Best Lincoln Mark LT Car Insurance in 2025 (Top 10 Companies Ranked)

State Farm, Allstate, and USAA offer the best Lincoln Mark LT car insurance with rates starting at $41 per month. State Farm is the top pick overall for its excellent value and comprehensive coverage. Compare these top providers to secure the best insurance for your Lincoln Mark LT.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Lincoln Mark LT

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Lincoln Mark LT

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Lincoln Mark LT

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, Allstate, and USAA lead the way for the best Lincoln Mark LT car insurance, offering rates as low as $41 per month. Among these, State Farm stands out as the top pick overall, delivering exceptional value and comprehensive coverage.

Prior to buying any vehicle, you need to know how the engine and safety specifics are going to impact your car insurance cost. This monthly car insurance premium is a significant part of the cost of car ownership.

Our Top 10 Company Picks: Best Lincoln Mark LT Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 12% B Many Discounts State Farm

#2 10% A+ Add-on Coverages Allstate

#3 15% A++ Military Savings USAA

#4 8% A Online App AAA

#5 14% A+ Innovative Programs Progressive

#6 11% A+ Usage Discount Nationwide

#7 9% A+ 24/7 Support Erie

#8 13% A++ Custom Plan Geico

#9 7% A Customizable Polices Liberty Mutual

#10 6% A Local Agents Farmers

Our free online comparison tool above allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

- State Farm offers the most competitive rates for Lincoln Mark LT insurance.

- Comprehensive coverage options are available to suit various driving needs.

- Insurance minimum coverage costs for Lincoln Mark LT are around $41 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Competitive Pricing: State Farm offers car insurance for the Lincoln Mark LT at $142 per month, which is quite competitive compared to the average rate. This can help Lincoln Mark LT owners save on their monthly insurance costs. More information about their rates in our State Farm car insurance review.

- Comprehensive Coverage Options: State Farm provides a wide range of coverage options tailored to meet the needs of Lincoln Mark LT owners, ensuring that your luxury truck is well-protected in various situations.

- Advanced Safety Feature Discounts: Lincoln Mark LT owners can benefit from State Farm’s discounts for vehicles equipped with advanced safety features, helping to reduce overall insurance costs.

Cons

- Limited Discounts: State Farm may offer fewer discounts specifically for Lincoln Mark LT insurance compared to some other providers, potentially leading to higher overall costs for certain drivers.

- Regional Availability: Coverage options and rates for the Lincoln Mark LT might vary significantly by region, which could affect the consistency of service and pricing for some owners.

#2 – Allstate: Best for Add-on Coverages

Pros

- Extensive Coverage: As mentioned in our Allstate car insurance review, Allstate provides extensive coverage options that can be customized to fit the specific needs of Lincoln Mark LT owners, ensuring comprehensive protection for your vehicle.

- Innovative Tools: With Allstate’s mobile app and online tools, Lincoln Mark LT owners can easily manage their policies, file claims, and access important information quickly and conveniently.

- Strong Financial Stability: Allstate’s strong financial ratings ensure that Lincoln Mark LT owners can trust the company to handle claims and provide reliable service in times of need.

Cons

- Higher Premiums: At $222 per month, Allstate’s insurance rates for the Lincoln Mark LT are higher than many competitors, which may be a drawback for budget-conscious owners.

- Average Customer Satisfaction: While generally reliable, Allstate’s customer satisfaction ratings are average, which might not provide the same level of reassurance for Lincoln Mark LT owners seeking top-tier support.

#3 – USAA: Best for Military Savings

Pros

- Exclusive Military Benefits: USAA offers exclusive benefits and discounts for military members and their families, which can be particularly advantageous for Lincoln Mark LT owners in the military community.

- High Customer Satisfaction: USAA consistently ranks high in customer satisfaction, ensuring that Lincoln Mark LT owners receive excellent support and service when needed.

- Comprehensive Coverage Options: USAA provides a range of coverage options tailored to meet the specific needs of Lincoln Mark LT owners, ensuring your vehicle is well-protected. Learn more in our USAA car insurance review.

Cons

- Membership Restrictions: USAA is only available to military members and their families, which limits access for other Lincoln Mark LT owners who do not meet these criteria.

