Cheapest Maryland Car Insurance Rates in 2025 (Top 10 Companies for Savings!)

Erie, USAA, and Travelers are the top providers for cheapest Maryland car insurance rates, starting at $22/month. These companies excel due to their competitive pricing, excellent customer service, and coverage options. For consistently affordable Maryland car insurance rates, these providers are the best choice.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jul 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Maryland

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Maryland

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Maryland

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviews

Maryland drivers can save significantly by choosing these top-rated providers. This guide breaks down the benefits and coverage details to help you make an informed decision on the best car insurance for your needs.

- Compare Maryland Car Insurance Rates

- Best Salisbury, MD Car Insurance in 2025

- Best Laurel, MD Car Insurance in 2025

- Best Hanover, MD Car Insurance in 2025

- Best Columbia, MD Car Insurance in 2025

- Best Bishopville, MD Car Insurance in 2025

- Best Bel Air, MD Car Insurance in 2025

- Best Beltsville, MD Car Insurance in 2025

- Best Baltimore, MD Car Insurance in 2025

- Best Arden On The Severn, MD Car Insurance in 2025

- Best Annapolis, MD Car Insurance in 2025

Our Top 10 Company Picks: Cheapest Maryland Car Insurance Rates

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $22 | A+ | Safe-Driving Discounts | Erie |

| #2 | $43 | A++ | Military Benefits | USAA | |

| #3 | $55 | A++ | Affordable Premiums | Travelers | |

| #4 | $56 | A+ | Customer Service | Nationwide |

| #5 | $57 | B | Local Agent | State Farm | |

| #6 | $64 | A+ | Snapshot Discounts | Progressive | |

| #7 | $72 | A++ | Substantial Discounts | Geico | |

| #8 | $74 | A | Customizable Policies | Farmers | |

| #9 | $96 | A | Financial Stability | Liberty Mutual |

| #10 | $107 | A+ | Comprehensive Coverage | Allstate |

Before you spend too much money on Maryland car insurance, it’s wise to understand more about what you need to pay for and why. Learn more in our “What is the best car insurance?”

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code above.

- Erie offers the cheapest Maryland car insurance rates

- Understand how rates vary and the importance of comprehensive coverage

- Learn about discounts and options to reduce your car insurance costs

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Erie: Top Overall Pick

Pros

- Exceptional Customer Service: As mentioned in our Erie car insurance review, Erie is renowned for its high customer satisfaction in Maryland car insurance.

- Affordable Rates: They offer some of the most competitive Maryland car insurance rates.

- Comprehensive Coverage: Erie provides extensive coverage options tailored to meet diverse needs in Maryland car insurance.

Cons

- Limited Availability: Erie Insurance is only available in a few states, including Maryland.

- Online Services: Their online services are not as robust compared to competitors.

#2 – USAA: Best for Military Benefits

Pros

- Military Focused: Tailored benefits and discounts for military members and their families in Maryland.

- Excellent Customer Service: High satisfaction ratings from Maryland car insurance customers. Learn more in our USAA car insurance review.

- Competitive Rates: Offers very competitive pricing for eligible members in Maryland.

Cons

- Eligibility Restrictions: Only available to military personnel and their families in Maryland.

- Limited Physical Locations: Fewer branch offices in Maryland compared to other insurers.

#3 – Travelers: Best for Affordable Premiums

Pros

- Low Premiums: Known for offering some of the most affordable premiums for Maryland car insurance.

- Extensive Discounts: Provides numerous discounts to lower Maryland car insurance rates further.

- Strong Financial Stability: Rated highly for financial strength in Maryland car insurance. See more details on our Travelers car insurance review.

Cons

- Average Customer Service: Customer service ratings for Maryland car insurance are average compared to top competitors.

- Digital Experience: The online experience for Maryland car insurance could be improved.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Customer Service

Pros

- Top-notch Customer Service: Highly rated for Maryland car insurance customer service. Check out insurance savings in our complete Nationwide car insurance discount.

- Diverse Coverage Options: Offers a variety of coverage options to fit different needs in Maryland car insurance.

- Strong Financial Ratings: High marks for financial stability and reliability in Maryland car insurance.

Cons

- Premium Costs: Slightly higher premiums for Maryland car insurance compared to some competitors.

- Discount Availability: Fewer discounts available for Maryland car insurance compared to others on this list.

#5 – State Farm: Best for Local Agent

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple Maryland car insurance policies.

- High Low-Mileage Discount: Provides a substantial discount for low-mileage usage in Maryland.

- Wide Coverage: Offers various coverage options tailored for different needs in Maryland car insurance. Unlock details in our State Farm car insurance review.

Cons

- Limited Multi-Policy Discount: The multi-policy discount for Maryland car insurance is not as high compared to some competitors.

- Premium Costs: Despite discounts, premiums for Maryland car insurance might still be relatively higher for certain coverage levels.

#6 – Progressive: Best for Snapshot Discounts

Pros

- Innovative Discounts: Snapshot program offers significant discounts for Maryland car insurance based on driving habits.

- Customizable Policies: Allows policyholders to tailor their Maryland car insurance coverage. Delve into our evaluation of Progressive car insurance review.

- Competitive Rates: Offers competitive pricing for Maryland car insurance, especially for younger drivers.

Cons

- Mixed Customer Service Reviews: Customer service experiences for Maryland car insurance can be inconsistent.

- Complex Discounts: Some discounts and programs for Maryland car insurance can be confusing to navigate.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Best for Substantial Discounts

Pros

- Wide Range of Discounts: Offers a variety of discounts that can significantly lower Maryland car insurance premiums.

- User-Friendly Online Services: Excellent online tools and mobile app for Maryland car insurance.

- Competitive Pricing: Known for offering very competitive Maryland car insurance rates. Learn more in our Geico car insurance review.

Cons

- Average Customer Service: Customer service for Maryland car insurance is satisfactory but not exceptional.

- Limited Personal Interaction: Fewer local agents in Maryland for in-person assistance.

#8 – Farmers: Best for Customizable Policies

Pros

- Tailored Coverage: Offers highly customizable Maryland car insurance policy options.

- Good Discounts: Farmers car insurance review provides several discounts to lower Maryland car insurance costs.

- Strong Customer Service: Generally positive customer service reviews for Maryland car insurance.

Cons

- Higher Premiums: Premiums for Maryland car insurance can be higher compared to some other providers.

- Limited Availability: Not available in all areas of Maryland.

#9 – Liberty Mutual: Best for Financial Stability

Pros

- Financial Strength: Highly rated for financial stability in Maryland car insurance.

- Comprehensive Coverage Options: Offers a wide range of coverage options for Maryland car insurance.

- Good Discounts: Liberty Mutual car insurance review provides several discount opportunities for Maryland car insurance.

Cons

- Higher Rates: Premiums for Maryland car insurance tend to be higher than some competitors.

- Mixed Customer Service: Customer service reviews for Maryland car insurance are varied.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Offers comprehensive and customizable Maryland car insurance coverage.

- Strong Digital Tools: Excellent online and mobile app services for Maryland car insurance.

- Good Discount Programs: Allstate car insurance review provides various discounts to lower Maryland car insurance premiums.

Cons

- High Premiums: Tends to have higher premiums for Maryland car insurance compared to other providers.

- Customer Service: Mixed reviews on Maryland car insurance customer service quality.

Maryland Car Insurance Coverage and Rates

Are you tired of spending too much money on car insurance in the Old Line State? Are you fed up with hours upon hours of researching insurance information? Comparing various resources can get overwhelming, confusing, and exhausting. That’s why we’re here to help.

Maryland Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $107 | $201 |

| Erie | $22 | $58 |

| Farmers | $74 | $140 |

| Geico | $72 | $135 |

| Liberty Mutual | $96 | $181 |

| Nationwide | $56 | $106 |

| Progressive | $64 | $121 |

| State Farm | $57 | $107 |

| Travelers | $55 | $103 |

| USAA | $43 | $80 |

We aren’t trying to sell you anything. We’re just car insurance experts here to help YOU. This guide will break down Maryland’s policy options, explain why certain types of coverage are important, and translate the jargon that makes your head spin.

We want you to get the proper car insurance coverage for the right amount of money, so let’s get started.

Minimum Car Insurance Requirements in Maryland

In Maryland, understanding the minimum car insurance requirements is crucial for all drivers. These requirements ensure that drivers meet legal obligations and provide financial protection in case of accidents, typically including liability coverage for bodily injury and property damage.

Maryland Car Insurance Minimum Requirements

| Coverages | Limits |

|---|---|

| Bodily Injury Liability (of one person) | $30,000 |

| Bodily Injury Liability (two or more people) | $60,000 |

| Property Damage Liability | $15,000 |

Maryland is a “fault” state, which means that the driver who caused the collision must assume responsibility for any harmful outcomes. Of course, the at-fault driver’s insurance provider will cover these losses within policy limits, and that’s why liability car insurance coverage is required.

