AIS Car Insurance Review for 2025 [Ratings, Cost, & Complaints]

AIS car offers affordable plans, with rates starting at $45/month for safe drivers and up to 25% discounts. AIS also provides extra benefits like roadside assistance, coverage for mechanical breakdowns, and customized policies designed specifically for California drivers. Check out the coverage options below.

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Nov 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

AIS Insurance

Average Monthly Rate For Good Drivers

$45A.M. Best Rating:

AComplaint Level:

LowPros

- Multiple coverage options are available

- Convenient online policy management

- Competitive insurance rate comparisons

Cons

- Limited to California residents

- Unclear other insurance offerings

AIS car insurance review reveals how this independent agency offers competitive coverage options tailored to California drivers’ needs.

AIS enables customers to compare policies from various insurance providers, ensuring they find the best fit for their needs in the car insurance company comparison.

AIS Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.5 |

| Business Reviews | 4.0 |

| Claims Processing | 3.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 2.7 |

| Coverage Value | 3.4 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 3.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.8 |

| Plan Personalization | 3.5 |

| Policy Options | 2.8 |

| Savings Potential | 4.2 |

Additional benefits, such as discounts of up to 20% and options for roadside assistance, enhance their offerings. By prioritizing customer service and online management, AIS makes navigating auto insurance simple and accessible for everyone.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code above into our free comparison tool to find the lowest prices in your area.

AIS Monthly Rates: A Breakdown by Age and Gender

The table shows how insurance premiums fluctuate, with age and gender playing a big role in the costs. The best rates for full coverage show up around age 45, where women pay $100, and men are close behind at $98. Check out our ranking of the top providers: Best Full Coverage Car Insurance

AIS Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $184 | $457 |

| Age: 16 Male | $201 | $477 |

| Age: 18 Female | $152 | $340 |

| Age: 18 Male | $174 | $390 |

| Age: 25 Female | $52 | $119 |

| Age: 25 Male | $53 | $122 |

| Age: 30 Female | $49 | $111 |

| Age: 30 Male | $50 | $115 |

| Age: 45 Female | $45 | $100 |

| Age: 45 Male | $58 | $98 |

| Age: 60 Female | $41 | $88 |

| Age: 60 Male | $42 | $89 |

| Age: 65 Female | $45 | $98 |

| Age: 65 Male | $44 | $96 |

It breaks down monthly premiums by different coverage levels, age, and gender. You’ll find the costs for minimum and full coverage, covering ages 16 up to 45. Across most age ranges, women tend to pay less than men.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

