Best Lincoln MKZ Car Insurance in 2025 (Your Guide to the Top 10 Companies)

The top picks for best car insurance for the Lincoln MKZ are Erie, USAA, and State Farm with rates starting at $71/mo. Erie leads with affordable coverage, while USAA offers exclusive benefits for military families. State Farm provides competitive rates and broad coverage options tailored for Lincoln MKZ drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Lincoln MKZ

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Lincoln MKZ

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Lincoln MKZ

A.M. Best Rating

Complaint Level

Pros & Cons

The best Lincoln MKZ car insurance options are Erie, Geico, and State Farm, each standing out for their affordability and comprehensive coverage. Erie claims the top spot overall with its exceptional service and customized plans.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Erie: Top Overall Pick

Pros

- Considerable Multi-Policy Savings: Erie provides a notable 20% discount for combining multiple insurance policies, resulting in significant savings for insuring your Lincoln MKZ. This offer is particularly valuable for those looking to optimize their insurance expenditures by consolidating their coverage.

- High Financial Stability: With an A+ rating from A.M. Best, Erie is acknowledged for its robust financial stability. This esteemed rating assures policyholders of Erie’s capability to deliver reliable and secure insurance for the Lincoln MKZ.

- Comprehensive Coverage Alternatives: Erie presents a broad selection of coverage options, tailored to meet the diverse needs of Lincoln MKZ owners. Whether you need extensive protection or specialized plans, Erie offers flexible solutions to accommodate various requirements. To discover more about the company, visit our guide titled, “Erie Car Insurance Review.”

Cons

- Limited Multi-Policy Savings: Although Erie’s 20% discount for Lincoln MKZ insurance is attractive, it might not be as extensive as the multi-policy discounts offered by some competitors. This could potentially limit the overall savings for Lincoln MKZ owners seeking maximum discounts.

- Potentially Elevated Premiums: Despite the appealing discounts, Erie’s premiums for certain Lincoln MKZ models or higher-end configurations may still be comparatively high, impacting overall affordability.

#2 – USAA: Best for Military Savings

Pros

- Exclusive Military Discounts: USAA offers a 10% discount tailored specifically for military personnel and their families. This unique advantage provides substantial savings on insurance premiums for Lincoln MKZ owners within the military community. For more information, check out our complete guide titled, “USAA Car Insurance Review.”

- Exceptional Financial Rating: USAA holds an A++ rating from A.M. Best, highlighting its superior financial health. This top rating reflects USAA’s strength and reliability, ensuring dependable coverage for your Lincoln MKZ.

- Customized Military Insurance Plans: USAA’s insurance offerings are specifically designed to meet the needs of military families. This specialization ensures that Lincoln MKZ owners in the armed forces receive targeted protection and support.

Cons

- Restricted Eligibility: USAA’s benefits are limited to military members and their families. Consequently, Lincoln MKZ owners outside this group may not be able to access these exclusive discounts and advantages.

- Less Competitive Multi-Policy Discount: The 10% multi-policy discount provided by USAA for Lincoln MKZ insurance may be less appealing compared to those offered by other insurance providers, which could reduce the overall value for Lincoln MKZ owners interested in bundling policies.

#3 – State Farm: Best for Young Drivers

Pros

- Noteworthy Discounts for Young Drivers: State Farm offers a 17% discount for younger drivers, significantly reducing insurance costs for younger Lincoln MKZ owners. This offer is particularly beneficial for new or younger drivers seeking affordable coverage. For further details, see our guide titled, “State Farm Car Insurance Review.”

- Varied Coverage Options: State Farm provides a wide range of coverage choices, allowing Lincoln MKZ owners to select policies that best fit their specific needs. This flexibility helps ensure that young drivers receive appropriate protection tailored to their circumstances.

- Decent Financial Rating: With a B rating from A.M. Best, State Farm maintains a solid level of financial stability. While not the highest among competitors, this rating still indicates a fair degree of reliability for insuring your Lincoln MKZ.

Cons

- Moderate Multi-Policy Savings: The 17% discount for bundling policies is beneficial for Lincoln MKZ owners but may not be as substantial as the discounts offered by some other insurers. This could limit potential savings for those looking to combine their Lincoln MKZ insurance coverage.

- Variable Premium Costs: Even with the available discounts, State Farm’s premiums might be relatively higher for certain Lincoln MKZ models or coverage options compared to some competitors, potentially affecting overall cost-efficiency.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Mobile App

Pros

- Substantial Multi-Policy Discounts: Geico offers a generous 25% discount for bundling multiple policies, making it an attractive choice for those insuring several Lincoln MKZ vehicles. This discount is among the highest available, providing considerable cost savings. Discover more by exploring our in-depth guide titled, “Geico Car Insurance Review.”

- Excellent Financial Strength: Geico’s A++ rating from A.M. Best signifies outstanding financial stability. This high rating assures policyholders of Geico’s reliability in providing secure coverage for their Lincoln MKZ.

- Advanced Mobile Application: Geico’s innovative mobile app enhances insurance management by offering easy access to policy information, claims processing, and other key functions. This feature improves the convenience for Lincoln MKZ owners.

Cons

- Limited Coverage Customization: While the mobile app is highly functional, Geico’s options for customizing coverage for the Lincoln MKZ may be more restrictive compared to other insurers. This could limit the ability to tailor insurance policies for the Lincoln MKZ to specific needs.

