits and discounts for families with teen drivers of BMW Z3s, promoting safe driving habits.

- Enhanced Safety Discounts: Discounts for safety features on BMW Z3s that are often used by teens can lead to significant savings. See more details on our American Family car insurance review.

- Supportive Educational Tools: Resources and tools that help teen BMW Z3 drivers learn about safe driving and insurance management are readily available.

Cons

- Focused on Family Needs: While excellent for families with teens, American Family’s offerings might not be as attractive to other BMW Z3 owners.

- Limited Customization for Luxury Cars: The customization options for coverage might not fully meet the luxury-specific needs of BMW Z3 owners without teen drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Claims Processing

Pros

- Efficient Claims Process: Travelers is known for its streamlined and effective claims process, which is ideal for BMW Z3 owners who value efficiency.

- Competitive Discounts for Safe Drivers: BMW Z3 owners who maintain a safe driving record can benefit greatly from Travelers’ discounts. See more details in our guide, “Travelers Car Insurance Review.”

- Robust Policy Options: Travelers offers robust policy options that provide comprehensive coverage for the unique aspects of owning a BMW Z3.

Cons

- Higher Pricing for Comprehensive Plans: Comprehensive coverage plans for BMW Z3s at Travelers can be costly, especially for those seeking extensive protection.

- Complexity in Policy Details: Some BMW Z3 owners might find the details of Travelers’ policies complex, requiring careful review to understand fully.

BMW Z3 Insurance Rate Comparison

The table below offers a clear snapshot of monthly car insurance premiums for a BMW Z3, broken down by coverage level and provider. It presents both minimum and full coverage options, allowing BMW Z3 owners to compare potential costs across different insurers.

BMW Z3 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $40 $135

American Family $34 $118

Farmers $38 $130

Geico $30 $100

Liberty Mutual $37 $125

Nationwide $32 $110

Progressive $28 $115

State Farm $35 $120

Travelers $36 $122

USAA $25 $90

For BMW Z3 owners looking for economical options, USAA presents the lowest monthly rate for full coverage at $90, while Progressive offers the least expensive minimum coverage at $28.

On the higher end, Allstate charges $135 for full coverage, illustrating a broader range in premium costs based on coverage depth. This variance highlights the importance of assessing both the extent of coverage and the financial outlay when selecting an insurance provider for a BMW Z3.

Comparing these rates ensures that owners can find a balance between cost and coverage that suits their specific needs and budget. Discover insights in our guide titled, “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