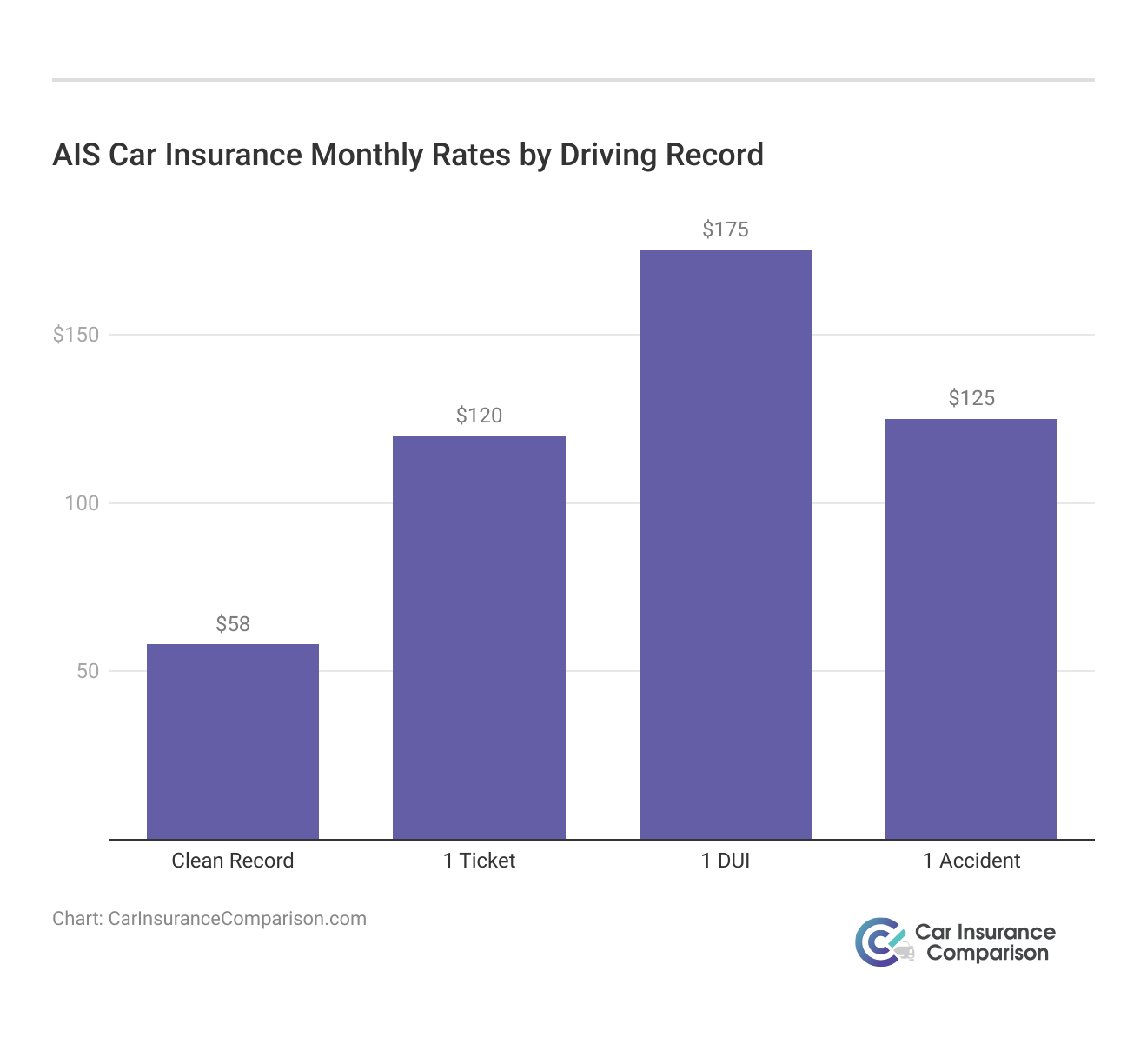

Impact of Driving Records on AIS Premiums

This table highlights how your monthly insurance premiums shift based on your driving history. It breaks down the cost differences between having a spotless record and one marked by tickets, a DUI, or accidents, showing how much more you might pay for full or basic coverage.

Understanding car accidents is essential as it categorizes rates into four distinct groups: a clean record, one ticket, one DUI, and one accident.

If you have a clean driving record, you’ll pay the lowest rates—just $58 for minimum and $120 for full coverage. If you’ve received one ticket, the cost increases to $75 for minimum coverage and $145 for full coverage. The numbers jump for more serious infractions; someone with a DUI will face much higher premiums, with full coverage costing around $175.

Even a single accident can significantly raise your rates, with full coverage costing $125. Sustaining a clean driving record is key to saving on insurance. Even small mistakes on the road can cause your premiums to rise, so it’s smart to drive safely and keep those costs in check.

AIS Monthly Rates vs. Top Competitors by Age & Gender

If you’re comparing monthly car insurance rates, AIS tends to offer some of the most competitive prices, regardless of who you are. Take an 18-year-old male driver, for instance—he could get coverage from AIS for around $390 a month. That’s significantly cheaper than what you’d pay with Allstate or Farmers, where premiums are closer to $519 and $629, respectively.

Female drivers in the same age group also see savings with AIS, paying just $340 compared to $448 with Allstate and $597 with Farmers. This makes AIS a clear choice for affordability and continues to stand out by offering competitive rates, with men typically paying about $115, while women pay around $111.

AIS Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $340 | $390 | $111 | $115 | $100 | $98 | $98 | $96 | |

| $448 | $519 | $168 | $176 | $162 | $160 | $158 | $157 | |

| $597 | $629 | $160 | $167 | $139 | $139 | $136 | $136 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $78 | $78 | |

| $522 | $626 | $174 | $200 | $171 | $174 | $167 | $170 |

| $303 | $387 | $124 | $136 | $113 | $115 | $111 | $112 |

| $591 | $662 | $131 | $136 | $112 | $105 | $109 | $103 | |

| $229 | $284 | $94 | $103 | $86 | $86 | $84 | $84 | |

| $530 | $740 | $99 | $108 | $98 | $99 | $96 | $97 |

Although Progressive and Nationwide tend to have slightly higher premiums, AIS provides more affordable options. For example, a 65-year-old man could expect to pay around $96, and a woman of the same age would likely pay close to $98. Even though prices differ slightly, these premiums still beat what most other insurers are offering.