- Potentially Higher Premium Costs: Although Geico’s multi-policy discount is appealing, some Lincoln MKZ drivers may find their premiums to be on the higher side, which might offset the savings from the discount.

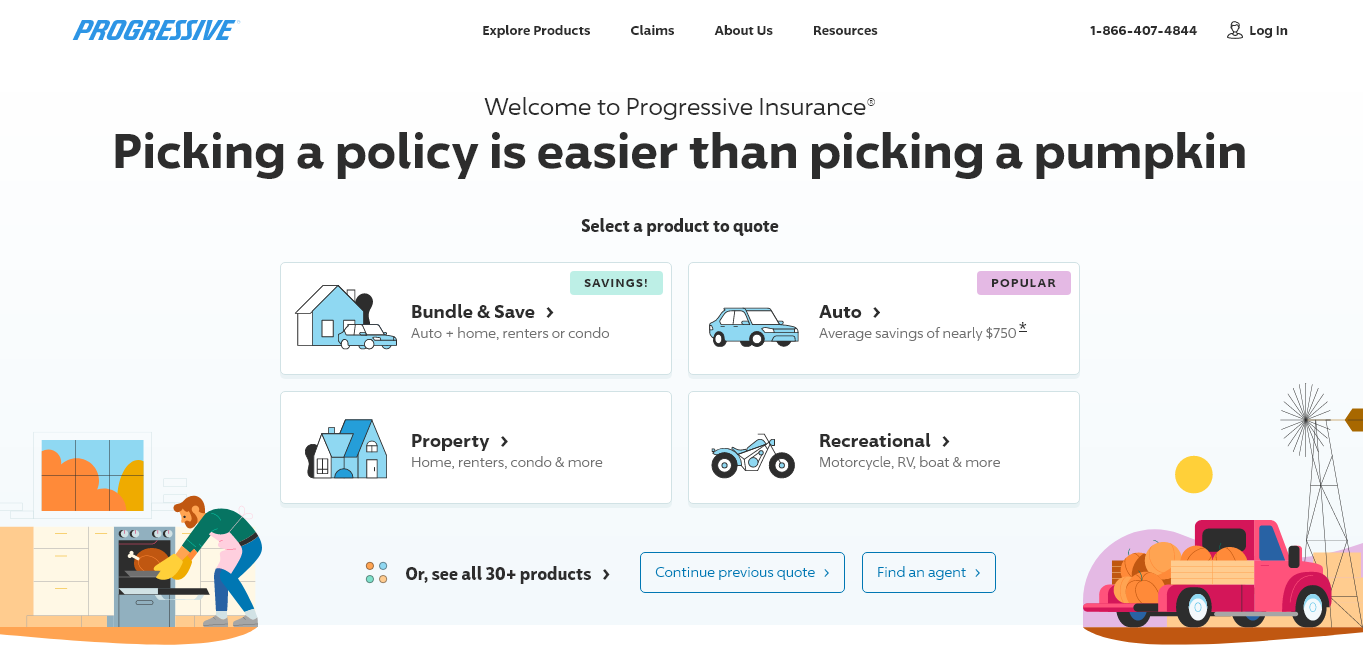

#5 – Progressive: Best for Customizable Premiums

Pros

- Customizable Premium Options: Progressive offers significant flexibility in adjusting premium plans, enabling Lincoln MKZ owners to tailor their coverage according to individual preferences. This customization helps find the optimal balance between cost and protection.

- Strong Financial Rating: With an A+ rating from A.M. Best, Progressive demonstrates a strong level of financial stability and reliability. This rating provides assurance that your Lincoln MKZ will be covered by a financially sound insurer. Obtain detailed insights by reading our guide titled, “Progressive Car Insurance Discounts.”

- Competitive Multi-Policy Discounts: Progressive provides a 10% discount for bundling multiple policies, which can help reduce overall insurance expenses for Lincoln MKZ owners who choose to combine their coverage.

Cons

- Less Generous Multi-Policy Discount: The 10% discount for bundling policies on Lincoln MKZ insurance may not be as significant as those offered by some other insurance companies. This could impact the overall value for Lincoln MKZ owners seeking greater savings from multiple policy bundles.

- Variability in Premium Costs: The customizable nature of Progressive’s premiums can result in fluctuations in insurance costs, potentially leading to higher rates for certain Lincoln MKZ models or driver profiles.

#6 – Nationwide: Best for Flexible Policies

Pros

- Bundling Discounts: Nationwide provides a 10% reduction on Lincoln MKZ insurance premiums when combined with other types of coverage. This flexibility can lead to considerable savings if you hold multiple policies with the insurer.

- Extensive Coverage Options: Nationwide’s insurance for the Lincoln MKZ includes a wide range of coverage choices, from basic liability to comprehensive and collision options, catering to diverse driving needs and preferences.

- Strong Financial Stability: With an A+ rating from A.M. Best, Nationwide’s financial health is robust, ensuring that Lincoln MKZ owners can depend on their insurer to process claims effectively and honor policy commitments. Explore insurance savings in our full guide titled, “Nationwide Car Insurance Discounts.”