- Higher Premiums for Some Drivers: At $201 per month, USAA’s rates for Lincoln Mark LT insurance might be higher for some drivers compared to other providers, depending on various factors.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – AAA: Best for Online App

Pros

- Roadside Assistance: As mentioned in AAA car insurance review, AAA offers excellent roadside assistance services, which can be a significant benefit for Lincoln Mark LT owners who want peace of mind while driving.

- Comprehensive Coverage: AAA provides a variety of coverage options tailored to the needs of Lincoln Mark LT owners, ensuring your vehicle is adequately protected.

- Discount Opportunities: AAA offers numerous discount opportunities that Lincoln Mark LT owners can take advantage of to lower their overall insurance costs.

Cons

- Higher Premiums: At $181 per month, AAA’s insurance rates for the Lincoln Mark LT are higher than some competitors, which might be a consideration for cost-conscious owners.

- Membership Requirement: AAA requires a membership for access to their insurance services, which could be an additional cost for Lincoln Mark LT owners who are not already members.

#5 – Progressive: Best for Innovative Programs

Pros

- Affordable Rates: Progressive offers competitive rates for Lincoln Mark LT insurance at $197 per month, which is below the average for luxury trucks. Learn more details in our Progressive car insurance review.

- Innovative Discount Programs: Progressive’s Snapshot program allows Lincoln Mark LT owners to potentially lower their premiums by demonstrating safe driving habits.

- Comprehensive Online Tools: Progressive provides a range of online tools and resources that make it easy for Lincoln Mark LT owners to manage their policies and file claims.

Cons

- Mixed Customer Satisfaction: Progressive has mixed customer satisfaction ratings, which may not provide the same level of confidence for Lincoln Mark LT owners seeking consistent service.

- Coverage Limitations: Some Lincoln Mark LT owners may find that Progressive’s coverage options are not as extensive or customizable as those offered by other providers.

#6 – Nationwide: Best for Usage Discount

Pros

- Strong Financial Stability: Nationwide’s strong financial ratings provide reassurance for Lincoln Mark LT owners that the company can handle claims effectively.

- Wide Range of Coverage Options: Nationwide offers a comprehensive selection of coverage options tailored to the needs of Lincoln Mark LT owners, ensuring robust protection for your vehicle.

- Discount Programs: Nationwide provides several discount programs that can help Lincoln Mark LT owners reduce their insurance costs, such as multi-policy discounts and safe driver discounts. Check out their ratings in our complete Nationwide car insurance discount.

Cons

- Higher Premiums: At $245 per month, Nationwide’s insurance rates for the Lincoln Mark LT are among the highest, which could be a deterrent for budget-conscious owners.

- Average Customer Service: Nationwide’s customer service ratings are average, which might not offer the level of support some Lincoln Mark LT owners expect from their insurer.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Erie: Best for 24/7 Support

Pros

- Competitive Pricing: Erie offers affordable insurance rates for the Lincoln Mark LT at $179 per month, making it a cost-effective option for many owners.

- Comprehensive Coverage: As mentioned in Erie car insurance review, Erie provides a variety of coverage options that can be customized to meet the specific needs of Lincoln Mark LT owners, ensuring thorough protection.

- High Customer Satisfaction: Erie consistently receives high marks in customer satisfaction surveys, providing confidence for Lincoln Mark LT owners seeking reliable service.

Cons

- Limited Availability: Erie’s insurance services are not available in all states, which could limit access for some Lincoln Mark LT owners.

- Fewer Discounts: Erie may offer fewer discount opportunities for Lincoln Mark LT insurance compared to some other providers, potentially leading to higher overall costs.

#8 – Geico: Best for Custom Plan

Pros

- Lowest Premiums: As outlined in Geico car insurance review, Geico offers the lowest insurance rates for the Lincoln Mark LT at $132 per month, making it an attractive option for cost-conscious owners.

- Extensive Discount Programs: Geico provides a variety of discount opportunities that can help Lincoln Mark LT owners save on their premiums, such as good driver and multi-policy discounts.

- User-Friendly Online Tools: Geico’s online tools and mobile app make it easy for Lincoln Mark LT owners to manage their policies, file claims, and access important information.

