Best Storage Car Insurance in 2025 (Your Guide to the Top 10 Companies)

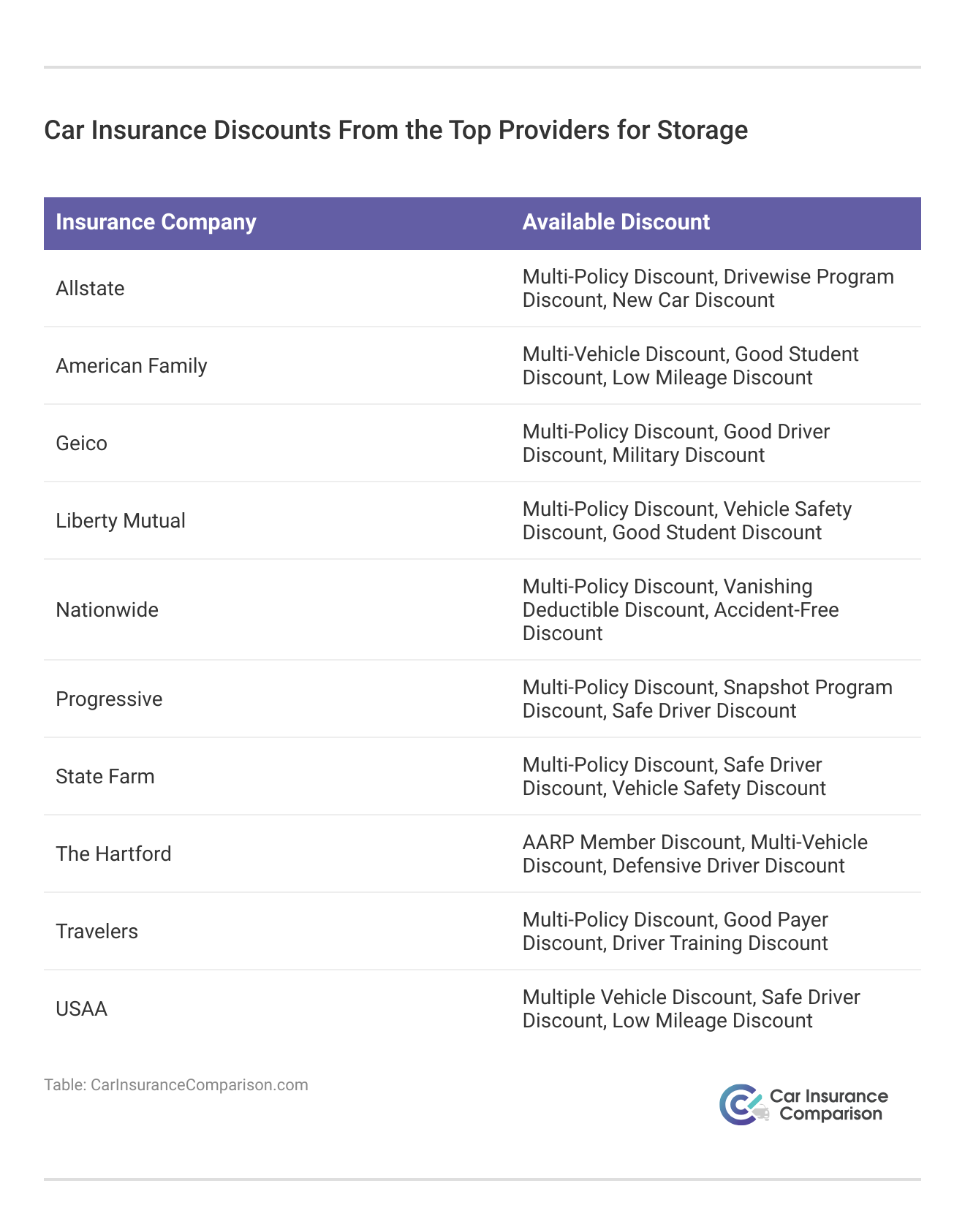

State Farm, USAA, and Geico have the best storage car insurance. State Farm's minimum car storage costs per month average $45/mo for most customers. Car insurance for cars in storage may be even cheaper at the best storage insurance companies if vehicle owners qualify for bundling discounts.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

UPDATED: Jan 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Storage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Storage

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Storage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsState Farm, USAA, and Geico have the best storage car insurance.

An automobile must be kept in a locked facility to be qualified for stored vehicle insurance.

The best companies for storage insurance coverage are below.