Cons

- Competitive Discount Levels: Although a 10% discount is offered for Lincoln MKZ insurance, it may be less generous compared to the more significant multi-policy reductions provided by some rivals, potentially affecting overall savings.

- Premium Costs: Even with available discounts, Lincoln MKZ insurance premiums with Nationwide might still be relatively high, particularly for enhanced coverage levels or additional features.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

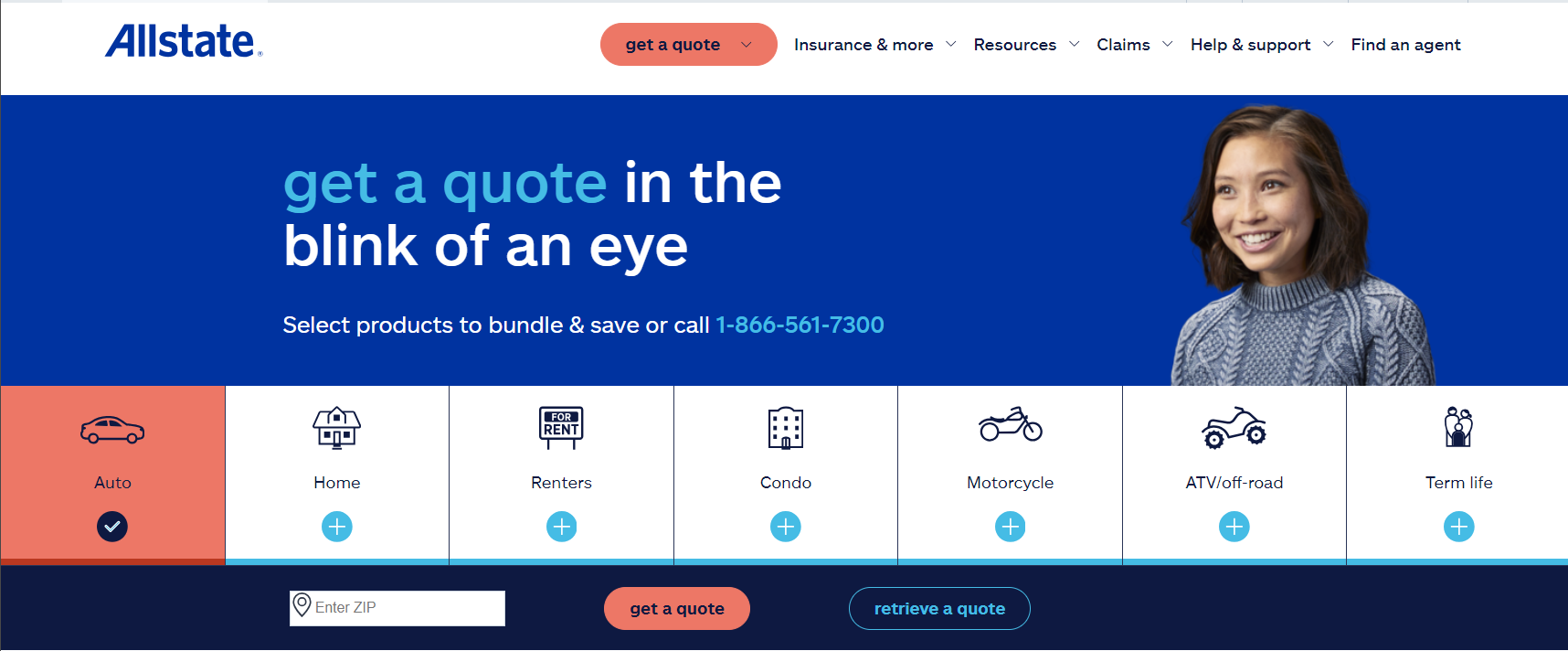

#7 – Allstate: Best for Usage-Based Insurance

Pros

- Innovative Usage-Based Savings: Allstate offers a distinctive opportunity for Lincoln MKZ owners to save through usage-based insurance, where discounts are determined by actual driving behavior and mileage. This can be particularly beneficial for low-mileage drivers. Learn more about the offerings in our guide titled, “Allstate Car Insurance Review.”

- Flexible Policy Structures: Lincoln MKZ drivers can select from various policy structures, including those tailored for different usage patterns, such as high-mileage or infrequent driving.

- A+ A.M. Best Rating: Allstate’s strong financial rating (A+) from A.M. Best highlights its reliability and financial strength, ensuring that Lincoln MKZ owners receive consistent coverage and support.

Cons

- Standard Multi-Policy Discount: The 10% multi-policy discount provided by Allstate for Lincoln MKZ insurance may not be as competitive as those from other insurers, potentially limiting savings for bundled policies.

- Potentially Elevated Premiums: Even with the usage-based discounts, the overall cost of insuring a Lincoln MKZ with Allstate may remain high, depending on coverage levels and individual risk factors.

#8 – Amica: Best for Comprehensive Package

Pros

- Broad Coverage Solutions: Amica delivers extensive insurance packages for the Lincoln MKZ, including comprehensive and collision coverage, along with optional add-ons like roadside assistance and rental coverage, ensuring thorough protection. Access detailed insights in our guide titled, “Amica vs. Progressive Car Insurance Comparison.”

- Attractive Multi-Policy Savings: A 10% reduction on multi-policy arrangements can provide substantial savings for Lincoln MKZ owners who bundle their insurance with Amica.

