Best Mercury Milan Car Insurance in 2025 (Find the Top 10 Companies Here)

The best Mercury Milan car insurance is offered by State Farm, Geico, and Progressive with monthly premiums as low as $35/mo. These top providers are praised for their competitive pricing, comprehensive coverage options, and reliable customer service, ensuring you get the best value for your car insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Mercury Milan

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews

Company Facts

Full Coverage for Mercury Milan

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Mercury Milan

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

State Farm, Geico, and Progressive are the top choices for the best Mercury Milan car insurance. These companies stand out for their exceptional coverage options, competitive rates, and excellent customer service.

Their commitment to providing reliable and affordable insurance makes them ideal for protecting your Mercury Milan.

Our Top 10 Company Picks: Best Mercury Milan Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 25% A++ Affordable Rates Geico

#3 20% A+ Snapshot Program Progressive

#4 10% A+ Coverage Options Allstate

#5 10% A++ Military Families USAA

#6 15% A Essential Workers Farmers

#7 20% A+ Accident Forgiveness Nationwide

#8 12% A Coverage Variety Liberty Mutual

#9 15% A++ Discount Availability Travelers

#10 15% A Personalized Service American Family

Discover why these providers lead the market in securing the best coverage for your vehicle. Learn more in our article called, “Best Full Coverage Car Insurance.”

Our free online comparison tool above allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Advantages for Mercury Milan: State Farm provides an impressive 17% reduction when combining multiple policies, such as pairing auto, home, or life insurance with coverage for your Mercury Milan. This bundling results in significant savings, helping Mercury Milan owners consolidate their insurance needs under one policy framework, reducing complexity and expenses. Discover insights in our article called, “State Farm Car Insurance Review.”

- Discounts for Low Mileage Mercury Milan Drivers: Owners of Mercury Milan vehicles who drive fewer miles can take advantage of notable savings through State Farm’s low-mileage program. This discount is ideal for drivers who use their Mercury Milan infrequently, offering a chance to cut premiums while still securing robust coverage.

- Tailored Business Insurance for Mercury Milan Use: State Farm shines in offering a range of coverage choices specifically designed for business owners who may use their Mercury Milan for professional purposes. Whether you’re utilizing the vehicle for light commercial tasks or client visits, State Farm ensures that entrepreneurs receive customized protection that fits their requirements.

Cons

- Smaller Multi-Policy Discount for Mercury Milan Holders: Although bundling policies results in savings, State Farm’s 17% discount might not be as competitive as some other providers, potentially leaving Mercury Milan owners wanting deeper discounts when merging their insurance products.

- Higher Premiums Despite Discounts: Even with bundling and mileage savings, some Mercury Milan drivers could still experience higher premiums, particularly if they need more extensive coverage that exceeds basic protections.

#2 – Geico: Best for Affordable Rates

Pros

- Substantial Savings for Policy Combinations: Geico delivers an impressive 25% multi-policy reduction, making it a top choice for Mercury Milan owners who want to combine their car insurance with other types of protection, such as renters or home insurance. This greatly reduces total insurance expenditures without compromising coverage quality.

- Economical Premiums for Mercury Milan Owners: Known for its low-cost pricing, Geico offers Mercury Milan drivers some of the most wallet-friendly rates in the industry. Whether seeking standard or more comprehensive insurance, Geico’s affordable premiums make it easier for Mercury Milan drivers to secure coverage.

- A++ Rating Ensures Solid Financial Standing: Backed by an A++ rating from A.M. Best, Geico’s financial resilience gives Mercury Milan owners confidence, ensuring that the company can manage claims efficiently and fairly, without unnecessary delays. Delve into our evaluation of Geico car insurance review.

Cons

- Fewer Benefits for High-Mileage Mercury Milan Drivers: While Geico excels for those driving fewer miles, Mercury Milan drivers who accumulate high mileage may find fewer opportunities for savings. Geico’s pricing models favor drivers with shorter commutes, leaving heavy users with less incentive.

- Limited Coverage Customization for Mercury Milan: Although Geico offers excellent prices, some Mercury Milan drivers may discover that the coverage options are more restricted, offering less flexibility for those who need more specialized or expansive protection.

#3 – Progressive: Best for Snapshot Program

Pros

- Snapshot Benefits for Drivers: Progressive’s innovative Snapshot program offers Mercury Milan owners the chance to earn significant reductions based on their driving behavior. By tracking how they drive, such as speed, braking, and distance, safe drivers can see savings of up to 20%, creating unique rewards for those who prioritize safe driving. Access comprehensive insights into our article called, “Progressive Car Insurance Review.”

- Discounted Bundling for Mercury Milan Policies: Progressive provides a solid 20% discount for customers who bundle their Mercury Milan auto insurance with additional policies, like homeowners or boat insurance. These bundling strategies can result in major savings while streamlining various insurance needs.

- A+ Rating Ensures Reliability: Progressive’s A+ rating from A.M. Best reassures Mercury Milan drivers that the company will handle their claims quickly and fairly, reflecting the insurer’s strong financial foundation.

Cons

- Privacy Issues with Snapshot’s Monitoring: Though Snapshot offers a chance for big savings, some Mercury Milan drivers may feel uncomfortable with the amount of personal driving data being collected. The constant tracking required by the program could be a concern for drivers who prefer their habits to remain private.

- Variable Premiums for Owners: Because Snapshot is based on driving behavior, premiums can fluctuate. For Mercury Milan drivers who don’t consistently meet the Snapshot program’s criteria for safe driving, this could lead to unexpected increases in their insurance costs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Coverage Options

Pros

- Comprehensive Protection Choices: Allstate is known for its vast array of coverage choices, appealing to the diverse needs of Mercury Milan owners. With features like accident forgiveness, new car replacement, deductible rewards, and rental car coverage, Allstate ensures Mercury Milan drivers are shielded from a variety of risks.

- Bundling Perks for Policies: Allstate offers a 10% discount when Mercury Milan owners combine their auto insurance with other policies, like renters or home insurance. Though smaller than some competitors, it still helps Mercury Milan owners save while enjoying extensive protection options.

