Fred Loya Car Insurance Review

Our Fred Loya car insurance review found it offers same-day insurance starting at $84/month, which is great for quick coverage. However, the company struggles with poor business ratings. Fred Loya Insurance customer service is also a concern, with negative reviews citing claims and customer satisfaction issues.

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Fred Loya

Average Monthly Rate For Good Drivers

$84A.M. Best Rating:

CComplaint Level:

HighPros

- Safe driver discount

- Roadside assistance

- Same-day coverage

Cons

- Numerous customer complaints

- Low A.M. Best rating

Our Fred Loya car insurance review highlights top benefits, such as affordable rates for high-risk drivers and a 15% safe driver discount.

However, while Fred Loya Insurance offers essential coverages like liability and collision, it lacks gap insurance and new car replacement.

Fred Loya Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 2.6 |

| Business Reviews | 2.0 |

| Claim Processing | 2.0 |

| Company Reputation | 2.0 |

| Coverage Availability | 2.1 |

| Coverage Value | 2.5 |

| Customer Satisfaction | 3.4 |

| Digital Experience | 2.0 |

| Discounts Available | 2.3 |

| Insurance Cost | 3.4 |

| Plan Personalization | 2.0 |

| Policy Options | 2.5 |

| Savings Potential | 3.0 |

Fred Loya’s customer satisfaction ratings are also below average, with numerous complaints about poor service and claims handling, so it is not one of the best car insurance companies for customer service.

While drivers with a history of accidents or DUIs may benefit from Fred Loya’s pricing, it’s essential to compare multiple quotes for the best deal.

- Fred Loya Insurance rates start at $84 per month

- A.M. Best gave Fred Loya Insurance a C rating for financial strength

- Fred Loya Insurance offers same-day car insurance coverage

Fred Loya Car Insurance Prices

When you get a Fred Loya car insurance quote, your rates will depend on several factors. To give you an idea of what Fred Loya charges for different types of drivers, we’ve put together average Fred Loya rates by gender, age, and more.

Fred Loya Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $186 | $374 |

| Age: 16 Male | $198 | $395 |

| Age: 18 Female | $174 | $355 |

| Age: 18 Male | $189 | $378 |

| Age: 25 Female | $132 | $248 |

| Age: 25 Male | $145 | $263 |

| Age: 30 Female | $112 | $215 |

| Age: 30 Male | $118 | $226 |

| Age: 45 Female | $98 | $180 |

| Age: 45 Male | $105 | $191 |

| Age: 60 Female | $87 | $165 |

| Age: 60 Male | $92 | $172 |

| Age: 65 Female | $84 | $161 |

| Age: 65 Male | $88 | $167 |

Minimum coverage will be the cheaper option at Fred Loya, but it will leave you vulnerable to financial issues if you cause an accident.