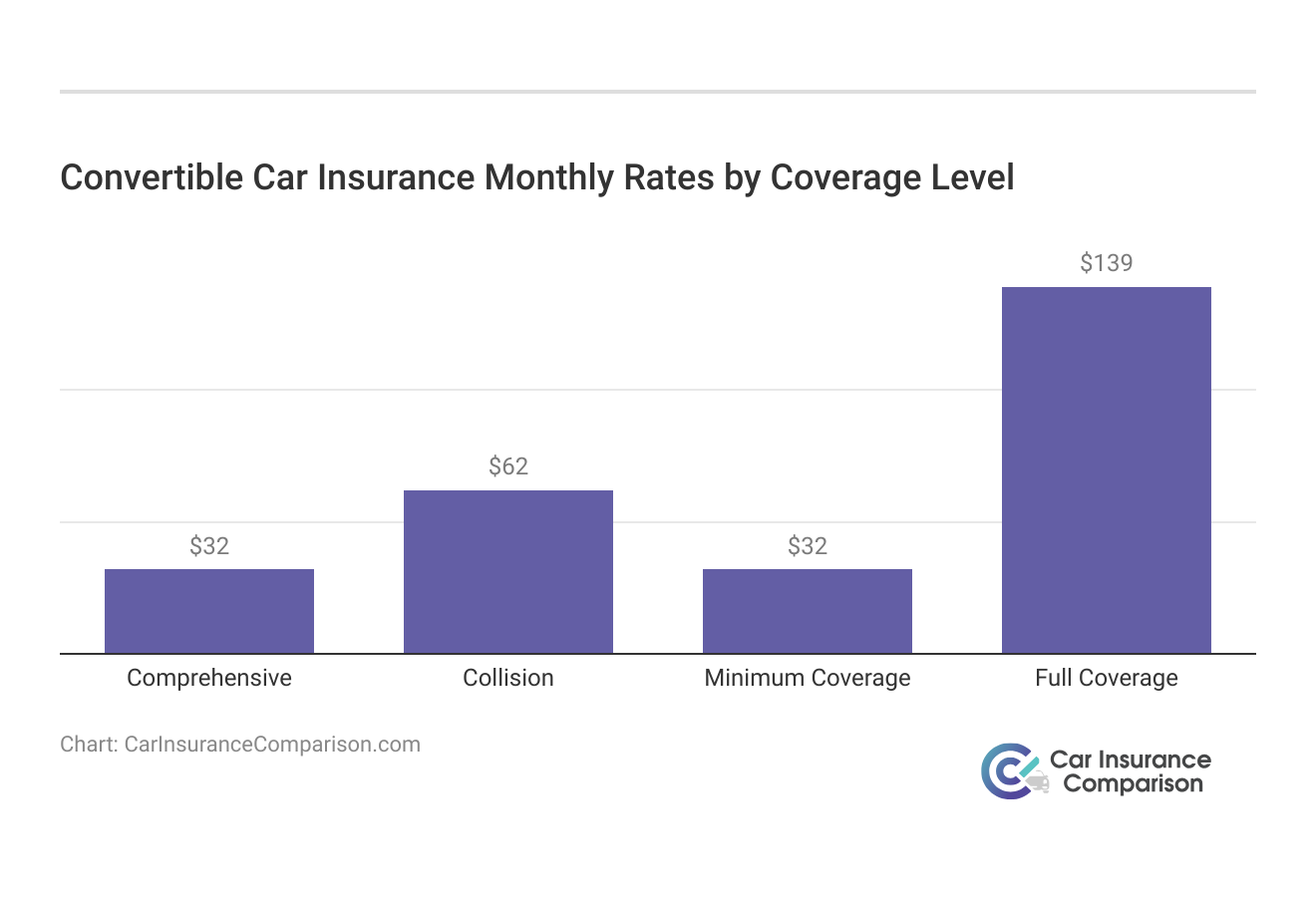

Are Vehicles Like the BMW Z3 Expensive to Insure

Insurance costs can vary significantly for luxury convertibles, and understanding these differences is crucial when considering a vehicle like the BMW Z3. See more details on our “How do you get competitive quotes for car insurance?“