- Strong A+ Financial Rating: Allstate’s A+ rating from A.M. Best provides reassurance to Mercury Milan owners that the company’s financial strength ensures swift claim payouts when needed, granting confidence that they’ll be supported during emergencies. More information is available about this provider in our article called, “Allstate Car Insurance Review.”

Cons

- Smaller Multi-Policy Discount for Owners: Although bundling policies results in savings, Allstate’s 10% multi-policy discount may feel underwhelming when compared to competitors with larger reductions. Drivers seeking the maximum discount might find Allstate’s offer less compelling.

- Higher Premiums for Owners Seeking Extra Coverage: While Allstate excels in coverage options, Mercury Milan owners seeking additional protections, such as accident forgiveness or new car replacement, may encounter higher premiums that could stretch their budgets.

#5 – USAA: Best for Military Families

Pros

- Military-Centric Savings for Mercury Milan Insurance: USAA is an outstanding choice for Mercury Milan drivers who are military members, offering an exclusive 10% multi-policy discount when bundling insurance policies. This discount extends to their families, ensuring that military households benefit from affordable insurance that reflects their service. Unlock details in our article called, “USAA Car Insurance Review.”

- A++ Financial Strength for Mercury Milan Owners: USAA’s A++ rating from A.M. Best reflects the company’s excellent financial security. Mercury Milan drivers insured with USAA can be confident that claims will be handled promptly and with the reliability they expect from a top-rated company.

- Coverage Tailored to Military Lifestyles: USAA understands the unique needs of military families, providing insurance options specifically suited to their circumstances. For Mercury Milan drivers who may face deployment or frequent relocations, USAA offers flexible policies, including vehicle storage during active duty and coverage for overseas moves.

Cons

- Strict Eligibility Limits for Mercury Milan Owners: Unfortunately, USAA’s robust offerings are only available to military members and their families. This means that non-military Mercury Milan owners won’t have access to USAA’s exclusive benefits or competitive rates.

- Fewer Discounts for Non-Military Mercury Milan Owners: While USAA is a fantastic option for those in the armed forces, non-military Mercury Milan owners will find limited incentives within the company’s offerings, making it less attractive to the general population.

#6 – Farmers: Best for Essential Workers

Pros

- Mercury Milan-Specific Package Benefits: Farmers delivers a notable 15% discount when consolidating multiple insurance policies. This benefit is especially valuable for Mercury Milan owners, who can secure significant savings by merging their auto, home, and additional insurance needs with Farmers.

- Discounts for Essential Workers: Farmers distinguishes itself with special reductions for essential workers, offering an extra benefit for Mercury Milan drivers in critical fields like healthcare, education, and emergency services. This targeted discount makes insurance more affordable and recognizes the crucial role of these professionals.

- Diverse Coverage Solutions: Farmers provides an extensive range of insurance options, specifically designed to meet the unique requirements of Mercury Milan drivers. Whether seeking basic liability or comprehensive packages with various add-ons, Farmers ensures that all aspects of owning a Mercury Milan are well-protected. Check out insurance savings in our complete guide titled, “Farmers Car Insurance Review.”

Cons

- Moderate Multi-Policy Discount: While Farmers offers a 15% discount for bundling policies, this rate might not be as competitive compared to some other insurers. Mercury Milan drivers might discover more substantial savings with different providers.

- Potentially Elevated Premiums: Even with available discounts, Farmers’ premiums could remain relatively high for some coverage levels, potentially impacting cost-effectiveness for Mercury Milan owners seeking affordable insurance solutions.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness for Mercury Milan Owners: Nationwide’s accident forgiveness feature provides significant peace of mind, especially for Mercury Milan drivers. This program ensures that the initial at-fault accident does not result in a premium increase, promoting financial stability.

- Generous Multi-Policy Discounts: Nationwide offers a 20% discount on bundling multiple insurance policies, presenting a substantial financial advantage. Mercury Milan owners can capitalize on this discount by combining their auto, home, and other insurance needs with Nationwide.

- Top A.M. Best Rating: With an A+ rating from A.M. Best, Nationwide showcases excellent financial health and dependability. This high rating underscores the insurer’s capability to handle claims efficiently and provide robust support for Mercury Milan drivers. Learn more in our guide titled “Nationwide Car Insurance Discounts.”

Cons

- Possibly Higher Premiums: Despite the appealing discount offers, Nationwide’s premiums for Mercury Milan coverage might still be on the higher side compared to other insurers. This could affect overall affordability for policyholders.

- Limited Discount Accessibility: Although Nationwide provides various discounts, some may be less attainable depending on the specific situation or location of Mercury Milan owners, potentially limiting the full benefit of available savings.

#8 – Liberty Mutual: Best for Coverage Variety

Pros

- Broad Mercury Milan Coverage Options: Liberty Mutual is known for its wide array of insurance solutions. Mercury Milan drivers benefit from this diversity, as they can tailor policies to fit numerous needs, from basic liability to comprehensive protection with multiple add-ons and customizations.

- Customizable Discounts for Mercury Milan Owners: Liberty Mutual offers a 12% discount on bundling, allowing Mercury Milan drivers to manage their insurance needs with flexibility. This facilitates tailored savings while adjusting coverage levels to suit personal preferences.

- Extensive Roadside Assistance: Liberty Mutual includes roadside assistance in certain policies, which is particularly useful for Mercury Milan drivers who encounter breakdowns or emergencies, ensuring comprehensive support in critical situations. Discover more about offerings in our article called, “Liberty Mutual Car Insurance Review.”

Cons

- Less Competitive Multi-Policy Discount: The 12% discount on bundling may not be as generous as those offered by other insurers. Mercury Milan drivers might find better savings opportunities elsewhere.

- Complex Policy Details: Liberty Mutual’s wide range of coverage options can sometimes be overwhelming. Mercury Milan owners might struggle with the intricate policy structures and additional options, complicating the decision-making process.

#9 – Travelers: Best for Discount Availability

Pros

- Outstanding A++ Rating: Travelers boasts an A++ rating from A.M. Best, highlighting its superior financial strength and stability. Mercury Milan drivers can trust this high rating as an indicator of the insurer’s reliability in managing claims and providing consistent support.

