State Auto Insurance Review for 2024 [Unbiased Evaluation]

Our State Auto car insurance review highlights why it's a top choice for cheap commercial car insurance. Minimum coverage starts at $49 per month with great discounts for even lower rates. The downside is reflected in State Auto Insurance customer service complaints about claim processing.

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Dec 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

State Auto

Average Monthly Rate For Good Drivers

$49A.M. Best Rating:

AComplaint Level:

HighPros

- Cheap commercial car insurance rates

- Big multi-policy discounts

- Rated 4.9 for coverage flexibility

Cons

- Low claim satisfaction rating

- Doesn’t sell personal car insurance

Read this State Auto insurance review to find out why drivers appreciate its top benefits. State Auto offers exceptional discounts, including up to 25% off for bundling and cost-effective rates starting at $49/month for 45-year-old drivers.

Liberty Mutual acquired State Auto Insurance Companies in 2022. It stands out for cheap business and commercial car insurance but may not be ideal if quick claim resolutions are a priority.

They have AutoXtended coverage endorsement that offers extra benefits like original equipment manufacturer (OEM) parts coverage and full safety glass protection

State Auto Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 4.0 |

| Business Reviews | 4.0 |

| Claim Processing | 2.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.9 |

| Coverage Value | 3.7 |

| Customer Satisfaction | 3.4 |

| Digital Experience | 4.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.2 |

| Plan Personalization | 4.0 |

| Policy Options | 4.1 |

| Savings Potential | 4.4 |

Commercial policies are more expensive than personal coverage, so see if you’re getting the best deal on car insurance by entering your ZIP code above.

- State Auto insurance starts at $49/month for commercial policies

- It does not offer personal car insurance coverage

- State Auto is owned by Liberty Mutual

State Auto Car Insurance Costs

State Auto car insurance rates can really change depending on your age, gender, and how much coverage you choose. Use this rate comparison to gauge your potential costs:

State Auto Car Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $191 | $536 |

| Age: 16 Male | $216 | $604 |

| Age: 18 Female | $160 | $447 |

| Age: 18 Male | $186 | $515 |

| Age: 25 Female | $89 | $268 |

| Age: 25 Male | $97 | $287 |

| Age: 30 Female | $70 | $213 |

| Age: 30 Male | $75 | $227 |

| Age: 45 Female | $49 | $147 |

| Age: 45 Male | $49 | $147 |

| Age: 60 Female | $47 | $137 |

| Age: 60 Male | $49 | $140 |

| Age: 65 Female | $50 | $143 |

| Age: 65 Male | $52 | $146 |

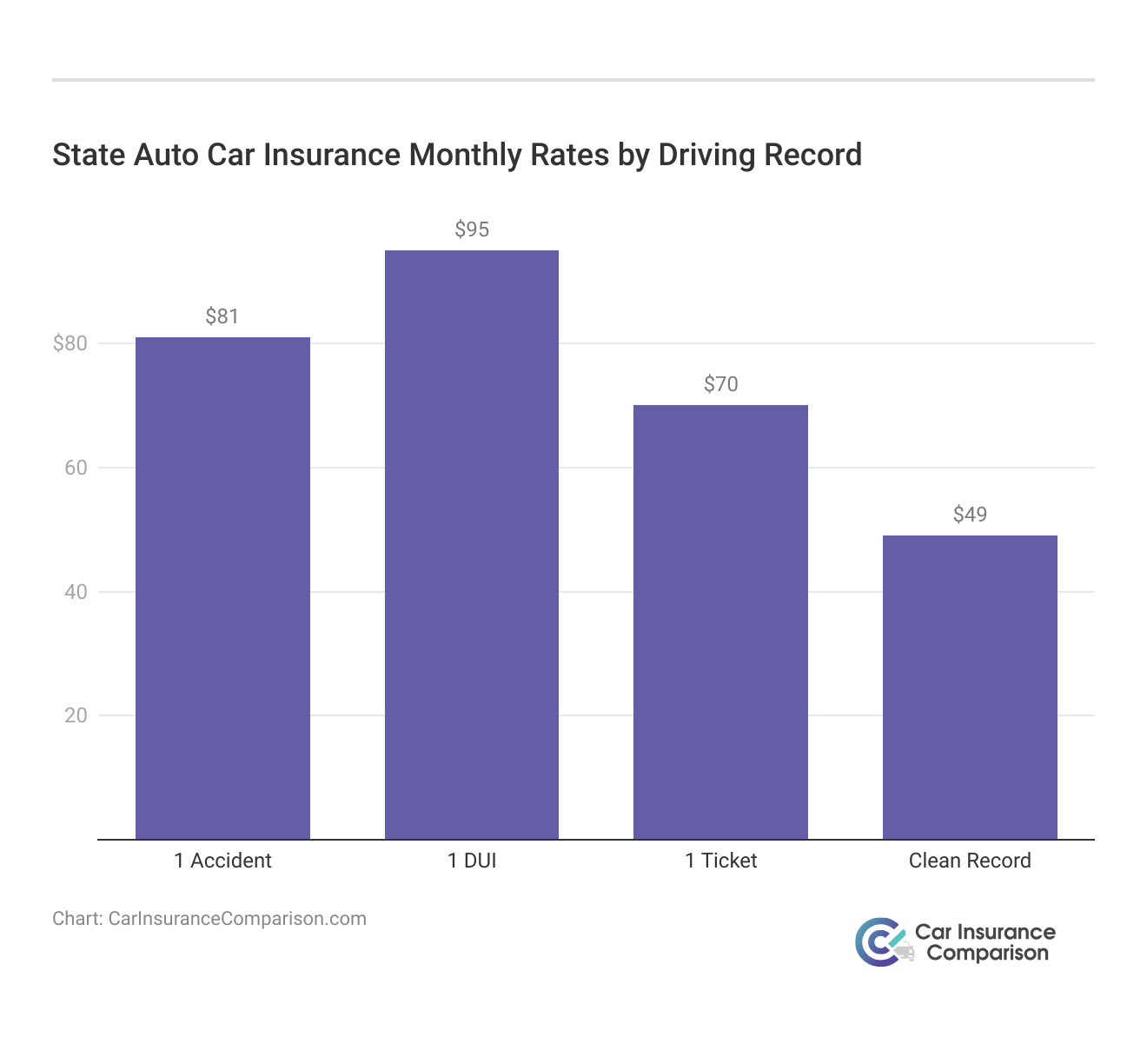

Along with age and gender, State Auto also considers driver records when setting rates. The table below outlines how different infractions, such as accidents, DUIs, and tickets, affect minimum and full coverage premiums.

Safe drivers get the cheapest State Auto car insurance. Use this information to understand how your driving behavior influences your costs and consider ways to maintain a clean record to take advantage of lower rates.

Learn More: Compare Commercial vs. Personal Car Insurance

Available Discounts From State Auto

There are many ways to reduce the cost of your insurance with State Auto, through various discount programs. Here’s a comprehensive breakdown of available savings opportunities you may qualify for:

Available Discount from State Auto Car Insurance

| Discount Name | Savings Percentage | Description |

|---|---|---|

| State Auto Safety 360℠ | 50% | Enroll in telematics program |

| Multi-Policy | 10% | Bundle auto and home policies |

| Driver Training | 10% | Complete driver education course |

| Good Student | 10% | Maintain a 'B' average or higher |

| Multi-Vehicle | 10% | Insure multiple vehicles |

| Accident Prevention Course | 5% | Complete approved course |

| Anti-Theft Device | 5% | Equip vehicle with anti-theft device |

| Paid in Full | 5% | Pay premium upfront |

| State Auto Start-Up | 5% | Switch from another insurer |

If you fit into a specific category and bundle up with other discounts, you should expect State Auto to give you some hefty discounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

State Auto Car Insurance Rates vs. the Competition

Compare different rates among the best commercial auto insurance companies to see if Safe Auto is the best near you. Examine some popular providers to find out what their premiums look like compared with each other.

State Auto Car Insurance Rates vs. Top Competitors

| Insurance Company | Monthly Rates |

|---|---|

| $105 |

| $110 | |

| $98 | |

| $115 | |

| $120 |

| $102 |

| $108 | |

| $95 | |

| $100 | |

| $112 |

These rates give you an idea of where you stand, but remember that your personal quote will differ depending on location, personal driving history, and coverage needs.

State Auto Car Insurance Coverage Options

State Auto provides diverse commercial car insurance coverage options, including minimum liability insurance, full coverage, and specialized add-ons like roadside assistance.

Notably, the AutoXtended coverage endorsement offers extra benefits like original equipment manufacturer (OEM) parts coverage and full safety glass protection. Get the right coverage by reading our best car insurance companies that cover OEM parts.

Discussing these options helps potential policyholders understand how State Auto caters to unique needs, especially for those interested in comprehensive coverage that goes beyond the basics.