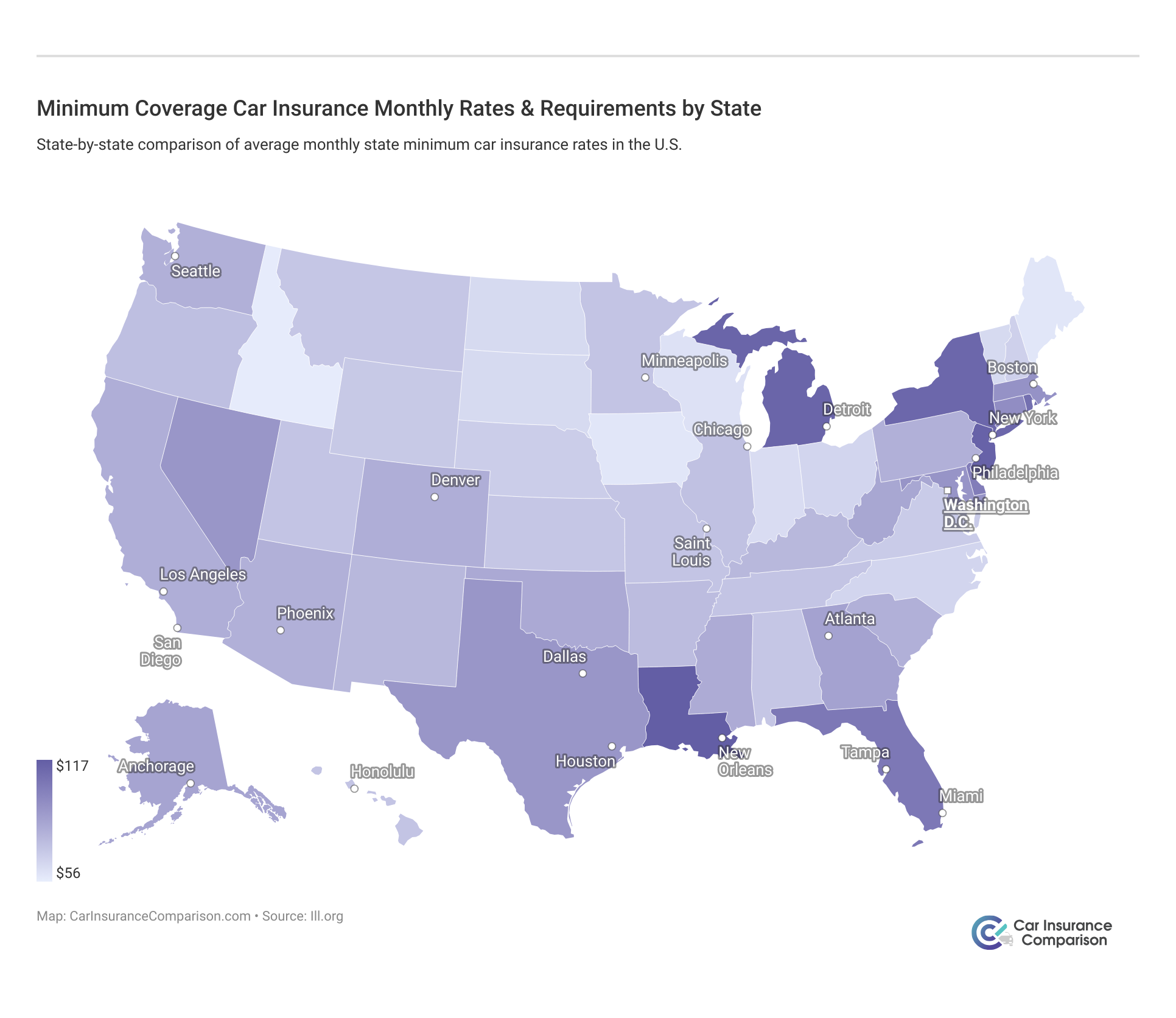

This means, like most states, you must carry a minimum insurance requirement to be able to cover any damages. This varies depending on where you live.

Liability insurance covers whoever (drivers, passengers, pedestrians) gets hurt in an accident that you — or someone under your policy — cause. It covers their medical bills, property damage costs, and other relevant bills within policy limits.

For added protection in the case of a wreck where people and cars are left in critical condition, Marylanders can carry more than liability coverage. To cover your own damage in a car crash situation, collision coverage, and uninsured motorist coverage are ideal.

Forms of Financial Responsibility in Maryland

Since Maryland requires car insurance, there may be times when you’ll need to prove you have coverage, especially when you get in a car accident or get pulled over for any reason.

Therefore, this state requires that you carry an up-to-date insurance identification card with you or in your car. It may be a paper, plastic, or electronic card. All that matters is that it’s current and accurate. Anyone unable to show this card can be fined $50.

If your insurance company notifies the Maryland Department of Transportation Motor Vehicle Administration (MDOT MVA) that you’ve canceled your only active insurance policy, you’ll get a “Proof of Insurance Needed” letter in the mail.

If this is the case, be sure to obtain a new insurance policy as soon as possible. If, however, there was some mistake and your vehicle is still insured, contact your insurance company and request that they send an eFR-19 form (not an ID card or policy) to the MDOT MVA; this form will be valid for 30 days.

Premiums as Percentage of Income in Maryland

In 2014, the monthly per capita disposable personal income in Maryland was $3,906. The monthly full coverage average of auto insurance premiums for 2014 was $91. Thus, on average, Maryland’s car insurance payments require about 2.34% of income.

Thankfully, when it comes to learning where to find the best car insurance at the lowest price, you’re in good hands with us here at Car Insurance Comparison.

Average Monthly Car Insurance Rates in MD (Liability, Collision, Comprehensive)

Let’s go over the cost of core car insurance coverage. When comparing Maryland to the car insurance rates across the U.S., Maryland costs are higher. The national average is $109, while Maryland’s average is $132 — the 11th highest average out of all 50 states.

We’ve collected the average premium costs for each core coverage type from 2015. If you’re in Maryland, there’s a chance these costs have already increased by now. The data in the above table comes from the National Association of Insurance Commissioners.

Additional Liability Coverage in Maryland

In 2015, 12.4% of motorists in Maryland didn’t have car insurance. This stat didn’t place Maryland at the top of the list for the highest percentage of uninsured drivers in the United States, but that percentage still isn’t great.

As mentioned, collision and uninsured motorist coverage are advisable additions, and your insurance company may already require them (even if Maryland State does not).

Additionally, comprehensive coverage is helpful because it covers car repairs that have nothing to do with collisions, like vandalism or natural disasters.

Loss Ratio

Loss ratios gauge the financial status of a car insurance company. A loss ratio is the money a company pays out for claims…to the money they receive for premiums.

So, if they pay $40 in claims out of $100 taken in on premiums, their loss ratio would be 40:100, or 40%. The other 60% goes to paying overhead.

A company that pays more in claims than it collects for premiums has a high loss ratio and isn’t in good financial health, so you want to steer clear of companies in this situation.

Add-ons, Endorsements, and Riders

We know your goal is to get the complete coverage you need at an affordable price. There are several impactful and inexpensive optional add-ons for your policy, also called “riders.”

Here’s a list of useful coverage available to you in Maryland:

- Guaranteed Auto Protection (Gap)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-you-drive or Usage-based Insurance

Choosing the right coverage ensures you’re prepared for various scenarios, from minor mishaps to more significant accidents, helping you drive with peace of mind.