- Varied Discount Options: Travelers offers a diverse range of discounts, including a 15% multi-policy discount. Mercury Milan owners can benefit from this variety, exploring multiple ways to save on auto, home, and other types of insurance.

- Innovative Telematics Program: The IntelliDrive program by Travelers offers additional savings based on safe driving practices. Mercury Milan drivers who demonstrate responsible driving can enjoy further discounts, enhancing overall insurance affordability. Read up on the “Travelers Car Insurance Review” for more information. coverage.

Cons

- Potentially Higher Premiums: Even with extensive discount options, Travelers’ premiums might still be comparatively high. This could influence the cost-effectiveness for Mercury Milan drivers seeking budget-friendly insurance solutions.

- Discount Eligibility Criteria: Some discounts from Travelers, such as those for safe driving, may come with stringent eligibility requirements. Mercury Milan owners might face challenges in meeting these criteria, potentially limiting the full benefit of available discounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Personalized Service

Pros

- Exceptional Personalized Service for Mercury Milan Drivers: American Family excels in providing tailored customer service, ensuring Mercury Milan owners receive customized attention and policy solutions. This personalized approach enhances the insurance experience.

- Beneficial Multi-Policy Savings: With a 15% discount for bundling, American Family offers Mercury Milan drivers the chance to consolidate their insurance policies and achieve consistent savings across various coverage types.

- Flexible Coverage Adjustments: American Family’s policies are designed to be adaptable, allowing Mercury Milan drivers to adjust coverage levels as their needs change. Whether increasing or decreasing coverage, policyholders can modify their insurance to fit evolving circumstances. More information is available about this provider in our guide titled, “American Family Car Insurance Review.”

Cons

- Regional Availability Limitations: American Family’s coverage options might not be available in all areas, potentially limiting access for Mercury Milan drivers in regions where the insurer does not operate.

- Higher Premiums in Certain Cases: Despite the high level of personalized service, American Family’s premiums for Mercury Milan coverage could be higher compared to other providers, which might be a consideration for cost-conscious policyholders.

Mercury Milan Insurance Rates by Coverage & Provider

When evaluating Mercury Milan car insurance, it’s essential to consider the varying rates offered by different providers based on the coverage level. The following table outlines the monthly rates for both minimum and full coverage from top insurance companies.

Mercury Milan Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $50 $140

American Family $44 $128

Farmers $47 $138

Geico $40 $120

Liberty Mutual $55 $145

Nationwide $46 $132

Progressive $48 $135

State Farm $45 $130

Travelers $42 $125

USAA $35 $115

For Mercury Milan drivers, car insurance costs can vary significantly depending on the chosen provider and the level of coverage. USAA offers the lowest rates, with $35 for minimum coverage and $115 for full coverage, making it a standout option for military families.

Geico also provides competitive rates at $40 for minimum coverage and $120 for full coverage, making it an excellent choice for those seeking affordable options. On the other hand, Liberty Mutual charges the highest rates, with $55 for minimum coverage and $145 for full coverage.

Understanding these differences can help Mercury Milan owners choose the best coverage based on their budget and needs. More information is available about this provider in our article called, “Car Insurance Coverage.”

