Compare Montana Car Insurance Rates [2025]

If you want cheap car insurance in Montana, you will need to take the time to compare Montana car insurance . Minimum liability insurance in Montana is an average of $33/mo. Full coverage insurance in Montana is more expensive at an average of $134/mo, but it does provide better protection.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Feb 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Explore the varying costs of auto insurance across cities in Montana with our comprehensive comparison tool. Whether you reside in Bozeman, Great Falls, Helena, or Missoula, discover the factors influencing insurance rates and find the best coverage options tailored to your needs.

Montana Statistics Summary

| Montana Statistics Summary | Details |

|---|---|

| Road Miles | Total in State – 74,983 Vehicle Miles Driven Annually – 12,157 million |

| Driving Deaths | Speeding Fatalities – 59 Drunk Driving Fatalities – 56 |

| Vehicles | Registered – 1,401,936 Total Stolen – 2,043 |

| Most Popular Vehicle | Ford F150 |

| Average Premiums (Annual) | Liability – $386.29 Collision – $265.32 Comprehensive – $211.91 Combined Premiums – $863.52 |

| Percent of Motorists Uninsured | 9.9% State Rank – 33rd |

| Cheapest Providers | SAFECO Ins Co of IL and USAA |

- Montana drivers need liability insurance in the amount of 25/50/20

- Minimum liability insurance costs an average of $33/mo in Montana

- Full coverage insurance in Montana is an average of $134/mo

Drivers who compare Montana car insurance rates will get the best deals on coverage. However, you should first know what insurance Montana requires and what coverages you want before you compare cheap car insurance in Montana.

Our guide goes over everything you need to know about finding cheap Montana car insurance, from car insurance requirements to the best insurance companies. Once you are ready to shop for the best car insurance in Montana, use our free quote comparison tool.

What are Montana car insurance coverage and rates?

The “Treasure State” is a great place to live if you love the open road, the great outdoors, and wildlife. Montana shares with Wyoming Yellowstone National Park which was the first national park in US history.

Before you decide to drive in Montana, consider your options in car insurance coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What are the minimum car insurance requirements in Montana?

Minimum Car Insurance Requirements in Montana

| Insurance Required | Minimum Limits – 25/50/20 |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per one person $50,000 per accident |

| Property Damage Liability Coverage | $20,000 minimum |

Liability car insurance coverage pays all individuals — drivers, passengers, pedestrians, bicyclists, etc. — who are owed compensation for property damage and/or injuries resulting from a car accident that you or anyone under your policy causes.

Montana is an “at-fault” accident state. This means, if you are the at-fault driver during an accident, you will be held liable for any personal injury or property claims.

As such, liability insurance is required in the state of Montana at these minimum coverage amounts:

- $25,000 – to cover Injury or death per person in an accident you caused

- $50,000 – to cover total injuries or death per accident that you caused

- $20,000 – to cover property damage in an accident you caused

Remember, these amounts are minimum requirements and do not cover injury, death, or damage to yourself or your own passengers! That will require additional coverage.

Your liability coverage does, however, kick in no matter who is driving your car.

What’s the required form of financial responsibility in Montana?

Under Montana law, motorists stopped for a traffic violation or involvement in a motor vehicle collision are required to show proof of insurance documents to law enforcement, in addition to displaying their driver license and vehicle registration.

Lost or expired proof of insurance card? No problem”¦almost.

The state of Montana developed a web-based verification system (MTIVS) for up-to-the-minute data to confirm if a vehicle has minimum liability insurance coverage. This system can be accessed by drivers and law enforcement anytime, anywhere.

However, the MTIVS cannot verify insurance from out of state, so if you are new to Montana, and you have not yet obtained Montana car insurance, be sure to carry proof of out-of-state insurance at all times.

Furthermore, the web-based system is not always accurate and up-to-date and has been causing problems for law enforcement officers and courts. Because you’re still required to carry proof of insurance in Montana, your safest bet is to do that.

Even though 46 out of Montana’s 56 counties are considered “frontier counties” with an average population of six or fewer people per square mile, Montana law takes driving without car insurance very seriously”¦

Driving without the minimum liability coverage in Montana is a misdemeanor.

The penalty for a no-insurance citation is between $250 and $500 or up to 10 days in jail for a first offense. Penalties increase for repeat offenders and also include revocation of your driver’s license for 90 days and five points on your driving record.

Read More: What is the penalty for driving without insurance in Montana?

What makes MTIVS so great?

Troopers will use MTIVS to electronically verify that liability insurance was in effect for the person at fault at the time of an accident, so don’t bank on purchasing car insurance while you wait for law enforcement to arrive on the scene.

Learn more: How do the police check for car insurance?

What percentage of income are insurance premiums in Montana?

Montana is known as the “Treasure State” for its history of gold and silver mining, but that doesn’t mean you’ll be rich living there.

In 2014, the annual per capita disposable personal income in Montana was $36,041.

Disposable personal income (DPI) is the total amount of money available for an individual to spend (or save) after their taxes have been paid.

The average annual cost of car insurance in Montana is $869, which is almost 2.5 percent of the average disposable personal income.

The average Montana resident has only $3,003 each month to buy food, pay bills etc. The car insurance bill alone will deduct about $73 out of that — much more if you have a less-than-perfect driving record.

Why is getting the best deal on car insurance so important?

American Consumer Credit Counseling suggests saving 20 percent of every paycheck. With Montana’s DPI, that’s a whopping $600 each month! How much are you putting aside for savings?

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What is the core car insurance coverage in Montana?

Core Car Insurance Coverage in Montana

| Coverage Type | Annual Costs in 2015 |

|---|---|

| Liability | $386.29 |

| Collision | $265.32 |

| Comprehensive | $211.91 |

| Combined | $863.52 |

The above table illustrates the most recent data provided by the leading source on the matter, the National Association of Insurance Commissioners. Expect auto insurance rates in Montana to be significantly higher for 2019 and on.

Don’t forget: Montana has minimum requirements for liability coverage, but experts suggest drivers purchase more than what state law requires, especially when the state is an “at-fault” state like Montana is.

You may be wondering: Why get more coverage than required?

Montana has the largest migratory elk herd in the nation. The average square mile of land in Montana contains 1.4 elks, 1.4 pronghorn antelope, and 3.3 deer.

With more big game animals than humans per square mile in over 82 percent of Montana’s counties, comprehensive coverage may be wise to consider.

Comprehensive insurance covers occurrences that many would call “out of our control” such as a cracked windshield, hitting an animal, or other events besides collisions.

In the spirit of Montana’s gold and silver mining history, let’s dig into some of the most popular coverage options to add to a basic auto insurance policy.

Is there additional liability coverage in Montana?

A loss ratio shows how much a company spends on claims to how much money they take in on premiums. A loss ratio of 60 percent indicates the company spent 60 on claims out of every 100 dollars earned in premiums.

Additional Liability Coverage in Montana

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (Med Pay) | 73% | 63% | 69% |

| Uninsured/Underinsured Motorist | 65% | 60% | 58% |

As of July 2018, two states required Medical Payments coverage (Maine and Wisconsin), two states (plus D.C.) required Uninsured Motorist coverage (Montana and Wisconsin), and 17 states required both Uninsured and Underinsured Motorist coverage.

Med Pay and Underinsured Motorist coverage are both optional in Montana; however, Uninsured Motorist coverage is required. All three are important. Why? In 2015 13 percent of motorists in the US were uninsured, and 10 percent of motorists in Montana, despite that driving without insurance is a misdemeanor.

Montana ranked 33rd in the nation in 2015 for uninsured or underinsured drivers according to the Insurance Information Institute.

By requiring uninsured motorist coverage, the strict laws of Montana have seemed to decrease the loss ratio. Unless you sign a form stating you do not want Uninsured Motorist coverage, your agent is required by law to provide it to you.

Are there any add-ons, endorsements, and riders?

We know getting the complete coverage you need for an affordable price is your goal.

Good news: there are lots of powerful but cheap extras you can add to your policy.

Do you know what’s crazy?

Montana’s temperatures can change drastically in a short period of time – sometimes in as few as seven minutes. Some cities have recorded temperatures as high as 117 degrees F and as low as -70 degrees F.

Aside from the usual preparedness of carrying flashlights, blankets, and keeping your vehicle fluids topped off (and dressing in layers), keep an eye on those tires as well!

One extra that is particularly important in Montana is Emergency Roadside Assistance.

With temperatures rising 82 degrees from morning to afternoon (Fort Belknap, MT in 2018) or falling some 84 degrees in 12 hours (Fairfield, MT in 1924), pay attention to tire pressure because it changes by one pound per square inch (PSI) for every 10 degrees of temperature change.

If you don’t regulate your tire pressure, you just may find yourself needing roadside assistance.

What causes these extreme temperature shifts?

Don’t get blown away by high car insurance premiums! Start comparison shopping today using our FREE online tool. Enter your ZIP code to get started!

Here’s a list of other useful coverage available to you in Montana.

- GAP insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-you-drive or Usage-based Insurance

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What are the male versus female annual car insurance rates in Montana?

In Montana, it’s illegal to consider gender and marital status in rates. Montana was the first state to secure laws against gender discrimination in determining insurance rates back in 1985. Six other states, most recently California, have also enacted laws based on gender and/or marital status.

Our researchers came to a surprising conclusion. They learned that age and the actual insurance carrier seem to be the most significant contributing factors in cost variance.

Let’s dig deeper!

Demographic and Insurance Carrier

Demo and Carrier - Average Annual Rates Montana

| Company | 60-year-old Annual Rate | 35-year-old Annual Rate | 25-year-old Annual Rate | 17-year-old Annual Rate |

|---|---|---|---|---|

| Allstate F&C | $2,507.60 | $2,740.02 | $2,955.90 | $10,484.90 |

| Depositors Insurance | $2,533.60 | $2,785.97 | $2,952.88 | $5,640.58 |

| Geico General | $2,527.59 | $2,653.99 | $2,218.97 | $6,445.87 |

| Mid-Century Ins Co | $2,462.45 | $2,755.44 | $3,016.88 | $7,395.41 |

| Progressive NorthWestern | $2,901.06 | $3,231.09 | $3,642.19 | $7,548.71 |

| Safeco Ins Co of IL | $999.67 | $1,021.71 | $1,218.77 | $2,064.28 |

| State Farm Mutual Auto | $1,439.41 | $1,640.33 | $1,776.55 | $4,814.65 |

| USAA | $1,139.97 | $1,280.16 | $1,603.83 | $4,103.59 |

Case in point, Allstate F&C charges 17-year-old drivers approximately $10,485 annually, which is several thousand dollars higher when compared to their averaged $2,735 yearly premiums for insureds over the age of 18; this is a 78 percent difference!