- Top Financial Stability: Amica’s A+ rating from A.M. Best underscores its strong financial standing, promising reliable claims handling and overall insurer stability for the Lincoln MKZ.

Cons

- Uniform Discount Rate: While Amica’s 10% multi-policy discount is beneficial, it may not be as generous as those offered by some other insurers, potentially affecting total savings for Lincoln MKZ owners.

- Premium Costs: Despite comprehensive coverage options, premiums for insuring a Lincoln MKZ with Amica might still be relatively high, particularly for additional coverage options or high-risk drivers.

#9 – Farmers: Best for Essential Workers

Pros

- Generous Multi-Policy Savings: Farmers offers a notable 15% discount on multi-policy bundles, which can be highly advantageous for Lincoln MKZ owners who also maintain other types of insurance with the same provider.

- Specialized Coverage for Essential Workers: Farmers provides tailored coverage solutions for essential workers, including those insuring a Lincoln MKZ, addressing specific needs such as higher liability coverage or enhanced protection for their daily commutes. Dive into our article called, “Farmers Car Insurance Review.”

- Solid Financial Rating: With an A rating from A.M. Best, Farmers demonstrates a reliable financial foundation, giving Lincoln MKZ owners confidence in their insurer’s ability to manage claims effectively and uphold policy terms.

Cons

- Discount Competitiveness: Despite the generous 15% multi-policy discount on Lincoln MKZ insurance, it may still be less competitive compared to the more substantial discounts offered by other insurance companies, potentially limiting overall savings

- Variable Premium Costs: Premiums for Lincoln MKZ insurance with Farmers might fluctuate based on coverage levels and individual risk profiles, potentially leading to higher costs despite the available discount.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Tailored Service

Pros

- Custom Coverage Solutions: American Family offers highly personalized insurance options for Lincoln MKZ drivers, customizing coverage to meet individual needs and preferences, which can enhance overall protection and satisfaction.

- Multi-Policy Savings: A 10% discount on multi-policy bundles is available, providing Lincoln MKZ owners with opportunities to save when combining different types of insurance under one provider.

- Strong Financial Standing: With an A rating from A.M. Best, American Family’s solid financial performance assures Lincoln MKZ owners of dependable coverage and reliable claims support. Uncover details in our guide titled, “American Family Car Insurance Review.”

Cons

- Standard Discount Rate: The 10% multi-policy discount, while useful, may not be as competitive as those from other insurers, potentially impacting overall savings for Lincoln MKZ owners who bundle multiple policies.

- Premium Variability: Even with personalized service, Lincoln MKZ insurance premiums with American Family might be higher depending on the coverage options selected and individual driving profiles.

Lincoln MKZ Insurance Rates: Minimum vs. Full Coverage Comparison

When choosing insurance for a Lincoln MKZ, the coverage rates vary significantly across different providers. The table below provides a snapshot of monthly rates for both minimum and full coverage options from various insurers.

Lincoln MKZ Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $96 $115

American Family $91 $111

Amica $94 $131

Erie $71 $98

Farmers $85 $110

Geico $83 $99

Nationwide $89 $107

Progressive $79 $113

State Farm $76 $95

USAA $87 $104

The monthly rates for Lincoln MKZ car insurance vary considerably depending on the coverage level and provider. Erie offers the most economical minimum coverage at $71, while Amica presents the highest rate for full coverage at $131.

Conversely, State Farm provides competitive rates with $76 for minimum coverage and $95 for full coverage. In comparison, American Family has a moderate range with $91 for minimum and $111 for full coverage.

The disparity among providers highlights the importance of comparing rates to find the most cost-effective option for both minimum and full coverage needs. Gain insights from our guide titled, “Minimum Car Insurance Requirements by State.”

Lincoln MKZ Insurance Cost

When budgeting for a Lincoln MKZ, it’s crucial to factor in the cost of car insurance. On average, insuring a Lincoln MKZ costs approximately $136 monthly, which breaks down to about $136 per month. Understanding these costs can help you plan your finances more effectively and make informed decisions about your coverage options.

In summary, the insurance expense for a Lincoln MKZ averages $136 monthly. This figure provides a baseline for evaluating different insurance plans and comparing rates among providers. Being aware of these average costs allows you to better prepare for the financial aspects of owning a Lincoln MKZ and ensures that you can select the most suitable coverage to fit your needs and budget.

To discover more about Lincoln MKZ, visit our guide titled, “Do I need the additional car insurance coverage options?“

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Are Lincoln MKZs Expensive to Insure

When considering the cost of insurance for luxury vehicles, the Lincoln MKZ often prompts questions about its affordability compared to other popular sedans.

The following chart provides a comparative analysis of insurance rates for the Lincoln MKZ against models such as the Chevrolet Malibu, Chevrolet Cruze, and Hyundai Elantra. This comparison examines various coverage types, including comprehensive, collision, and both minimum and full coverage options.