Mercury Milan Insurance Cost

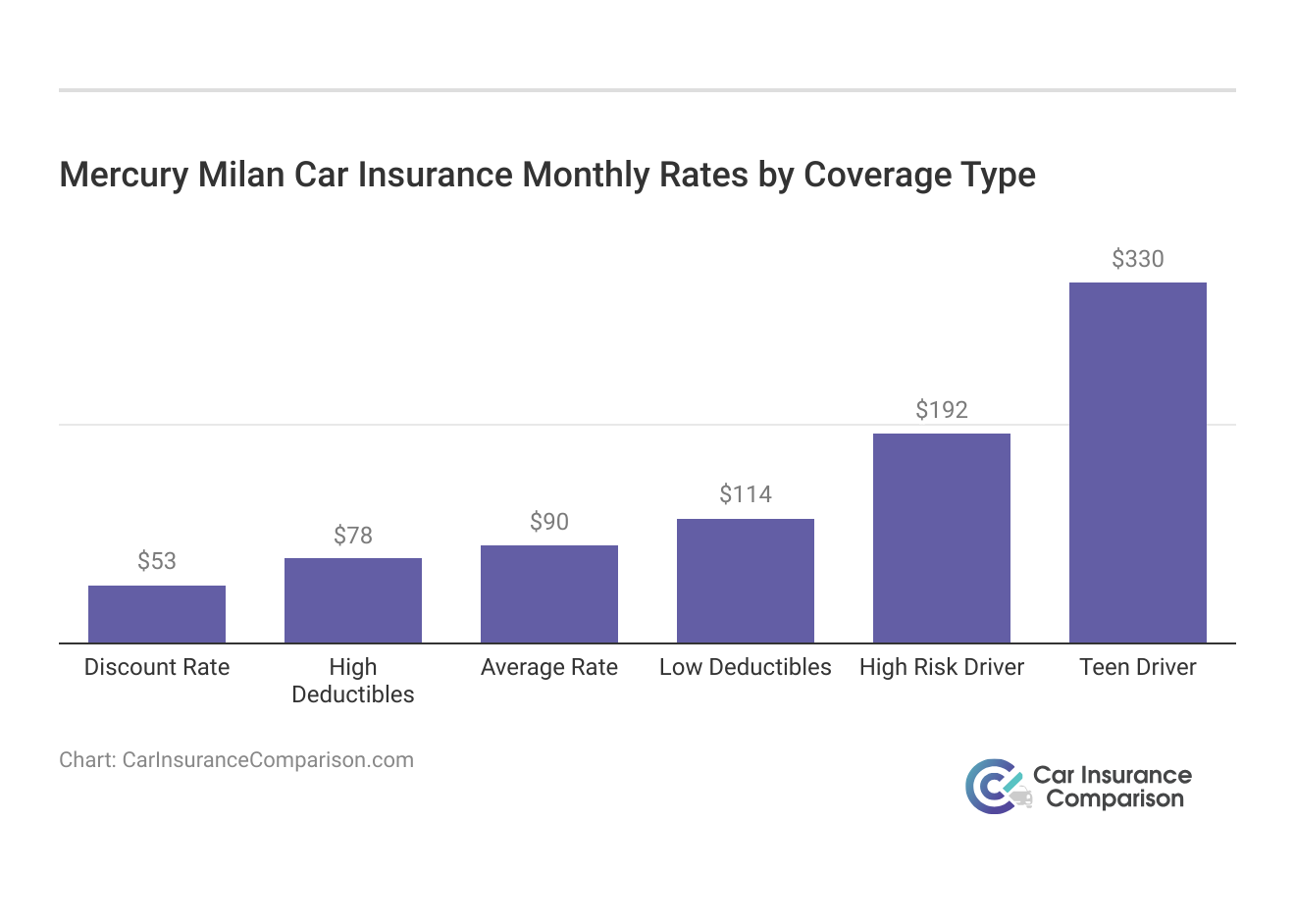

The average Mercury Milan auto insurance costs are $1,082 a year or $90 a month. If you want to learn more about the company, head to our guide titled, “What is a car insurance premium?”

Grasping the costs of Mercury Milan insurance is crucial for effective budgeting and securing optimal coverage. With an annual average of $1,082, being aware of specific rates allows you to make informed choices and possibly reduce your monthly premiums.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of Mercury Milan Insurance

The Mercury Milan trim and model you choose will affect the total price you will pay for Mercury Milan insurance coverage. Unlock details in our article called “How to Purchase the Right Car Insurance Quote Online.”

Age of the Vehicle

The average Mercury Milan car insurance rates are higher for newer models. For example, car insurance rates for a 2011 Mercury Milan are $1,082, while 2010 Mercury Milan rates are $1,056, a difference of $26.

Mercury Milan Car Insurance Monthly Rates by Model Year & Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Mercury Milan | $14 | $20 | $73 | $152 |

| 2023 Mercury Milan | $15 | $23 | $85 | $166 |

| 2022 Mercury Milan | $13 | $22 | $79 | $154 |

| 2021 Mercury Milan | $12 | $21 | $78 | $150 |

| 2020 Mercury Milan | $11 | $20 | $75 | $146 |

Newer models tend to have higher rates due to increased replacement and repair costs, making it essential to consider both your car’s age and insurance expenses.

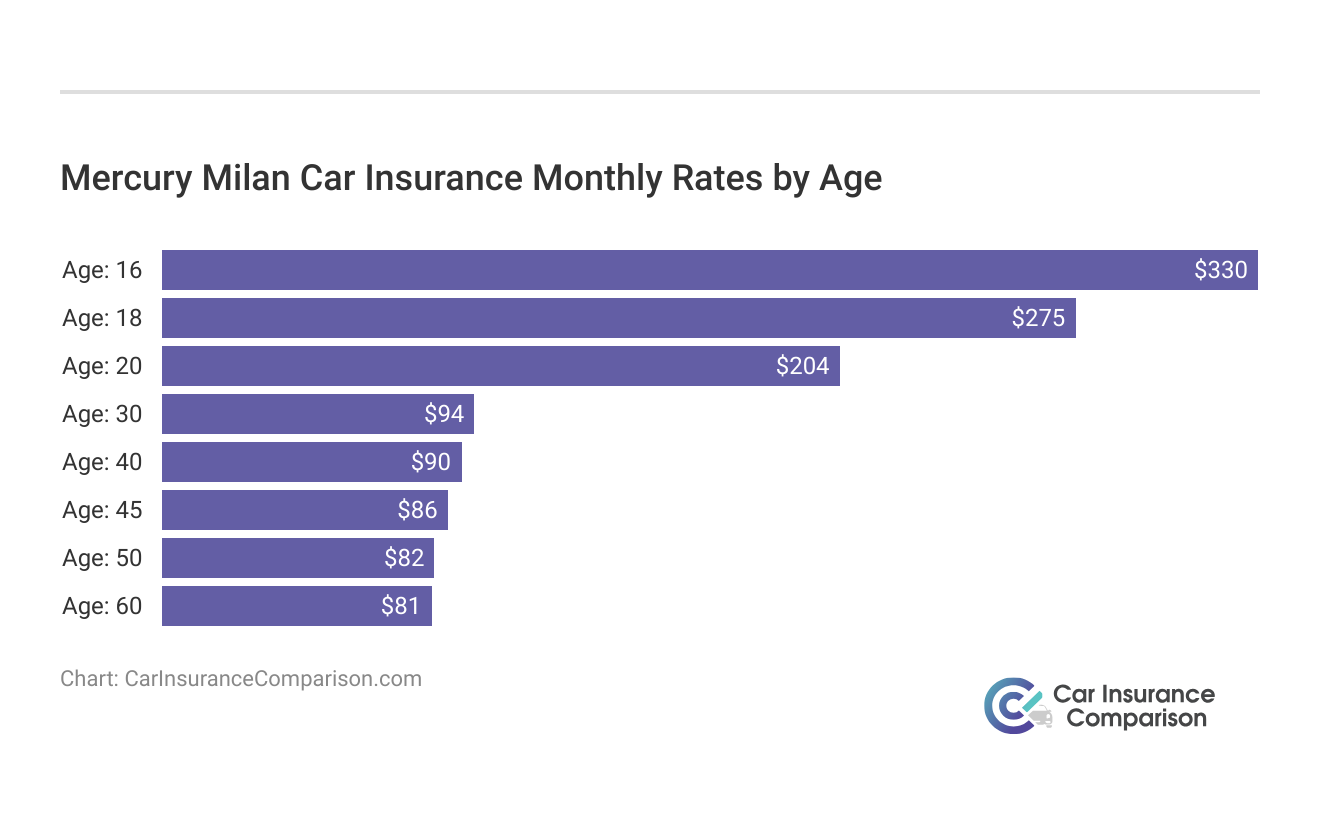

Driver Age

Driver age can have a significant effect on Mercury Milan car insurance rates. As an example, a 30-year-old driver pays around $48 more each year for their Mercury Milan car insurance than a 40-year-old driver.