AIS strikes a great balance between affordability and coverage, especially for younger and middle-aged drivers. This is especially evident in the average car insurance rates by age and gender, AIS continuously offers prices that stay competitive with other companies, giving it an edge in the market.

Maximize Your Savings With AIS Discounts

AIS offers several practical ways to help you cut down on your insurance premiums. For instance, bundling your auto insurance with your home or renters policy could save up to 25% off your rates with their multi-policy car insurance discount. If you have a clean driving record, you’re lucky—AIS rewards safe drivers with a 20% discount.

AIS Car Insurance Discounts

| Discount Name | Description | Potential Savings |

|---|---|---|

| Multi-Policy Discount | Bundle auto insurance with another policy, such as home or renters insurance | 25% |

| Good Driver Discount | For drivers with a clean record for a specified period (no accidents or tickets) | 20% |

| Good Student Discount | Available for full-time students who maintain a high GPA | 15% |

| Multi-Vehicle Discount | Insure more than one vehicle on the same policy | 20% |

| Safety Features Discount | Cars equipped with advanced safety features like airbags and anti-theft devices | 10% |

| Telematics Discount | Using a device or app to track safe driving habits | 30% |

| Loyalty Discount | Rewards for staying with the same insurer over a period of time | 10% |

| Pay-in-Full Discount | Pay the entire premium upfront instead of monthly installments | 10% |

| Defensive Driving Discount | Completing an approved defensive driving course | 10% |

Full-time students who sustain good grades can qualify for a 15% discount through their school’s good student program. You can save even more by insuring multiple cars, which knocks 20% off, or by having advanced safety features or taking a defensive driving course, which brings a 10% discount.

If you use a telematics device, you could see up to 30% in savings. Loyal customers get an extra 10% off, and if you pay your premium upfront, you can pocket another 10% discount. At AIS, we’re all about helping you save on car insurance while promoting safe and responsible driving habits.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

AIS Policy: What California Drivers Need to Know

Knowing what your policy covers is important if you’re a California driver looking into car insurance. Auto insurance can feel overwhelming, but breaking it down into key components makes it easier. In this guide, we’ll walk through the essentials, like bodily injury liability and collision coverage, so that you can feel confident in your insurance choices.

- Bodily Injury Liability: This type of insurance helps cover the costs if you cause an accident that results in someone else getting hurt or even worse, killed.

- Medical Payments: If you or your riders are injured in a collision, this coverage kicks in to handle medical expenses, no matter who’s to blame.

- Uninsured Motorist Coverage: This protects you if you’re hit by someone who doesn’t have insurance or doesn’t have enough to cover the damage.

- Comprehensive Physical Damage Coverage: This covers repairs or replacements if your car gets damaged by things like theft, vandalism, or a natural disaster—basically anything other than a collision.

- Collision Coverage: If you’re in an accident, this insurance helps pay to restore or replace your car, whether or not the accident was your fault.

Grasping the details of your car insurance policy can significantly impact your sense of security while driving. Understanding your car insurance policy helps ensure you are well-informed about your coverage, letting you to discover the roads securely and safely.

With coverage options like medical payments and uninsured motorist protection, you’ll better grasp what to expect in various situations. Take a moment to review your coverage, and you’ll find yourself in a much better position to pick the best plan that fits your needs perfectly.

The Quality of Customer Service at AIS

This section examines how AIS car insurance performs based on business ratings and customer reviews, showing that the company consistently performs well across different measures. For instance, AIS earned a solid score of 860 out of 1,000 in J.D. Power’s ratings, a sign that most customers are pretty happy with the service they’re getting.

AIS Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 860/1,000 Above Average |

|

| Score: A Excellent Business Rating |

|

| Score: 85/100 Good Customer Feedback |

|

| Score: 0.66 Fewer Complaints Than Average |

|

| Score: A Excellent Financial Strength |

AIS has also been recognized by the Better Business Bureau, receiving an A rating for strong business practices. Consumer Reports gave the company an 85 out of 100, reflecting solid customer feedback, while the NAIC shows AIS has fewer complaints than average, with a score of 0.66.

