Best Acura TSX Car Insurance in 2025 (Your Guide to the Top 10 Companies)

The best Acura TSX car insurance options are Allstate, Erie, and AAA, offering competitive rates starting at $39/month. These providers stand out for their competitive pricing, strong customer service, and comprehensive coverage, making them top choices for Acura TSX car insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Acura TSX

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Acura TSX

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Acura TSX

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsThe leading providers for the best Acura TSX car insurance are Allstate, Erie, and AAA, with rates starting as low as $39/month.

These providers excel in their exceptional pricing, comprehensive coverage, and strong customer service, making them ideal choices for Acura TSX owners. This guide explores how factors like your vehicle’s age, driving history, and location can influence your insurance costs and provides tips to help you secure the best rates.

Our Top 10 Company Picks: Best Acura TSX Car Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 18% | A+ | Add-on Coverages | Allstate | |

| #2 | 13% | A+ | 24/7 Support | Erie |

| #3 | 10% | A | Online App | AAA |

| #4 | 12% | A | Local Agents | Farmers | |

| #5 | 16% | A+ | Innovative Programs | Progressive | |

| #6 | 9% | A+ | Usage Discount | Nationwide |

| #7 | 10% | A++ | Custom Plan | Geico | |

| #8 | 8% | B | Many Discounts | State Farm | |

| #9 | 10% | A++ | Military Savings | USAA | |

| #10 | 11% | A | Customizable Polices | Liberty Mutual |

With the right information, you can secure the best coverage at an affordable price for your Acura TSX. To gain in-depth knowledge, consult our comprehensive resource titled, “Car Insurance Guide.”

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool above to find the best policy for you.

- Allstate offers the best Acura TSX car insurance with top rates and coverage

- Compare quotes to find the most affordable Acura TSX insurance for your needs

- Acura TSX insurance costs can be affected by your driving history and location

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Allstate: Overall Top Pick

Pros:

- Comprehensive Coverage Options: Allstate provides extensive coverage options for the best Acura TSX car insurance, ensuring protection against a wide range of risks.

- Strong Customer Service: Known for excellent customer support, Allstate’s service makes managing the best Acura TSX car insurance straightforward and efficient. Find out more in our Allstate car insurance review.

- High Satisfaction Ratings: Allstate’s reputation for customer satisfaction helps Acura TSX owners feel confident in their insurance choice.

Cons:

- Higher Premiums: Allstate’s premiums for the best Acura TSX car insurance can be higher compared to some competitors, impacting budget-conscious buyers.

- Limited Discounts: While Allstate offers many features, its discount options for the best Acura TSX car insurance may be less varied than other providers.

#2 – Erie: Best for 24/7 Support

Pros:

- Round-the-Clock Assistance: Erie offers 24/7 support for the best Acura TSX car insurance inquiries, ensuring help is available whenever needed which is covered in our Erie car insurance review.

- Personalized Service: With dedicated support, Erie provides tailored advice for the best Acura TSX car insurance needs, enhancing customer satisfaction.

- Quick Claims Processing: Erie’s efficient claims process ensures fast resolution for the best Acura TSX car insurance claims, minimizing hassle.

Cons:

- Limited Physical Locations: Erie may have fewer local offices, potentially complicating in-person support for the best Acura TSX car insurance.

- Average Pricing: Erie’s rates for the best Acura TSX insurance are competitive but might not be the lowest compared to other insurers.

#3 – AAA: Best for Online App

Pros:

- User-Friendly Online Tools: AAA’s online app provides a seamless experience for managing the best Acura TSX car insurance policies and claims.

- Efficient Quote Comparison: The app allows easy comparison of the best Acura TSX car insurance quotes, helping users find the best rates quickly.

- Accessible Account Management: AAA’s app makes it simple to update and track the best Acura TSX car insurance information anytime. Read more in our review of AAA car insurance.

Cons:

- Limited In-App Support: While the app is user-friendly, it may not offer extensive support options for complex best Acura TSX car insurance issues.

- Online-Only Discounts: Some discounts for the best Acura TSX car insurance might only be available through the app, limiting flexibility.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Farmers: Best for Local Agents

Pros:

- Personalized Local Service: Farmers’ local agents provide tailored advice for the best Acura TSX car insurance, addressing specific needs.