Younger drivers often face higher premiums compared to their older counterparts, which can significantly affect overall insurance costs. This insight helps drivers of different ages make informed decisions to potentially lower their insurance expenses.

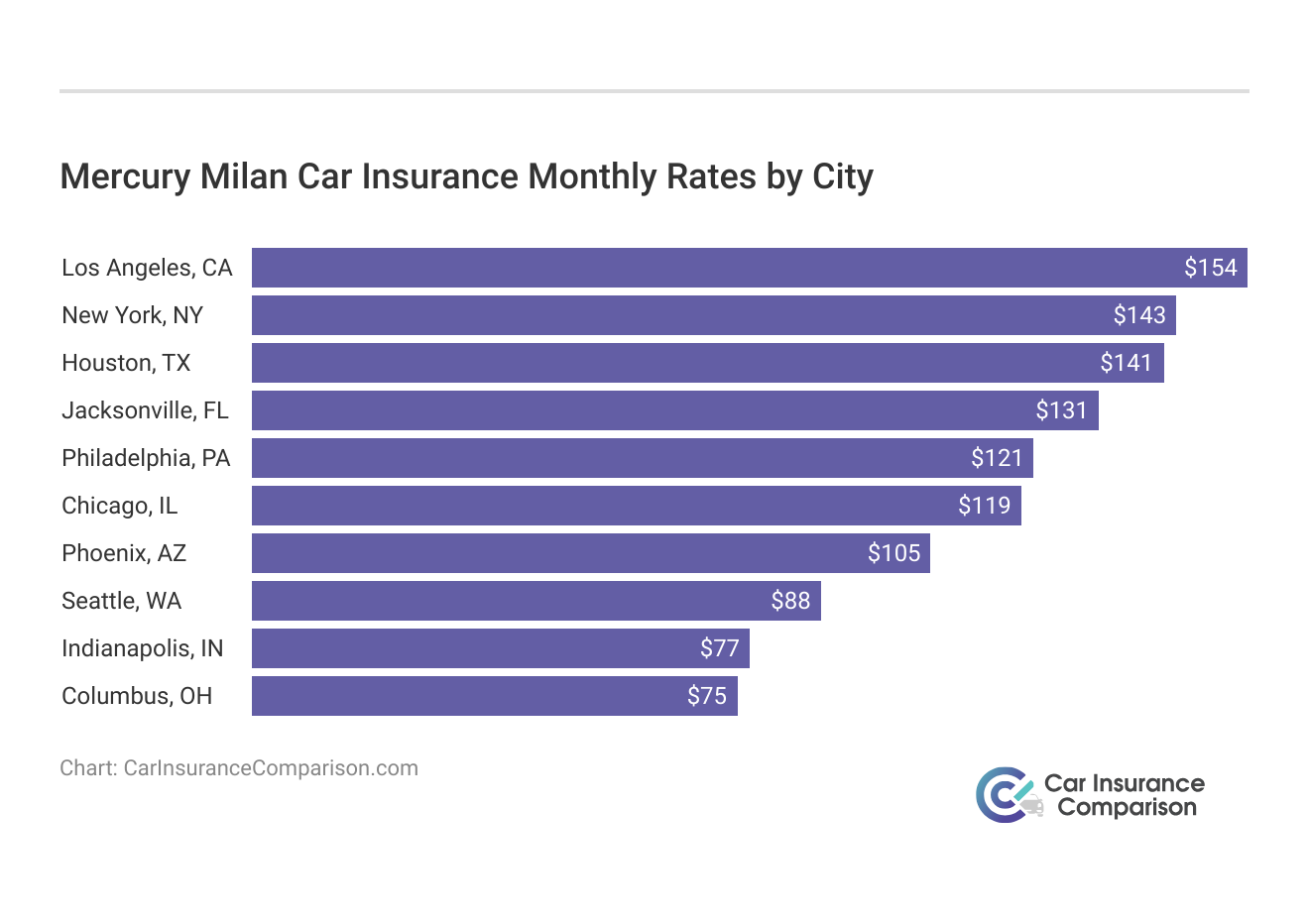

Driver Location

Where you live can have a large impact on Mercury Milan insurance rates. For example, drivers in New York may pay $660 a year more than drivers in Seattle.

Knowing how location affects Mercury Milan insurance rates is essential for budgeting. Costs can vary widely by region, helping drivers choose the right insurance provider and manage expenses.