On top of that, A.M. Best gave them an A for financial stability, meaning they’re in good shape to meet financial obligations, which means they’re reassuring for consumers.

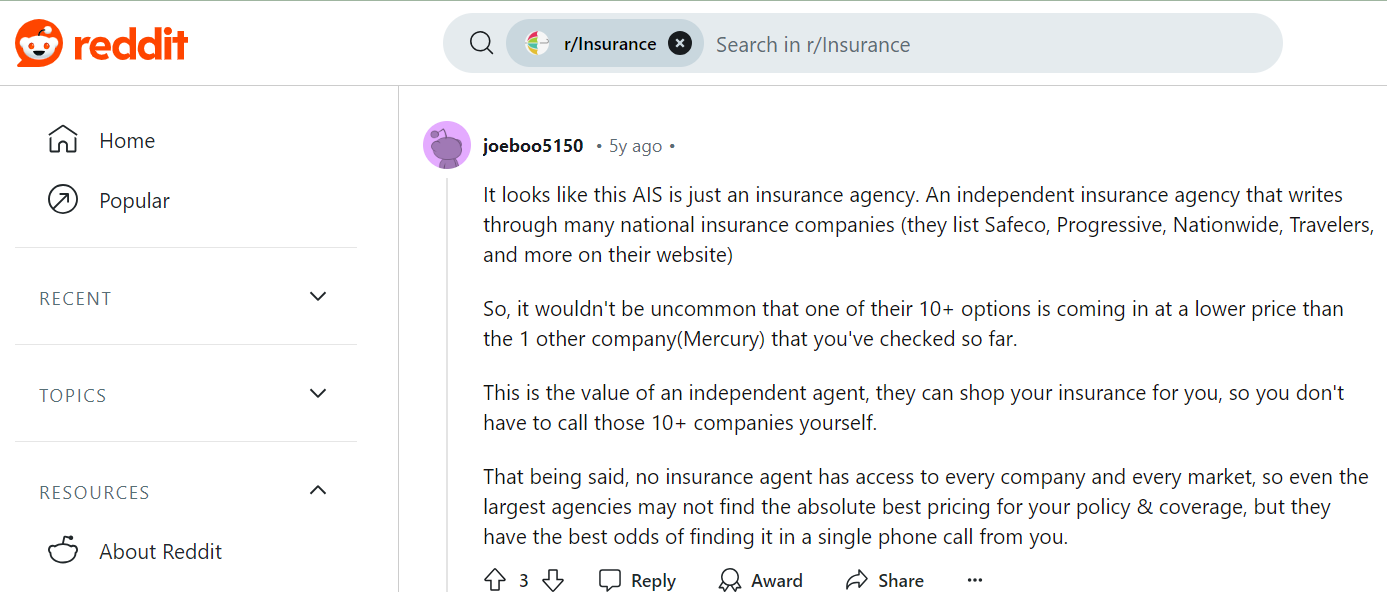

Someone on Reddit shared that AIS works as an independent insurance agency, and mentioned how companies like Progressive and Nationwide offer plenty of attractive discounts. These deals can really catch your eye, but it’s important to remember that no single agent can always find the best rate for everyone.

Agents definitely help make things easier, but you won’t always get the lowest price. And customer service can vary between insurers. AIS, for example, is often praised for its easy-to-use online tools that make it simple to manage your policies.

Still, when you’re shopping for car insurance, it’s good to keep in mind that the cheapest option might not always be the smartest choice. A deal that looks great might leave you without the coverage you actually need.

The cheapest policy doesn’t assure you of the best customer experience. AIS offers practical tips on how to lower your car insurance rates. Through following their tips, you can feel secured about receiving the best appropriate discounts to protect your vehicle.

Exploring the Advantages and Limitations for Savvy Drivers

AIS provides affordable car insurance and strong customer service tailored for California drivers. They provide a range of discounts, allowing customers to reduce their premiums and maximize their savings. Below, you’ll find a list of pros and cons to help you determine if AIS is the right option for you.

- Affordable Rates: As a careful driver aiming to save money, consider AIS for your insurance needs. With plans starting at just $45 per month, you can secure reliable coverage without breaking the bank.

- Discount Opportunities: AIS also provides discounts of up to 20%, allowing you to save even more compared to other insurance providers.

