Best Audi A5 Sportback Car Insurance in 2025 (Check Out the Top 10 Companies)

Explore the best Audi A5 Sportback car insurance with top providers State Farm, Geico, and Progressive, offering rates from $40 per month. These companies provide great coverage and competitive pricing for Audi A5 insurance. Compare quotes to secure the best deal for your Audi A5 Sportback.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Audi A5 Sportback

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Audi A5 Sportback

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Audi A5 Sportback

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, Geico, and Progressive offer the best Audi A5 Sportback car insurance rates, starting at $40 per month. State Farm stands out as the top pick for its competitive rates and comprehensive coverage. For optimal Audi A5 insurance, these providers deliver the best value.

The article also delves into how factors like safety ratings and trim levels impact your car insurance premium. It offers insights into adjusting coverage based on the Audi A5 Sportback’s features and compares rates for similar models to help you make an informed choice.

Our Top 10 Company Picks: Best Audi A5 Sportback Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Reliable Rates State Farm

#2 25% A++ Affordable Rates Geico

#3 20% A+ Customizable Plans Progressive

#4 10% A+ New Drivers Allstate

#5 10% A++ Military Families USAA

#6 15% A Personal Service Farmers

#7 12% A Coverage Options Liberty Mutual

#8 20% A+ Claims Process Nationwide

#9 13% A++ Customer Support Travelers

#10 15% A Young Drivers American Family

Our free online comparison tool above allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

- Best Audi A5 Sportback insurance starts at $40 per month

- Learn how safety features impact your Audi A5 rates

- State Farm provides top coverage and rates for Audi A5 owners

#1 – State Farm: Top Pick Overall

Pros

- Affordable Premiums: State Farm offers competitive rates for Audi A5 Sportback drivers at approximately $125 per month, which is among the more economical options for this luxury vehicle. More information about their rates in our State Farm car insurance review.

- Comprehensive Coverage Options: State Farm provides a variety of coverage options specifically tailored for the Audi A5 Sportback owners, including comprehensive and collision coverage that ensures robust protection for your vehicle.

- Discounts for Safe Driving: State Farm offers significant discounts for safe driving records, which can be beneficial for maintaining lower premiums on your Audi A5 Sportback policies, especially if you have a clean driving history.

Cons

- Limited High-End Vehicle Discounts: While State Farm provides good rates, it may offer fewer discounts for high-end luxury vehicles like the Audi A5 Sportback compared to some competitors.

- Customer Service Variability: Customer service experiences can vary with State Farm, which might impact the overall satisfaction with Audi A5 Sportback owners, especially if you require frequent assistance or claims support.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Low Monthly Premiums: Geico offers some of the lowest premiums for Audi A5 Sportback owners, with rates starting at about $110 per month, making it a budget-friendly option. Learn more in our Geico car insurance review.

- Excellent Online Tools: Geico provides a robust online platform for managing your Audi A5 Sportback, including easy access to policy details and claims management through their user-friendly website and mobile app.

- Strong Customer Satisfaction: Geico has a reputation for high customer satisfaction, which is beneficial when dealing with Audi A5 Sportback insurance claims, ensuring a positive experience in terms of service and support.

Cons

- Limited Local Agent Availability: Geico’s emphasis on online service means fewer local agents are available, which might be a drawback for those seeking personalized service for their Audi A5 Sportback.

- Higher Rates for Younger Drivers: Geico’s rates for younger drivers might be higher, potentially impacting the affordability of the Audi A5 Sportback for younger policyholders.

#3 – Progressive: Best for Customizable Plans

Pros

- Customizable Coverage Options: Progressive offers a wide range of customizable Audi A5 Sportback coverage options, allowing you to tailor your policy to meet specific needs and preferences.

- Snapshot Program Discounts: Progressive’s Snapshot program can provide discounts based on your driving habits, which can help reduce costs for Audi A5 Sportback owners if you demonstrate safe driving.

- Strong Claims Handling: Progressive is known for efficient claims handling, which is advantageous for Audi A5 Sportback claims processing, ensuring timely and effective resolution of any issues. Learn more details in our Progressive car insurance review.

Cons

- Potentially Higher Costs for High-Risk Drivers: Progressive may have higher rates for Audi A5 Sportback drivers with a history of accidents or violations.

- Complex Policy Options: The wide range of options and add-ons available through Progressive might be overwhelming, making it challenging to select the most appropriate coverage for the Audi A5 Sportback.