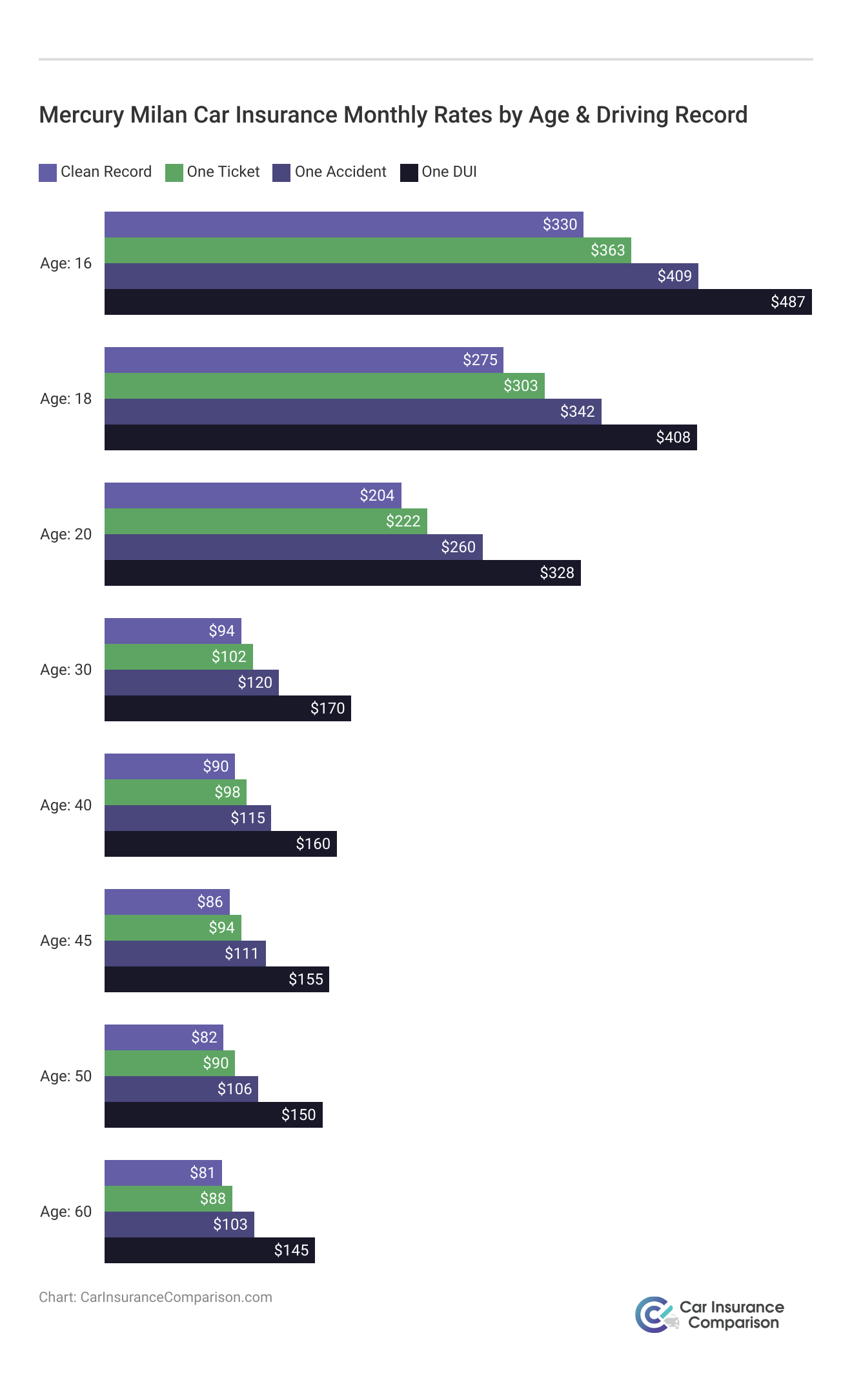

Your Driving Record

Your driving record can have an impact on the cost of Mercury Milan auto insurance. Teens and drivers in their 20’s see the highest jump in their Mercury Milan car insurance with violations on their driving record.

Your driving record affects Mercury Milan auto insurance rates. Violations, especially for teens and young adults, lead to higher premiums. Keeping a clean record can help lower your insurance costs.

Mercury Milan Safety Ratings

Your Mercury Milan car insurance rates are influenced by the safety ratings of the Mercury Milan. See the breakdown below:

Mercury Milan Safety Ratings

| Test | Rating |

|---|---|

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Mercury Milan’s safety ratings impact insurance rates, with higher ratings potentially lowering premiums. This overview shows how safety features influence insurance costs, emphasizing the role of vehicle safety in managing your premiums.

Mercury Milan Crash Test Ratings

Poor Mercury Milan crash test ratings could mean higher Mercury Milan car insurance rates.

Mercury Milan Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Mercury Milan | 4 stars | 3 stars | 4 stars | 4 stars |

| 2023 Mercury Milan | 4 stars | 3 stars | 4 stars | 4 stars |

| 2022 Mercury Milan | 4 stars | 3 stars | 4 stars | 4 stars |

| 2021 Mercury Milan | 4 stars | 3 stars | 4 stars | 4 stars |

| 2020 Mercury Milan | 4 stars | 3 stars | 4 stars | 4 stars |

| 2019 Mercury Milan | 4 stars | 3 stars | 4 stars | 4 stars |

| 2018 Mercury Milan | 4 stars | 3 stars | 4 stars | 4 stars |

Mercury Milan crash test ratings is crucial because lower ratings can lead to increased car insurance premiums. With a 4-star overall rating but lower scores in frontal impact, it’s important to factor in these ratings when assessing potential insurance costs.

Mercury Milan Safety Features

The safety features of the Mercury Milan can impact your Mercury Milan car insurance rates. The 2011 Mercury Milan has the following safety features:

- Driver Air Bag

- Passenger Air Bag

- Front Head Air Bag

- Rear Head Air Bag

- Front Side Air Bag

Knowing the Mercury Milan’s safety features, like multiple airbags, is important because they can lower your insurance rates. Better safety features reduce risk, leading to potentially lower premiums for your Mercury Milan.

Are Mercury Milans Expensive to Insure

The chart below details how Mercury Milan insurance rates compare to other sedans like the Dodge Charger, Audi A3, and Lincoln MKZ.

Mercury Milan Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Dodge Charger | $31 | $52 | $39 | $139 |

| Audi A3 | $24 | $47 | $33 | $117 |

| Lincoln MKZ | $27 | $57 | $38 | $136 |

| Ford Taurus | $29 | $50 | $33 | $125 |

| Nissan Altima | $26 | $48 | $33 | $119 |

| Audi S4 | $31 | $62 | $28 | $132 |

| Mercury Milan | $23 | $42 | $32 | $113 |

However, there are a few things you can do to find the cheapest Mercury insurance rates online. Discover insights in our article called, “Finding Free Car Insurance Quotes Online.”

Mercury Milan Finance and Insurance Cost

If you are financing a Mercury Milan, most lenders will require your carry higher Mercury Milan coverages including comprehensive coverage, so be sure to compare Mercury Milan car insurance rates from the best companies using our FREE tool below.

Read More: How do you get a mercury car insurance quote online?

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Mercury Milan Insurance

You have more options at your disposal to save money on your Mercury Milan auto insurance costs. For example, try taking advantage of the following five strategies to reduce your Mercury Milan car insurance rates

- Choose a Mercury Milan with cheaper repair costs.

- Check the odometer on your Mercury Milan.

- Compare insurance companies after moving.

- Reduce modifications on your Mercury Milan.

- Ask for a new Mercury Milan auto insurance rate based on your improved credit score.

Saving on Mercury Milan insurance is key to cutting costs. Strategies like choosing cars with lower repair costs, tracking mileage, comparing rates after moving, reducing modifications, and using an improved credit score can all lower your premiums and maximize your insurance value.