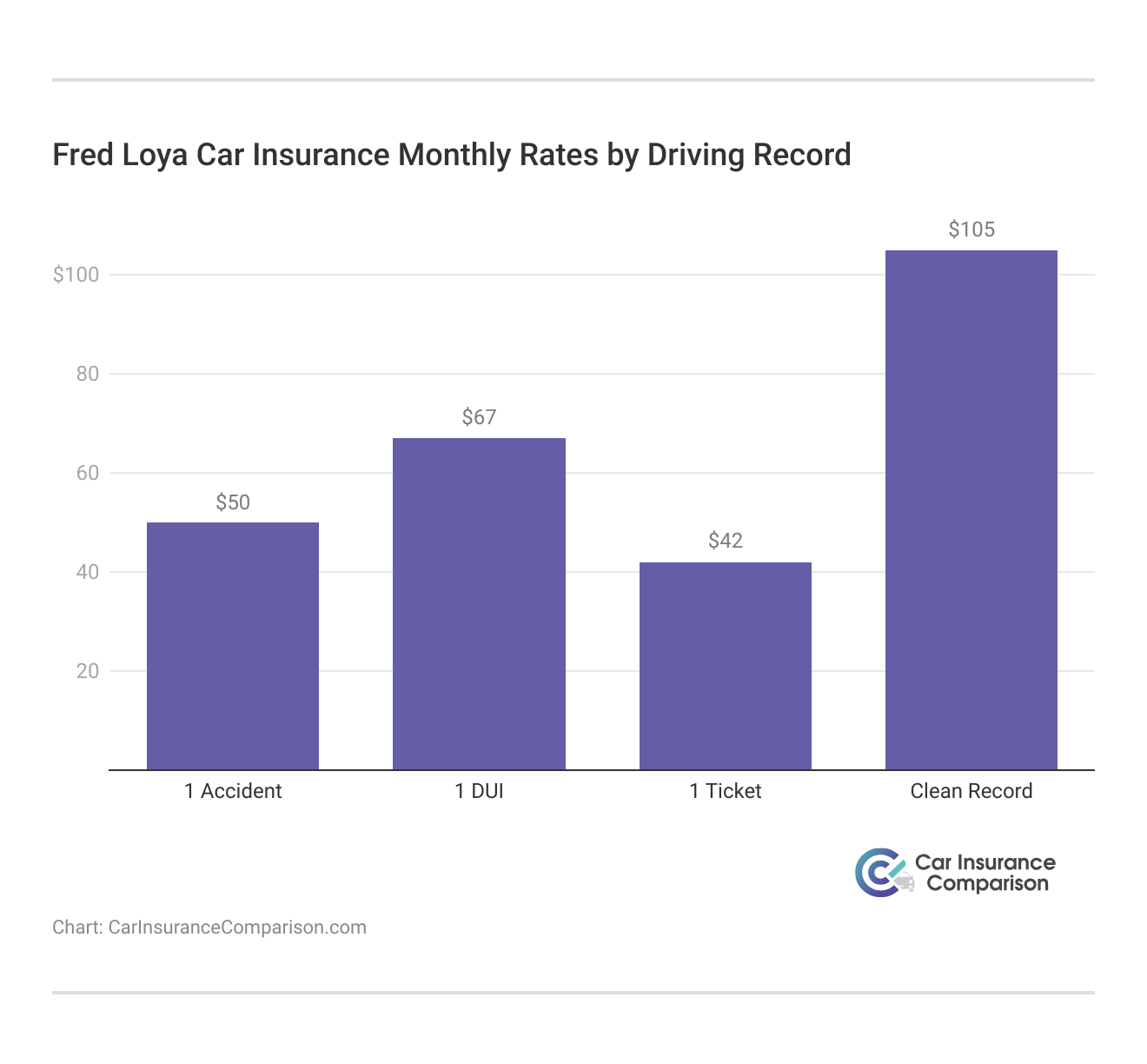

Another important factor affecting your Fred Loya rates is your driving record. Do all car insurance companies check your driving records? Many do, and Fred Loya is one of them. However, it caters its rates to high-risk drivers.

DUIs are the worst offense you can have on your driving record, as a DUI will raise rates to an average of $105/mo for just minimum coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Fred Loya Car Insurance Rates vs. the Competition

Let’s dive deeper into Fred Loya Insurance rates by seeing how they compare to other companies on the market. If you are looking for the most affordable auto insurance company on the market, Fred Loya won’t be the top choice.

Fred Loya Car Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $420 | $460 | $240 | $260 | $200 | $210 | $190 | $200 | |

| $395 | $445 | $225 | $245 | $185 | $195 | $175 | $185 | |

| $400 | $450 | $230 | $250 | $190 | $200 | $180 | $190 |

| $390 | $440 | $220 | $240 | $180 | $190 | $170 | $180 | |

| $430 | $470 | $250 | $270 | $210 | $220 | $200 | $210 |

| $400 | $445 | $225 | $245 | $185 | $195 | $175 | $185 |

| $405 | $450 | $230 | $250 | $190 | $200 | $180 | $190 | |

| $410 | $455 | $235 | $255 | $195 | $205 | $185 | $195 | |

| $415 | $460 | $240 | $260 | $200 | $210 | $190 | $200 | |

| $380 | $430 | $215 | $235 | $175 | $185 | $165 | $175 |

While it is not the most expensive, other companies like USAA, Geico, and Nationwide offer cheaper rates based on age and gender.