Safeco, however, charges only 48 percent more in annual premiums based on age difference.

Highest and Lowest Rates in Montana by ZIP Code

Montana Zip and Carrier Average Annual Rates

| Zip code | Average Annual Rate | Zip code | Average Annual Rate |

|---|---|---|---|

| 59001 | $3,374.37 | 59089 | $3,457.80 |

| 59002 | $3,324.24 | 59853 | $3,440.51 |

| 59003 | $3,335.42 | 59035 | $3,436.52 |

| 59006 | $3,329.98 | 59050 | $3,433.47 |

| 59007 | $3,399.96 | 59075 | $3,433.31 |

| 59008 | $3,398.10 | 59417 | $3,420.37 |

| 59010 | $3,290.70 | 59068 | $3,414.03 |

| 59011 | $3,372.28 | 59448 | $3,408.40 |

| 59012 | $3,354.42 | 59007 | $3,399.96 |

| 59013 | $3,348.69 | 59070 | $3,398.91 |

| 59014 | $3,371.67 | 59008 | $3,398.10 |

| 59015 | $3,305.39 | 59920 | $3,391.20 |

| 59016 | $3,327.72 | 59932 | $3,389.23 |

| 59018 | $3,128.77 | 59411 | $3,387.91 |

| 59019 | $3,357.26 | 59930 | $3,387.14 |

| 59020 | $3,104.72 | 59844 | $3,386.85 |

| 59022 | $3,338.39 | 59935 | $3,386.28 |

| 59024 | $3,264.17 | 59925 | $3,378.26 |

| 59025 | $3,348.11 | 59931 | $3,377.84 |

| 59026 | $3,348.69 | 59066 | $3,377.49 |

| 59027 | $3,092.38 | 59033 | $3,376.50 |

| 59028 | $3,349.80 | 59001 | $3,374.37 |

| 59029 | $3,351.51 | 59922 | $3,374.36 |

| 59030 | $3,147.92 | 59917 | $3,372.37 |

| 59031 | $3,309.23 | 59011 | $3,372.28 |

| 59032 | $3,204.36 | 59434 | $3,372.07 |

| 59033 | $3,376.50 | 59427 | $3,372.00 |

| 59034 | $3,330.35 | 59014 | $3,371.67 |

| 59035 | $3,436.52 | 59874 | $3,365.74 |

| 59036 | $3,335.54 | 59074 | $3,365.74 |

| 59037 | $3,251.00 | 59923 | $3,364.97 |

| 59038 | $3,260.74 | 59873 | $3,364.34 |

| 59039 | $3,265.79 | 59460 | $3,364.22 |

| 59041 | $3,291.92 | 59317 | $3,364.13 |

| 59043 | $3,304.24 | 59071 | $3,362.59 |

| 59044 | $3,127.14 | 59484 | $3,362.14 |

| 59046 | $3,281.67 | 59486 | $3,361.11 |

| 59047 | $3,089.78 | 59057 | $3,359.10 |

| 59050 | $3,433.47 | 59077 | $3,359.05 |

| 59052 | $3,342.41 | 59467 | $3,358.68 |

| 59053 | $3,096.84 | 59019 | $3,357.26 |

| 59054 | $3,246.91 | 59012 | $3,354.42 |

| 59055 | $3,347.37 | 59524 | $3,354.13 |

| 59057 | $3,359.10 | 59466 | $3,352.80 |

| 59058 | $3,296.35 | 59921 | $3,351.97 |

| 59059 | $3,211.85 | 59029 | $3,351.51 |

| 59061 | $3,342.03 | 59063 | $3,351.41 |

| 59062 | $3,341.41 | 59918 | $3,351.38 |

| 59063 | $3,351.41 | 59933 | $3,351.38 |

| 59064 | $3,330.28 | 59934 | $3,351.38 |

| 59065 | $3,161.32 | 59067 | $3,351.27 |

| 59066 | $3,377.49 | 59078 | $3,350.96 |

| 59067 | $3,351.27 | 59028 | $3,349.80 |

| 59068 | $3,414.03 | 59013 | $3,348.69 |

| 59069 | $3,329.76 | 59026 | $3,348.69 |

| 59070 | $3,398.91 | 59859 | $3,348.30 |

| 59071 | $3,362.59 | 59025 | $3,348.11 |

| 59072 | $3,241.63 | 59916 | $3,347.79 |

| 59074 | $3,365.74 | 59055 | $3,347.37 |

| 59075 | $3,433.31 | 59482 | $3,345.49 |

| 59076 | $3,248.89 | 59085 | $3,342.87 |

| 59077 | $3,359.05 | 59052 | $3,342.41 |

| 59078 | $3,350.96 | 59061 | $3,342.03 |

| 59079 | $3,262.08 | 59062 | $3,341.41 |

| 59081 | $3,122.05 | 59914 | $3,340.71 |

| 59082 | $3,133.14 | 59527 | $3,339.71 |

| 59083 | $3,252.49 | 59929 | $3,339.12 |

| 59084 | $3,271.07 | 59022 | $3,338.39 |

| 59085 | $3,342.87 | 59454 | $3,336.91 |

| 59086 | $3,112.29 | 59318 | $3,336.70 |

| 59087 | $3,310.52 | 59911 | $3,336.07 |

| 59088 | $3,287.69 | 59036 | $3,335.54 |

| 59089 | $3,457.80 | 59926 | $3,335.52 |

| 59101 | $3,224.44 | 59936 | $3,335.52 |

| 59102 | $3,218.22 | 59003 | $3,335.42 |

| 59105 | $3,201.49 | 59901 | $3,334.32 |

| 59106 | $3,217.29 | 59913 | $3,332.19 |

| 59201 | $3,230.57 | 59848 | $3,331.29 |

| 59211 | $3,237.68 | 59912 | $3,331.09 |

| 59212 | $3,213.21 | 59432 | $3,330.49 |

| 59213 | $3,239.69 | 59034 | $3,330.35 |

| 59214 | $3,241.41 | 59064 | $3,330.28 |

| 59215 | $3,271.34 | 59006 | $3,329.98 |

| 59217 | $3,258.06 | 59069 | $3,329.76 |

| 59218 | $3,233.90 | 59337 | $3,328.66 |

| 59219 | $3,204.38 | 59016 | $3,327.72 |

| 59221 | $3,254.48 | 59530 | $3,326.42 |

| 59222 | $3,219.91 | 59928 | $3,326.39 |

| 59223 | $3,262.14 | 59444 | $3,325.35 |

| 59225 | $3,233.71 | 59927 | $3,324.68 |

| 59226 | $3,208.77 | 59002 | $3,324.24 |

| 59230 | $3,257.57 | 59345 | $3,324.17 |

| 59231 | $3,258.89 | 59919 | $3,323.94 |

| 59240 | $3,247.55 | 59915 | $3,323.40 |

| 59241 | $3,270.91 | 59545 | $3,322.39 |

| 59242 | $3,212.08 | 59419 | $3,322.24 |

| 59243 | $3,262.80 | 59456 | $3,322.02 |

| 59244 | $3,267.58 | 59529 | $3,320.76 |

| 59247 | $3,185.91 | 59314 | $3,319.09 |

| 59248 | $3,251.97 | 59522 | $3,318.83 |

| 59250 | $3,268.86 | 59531 | $3,318.09 |

| 59252 | $3,231.83 | 59521 | $3,317.89 |

| 59253 | $3,268.30 | 59520 | $3,316.98 |

| 59254 | $3,201.06 | 59845 | $3,316.19 |

| 59255 | $3,224.91 | 59341 | $3,313.92 |

| 59256 | $3,226.98 | 59343 | $3,313.86 |

| 59257 | $3,233.59 | 59351 | $3,312.70 |

| 59258 | $3,235.69 | 59447 | $3,311.62 |

| 59259 | $3,282.47 | 59542 | $3,311.40 |

| 59260 | $3,247.44 | 59856 | $3,310.72 |

| 59261 | $3,255.03 | 59469 | $3,310.68 |

| 59262 | $3,249.90 | 59435 | $3,310.63 |

| 59263 | $3,213.04 | 59087 | $3,310.52 |

| 59270 | $3,210.99 | 59461 | $3,310.25 |

| 59273 | $3,269.32 | 59526 | $3,309.36 |

| 59274 | $3,229.80 | 59031 | $3,309.23 |

| 59275 | $3,218.65 | 59937 | $3,309.17 |

| 59276 | $3,228.04 | 59474 | $3,308.81 |

| 59301 | $3,239.85 | 59547 | $3,307.56 |

| 59311 | $3,272.57 | 59015 | $3,305.39 |

| 59312 | $3,247.75 | 59537 | $3,305.30 |

| 59313 | $3,219.31 | 59535 | $3,304.56 |

| 59314 | $3,319.09 | 59043 | $3,304.24 |

| 59315 | $3,226.51 | 59546 | $3,304.18 |

| 59316 | $3,245.95 | 59322 | $3,303.97 |

| 59317 | $3,364.13 | 59462 | $3,299.50 |

| 59318 | $3,336.70 | 59525 | $3,299.01 |

| 59319 | $3,273.36 | 59058 | $3,296.35 |

| 59322 | $3,303.97 | 59532 | $3,293.80 |

| 59323 | $3,209.30 | 59479 | $3,293.44 |

| 59324 | $3,250.85 | 59041 | $3,291.92 |

| 59326 | $3,273.41 | 59452 | $3,290.91 |

| 59327 | $3,213.52 | 59010 | $3,290.70 |

| 59330 | $3,209.70 | 59425 | $3,288.25 |

| 59332 | $3,268.10 | 59450 | $3,288.19 |

| 59333 | $3,205.98 | 59088 | $3,287.69 |

| 59336 | $3,230.76 | 59540 | $3,286.64 |

| 59337 | $3,328.66 | 59538 | $3,286.47 |

| 59338 | $3,245.19 | 59544 | $3,283.26 |

| 59339 | $3,232.92 | 59259 | $3,282.47 |

| 59341 | $3,313.92 | 59046 | $3,281.67 |

| 59343 | $3,313.86 | 59863 | $3,279.47 |

| 59344 | $3,230.42 | 59910 | $3,278.43 |

| 59345 | $3,324.17 | 59528 | $3,277.83 |

| 59347 | $3,266.20 | 59349 | $3,273.91 |

| 59349 | $3,273.91 | 59326 | $3,273.41 |

| 59351 | $3,312.70 | 59319 | $3,273.36 |

| 59353 | $3,217.20 | 59824 | $3,273.13 |

| 59354 | $3,249.43 | 59311 | $3,272.57 |

| 59401 | $3,190.43 | 59831 | $3,272.40 |

| 59402 | $3,155.30 | 59215 | $3,271.34 |

| 59404 | $3,174.69 | 59084 | $3,271.07 |

| 59405 | $3,155.69 | 59241 | $3,270.91 |

| 59410 | $3,140.66 | 59273 | $3,269.32 |

| 59411 | $3,387.91 | 59250 | $3,268.86 |

| 59412 | $3,251.80 | 59253 | $3,268.30 |

| 59414 | $3,192.53 | 59332 | $3,268.10 |

| 59416 | $3,239.42 | 59244 | $3,267.58 |

| 59417 | $3,420.37 | 59420 | $3,267.53 |

| 59418 | $3,235.45 | 59424 | $3,267.24 |

| 59419 | $3,322.24 | 59347 | $3,266.20 |

| 59420 | $3,267.53 | 59442 | $3,265.94 |

| 59421 | $3,164.99 | 59039 | $3,265.79 |

| 59422 | $3,251.00 | 59430 | $3,264.98 |

| 59424 | $3,267.24 | 59024 | $3,264.17 |

| 59425 | $3,288.25 | 59821 | $3,263.80 |

| 59427 | $3,372.00 | 59243 | $3,262.80 |

| 59430 | $3,264.98 | 59865 | $3,262.24 |

| 59432 | $3,330.49 | 59223 | $3,262.14 |

| 59433 | $3,241.90 | 59079 | $3,262.08 |

| 59434 | $3,372.07 | 59446 | $3,261.37 |

| 59435 | $3,310.63 | 59038 | $3,260.74 |

| 59436 | $3,234.64 | 59231 | $3,258.89 |

| 59440 | $3,163.46 | 59217 | $3,258.06 |

| 59441 | $3,239.30 | 59230 | $3,257.57 |

| 59442 | $3,265.94 | 59860 | $3,255.76 |

| 59443 | $3,124.90 | 59261 | $3,255.03 |

| 59444 | $3,325.35 | 59221 | $3,254.48 |

| 59446 | $3,261.37 | 59468 | $3,252.94 |

| 59447 | $3,311.62 | 59083 | $3,252.49 |

| 59448 | $3,408.40 | 59248 | $3,251.97 |

| 59450 | $3,288.19 | 59523 | $3,251.82 |

| 59451 | $3,228.63 | 59412 | $3,251.80 |

| 59452 | $3,290.91 | 59422 | $3,251.00 |

| 59453 | $3,247.34 | 59037 | $3,251.00 |