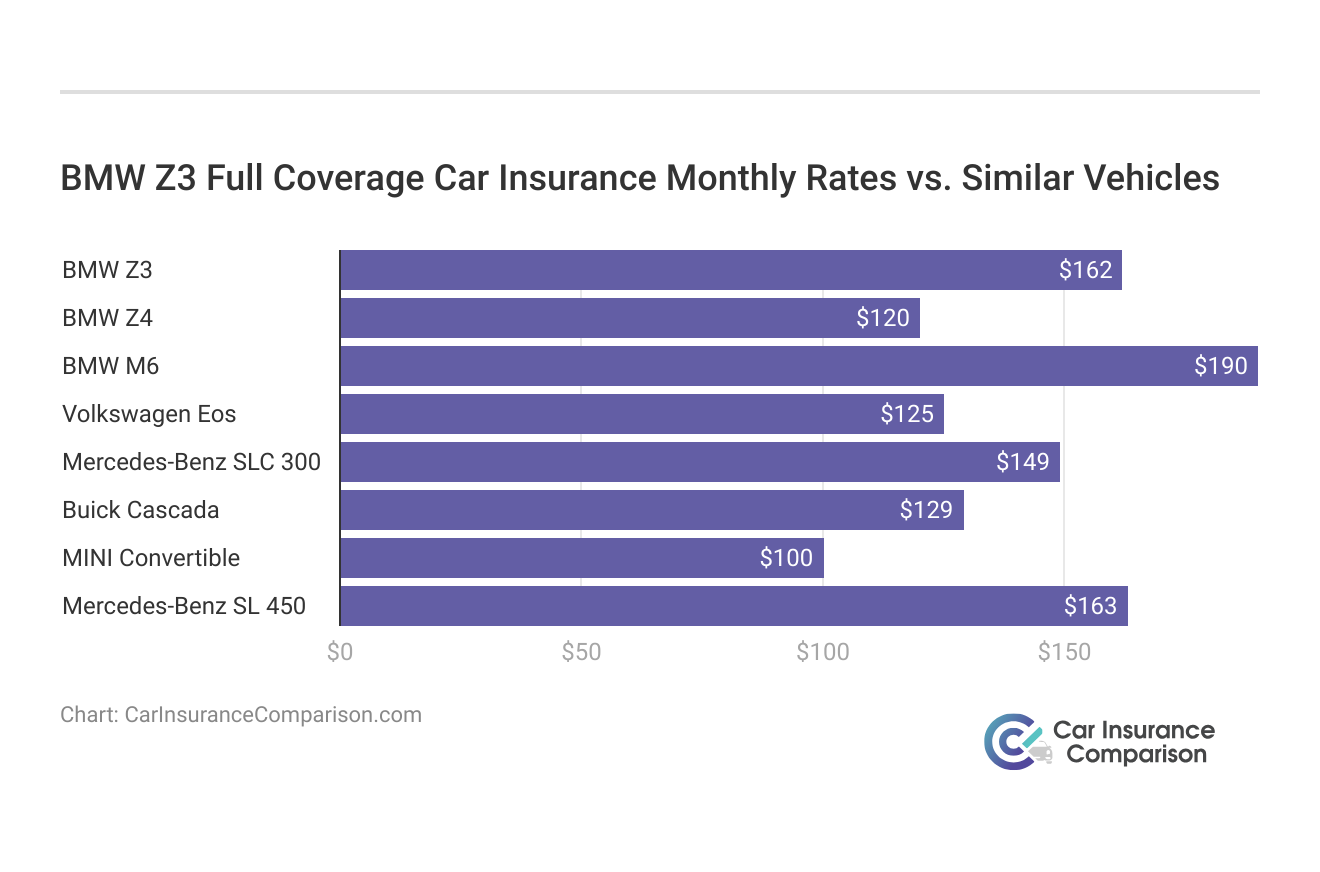

By examining the insurance rates for models similar to the BMW Z3, such as the Infiniti Q60 Convertible, Mercedes-Benz SLC 300, and Toyota MR2 Spyder, potential owners can better anticipate the financial aspects of insuring a luxury convertible.

The data illustrates a diverse range of insurance costs for luxury vehicles, with the BMW Z3 positioned near the upper end of the spectrum.

Such insights help prospective and current owners make informed decisions about the potential insurance expenses associated with different high-end cars.

Insurance Rates for Vehicles Similar to the BMW Z3

This comparison chart delves into the insurance rates for vehicles akin to the BMW Z3, breaking down the costs into comprehensive, collision, minimum, and full coverage categories for each model.

BMW Z3 Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Mercedes-Benz SL 450 | $40 | $77 | $33 | $163 |

| BMW Z3 | $28 | $54 | $35 | $162 |

| BMW Z4 | $28 | $51 | $30 | $120 |

| Buick Cascada | $28 | $55 | $33 | $129 |

| BMW M6 | $43 | $94 | $38 | $190 |

| Mercedes-Benz SLC 300 | $36 | $67 | $33 | $149 |

| Volkswagen Eos | $25 | $44 | $36 | $118 |

| MINI Convertible | $25 | $45 | $22 | $100 |

Analyzing these figures provides a clearer picture of how the BMW Z3’s insurance rates compare to similar vehicles, aiding consumers in evaluating the financial implications of insuring various luxury and performance cars.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of BMW Z3 Insurance

The average annual rate for the BMW Z3 is just that, an average. Your insurance rates for a BMW Z3 can be higher or lower depending on the trim level and personal factors.

Those factors include your age, home address, driving history, and the model year of your BMW Z3. To find out more, explore our guide titled, “Factors That Affect Car Insurance Rates.”

Ways to Save on BMW Z3 Insurance

Securing affordable car insurance for a BMW Z3 doesn’t have to be a challenge. By exploring various strategies, you can potentially lower your premiums and enjoy significant savings.

- Ask about welcome discounts.

- Don’t assume your BMW Z3 is cheaper to insure than another vehicle.

- Use an accurate job title when requesting BMW Z3 auto insurance.

- Consider renting a car instead of buying a second BMW Z3.

- Tell your insurer how you use your BMW Z3.