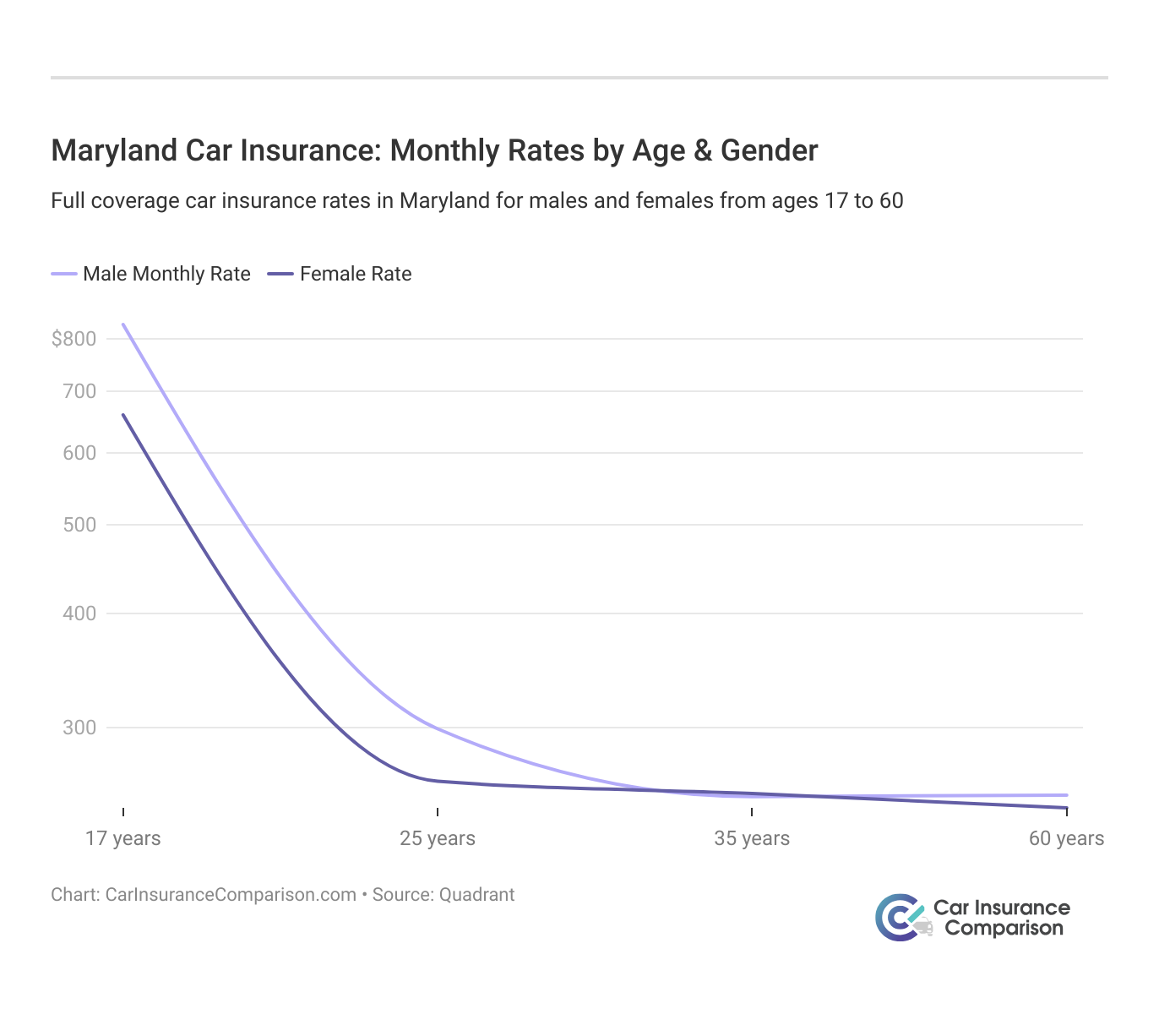

Average Auto Insurance Rates by Age & Gender in MD

Understanding these variations is crucial for drivers navigating insurance options tailored to their demographic characteristics in the state.

In most states, that isn’t true, and Maryland is one of them. In Maryland, Geico and Progressive charge females more than males with the same profile and driving record.

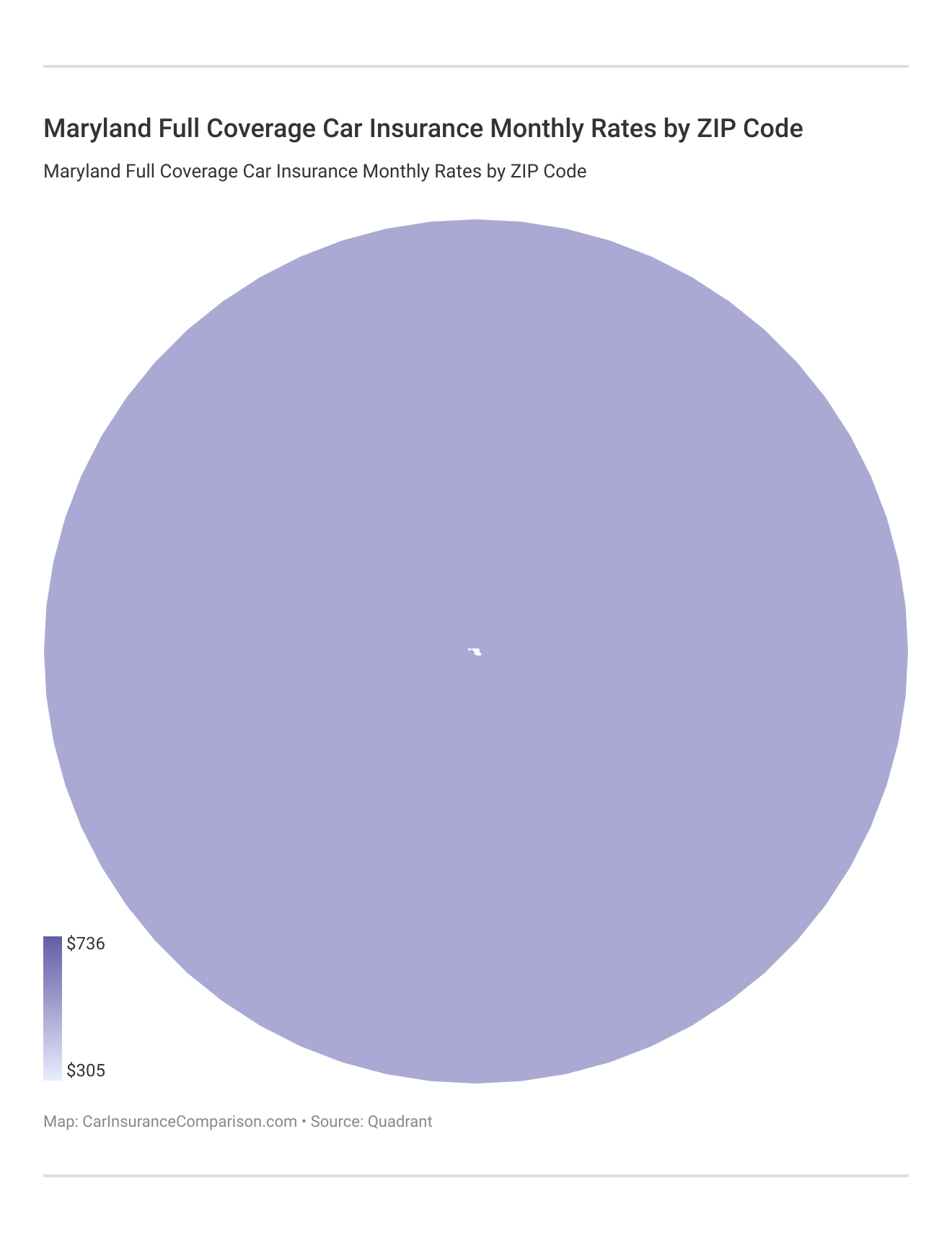

Maryland Car Insurance Rates by ZIP Code

Maryland Car insurance rates can vary significantly depending on the ZIP code in which you reside. Factors such as local traffic patterns, crime rates, and population density play crucial roles in determining insurance premiums across different areas of the state.

These tables show the top ZIP codes with the highest average rates and the top ZIP codes with the lowest average rates. If you live where there are higher rates in Maryland, know that you’re not the only one paying a lot of money for car insurance.

Maryland Full Coverage Car Insurance Monthly Rates for the 25 Cheapest ZIP Codes

| City | ZIP Codes | Rates | Most Expensive Company | Most Expensive Rates | Cheapest Company | Cheapest Rates |

|---|---|---|---|---|---|---|

| Easton | 21601 | $307 | Liberty Mutual | $672 | Nationwide | $183 |

| Crocheron | 21627 | $308 | Liberty Mutual | $645 | Nationwide | $188 |

| Denton | 21629 | $307 | Liberty Mutual | $645 | USAA | $180 |

| Federalsburg | 21632 | $308 | Liberty Mutual | $645 | Nationwide | $188 |

| Hillsboro | 21641 | $307 | Liberty Mutual | $672 | USAA | $180 |

| Neavitt | 21652 | $309 | Liberty Mutual | $672 | Nationwide | $183 |

| Newcomb | 21653 | $309 | Liberty Mutual | $672 | Nationwide | $183 |

| Oxford | 21654 | $309 | Liberty Mutual | $672 | Nationwide | $183 |

| Preston | 21655 | $307 | Liberty Mutual | $672 | USAA | $180 |

| Rhodesdale | 21659 | $309 | Liberty Mutual | $645 | Nationwide | $188 |

| Ridgely | 21660 | $307 | Liberty Mutual | $645 | USAA | $180 |

| Saint Michaels | 21663 | $309 | Liberty Mutual | $672 | Nationwide | $183 |

| Templeville | 21670 | $307 | Liberty Mutual | $672 | USAA | $180 |

| Cascade | 21719 | $308 | Liberty Mutual | $650 | Nationwide | $191 |

| Chewsville | 21721 | $307 | Liberty Mutual | $650 | Nationwide | $191 |

| Funkstown | 21734 | $309 | Liberty Mutual | $650 | Nationwide | $191 |

| Hagerstown | 21742 | $308 | Liberty Mutual | $650 | Nationwide | $191 |

| Maugansville | 21767 | $307 | Liberty Mutual | $650 | Nationwide | $191 |

| Smithsburg | 21783 | $305 | Liberty Mutual | $650 | Nationwide | $191 |

| Williamsport | 21795 | $309 | Liberty Mutual | $650 | Nationwide | $191 |

| Allen | 21810 | $308 | Liberty Mutual | $645 | Nationwide | $187 |

| Berlin | 21811 | $308 | Liberty Mutual | $645 | Nationwide | $184 |

| Ocean City | 21842 | $308 | Liberty Mutual | $645 | Nationwide | $184 |

| Powellville | 21852 | $309 | Liberty Mutual | $645 | Nationwide | $187 |

| Showell | 21862 | $308 | Liberty Mutual | $645 | Nationwide | $184 |

A ZIP code in Smithsburg has the cheapest car insurance rates. This makes it an attractive location for drivers looking to save on insurance premiums. Additionally, many residents appreciate the combination of low costs and comprehensive coverage options available.