Read More: Where to Find Car Insurance Company Reviews

State Auto Insurance Customer Reviews & Business Ratings

In the table below, you can see scores from J.D. Power, A.M. Best, and Consumer Reports that show how State Auto fared in terms of financial strength and customer satisfaction.

State Auto Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 820 / 1,000 Avg. Satisfaction |

|

| Score: A- Great Business Practices |

|

| Score: 60/100 Mixed Customer Feedback |

|

| Score: 1.89 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

State Auto Insurance reviews stated mixed customer feedback, as some find the company’s discounts and affordable rates a great value, while others find the claim process a thorn in their side. The positive customer experience Kent H. has posted in the Yelp review gives us a good example of one.

Read Kent H.‘s

review of

State Auto Insurance Companies on

Yelp

Despite facing two total losses within three months after 16 years of clean driving, he praises State Auto for exceeding his expectations in claim handling, giving them a 5-star rating. Reviews often mention the pros of low rates but highlight the cons of delayed claim resolutions.

Read More: How do customer satisfaction ratings affect car insurance companies?

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Key Highlights and Drawbacks of State Auto Insurance

State Auto car insurance is recognized for its affordable rates, a bunch of discounts, and solid coverage options that cater to different types of drivers:

- Competitive Rates: Rates start as low as $49/month for 45-year-old policyholders.

- Extensive Discounts: Enjoy up to 25% off for bundling policies and safe driver car insurance discounts.

- High Coverage Availability: Rated 4.9 for coverage flexibility, meeting diverse driver needs with options like AutoXtended coverage.

However, State Auto insurance company has difficulty settling claims and does not have enough hours for customer service.

- Low Claim Satisfaction: Claim processing has a rating of 2.5, which means it can be pretty slow and sometimes frustrating.

- No Personal Auto Coverage: State Auto offers a variety of property and business insurance plans, but it doesn’t offer personal car insurance, only commercial and farm vehicle coverage.

Consider the good and bad of State Auto and know what matters to you — the cost or how well it handles claims — before you decide.

Deciding to Buy State Auto Commercial Car Insurance

Our State Auto car insurance review found that State Auto provides highly affordable commercial car insurance rates, starting at $49 per month for 45-year-old drivers.

However, its claim satisfaction rating of 2.5 can be a drawback for those prioritizing speedy resolutions, but it’s not one of the car insurance companies with the worst customer satisfaction.

One standout feature is the AutoXtended coverage endorsement, providing added protection such as OEM parts coverage and full safety glass coverage.

State Auto does not offer personal car insurance. If you need cheap rates on a personal policy, enter your ZIP code below to see how much you could save.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Who owns State Auto Insurance Companies?

Liberty Mutual acquired State Auto in 2022. Read our Liberty Mutual car insurance review to learn more.

Are State Auto and Safeco the same company?

No, State Auto and Safeco are not the same company. While both are subsidiaries under Liberty Mutual, they operate as separate insurance brands.

Is State Auto Insurance part of Liberty Mutual?

Yes, As mentioned in our State Auto reviews, they are part of Liberty Mutual.

What did Liberty Mutual used to be called?

Liberty Mutual has always operated under its current name since its founding in 1912. Learn how to get Liberty Mutual car insurance quotes online to get the best deal.

When did Liberty Mutual buy State Auto?

Liberty Mutual bought State Auto in March 2022.

How much did Liberty Mutual pay for State Auto?

Liberty Mutual paid approximately $1 billion for the acquisition of State Auto.

Who is cheaper than Liberty Mutual?

Most providers, including Geico, State Farm, and Progressive, have cheaper car insurance rates than Liberty Mutual. Enter your ZIP code below to find the cheapest insurance company near you.

What insurance company did Allstate merge with?

Allstate merged with National General in 2021 to increase its high-risk market. Learn more in our National General Insurance review.

Who insures the most cars in the U.S.?

State Farm is the largest auto insurer in the U.S., holding the highest market share. Learn more in our State Farm car insurance review.

What insurance company is owned by the government?

The National Flood Insurance Program (NFIP) is a government-run insurance program that provides flood coverage to property owners in the U.S.

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Someone_Looking_for_a_Good_Insurance_Company

Do not get State Auto - they are completely incompetent

KKing82

Scam Likely

Jennporter4

Don’t use State Auto

bdom

SCAM ALERT!!!

Daby0729

Read reviews before you purchase

JStou

Avoid State Auto at all cost!

Susan333

CRIMINALS THAT WILL STEAL YOUR MONEY

Disapprove

State Auto is inefficient, should not be in business.

Apar

Horrible Insurance Provider!

atiqa

Good customer service