Best Dodge Caliber Car Insurance in 2024 (Check Out the Top 10 Companies)

Geico, State Farm, and Progressive have the best Dodge Caliber car insurance, with monthly prices beginning at $60. Compare alternatives for the best Dodge Caliber car insurance and ask about discounts to receive the best deal. Read this article to learn more about the best Dodge Caliber car insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Dodge Caliber

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 17,759 reviews

17,759 reviewsCompany Facts

Full Coverage for Dodge Caliber

A.M. Best Rating

Complaint Level

Pros & Cons

17,759 reviews

17,759 reviews 13,128 reviews

13,128 reviewsCompany Facts

Full Coverage for Dodge Caliber

A.M. Best Rating

Complaint Level

Pros & Cons

13,128 reviews

13,128 reviewsGeico, State Farm, and Progressive have the best Dodge Caliber car insurance, with monthly costs starting at $60. Insurance rates for this model are significantly lower than those of other cars.

Compared to the average car, Dodge Caliber insurance premiums are significantly lower, with full coverage often costing $96 per month.

By driving safely, good drivers can receive insurance discounts of up to $39 monthly. We’ll examine safety features, insurance costs, and other aspects of the Dodge Caliber.

Our Top 10 Company Picks: Best Dodge Caliber Car Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Competitive Premiums | Geico | |

| #2 | 20% | B | Local Agent | State Farm | |

| #3 | 15% | A+ | Innovative Coverage | Progressive | |

| #4 | 12% | A++ | Customer Service | USAA | |

| #5 | 10% | A+ | Drivewise Program | Allstate | |

| #6 | 10% | A | Multiple Discount | Liberty Mutual |

| #7 | 10% | A+ | Comprehensive Coverage | Nationwide |

| #8 | 8% | A++ | IntelliDrive Rewards | Travelers | |

| #9 | 11% | A+ | Financial Stability | Amica | |

| #10 | 10% | A+ | Personalized Service | Farmers |

With our free online tool, you can begin comparing prices for the best Dodge car insurance rates from some of the top auto insurance providers right now. Enter your ZIP code now to start.

- Minimum coverage costs around $60 each month

- A liability-only policy costs around $38 each month

- Dodge Caliber insurance costs around $373 less per year than the average vehicle

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Known for offering competitive prices, Geico provides some of the best Dodge Caliber car insurance rates, with monthly premiums starting at $135. They also offer a multi-vehicle discount of up to 25%, making it a top choice for budget-conscious drivers. Read our Geico insurance review to learn more.

- Extensive Discounts: Geico’s variety of discounts, such as multi-policy and safe driver discounts, can help lower the cost of the best Dodge Caliber car insurance. With an A++ rating from A.M. Best, Geico is a reliable choice for those seeking affordable and dependable coverage.

- User-Friendly App: Their highly rated mobile app allows you to manage your policy, file claims, and access ID cards conveniently, making it easier to handle your best Dodge Caliber car insurance needs on the go.

Cons

- Limited Local Agents: Geico’s reliance on online services and phone support might not be ideal for those who prefer face-to-face interactions with local agents, which could impact the experience of obtaining the best Dodge Caliber car insurance.

- Higher Rates for Certain Drivers: Drivers with a history of traffic violations or high-risk profiles may find Geico’s rates less competitive compared to other providers, which could affect those seeking the most affordable best Dodge Caliber car insurance.

#2 – State Farm: Best for Local Agent

Pros

- Customizable Coverage Options: State Farm’s range of coverage options allows you to tailor your policy to your specific needs for the best Dodge Caliber car insurance. Their multi-vehicle discount of up to 20% can provide additional savings for households with more than one car, making it a versatile choice.

- Local Agent Network: With a large network of local agents, State Farm provides personalized service and support, which can be beneficial for those who prefer face-to-face interactions when looking for the best Dodge Caliber car insurance. Visit our State Farm insurance review for more.

- Good Student Discounts: If you have a student driver, State Farm offers discounts for good grades, which can help reduce the cost of insuring a young driver with the best Dodge Caliber car insurance. The B rating from A.M. Best indicates strong reliability.