Implementing these tips can lead to more affordable insurance rates for your BMW Z3, enhancing the overall ownership experience. Being proactive about exploring discounts and accurately presenting your situation to insurers are key steps in achieving the best possible insurance terms. Access comprehensive insights into our guide titled, “What makes car insurance more expensive?“

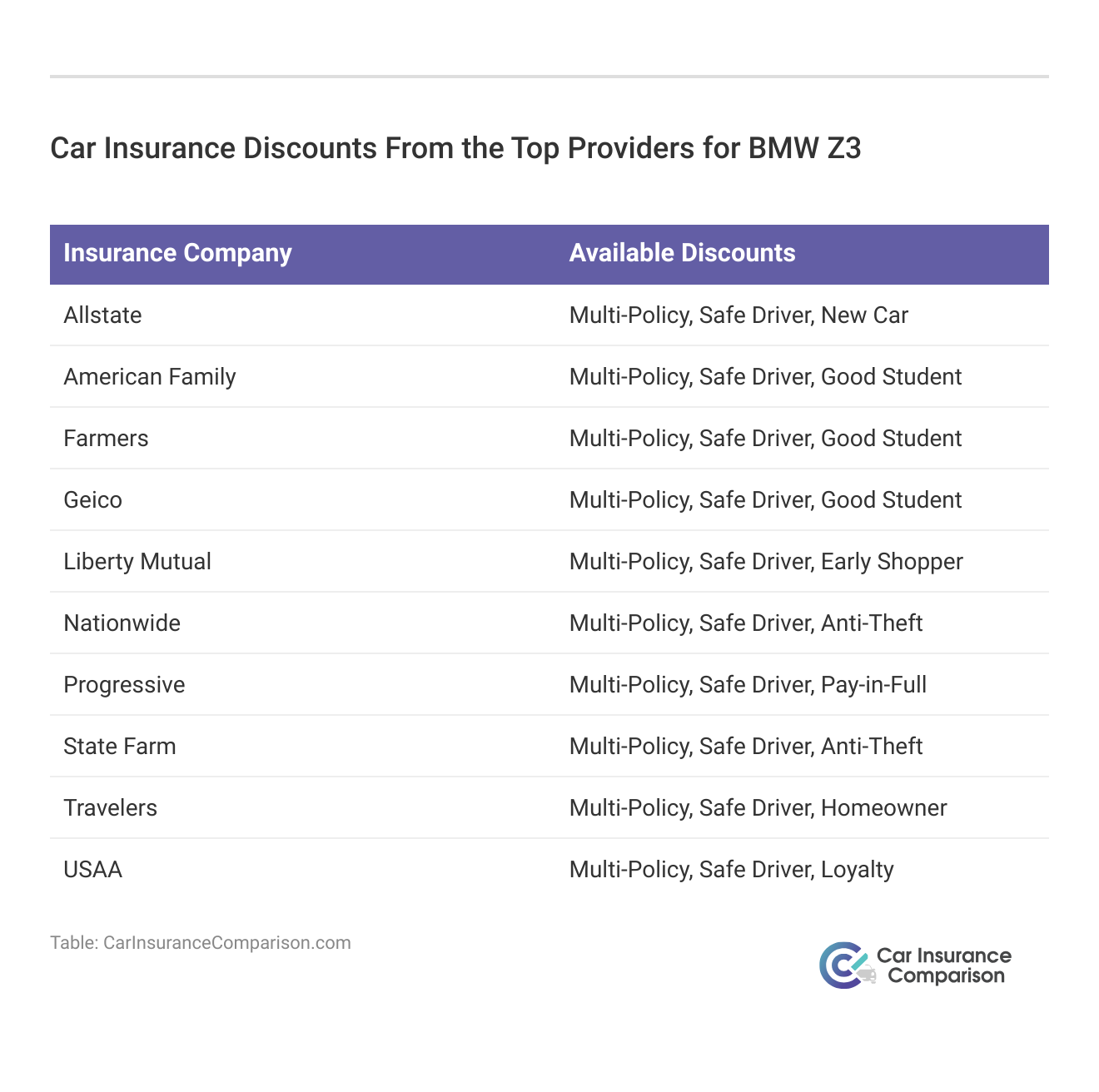

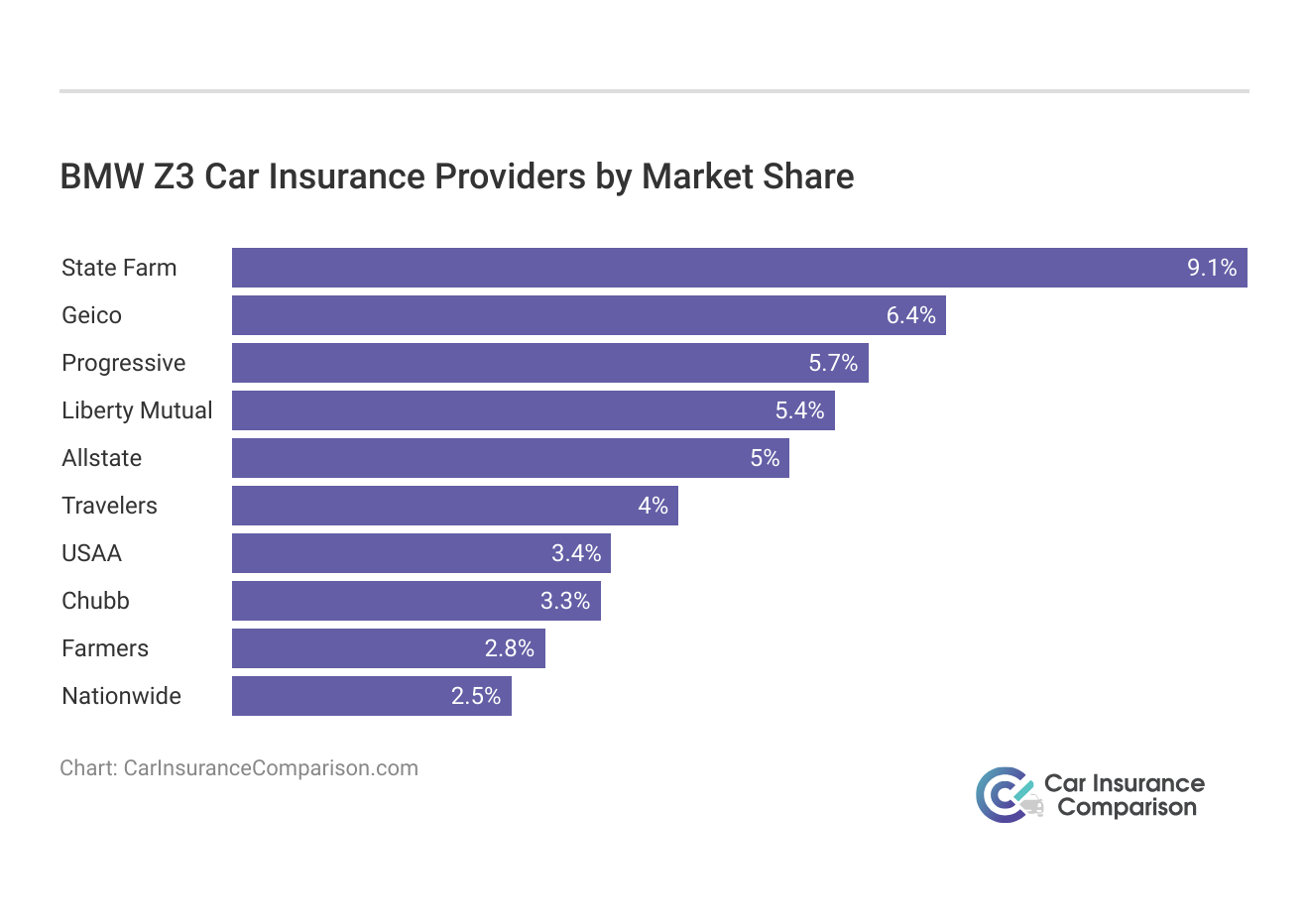

Top BMW Z3 Insurance Companies

Several insurance companies offer competitive rates for the BMW Z3 based on factors like discounts for safety features. Take a look at these best car insurance companies that are popular with BMW Z3 drivers organized by market share.

Selecting from the top insurance providers for the BMW Z3 allows you to benefit from the best rates and discounts tailored specifically to the needs of luxury car owners.

For BMW Z3 owners looking for reliability, State Farm's exceptional customer service provides unparalleled support.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

It’s important to consider each company’s market share and reputation to ensure you get the most value from your insurance policy.

Largest Auto Insurers by Market Share

Understanding the market share of the largest auto insurers provides valuable insights into which companies dominate the BMW Z3 car insurance landscape. Here’s a detailed breakdown of the top providers by their share of the market and premiums written.