However, look at Fred Loya if you need cheap car insurance after a DUI. It’s also one of the cheapest on the market for drivers with at-fault accidents, as you can see in the table below.

Fred Loya Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $130 | $150 | $190 | $240 | |

| $120 | $140 | $180 | $230 | |

| $115 | $135 | $170 | $220 |

| $110 | $125 | $160 | $210 | |

| $140 | $165 | $200 | $260 |

| $125 | $145 | $185 | $235 |

| $120 | $140 | $180 | $230 | |

| $115 | $135 | $175 | $225 | |

| $120 | $145 | $185 | $240 | |

| $100 | $120 | $150 | $200 |

While Fred Loya is not the best for drivers with clean records, it’s cheaper for higher-risk drivers. Fred Loya insurance rates are just one part of the picture; read on to learn about Loya’s car insurance options, discounts, and ratings.

Car Insurance Options at Fred Loya

Now that you know how much Fred Loya charges compared to the competition, we want to look at what car insurance coverages Fred Loya sells.

Fred Loya Car Insurance Coverage Options

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers damages to others if you're at fault |

| Collision Coverage | Pays for your car’s damage in a collision |

| Comprehensive Coverage | Covers theft, vandalism, and natural disasters |

| Uninsured/Underinsured Motorist | Protects you in accidents with uninsured drivers |

| Medical Payments Coverage | Covers medical expenses for you and passengers |

| Personal Injury Protection (PIP) | Covers medical costs, lost wages, and related expenses |

| Rental Reimbursement | Pays for a rental car during repairs |

| Roadside Assistance | Covers towing and emergency services |

Fred Loya sells all the basic car insurance coverages that customers need for a Fred Loya Insurance full coverage policy, such as liability, collision, and comprehensive coverage.

It also has a few add-ons like roadside assistance available to purchase. However, Fred Loya doesn’t sell gap insurance, modified car insurance, or new car replacement coverage. If you want to add any of these to your policy, you will have to choose a different auto insurance company.

Learn More: Compare Full Coverage vs. Liability Car Insurance

Fred Loya Car Insurance Discounts

Fred Loya auto insurance discounts vary from multi-policy discounts to loyalty discounts. The largest discount Fred Loya Insurance offers is a safe driver discount of 15%.

Fred Loya Car Insurance Discounts and Savings

| Discount Name | Savings Percentage |

|---|---|

| Multi-Policy | 10% |

| Safe Driver | 15% |

| Good Student | 10% |

| Paid-in-Full | 5% |

| Multi-Vehicle | 10% |

| Anti-Theft Device | 5% |

| Loyalty | 5% |

| Low-Mileage | 7% |

You can also save 10% by bundling policies, insuring multiple vehicles, or being a good student. To qualify for some of the discounts, like a good student discount, you will have to provide proof that you’re eligible.

Read More: Best Car Insurance Discounts

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Customer Reviews of Fred Loya

Fred Loya Google reviews and Reddit reviews aren’t always positive, with customers citing issues with claims and customer service. See the Reddit review below for an idea of what customers think of Fred Loya.

Fred Loya insurance reviews on Yelp, Reddit, and other popular sites can provide some insight into customer issues with the company

Learn More: How do cus.tomer satisfaction ratings affect car insurance companies?

Business Ratings of Fred Loya

Fred Loya insurance reviews from BBB, A.M. Best, and other major rating sites will also offer insight into Fred Loya as a company, from financial strength to complaints.

Fred Loya Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 780 / 1,000 Below Satisfaction |

|

| Score: B- Fair Business Practices |

|

| Score: 74/100 Low Customer Feedback |

|

| Score: 4.50 Higher Complaints Than Avg. |

|

| Score: C Poor Financial Strength |

To start, Fred Loya Insurance has a below-average rating from J.D. Power for customer satisfaction, as well as poor Fred Loya insurance reviews on Consumer Reports. It also has a dismal score for financial management from A.M. Best and a high number of Fred Loya insurance complaints recorded by NAIC.