Cons

- Higher Premiums for Some Drivers: State Farm’s premiums might be higher compared to other insurers, especially for drivers with less-than-perfect records, potentially impacting the affordability of the best Dodge Caliber car insurance.

- Limited Online Tools: While State Farm is improving its digital tools, some users find their online resources and apps less intuitive than competitors, which may affect the convenience of managing the best Dodge Caliber car insurance.

#3 – Progressive: Best for Innovative Coverage

Pros

- Snapshot Program: Progressive’s Snapshot program rewards safe driving with discounts, making it a good choice for those seeking the best Dodge Caliber car insurance. This program can significantly lower your rates based on your driving habits.

- Competitive Pricing: Progressive provides competitive rates and various options to find the best price for your coverage needs. Their A+ rating from A.M. Best reflects their strong financial stability, ensuring reliability for the best Dodge Caliber car insurance.

- Flexible Payment Plans: Offers a variety of payment options, including monthly installments, which help manage insurance expenses effectively. This flexibility is favored for maintaining the best Dodge Caliber car insurance within your budget. Here’s our Progressive insurance review to find out more.

Cons

- Complex Pricing Structure: The pricing and discounts can be complex, potentially making it difficult to understand how to get the best Dodge Caliber car insurance. This complexity might require extra effort to fully grasp the best options.

- Mixed Customer Reviews: Customer satisfaction can vary, with some users reporting issues with claims processing and customer service, which could impact the experience of obtaining the best Dodge Caliber car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Customer Service

Pros

- Exceptional Rates for Military Families: USAA offers highly competitive rates for military personnel and their families, with discounts of up to 12% for multiple vehicles. This makes it a top choice for the best Dodge Caliber car insurance for those eligible.

- Outstanding Customer Service: Known for excellent customer service and support, USAA has a strong focus on serving military members and their families. Their A++ rating from A.M. Best further reflects their reliability for the best Dodge Caliber car insurance.

- Comprehensive Coverage Options: Provides a wide range of coverage options and additional benefits tailored to military needs. This comprehensive approach ensures you get the best Dodge Caliber car insurance suited to your requirements.

Cons

- Eligibility Restrictions: USAA’s insurance is only available to military members, veterans, and their families, limiting access for others. This eligibility requirement can be a significant limitation for those outside these groups. Delve more through our Allstate vs. USAA insurance review.

- Fewer Local Agents: As a primarily online and phone-based service, there may be fewer opportunities for face-to-face interaction with local agents, which could be a consideration for those who prefer in-person service for the best Dodge Caliber car insurance.

#5 – Allstate: Best for Drivewise Program

Pros

- Accident Forgiveness: Allstate’s accident forgiveness programs prevent your first accident from raising your rates, making it a strong contender for the best Dodge Caliber car insurance. This feature provides peace of mind for drivers concerned about maintaining affordable rates.

- Variety of Discounts: Allstate’s numerous discounts, such as multi-car and safe driving discounts, help lower insurance costs for the best Dodge Caliber car insurance. Their A+ rating from A.M. Best reflects their solid financial stability and commitment to providing value.

- Comprehensive Coverage Options: Provides a wide range of coverage options and additional protection features to ensure you find the best Dodge Caliber car insurance tailored to your needs. This comprehensive approach adds significant value.

Cons

- Higher Premiums for Some: Depending on your driving record and location, Allstate’s premiums might be higher compared to other insurers, which could affect the affordability of the best Dodge Caliber car insurance.

- Less Competitive Rates for New Drivers: New or young drivers may find Allstate’s rates less competitive, potentially impacting their ability to find the most affordable best Dodge Caliber car insurance. Visit our Allstate insurance review to view more.

#6 – Liberty Mutual: Best for Multiple Discount

Pros

- Personalized Policies: Liberty Mutual offers customizable coverage options, making it easier to tailor your policy to secure the best Dodge Caliber car insurance. Their multi-discount opportunities, can lead to substantial savings. Look into our Liberty Mutual auto insurance review for more details.