| 59454 | $3,336.91 | 59324 | $3,250.85 |

| 59456 | $3,322.02 | 59262 | $3,249.90 |

| 59457 | $3,191.21 | 59354 | $3,249.43 |

| 59460 | $3,364.22 | 59076 | $3,248.89 |

| 59461 | $3,310.25 | 59312 | $3,247.75 |

| 59462 | $3,299.50 | 59240 | $3,247.55 |

| 59463 | $3,185.83 | 59260 | $3,247.44 |

| 59464 | $3,216.18 | 59453 | $3,247.34 |

| 59465 | $3,153.30 | 59501 | $3,247.27 |

| 59466 | $3,352.80 | 59054 | $3,246.91 |

| 59467 | $3,358.68 | 59316 | $3,245.95 |

| 59468 | $3,252.94 | 59338 | $3,245.19 |

| 59469 | $3,310.68 | 59864 | $3,244.78 |

| 59471 | $3,201.01 | 59433 | $3,241.90 |

| 59472 | $3,141.25 | 59072 | $3,241.63 |

| 59474 | $3,308.81 | 59214 | $3,241.41 |

| 59477 | $3,129.08 | 59301 | $3,239.85 |

| 59479 | $3,293.44 | 59213 | $3,239.69 |

| 59480 | $3,217.35 | 59416 | $3,239.42 |

| 59482 | $3,345.49 | 59441 | $3,239.30 |

| 59483 | $3,177.95 | 59489 | $3,237.77 |

| 59484 | $3,362.14 | 59211 | $3,237.68 |

| 59485 | $3,148.50 | 59258 | $3,235.69 |

| 59486 | $3,361.11 | 59418 | $3,235.45 |

| 59487 | $3,141.11 | 59436 | $3,234.64 |

| 59489 | $3,237.77 | 59218 | $3,233.90 |

| 59501 | $3,247.27 | 59225 | $3,233.71 |

| 59520 | $3,316.98 | 59257 | $3,233.59 |

| 59521 | $3,317.89 | 59339 | $3,232.92 |

| 59522 | $3,318.83 | 59252 | $3,231.83 |

| 59523 | $3,251.82 | 59336 | $3,230.76 |

| 59524 | $3,354.13 | 59201 | $3,230.57 |

| 59525 | $3,299.01 | 59344 | $3,230.42 |

| 59526 | $3,309.36 | 59274 | $3,229.80 |

| 59527 | $3,339.71 | 59451 | $3,228.63 |

| 59528 | $3,277.83 | 59276 | $3,228.04 |

| 59529 | $3,320.76 | 59256 | $3,226.98 |

| 59530 | $3,326.42 | 59315 | $3,226.51 |

| 59531 | $3,318.09 | 59255 | $3,224.91 |

| 59532 | $3,293.80 | 59101 | $3,224.44 |

| 59535 | $3,304.56 | 59867 | $3,221.49 |

| 59537 | $3,305.30 | 59222 | $3,219.91 |

| 59538 | $3,286.47 | 59313 | $3,219.31 |

| 59540 | $3,286.64 | 59275 | $3,218.65 |

| 59542 | $3,311.40 | 59102 | $3,218.22 |

| 59544 | $3,283.26 | 59480 | $3,217.35 |

| 59545 | $3,322.39 | 59106 | $3,217.29 |

| 59546 | $3,304.18 | 59353 | $3,217.20 |

| 59547 | $3,307.56 | 59866 | $3,217.11 |

| 59601 | $2,883.49 | 59464 | $3,216.18 |

| 59602 | $2,877.23 | 59327 | $3,213.52 |

| 59625 | $2,907.72 | 59212 | $3,213.21 |

| 59626 | $2,878.40 | 59263 | $3,213.04 |

| 59631 | $3,041.19 | 59242 | $3,212.08 |

| 59632 | $3,000.45 | 59059 | $3,211.85 |

| 59633 | $3,063.99 | 59826 | $3,211.81 |

| 59634 | $3,038.94 | 59270 | $3,210.99 |

| 59635 | $2,866.45 | 59330 | $3,209.70 |

| 59636 | $2,887.70 | 59323 | $3,209.30 |

| 59638 | $3,058.40 | 59226 | $3,208.77 |

| 59639 | $3,108.68 | 59872 | $3,206.64 |

| 59640 | $3,051.21 | 59333 | $3,205.98 |

| 59641 | $2,988.11 | 59219 | $3,204.38 |

| 59642 | $2,997.30 | 59032 | $3,204.36 |

| 59643 | $3,029.11 | 59830 | $3,202.42 |

| 59644 | $3,007.52 | 59842 | $3,202.42 |

| 59645 | $3,040.78 | 59105 | $3,201.49 |

| 59647 | $3,062.67 | 59254 | $3,201.06 |

| 59648 | $3,086.19 | 59471 | $3,201.01 |

| 59701 | $3,185.56 | 59414 | $3,192.53 |

| 59710 | $3,059.37 | 59457 | $3,191.21 |

| 59711 | $3,091.89 | 59401 | $3,190.43 |

| 59713 | $2,979.79 | 59247 | $3,185.91 |

| 59714 | $3,057.10 | 59463 | $3,185.83 |

| 59715 | $3,052.10 | 59701 | $3,185.56 |

| 59716 | $3,108.61 | 59750 | $3,185.34 |

| 59718 | $3,053.16 | 59820 | $3,181.40 |

| 59720 | $3,055.56 | 59483 | $3,177.95 |

| 59721 | $3,002.37 | 59404 | $3,174.69 |

| 59722 | $3,025.76 | 59421 | $3,164.99 |

| 59724 | $3,062.28 | 59440 | $3,163.46 |

| 59725 | $3,030.63 | 59065 | $3,161.32 |

| 59727 | $3,053.49 | 59868 | $3,156.10 |

| 59728 | $2,993.81 | 59405 | $3,155.69 |

| 59729 | $3,037.95 | 59402 | $3,155.30 |

| 59730 | $3,121.79 | 59465 | $3,153.30 |

| 59731 | $3,011.23 | 59485 | $3,148.50 |

| 59732 | $3,009.30 | 59030 | $3,147.92 |

| 59733 | $3,031.96 | 59472 | $3,141.25 |

| 59735 | $2,998.46 | 59487 | $3,141.11 |

| 59736 | $3,043.02 | 59410 | $3,140.66 |

| 59739 | $3,059.80 | 59082 | $3,133.14 |

| 59740 | $3,041.85 | 59477 | $3,129.08 |

| 59741 | $3,077.05 | 59018 | $3,128.77 |

| 59743 | $3,112.93 | 59044 | $3,127.14 |

| 59745 | $3,038.56 | 59443 | $3,124.90 |

| 59746 | $3,009.30 | 59081 | $3,122.05 |

| 59747 | $3,056.23 | 59730 | $3,121.79 |

| 59748 | $3,112.23 | 59743 | $3,112.93 |

| 59749 | $3,050.90 | 59086 | $3,112.29 |

| 59750 | $3,185.34 | 59748 | $3,112.23 |

| 59751 | $3,096.48 | 59823 | $3,111.40 |

| 59752 | $3,017.23 | 59639 | $3,108.68 |

| 59754 | $3,046.03 | 59716 | $3,108.61 |

| 59755 | $3,041.29 | 59020 | $3,104.72 |

| 59758 | $3,092.38 | 59053 | $3,096.84 |

| 59759 | $3,043.29 | 59854 | $3,096.75 |

| 59760 | $3,046.10 | 59751 | $3,096.48 |

| 59761 | $3,011.68 | 59027 | $3,092.38 |

| 59762 | $3,001.95 | 59758 | $3,092.38 |

| 59801 | $2,963.80 | 59711 | $3,091.89 |

| 59802 | $2,952.56 | 59047 | $3,089.78 |

| 59803 | $2,941.55 | 59648 | $3,086.19 |

| 59804 | $2,976.54 | 59741 | $3,077.05 |

| 59808 | $2,950.55 | 59846 | $3,068.77 |

| 59812 | $2,963.16 | 59633 | $3,063.99 |

| 59820 | $3,181.40 | 59647 | $3,062.67 |

| 59821 | $3,263.80 | 59724 | $3,062.28 |

| 59823 | $3,111.40 | 59870 | $3,060.84 |

| 59824 | $3,273.13 | 59739 | $3,059.80 |

| 59825 | $3,019.22 | 59710 | $3,059.37 |

| 59826 | $3,211.81 | 59638 | $3,058.40 |

| 59827 | $3,027.92 | 59714 | $3,057.10 |

| 59828 | $2,990.63 | 59747 | $3,056.23 |

| 59829 | $3,023.61 | 59834 | $3,055.89 |

| 59830 | $3,202.42 | 59720 | $3,055.56 |

| 59831 | $3,272.40 | 59727 | $3,053.49 |

| 59832 | $3,029.57 | 59718 | $3,053.16 |

| 59833 | $3,047.96 | 59715 | $3,052.10 |

| 59834 | $3,055.89 | 59640 | $3,051.21 |

| 59835 | $2,996.26 | 59749 | $3,050.90 |

| 59837 | $3,018.48 | 59833 | $3,047.96 |

| 59840 | $3,004.49 | 59760 | $3,046.10 |

| 59841 | $2,996.26 | 59754 | $3,046.03 |

| 59842 | $3,202.42 | 59759 | $3,043.29 |

| 59843 | $3,027.26 | 59736 | $3,043.02 |

| 59844 | $3,386.85 | 59740 | $3,041.85 |

| 59845 | $3,316.19 | 59755 | $3,041.29 |

| 59846 | $3,068.77 | 59631 | $3,041.19 |

| 59847 | $2,995.39 | 59645 | $3,040.78 |

| 59848 | $3,331.29 | 59634 | $3,038.94 |

| 59851 | $2,988.25 | 59745 | $3,038.56 |

| 59853 | $3,440.51 | 59729 | $3,037.95 |

| 59854 | $3,096.75 | 59733 | $3,031.96 |

| 59856 | $3,310.72 | 59725 | $3,030.63 |

| 59858 | $3,026.79 | 59832 | $3,029.57 |

| 59859 | $3,348.30 | 59643 | $3,029.11 |

| 59860 | $3,255.76 | 59827 | $3,027.92 |

| 59863 | $3,279.47 | 59843 | $3,027.26 |

| 59864 | $3,244.78 | 59858 | $3,026.79 |

| 59865 | $3,262.24 | 59722 | $3,025.76 |

| 59866 | $3,217.11 | 59829 | $3,023.61 |

| 59867 | $3,221.49 | 59825 | $3,019.22 |

| 59868 | $3,156.10 | 59837 | $3,018.48 |

| 59870 | $3,060.84 | 59752 | $3,017.23 |

| 59871 | $3,013.66 | 59871 | $3,013.66 |

| 59872 | $3,206.64 | 59761 | $3,011.68 |

| 59873 | $3,364.34 | 59731 | $3,011.23 |

| 59874 | $3,365.74 | 59732 | $3,009.30 |

| 59875 | $2,996.83 | 59746 | $3,009.30 |

| 59901 | $3,334.32 | 59644 | $3,007.52 |

| 59910 | $3,278.43 | 59840 | $3,004.49 |

| 59911 | $3,336.07 | 59721 | $3,002.37 |

| 59912 | $3,331.09 | 59762 | $3,001.95 |

| 59913 | $3,332.19 | 59632 | $3,000.45 |

| 59914 | $3,340.71 | 59735 | $2,998.46 |

| 59915 | $3,323.40 | 59642 | $2,997.30 |

| 59916 | $3,347.79 | 59875 | $2,996.83 |

| 59917 | $3,372.37 | 59835 | $2,996.26 |

| 59918 | $3,351.38 | 59841 | $2,996.26 |

| 59919 | $3,323.94 | 59847 | $2,995.39 |

| 59920 | $3,391.20 | 59728 | $2,993.81 |

| 59921 | $3,351.97 | 59828 | $2,990.63 |

| 59922 | $3,374.36 | 59851 | $2,988.25 |

| 59923 | $3,364.97 | 59641 | $2,988.11 |

| 59925 | $3,378.26 | 59713 | $2,979.79 |

| 59926 | $3,335.52 | 59804 | $2,976.54 |

| 59927 | $3,324.68 | 59801 | $2,963.80 |

| 59928 | $3,326.39 | 59812 | $2,963.16 |

| 59929 | $3,339.12 | 59802 | $2,952.56 |

| 59930 | $3,387.14 | 59808 | $2,950.55 |

| 59931 | $3,377.84 | 59803 | $2,941.55 |

| 59932 | $3,389.23 | 59625 | $2,907.72 |

| 59933 | $3,351.38 | 59636 | $2,887.70 |

| 59934 | $3,351.38 | 59601 | $2,883.49 |

| 59935 | $3,386.28 | 59626 | $2,878.40 |

| 59936 | $3,335.52 | 59602 | $2,877.23 |

| 59937 | $3,309.17 | 59635 | $2,866.45 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Most Expensive/Least Expensive Carrier Rates by City