Our Top 10 Company Picks: Best Storage Car Insurance

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Comprehensive Options | State Farm | |

| #2 | 10% | A++ | Military Benefits | USAA | |

| #3 | 15% | A++ | Low Rates | Geico | |

| #4 | 12% | A+ | Online Tools | Progressive | |

| #5 | 10% | A+ | Claim Satisfaction Guarantee | Allstate | |

| #6 | 15% | A | Unique Discounts | American Family | |

| #7 | 20% | A+ | Bundling Discount | Nationwide |

| #8 | 10% | A | Customizable Policies | Liberty Mutual |

| #9 | 13% | A++ | Financial Stability | Travelers | |

| #10 | 10% | A+ | AARP Members | The Hartford |

Read on to learn more about the best companies, car storage prices, understanding your car insurance policy for stored cars, and more. Ready to shop for cheap vehicle storage? Using your ZIP code, start comparing car insurance quotes online right now to find storage auto for vehicles.

- State Farm has the best storage insurance for vehicles

- You can get comprehensive-only insurance coverage for your stored vehicle

- Many insurance companies offer reduced-rate options for vehicle storage insurance

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Comprehensive Options: State Farm offers good comprehensive coverage options. Read our State Farm review to learn more.

- Multi-Policy Discount: There is a discount for multi-policy holders at State Farm.

- Personalized Service: Local agent availability adds a personalized touch to customer service.

Cons

- Financial Rating: State Farm’s A.M. Best rating is a B.

- Online Capabilities: Some policy actions, like buying a plan, must be finalized through agents.

#2 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA customers get benefits like travel discounts. Learn more in our review of USAA.

- Deployment Experience: USAA makes it easy to switch to storage coverage when deployed.

- Ratings: USAA is rated highly for customer satisfaction and financial stability.

Cons

- Eligibility: Eligibility is restricted to veterans, military service members, and their families.

- Lack of Local Agents: There are limited branches for in-person service.

#3 – Geico: Best for Low Rates

Pros

- Low Rates: Geico’s storage rates are affordable for most customers.

- Multi-Policy Discount: Storage coverage may be even cheaper for multi-policy holders.

- Online Tools: User-friendly online management is available at Geico. Learn more in our Geico review.

Cons

- Coverage Options: May be limited depending on location.

- Services Mostly Online: Reliance on online tools means there isn’t local agent assistance in most locations.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Online Tools

Pros

- Online Tools: Easy-to-use tools are available at Progressive to assist customers.

- Flexible Policies: Terms for policies and stored vehicle options are flexible. Learn more in our Progressive review.

- Multi-Policy Discount: Save on car storage insurance by bundling insurance.

Cons

- Customer Service: Representative responsiveness isn’t always rated highly.

- Rate Increases: Some customers report rate increases after their first policy period.

#5 – Allstate: Best for Claim Satisfaction Guarantee

Pros

- Claim Guarantee: Allstate offers a claim satisfaction guarantee, which means it may offer unsatisfied customers discounted rates during the next policy period.

- Online Convenience: Allstate’s app provides simple management options.

- Multi-Policy Discount: Multi-policy holders may be able to save on auto storage insurance.

Cons

- Higher Rates: Compared to other companies, rates can be more expensive. Learn more in our Allstate review.

- Claim Settlements: Complaints are higher than normal.

#6 – American Family: Best for Unique Discounts

Pros

- Unique Discounts: American Family has unique discounts. Learn more in our American Family review.

- Customer Service: American Family scored well for its customer service.

- Financial Ratings: American Family’s A.M. Best rating is an A.

Cons

- Young Driver Rates: Rates are best for senior drivers.

- Availability: Coverage for stored cars won’t be sold in all states.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Bundling Discount

Pros

- Bundling Discount: A multi-policy discount is just one of many Nationwide car insurance discounts.

- Financial Rating: Nationwide has an A+ rating from A.M. Best.

- Flexible Payments: Choose your frequency and method of payment.

Cons

- Online Management: Online management may be more complicated at Nationwide.

- Customer Service: Service ratings vary by location.

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: If you take your vehicle out of storage, you will find policies are easily customized.

- 24/7 Support: Liberty Mutual representatives are always available. Learn more in our review of Liberty Mutual.

- Online Management: The company has an app for customers who want to manage policies virtually.

Cons

- Less Personalized Customer Service: Most services are provided virtually.

- Discount Options: These are sometimes limited to certain states.

#9 – Travelers: Best for Financial Stability

Pros

- Financial Stability: A.M. Best gave Travelers a high A++ rating. Learn more in our review of Travelers.

- 24/7 Support: Representatives from Travelers can always be reached by customers.

