Best Car Insurance for Hybrids in 2025 (Your Guide to the Top 10 Companies)

The best car insurance for hybrids can be found at Allstate, Auto-Owners, and Dairyland. These companies cover everything from high-end hybrid vehicles to drivers who need high-risk auto insurance, all for a starting monthly rate of $80. Get the best hybrid car insurance with add-ons like roadside assistance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Hybrids

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 563 reviews

563 reviewsCompany Facts

Full Coverage for Hybrids

A.M. Best Rating

Complaint Level

Pros & Cons

563 reviews

563 reviews 175 reviews

175 reviewsCompany Facts

Full Coverage for Hybrids

A.M. Best Rating

Complaint Level

Pros & Cons

175 reviews

175 reviewsAllstate, Auto-Owners, and Dairyland offer the best car insurance for hybrids with excellent coverage options and affordable rates.

Allstate — which is one of the most environmentally friendly car insurance companies — takes our top spot for hybrid vehicles because of its UBI discounts and personalized service.

Our Top 10 Company Picks: Best Car Insurance for Hybrids

| Company | Rank | Good Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 45% | A+ | Safe Drivers | Allstate | |

| #2 | 35% | A++ | Comprehensive Coverage | Auto-Owners | |

| #3 | 15% | A+ | High-Risk | Dairyland | |

| #4 | 20% | A+ | Personalized Service | Erie |

| #5 | 25% | A | Diverse Options | Farmers | |

| #6 | 26% | A++ | Savings Focus | Geico | |

| #7 | 10% | A | Policy Forgiveness | The General | |

| #8 | 20% | A+ | Elderly Drivers | The Hartford |

| #9 | 30% | A | Customized Solutions | Liberty Mutual | |

| #10 | 15% | A | Affordable Coverage | Mercury |

Explore our choices for the best hybrid car insurance below to see which company might suit your needs best. Then, enter your ZIP code above to find the best hybrid auto insurance quotes today.

- Hybrid cars usually have higher insurance rates because they cost more to repair

- Some insurance companies offer a hybrid car discount to help drivers save

- Allstate and Auto-Owners have the cheapest hybrid insurance

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Allstate: Top Pick Overall

Pros

- Coverage Options: Allstate offers a variety of valuable add-ons for hybrid car owners, including accident forgiveness and new car replacement coverage. Explore all your add-on options in our Allstate car insurance review.

- Drivewise and Milewise: Allstate offers two UBI programs to help drivers save. Drivewise provides a discount of up to 40% if you agree to have your driving habits tracked, and Milewise offers pay-per-mile insurance to low-mileage drivers.

- Extensive Network of Agents: With one of the largest networks of agents in the country, it’s easy to get personalized help when you need it.

Cons

- Mixed Reviews: Although Allstate offers some of the best hybrid car insurance on the market, many of its customers report being unsatisfied with the speed of its claims handling.

- Higher Rates: Allstate usually isn’t the best choice for cheap hybrid auto insurance. In fact, most drivers see higher rates with Allstate no matter what they drive.

#2 – Auto-Owners: Best for High-End Hybrid Cars

Pros

- Solid Customer Service: Drivers looking for the best insurance for hybrid cars should look at customer service ratings. When it comes to service, Auto-Owners consistently scores well.

- High-End Insurance: Auto-Owners is an ideal choice if you’re looking for high-end car insurance for hybrid cars, as it specializes in the coverage needs of luxury vehicles.

- Excellent Coverage Choices: Add coverage options like diminished value protection, gap insurance, and accident forgiveness to maximize the protection on your hybrid.

Cons

- Limited Availability: Auto-Owners is currently available in just 26 states. See if you live in an Auto-Owners state in our car insurance review of Auto-Owners.

- Higher Premiums: With its specialization in high-end cars, Auto-Owners generally has higher rates than many of its competitors.

#3 – Dairyland: Best for SR-22 Insurance

Pros

- No Fees for SR-22 Insurance: One of the perks of buying a Dairyland policy is that the company does not charge a fee to file SR-22 forms on your behalf.

- High-Risk Coverage: Dairyland accepts drivers that standard companies don’t. See if you might qualify for coverage in our Dairyland car insurance review.

- Add-on Options: Dairyland offers a few add-ons to help customize your policy, including special equipment coverage for things like rims and stereos.

Cons

- Less Competitive Rates: Since Dairyland specializes in high-risk drivers, its rates are usually higher than the average cost at standard companies.

- Limited Online Tools: Dairyland’s online policy management tools are not the most robust and often leave customers unsatisfied.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Erie: Best Customer Service Experience

Pros

- Superior Customer Service Ratings: Erie consistently earns excellent ratings for its customer service experience and how quickly it resolves claims.

- Competitive Rates: If you’re looking for the cheapest hybrid auto insurance, Erie may be able to help. It’s typically one of the least expensive options for car insurance.

- Personalized Help: Erie focuses on providing policyholders with the very best insurance experience. One way it does so is by ensuring there are enough agents to provide personalized help whenever you need it.

Cons

- Fewer Discounts: Erie offers fewer discounts than many of its competitors. However, Erie still offers some of the cheapest hybrid car insurance.

- Not Available Everywhere: Unfortunately, Erie is only available in 12 states. See if you qualify for the best insurance for electric cars in our Erie car insurance review.

#5 – Farmers: Best for Hybrid Vehicle Discounts

Pros

- Financially Stable: Farmers has an A from A.M. Best, meaning it’s a financially stable company. See how Farmers rates in other areas in our review of Farmers car insurance.