- Multi-Policy Discounts: Bundling home and auto insurance with Liberty Mutual can provide significant savings on the best Dodge Caliber car insurance. This approach is especially advantageous for households with multiple insurance needs.

- New Car Replacement: Provides coverage that replaces your vehicle with a new one if it’s totaled in the first year, adding extra value to the best Dodge Caliber car insurance. This feature ensures you’re protected in case of a total loss.

Cons

- Higher Initial Rates: Initial quotes from Liberty Mutual might be higher compared to some competitors, which could affect the cost of securing the best Dodge Caliber car insurance. Discounts may offset this, but it’s important to compare options.

- Complex Discount System: Liberty Mutual’s discount structure can be complex, making it challenging to fully understand potential savings for the best Dodge Caliber car insurance. This complexity may require additional effort to navigate.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Comprehensive Coverage

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible program reduces your deductible by $100 for every year of safe driving, making it easier to achieve the best Dodge Caliber car insurance. This program can significantly lower your out-of-pocket costs in the event of a claim.

- Comprehensive Coverage: Offers a broad range of coverage options tailored to various needs, helping you secure the best Dodge Caliber car insurance. Their A+ rating from A.M. Best underscores their strong financial stability. See our Nationwide insurance review to read more.

- Multi-Car Discounts: Provides discounts for insuring multiple vehicles, which can help reduce overall insurance costs for the best Dodge Caliber car insurance. This can be a valuable benefit for households with more than one car.

Cons

- Higher Costs for Young Drivers: Premiums can be higher for younger drivers, potentially affecting the affordability of the best Dodge Caliber car insurance for this demographic. This could be a consideration if you have a new or young driver in the household.

- Limited Discounts in Some States: The availability of certain discounts can vary by state, which might affect the savings you can achieve for the best Dodge Caliber car insurance. It’s important to check what discounts are available in your area.

#8 – Travelers: Best for IntelliDrive Rewards

Pros

- Unique Coverage Options: Travelers offers unique coverage features like roadside assistance and accident forgiveness, adding value to the best Dodge Caliber car insurance. Their IntelliDrive Rewards program also provides additional savings based on driving habits.

- Discounts for Safety Features: Provides discounts for vehicles equipped with advanced safety features, which can help lower your insurance costs for the best Dodge Caliber car insurance. This aligns well with those seeking cost-effective coverage for safety-conscious vehicles.

- Flexible Payment Plans: Offers flexible payment options to accommodate different financial situations, making it easier to manage the best Dodge Caliber car insurance expenses. This flexibility helps in budgeting for insurance costs. For more details, visit our Travelers insurance review.

Cons

- Higher Rates for High-Risk Drivers: Travelers may charge higher premiums for drivers with poor credit or high-risk profiles, potentially impacting those seeking the best Dodge Caliber car insurance. This could affect affordability for some customers.

- Mixed Customer Feedback: Customer feedback can vary, with some reporting issues with claims processing or customer service, which could impact the overall experience of obtaining the best Dodge Caliber car insurance.

#9 – Amica: Best for Financial Stability

Pros

- Financial Stability: Amica’s strong financial ratings indicate that they are financially stable and capable of handling claims effectively. This adds a layer of security to your coverage for the best Dodge Caliber car insurance, ensuring reliability.

- Excellent Customer Service: Known for high customer satisfaction, Amica provides responsive and effective service, making it easier to manage your insurance needs for the best Dodge Caliber car insurance. Their reputation for service quality enhances the customer experience.

- Multi-Vehicle Discounts: Offers multi-vehicle discounts of up to 11%, which can significantly lower your insurance costs if you have more than one car, making it a great choice for securing the best Dodge Caliber car insurance.

Cons

- Higher Premiums for Certain Drivers: Amica’s rates can be higher for some drivers, particularly those with a history of accidents or violations. This could impact those seeking the most affordable best Dodge Caliber car insurance. Our complete Amica car insurance review goes over this in more detail.