Maryland Full Coverage Car Insurance Monthly Rates for the 25 Most Expensive ZIP Codes

| City | ZIP Code | Rates | Most Expensive Company | Most Expensive Monthly Rate | Cheapest Company | Cheapest Monthlyl Rate |

|---|---|---|---|---|---|---|

| Baltimore | 21216 | $736 | Liberty Mutual | $1,504 | USAA | $4,945 |

| Baltimore | 21215 | $721 | Liberty Mutual | $1,504 | USAA | $4,632 |

| Baltimore | 21213 | $705 | Liberty Mutual | $1,368 | USAA | $4,390 |

| Baltimore | 21217 | $701 | Liberty Mutual | $1,504 | USAA | $4,626 |

| Baltimore | 21223 | $686 | Liberty Mutual | $1,282 | USAA | $4,945 |

| Baltimore | 21205 | $657 | Liberty Mutual | $1,368 | USAA | $3,762 |

| Gwynn Oak | 21207 | $643 | Liberty Mutual | $1,282 | USAA | $4,882 |

| Baltimore | 21251 | $633 | Liberty Mutual | $1,282 | USAA | $4,159 |

| Baltimore | 21218 | $633 | Liberty Mutual | $1,282 | USAA | $3,928 |

| Baltimore | 21239 | $624 | Liberty Mutual | $1,290 | USAA | $4,159 |

| Baltimore | 21202 | $609 | Liberty Mutual | $1,282 | USAA | $3,762 |

| Baltimore | 21206 | $609 | Liberty Mutual | $1,050 | USAA | $4,219 |

| Randallstown | 21133 | $607 | Liberty Mutual | $1,282 | USAA | $3,683 |

| Windsor Mill | 21244 | $597 | Liberty Mutual | $1,282 | USAA | $3,906 |

| Baltimore | 21233 | $587 | Liberty Mutual | $1,282 | USAA | $3,831 |

| Baltimore | 21201 | $584 | Liberty Mutual | $1,282 | USAA | $3,735 |

| Baltimore | 21231 | $571 | Liberty Mutual | $1,282 | USAA | $3,831 |

| Pikesville | 21208 | $565 | Liberty Mutual | $1,168 | USAA | $3,662 |

| Baltimore | 21214 | $558 | Liberty Mutual | $901 | USAA | $3,955 |

| Baltimore | 21209 | $543 | Liberty Mutual | $1,168 | USAA | $3,358 |

| Capitol Heights | 20743 | $543 | Liberty Mutual | $1,215 | Nationwide | $4,078 |

| District Heights | 20747 | $534 | Liberty Mutual | $1,215 | USAA | $4,041 |

| Hyattsville | 20785 | $530 | Liberty Mutual | $1,215 | USAA | $4,033 |

| Baltimore | 21212 | $527 | Liberty Mutual | $998 | USAA | $3,833 |

| Bladensburg | 20710 | $526 | Liberty Mutual | $1,215 | Nationwide | $3,589 |

If you’re seeking affordable car insurance in Maryland, exploring rates in Smithsburg could save you money. Comparing quotes from different insurers in this area may help you find the best coverage at a competitive rate tailored to your needs.

Maryland Car Insurance Rates by City

The tables below show the cheapest and most expensive cities in Maryland. The data highlights the varying costs of living across different regions. This information can be useful for individuals considering relocation or budget planning within the state.

Maryland Car Insurance Monthly Rates for the 25 Cheapest Cities

| City | Monthly Rate | Most Expensive Company | Most Expensive Monthly Rate | Cheapest Company | Cheapest Monthly Rate |

|---|---|---|---|---|---|

| Cavetown | $305 | Liberty Mutual | $650 | Nationwide | $191 |

| Denton | $307 | Liberty Mutual | $645 | USAA | $180 |

| Maugansville | $307 | Liberty Mutual | $650 | Nationwide | $191 |

| Chewsville | $307 | Liberty Mutual | $650 | Nationwide | $191 |

| Ridgely | $307 | Liberty Mutual | $645 | USAA | $180 |

| Hillsboro | $307 | Liberty Mutual | $672 | USAA | $180 |

| Templeville | $307 | Liberty Mutual | $672 | USAA | $180 |

| Preston | $307 | Liberty Mutual | $672 | USAA | $180 |

| Easton | $307 | Liberty Mutual | $672 | Nationwide | $183 |

| Cascade | $308 | Liberty Mutual | $650 | Nationwide | $191 |

| Berlin | $308 | Liberty Mutual | $645 | Nationwide | $184 |

| Federalsburg | $308 | Liberty Mutual | $645 | Nationwide | $188 |

| Fountainhead-Orchard Hills | $308 | Liberty Mutual | $650 | Nationwide | $191 |

| Ocean City | $308 | Liberty Mutual | $645 | Nationwide | $184 |

| Showell | $308 | Liberty Mutual | $645 | Nationwide | $184 |

| Allen | $308 | Liberty Mutual | $645 | Nationwide | $187 |

| Crocheron | $308 | Liberty Mutual | $645 | Nationwide | $188 |

| St. Michaels | $309 | Liberty Mutual | $672 | Nationwide | $183 |

| Neavitt | $309 | Liberty Mutual | $672 | Nationwide | $183 |

| Newcomb | $309 | Liberty Mutual | $672 | Nationwide | $183 |

| Halfway | $309 | Liberty Mutual | $650 | Nationwide | $191 |

| Powellville | $309 | Liberty Mutual | $645 | Nationwide | $187 |

| Oxford | $309 | Liberty Mutual | $672 | Nationwide | $183 |

| Rhodesdale | $309 | Liberty Mutual | $645 | Nationwide | $188 |

| Funkstown | $309 | Liberty Mutual | $650 | Nationwide | $191 |

Cavetown and Denton have the cheapest car insurance rates. Their low premiums make them attractive options for budget-conscious drivers. Additionally, both locations offer a variety of policy options to cater to different needs and preferences.

Maryland Full Coverage Car Insurance Monthly Rates for the 25 Most Expensive Cities

| City | Rate | Most Expensive Company | Most Expensive Rate | Cheapest Company | Cheapest Rate |

|---|---|---|---|---|---|

| Randallstown | $607 | Liberty Mutual | $1,282 | USAA | $307 |

| Windsor Mill | $597 | Liberty Mutual | $1,282 | USAA | $326 |

| Baltimore | $572 | Liberty Mutual | $1,129 | USAA | $325 |

| Capitol Heights | $543 | Liberty Mutual | $1,215 | Nationwide | $340 |

| District Heights | $534 | Liberty Mutual | $1,215 | USAA | $337 |

| Cheverly | $530 | Liberty Mutual | $1,215 | USAA | $336 |

| Bladensburg | $526 | Liberty Mutual | $1,215 | Nationwide | $299 |

| Forest Heights | $517 | Liberty Mutual | $1,126 | USAA | $336 |

| East Riverdale | $512 | Liberty Mutual | $1,215 | Nationwide | $299 |

| Garrison | $509 | Liberty Mutual | $998 | USAA | $296 |

| Camp Springs | $501 | Liberty Mutual | $1,093 | USAA | $323 |

| Hyattsville | $497 | Liberty Mutual | $1,026 | Nationwide | $299 |

| Arbutus | $497 | Liberty Mutual | $764 | USAA | $253 |

| Brentwood | $493 | Liberty Mutual | $1,026 | Nationwide | $299 |

| Adelphi | $491 | Liberty Mutual | $1,052 | Nationwide | $315 |

| Riverdale | $490 | Liberty Mutual | $1,026 | Nationwide | $299 |

| Essex | $489 | Liberty Mutual | $901 | USAA | $268 |

| Mount Rainier | $489 | Liberty Mutual | $1,026 | Nationwide | $299 |

| Glenarden | $477 | Liberty Mutual | $1,026 | USAA | $272 |

| Bowleys Quarters | $476 | Liberty Mutual | $901 | USAA | $283 |

| Clinton | $469 | Liberty Mutual | $1,027 | USAA | $279 |

| Reisterstown | $469 | Liberty Mutual | $890 | USAA | $275 |

| Edgemere | $466 | Liberty Mutual | $842 | USAA | $268 |

| Kettering | $466 | Liberty Mutual | $1,026 | USAA | $270 |

| Cheltenham | $465 | Liberty Mutual | $1,027 | USAA | $279 |

It’s also helpful to know that rates aren’t just based on where you live. Demographics affect the types of coverage you have. Do you live in Maryland and fit into any of the following descriptions?