- Strong Community Presence: With a local focus, Farmers offers the best Acura TSX car insurance that is well-adapted to community standards and regulations.

- Detailed Coverage Options: Farmers’ local agents can customize the best Acura TSX car insurance policies to fit individual needs and preferences.

Cons:

- Higher Costs: Farmers’ personalized service may come at a higher cost for best Acura TSX car insurance compared to more automated providers. Read our Farmers car insurance review to learn what else is offered.

- Inconsistent Service Quality: The quality of service may vary by location, affecting the overall experience for best Acura TSX car insurance customers.

#5 – Progressive: Best for Innovative Programs

Pros:

- Unique Coverage Programs: Progressive offers innovative programs such as usage-based insurance for best Acura TSX car insurance, potentially lowering costs.

- Advanced Technology: Progressive’s technology-driven approach provides valuable tools for managing the best Acura TSX car insurance efficiently. Discover our Progressive car insurance review for a full list.

- Flexible Payment Options: With various payment plans, Progressive allows Acura TSX owners to tailor their insurance to fit their financial situation.

Cons:

- Complex Policy Details: The innovative programs may come with complex terms that could be confusing for some Acura TSX insurance buyers.

- Variable Customer Service: While innovative, Progressive’s customer service experiences can vary, affecting the ease of managing the best Acura TSX car insurance.

#6 – Nationwide: Best for Usage Discount

Pros:

- Usage-Based Discounts: Nationwide offers significant discounts for low-mileage Acura TSX drivers, reducing overall insurance costs which you can check out in our review of Nationwide car insurance discounts.

- Comprehensive Coverage: Nationwide provides extensive coverage options for the best Acura TSX car insurance, ensuring broad protection.

- Easy-to-Use Online Tools: The insurer’s online tools simplify managing the best Acura TSX car insurance policies and tracking discounts.

Cons:

- Discount Eligibility: To benefit from usage-based discounts, Acura TSX drivers must meet specific criteria, which may not be applicable to all.

- Higher Base Rates: Without discounts, Nationwide’s base rates for the best Acura TSX car insurance might be higher compared to some competitors.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Best for Custom Plan

Pros:

- Highly Customizable Plans: Geico allows Acura TSX owners to tailor their insurance coverage extensively, fitting unique needs which you can learn about in our Geico car insurance review.

- Competitive Pricing: Geico offers competitive rates for customized best Acura TSX car insurance plans, providing cost-effective solutions.

- User-Friendly Website: Geico’s website makes it easy to adjust and manage custom best Acura TSX car insurance policies.

Cons:

- Basic Customer Support: Geico’s customer service may not be as robust for resolving complex best Acura TSX car insurance issues.

- Limited Personalized Discounts: Geico’s custom plans might not always include personalized discounts, potentially affecting overall savings.

#8 – State Farm: Best for Many Discounts

Pros:

- Wide Range of Discounts: State Farm offers numerous discounts for the best Acura TSX car insurance, which can lead to substantial savings.

- Strong Financial Stability: As a well-established insurer, State Farm provides owners a reliable coverage for the best Acura TSX car insurance.

- Easy Claims Process: The insurer’s streamlined claims process simplifies managing the best Acura TSX car insurance claims. For a complete list, read our State Farm car insurance review.

Cons:

- Potentially Higher Rates Without Discounts: Without applicable discounts, State Farm’s rates for the best Acura TSX car insurance can be higher.

- Inconsistent Discount Availability: Some discounts may not be available in all regions, affecting the best Acura TSX car insurance pricing.

#9 – USAA: Best for Military Savings

Pros:

- Exclusive Military Discounts: USAA provides substantial discounts for military personnel insuring their Acura TSX, enhancing affordability.

- Exceptional Customer Service: Known for superior service, USAA ensures high-quality support for the best Acura TSX car insurance needs.

- Comprehensive Coverage: USAA offers extensive coverage options specifically tailored for military members and their families.

Cons:

- Eligibility Restrictions: USAA’s services are limited to military members and their families, excluding others from accessing its best Acura TSX car insurance. Learn more in our USAA car insurance review.