Cons

- Mixed Customer Service Ratings: Geico has mixed customer service ratings, which may not provide the same level of support for Lincoln Mark LT owners seeking consistent and reliable assistance.

- Coverage Limitations: Some Lincoln Mark LT owners may find that Geico’s coverage options are not as comprehensive or customizable as those offered by other insurers.

#9 – Liberty Mutual: Best for Customizable Polices

Pros

- Customizable Coverage Options: Liberty Mutual offers a wide range of coverage options that can be tailored to meet the specific needs of Lincoln Mark LT owners, ensuring thorough protection.

- Accident Forgiveness: Liberty Mutual’s accident forgiveness program can be a significant benefit for Lincoln Mark LT owners, helping to keep premiums stable after an at-fault accident.

- Strong Financial Stability: Liberty Mutual’s strong financial ratings ensure that Lincoln Mark LT owners can trust the company to handle claims effectively. Learn more in our Liberty Mutual car insurance review.

Cons

- Higher Premiums: At $173 per month, Liberty Mutual’s insurance rates for the Lincoln Mark LT are higher than some competitors, which might be a consideration for budget-conscious owners.

- Mixed Customer Satisfaction: Liberty Mutual has mixed customer satisfaction ratings, which may not provide the same level of confidence for Lincoln Mark LT owners seeking consistent service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Local Agents

Pros

- Comprehensive Coverage: Farmers offers a variety of coverage options tailored to meet the needs of Lincoln Mark LT owners, ensuring your vehicle is well-protected.

- Discount Opportunities: Farmers provides several discount programs that can help Lincoln Mark LT owners reduce their insurance costs, such as good driver and multi-policy discounts.

- Strong Financial Stability: Farmers’ strong financial ratings ensure that Lincoln Mark LT owners can trust the company to handle claims effectively. Learn more in our Farmers car insurance review.

Cons

- Higher Premiums: At $224 per month, Farmers’ insurance rates for the Lincoln Mark LT are among the highest, which could be a deterrent for cost-conscious owners.

- Average Customer Satisfaction: Farmers’ customer service ratings are average, which might not offer the level of support some Lincoln Mark LT owners expect from their insurer.

How Car Insurance Companies Evaluates the Lincoln Mark LT

Do vehicle specifics really affect insurance rates? Yes, they do. The table below compares monthly rates for minimum and full coverage car insurance for a Lincoln Mark LT from various providers.

Lincoln Mark LT Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $41 $181

Allstate $63 $222

Erie $70 $179

Farmers $62 $224

Geico $93 $132

Liberty Mutual $78 $173

Nationwide $65 $245

Progressive $74 $197

State Farm $56 $142

USAA $76 $201

Insurance is a business like any other and the insurance provider’s main goal is to make a profit. In order to make a profit and stay in business, car insurance companies have to take in more money in premiums than they pay out each year.

State Farm stands out as the top pick overall, delivering exceptional value and comprehensive coverage.

Kristen Gryglik LICENSED INSURANCE AGENT

They manage to do this by tracking and applying current statistics. Think of it like educated gambling on their part.

Statistically speaking, if you are a young 18 years old driver with a suped-up, ticket-prone, drag racing style of car, you are seen as an extremely high-risk and a risky gamble according to the insurance company.

However, everyone needs insurance and sometimes great risk means a heftier quote on insurance premiums.

Lincoln Mark LT Construction and Car Insurance Cost

The Lincoln Mark LT is a luxury pickup truck that was made by the American Ford Motor Company under the Lincoln name. These trucks were first introduced for sale in January 2005 (for the 2006 model year) and the company continued production on them until the 2008 model year. These are very upscale trucks and have features like:

- A handsome chrome grille

- Unique tail lights

- Wood trim

- Heated leather seating

- Keyless entry

Some models even have a built-in DVD player and a navigation system, as well as a rearview camera which helps drivers avoid bumper dents when parking. The truck’s engine was 5.4 L Triton V8 with rear-wheel drive or four-wheel drive.

As exciting as this truck was in its time, it was discontinued in 2008. Ford Lincoln still has plans to repackage the truck to the Mexican auto market. For more information, read our article titled “Cheap Car Insurance for Pickup Trucks.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Lincoln Mark LT Rankings in Numbers and Statistics

The good news is that J.D. Power Quality listed this luxury truck as one of the top trucks for dependability and quality—and it has done so every year since the truck was manufactured. These reliability tests can help determine the average cost for basic repairs and major repairs, as well as the likelihood of an accident.