- A family with young drivers pays an monthly average of $703 for car insurance, compared to a range of $160 to $245 for a family with no young drivers.

- A young single male (age 30) pays almost the exact amount as a single male (age 50) with monthly averages of $132 and $133, respectively.

- A senior female (age 65) pays an monthly average of $91 for auto insurance.

Now that you know how auto insurance rates compare between some Maryland ZIP codes, cities, and demographics, let’s look at the insurance companies licensed in your state to help you find the right company for your coverage needs.

Compare Car Insurance Rates in Your City: Finding the Best Deals for You

Explore and compare car insurance rates in Annapolis, Bel Air, Hanover, Arden On The Severn, Beltsville, Laurel, Bishopville, Columbia, and Salisbury, MD.

Maryland Car Insurance Cost by City

Finding the best deals tailored to your location can help you secure optimal coverage at competitive rates. By comparing policies from various providers in your area, you can ensure that you are getting the best value for your specific needs and circumstances.

Maryland Auto Insurance Companies

With the hundreds of car insurance providers out there today, it’s nearly impossible to know who to trust. You’re probably wondering, “Is it safe to switch to a smaller company that offers lower rates?” Let us help you decide.

Keep reading to discover the best providers across the Old Line State.

Top-rated Auto Insurance Companies in Maryland

Top-rated auto insurance companies in Maryland are known for their exceptional financial stability and customer service. Let’s discuss Maryland auto insurance companies’ financial ratings.

Financial Ratings From the Top Maryland Car Insurance Providers

| Insurance Company | A.M. Best |

|---|---|

| Allstate | A+ |

| Erie | A+ |

| Geico | A++ |

| Liberty Mutual | A |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | B |

| The Hartford | A+ |

| Travelers | A++ |

| USAA | A++ |

These insurers also offer a range of coverage options and discounts tailored to the needs of Maryland drivers, ensuring both comprehensive protection and affordability.

Maryland’s Auto Insurance Companies With the BEST Customer Ratings

Since Maryland is a Mid-Atlantic state, we’ve consulted J.D. Power’s study on car insurance companies with the best customer ratings in this region. With a score of 854 out of 1,000, Erie Insurance is number one with the best customer ratings in Maryland (and other Mid-Atlantic states).

Read More: Erie Car Insurance Review

You’ll also notice several other top companies in the 800s, some of which fall below average. While you search for the right auto insurance company for you, keep a company’s customer satisfaction ranking in mind. After all, you could become their customer, too.

Maryland’s Auto Insurance Companies With the MOST Customer Complaints

Since State Farm ranks “below average” in the J.D. Power graphic, it’s no surprise that they received a grand total of 1,482 customer complaints in Maryland in 2017, making them the Maryland car insurance company with the most complaints.

The company with the second-highest amount of complaints is Government Employees Insurance Company, with a total of 333.

That’s a huge drop from State Farm. As a Marylander, it’s wise to keep these numbers in mind.

Understanding the experiences of others can guide you in finding a company that meets your needs and provides reliable customer service.

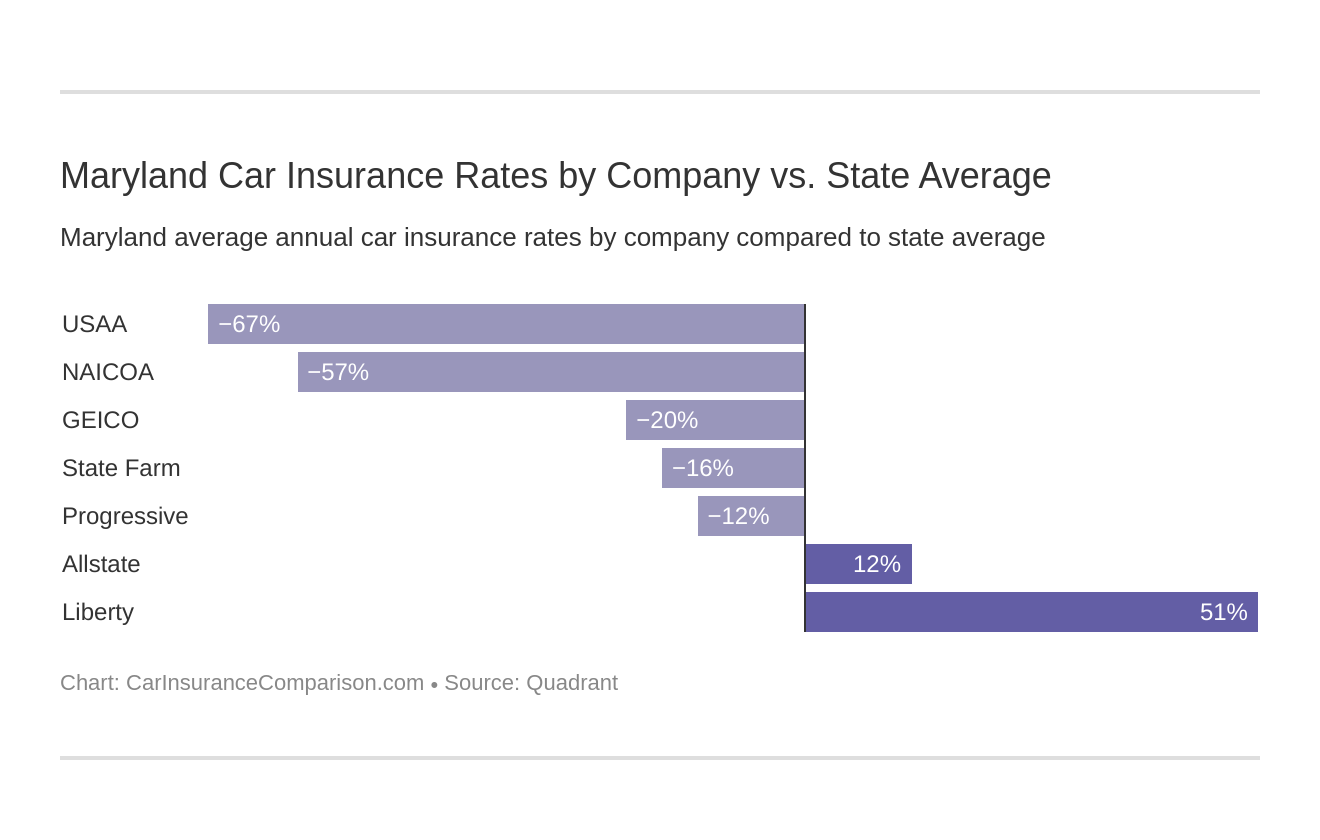

Maryland’s Car Insurance Rates by Company

We’ve compiled a list of the top five cheapest companies that serve Maryland — along with the top five most expensive companies you should avoid if you want cheaper car insurance. That way, you don’t have to do all the research yourself.

Read more: Encompass Car Insurance Discounts

We’ve also put together a chart that shows how these companies’ rates compare versus the state average. This chart highlights any significant discrepancies, providing a clear visual representation of the cost differences.

What’s more, we can help you find the cheapest rates around. Additionally, it offers insights into which companies offer the most competitive rates. By examining this chart, you can make a more informed decision about which insurance provider best fits your needs.