Most Expensive/Least Expensive Cities Montana

| City | Average Annual Rate |

|---|---|

| Absarokee | $3,374.37 |

| Acton | $3,324.24 |

| Alberton | $3,181.40 |

| Alder | $3,059.37 |

| Alzada | $3,272.57 |

| Anaconda | $3,091.89 |

| Angela | $3,247.75 |

| Antelope | $3,237.68 |

| Arlee | $3,263.80 |

| Ashland | $3,335.42 |

| Augusta | $3,140.66 |

| Avon | $2,979.79 |

| Babb | $3,387.92 |

| Bainville | $3,213.21 |

| Baker | $3,219.31 |

| Ballantine | $3,329.98 |

| Basin | $3,041.19 |

| Bearcreek | $3,399.96 |

| Belfry | $3,398.10 |

| Belgrade | $3,057.10 |

| Belt | $3,251.80 |

| Biddle | $3,319.09 |

| Big Arm | $3,278.43 |

| Big Sandy | $3,316.98 |

| Big Sky | $3,108.61 |

| Big Timber | $3,372.28 |

| Bigfork | $3,336.07 |

| Bighorn | $3,290.69 |

| Billings | $3,215.36 |

| Birney | $3,354.42 |

| Black Eagle | $3,192.53 |

| Bloomfield | $3,226.51 |

| Bonner | $3,111.40 |

| Boulder | $3,000.45 |

| Box Elder | $3,317.89 |

| Boyd | $3,348.69 |

| Boyes | $3,245.95 |

| Bozeman | $3,052.63 |

| Brady | $3,239.42 |

| Bridger | $3,371.67 |

| Broadus | $3,364.13 |

| Broadview | $3,305.39 |

| Brockton | $3,239.69 |

| Brockway | $3,241.41 |

| Browning | $3,420.37 |

| Brusett | $3,336.70 |

| Buffalo | $3,235.45 |

| Busby | $3,327.72 |

| Butte | $3,185.45 |

| Bynum | $3,322.24 |

| Cameron | $3,055.56 |

| Canyon Creek | $3,064.00 |

| Capitol | $3,273.36 |

| Cardwell | $3,002.38 |

| Carter | $3,267.53 |

| Cascade | $3,164.99 |

| Charlo | $3,273.13 |

| Chester | $3,318.83 |

| Chinook | $3,251.82 |

| Choteau | $3,251.00 |

| Circle | $3,271.34 |

| Clancy | $3,038.94 |

| Clinton | $3,019.22 |

| Clyde Park | $3,128.77 |

| Coffee Creek | $3,267.24 |

| Cohagen | $3,303.97 |

| Colstrip | $3,209.30 |

| Columbia Falls | $3,331.09 |

| Columbus | $3,357.26 |

| Condon | $3,211.81 |

| Conner | $3,027.92 |

| Conrad | $3,288.25 |

| Cooke City | $3,104.72 |

| Coram | $3,332.19 |

| Corvallis | $2,990.63 |

| Crane | $3,258.06 |

| Crow Agency | $3,338.39 |

| Culbertson | $3,233.90 |

| Custer | $3,264.17 |

| Cut Bank | $3,372.00 |

| Dagmar | $3,204.38 |

| Darby | $3,023.61 |

| Dayton | $3,340.70 |

| De Borgia | $3,202.42 |

| Decker | $3,348.11 |

| Deer Lodge | $3,025.76 |

| Dell | $3,062.28 |

| Denton | $3,264.98 |

| Dillon | $3,030.63 |

| Divide | $3,053.49 |

| Dixon | $3,272.40 |

| Dodson | $3,354.13 |

| Drummond | $3,029.57 |

| Dupuyer | $3,330.49 |

| Dutton | $3,241.90 |

| East Glacier Park | $3,372.07 |

| East Helena | $2,866.45 |

| Edgar | $3,348.69 |

| Ekalaka | $3,250.85 |

| Elliston | $2,993.81 |

| Elmo | $3,323.40 |

| Emigrant | $3,092.39 |

| Ennis | $3,037.95 |

| Essex | $3,347.78 |

| Ethridge | $3,310.63 |

| Eureka | $3,372.37 |

| Fairfield | $3,234.64 |

| Fairview | $3,254.48 |

| Fallon | $3,273.41 |

| Fishtail | $3,349.81 |

| Flaxville | $3,219.91 |

| Florence | $3,047.96 |

| Floweree | $3,163.46 |

| Forest Grove | $3,239.30 |

| Forsyth | $3,213.52 |

| Fort Benton | $3,265.94 |

| Fort Harrison | $2,887.70 |

| Fort Peck | $3,262.14 |

| Fort Shaw | $3,124.90 |

| Fort Smith | $3,436.52 |

| Fortine | $3,351.37 |

| Frazer | $3,233.71 |

| Frenchtown | $3,055.89 |

| Froid | $3,208.77 |

| Fromberg | $3,351.51 |

| Galata | $3,325.35 |

| Gallatin Gateway | $3,121.79 |

| Gardiner | $3,147.92 |

| Garrison | $3,011.23 |

| Garryowen | $3,309.23 |

| Geraldine | $3,261.38 |

| Geyser | $3,311.62 |

| Gildford | $3,299.01 |

| Glasgow | $3,257.57 |

| Glen | $3,009.31 |

| Glendive | $3,209.70 |

| Glentana | $3,247.55 |

| Gold Creek | $3,031.96 |

| Grantsdale | $2,996.26 |

| Grass Range | $3,204.36 |

| Great Falls | $3,173.60 |

| Greycliff | $3,376.50 |

| Hall | $3,018.48 |

| Hamilton | $3,004.49 |

| Hammond | $3,268.10 |

| Hardin | $3,330.35 |

| Harlem | $3,309.36 |

| Harlowton | $3,335.54 |

| Harrison | $2,998.46 |

| Hathaway | $3,205.98 |

| Haugan | $3,202.42 |

| Havre | $3,247.27 |

| Hays | $3,339.71 |

| Heart Butte | $3,408.40 |

| Helena | $2,886.71 |

| Helmville | $3,027.26 |

| Heron | $3,386.85 |

| Highwood | $3,288.20 |

| Hilger | $3,228.63 |

| Hingham | $3,277.83 |

| Hinsdale | $3,270.91 |

| Hobson | $3,290.91 |

| Hogeland | $3,320.76 |

| Homestead | $3,212.08 |

| Hot Springs | $3,316.19 |

| Hungry Horse | $3,323.94 |

| Huntley | $3,251.00 |

| Huson | $3,068.77 |

| Hysham | $3,260.74 |

| Ingomar | $3,265.79 |

| Inverness | $3,326.42 |

| Ismay | $3,230.76 |

| Jackson | $3,043.02 |

| Jefferson City | $3,058.40 |

| Joliet | $3,291.92 |

| Joplin | $3,318.09 |

| Jordan | $3,328.66 |

| Judith Gap | $3,247.34 |

| Kalispell | $3,334.32 |

| Kevin | $3,336.91 |

| Kila | $3,391.20 |

| Kinsey | $3,245.19 |

| Kremlin | $3,293.80 |

| Lake McDonald | $3,351.97 |

| Lakeside | $3,374.36 |

| Lambert | $3,262.80 |

| Lame Deer | $3,304.24 |

| Larslan | $3,267.58 |

| Laurel | $3,127.14 |

| Lavina | $3,281.68 |

| Ledger | $3,322.02 |

| Lewistown | $3,191.21 |

| Libby | $3,364.96 |

| Lima | $3,059.80 |

| Lincoln | $3,108.68 |

| Lindsay | $3,232.92 |

| Livingston | $3,089.78 |

| Lloyd | $3,304.56 |

| Lodge Grass | $3,433.47 |

| Lolo | $2,995.39 |

| Loma | $3,364.22 |

| Lonepine | $3,331.28 |

| Loring | $3,305.30 |

| Lothair | $3,310.25 |

| Malmstrom AFB | $3,155.30 |

| Malta | $3,286.47 |

| Manhattan | $3,077.05 |

| Marion | $3,378.26 |

| Martin City | $3,335.52 |

| Martinsdale | $3,096.84 |

| Marysville | $3,051.21 |

| McAllister | $3,041.86 |

| McLeod | $3,342.41 |

| Medicine Lake | $3,185.92 |

| Melrose | $3,112.93 |

| Melstone | $3,246.91 |

| Melville | $3,347.37 |

| Mildred | $3,313.92 |

| Miles City | $3,239.85 |

| Milltown | $2,988.25 |

| Missoula | $2,958.03 |

| Moccasin | $3,299.50 |

| Molt | $3,359.10 |

| Monarch | $3,185.83 |

| Moore | $3,216.18 |