- Multi-Policy Discount: Vehicle storage insurance rates could be lowered by bundling.

Cons

- Customer Reviews: While not terrible, reviews and ratings could be improved.

- Claims Processing: Slower processing by Travelers has been mentioned in some reviews.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – The Hartford: Best for AARP Members

Pros

- AARP Members: The Hartford offers insurance deals to AARP members (learn more: AARP Auto Insurance Program From The Hartford Review).

- Repair Shop Network: If an accident befalls your stored vehicle, The Hartford has a list of trustworthy repair shops.

- Multi-Policy Discount: Rates may be lower for policyholders who purchased more than one type of coverage.

Cons

- Best for AARP Members: The Hartford’s rates for younger drivers aren’t as good.

- Claims Satisfaction: Usually just rated as average by The Hartford customers.

Vehicle Storage Insurance Cost

What is parked car insurance? Generally, this refers to a type of comprehensive-only insurance that covers damages to a vehicle while it’s stored away or parked long-term in a garage or storage unit. You might not end up in a car accident, but plenty of other things can happen to a vehicle in storage.

How much is car storage? Take a look at the rates below to see how much does car storage cost on average.

Storage Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $50 | $135 |

| American Family | $45 | $125 |

| Geico | $30 | $95 |

| Liberty Mutual | $55 | $145 |

| Nationwide | $42 | $115 |

| Progressive | $40 | $110 |

| State Farm | $45 | $120 |

| The Hartford | $47 | $128 |

| Travelers | $48 | $130 |

| USAA | $35 | $100 |

Storing a vehicle securely isn’t cheap. Add in the cost of insurance and the amount may simply be too much.

View this post on Instagram

However, if you are in the military, talk to your insurance agent. You may be eligible for an emergency deployment discount or other military discounts if you are stationed overseas and can prepay for coverage.

Read more: Compare Prepaid Car Insurance: Rates, Discounts, & Requirements

Comprehensive Car Insurance

Full coverage car insurance includes liability, collision, and comprehensive coverage. Collision car insurance helps to repair your own vehicle in the event of a car accident.

If you plan to drive your car at all, even just around the block, you have to keep liability coverage, which is mandated in every state.

Brandon Frady Licensed Insurance Agent

Comprehensive insurance is what comes into play for stored vehicle coverage. What does storage insurance cover on a vehicle? Comprehensive covers damage in the event that:

- A tree limb falls on your vehicle

- A ladder or tool falls off its hook in the garage and scratches your car

- Natural disasters or fires impact your vehicle

- Theft or vandalism occurs

Comprehensive coverage is a vital part of protecting your stored vehicle.

Other Insurance Options for Stored Vehicles

Many insurance companies offer particular insurance options at a much-reduced rate for vehicles that aren’t being driven:

- COMP Insurance: Comprehensive coverage designed to provide vehicle coverage against damage while it is stored. It also covers theft of your stored vehicle but does not provide liability insurance, which means you would still have to turn in your tags because you won’t be carrying the state minimum. (For more information, read our “Do I need liability car insurance for a stored car?“).

- Low Mileage Car Insurance Coverage: A reduction of what you already have based on a new mileage calculation. Typically, you can save between $200 and $400 a year when choosing this option. In addition, because you won’t be driving, you should also consider dropping your collision insurance if you have it.

- Pay As You Go Insurance: When your vehicle is tagged with a tracking device. You only pay a base amount plus a predetermined amount for each mile you drive. If you aren’t driving, you won’t have to pay anything other than the small base amount.

- Classic car insurance: Allows you to drive occasionally. Your car must qualify as a classic.

You can also purchase storage car insurance, which is usually available through your car insurance company. You can get storage insurance quotes from companies like State Farm or use a comparison tool.

If not, check with the storage company you are using, as they often provide this coverage to protect you against theft and damage while your vehicle is being stored.

Storage Insurance on Cars With Loans

Can you put storage insurance on a car with a loan? It’s highly unlikely that you can put storage insurance on your vehicle if it’s being financed or leased, as most lenders require that you keep full coverage car insurance for the duration of your loan. (For more information, read our “Compare Best Car Insurance Companies for Financed Cars“).

If you don’t keep full coverage, lenders can purchase force-placed car insurance on your behalf. This is generally a lot more expensive than if you had just purchased your own policy, and the price may be tacked onto your loan.

You need to shop around for different options to save as much money on car storage insurance costs as possible. Whether you’re in Michigan, Virginia, or California, you can search for storage insurance for cars.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Canceling Car Insurance for Stored Vehicles

If you decide to cancel your coverage because your vehicle is in storage, car insurance companies will automatically inform your state DMV or other car insurance authority of your cancellation, as they are required to do by law. You will receive a notice from your DMV or other insurance authority that your coverage has been canceled, and you have a certain amount of time to provide proof of insurance.