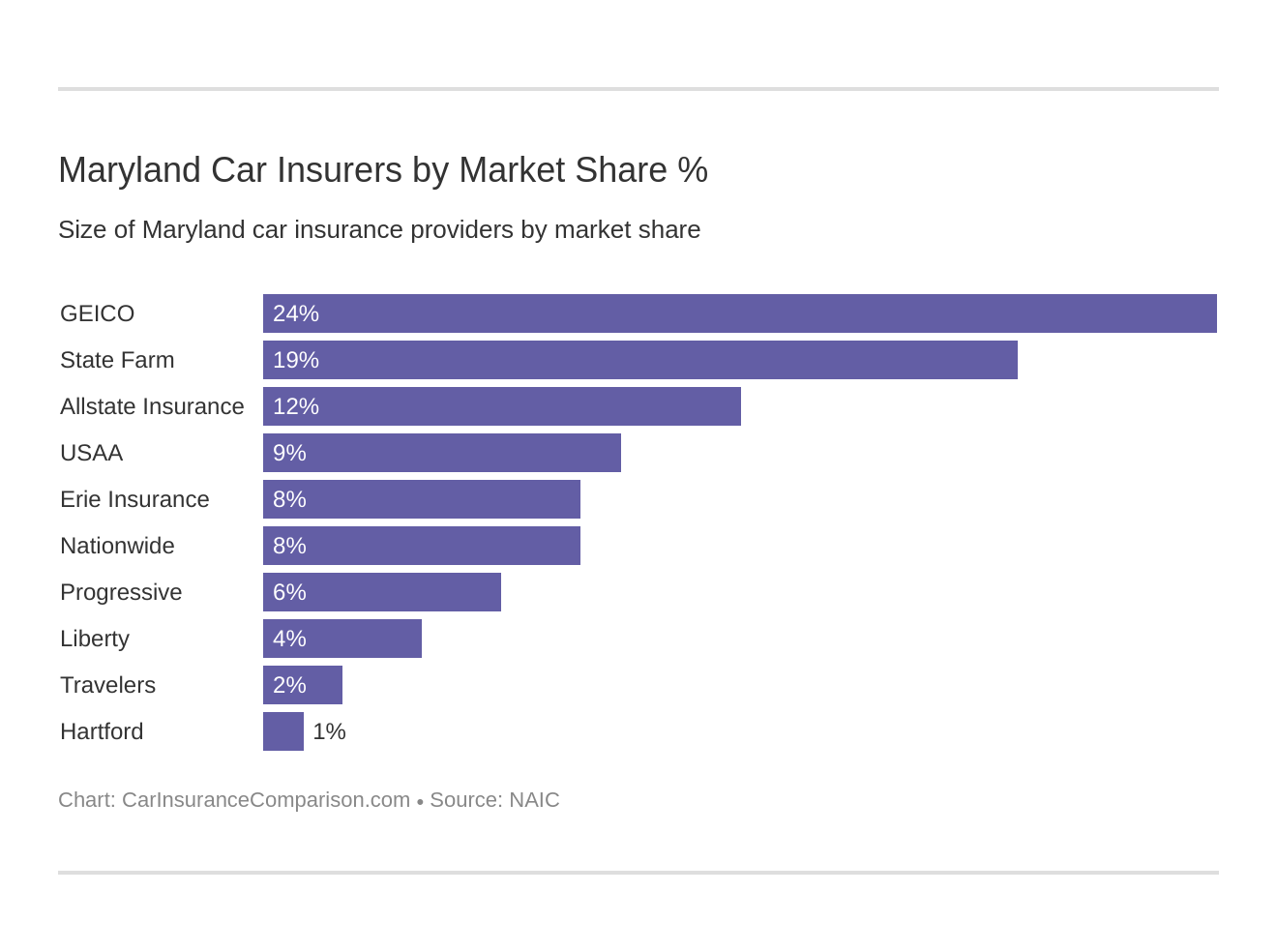

The 10 Largest Auto Insurance Companies in Maryland

We’ve already shown you Maryland’s 10 largest car insurance companies and their financial ratings. But, to give you a better idea of what makes these companies large, for a deeper insight into their prominence, explore their market shares and the volume of premiums they administer.

Number of Property and Casualty Insurance Companies in Maryland

Here are how the top ten insurance companies in the state stack up in their market shares. The market is competitive, with each company vying for a larger portion of the policyholder base.

Whether for auto, home, or business insurance, consumers can choose from a range of providers offering different coverage options and premiums tailored to their specific requirements and budgets.

Commute Rates by Company in Maryland

Commute time is one of a number of factors that play a role in increasing or decreasing your rates. Take a look at how it stacks up.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Maryland Car Insurance Laws

Following your state car insurance laws is important, but they can be difficult to decipher. Not to worry, though — that’s just another reason why we’re here to help. Check out our comprehensive guide titled “Which states do not require car insurance?”

To keep you informed, we’ll give you an inside look at some of the most important car insurance laws in Maryland.

Car Insurance Debt-Reduction Program

If you’ve racked up car insurance debt in Maryland, there’s a chance that 80% of your penalty fees could be waived.

You’ll qualify for the Debt Reduction Program if the following is true of you:

- Are a Maryland resident

- Own a car that isn’t insured yet or buy a car after enrolling in this program

- Have had a delinquent uninsured motorist penalty since before January 1, 2014

- Don’t have a court ruling administered by the Department of Budget and Management, Central Collection Unit (CCU)

Windshield Coverage

If you break or damage your windshield, your insurer can repair or replace it with aftermarket parts that are similar to the original in type and quality.

In preparation for a possible damaged windshield situation, you could purchase a separate insurance clause requiring your provider to install original equipment manufacturer parts.

You can use any repair shop you want, but you may have to pay the cost difference out-of-pocket.

Insurance Fraud

Maryland insurance fraud penalties depend on whether your case is a criminal case, an administrative case, or a civil case. For example, if a person is convicted of criminal insurance fraud, they can get up to five years in prison, a fine of up to $5,000, plus a combined sentence if there are any additional charges.

But an administrative penalty could result in a fine of up to $25,000. From January 2018 through June 2018 in Maryland, there were a total of 25 civil insurance fraud cases (not just car insurance fraud). The combined penalty charges were $ 66,450, and the combined restitution payments totaled $ 42,461.

From January 2018 through June 2018 in Maryland, there were a total of 12 criminal insurance fraud cases. The combined fines totaled $ 1,642, and the combined restitution payments totaled $ 103,939.

Maryland Statute of Limitations

Injured? Vehicle damaged? The statute of limitations is three years for both personal injury and property damage claims, so that’s how long you’ll have to file a claim and fight for the money owed to you.

Penalties for Driving Without Insurance

If you don’t file an aforementioned eFR-19 form and get caught driving again without insurance, you can:

- Lose license plates and vehicle registration privileges

- Pay uninsured motorist penalty fees for each lapse of insurance — $150 for the first 30 days, $7 for each day thereafter

- Pay a restoration fee of up to $25 for a vehicle’s registration

Vehicle Licensing Laws

Whether you’re an older driver, have a driving teen in your family, or are a new Maryland resident, it’s important to know the licensing laws that apply to your age and circumstances. Every state does things a little differently, so let’s look at Maryland’s licensing laws.

Teen Driver Laws

Is your teenager close to driving age? Let’s walk you through the requirements and restrictions for teens in Maryland. Maryland’s Graduated Licensing System ensures that new drivers gain experience gradually, with specific rules for learner’s permits, provisional licenses, and full licenses.

Maryland Teen Driving License Laws

| Type of License | Age Requirements | Pre-Requisites | Passenger Restrictions | Driving Restrictions |

|---|---|---|---|---|

| Learners Permit | Minimum 15 and 9 months | Submit completed identity verification form and/or school attendance form If under 18, parent/guardian must co-sign the permit application Pass a vision screening and knowledge exam | Must be a licensed driver (for at least three years) age 21 or older in the front passenger seat | If under 18, prohibited to use a cell phone or hands-free device except to call 911 |

| Restricted License | Minimum 16 and 6 months | Nine-month holding period Minimum supervised 60 hours of driving (10 must be at night) | If driver is younger than 18, no passengers younger than 18 are allowed, except family members. (Restrictions lifted after five months or until age 18 — whichever comes first.) | If younger than 18, no driving from midnight to 5 a.m. (Restrictions lifted after five months or until age 18 — whichever comes first.) |

| Unrestricted License | Minimum 18 | Must satisfy all previous requirements | None if 18 or older | None if 18 or older |

Understanding these laws will help you support your teen in becoming a responsible, safe and compliant with state regulations and confident driver on the road.

Older Driver License Renewal

In Maryland, all drivers, no matter their ages, must renew their licenses every eight years. However, drivers age 40 and older have to complete a vision assessment every time they renew their licenses.

Anyone over age 70 getting their license for the first time must prove previous satisfactory driving ability or a certificate of physical fitness from their primary doctor.

New Maryland Residents

If you’ve just moved to Maryland from another state with an already valid driver’s license, you’ll have 60 days to replace it with a Maryland license — unless you’re a commercial driver, then you’ll only have 30 days.

Unless your out-of-state license has been expired for over a year, you won’t need to take a knowledge and skills exam. However, you will need to pass a vision exam either way.

Maryland’s Road Rules

To drive safely, you need to drive well and to do that, you must know Maryland’s road rules. Imagine driving on a road where every driver followed their own set of rules.

“Move Over” Rules and Speed Limits

If you’re traveling at least 10 mph below the speed limit or driving slower than traffic on a Maryland highway, you must move out of the left lane. Remember it like this: Slower cars should keep right, but you should always follow the speed limit either way.

The table above shows the max speed limits of different types of Maryland roadways. Note that this table does not include slower-speed residential areas and school zones.

Seat Belt and Car Seat Laws

In Maryland, seat belts are enforced. People aged 16 and older must wear a seat belt. $50 (not including any possible additional fees) is the maximum base fine for a first offense when breaking a seat belt law.

When it comes to car seat laws…Kids aged seven and younger and less than 57 inches tall must be in a car seat. $50 (not including any possible additional fees) is the maximum base fine for a first offense when breaking a car seat law.

When it comes to seat belt laws and pickup trucks…There are restrictions on riding in the cargo areas of pickup trucks, but there are certain groups of people not covered by these restrictions:

- People 16 and older

- People 15 and younger if the car is traveling 25 mph or less

- Employees being driven to work sites or people doing farming work

According to the Insurance Institute for Highway Safety, “exceptions do not eliminate the requirement to use child restraint or belts,” and these restrictions are “inapplicable to pickup trucks with covered cargo areas.”