| Mosby | $3,296.35 |

| Musselshell | $3,211.85 |

| Nashua | $3,251.97 |

| Neihart | $3,153.30 |

| Norris | $3,038.56 |

| Noxon | $3,440.51 |

| Nye | $3,342.03 |

| Oilmont | $3,352.80 |

| Olive | $3,313.86 |

| Olney | $3,324.68 |

| Opheim | $3,268.86 |

| Otter | $3,341.41 |

| Outlook | $3,231.83 |

| Ovando | $3,096.75 |

| Paradise | $3,310.71 |

| Park City | $3,351.41 |

| Peerless | $3,268.30 |

| Pendroy | $3,358.68 |

| Philipsburg | $3,026.79 |

| Pinesdale | $2,996.26 |

| Plains | $3,348.30 |

| Plentywood | $3,201.06 |

| Plevna | $3,230.42 |

| Polaris | $3,009.31 |

| Polebridge | $3,326.39 |

| Polson | $3,255.75 |

| Pompeys Pillar | $3,330.28 |

| Pony | $3,056.23 |

| Poplar | $3,224.91 |

| Powderville | $3,324.17 |

| Power | $3,252.94 |

| Pray | $3,161.32 |

| Proctor | $3,339.12 |

| Pryor | $3,377.49 |

| Radersburg | $2,988.11 |

| Ramsay | $3,112.23 |

| Rapelje | $3,351.27 |

| Ravalli | $3,279.47 |

| Raymond | $3,226.98 |

| Raynesford | $3,310.68 |

| Red Lodge | $3,414.03 |

| Redstone | $3,233.59 |

| Reed Point | $3,329.76 |

| Reserve | $3,235.69 |

| Rexford | $3,387.13 |

| Richey | $3,282.47 |

| Richland | $3,247.44 |

| Ringling | $2,997.31 |

| Roberts | $3,398.91 |

| Rollins | $3,377.84 |

| Ronan | $3,244.78 |

| Roscoe | $3,362.59 |

| Rosebud | $3,266.20 |

| Roundup | $3,241.63 |

| Roy | $3,201.01 |

| Rudyard | $3,286.64 |

| Ryegate | $3,365.74 |

| Saco | $3,255.03 |

| Saint Ignatius | $3,262.24 |

| Saint Marie | $3,258.89 |

| Saint Regis | $3,217.11 |

| Saint Xavier | $3,433.31 |

| Saltese | $3,221.49 |

| Sand Coulee | $3,141.25 |

| Sand Springs | $3,359.05 |

| Sanders | $3,248.89 |

| Savage | $3,249.90 |

| Scobey | $3,213.04 |

| Seeley Lake | $3,156.10 |

| Shawmut | $3,350.96 |

| Shelby | $3,308.81 |

| Shepherd | $3,262.08 |

| Sheridan | $3,050.90 |

| Sidney | $3,210.99 |

| Silver Gate | $3,122.05 |

| Silver Star | $3,096.49 |

| Simms | $3,129.09 |

| Somers | $3,389.23 |

| Springdale | $3,133.14 |

| Stanford | $3,293.44 |

| Stevensville | $3,060.84 |

| Stockett | $3,217.35 |

| Stryker | $3,351.37 |

| Sula | $3,013.66 |

| Sumatra | $3,252.49 |

| Sun River | $3,177.95 |

| Sunburst | $3,345.49 |

| Superior | $3,206.64 |

| Sweet Grass | $3,362.14 |

| Teigen | $3,271.07 |

| Terry | $3,273.91 |

| Thompson Falls | $3,364.34 |

| Three Forks | $3,017.23 |

| Toston | $3,029.11 |

| Townsend | $3,007.52 |

| Trego | $3,351.37 |

| Trout Creek | $3,365.74 |

| Troy | $3,386.28 |

| Turner | $3,311.40 |

| Twin Bridges | $3,046.03 |

| Two Dot | $3,342.88 |

| Ulm | $3,148.50 |

| Valier | $3,361.11 |

| Vandalia | $3,269.32 |

| Vaughn | $3,141.11 |

| Victor | $2,996.84 |

| Vida | $3,229.80 |

| Virginia City | $3,041.30 |

| Volborg | $3,312.70 |

| West Glacier | $3,335.52 |

| West Yellowstone | $3,092.39 |

| Westby | $3,218.65 |

| White Sulphur Springs | $3,040.78 |

| Whitefish | $3,309.17 |

| Whitehall | $3,043.29 |

| Whitetail | $3,228.04 |

| Whitewater | $3,283.26 |

| Whitlash | $3,322.39 |

| Wibaux | $3,217.20 |

| Willard | $3,249.43 |

| Willow Creek | $3,046.10 |

| Wilsall | $3,112.29 |

| Winifred | $3,237.77 |

| Winnett | $3,310.52 |

| Winston | $3,062.67 |

| Wisdom | $3,011.68 |

| Wise River | $3,001.95 |

| Wolf Creek | $3,086.19 |

| Wolf Point | $3,230.57 |

| Worden | $3,287.69 |

| Wyola | $3,457.80 |

| Zortman | $3,304.18 |

| Zurich | $3,307.56 |

Take a look at the table above, listing the most/least expensive carrier rates according to the city. As you can see, your location is a significant factor in the rates you can expect to pay.

What are the best Montana car insurance companies?

There are so many car insurance carriers vying for your business these days, it’s hard to know which ones actually come through on their promises.

No need to worry, we’ve got you covered! Keep scrolling to find out who the 10 largest providers are across the state.

Ready to go? Let’s get this show on the road”¦

The 10 Largest Montana Car Insurance Companies’ Financial Rating

AM Best gives insurance companies financial ratings. A good score means they are highly likely to stay solvent and have the ability to pay customer claims.

The 10 Largest Montana Car Insurance Companies Financial Rating

| Providers (Listed by Size, Largest to Smallest) | A.M. Best Rating |

|---|---|

| Allstate | A+ |

| Farmers | A |

| Geico | A++ |

| Liberty Mutual | A |

| Mountain West Farm | A- |

| Progressive | A++ |

| QBE Insurance | A |

| State Farm | A++ |

| Travelers | A++ |

| USAA | A++ |

Besides auto insurance premium, one of the other components that should factor into your decision when picking an insurance carrier is customer ratings. Want to find out what customers really think about the top Montana car insurance carriers?

Here we go”¦

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What are the car insurance company complaints?

Company complaints specific to Montana are not tracked. However, on a national level, the number of complaints and the ratio of complaints per 1,000 automobiles from 2017 are listed below for the top 10 insurance companies in Montana.

Montana Car Insurance Companies with Most Customer Complaints

| Top Providers by Market Share in Montana | Number of Complaints Received | Ratio of Complaints per 1,000 Autos |

|---|---|---|

| Allstate Insurance Group | 163 | 0.5 |

| Farmers Insurance Group | 7 | 0.59 |

| Geico | 333 | 0.68 |

| Liberty Mutual Group | 222 | 5.95 |

| Mountain West Farm Group | 10 | 1.47 |

| Progressive Group | 120 | 0.75 |

| QBE Insurance Group | 4 | 32.86 |

| State Farm Group | 1482 | 0.44 |

| Travelers Group | 2 | 0.09 |

| USAA Group | no data | no data |

Bear in mind, some complaints are based on general customer satisfaction, so factor that into your final decision.