#4 – Allstate: Best for New Drivers

Pros

- Extensive Coverage Choices: As mentioned in our Allstate car insurance review, Allstate offers a broad range of Audi A5 Sportback coverage options, including additional protection for luxury features and comprehensive coverage plans.

- Multi-Policy Discounts: Allstate provides discounts for bundling multiple policies, which can help reduce the overall cost of the Audi A5 Sportback if you also insure other vehicles or properties with them.

- High Customer Satisfaction: Allstate is known for its high level of customer satisfaction, which can enhance your experience with the Audi A5 Sportback, ensuring responsive support and service.

Cons

- Higher Premiums: Allstate’s premiums for the Audi A5 Sportback are generally higher, with rates starting around $140 per month, which may be less competitive compared to other insurers.

- Varied Customer Service Experiences: While Allstate offers good coverage, customer service quality can vary depending on the local agency, potentially impacting your experience with the Audi A5 Sportback.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Families

Pros

- Competitive Pricing: USAA offers competitive rates for the Audi A5 Sportback at approximately $120 per month, often resulting in lower premiums for eligible members. Learn more in our USAA car insurance review.

- Excellent Service for Military Families: USAA provides exceptional service and benefits for military families, which can enhance the value of the Audi A5 Sportback for eligible members.

- Comprehensive Coverage Options: USAA offers a wide array of coverage options for Audi A5 Sportback owners, ensuring you can customize your policy to fit your specific needs.

Cons

- Eligibility Restrictions: USAA is only available to military members and their families, limiting access to Audi A5 Sportback owners outside of this group.

- Limited Local Presence: With fewer local branches, USAA’s service for the Audi A5 Sportback may rely more on online and phone support, which might not appeal to those who prefer face-to-face interactions.

#6 – Farmers: Best for Personal Service

Pros

- Wide Range of Coverage Options: Farmers offers extensive Audi A5 Sportback coverage options, including customizable plans that cater to various needs and preferences.

- Discounts for Multiple Vehicles: Farmers provides discounts if you insure multiple vehicles, which can help lower the cost of the Audi A5 Sportback if you have other cars to insure. Learn more in our Farmers car insurance review.

- Strong Financial Stability: Farmers is known for its strong financial stability, which ensures reliability in handling claims and providing support for Audi A5 Sportback drivers.

Cons

- Higher Premium Rates: Farmers’ rates for the Audi A5 Sportback are on the higher end, starting at around $142 per month, which may be less competitive compared to other providers.

- Variable Customer Service: Customer service experiences with Farmers can be inconsistent, which might affect your overall satisfaction with the Audi A5 Sportback, especially if you need frequent assistance.

#7 – Liberty Mutual: Best for Coverage Options

Pros

- Comprehensive Coverage Options: Liberty Mutual offers a wide range of coverage options for the Audi A5 Sportback, allowing you to select the most suitable protection for your luxury vehicle. Learn more in our Liberty Mutual car insurance review.

- Discounts for Bundling: Liberty Mutual provides discounts for bundling multiple policies, which can reduce the overall cost of the Audi A5 Sportback if you also have other types of insurance with them.

- Customizable Policies: Liberty Mutual’s policies for Audi A5 Sportback drivers can be tailored to meet specific needs, providing flexibility and enhanced coverage options.

Cons

- Higher Insurance Costs: The cost of the Audi A5 Sportback with Liberty Mutual is relatively high, with premiums around $138 per month, which might not be as competitive as other providers.

- Customer Service Variability: Customer service at Liberty Mutual can vary, potentially impacting your satisfaction with the Audi A5 Sportback if you encounter issues or require support.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Claims Process

Pros

- Affordable Coverage Rates: Nationwide offers competitive rates for the Audi A5 Sportback at approximately $132 per month, making it a cost-effective option for this luxury vehicle.

- Strong Claims Handling: Nationwide is known for its effective claims handling, which is beneficial for Audi A5 Sportback owners, ensuring prompt and fair resolution of claims.

- Discounts for Safe Driving: Nationwide provides discounts for maintaining a clean driving record, which can help reduce premiums for the Audi A5 Sportback if you are a safe driver. Check out their ratings in our complete Nationwide car insurance discount.

Cons

- Limited High-End Vehicle Discounts: Nationwide may offer fewer discounts for high-end vehicles like the Audi A5 Sportback compared to some competitors, which could impact overall affordability.

- Customer Service Issues: There can be variability in customer service experiences with Nationwide, potentially affecting the overall satisfaction with the Audi A5 Sportback if you need frequent assistance.