- Higher Rates for Non-Military: For those not eligible, similar coverage from USAA may be more expensive compared to other providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customizable Polices

Pros:

- Flexible Policy Options: Liberty Mutual provides highly customizable best Acura TSX car insurance policies, allowing for extensive personalization.

- Range of Coverage Add-Ons: The insurer offers various add-ons to enhance the best Acura TSX car insurance coverage, addressing specific needs which you can read more about in our review of Liberty Mutual car insurance.

- Convenient Online Tools: Liberty Mutual’s online tools facilitate easy customization and management of the best Acura TSX car insurance.

Cons:

- Potential for High Costs: Customizable options can lead to higher premiums for best Acura TSX car insurance if not managed carefully.

- Complex Policy Choices: The variety of customization options may be overwhelming for some Acura TSX insurance buyers, leading to decision fatigue.

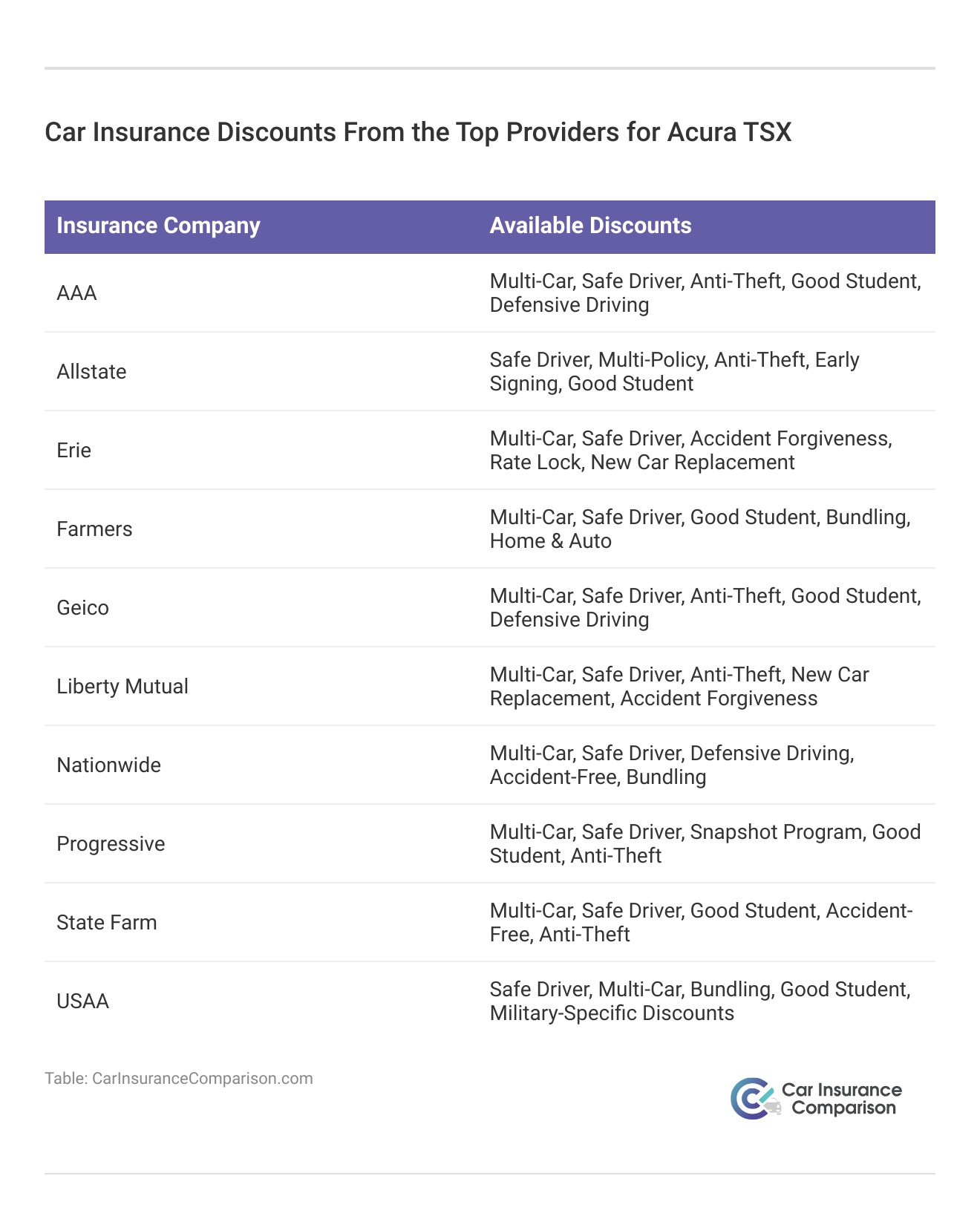

Acura TSX Car Insurance Rates and Discounts by Provider

When choosing car insurance for your Acura TSX, it’s crucial to consider both the cost and the potential savings available through discounts. Insurance rates can differ significantly based on the provider and the type of coverage you choose—whether it’s the minimum amount of liability car insurance coverage required or full protection.

Acura TSX Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $51 | $140 |

| AAA | $70 | $217 |

| Erie | $58 | $179 |

| Farmers | $39 | $127 |

| Geico | $64 | $194 |

| Liberty Mutual | $58 | $170 |

| Nationwide | $60 | $174 |

| Progressive | $69 | $200 |

| State Farm | $85 | $240 |

| USAA | $70 | $219 |

Understanding these differences can help you make an informed decision that balances affordability and peace of mind. Additionally, many insurance companies offer discount programs that can reduce your monthly premium, especially if you qualify for safe driving or member incentives.

By comparing options from leading providers and exploring their discount programs, you can ensure that you’re getting the best value for your money. Keep both coverage and savings in mind to find the policy that best suits your needs.

Acura TSX Car Insurance Monthly Rates by Coverage Type