Many NAIC complaints indicate customer dissatisfaction and issues with claims processing or customer service. This can damage an auto insurance company's reputation, leading to regulatory scrutiny and financial penalties or market share loss.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

These poor ratings are a red flag and suggest that the Fred Loya Insurance Agency could be one of the car insurance companies with the worst customer satisfaction.

Fred Loya Car Insurance Pros and Cons

As a recap, let’s go over the pros and cons of Loya Insurance Group. Some of the benefits customers can take advantage of when buying Fred Loya Insurance include:

- Roadside Assistance: Add this extra coverage from Fred Loya for help with lockouts, dead batteries, tows, and more.

- Safe Driver Discount: Fred Loya offers 15% off an auto insurance policy to safe drivers.

- Same-Day Coverage: Get car insurance fast with Fred Loya’s same-day coverage.

While these are some good pros, there are also significant cons that may make you think twice about buying Fred Loya Insurance.

- Business Ratings: Fred Loya Insurance has poor ratings for claim satisfaction, financial strength, complaints, and more.

- Customer Satisfaction: Fred Loya has a number of negative reviews on rating sites like Reddit.

These cons could outweigh the pros if you value customer service, which is an important aspect of a car insurance company.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Deciding if Fred Loya Insurance is the Best Choice for You

Our Fred Loya car insurance review found that a pro is its low rates for high-risk drivers, particularly those with DUIs, while a key con is the company’s poor customer satisfaction ratings.

You want to avoid the worst car insurance companies in America, so it’s important to remember that Fred Loya’s customer service issues may affect your overall experience, as it has very poor ratings from the NAIC and other rating sites.

To ensure you get the best deal, be sure to compare quotes from multiple insurance companies online. This will help you find the policy that best suits your needs and budget.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Does Fred Loya pay claims?

Yes, Fred Loya pays claims. However, it has a low claim satisfaction rating from J.D. Power. There have been a few Fred Loya lawsuits over denied claims.

How does Fred Loya Insurance rate?

Businesses do not rate Fred Loya well. For example, Fred Loya has a C from A.M. Best.

Does Fred Loya do full coverage?

Yes, Fred Loya sells full coverage car insurance policies.

Is Fred Loya only in Texas?

No, Fred Loya also sells insurance in Ohio, California, New Mexico, Colorado, Georgia, Nevada, Illinois, Arizona, Indiana, and Alabama. Wondering who has the cheapest car insurance in Texas? Enter your ZIP in our free tool to find the cheapest Texas company for your needs.

Is Fred Loya Insurance a broker in California?

Yes, Fred Loya Insurance is also available in California.

Does Fred Loya have roadside assistance?

Yes, Fred Loya offers roadside assistance for breakdowns (Learn More: Cheap Car Insurance With Breakdown Coverage).

Does Fred Loya do same-day insurance?

Yes, Fred Loya Insurance claims on its website that it offers same-day auto insurance policies.

What’s the grace period for Fred Loya Insurance?

Fred Loya does not offer a grace period.

How many days is the grace period in insurance?

It depends on the auto insurance company, but some offer grace periods of 10 days before they cancel an auto insurance policy (Learn More: What happens after a late car insurance payment?).

Who owns Fred Loya Insurance?

Fred Loya owns Fred Loya Insurance.

Does Fred Loya cover vandalism?

Does car insurance cover vandalism? Fred Loya will only cover vandalism if you have comprehensive insurance.

Who is the richest insurance company?

State Farm has the largest market share in the U.S. auto insurance industry.

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Phong

Happy that I am now no more with FredLoya

NormalMan

Cheap, just hope you never need a claim

BCM2316Te

A false claim has a positive ending thankx to having Fred Lo

Jennjenn

Fred loya employees not informativeVery

SayNOtoFredLoya

Pls save yourself the hassle! Deceptive business practices

Ayla28

Wish u had the same prices that were 5 months ago

Pez81

Better than yours

RobotPete

Bad Company That Treats Their Customers Poorly

mrxtc89117

Good company

jacks0213

You’ll regret it