All of this data is significant because it could add up and cost you more money for regular coverage. Insurance companies take note of studies like these because they do occasionally help lower car insurance premiums for certain car models.

However, the more expensive and newer the car, the more you tend to pay in premiums, as it is costlier to replace these specialty parts.

If the Lincoln Mark LT you drive has a full package with DVD player and navigation system, understand you are paying for all those things to be covered in a claim if your truck happens to get stolen or totaled.

Read More: Do I have to pay insurance for a totaled car?

Cheap Car Insurance Quotes for the Lincoln Mark LT

If you want to find a ballpark figure for insurance on the Lincoln Mark LT, then it is best you call an agent or search online. Every company’s quote is going to be different.

How can this be if several people all buy the same type of truck? Statistics aren’t only about the type of truck, but also various factors about the driver himself as well as the region and location.

Your age, sex, marital status, driving history and location all play a key role in determining your insurance rates. Did you know that your credit score can affect your rate? Read our article titled “Best Car Insurance Companies That Don’t Use Credit Scores” for more information.

Did you know that when you choose to live in the city over the countryside, you increase your premiums by a significant margin?

To make sure you are getting the best deal, pursue all available discounts through coupon codes, special promotions, and of course alterations to your car. For example, safety features can help reduce a car’s risk of damage. These include:

- Air bags

- Anti-lock brakes

- Anti-theft devices

You can also ask for discounts such as good student discounts, defensive driving course discounts, senior rates and other local deals.