Montana’s Car Insurance Rates by Provider

Montana Insurance Rates by Company

| Company | Average Annual Rate | Compared to State Average | Percentage Over/Under State Average |

|---|---|---|---|

| Allstate F&C | $4,672.10 | +$1,451.26 | +31.06% |

| Depositors Insurance | $3,478.26 | +$257.41 | +7.40% |

| Geico General | $3,602.35 | +$381.50 | +10.59% |

| Mid-Century Ins Co | $3,907.55 | +$686.70 | +17.57% |

| Progressive NorthWestern | $4,330.76 | +$1,109.92 | +25.63% |

| SAFECO Ins Co of IL | $1,326.11 | -$1,894.73 | -142.88% |

| State Farm Mutual Auto | $2,417.73 | -$803.11 | -33.22% |

| USAA | $2,031.89 | -$1,188.96 | -58.51% |

We understand that rates are one of the biggest, if not the biggest factor when you pick Montana car insurance. The above chart shows eight of the top carriers in the state, along with their average rates compared to the overarching state average.

Our researchers discovered that Allstate F&C charges the most in average premiums, with Mid-Century coming in at second place for the highest annual rates. Meanwhile, Safeco comes in number one for the most affordable average rates.

Commute Rates

Montana Commute Rates

| Company | 25-mile commute/12000 annual mileage | 10-mile commute/6000 annual mileage |

|---|---|---|

| Allstate | $4,782.74 | $4,561.46 |

| Farmers | $3,907.55 | $3,907.55 |

| Geico | $3,666.20 | $3,538.49 |

| Liberty Mutual | $1,326.11 | $1,326.11 |

| Nationwide | $3,478.26 | $3,478.26 |

| Progressive | $4,330.76 | $4,330.76 |

| State Farm | $2,489.21 | $2,346.26 |

| USAA | $2,056.29 | $2,007.49 |

The table above compares the rates of top carriers in the state against average commute times. Interestingly enough, Allstate comes in again with the highest premium ratio to annual mileage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Coverage Level Rates

Montana Cost by Company with Different Coverage Levels

| Company | High Coverage Annual Rate | Medium Coverage Annual Rate | Low Coverage Annual Rate |

|---|---|---|---|

| Allstate | $4,449 | $4,661.15 | $4905.69 |

| Farmers | $4,188.01 | $3,903.65 | $3630.98 |

| Geico | $3,769.03 | $3,577.02 | $3460.99 |

| Liberty Mutual | $1416.55 | $1,329.79 | $1231.99 |

| Nationwide | $4049.52 | $3,706.80 | $2678.46 |

| Progressive | $4583.63 | $4,318.46 | $4090.2 |

| State Farm | $2555.66 | $2,407.88 | $2289.67 |

| USAA | $2130.37 | $2,021.60 | $1943.7 |

Credit History Rates

Montana Cost by Company with Different Credit History

| Company | Annual Rate Poor Credit | Annual Rate Fair Credit | Annual Rate Good Credit |

|---|---|---|---|

| Allstate | $5,648.45 | $4,519.28 | $3,848.58 |

| Farmers | $4,607.55 | $3,661.37 | $3,453.72 |

| Geico | $5,675.22 | $3,025.06 | $2,106.77 |

| Liberty Mutual | $1,326.11 | $1,326.11 | $1,326.11 |

| Nationwide | $4,396.26 | $3,172.44 | $2,866.07 |

| Progressive | $5,240.66 | $4,005.65 | $3,745.98 |

| State Farm | $3,476.81 | $2,116.08 | $1,660.31 |

| USAA | $2,740.31 | $1,854.79 | $1,500.57 |

According to a study conducted by Experian, the average resident of Montana has a credit card VantageScore of 689 and around 2.87 credit cards in their name. The average Montanan consumer has a credit card balance of $5,845.

If you think that your credit card debt and car insurance rates have no correlation, think again. Insurance carriers run credit checks on their insureds to assess the likelihood of them filing a claim at any point.

If your credit score doesn’t meet their standards, you might just see a spike in your rates, regardless if you’ve had an accident or not.

Driving Record Rates

Montana Driving Record Rates

| Company | Clean record | With one speeding violation | With one accident | With one DUI |

|---|---|---|---|---|

| Allstate | $3,925.26 | $4,485.46 | $4,642.32 | $5,635.38 |

| Farmers | $3,433.60 | $3,433.60 | $4,436.87 | $4,326.13 |

| Geico | $2,316.09 | $2,767.01 | $3,664.68 | $5,661.62 |

| Liberty Mutual | $903.51 | $1,259.73 | $1,570.59 | $1,570.59 |

| Nationwide | $2,525.70 | $3,051.00 | $3,638.09 | $4,698.24 |

| Progressive | $3,739.67 | $4,147.16 | $4,819.80 | $4,616.41 |

| State Farm | $2,255.63 | $2,417.73 | $2,579.85 | $2,417.73 |

| USAA | $1,531.17 | $1,868.12 | $1,901.51 | $2,826.76 |

As you’ll note in the table above, your driving history has a direct effect on the premiums you can expect to pay. If you look at the rates listed for Geico, for example, you’ll notice that the rate difference for a clean record versus one DUI is over a $3,300 premium jump which is a 59 percent increase!

How Much Auto Insurance Costs in Montana

Explore the varying costs of auto insurance across cities in Montana with our comprehensive comparison tool. Whether you reside in Bozeman, Great Falls, Helena, or Missoula, discover the factors influencing insurance rates and find the best coverage options tailored to your needs.

| Compare Car Insurance Rates in Your City |

|---|

| Bozeman, MT |

| Great Falls, MT |

| Helena, MT |

| Missoula, MT |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The 10 Largest Car Insurance Companies in Montana

Largest Car Insurance Companies in Montana

| Company Group/group/Code Company Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Allstate Insurance Group | $29,149 | 47.79% | 4.02% |

| Farmers Insurance Group | $64,633 | 46.34% | 8.91% |

| Geico | $39,509 | 73.41% | 5.45% |

| Liberty Mutual Group | $93,428 | 56.54% | 12.88% |

| Mountain West Farm Group | $38,879 | 58.37% | 5.36% |

| Progressive Group | $92,619 | 60.42% | 12.77% |

| QBE Insurance Group | $22,480 | 62.39% | 3.10% |

| State Farm Group | $166,714 | 58.29% | 22.99% |

| Travelers Group | $23,589 | 55.63% | 3.25% |

| USAA Group | $50,954 | 70.92% | 7.03% |

Number of Car Insurance Providers in Montana

Total of Insurers in Louisiana

| Property and Casualty Insurance | Total Providers |

|---|---|

| Domestic | 14 |

| Foreign | 822 |

| Total | 836 |

What are Montana’s car insurance laws?

In order to keep your car insurance rates low, you have to know the laws in your state so you’re not blindsided by a fine.

Don’t worry! We’re here to help.

Keep reading to learn about the laws specific to the state of Montana.

Car insurance laws vary from state to state, and Montana is no different.

Montana has important laws worth noting, especially as it relates to age. Teens as young as 14 and 1/2 can obtain a learners permit. This may seem a bit early to you, so there are limitations, but they are still permitted to use a cell phone for any purpose while driving.

Additionally, drivers over the age of 75 are required to renew their license only every four years.

Montana also has no restrictions on helmet usage for motorcyclists or bicyclists. Also worth noting is that their seat belt laws are under secondary enforcement only which means an officer must be enforcing a primary law in order to issue a seat belt citation.

Do you know what’s really crazy?

Seat belt non-use cannot decrease monetary awards for injuries in lawsuits – and the seat belt laws in Montana have not been updated since 1987.

The lack of restrictions in Montana based on age and safety is more reason to get the right coverage, especially when it comes to protecting other drivers with the required uninsured motorists coverage as well as additional liability coverage.

How to Get High-risk Insurance

Drivers with accident history or traffic violations may find themselves unable to purchase coverage from an auto insurance carrier. This is where a type of insurance known as high-risk insurance comes into play.

But, don’t fret!

The Montana Automobile Insurance Plan was created to provide automobile insurance coverage to eligible risks who seek coverage and are unable to obtain such coverage through the voluntary market.

Eligible Montana Automobile Insurance Plan risks are shared among companies writing automobile insurance in the state of Montana.

Montana is one of several states that comprise an association of auto plans referred to as the Western Association of Automobile Insurance Plans (WAAIP).

WAAIP is a processing center where people who have trouble buying automobile insurance are put in touch with an insurance company which will insure them.

How do you get low-cost insurance?

The state of Montana currently does not provide any special low-cost auto insurance program. Montana law requires drivers to carry a minimum amount of liability insurance. Penalties for not having insurance can be severe. You can’t afford not to have insurance.

How to Get Windshield Coverage

While some states mandate a waived deductible for windshield repairs, and others specify the use of only auto manufacturers replacement parts, Montana has no laws specific to windshield coverage.

If windshield coverage is something you desire, you will need to have comprehensive coverage and you will have to carefully examine how the different insurance providers handle windshield claims.

Is there an automobile insurance fraud in Montana?

Insurance fraud is a criminal offense in the state of Montana, occurring when an individual attempts to deceive an insurer to receive benefits or payouts they are not qualified to obtain.

There are three ways in which insurance fraud is committed:

- Knowingly misreporting or hiding facts to get benefits, coverage, or compensation

- Aiding someone in misreporting or altering the facts to receive benefits

- Knowingly making false claims or statements on someone else’s behalf at an official proceeding

Insurance fraud is considered a:

- Class B felony if the value in question is over $20,000, punishable by as much as 10 years imprisonment and/or $25,000 fine

- Class C felony if the value in question is over $300, punishable by as much as five years imprisonment and/or $10,000 fine

- A misdemeanor if the value in question is $300 or under, punishable by as much as one year’s imprisonment and/or $2,000 fine

Simply put, don’t commit insurance fraud, and you’re good to go.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What’s the statute of limitations?

A statute of limitations is the limit on the amount of time you have to bring a lawsuit to court. Different states have different statutes of limitations for personal injury and property damage liability insurance matters.

If you are ever in an auto accident involving extensive injuries and damages, you need to know your rights in the matter.

What are Montana’s vehicle licensing laws?

Now, we all know that you can’t drive a car without a license. Let’s find out what Montana’s mandatory vehicle licensing laws are.