#9 – Travelers: Best for Customer Support

Pros

- Comprehensive Coverage Plans: Travelers provides a range of comprehensive coverage options for the Audi A5 Sportback, ensuring robust protection for your vehicle’s needs.

- Discounts for Multiple Policies: Travelers offers discounts if you bundle multiple policies, which can help lower the cost of the Audi A5 Sportback if you have other types of insurance with them.

- Strong Financial Stability: Travelers is known for its financial stability, which enhances the reliability of its coverage and support for the Audi A5 Sportback. See more details on our Travelers car insurance review.

Cons

- Higher Premiums: The cost of the Audi A5 Sportback with Travelers is relatively high, with rates around $137 per month, which may be less competitive compared to other insurers.

- Customer Service Variability: Experiences with Travelers’ customer service can be inconsistent, potentially impacting your satisfaction with the Audi A5 Sportback if you require support.

#10 – American Family: Best for Young Drivers

Pros

- Competitive Coverage Options: American Family offers a variety of coverage options for Audi A5 Sportback owners, allowing you to tailor your policy to meet specific needs.

- Multi-Policy Discounts: American Family provides discounts for bundling multiple policies, which can help reduce the overall cost of the Audi A5 Sportback if you also insure other properties or vehicles with them.

- Strong Customer Support: American Family is known for its excellent customer support with the Audi A5 Sportback by providing responsive and helpful service. More information in our American Family car insurance review.

Cons

- Premium Rates: American Family’s premiums for the Audi A5 Sportback drivers are relatively high, with rates starting around $135 per month, which might not be as competitive as other providers.

- Limited Discount Options: American Family may offer fewer discount opportunities for high-end vehicles like the Audi A5 Sportback, potentially impacting overall savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Audi A5 Sportback Insurance Cost

This section provides a detailed breakdown of monthly insurance rates for the Audi A5 Sportback, comparing costs for minimum and full coverage across various insurance companies. By examining these rates, you can make a well-informed decision on which insurer offers the most cost-effective coverage for your needs.

Audi A5 Sportback Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $55 $140

American Family $58 $135

Farmers $48 $142

Geico $40 $110

Liberty Mutual $52 $138

Nationwide $47 $132

Progressive $50 $130

State Farm $45 $125

Travelers $49 $137

USAA $42 $120

You can better evaluate which insurance company offers the best value for both minimum and full coverage. Remember, the cheapest option isn’t always the best, so consider factors such as customer service and additional benefits when making your final decision.

State Farm offers comprehensive add-on coverages, making it the top choice for Audi A5 owners.

Brad Larson LICENSED INSURANCE AGENT

Having a clear picture of average insurance rates for hatchbacks can guide you in budgeting for your auto insurance and selecting the coverage that best fits your needs. Take a look at how insurance rates for similar models to the Audi A5 Sportback look. These insurance rates for other hatchbacks like the Hyundai Ioniq Hybrid, Volkswagen e Golf, and Ford Mustang SVT Cobra give you a good idea of what to expect.

Audi A5 Sportback Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Liability | Collision | Comprehensive | Full Coverage |

|---|---|---|---|---|

| Audi A5 Sportback | $40 | $60 | $30 | $130 |

| Dodge Caliber | $38 | $28 | $16 | $96 |

| FIAT 500 | $39 | $39 | $20 | $113 |

| Ford C-Max Energi | $35 | $49 | $24 | $120 |

| Honda CR-Z | $36 | $37 | $25 | $111 |

| Kia Soul | $31 | $42 | $26 | $112 |

| Mazda 2 | $38 | $27 | $17 | $95 |

| Mazda 3 | $31 | $47 | $26 | $117 |

| Porsche Panamera | $33 | $87 | $43 | $177 |

Overall, these insights help in assessing whether you’re getting the best possible value for your car insurance premiums. By comparing your car insurance premiums with those of similar vehicles, you can identify potential savings and adjust your coverage as needed.

Understanding how your vehicle’s insurance rates stack up against similar cars allows you to make more informed decisions to ensure you have the right coverage at the best price.

This proactive approach can lead to significant savings and more tailored coverage for your specific needs. Learn more in our “Compare Monthly Car Insurance: Rates, Discounts, & Requirements.”

Factors Affecting Audi A5 Sportback Insurance Cost

The average annual rate for the Audi A5 Sportback is just that, an average. Your insurance rates for a Audi A5 Sportback can be higher or lower depending upon the trim level and personal factors.

Those factors include your age, home address, driving history, and the model year of your Audi A5 Sportback. To find out more, explore our guide titled “Best Low-Mileage Car Insurance.”