Lincoln MKZ Car Insurance Monthly Rates vs. Other Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Lincoln MKZ | $27 | $57 | $38 | $136 |

| Chevrolet Malibu | $27 | $44 | $31 | $115 |

| Chevrolet Cruze | $26 | $50 | $31 | $119 |

| Hyundai Elantra | $23 | $47 | $31 | $114 |

| Audi A3 | $24 | $47 | $33 | $117 |

| Ford Taurus | $29 | $50 | $33 | $125 |

| Nissan Versa | $22 | $45 | $33 | $113 |

The data indicates that the Lincoln MKZ generally incurs higher insurance rates compared to some of its peers, such as the Chevrolet Malibu and Hyundai Elantra. While its comprehensive and collision coverage rates are relatively competitive, the full coverage premium for the MKZ tends to be higher than that of many other sedans in the comparison.

Prospective buyers should consider these insurance costs when budgeting for a Lincoln MKZ, as they may impact the overall ownership expenses. For more information, check out our complete guide titled, “Calculating Car Insurance Cost.”

What Impacts the Cost of Lincoln MKZ Insurance

The Lincoln MKZ trim and model you choose can impact the total price you will pay for Lincoln MKZ insurance coverage. For further details, see our guide titled, “Compare Full Coverage vs. Liability Car Insurance: Rates, Discounts, & Requirements.”

Age of the Vehicle

When assessing insurance costs for the Lincoln MKZ, the age of the vehicle plays a significant role in determining monthly premiums. Generally, older models of the Lincoln MKZ tend to be less expensive to insure compared to newer ones.

This trend is evident when comparing the insurance rates of different model years, reflecting how the value and risk associated with the vehicle impact insurance costs.

Lincoln MKZ Car Insurance Monthly Rates by Model Year & Coverage Type

| Model Year | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Lincoln MKZ | $30 | $60 | $36 | $138 |

| 2023 Lincoln MKZ | $29 | $59 | $37 | $137 |

| 2022 Lincoln MKZ | $28 | $58 | $37 | $137 |

| 2021 Lincoln MKZ | $28 | $57 | $38 | $136 |

| 2018 Lincoln MKZ | $27 | $57 | $38 | $136 |

| 2017 Lincoln MKZ | $26 | $56 | $39 | $136 |

| 2016 Lincoln MKZ | $25 | $53 | $41 | $134 |

| 2015 Lincoln MKZ | $24 | $52 | $42 | $132 |

| 2014 Lincoln MKZ | $23 | $48 | $43 | $128 |

| 2013 Lincoln MKZ | $22 | $45 | $43 | $125 |

| 2012 Lincoln MKZ | $21 | $40 | $43 | $119 |

| 2011 Lincoln MKZ | $19 | $37 | $43 | $115 |

| 2010 Lincoln MKZ | $19 | $35 | $44 | $112 |

The data clearly demonstrates that as the Lincoln MKZ ages, the cost of insurance typically decreases. For instance, the 2018 Lincoln MKZ incurs an averagemonthly insurance cost of $136, whereas the 2010 model’s insurance rates are notably lower at $112.

This difference of $24 highlights the impact that vehicle age has on insurance premiums, making older models a more budget-friendly option for those looking to save on their insurance expenses.

Driver Age

Driver age plays a crucial role in determining auto insurance premiums, particularly for vehicles like the Lincoln MKZ. Insurance providers assess risk differently based on the age of the driver, leading to notable variations in rates. For instance, the monthly insurance cost for a Lincoln MKZ can differ substantially between younger and more experienced drivers.

Understanding the impact of driver age on insurance rates is essential for budget planning. As illustrated, a 40-year-old driver could enjoy significantly lower monthly premiums up to $173 less compared to a 20-year-old. This disparity highlights the importance of age-related risk assessments in shaping insurance costs for the Lincoln MKZ.

Driver Location

Where you live can have a large impact on Lincoln MKZ insurance rates. For example, drivers in Phoenix may pay $158 a month less than drivers in Los Angeles.

In summary, understanding the impact of your geographic location on Lincoln MKZ insurance rates is crucial for budgeting and planning.

Your Driving Record

Your driving record plays a crucial role in determining the cost of auto insurance for your Lincoln MKZ. Insurance providers closely examine your history of traffic violations, accidents, and overall driving behavior to assess risk and set premiums.

For younger drivers, particularly those in their teens and twenties, a clean driving record is especially important, as even minor infractions can significantly increase insurance costs.

Maintaining a clean driving record is essential for minimizing insurance premiums on your Lincoln MKZ. Younger drivers are particularly affected by violations, which can lead to substantial increases in their insurance rates.

By adhering to safe driving practices and avoiding traffic infractions, you can help keep your insurance costs lower and enjoy the benefits of more affordable coverage.

Lincoln MKZ Safety Ratings

The safety ratings of your Lincoln MKZ play a crucial role in determining your car insurance premiums. Insurance providers assess the vehicle’s safety features to evaluate risk, which directly impacts the rates you pay. The following breakdown offers a comprehensive view of the Lincoln MKZ’s performance across various safety tests.

Lincoln MKZ Safety Ratings

| Test | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

| Headlights | Acceptable |

| Front crash prevention: vehicle-to-vehicle | Superior |

| Front crash prevention: vehicle-to-pedestrian | Advanced |

| Child seat anchors (LATCH) | Marginal |

Overall, the Lincoln MKZ demonstrates strong safety performance, particularly in front crash prevention and structural integrity. While most safety aspects are rated highly, with “Good” ratings in numerous categories, the vehicle’s headlights and child seat anchors receive more modest evaluations.