Learn more: How to Cancel Car Insurance: Step-by-Step

If you live in a state that allows you to cancel your insurance while your vehicle is being stored, you will also be informed that you must turn in your license plates while your vehicle is being stored or else start a new insurance policy.

Every state requires that any registered vehicle maintains an insurance policy.

But do you need liability insurance on a car in storage? You don’t, but most states require that you take some extra steps with the DMV before you can drop liability coverage. Once you store your vehicle and turn in your plates, you are “unregistering” it until the time comes that you want to drive it again.

These laws vary by state. For instance, the North Carolina Department of Transportation requires that you turn in your license plate before dropping liability coverage.

On the other hand, California’s DMV allows you to file your car as Planned Non-Operable before your registration renews. At that point, you are no longer able to drive, tow, or park your car in a public area. If you take this option, your vehicle is uninsured. Homeowners insurance will cover the cost of your property inside your vehicle if it is stolen, but it won’t cover the loss of your vehicle itself.

This is something to consider before you make the decision to completely cancel your insurance. Do your research to find out if you want Progressive or Geico storage insurance for your car. Or another nearby car insurance provider may offer better rates for coverage of your stored car.

Finding the Best Storage Insurance for Cars

State Farm, USAA, and Geico are the top companies for storage auto insurance. Car storage insurance will protect your vehicle if something happens to it while in storage, protecting you from a financial loss. To get the cheapest car storage insurance coverage, make sure to shop around for quotes (learn more: How do you get competitive quotes for car insurance?).

If you are ready to quickly find cheap comprehensive insurance for your stored vehicle, use our free rate comparison tool.

Frequently Asked Questions

What is car storage insurance?

Car storage insurance is comprehensive-only coverage for when your vehicle is in storage. What does storage insurance cover? It provides protection against damages while the vehicle is not in use. Stored vehicle car insurance can be a cost-effective option.

If you want to find cheap car insurance on stored vehicles, you should be aware of the laws in your state regarding vehicle storage. Car insurance on stored cars may not be required in this case, making it possible for you to save money with vehicle storage insurance.

Can you store classic cars?

You may choose to keep your vehicle in short-term or long-term storage rather than driving it because it’s considered a classic car, which is eligible for classic car insurance (read our classic auto insurance guide for more information). In many cases, rather than standard storage, you might keep your classic car in a climate-controlled environment or parked in your garage at all times.

How much does storage insurance on a car cost?

Wondering how much is storage insurance? Vehicle storage costs per day vary, but on average, comprehensive insurance for stored cars costs under $40 per month. Compare rates today with our free quote comparison tool.

Can I drive a car with storage insurance?

No, driving a car with only storage insurance is illegal. You need to have liability insurance to drive legally on public roads (read more: Compare Liability Car Insurance: Rates, Discounts, & Requirements).

Do I need insurance on a car that doesn’t run?

Yes, any registered vehicle needs to carry insurance, even if it doesn’t run. Any registered vehicle needs to carry insurance. Check with your insurance provider to negotiate the best auto insurance policy or additional coverage for your long-term car storage.

Can I put storage insurance on a financed car?

It’s unlikely that you can put storage insurance on a financed car. Most lenders require full coverage car insurance for the duration of the loan.

Can you drive a car with storage insurance?

No. Driving a car with only comprehensive coverage is breaking the law, as you also need to meet your state’s liability insurance requirements to drive on public roads (learn more: Minimum Car Insurance Requirements by State).

What car insurance companies offer storage coverage?

Most car insurance companies — Progressive, Geico, State Farm, etc. — offer some form of coverage for stored vehicles. As do many specialty car insurers.

Does ICBC have storage insurance for cars?

Yes, they have specialized coverages for off-road vehicles, vehicles in storage, and luxury vehicles.

How do I prepare my car for storage?

If you’re going to store your car away for an extended period of time, you’ll want to take some steps to make sure it stays in good condition during that time. Most importantly, make sure to wash and wax your car before it goes into long-term vehicle storage.

Does home insurance cover storage units?

It depends on your policy, but most of the best home insurance companies will cover at least a portion of the items in your storage unit. You may even get a bundling discount for having home and auto insurance (read more: Best Companies for Bundling Home and Car Insurance).

Can you store a car in a storage unit?

Yes, in most cases, you can store a car in a storage unit, but make sure you check the unit’s rules first.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.