Audi A5 Sportback MSRP

The MSRP for an Audi A5 Sportback is listed as $41,800. Of course, this cost will vary depending on the trim level of the Audi A5 Sportback you choose and any dealer incentives that might be available to you. For more information, read our article titled “Buying Car Insurance for Your New Car.”

Safety Ratings

Safety ratings play a pivotal role in determining auto insurance rates, and the Audi A5 Sportback’s impressive ratings reflect positively on its insurance costs.

Audi A5 Sportback Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

These top ratings not only highlight the Audi A5 Sportback’s robust safety features but also contribute to potentially lower insurance premiums. Insurance providers often offer better rates for vehicles with higher safety ratings due to the reduced risk of severe accidents and injuries.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

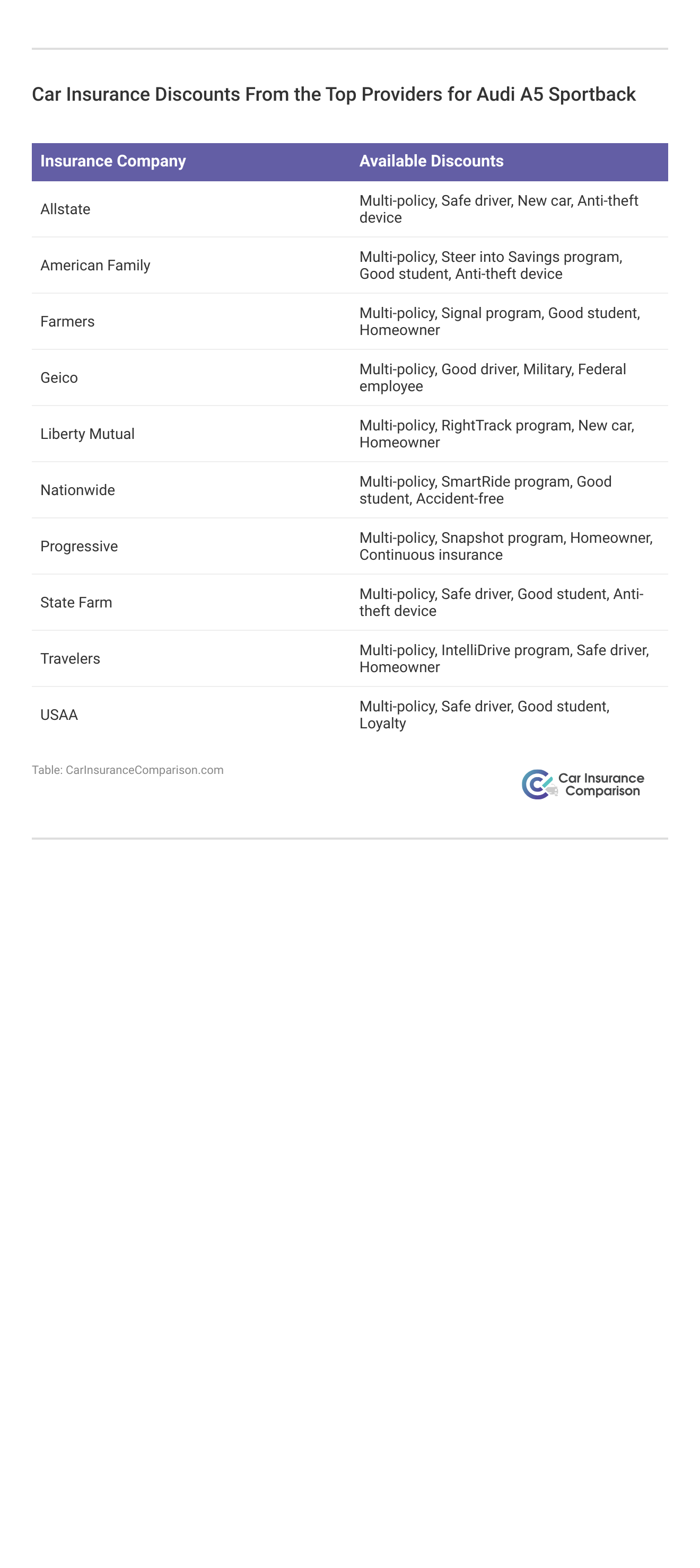

Cutting Costs on Audi A5 Sportback Insurance

If you want to reduce the cost of your Audi A5 Sportback insurance rates, follow these tips below:

- Audit your Audi A5 Sportback driving when you move to a new location or start a new job.