- Limited Local Agents: Amica operates primarily online and over the phone, which may not be ideal for those who prefer face-to-face interactions with local agents. This could be a drawback when looking for the best Dodge Caliber car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Personalized Service

Pros

- Customizable Coverage: Farmers allows for extensive customization of your insurance policy to meet specific needs for the best Dodge Caliber car insurance. This flexibility can ensure you have the right coverage and adapt it as needed.

- Strong Local Agent Network: Offers access to a wide network of local agents for personalized service and support, which can be beneficial for those seeking in-person assistance with the best Dodge Caliber car insurance.

- Discounts for Bundling: Provides discounts for bundling home and auto insurance, which can lead to significant savings for the best Dodge Caliber car insurance. This is particularly valuable for households with multiple insurance needs.

Cons

- Higher Premiums: Farmers’ rates can be higher compared to some competitors, especially for drivers with less-than-perfect records, which could affect the affordability of the best Dodge Caliber car insurance.

- Limited Online Resources: Their online tools and resources may not be as advanced or user-friendly as those offered by some other providers, which could impact the ease of managing the best Dodge Caliber car insurance. Read more insights through our Farmers auto insurance review.

Dodge Caliber: What to Expect for Insurance

The cost of insuring a Dodge Caliber typically averages approximately $96 per month. This cost can vary depending on several factors, including the driver’s age, location, driving history, and the level of coverage selected.

Dodge Caliber Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $69 | $155 | |

| $62 | $135 | |

| $68 | $150 | |

| $64 | $140 | |

| $72 | $160 |

| $63 | $140 |

| $65 | $142 | |

| $66 | $145 | |

| $67 | $148 | |

| $60 | $135 |

Insurance premiums for the Dodge Caliber are generally influenced by the vehicle’s safety features, repair costs, and overall risk profile.

Dodge Caliber Car Insurance Rate Comparison by Driver Profile

| Driver Profile | Monthly Rates |

|---|---|

| Discount Rate | $56 |

| High Deductibles | $82 |

| Average Rate | $96 |

| Low Deductibles | $120 |

| High Risk Driver | $203 |

| Teen Driver | $349 |

Despite being a compact car, which usually means lower insurance rates, the specific rate for a Dodge Caliber may fluctuate based on individual circumstances and the best auto insurance companies chosen.

Dodge Caliber Insurance Costs and Options

The chart below illustrates how the insurance rates for a Dodge Caliber compare to other popular hatchbacks such as the Toyota Yaris, Kia Soul, and FIAT 500L. The Toyota Yaris has a total monthly insurance cost of $107, with comprehensive coverage costing $21, collision at $39, and liability at $32.

The Kia Soul is slightly higher at $111 monthly, with comprehensive coverage at $25, collision at $41, and liability at $31. The FIAT 500L has the highest total insurance cost at $113, driven by a comprehensive cost of $21, collision at $39, and liability at $37.

To secure the cheapest insurance rates for your Dodge Caliber, consulting a car insurance guide and comparing quotes from multiple providers is essential.

Maintaining a clean driving record, choosing higher deductibles, and taking advantage of discounts for safety features or bundling policies can further lower your overall insurance costs. Enter your ZIP code below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Key Factors Affecting Dodge Caliber Insurance Costs

The cost of insuring a Dodge Caliber is influenced by several factors that affect car insurance rates. The vehicle’s trim and model can affect the insurance price, with older models generally being cheaper to insure—like a 2012 model costing $96 monthly, compared to $90 for a 2010 model.

Schimri Yoyo Licensed Agent & Financial Advisor

Additionally, a driver’s record can impact rates, especially for younger drivers who see the highest increases in traffic violations.

Safety Ratings for the Dodge Caliber

The Dodge Caliber’s safety ratings impact its insurance costs, with mixed results across various tests. It received a “Good” rating for moderate overlap front impacts and head restraints, ensuring decent protection in these areas.

Dodge Caliber Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Poor |

| Small overlap front: passenger-side | Acceptable |

| Moderate overlap front | Acceptable |

| Side | Marginal |

| Roof strength | Marginal |

| Head restraints and seats | Poor |

However, it earned a “Marginal” rating for side impacts and an “Acceptable” rating for roof strength. Notably, the vehicle wasn’t tested for small overlap front crashes on either side.