Penalties for Driving Without Insurance

- First Offense – Fine: $250 to $500 fine and/or imprisonment for no more than 10 days

- Second Offense – Fine: $350 and/or imprisonment for no more than 10 days — within five years; license and registration revoked until proof of insurance and payment of reinstatement fees within 90 days

Practically speaking, you won’t do jail time for a first or second no insurance offense, but you will pay a fine.

The state of Montana developed a web-based verification system (MTIVS) to confirm if a vehicle has minimum liability insurance coverage. This system can be accessed by drivers and law enforcement anytime, anywhere.

Teen Driver Laws

Teen Driver Laws Montana

| Young Driver Licensing Laws | Minimum Age | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit | 14 years, 6 months if enrolled in an approved driver education program 16 years old otherwise | A licensed parent, guardian or another authorized (by parent or guardian) individual must supervise All passengers must be seat belted | Teens must have a supervised 50 hours of driving practice, including 10 hours at night |

| Provisional License | 15 years old and have held learner's permit for at least 6 months. | First six months – no more than one passenger younger than 18; second six months – no more than three passengers younger than 18 (family members excepted unless otherwise noted) | Between 11 p.m. and 5 a.m. Nighttime Restrictions: 12 months or at age 18, whichever occurs first (min. age: 16) |

| Full License | 16 years old if held provisional license for at least 12 months. 18 years old otherwise | None | None |

Older Driver and General Population License Renewal Procedure

Older Driver and General Population Renewal Procedures Montana

| License Renewal Procedures | General population | Older population |

|---|---|---|

| License Renewal Cycle | Eight years or 75th birthday, whichever occurs first | Four years for people 75 and older |

| Mail or Online Renewal Permitted | Both, every other renewal | Both, every other renewal |

| Proof of Adequate Vision required at Renewal | Every renewal | Every renewal |

What’s the procedure for new residents?

If you are about to make the move to Montana or even just planning on visiting, here’s what you need to know:

- The Montana Motor Vehicle Division handles all matters related to vehicle licensing.

- New residents must apply for a Montana driver license within 60 days of moving to the state if seeking a non-commercial driver license and within 30 days if they need a commercial license.

- New residents also may be required to pass written and road tests, in addition to a vision test, unless licensed in another state in which case these three tests may be waived.

- Maximum posted speed limits are 80 mph on rural interstates, 65 mph on urban interstates, and 70 mph during the day and 65 mph during the night on both limited access roads and all other roads.

- In Montana, when two vehicles meet on a steep road that isn’t wide enough for both to pass safely, a vehicle going downhill should yield the right-of-way to a vehicle going uphill.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What’s considered comparative negligence?

Montana’s negligence laws err on the side of 51 percent comparative negligence.

What does this mean?

If you wish to pursue a case against the at-fault driver for additional damages, you must prove negligence on behalf of the other party as direct causation to your injuries.

However, the injured individual must be less than 51 percent at fault to claim damages. If it is discovered that you were 51 percent or more at fault, you would not be able to proceed with a claim against the other driver.

Furthermore, if you bear less than 51 percent of fault in the accident, the percentage of fault you carry will be subtracted from any damages you do recover.

What are Montana’s rules of the road?

Now, before you get out on the open road in the Treasure State, you need to know the rules so you can stay safe and keep your rates down.

Ready?

Is Montana at fault or no-fault?

The first thing to know is that Montana follows a traditional fault-based system when it comes to financial responsibility for losses stemming from a crash: that includes car accident injuries, lost income, vehicle damage, and so on.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What are the keep right and move over laws?

Montana’s 2017 annotated statute 61-8-321 states that you should keep right if you are driving slower than the average speed of surrounding traffic.

Move over laws in Montana require that when emergency and maintenance vehicles are on stopped on the roadside, drivers move into a non-adjacent lane if safe and prudent to do so. If unable to move into a non-adjacent lane, drivers must slow down.

What’s the maximum speed limit?

Maximum posted speed limits are 80 mph on rural interstates, 65 mph on urban interstates, and 70 mph during the day and 65 mph during the night on both limited access roads and all other roads.

What are the car seat and cargo area laws?

All children 5 years and younger or less than 60 pounds must be restrained in a child safety seat.

Violation of Montana’s child seat law may not only put the child in danger, but could result in a base fine of $100 plus additional fees.

Children six years of age and up who weigh 60 pounds or more are allowed to sit in all seats with no preference for the rear seat. It’s important to note children may not move out of child safety seat until both requirements are met: six years and 60 pounds.

Montana does not impose restrictions on who can ride in pickup truck cargo areas.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Is ridesharing available?

Rideshare services like Uber and Lyft mandate that all their drivers carry personal car insurance policies that align or exceed the minimum coverages dictated by state law. Drivers rarely carry their own commercial insurance coverage; however, Farmers does provide rideshare car insurance.

Is there an automation on the road?

According to the Insurance Institute for Highway Safety (IIHS),

“Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In driving, automation involves using radar, camera and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving task on a sustained basis.”

Currently, Montana has no restrictions on autonomous vehicles.

What are Montana’s safety laws?

But wait, there’s more! Let’s dig deeper into Montana’s safety laws to protect you on the open road.

DUI Laws

Montana's DUI Laws

| DUI Laws | Details |

|---|---|

| BAC Limit | 0.08 |

| HIGH BAC Limit | N/A |

| Criminal Status by Offense | 1st-3rd misdemeanors, 4th+ felonies |

| Formal Name for Offense | Driving Under the Influence (DUI) |

| Look Back Period/Washout Period | 10 years for 2nd offense, unlimited/lifetime for 3rd+ |

Penalties for Violating Montana's DUI Laws

| DUI Penalties | First Offense | Second Offense | Third Offense |

|---|---|---|---|

| ALS or DL Revocation | Six-month suspension | One-year suspension | One-year suspension |

| Imprisonment | 24 hours to six months | Seven days to one year | 30 days to one year |

| Fine | $600–$1000 +$200 reinstatement fee | $1200–$2000 | $2500–$5000 |

| Other | 10 license points for life; must participate in ACT phases (assessment, course, treatment); may be ordered to use IID | 10 license points for life; may be required to enroll in 24-17 sobriety program | 10 license points=30 total DL revoked for Habitual Traffic Offender |

| Mandatory Interlock | No | No | No |

Marijuana-impaired Driving Laws

Montana currently has marijuana-specific impaired driving laws. The blood level is not to exceed five nanograms of THC per se.

What are the distracted driving laws?

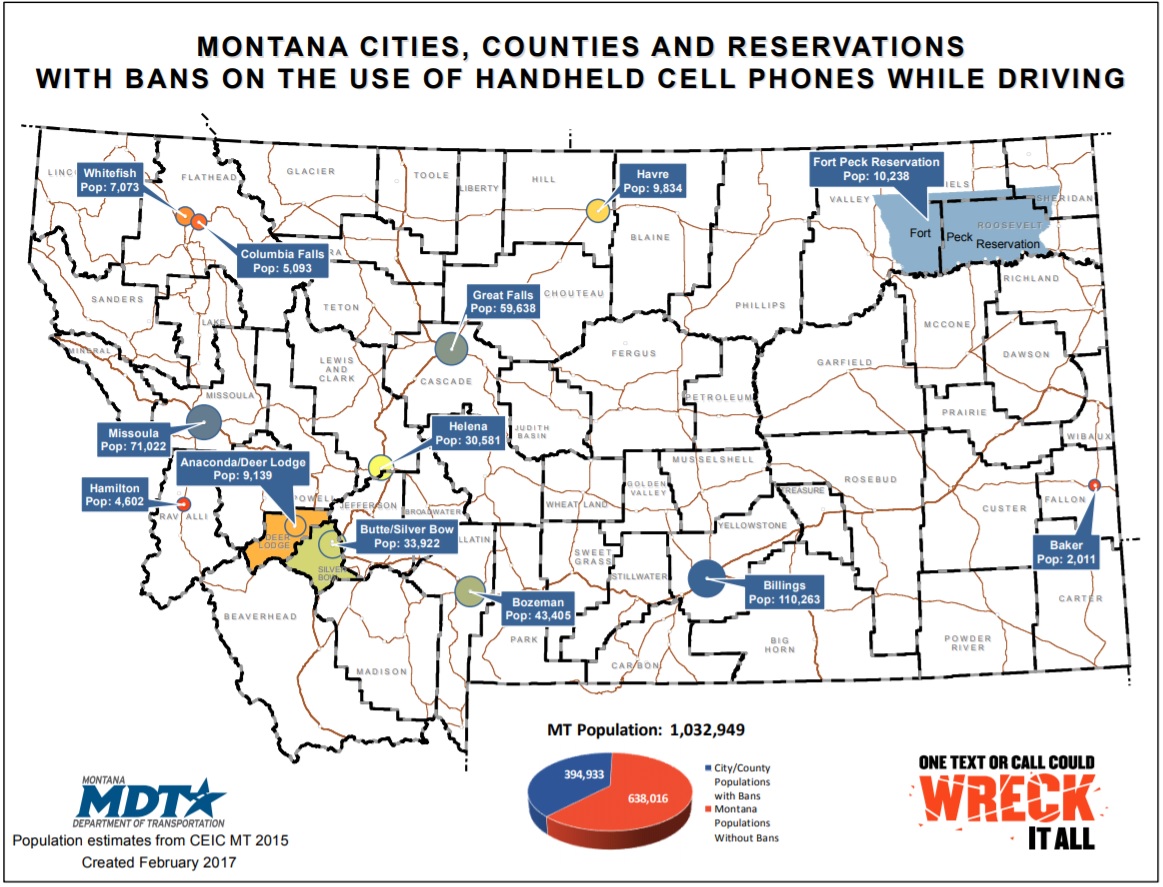

The state of Montana currently has no ban on texting and hand-held devices for all drivers. It’s the only state in the US that has no bans for cell phone use while driving.

Be aware, though, that although there are no state-wide bans, select cities and counties — where over 1/3 of the population lives — have enacted handheld bands. In fact, all the major cities with the exception of Kalispell have hands-free and distracted driving laws. Check out this map below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Montana Fascinating Facts You Need to Know

Do you want to know how safe it really is for drivers in Montana? Well, the data our researchers found might surprise you.

Let’s take a look…

Is there a vehicle theft in Montana?

In 2016 alone, there were just over 1,600 motor vehicle thefts in the state of Montana. Here are the top 10 stolen cars in Montana.