Ridesharing in Maryland

There are six insurance companies that offer coverage for ridesharing services:

- Allstate

- Erie

- Farmers

- Geico

- Liberty Mutual

- USAA

Maryland law gives insurance providers permission not to cover injuries and damages that happen when you drive for a rideshare service like Lyft, Sidecar, or Uber. Thus, you will likely need to purchase a commercial policy to have the right coverage.

If you don’t have coverage, you could be personally responsible for any medical bills and damages that occur in the case of an accident. But you should have adequate insurance coverage anyway.

If you get in an accident, you will need to provide rideshare insurance proof.

Automation on the Road

In Maryland, there are currently no deployment or testing laws for automatic vehicles.

Maryland Safety Laws

There are safety laws that deal with driving impaired by drugs/alcohol or driving distracted. Let’s break them down for you.

DUI Laws in Maryland

If you’re caught driving impaired with a blood alcohol content (BAC) of 0.08% or more, you’ll be charged with driving under the influence (DUI).

Maryland DUI Laws

| Penalty Type | First Offense | Second Offense | Third Offense |

|---|---|---|---|

| License Suspension or Revocation | Six months | One year; if two convictions within five years, Ignition Interlock Device program is mandatory | 18 months up to lifetime |

| Imprisonment | No minimum, but up to one year | Five days to two years | No minimum, but up to three years |

| Fine | No minimum, but up to $1000 | No minimum, but up to $2,000 | No minimum, but up to $3,000 |

| Other | 12 points on license | 12 points on license | 12 points on license |

Considering that the state has a five-year look-back period? This period signifies the duration a DUI will be retained on an individual’s record.

Read more: What are the DUI insurance laws in Maryland?

Marijuana-impaired Driving Laws

In Maryland, there is no law specific to driving while under the influence of marijuana.

Distracted Driving Laws

In Maryland, all drivers are prohibited from handheld cell phone use while driving. This law aims to reduce distractions and improve road safety by ensuring that drivers keep their focus on the road and their hands on the wheel.

Reminder: Drivers under 18 are banned from using their cell phones at all, unless they need to call 911.

Texting while driving is also banned for everyone. No matter where you live and drive — Maryland or otherwise — don’t text and drive. Also, be alert while driving and talking on the phone with earbuds in, and keep your eyes on the road.

Maryland Can’t-miss Facts

Let’s discuss other important facts and stats about Maryland. We have all the interesting data right here. To learn more insights, browse our guide “How do you get competitive quotes for car insurance?”

Vehicle Theft in Maryland

Which vehicles get stolen the most? Let’s take a look.

Top Make and Model for Theft

Below are the makes and models of the cars most often targeted by thieves in Maryland. This information can help car owners take necessary precautions to protect their vehicles. Understanding these trends can also influence decisions on car insurance coverage.

Most Stolen Cars in Maryland by Make, Model, & Year 2024

| Make & Model | Rank | Vehicle Year | Total Stolen |

|---|---|---|---|

| Dodge Caravan | #1 | 2003 | 250 |

| Honda Accord | #2 | 1997 | 220 |

| Toyota Camry | #3 | 2009 | 200 |

| Honda Civic | #4 | 2000 | 180 |

| Ford Pickup (Full Size) | #5 | 2006 | 160 |

| Nissan Altima | #6 | 2015 | 140 |

| Toyota Corolla | #7 | 2018 | 120 |

| Jeep Cherokee/Grand Cherokee | #8 | 2001 | 100 |

| Chevrolet Pickup (Full Size) | #9 | 2004 | 80 |

| Hyundai Sonata | #10 | 2016 | 60 |

It’s essential to consider these factors when choosing a vehicle and to take appropriate measures to protect against theft, such as using anti-theft devices and parking in secure areas.

Maryland Fatality Rates

If you’re wondering about Maryland fatality rates, check out the following data related to demographics, car accidents with alcohol-impaired drivers, and more. The NHTSA is the source for all of the following fatality data.

Rural Versus Urban Traffic Fatalities

In analyzing traffic fatalities, comparing rural and urban settings reveals distinct trends.

While urban areas often see higher overall accident rates due to density, rural areas often contend with higher fatality rates per accident due to factors like higher speeds and limited emergency response times.

Fatalities by Person Type

This refers to the statistical analysis of road accident fatalities categorized by the type of individuals involved, such as drivers, passengers, pedestrians, and cyclists.

Understanding these distinctions helps identify trends, risks, and areas for improved safety measures in traffic management and public policy.

Fatalities by Crash Type

This is a categorization and analysis of road fatalities based on the specific circumstances and mechanisms of crashes, such as head-on collisions, rollovers, or pedestrian incidents.

Understanding these distinctions is crucial for improving road safety measures and developing targeted interventions to reduce the incidence of fatal accidents.

Five-year Fatalities in 10 Maryland Counties

Examining the five-year fatalities in ten Maryland counties reveals critical insights into regional traffic safety trends and challenges.

This analysis aims to uncover patterns, assess risk factors, and highlight potential areas for targeted safety improvements within these specific regions.

Speeding Fatalities by County

Speeding fatalities by county reveal significant disparities in traffic safety across regions, reflecting varying enforcement measures and infrastructure conditions.

Analyzing these statistics can provide insights into the effectiveness of local road safety initiatives and the impact of speeding on community well-being.

Alcohol-impaired Driver Fatalities by County

Alcohol-impaired driver fatalities by county reveal crucial insights into the impact of impaired driving on local communities.

Analyzing these statistics provides a nuanced understanding of geographical trends and helps inform targeted interventions to improve road safety.

Maryland Teen Drinking and Driving

Here are the facts about teen (18 years old and under) DUIs in Maryland in 2016:

- 60 DUI arrests

- 44.49 arrests per million people

- Maryland ranks 39th for 18-and-under DUI arrests

Below are the facts concerning underage (under 21 years old) drinking-related fatalities:

- 0.6 fatalities per 100,000 people in Maryland

- 1.2 fatalities per 100,000 people is the national average

EMS Response Time in Maryland

If you’re severely injured in a car accident, the Emergency Medical Services (EMS) response time could make the difference between life and death.

Table above are the average response times for both urban and rural areas of Maryland.

Maryland Transportation Facts

Check out these facts about car ownership, commute time, commuter transportation, and traffic congestion in Maryland.

Car Ownership

The average household in Maryland has two cars — 40.3%. This is the same percentage of the households in the nation that own two cars.

Commute Time

The average commute time in Maryland is 31.3 minutes, which is longer than the national average of 25.3 minutes.

Commuter Transportation

In 2016, the top three commute methods and circumstances were as follows:

- 73.8% of people drove alone (below the national average of 76.3%)

- 9% carpooled

- 8.5% took public transit

Top Five Cities for Traffic Congestion

Baltimore City ranks 36th for most traffic congestion — out of all cities in the US. It ranks 42nd out of 319 North American cities and 252nd out of 1,360 cities in the world.

Now that you have quality car insurance facts (and beyond) for Maryland, you’re ready to follow the rules of the road, insurance requirements, and more.

Case Studies: Success Stories with Maryland Car Insurance Rates

Explore how Maryland drivers have benefited from choosing the right car insurance provider. These case studies highlight real-life scenarios where selecting Erie, USAA, and Travelers has made a significant impact on their insurance costs and coverage.

- Case Study #1 – Erie Saves a Family: John and Sarah, a young couple with two kids, found that Erie offered the cheapest Maryland car insurance rates for their needs. By switching to Erie, they saved $22 monthly while enjoying comprehensive coverage and excellent customer service.

- Case Study #2 – Superior Coverage for Military Personnel: Mike, an active-duty military member, chose USAA for his car insurance due to their unbeatable rates and tailored benefits for service members. With USAA, he secured the lowest rates and gained access to exceptional support, ensuring peace of mind for his family.

- Case Study #3 – Senior Driver Lower Premiums: Linda, a 65-year-old driver, switched to Travelers and reduced her premiums by 20%. Travelers offered her affordable rates and additional discounts for safe driving, making it the best choice for her budget and coverage needs.

These case studies demonstrate how selecting the right car insurance provider can lead to substantial savings and better coverage. Read more: How do you get competitive quotes for car insurance?

Erie offers the best combination of affordable rates and exceptional customer service for Maryland drivers.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

By choosing Erie, USAA, or Travelers, Maryland drivers can achieve the best rates and protection for their specific situations. Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How can I compare car insurance rates in Maryland?

Gather necessary information, research providers, obtain and compare quotes, and evaluate customer service. Learn more in our “Is it cheaper to purchase car insurance online?”

Why is it important to compare car insurance rates in Maryland?