Understanding how different factors affect your Acura TSX car insurance rates can help you make informed decisions about your coverage. Here’s a detailed look at the average monthly rates based on various coverage types and driver profiles.

Acura TSX Car Insurance Rates by Driver Profile

| Driver Profile | Monthly Rates |

|---|---|

| Average Rate | $108 |

| Discount Rate | $63 |

| High Deductibles | $93 |

| High Risk Driver | $229 |

| Low Deductibles | $135 |

| Teen Driver | $393 |

By checking these rates, you can better navigate your insurance options and potentially find ways to lower your premiums. Whether you’re considering high deductibles or looking to secure a discount, comparing these figures can guide you in choosing the best insurance plan for your Acura TSX. For a comprehensive overview, explore our resource titled, “Learning About High-Risk Car Insurance.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Acura TSX Insurance Rates Comparison Breakdown

Choosing the right car insurance involves comparing how different vehicles affect your premiums based on the type of coverage. This comparison provides a breakdown of monthly insurance rates for the Acura TSX and similar models across various coverage options: comprehensive, collision, minimum, and full coverage.

Acura TSX Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Cadillac ATS-V | $34 | $70 | $33 | $150 |

| Porsche 911 | $40 | $87 | $33 | $173 |

| Audi TT RS | $35 | $65 | $28 | $139 |

| Porsche 718 Boxster | $37 | $79 | $28 | $156 |

| Audi TTS | $33 | $60 | $28 | $132 |

| Chevrolet Camaro | $29 | $50 | $31 | $123 |

Knowing how the Acura TSX compares to other cars regarding insurance costs can aid in making a well-informed choice. By evaluating these rates, you can find the best insurance option that best suits your needs and budget. To expand your knowledge, refer to our comprehensive handbook titled, “Compare Full Coverage vs. Liability Car Insurance: Rates, Discounts, & Requirements.”

Key Factors Affecting Acura TSX Insurance Costs

Insurance costs for an Acura TSX can vary significantly depending on multiple factors. This guide will delve into how the age of the vehicle, the driver’s age, location, and driving history all influence monthly insurance rates.

Evaluating the vehicle’s age, driver’s age, location, and driving record will help you understand and manage insurance costs more effectively. Use these insights to compare rates and choose coverage that could lead to substantial savings on your Acura TSX car insurance premiums.