Progressive's strong discounts, with savings up to 31%, make it a top choice for Rolls-Royce Cullinan owners looking to bundle their auto and home insurance.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Understanding these ratings can help you gauge how your insurance rates may be affected and highlight areas where improvements could potentially benefit your coverage.

Lincoln MKZ Crash Test Ratings

When evaluating vehicle safety, crash test ratings are a critical factor that can influence both your protection on the road and your insurance premiums. The Lincoln MKZ consistently earns high marks in these assessments, reflecting its robust safety features and design.

Lincoln MKZ Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Lincoln MKZ HEV 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2024 Lincoln MKZ 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2024 Lincoln MKZ 4 DR AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Lincoln MKZ HEV 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Lincoln MKZ 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Lincoln MKZ 4 DR AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Lincoln MKZ HEV 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Lincoln MKZ 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Lincoln MKZ 4 DR AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Lincoln MKZ HEV 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Lincoln MKZ 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Lincoln MKZ 4 DR AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Lincoln MKZ HEV 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Lincoln MKZ 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Lincoln MKZ 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Lincoln MKZ HEV 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Lincoln MKZ 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Lincoln MKZ 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

The impressive crash test ratings of the Lincoln MKZ underscore its commitment to passenger safety, with each model achieving top scores across various tests. This stellar performance not only enhances driver and passenger protection but can also contribute to more affordable insurance rates, making the Lincoln MKZ a prudent choice for those prioritizing safety and cost-efficiency.

Lincoln MKZ Safety Features

Having a variety of safety features on your Lincoln MKZ can help lower your Lincoln MKZ insurance costs. The Lincoln MKZ’s safety features include:

- Driver Air Bag

- Passenger Air Bag

- Front Head Air Bag

- Rear Head Air Bag

- Front Side Air Bag

The Lincoln MKZ stands out with its robust array of safety features, including multiple air bags designed to protect occupants in various collision scenarios. This commitment to safety not only ensures greater peace of mind while driving but can also lead to lower insurance premiums.

By investing in a Lincoln MKZ, you are not only choosing a vehicle with high safety standards but also making a financially savvy decision that could result in insurance savings.

Lincoln MKZ Insurance Loss Probability

The Lincoln MKZ’s insurance loss probability varies between different coverage types. The lower percentage means lower Lincoln MKZ auto insurance costs; higher percentages mean higher Lincoln MKZ auto insurance costs.

Lincoln MKZ Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Collision | 37% |

| Property Damage | -15% |

| Comprehensive | 7% |

| Personal Injury | -5% |

| Medical Payment | -11% |

| Bodily Injury | -25% |

By examining these probabilities, drivers can better gauge which coverage options might be more cost-effective or risky, enabling them to tailor their insurance choices to balance both protection and affordability.

Lincoln MKZ Finance and Insurance Cost

If you are financing a Lincoln MKZ, you will pay more if you purchase Lincoln MKZ car insurance at the dealership, so be sure to shop around and compare Lincoln MKZ car insurance quotes from the best companies using our free tool below. Discover more by exploring our in-depth guide titled, “16 Ways to Lower the Cost of Your Insurance.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Lincoln MKZ Insurance

You have more options at your disposal to save money on your Lincoln MKZ auto insurance costs. For example, try taking advantage of the following five strategies to reduce your Lincoln MKZ car insurance rates

- Take advantage of referral fees.

- Consider using a tracking device on your Lincolnmkz.

- Improve your credit score.

- Watch your insurer closely when your Lincolnmkz needs repairs.

- Buy a Lincolnmkz with an anti-theft device.

By leveraging these effective strategies, you can achieve significant savings on your Lincoln MKZ insurance premiums. Whether it’s through referral fees, using a tracking device, enhancing your credit score, monitoring repair costs, or opting for an anti-theft device, each approach offers a pathway to lower your insurance costs.

Implementing these tips not only helps you save money but also ensures that you continue to enjoy comprehensive coverage for your vehicle. Read our guide titled, “Best Car Insurance Companies That Don’t Use Credit Scores” for more information

Top Lincoln MKZ Insurance Companies

When selecting insurance for your Lincoln MKZ, it’s crucial to evaluate the options provided by leading insurers, as rates and coverage can vary significantly.

Top Lincoln MKZ Insurance Companies

| Rank | Insurance Company | Premium Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 million | 9.3% |

| #2 | Geico | $46.1 million | 6.6% |

| #3 | Progressive | $39.2 million | 5.6% |

| #4 | Liberty Mutual | $35.6 million | 5.1% |

| #5 | Allstate | $35 million | 5% |

| #6 | Travelers | $28 million | 4% |

| #7 | USAA | $23.4 million | 3.3% |

| #8 | Chubb | $23.3 million | 3.3% |

| #9 | Farmers | $20.6 million | 2.9% |

| #10 | Nationwide | $18.4 million | 2.6% |

The following list highlights the top insurance companies that offer competitive premiums for the Lincoln MKZ, organized by their market share. This ranking reflects the premium volumes written by each company, giving you a snapshot of their prominence and reliability in the market.

By comparing these top insurers, you can find a policy that best fits your needs while taking advantage of competitive rates and comprehensive coverage. Obtain detailed insights by reading our guide titled, “Compare the Cheapest Car Insurance Companies.”