Access comprehensive insights into our article called, “Best Car Insurance for Modified Cars.”

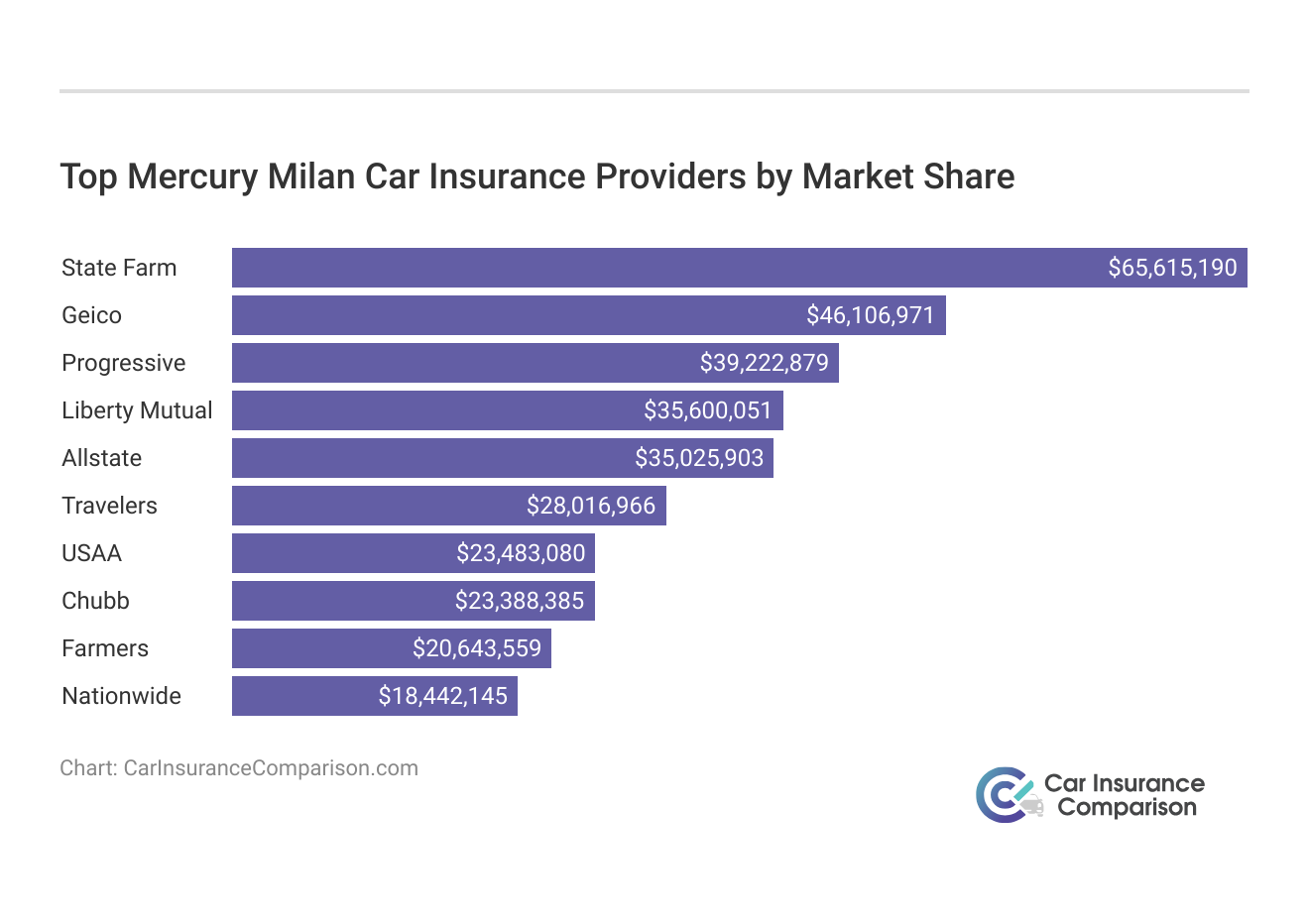

Top Mercury Milan Insurance Companies

Who is the top car insurance company for Mercury Milan insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Mercury Milan auto insurance coverage (ordered by market share).

Top Mercury Milan Insurance Companies

| Rank | Insurance Company | Premium Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 million | 9.3% |

| #2 | Geico | $46.1 million | 6.6% |

| #3 | Progressive | $39.2 million | 5.6% |

| #4 | Liberty Mutual | $35.6 million | 5.1% |

| #5 | Allstate | $35 million | 5% |

| #6 | Travelers | $28 million | 4% |

| #7 | USAA | $23.4 million | 3.3% |

| #8 | Chubb | $23.3 million | 3.3% |

| #9 | Farmers | $20.6 million | 2.9% |

| #10 | Nationwide | $18.4 million | 2.6% |

Although individual insurance rates will vary based on personal factors, this guide simplifies the process of finding reliable and competitive insurance options for the Mercury Milan.

Many of these companies offer discounts for security systems and other safety features that the Mercury Milan offers. Discover more about offerings in our guide titled, “Car Safety Comparisons.”

Compare Free Mercury Milan Insurance Quotes Online

You can start comparing quotes for Mercury Milan car insurance rates from some of the best car insurance companies by using our free online tool now.

Insurance companies have a variety of ways of combining all of these factors into a formula that produces a number for your premiums.

Consider that individual states have different regulations which also affect the cost of your insurance.

The average base price of the 2010 Mercury Milan is $21,860, but you need to make sure you find the best deal for your specific situation.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Car Insurance Cost for a Mercury Milan Affected by Safety

There are several factors car insurance companies take into consideration when determining how much to charge you for premiums.

One of those factors is the safety ratings an individual car receives from two nationally known organizations who conduct car crash tests, the Insurance Institute for Highway Safety and the National Highway Traffic Safety Administration.

Car insurance companies are interested in safety ratings due to the fact that accidents may require them to pay out significant amounts of money for bodily injury.

The 2010 Mercury Milan received a score of five stars for front-impact on both the driver and passenger sides. However, side-impact was rated at four stars for the area of the rear passenger door. The rest of the car received five stars for side impact.