Age of the Vehicle

The monthly insurance rates for the Acura TSX reflect differences in coverage levels and model years. The table below outlines the monthly car insurance rates for the Acura TSX across different model years and coverage options. As the vehicle ages, insurance costs generally decrease, with notable variations in pricing based on the level of coverage chosen which is covered in our detailed guide titled, “Does the age of a car affect car insurance rates?”

Acura TSX Car Insurance Monthly Rates by Model Year and Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Acura TSX | $27 | $47 | $34 | $115 |

| 2023 Acura TSX | $26 | $46 | $33 | $113 |

| 2022 Acura TSX | $25 | $45 | $33 | $112 |

| 2021 Acura TSX | $24 | $43 | $33 | $110 |

| 2014 Acura TSX | $23 | $42 | $32 | $108 |

| 2013 Acura TSX | $22 | $39 | $32 | $105 |

| 2012 Acura TSX | $21 | $35 | $33 | $100 |

| 2011 Acura TSX | $19 | $32 | $33 | $96 |

| 2010 Acura TSX | $19 | $30 | $33 | $93 |

For instance, a 2024 Acura TSX costs $115 per month for full coverage, while a 2010 Acura TSX costs $93 for the same coverage. Reviewing these rates by year and coverage type can help you assess how your insurance costs may change over time and choose the best policy for your Acura TSX insurance.

Driver Age

The table below demonstrates a clear trend where younger drivers face significantly higher premiums for Acura TSX monthly insurance rates. Younger drivers should be aware of the higher costs associated with their age group, while older drivers can benefit from reduced premiums.

Acura TSX Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $482 |

| Age: 18 | $393 |

| Age: 20 | $244 |

| Age: 30 | $112 |

| Age: 40 | $108 |

| Age: 45 | $105 |

| Age: 50 | $98 |

| Age: 60 | $96 |

This data highlights the impact of age on insurance costs, emphasizing the advantages of driving experience and safety records as drivers transition into older age brackets. To gain further insights, consult our comprehensive guide titled, “Why is the cost of car insurance higher for teenage boys than teenage girls?”

Driver Location

When it comes to securing affordable car insurance for your Acura TSX, rates can vary significantly depending on where you live. Understanding these regional differences can help you make informed decisions and potentially save on your monthly premiums. Here’s a breakdown of Acura TSX insurance costs across various cities in the U.S., illustrating how location impacts your insurance rates.

Acura TSX Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $184 |

| New York, NY | $170 |

| Houston, TX | $168 |

| Jacksonville, FL | $156 |

| Philadelphia, PA | $144 |

| Chicago, IL | $142 |

| Phoenix, AZ | $125 |

| Seattle, WA | $104 |

| Indianapolis, IN | $91 |

| Columbus, OH | $89 |

By comparing these figures, you can better assess your options and seek out the best rates available in your city. Remember to consider additional factors such as coverage options and discounts to find the most suitable insurance policy for your needs. Discover our guide titled, “Minimum Car Insurance Requirements by State” for more insights.

Your Driving Record

This comprehensive chart outlines the monthly car insurance rates for an Acura TSX, categorized by driver age and driving record. For drivers with a clean record, rates start as low as $96 for those aged 60 and increase for younger drivers, with 16-year-olds facing the highest premiums at $482. Rates also vary based on driving infractions, such as accidents, DUIs, and tickets.

Acura TSX Car Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $482 | $769 | $880 | $750 |

| Age: 18 | $393 | $653 | $772 | $640 |

| Age: 20 | $244 | $499 | $620 | $520 |

| Age: 30 | $112 | $290 | $435 | $280 |

| Age: 40 | $108 | $286 | $420 | $270 |

| Age: 45 | $105 | $280 | $410 | $265 |

| Age: 50 | $98 | $272 | $398 | $258 |

| Age: 60 | $96 | $266 | $393 | $250 |

For instance, a DUI can substantially raise rates across all age groups, with 16-year-olds experiencing the most significant impact. By comparing these rates, you can better understand how age and driving history affect your insurance costs and take steps to manage your premiums effectively. To delve deeper, refer to our in-depth report titled, “How far back do car insurance companies look?”