Lincoln MKZ Compare in Monthly Car Insurance Rates

Data shows that the Lincoln MKZ is fairly comparable to the Ford Fusion and the Mazda 6.

According to Intellichoice, the monthly ownership cost for the Lincoln MKZ is approximately $108 per month.

Keep in mind that this number is only applicable to the gasoline-powered MKZ.

Lincoln makes a hybrid version of this vehicle that has higher average rates. At $108 monthly, the cost of car insurance represents approximately 12% of the total cost of ownership. This is good news on two fronts.

It’s generally accepted in the industry that insurance should not exceed 18% to 20% of the total cost of ownership, so 12% for this car is actually very good. Read the article called “Compare Car Insurance Rates by State” for additional insights.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Lincoln MKZ Features Will Affect Car Insurance Cost

The safety features are very important when an insurance company determines premiums. The age of your Lincoln MKZ will impact what the safety ratings and features are going to be.

A brand new Lincoln MKZ has several features including:

- AdvanceTrac

- Anti-lock brakes

- Blind spot information system

The 2007 to 2010 models all have the six standard air bags. The 2009-2011 MKZ models all have the maximum ratings for rear end collision.

However, in front impact tests the 2007 to 2009 models have average ratings, 2010 to 2011 have maximum ratings, and all Lincoln MKZs that are older than 2007 have marginal ratings.

These ratings also apply to roof strength for the MKZ 2007. After 2007 the steel cage was introduced to the Lincoln MKZ which accounts for the higher safety ratings. Explore insurance savings in our full guide titled, “Safety Features Car Insurance Discounts.”

Safety Ratings and Car Insurance Rates

Safety ratings certainly play a role in determining how much you will pay for car insurance. This is especially true when it comes to minimum liability coverage and bodily injury. For further details, see our guide titled, “What is the minimum amount of liability car insurance coverage required?”

Since car insurance companies must provide coverage for injuries sustained by passengers, the safer a vehicle is the better it is for your rates.

Conversely, a vehicle that is deemed less safe presents the insurance company with the potential of having to pay out more in bodily injury insurance claims.

According to Edmunds, the Insurance Institute for Highway Safety (IIHS) rated the 2012 Lincoln MKZ and reported good results.

The IIHS gave the vehicle a good (G) rating for the following four categories:

- Front impact

- Side impact

- Rear impact/head restraint

- Roof strength

In achieving such high ratings, Lincoln has demonstrated that its MKZ is a very safe vehicle for both drivers and passengers.

Another typical source of crash test safety ratings is the National Highway Traffic Safety Administration (NHTSA). Unfortunately, there is no data to glean from them because they have not tested the Lincoln MKZ for the 2011 or 2012 model years.

How to Lower Lincoln MKZ Car Insurance Cost

To reduce your auto insurance premiums, it’s essential to capitalize on any available discounts provided by your insurer. These discounts may encompass options such as bundling multiple policies with the same provider, installing anti-theft devices, opting for a higher deductible, or completing defensive driving courses.

Additionally, you can further lower costs by maintaining a clean driving record, minimizing your vehicle’s mileage, and comparing insurance rates from different companies. Learn more about the offerings in our guide titled, “Compare Monthly Car Insurance: Rates, Discounts, & Requirements.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tips for Reducing Your Car Insurance Premium

Some insurance companies are very flexible when it comes to their established customers. If you are happy with your insurance company but aren’t sure about the rates that they are charging, especially if they haven’t gone down over the years, then you should call them.

If you are happy with your insurance company but aren’t sure about the rates that they are charging, especially if they haven’t gone down over the years, then you should call them.

If you have a good driving record and no claims, then you should be able to negotiate on your rates.

If you get a car insurance quote from other companies before you call your insurance company, then you can use those quoted lower rates to negotiate. For example, Progressive is known for their great customer service and fast paying claims. Access detailed insights in our guide titled, “Different Ways to Lower Car Insurance Rates.”

However, if you are paying $140 a month at Progressive and are quoted $120 a month from another company you need to decide if a service you rarely use is worth an additional $20 a month. If your insurance company won’t work with you, switch to a new company.

Compare Free Lincoln MKZ Insurance Quotes Online

You can start comparing quotes for Lincoln MKZ auto insurance rates from some of the best auto insurance companies by using our free online tool now.

You will find that your insurance rates for your Lincoln MKZ will vary depending on a variety of factors. Read the following article and see how you can lower your auto insurance rates with a local insurance company. To discover more about the company, visit our guide titled, “Online Car Insurance Quotes Without Personal Information.”

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Frequently Asked Questions

How can I compare insurance rates for a Lincoln MKZ?

To compare Lincoln MKZ insurance rates, gather your car details, research providers, request quotes, and provide accurate information. Then, compare coverage and premiums, factoring in insurer reputation, service, and discounts, before choosing the best option.

For additional details, explore our comprehensive resource titled, “How do you find competitive car insurance rates?”

What factors can affect insurance rates for a Lincoln MKZ

Insurance rates for a Lincoln MKZ are influenced by location, driving record, age, vehicle specs, annual mileage, credit history, and your chosen coverage and deductibles.

Are there any discounts available for insuring a Lincoln MKZ?