- Excellent Customer Service: AIS consistently gets high marks from groups like J.D. Power and the Better Business Bureau, showing they care about keeping customers satisfied and making policy management hassle-free.

This company offers competitive rates starting at $45/month for good drivers and discounts of up to 20% on car insurance premiums. With high customer service ratings from J.D. Power and the Better Business Bureau, AIS make sure that excellent support and satisfaction is provided to the policyholders.

AIS car insurance stands out for its flexible deals and exceptional customer assistance, making it a best choice for California drivers seeking customized coverage..

Brad Larson Licensed Insurance Agent

In short, AIS offers great rates and stellar customer service, but if you’re outside California or need more insurance options, you might want to consider those factors when making your decision.

- Limited Availability: Since AIS mainly operates in California, drivers in other states may find it difficult to access their services.

- Fewer Additional Products: Compared to larger insurance companies, AIS doesn’t offer as many additional coverage types, which could be a downside if you’re looking to combine policies.

AIS takes pride in offering competitive rates and a proven track record of keeping customers satisfied. While they primarily serve California residents, they also have some additional insurance options that are worth checking out. If you’re considering AIS for your car insurance, it’s a great idea to explore these options and see if they fit your needs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

AIS Car Insurance: A Competitive Choice for California Drivers

When you’re checking out your choices, our free car insurance comparison tool helps you quickly see how your AIS quotes measure up against other top companies. This way, you can easily find the best deal and get the most out of your car insurance search. Compare car insurance by coverage type to find the one that suits your needs and budget correctly.

data-media-max-width=”560″>

Many factors can influence your upcoming auto insurance rate, even without filing a claim. Learn more about how rates are determined and explore ways on how to potentially save!

🔗: https://t.co/BcZ95WA8nV#CarInsurance #InsuranceRate #Budgeting #InsuranceNews pic.twitter.com/7EBiHsutli

— AIS Insurance (@AISinsurance) May 16, 2024

If you’re short on time, you can get an instant quote online, helping you speed up your search for the right auto insurance provider. With so many companies out there, it’s more useful than ever to have quick access to coverage details and read honest reviews like this one.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

How does AIS work?

AIS is a company that specializes in helping drivers find affordable car insurance. They offer a comparison service that lets you explore different policy options from various insurance providers, making it easier to find coverage that fits your needs and budget.

How can I get an AIS quote?

You can easily obtain an AIS quote by visiting their official website at aisinsurance.com or calling customer service. Enter your details to get a personalized quote. Enter your ZIP code below into our free comparison tool to see how much car insurance costs in your area.

What is the AIS phone number for customer inquiries?

The AIS phone number is (800) 900-4247. You can call this number for questions regarding your policy, claims, or quotes. Discover additional information in our article “How to File a Car Insurance Claim.”

Are there any AIS reviews available online?

Numerous AIS reviews can be found on various platforms, including customer feedback websites and forums. These reviews often highlight customer experiences with pricing, claims processing, and customer service.

How can I manage my AIS insurance policy online?

To manage your AIS insurance policy, visit aisinsurance.com and log into your account. You can update your information, make payments, and access policy documents.

What types of coverage does AIS offer?

AIS Automobile Insurance provides several coverage options, including liability, collision, comprehensive, roadside assistance, and motorcycle insurance. Customers can tailored their policies to fit their specific needs. For further details, check out our article titled “Compare Collision Car Insurance.”

Is AIS considered a good option?

Many people trust AIS Insurance because of its great rates and solid customer service. If you want to get a better feel for what they offer, checking out reviews is a good way to see how they stack up overall.

Where is AIS located in California?

AIS has multiple locations throughout California, including a notable office in Cerritos. You can find your nearest AIS office by visiting their website or contacting customer support. Ready to find affordable car insurance? Use our free comparison tool below to get started.

Does AIS offer motorcycle insurance?

Yes, AIS offers motorcycle insurance as part of its range of auto insurance products. This coverage can be tailored to meet the specific needs of motorcycle owners. Check out our “Compare Motorcycle and Car Insurance Rates” article for further information.

How does AIS compare to other providers like Geico?

While AIS and Geico offer competitive rates and coverage options, customer preferences may vary based on personal experiences. Checking the Geico AIS review and comparing features, pricing, and customer service can help you make an informed decision.

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.