Acura TSX Safety Ratings

The Acura TSX’s impressive safety ratings highlight its robust protection capabilities in various crash scenarios. Its solid performance in various crash tests highlights the vehicle’s engineering excellence and dedication to protecting its occupants. Here’s a detailed breakdown of the Acura TSX’s safety performance based on various crash tests.

Acura TSX Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

Whether you’re commuting or embarking on a road trip, the Acura TSX offers peace of mind through its impressive safety features. For further details on how the TSX compares in safety to other models, consult our guide titled, “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

Acura TSX Crash Test Ratings

When it comes to safety, crash test ratings are a crucial factor for potential car buyers. The Acura TSX has consistently demonstrated exceptional performance in crash safety evaluations, providing peace of mind for drivers and passengers alike. To broaden your understanding, explore our comprehensive resource titled, “Understanding Car Accidents.”

Acura TSX Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Acura TSX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Acura TSX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Acura TSX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Acura TSX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Acura TSX | 4 stars | 5 stars | 4 stars | 4 stars |

These impressive ratings provide peace of mind for Acura TSX owners, ensuring that the vehicle delivers robust protection in various driving scenarios. For those prioritizing safety in their vehicle choice, the Acura TSX remains a top contender.

Acura TSX Safety Features

The Acura TSX is more than just a luxury vehicle; it’s a well-rounded car that prioritizes safety at every turn. Here are the key safety features of the 2020 Acura TSX:

- Comprehensive Air bag System: Driver, passenger, front head, rear head, and front side air bags.

- Enhanced Braking: 4-wheel ABS, disc brakes, and brake assist.

- Stability and Traction Control: Electronic stability and traction control for better handling.

- Child Safety Locks: Added protection with child safety locks.

- Visibility Features: Daytime running lights and turn signal mirrors for improved visibility.

These comprehensive safety features make the Acura TSX an excellent option for drivers who prioritize both their safety on the road and the potential for reduced insurance premiums. To learn more, explore our comprehensive resource titled, “How much do air bags affect car insurance rates?”

By investing in a vehicle equipped with such advanced safety technologies, you’re not only protecting yourself and your passengers but also positioning yourself to benefit from potential insurance discounts. Whether you’re commuting daily or embarking on long trips, the Acura TSX ensures you and your passengers are well-protected, making it a wise investment for safety-conscious drivers.

Understanding Acura TSX Finance and Insurance Costs

When considering the Acura TSX, it’s essential to understand both the financing and insurance aspects to make an informed decision. The Acura TSX, a model known for its reliability and performance, can have varying costs depending on factors such as the model year, your credit score, and the insurance provider you choose.

On the insurance front, rates are influenced by your driving record, location, and the specific coverage options you select. Generally, insurance for the Acura TSX is more affordable compared to other luxury vehicles, especially when factoring in its robust safety features which may qualify for discounts. Understanding these financial aspects can help you budget better and potentially save on financing and insurance premiums.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Acura TSX Insurance

Discovering effective ways to save on your Acura TSX car insurance can lead to significant cost reductions which is covered in our guide titled, “Different Ways to Lower Car Insurance Rates.” Here are five practical tips to help you maximize your savings on insurance premiums.

- Welcome Discounts: Ask if your insurer offers new customer discounts.

- Usage-Based Discounts: Share your driving habits to check for savings.

- Farm and Ranch Discounts: Inquire about discounts for farm or ranch vehicles.

- Move to the Countryside: Consider relocating to areas with lower insurance rates.

- Rate Changes: Know that insurers can adjust rates mid-term based on various factors.

By adopting these strategies, you can significantly reduce your Acura TSX insurance costs while maintaining comprehensive coverage. Start by exploring various discounts and comparing quotes to find the most cost-effective policy. Regularly review your insurance plan to ensure it still meets your needs and check for any new discounts or changes in coverage options.

Allstate stands out as the best choice for Acura TSX insurance, offering unbeatable coverage and competitive rates.

Brandon Frady Licensed Insurance Agent

Be proactive in checking for any new discounts, changes in coverage options, or updates in state regulations that may affect your policy. Staying informed and proactive about your policy can help you maximize savings and ensure you have the right protection for your vehicle.