State Farm provides comprehensive coverage for Mercury Milan at just $130 per month, ensuring robust protection.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Standard safety features built into the car such as anti-lock brakes, front and side air bags, overhead air bag, and side-impact bars also contribute to lower auto insurance costs. Read up on the “How much car insurance coverage do I need for a new car?” for more information.

Car Insurance Cost for a Mercury Milan Affected by Anti-theft Devices

If you choose to purchase fire and theft coverage for your vehicle, then standard and additional anti-theft devices will certainly help reduce the car insurance cost for a Mercury Milan.

The 2010 model comes standard with:

- An ignition disabling system

- A security system

- A panic alarm

You could further reduce the cost of your insurance, in terms of theft, by parking your vehicle in a garage overnight. Fortunately, for owners of the Mercury Milan, their car of choice is not one that is popular among U.S. car thieves.

Surprisingly, most of the cars listed among the top 10 of most stolen in America are more than 15 years old.

Theft insurance for your Mercury Milan is less affected by the type of car itself than it is by the incidence of car theft in your area. Learn more in our article called, “Anti-Theft Car Insurance Discounts.”

Impact of Replacement Value on Mercury Milan Insurance Costs

When you purchase collision coverage for your vehicle, the insurance company must consider how much it would cost to replace the vehicle if it were totaled in an accident.

When you first purchase insurance, your provider will consider that price along with a replacement value based on factors like the Kelly Blue Book price.

Unfortunately, as your car depreciates your insurance costs will not come down.

Other factors to consider in terms of how much your car insurance costs include:

- Who the primary driver is

- How often the car is driven

- How many miles are put on it annually

- General driving history

Your best bet is to shop around and compare costs before deciding on a particular insurance carrier. Read up on the “Types of Car Insurance Coverage” for more information.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Does the car insurance cost for a Mercury Milan depend on anti-theft devices?

Having anti-theft devices, such as the standard features on the Mercury Milan, can help reduce insurance costs, especially for comprehensive coverage. However, the incidence of car theft in your area also affects insurance rates.

For additional details, explore our comprehensive resource titled, “How do car insurance table ratings affect car insurance rates?“

Is the car insurance cost for a Mercury Milan affected by safety?

Yes, car insurance companies consider safety ratings when determining premiums. A car with good safety ratings, like the Mercury Milan, may have lower insurance costs.

Does the replacement value of the Mercury Milan affect insurance costs?

Yes, the replacement value of the Mercury Milan is a factor that insurance companies consider when determining premiums for collision coverage. The cost to replace the vehicle if it is totaled in an accident can impact insurance costs.

Do safety features impact Mercury Milan insurance rates?

Yes, safety features can affect Mercury Milan insurance rates. The presence of features such as airbags, anti-lock brakes, and electronic stability control can help reduce insurance premiums.

What safety ratings does the Mercury Milan have?

The Mercury Milan has good safety ratings. It received 4 out of 5 stars for overall crash test ratings from the National Highway Traffic Safety Administration (NHTSA).

To find out more, explore our guide titled, “The Best Small Car Safety Ratings.”

Does driver location affect Mercury Milan insurance rates?

Yes, the location where the driver resides can affect Mercury Milan insurance rates. Factors such as local traffic patterns, crime rates, and the overall risk of accidents in the area can influence insurance premiums.

What is the current Blue Book value of a 2010 Mercury Milan?

The current Blue Book value for a 2010 Mercury Milan varies based on condition and mileage, but it generally falls between $3,500 and $6,500.

What factors influence insurance rates for a Mercury Milan?

Insurance rates for a Mercury Milan are influenced by factors such as your driving history, location, vehicle age, and coverage level.

Does the Blue Book value of a 2010 Mercury Milan change based on location?

Yes, the Blue Book value of a 2010 Mercury Milan can vary depending on your location and regional demand.

To learn more, explore our comprehensive resource on “Compare Car Insurance Rates by State.”

What factors affect the Blue Book value of a 2010 Mercury Milan?

Factors affecting the Blue Book value of a 2010 Mercury Milan include mileage, condition, accident history, and market trends.

Is the Blue Book value of a 2010 Mercury Milan accurate for selling purposes?

The Blue Book value of a 2010 Mercury Milan provides a good estimate for selling, but actual selling prices can vary based on market conditions and vehicle specifics.

Get the right Mercury Milan car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Are Mercury Milan models expensive to insure?

The insurance costs for a Mercury Milan vary, but factors such as your location, driving history, and coverage level impact the overall expense.

What is the cheapest car insurance for a Mercury Milan?

For a Mercury Milan, affordable insurance options are typically offered by USAA, Geico, and Progressive, which often provide competitive rates.

Learn more by reading our guide titled, “Compare Car Insurance Rates by City.”

Which type of car insurance is most expensive for a Mercury Milan?

Comprehensive insurance is usually the priciest option for a Mercury Milan, covering extensive damages including those not caused by collisions.

When is car insurance the most costly for a Mercury Milan?

Insurance for a Mercury Milan tends to be more expensive for younger drivers due to higher perceived risk and inexperience.

Which insurance company offers the best value for insuring a Mercury Milan?

Nationwide and USAA often provide the best value for insuring a Mercury Milan, balancing cost with comprehensive coverage options.

Which insurance company has the highest claim denial rate for a Mercury Milan?

UnitedHealthcare tends to have a higher claim denial rate, which can affect those insuring a Mercury Milan, though this is more relevant for health insurance.

Access comprehensive insights into our guide titled, “How do you file a car insurance claim?“

What is the cheapest category of insurance for a Mercury Milan?

For a Mercury Milan, basic liability insurance is generally the least expensive category, offering essential coverage with lower premiums.

Is comprehensive coverage worth it for a Mercury Milan?

Yes, comprehensive coverage is beneficial for a Mercury Milan if you want protection against non-collision damages like theft or natural disasters.

How does the age of a Mercury Milan affect insurance costs?

Older Mercury Milan models might have lower insurance costs compared to new models, due to decreased value and repair costs.

By entering your ZIP code below, you can get instant Mercury Milan car insurance quotes from top providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.