These safety ratings can affect insurance premiums, with better ratings generally leading to lower costs and potentially qualifying for safe driver car insurance discounts. Enter your ZIP code now to compare quotes!

As you navigate the search for the best car insurance for your Dodge Caliber, it’s essential to consider both your budget and the level of coverage you require.

Leading providers such as Geico, State Farm, and Progressive offer competitive rates starting at around $60 per month, reflecting Dodge Caliber’s typically lower insurance costs. To ensure you’re getting the most value, leverage comparison tools to explore various options and inquire about available discounts.

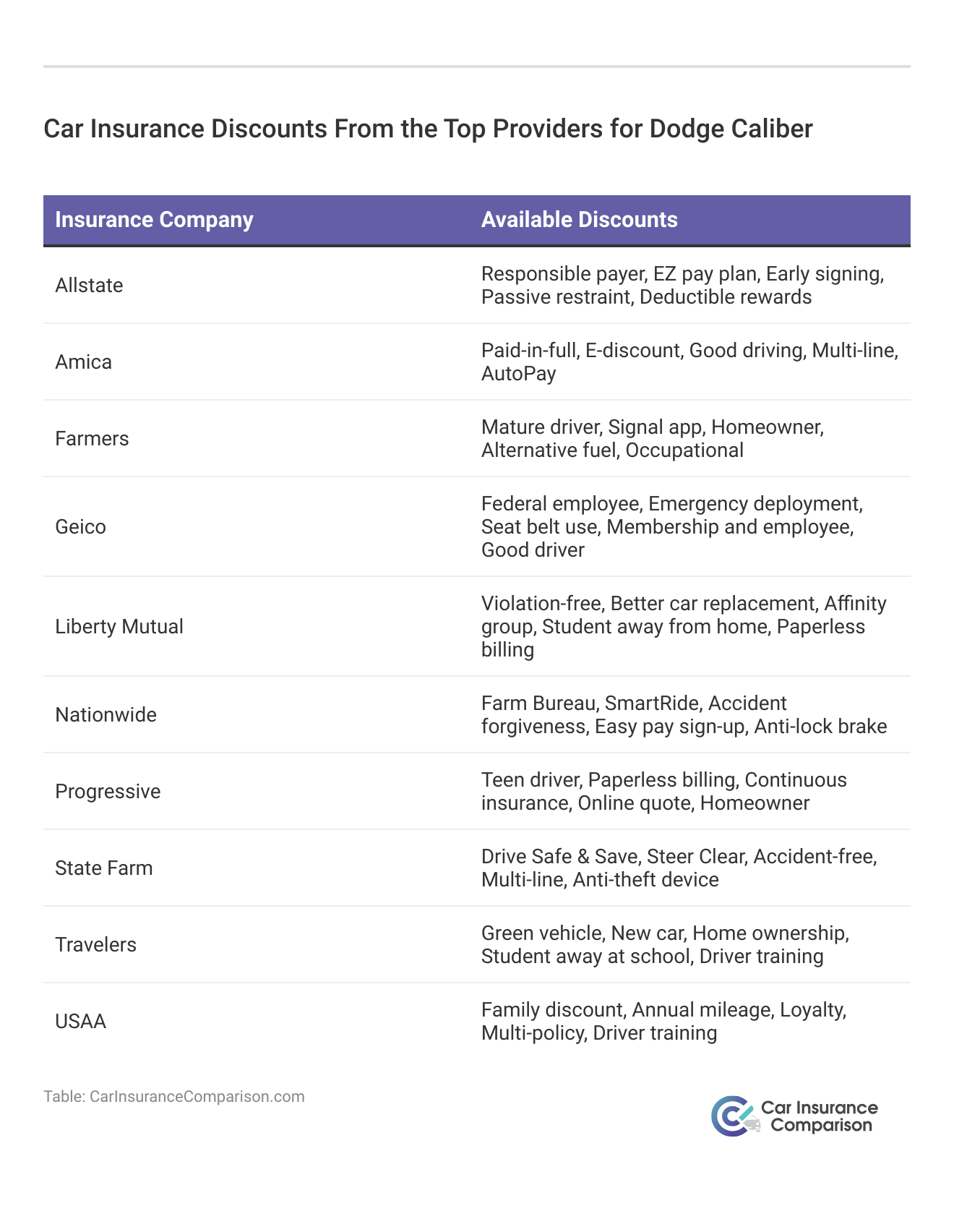

By maintaining a clean driving record, and taking advantage of safety features and car insurance discounts, you can further reduce your insurance premiums. Understanding factors like safety ratings and repair costs will help you make an informed decision, potentially leading to substantial savings.

For tailored insurance solutions and to find the most cost-effective rates, enter your ZIP code and start comparing quotes today.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Why was the Dodge Caliber discontinued?

Chrysler-Dodge started manufacturing the Caliber to replace both the Dodge Neon and the Chrysler PT Cruiser. There is no clear reason as to why they stopped producing this model since it performed well with sales numbers.

The Caliber was replaced by the Dodge Dart, and it seems as though Chrysler made it a point to try new and different models to fit this vehicle segment.

Is a Dodge Caliber an SUV or a car?

The Dodge Caliber is officially classified as a front-engine, five-door compact hatchback. It is definitely not an SUV as it falls somewhere between a station wagon and a minivan. Due to its versatile nature, the IIHS has grouped the Caliber into the “small minivan” category. Enter your ZIP code today.

What does a Dodge Caliber look like?

As an adaptable car, the Dodge Caliber resembles both a station wagon and a minivan. It has the height of a minivan with the body structure of a wagon, giving it a unique design that is best suited for drivers who value versatility.

How much weight can a Dodge Caliber haul?

The Dodge Caliber has a towing capacity of up to 1,500 pounds. While some of the best pickup trucks on the market can pull about three times as much, the Caliber isn’t built for towing but still offers a good option if you need to pull some extra weight.