Top BMW Z3 Car Insurance Providers by Market Share

| Rank | Insurance Company | Premium Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9.1% |

| #2 | Geico | $46.3 million | 6.4% |

| #3 | Progressive | $41.7 million | 5.7% |

| #4 | Liberty Mutual | $39.2 million | 5.4% |

| #5 | Allstate | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3.4% |

| #8 | Chubb | $24.1 million | 3.3% |

| #9 | Farmers | $20.0 million | 2.8% |

| #10 | Nationwide | $18.4 million | 2.5% |

This list of the largest auto insurers by market share illustrates the competitive positions of key players in the BMW Z3 insurance sector. Analyzing this data helps BMW Z3 owners identify which insurers are the most influential and possibly the most reliable in the market. Save money by comparing BMW Z3 insurance rates with our free quotes online tool below now.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Are BMW Z3 cars expensive to insure?

Insurance rates for BMW Z3 cars can vary based on factors like driving history, location, and vehicle trim level. Learn more in our guide titled, “Cheap Car Insurance.”

What factors affect BMW Z3 insurance rates?

Factors that impact BMW Z3 insurance rates include driving history, location, and the specific trim level of the vehicle.

How can I save on BMW Z3 insurance?

You can save on BMW Z3 insurance by comparing quotes, maintaining a good driving record, and taking advantage of available discounts. Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Which insurance companies offer competitive rates for BMW Z3?

Several insurance companies offer competitive rates for BMW Z3 based on factors like safety feature discounts. Comparing quotes can help you find the best option.

How can I compare BMW Z3 insurance quotes online?

You can compare BMW Z3 insurance quotes online for free by using online quote tools that provide quotes from multiple companies. To find out more, explore our guide titled, “Is it cheaper to purchase car insurance online?“

What insurance group is a BMW Z3?

The BMW Z3 typically falls into higher insurance groups due to its classification as a sports car with performance capabilities.

How much is the road tax for a BMW Z3?

Road tax for the BMW Z3 varies depending on the engine size and emissions, with rates generally higher due to its sports car status.

Are BMW Z3s expensive to insure?

Insuring a BMW Z3 can be costly due to its classification as a sports car, which generally carries higher insurance premiums.

What factors affect the insurance costs for a BMW Z3?

Insurance costs for the BMW Z3 are influenced by factors such as the car’s age, engine size, repair costs, and the driver’s history. Delve into our evaluation of “What affects a car insurance quote?”

Is it worth getting comprehensive insurance on a BMW Z3?

Given the BMW Z3’s value as a potential classic and its cost to repair, comprehensive insurance is generally recommended to protect against all types of physical damage.

What are common insurance claims for the BMW Z3?

Common insurance claims for the BMW Z3 include bodywork damage from accidents, theft of the vehicle, and windshield damage.

How can I reduce my BMW Z3 insurance costs?

Reducing insurance costs for a BMW Z3 can involve increasing the deductible, maintaining a clean driving record, and utilizing car safety features.

Does the BMW Z3 qualify for classic car insurance?

As the BMW Z3 ages and becomes more collectible, it may qualify for classic car insurance, which can offer specialized coverage at potentially lower rates. To learn more, explore our comprehensive resource on “Cheap Car Insurance for Older Vehicles.”

Are there specific insurers known for good rates on BMW Z3 insurance?

Certain insurers are known to provide competitive rates for sports cars like the BMW Z3; shopping around and comparing quotes is advisable.

What should I look for in a policy when insuring a BMW Z3?

When insuring a BMW Z3, look for policies that offer adequate coverage for collisions, theft, and potential repairs, which can be costly for such a vehicle.

What is the impact of modifications on BMW Z3 insurance rates?

Modifying a BMW Z3, such as performance enhancements or custom bodywork, can increase insurance rates due to higher repair costs and theft risk.

How does the BMW Z3’s safety rating affect insurance costs?

The safety rating of the BMW Z3 can impact insurance costs; a higher safety rating typically leads to lower premiums due to reduced injury risk in an accident. To find out more, explore our guide titled, “Finding Free Car Insurance Quotes Online.”

What discounts are available for BMW Z3 insurance?

Discounts for BMW Z3 insurance might include multi-car discounts, anti-theft device installations, and safe driver programs.

Can the BMW Z3’s insurance premium vary by location?

Yes, insurance premiums for the BMW Z3 can vary significantly by location, influenced by local crime rates, weather conditions, and the frequency of claims in the area.

What are the benefits of adding roadside assistance to my BMW Z3 insurance policy?

Adding roadside assistance to your BMW Z3 insurance policy provides benefits like towing, flat tire service, and emergency fuel delivery, which are valuable for a sports car that may be driven on longer trips. Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.