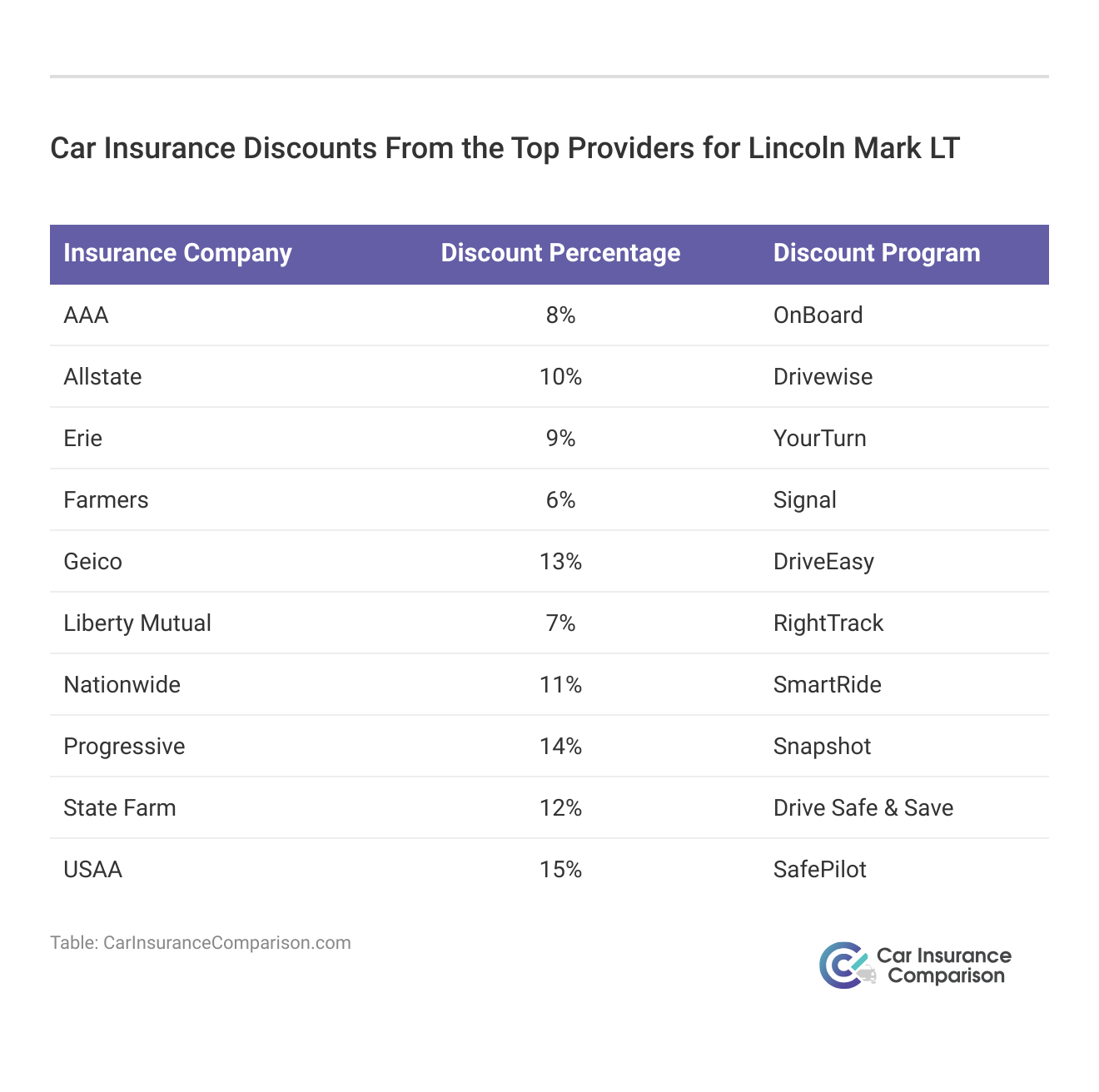

These discounts from top insurance providers for Lincoln Mark LT offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road. No matter how good the rate seems, always remember to comparison shop and read the fine print of the contract. Make sure that you are getting all the coverage you need.

No matter the high price, a policy is not worth the money if it the company is not dependable when you need a claim paid.

The good news is that the Lincoln Mark LT does have a good crash rating as well as very few recalls and fairly low estimated repair costs. By applying for all available discounts and doing whatever you can as a driver to lower your rates, insurance on the Lincoln Mark LT should be relatively easy to find.

This truck is commonly known as an inexpensive alternative to other truck models, and certainly has a great deal of personality and high-tech performance. If you want to know how much would car insurance cost for a Lincoln Mark LT, enter your ZIP code and start checking car insurance quotes now.

Frequently Asked Questions

How much does car insurance for a Lincoln Mark LT cost?

The cost of car insurance for a Lincoln Mark LT varies based on factors like location, driving history, coverage options, and the insurer. To get an accurate estimate, it’s best to compare quotes from multiple insurers.

What factors affect Lincoln Mark LT car insurance rates?

Lincoln Mark LT car insurance rates are influenced by factors such as your driving record, age, location, coverage levels, and the vehicle’s safety features.

Read More: Factors That Affect Car Insurance Rates

What are the recommended coverage options for Lincoln Mark LT car insurance?

While minimum insurance requirements differ by state, it’s advisable to consider comprehensive and collision coverage for better protection of your Lincoln Mark LT.

Are there any discounts available for Lincoln Mark LT car insurance?

Yes, various discounts may be available, including those for safe driving, multi-policy bundling, good credit, and anti-theft devices. Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Can I compare Lincoln Mark LT car insurance online?

Yes, you can compare Lincoln Mark LT car insurance online using tools provided by insurance companies and comparison websites to view quotes and coverage options from multiple insurers. Read our article titled “Where can I find the lowest car insurance quotes?” for more information.

How does the Lincoln Mark LT’s safety rating impact insurance rates?

A higher safety rating can potentially lower your insurance premiums, as it reduces the risk of accidents and claims.

Does the age of my Lincoln Mark LT affect my insurance rates?

Yes, the age of your Lincoln Mark LT can impact insurance rates; older vehicles may have lower premiums but may not benefit from newer safety technologies.

What impact does my driving history have on my Lincoln Mark LT insurance rates?

A clean driving history typically results in lower insurance premiums, while a history of accidents or violations can increase your rates.

How can I lower my Lincoln Mark LT insurance premiums?

There are different ways to lower car insurance rates, consider increasing your deductible, maintaining a clean driving record, and exploring discounts such as safe driver and multi-car savings.

Is State Farm a good choice for Lincoln Mark LT insurance?

State Farm is highly recommended for Lincoln Mark LT insurance due to its competitive rates and extensive coverage options, making it a top pick. Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.