For businesses using the Caliber for light towing, considering commercial car insurance could provide the necessary coverage for these activities.

How many miles will my Dodge Caliber last?

Some vehicle owners have reported that their Dodge Caliber has lasted over 100,000 miles with ease. Ultimately, how well you take care of your vehicle will determine how long it will last.

With regularly scheduled maintenance appointments, your Dodge Caliber can last you a look time, providing an excellent value. Enter your ZIP code today.

Are car insurance rates for the Dodge Caliber different in each state?

Yes, car insurance rates can vary by state. Insurance companies consider state-specific factors such as local laws and regulations, accident rates, population density, and average repair costs when determining rates.

Therefore, the car insurance rates for the Dodge Caliber may differ from state to state. It’s advisable to consult with insurance providers or use online comparison tools to obtain accurate rates for your specific location.

Should I consider specialized coverage for my Dodge Caliber, such as comprehensive or collision insurance?

The decision to add comprehensive or collision insurance to your policy depends on your specific circumstances and preferences. Comprehensive insurance covers damages to your vehicle caused by non-collision incidents, such as theft, vandalism, or natural disasters.

Collision insurance covers damages resulting from collisions with other vehicles or objects. If you want financial protection for potential damages to your Dodge Caliber beyond the mandatory liability coverage, adding comprehensive and collision coverage may be beneficial.

What is a notable benefit of Geico’s insurance for the Dodge Caliber?

Geico offers competitive premiums and a multi-vehicle discount of up to 25%, making it a cost-effective option for the best Dodge Caliber car insurance. Enter your ZIP code today.

How does State Farm’s local agent network benefit Dodge Caliber insurance customers?

State Farm’s extensive network of local agents provides personalized service and support, which can be advantageous for those seeking tailored assistance with their Dodge Caliber insurance.

What discount does Progressive offer that can impact the cost of Dodge Caliber insurance?

Progressive’s Snapshot program rewards safe driving with discounts, which can help reduce the cost of the best Dodge Caliber car insurance based on driving habits.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.