Insurance providers often offer discounts for insuring a Lincoln MKZ, including multi-policy, safe driver, anti-theft, good student, low mileage, and loyalty discounts.

Can I get an estimate of insurance rates for a Lincoln MKZ without providing personal information?

While it’s possible to get a general idea of insurance rates for a Lincoln MKZ without providing personal information, obtaining accurate quotes usually requires providing specific details about yourself and the vehicle. Insurance rates are determined by multiple factors, including those unique to you, so personalized information is necessary for an accurate estimate.

Are Lincoln MKZs generally expensive to insure?

The cost of insuring a Lincoln MKZ can vary based on several factors, including those mentioned earlier (such as location, driving record, and vehicle specifications). It’s best to obtain quotes from insurance providers to get an accurate understanding of the insurance costs for your specific Lincoln MKZ.

Insurance rates can vary between individuals and insurance companies, so comparing quotes is essential to find the best coverage at a competitive rate for your Lincoln MKZ.

To find out more, explore our guide titled, “Finding Free Car Insurance Quotes Online.”

Are Lincolns expensive to insure?

Yes, Lincolns can be expensive to insure due to their luxury status and higher repair costs. Insurance rates vary based on model, driver history, and location.

What do I need to know about insuring a Lincoln MKS?

Lincoln MKS car insurance rates depend on factors like the driver’s record and location. Comprehensive coverage is recommended due to the MKS’s luxury features.

How reliable is the Lincoln MKZ when it comes to insurance claims?

The Lincoln MKZ has an average reliability score of 3.0 out of 5.0 from RepairPal, indicating that while it may require more frequent maintenance, insurance claims related to common issues like transmission problems or brake failure should be manageable.

Which type of insurance is best for a Lincoln MKZ?

For a Lincoln MKZ, comprehensive car insurance is recommended. It offers the highest level of coverage, protecting against damage to your vehicle, as well as liability for accidents, regardless of who is at fault.

To learn more, explore our comprehensive resource on “Understanding Car Accidents.”

How does the Lincoln MKZ’s performance affect its insurance rates?

The Lincoln MKZ’s performance, including its 0-60 mph time of approximately 7.6 seconds, can impact insurance rates. Higher performance or luxury vehicles often have higher insurance premiums due to increased repair costs and risk.

Does the Lincoln MKZ’s luxury status affect its insurance costs?

Yes, the Lincoln MKZ’s classification as a luxury car can lead to higher insurance premiums. Luxury vehicles typically incur higher repair and replacement costs, which can influence the overall cost of insurance.

Get the right Lincoln MKZ car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Is the Lincoln MKZ fuel efficiency a factor in insurance costs?

The Lincoln MKZ’s fuel efficiency, with an EPA-estimated 20 mpg city and 31 mpg highway, might have a minor impact on insurance costs. Generally, fuel-efficient vehicles can be slightly less expensive to insure due to lower overall running costs.

How does the Lincoln MKZ’s engine choice affect insurance premiums?

The Lincoln MKZ’s engine options, including the standard 245-horsepower turbocharged 2.0-liter four-cylinder and the optional twin-turbocharged 3.0-liter V6, can affect insurance premiums. Higher-powered engines might lead to higher insurance costs due to increased risk.

Learn more by reading our guide titled, “What happens if you stop paying car insurance premiums?”

What are the resale value implications for Lincoln MKZ insurance rates?

The Lincoln MKZ’s resale value, which can depreciate significantly over time, may affect insurance costs. Vehicles that lose value quickly might have lower insurance premiums, but this can vary based on specific coverage needs and options.

Are there specific discounts available for insuring a Lincoln MKZ?

Insurance providers may offer various discounts for insuring a Lincoln MKZ, such as multi-policy discounts for bundling with home insurance, safe driver discounts, or anti-theft discounts if you have security features installed.

Which insurance companies offer the best rates for Lincoln MKZ owners?

Insurance rates for Lincoln MKZ owners can vary. Companies like Geico, Progressive, and Travelers are known for offering competitive rates and may provide the best options for Lincoln MKZ insurance, depending on your specific needs and driving record.

How does owning a Lincoln MKZ impact insurance costs?

Owning a Lincoln MKZ can impact insurance costs due to its luxury status and repair expenses. Insurance premiums may be higher compared to non-luxury vehicles, reflecting the higher cost of repairs and replacement parts.

Access comprehensive insights into our guide titled, “Does car insurance cover non-accident repairs?”

Are there any special considerations for insuring a Lincoln MKZ hybrid?

Yes, insuring a Lincoln MKZ hybrid may involve special considerations. Hybrid vehicles often have higher repair costs due to their complex technology, which can influence insurance premiums. Comprehensive coverage is advisable to cover any potential hybrid-specific repairs.

How does the Lincoln MKZ’s safety rating affect its insurance premiums?

The Lincoln MKZ’s safety rating can influence insurance premiums. Vehicles with high safety ratings typically benefit from lower insurance rates, as they are considered less risky to insure. Always check the latest safety ratings for the most accurate impact on insurance costs.

Does the Lincoln MKZ’s trim level affect its insurance cost?

Yes, the trim level of a Lincoln MKZ can affect insurance costs. Higher trim levels, which often come with more advanced features and higher repair costs, may result in higher insurance premiums compared to base models.

Stop overpaying for Lincoln MKZ car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.