Comparing car insurance rates in Maryland ensures you get the best coverage at the most affordable price. Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

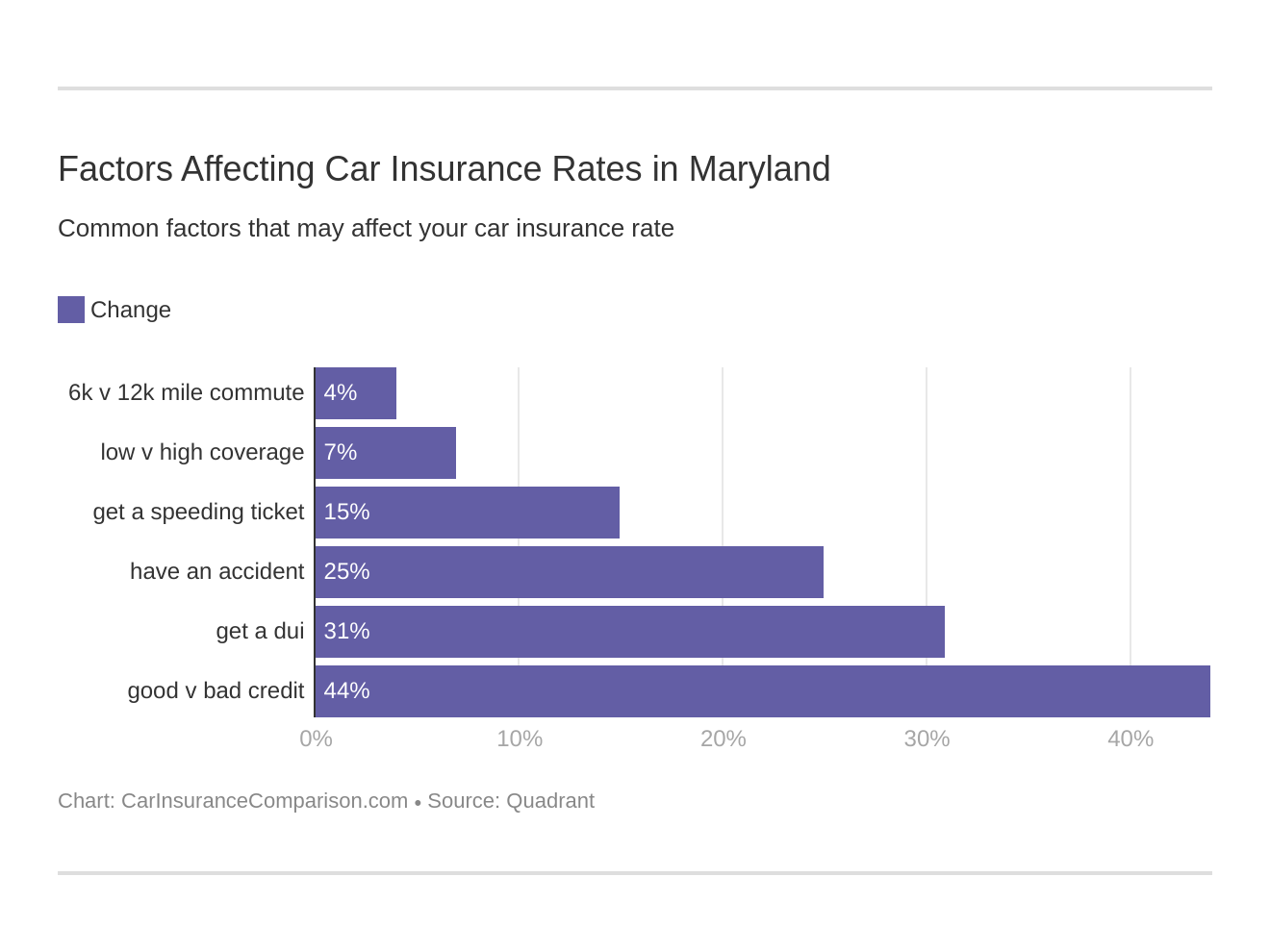

What factors affect car insurance rates in Maryland?

Factors include driving record, age, vehicle type, coverage options, deductibles, credit history, location, annual mileage, and insurance history.

Are there any specific requirements for car insurance in Maryland?

Yes, minimum liability coverage of $30,000 per person, $60,000 per accident, and $15,000 for property damage. To learn more, explore our comprehensive resource on “What is the minimum amount of liability car insurance coverage required?“

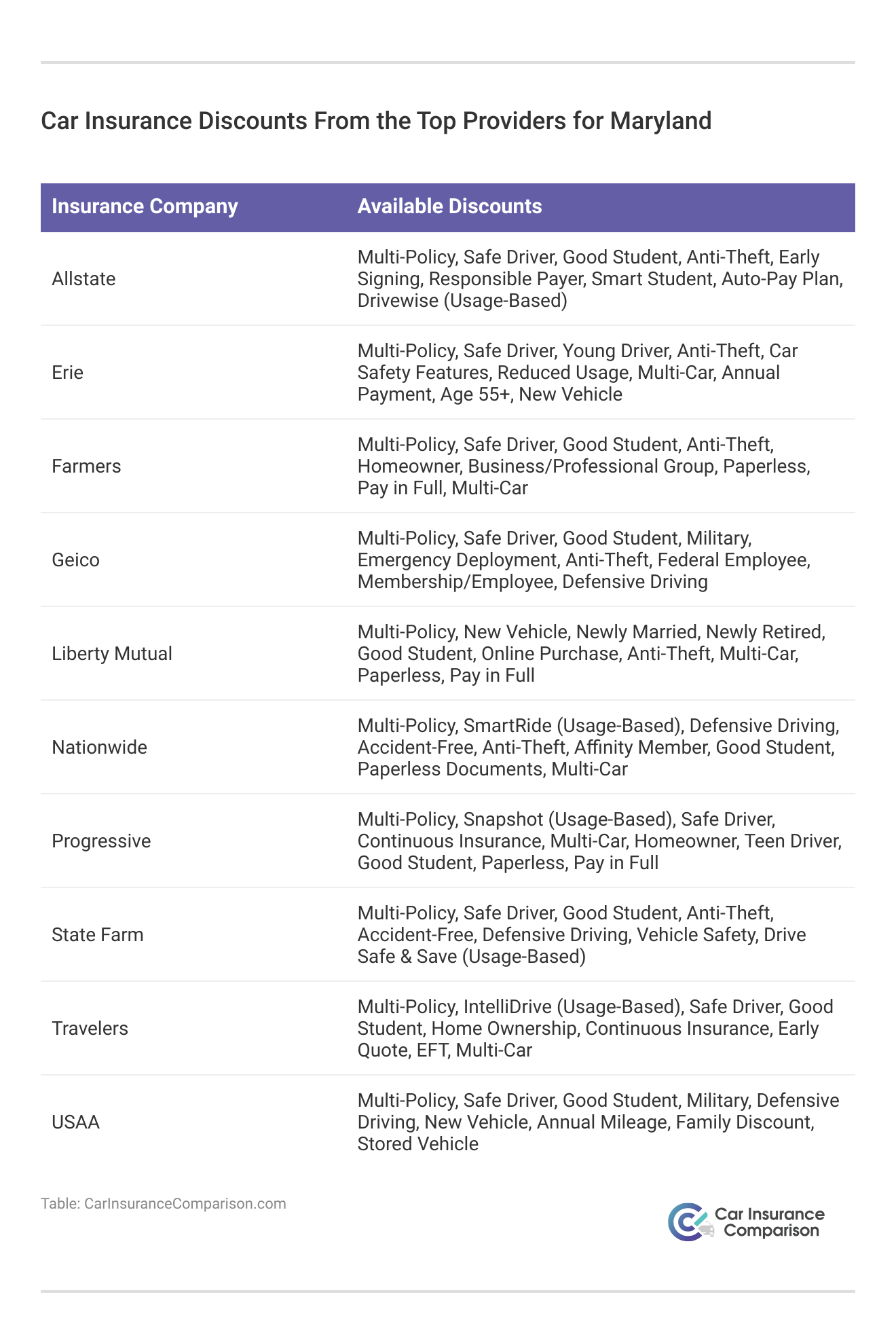

Can I get discounts on car insurance in Maryland?

Yes, discounts are available for multi-policy, safe driving, good students, anti-theft devices, defensive driving courses, and low mileage.

What are the cheapest car insurance companies in Maryland?

The cheapest car insurance companies in Maryland include Erie, USAA, and Travelers, with rates starting at $22/month.

What coverage options should I consider for my car insurance in Maryland?

In addition to the minimum liability coverage, consider collision, comprehensive, uninsured motorist, and personal injury protection (PIP) for enhanced protection.

How can I reduce my car insurance premiums in Maryland?

To reduce your car insurance premiums, maintain a clean driving record, bundle multiple policies, take advantage of discounts, choose higher deductibles, and shop around for the best rates.

What should I do if I have a car accident in Maryland?

If you have a car accident in Maryland, ensure everyone’s safety, call the police, exchange information with the other driver, document the scene, and report the accident to your insurance company.

How does my driving record affect my car insurance rates in Maryland?

A clean driving record can lead to lower premiums, while a history of accidents or traffic violations can result in higher rates due to the increased risk to insurers. Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.