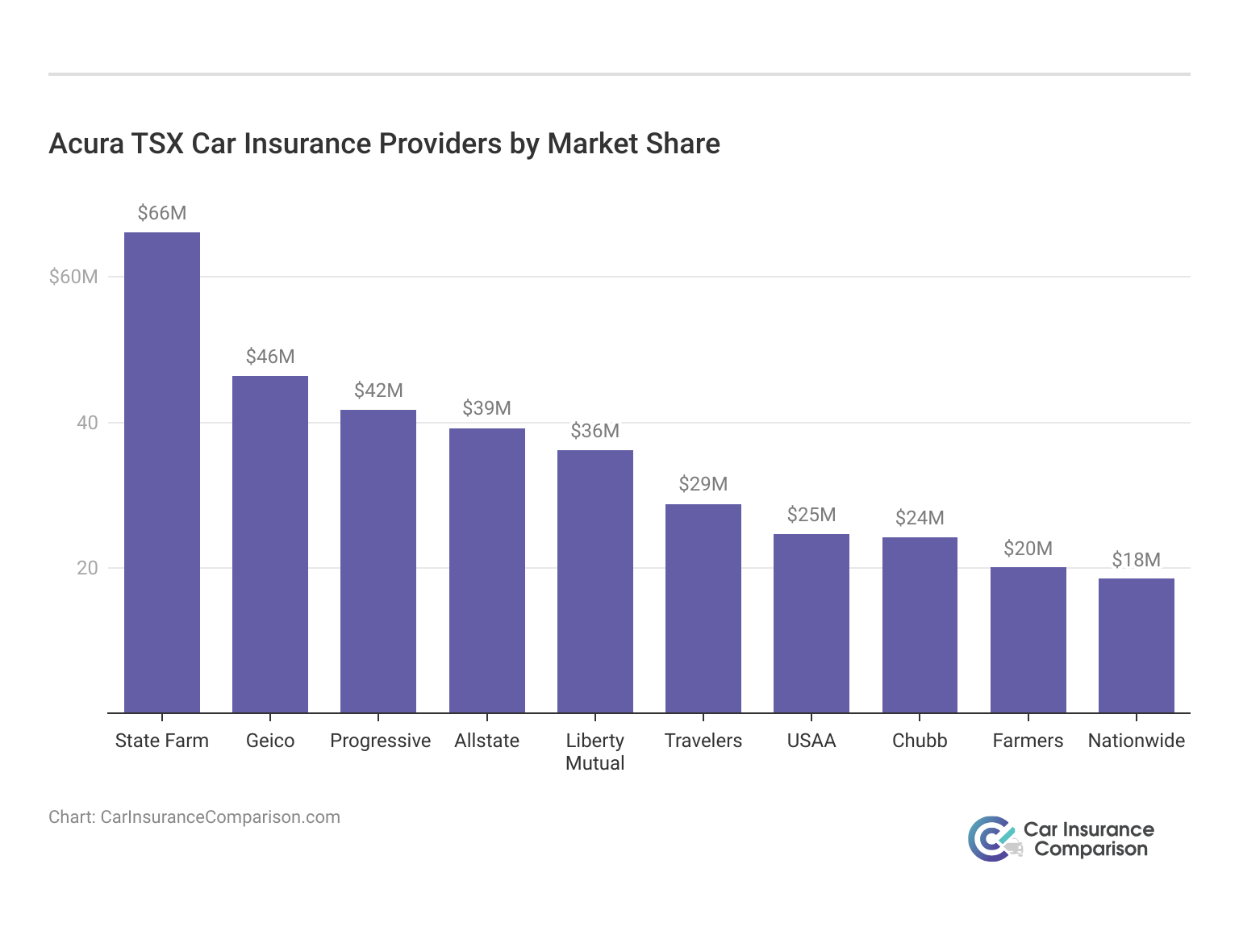

Top Acura TSX Insurance Companies

Finding the right car insurance provider is crucial for Acura TSX owners looking to protect their investment. In this guide, we present the top Acura TSX car insurance providers ranked by market share. To learn more, explore our comprehensive resource titled, “Do car insurance companies share information?”

Top Acura TSX Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

This article ranks the top insurance companies providing coverage for the Acura TSX based on their market share and premiums written. The list highlights key players in the industry, including State Farm, Geico, and Progressive, showcasing their financial commitment to insuring Acura TSX vehicles.