- Ask about Audi A5 Sportback low mileage discounts.

- Park your Audi A5 Sportback somewhere safe – like a garage or private driveway. Read our article titled “Garaged Car Insurance” for more information.

- Check your Audi A5 Sportback policy carefully to ensure all information is correct.

- Ask about seasonal insurance for your Audi A5 Sportback.

These steps not only help in reducing your insurance premiums but also contribute to better overall vehicle management. Staying informed and making adjustments as needed can lead to significant savings and enhanced protection for your vehicle.

Each provider offers a range of savings opportunities, so consider which discounts you qualify for and discuss them with your insurance agent. Optimizing these discounts not only helps reduce your premiums but also ensures you’re maximizing the value of your insurance policy.

Audi A5 Sportback Leading Providers

Several insurance companies offer competitive rates for the Audi A5 Sportback based on factors like discounts for safety features. Take a look at these top car insurance companies that are popular with Audi A5 Sportback drivers organized by market share.

Top Audi A5 Sportback Car Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9% |

| #2 | Geico | $46.3 million | 6% |

| #3 | Progressive | $41.7 million | 5% |

| #4 | Allstate | $39.2 million | 5% |

| #5 | Liberty Mutual | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3% |

| #8 | Chubb | $24.1 million | 3% |

| #9 | Farmers | $20 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

By considering these top providers, you can find options that suit your needs and potentially benefit from better coverage and pricing. Each company’s market share reflects its popularity and reliability, which can help you make a more informed choice when selecting insurance for your Audi A5 Sportback.

Save money by comparing Audi A5 Sportback insurance rates with free quotes online now.

Frequently Asked Questions

Are vehicles like the Audi A5 Sportback expensive to insure?

Insurance rates for vehicles like the Audi A5 Sportback can vary. To get an accurate idea of costs, it’s best to compare insurance rates from multiple companies. Generally, due to its luxury status and advanced features, the Audi A5 Sportback may have higher insurance premiums compared to non-luxury vehicles.

Read More: What Is a Car Insurance Premium?

What impacts the cost of Audi A5 Sportback insurance?

The cost of Audi A5 Sportback insurance can be influenced by factors such as your age, home address, driving history, and the model year of your vehicle. Additionally, factors like your credit score and any past claims can also play a role in determining your insurance rates.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

How much is the Audi A5 Sportback?

The MSRP for an Audi A5 Sportback is listed as $41,800. The actual cost may vary based on the trim level and any available dealer incentives. Optional features and packages can also affect the final price of the vehicle.

How do Audi A5 Sportback safety ratings affect insurance rates?

Audi A5 Sportback safety ratings can impact car insurance rates. Higher safety ratings may result in lower insurance premiums, as insurers often offer discounts for vehicles that are deemed safer.

Where can I find Audi A5 Sportback safety ratings and crash test results?

You can find Audi A5 Sportback safety ratings and crash test results from reputable sources such as the National Highway Traffic Safety Administration (NHTSA) or the Insurance Institute for Highway Safety (IIHS). These organizations provide comprehensive safety assessments and ratings.

Read More: Safety Features Car Insurance Discounts

What discounts might be available for Audi A5 Sportback insurance?

Many insurance companies offer discounts for vehicles equipped with advanced safety features, such as those found in the Audi A5 Sportback. Other potential discounts include multi-policy discounts, safe driver discounts, and discounts for low mileage.

How can I lower my Audi A5 Sportback insurance rates?

To lower your Audi A5 Sportback insurance rates, consider increasing your deductible, maintaining a clean driving record, and taking advantage of available discounts. Comparing quotes from multiple insurance providers can also help you find the best rate.

Is it worth getting full coverage for an Audi A5 Sportback?

Full coverage for an Audi A5 Sportback is often recommended, especially if you have a loan or lease on the vehicle. Full coverage includes comprehensive and collision insurance, which can provide protection against a wide range of risks, including accidents, theft, and natural disasters.

Read More: Best Full Coverage Car Insurance

How does the Audi A5 Sportback’s trim level affect insurance costs?

The trim level of the Audi A5 Sportback can impact insurance costs, as higher trims with more advanced features may be more expensive to repair or replace. Additionally, more powerful engines and premium features might lead to higher premiums.

Can I bundle my Audi A5 Sportback insurance with other policies?

Yes, many insurance companies offer discounts if you bundle your Audi A5 Sportback insurance with other policies, such as home or life insurance. Bundling can be an effective way to save on your overall insurance costs.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.