Make/Model Theft in Montana

| Make/Model | Year | Number of Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 1999 | 165 |

| Ford Pickup (Full Size) | 1995 | 145 |

| Dodge Pickup (Full Size) | 2006 | 78 |

| GMC Pickup (Full Size) | 2008 | 55 |

| Honda Accord | 1994 | 52 |

| Chevrolet Impala | 2001 | 31 |

| Ford Explorer | 1996 | 27 |

| Chevrolet Pickup (Small Size) | 1995 | 24 |

| Toyota Camry | 2015 | 23 |

| Ford Pickup (Small Size) | 2000 | 22 |

What’s considered a risky/harmful driving behavior?

The best way to stay safe while driving is to always keep your eyes on the road and stay aware of common risky driving issues in your state.

Let’s delve into this a bit further…

2017 Traffic Fatalities

2017 Traffic Fatalities Montana

| Type | Number of Fatalities |

|---|---|

| Drivers Involved in Fatal Crashes | 228 |

| Traffic Fatalities | 186 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 143 |

| Motorcyclist Fatalities | 23 |

| Pedestrian Fatalities | 14 |

| Bicyclist and other Cyclist Fatalities | 1 |

Fatalities by Person Type

Montana Fatalities by Person Type

| Person Type | Number |

|---|---|

| Occupants (Enclosed Vehicles) | 144 |

| Motorcyclists | 23 |

| Nonoccupants | 14 |

Fatalities by Crash Type

Montana Fatalities by Crash Type

| Crash Type | Number |

|---|---|

| Involving a Roadway Departure | 139 |

| Single Vehicle | 116 |

| Involving a Rollover | 90 |

| Involving Speeding | 59 |

| Involving an Intersection (or Intersection Related) | 23 |

| Involving a Large Truck | 22 |

Five-year Trend for the Top 10 Counties

5 Year Trend for Top 10 Counties of 2017- Montana

| Montana Counties by 2017 Ranking | Fatalities 2013 | Fatalities 2014 | Fatalities 2015 | Fatalities 2016 | Fatalities 2017 |

|---|---|---|---|---|---|

| Missoula | 15 | 15 | 15 | 20 | 17 |

| Flathead | 21 | 13 | 12 | 18 | 15 |

| Big Horn | 10 | 9 | 11 | 13 | 13 |

| Yellowstone | 21 | 18 | 17 | 17 | 12 |

| Lewis And Clark | 7 | 6 | 15 | 4 | 11 |

| Gallatin | 9 | 9 | 10 | 10 | 9 |

| Lake | 11 | 6 | 6 | 8 | 9 |

| Glacier | 15 | 7 | 6 | 7 | 7 |

| Broadwater | 2 | 3 | 2 | 0 | 6 |

| Cascade | 12 | 15 | 9 | 12 | 6 |

| Top Ten Counties | 130 | 109 | 114 | 118 | 105 |

| All Other Counties | 99 | 83 | 110 | 72 | 81 |

| All Counties | 229 | 192 | 224 | 190 | 186 |

Fatalities Involving Speeding by County

Fatalities in Crashes Involving Speeding By County Montana

| County | Fatalities 2013 | Fatalities 2014 | Fatalities 2015 | Fatalities 2016 | Fatalities 2017 | Fatalities Per 100K 2013 | Fatalities Per 100K 2014 | Fatalities Per 100K 2015 | Fatalities Per 100K 2016 | Fatalities Per 100K 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Big Horn | 1 | 1 | 3 | 8 | 2 | 7.62 | 7.5 | 22.6 | 59.83 | 14.97 |

| Broadwater | 1 | 0 | 0 | 0 | 2 | 17.6 | 0 | 0 | 0 | 33.69 |

| Flathead | 8 | 5 | 6 | 5 | 5 | 8.62 | 5.29 | 6.27 | 5.12 | 5 |

| Gallatin | 2 | 3 | 4 | 4 | 5 | 2.12 | 3.09 | 3.99 | 3.84 | 4.64 |

| Glacier | 9 | 3 | 5 | 3 | 3 | 65.36 | 21.92 | 36.71 | 21.95 | 21.99 |

| Hill | 0 | 1 | 5 | 0 | 3 | 0 | 6.07 | 30.45 | 0 | 18.22 |

| Lewis and Clark County | 0 | 1 | 3 | 3 | 4 | 0 | 1.52 | 4.54 | 4.49 | 5.9 |

| Missoula | 5 | 5 | 5 | 3 | 3 | 4.48 | 4.45 | 4.39 | 2.59 | 2.55 |

| Treasure | 0 | 0 | 0 | 0 | 3 | 0 | 0 | 0 | 0 | 441.83 |

| Yellowstone | 8 | 7 | 7 | 5 | 5 | 5.21 | 4.51 | 4.48 | 3.17 | 3.15 |

Fatalities in Crashes Involving an Alcohol-impaired Driver by County

Fatalities in Crashes Involving Alcohol By County Montana

| County | Fatalities 2013 | Fatalities 2014 | Fatalities 2015 | Fatalities 2016 | Fatalities 2017 | Fatalities Per 100K 2013 | Fatalities Per 100K 2014 | Fatalities Per 100K 2015 | Fatalities Per 100K 2016 | Fatalities Per 100K 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Big Horn | 5 | 4 | 5 | 6 | 5 | 38.12 | 30.01 | 37.66 | 44.87 | 37.43 |

| Broadwater | 0 | 1 | 0 | 0 | 2 | 0 | 17.68 | 0 | 0 | 33.69 |

| Cascade | 6 | 9 | 3 | 5 | 2 | 7.31 | 10.98 | 3.67 | 6.14 | 2.45 |

| Dawson | 1 | 0 | 3 | 0 | 3 | 10.67 | 0 | 31.39 | 0 | 33.52 |

| Gallatin | 3 | 5 | 3 | 6 | 6 | 3.18 | 5.15 | 2.99 | 5.77 | 5.57 |

| Glacier | 12 | 3 | 5 | 7 | 4 | 87.15 | 21.92 | 36.71 | 51.21 | 29.33 |

| Lake | 4 | 4 | 1 | 4 | 4 | 13.77 | 13.73 | 3.4 | 13.46 | 13.21 |

| Lewis and Clark | 3 | 1 | 1 | 4 | 4 | 4.61 | 1.52 | 1.51 | 5.99 | 5.9 |

| Missoula | 6 | 3 | 5 | 5 | 4 | 5.38 | 2.67 | 4.39 | 4.31 | 3.41 |

| Yellowstone | 6 | 13 | 5 | 9 | 4 | 3.91 | 8.38 | 3.2 | 5.71 | 2.52 |

Teen Drinking and Driving

Teens and Drunk Driving Montana

| Teens and Drunk Driving | Details |

|---|---|

| Alcohol-Impaired Driving Fatalities Per 100K Population | 3.0 |

| Higher/Lower Than National Average (1.2) | Highest in the Nation |

| DUI Arrest (Under 18 years old) | 42 |

| DUI Arrests (Under 18 years old) Total Per Million People | 184.53 |

EMS Response Time

EMS Response Time-Urban vs. Rural (Montana)

| Type of Crash | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural Fatal Crashes | 9.23 | 15.55 | 42.33 | 59.38 |

| Urban Fatal Crashes | 1.23 | 6.25 | 27.77 | 35.38 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What’s transportation like?

If you live in Montana, chances are you live in a two-car (or more!) household, drive alone to work, and spend a hefty amount of your day commuting!

With an average commute time of 16.4 minutes, Montana ranks below the national average, but with over 76 percent of the population driving alone, that commute doesn’t exactly rank Montana as the greenest state when it comes to carbon emissions.

What’s the percentage of car ownership?

In 2018, 38.2 percent of households in Montana owned two cars. That’s less than the national average of 40.3 percent.

What is the average commute time?

Workers in Montana have an average commute time of 17.2 minutes, compared to the national average of 25.7 minutes. Some Montanans (1.55 percent to be exact) even suffer through a “super commute” — spending in excess of 90 minutes in the car!

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What’s the preferred commuter transportation?

A majority of Montanans, 74.9 percent commute to work alone. Only 9.45 percent carpooled in 2018.

Traffic Congestion

Is traffic a major problem in Montana?

The time spent in traffic doesn’t compare to a city like Los Angeles, that’s for sure, but as people flood into the state, metropolitan areas are experiencing significantly more traffic.

Don’t waste another minute to compare Montana car insurance rates while you wait. Start comparison shopping car insurance rates today!

Frequently Asked Questions

How much does car insurance in Montana?

The of car insurance in Montana can vary depending on several factors, including your age, driving record, location, coverage options, and the type of vehicle you drive. On average, Montana residents pay slightly higher car insurance premiums compared to the national average.

What are the minimum car insurance requirements in Montana?

In Montana, the minimum car insurance requirements are as follows:

- $25,000 bodily injury liability coverage per person

- $50,000 bodily injury liability coverage per accident

- $20,000 property damage liability coverage per accident

Are there any additional insurance coverages recommended for Montana drivers?

While the minimum liability coverage is required in Montana, it’s often beneficial to consider additional coverage options for enhanced protection. Some recommended coverage options include:

- Uninsured/underinsured motorist coverage: Protects you if you’re involved in an accident with a driver who lacks insurance or has insufficient coverage.

- Comprehensive coverage: Covers damages to your vehicle resulting from incidents other than collisions, such as theft, vandalism, or natural disasters.

- Collision coverage: Covers damages to your vehicle resulting from a collision with another vehicle or object.

- Medical payments coverage: Helps cover medical expenses for you and your passengers in the event of an accident.

How can I find affordable car insurance in Montana?

To find affordable car insurance in Montana, consider the following tips:

- Shop around and compare quotes from multiple insurance providers.

- Maintain a clean driving record and avoid traffic violations.

- Consider bundling your car insurance with other policies, such as homeowners or renters insurance, for potential discounts.

- Inquire about available discounts, such as safe driver discounts, good student discounts, or discounts for safety features installed in your vehicle.

- Opt for higher deductibles, but make sure you can afford the out-of-pocket costs in case of a claim.

Are there any specific discounts available for Montana car insurance?

Insurance companies in Montana may offer various discounts to policyholders. Some common discounts include:

- Safe driver discount: Reward for maintaining a clean driving record.

- Multi-vehicle discount: Savings for insuring multiple vehicles with the same provider.

- Good student discount: Discount for students who maintain good grades.

- Anti-theft device discount: Discounts for having anti-theft features installed in your vehicle.

How much is full coverage car insurance in Montana?

Full coverage car insurance in Montana costs an average of $134 per month.