Understanding these market dynamics can help you select a provider that not only fits your budget but also offers reliable coverage. Compare quotes and coverage plans from these leading companies to find the best fit for your insurance needs.

Comprehensive Guide for Acura TSX Car Insurance

The article delivers an in-depth analysis of the best car insurance options for Acura TSX owners, featuring top providers like Allstate, Erie, and AAA. These companies offer rates starting at $39 per month and consider factors like vehicle age, driver age, location, and driving history. The Acura TSX’s advanced safety features can also help lower insurance premiums.

The guide provides tips for reducing insurance costs by comparing quotes, using discounts, and choosing the right coverage. Readers are encouraged to enter their ZIP code into a free comparison tool to access personalized quotes and find the most cost-effective and best insurance coverage for their Acura TSX. To expand your knowledge, refer to our guide titled, “How do you compare multiple car insurance quotes online?”

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What factors affect Acura TSX car insurance rates?

Several factors can influence the insurance rates for an Acura TSX. These may include the driver’s age, location, driving record, credit score, the level of coverage desired, the deductible chosen, and the specific insurance provider’s pricing model. Read more in our guide titled, “Factors That Affect Car Insurance Rates.”

Are Acura TSX insurance rates higher compared to other vehicles?

Insurance rates can vary depending on the make and model of the vehicle. While Acura TSX insurance rates can be influenced by factors such as the car’s value, safety features, and repair costs, they may not necessarily be higher compared to other vehicles. Insurance rates are determined on a case-by-case basis.

Are there any specific safety features on the Acura TSX that could lower insurance rates?

The Acura TSX is equipped with various safety features that may help lower insurance rates. These can include anti-lock brakes, stability control, traction control, air bags, and advanced driver assistance systems. Contact your insurance provider to inquire about specific discounts for safety features.

Which car insurance is best for Acura TSX?

The best car insurance for an Acura TSX typically comes from providers known for competitive rates and comprehensive coverage. Top choices include Allstate, Erie, and AAA, each offering strong customer service and rates starting around $39 per month.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Can I insure my Acura TSX under a different driver’s name, such as a parent or spouse, to get lower rates?

Insurance providers typically consider the primary driver’s details, including their driving history and location, when determining rates. Misrepresenting the primary driver’s information could potentially lead to insurance fraud, which is illegal. Learn more in our resource titled, “Does car insurance cover all other drivers?”

Are Acura TSX reliable?

The Acura TSX is known for its reliability. It consistently receives high marks for durability and long-term performance, making it a dependable choice for drivers looking for a lasting vehicle.

Which value is it best to insure an Acura TSX car?

The value for insuring an Acura TSX is best determined by considering factors like the vehicle’s age, condition, and coverage needs. Generally, insuring a well-maintained, mid-range model provides a balance between cost and coverage.

What age is Acura TSX car insurance most expensive?

Insurance for the Acura TSX is typically more expensive for younger drivers, particularly those under 25. Older models and experienced drivers generally benefit from lower insurance rates. Discover our resource review for a full list here “Compare Teen Driver Car Insurance Rates.”

Is the Acura TSX comfortable?

Yes, the Acura TSX is known for its comfort. It features a well-designed interior with ample space, supportive seats, and a smooth ride, making it a comfortable choice for both daily commutes and long drives.

Is Acura TSX a luxury car?

Yes, the Acura TSX is considered a luxury vehicle. It is part of Acura’s lineup, known for its premium features, high-quality materials, and refined performance.

Are Acura TSX expensive to repair?

Repair costs for the Acura TSX are generally moderate compared to other vehicles. While not the cheapest, it is not considered excessively expensive either. Maintenance costs may vary based on the model year and specific repairs needed. Find additional details in our resource titled, “Compare Ding & Dent Car Insurance: Rates, Discounts, & Requirements.”

Is Acura TSX or TL faster?

The Acura TL generally offers faster performance compared to the Acura TSX. The TL, particularly in its sportier trims, is equipped with more powerful engines and advanced performance features.

Ready to find affordable car insurance? Use our free comparison tool below to get started.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.