- Electric Vehicle Discount: Farmers is one of the few companies that offers a hybrid car insurance discount.

- Valuable Coverage Options: Get the best auto insurance for hybrid cars with Farmers’ valuable add-ons. These include loss-of-use coverage and roadside assistance.

Cons

- Mixed Customer Reviews: Farmers may offer quality hybrid auto insurance, but not everyone is impressed. Many Farmers complaints focus on the speed of the claims resolution process.

- Higher Premiums: Farmers is not always the cheapest option for hybrid cars insurance, especially for young drivers.

#6 – Geico: Best for Affordable Rates

Pros

- Excellent Discounts: Geico offers 16 discounts to help drivers save, including the UBI program DriveEasy. Learn more about DriveEasy in our Geico car insurance review.

- 24/7 Support: Geico is always available to help with the claims process, no matter what time you need them. Simply call the claims support number to get in touch with a representative.

- Affordable Premiums: If cheap hybrid car insurance is what you need, Geico might be the right choice. Geico is almost always an affordable option for car insurance.

Cons

- Limited Specialized Coverage: Despite being one of the largest insurance companies in the U.S., Geico has a surprising lack of specialized coverage options for hybrid vehicles.

- Negative Claims Reviews: Many customers report being unsatisfied with how their Geico claims were resolved.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – The General: Best for High-Risk Drivers

Pros

- Solid Online Tools: The General makes it easy to get the coverage you need online, including a quick quote process.

- High-Risk Insurance: The General insures drivers that other companies would pass on. Explore what The General can do for high-risk drivers in our review of The General car insurance.

- Competitive Rates: Many companies that specialize in high-risk auto insurance often have higher average rates, but that’s not necessarily so with The General. Average hybrid auto insurance costs from The General tend to be on the low side.

Cons

- Limited Coverage Options: To help keep rates low, The General limits how many add-ons it offers, even for insurance on hybrid cars.

- Higher Deductibles: Your deductible is the portion of your insurance that you have to pay before your policy kicks in when you file a claim. Most drivers have higher deductibles at The General.

#8 – The Hartford: Best for Older Drivers

Pros

- AARP Perks: The Hartford writes and manages car insurance policies for AARP members. If you’re a member, The Hartford’s insurance for hybrid cars comes with special perks – read our AARP and The Hartford car insurance review to learn more.

- Hybrid Discount: The Hartford offers a special discount for buying eco-friendly vehicle insurance.

- Excellent Reputation for Service: Most policyholders agree that The Hartford offers excellent customer service and claims handling.

Cons

- Higher Rates: Hybrid auto insurance costs are usually higher at The Hartford than the national average.

- Age Restrictions: Since The Hartford exclusively sells insurance to AARP, it doesn’t sell new policies to younger drivers. However, a parent or guardian who is a member of AARP can add a teen to their policy.

#9 – Liberty Mutual: Best Coverage Options

Pros

- Ample Customization Opportunities: Liberty Mutual has tons of ways to increase your policy coverage, including original parts replacement and better car replacement coverages.

- Excellent Discounts: Liberty Mutual offers 17 ways to save on hybrid car insurance. See how you can lower your insurance rates in our Liberty Mutual car insurance review.

- Specialized Hybrid Car Coverage: Aside from its standard coverage options, Liberty Mutual also protects everything important to your hybrid, like your battery or charging equipment in your home.

Cons

- Discount Availability Varies: Liberty Mutual may advertise 17 discount options, but they’re not always available everywhere. You’ll need to check with a representative to see how much you can save.

- More Complaints Than Other Companies: Liberty Mutual receives more complaints than expected for a company of its size.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Mercury: Best Rates for Young Drivers

Pros

- Low Rates for Young Drivers: Mercury offers lower rates than many of its competitors for young, inexperienced drivers.

- Quick Claims Processing: Many Mercury customers praise the company for how quickly it resolves claims. Learn about the Mercury claims process in our Mercury car insurance review.

- Coverage Options: It doesn’t offer as many coverage options as some of its larger competitors, but Mercury still has a few good choices for hybrid owners. Popular choices include roadside assistance and rideshare insurance.

Cons

- Higher Rates for Some: If you have a DUI, speeding tickets, or at-fault accidents, you’ll probably find cheaper hybrid insurance elsewhere.

- Limited Availability: Mercury sells insurance in just 11 states, including California, Arizona, and Florida. You’ll have to check if you can get a Mercury car insurance quote online in your state.

Hybrid Car Insurance Rates

If you’re thinking of buying a hybrid car, you’re probably wondering if hybrids are more expensive to insure. Compared to similar size and gas versions, hybrid cars can be more expensive to insure. This is so because insurers know that hybrids are saving on fuel consumption and cover more miles.

Sometimes, hybrids can cost around 7% more to insure, but there are variations based on make, model, and year.

Insurance premiums may typically be higher for hybrids because these cars are worth more than gas-powered vehicles and repair costs are often higher for hybrids due to the expensive parts like battery systems. Check below to see how much hybrid car insurance costs on average from our top companies.

Hybrid Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $100 | $200 |

| Auto-Owners | $90 | $180 |

| Dairyland | $80 | $160 |

| Erie | $85 | $175 |

| Farmers | $95 | $190 |

| Geico | $70 | $140 |

| Liberty Mutual | $100 | $200 |

| Mercury | $75 | $150 |

| The General | $110 | $220 |

| The Hartford | $90 | $180 |

Additionally, the average damage claim for hybrids is higher, because you’re considered a high-risk driver if you drive a fuel-efficient model. Even though hybrid cars are safer to drive on the road, the repair costs are higher, regardless of their safety.

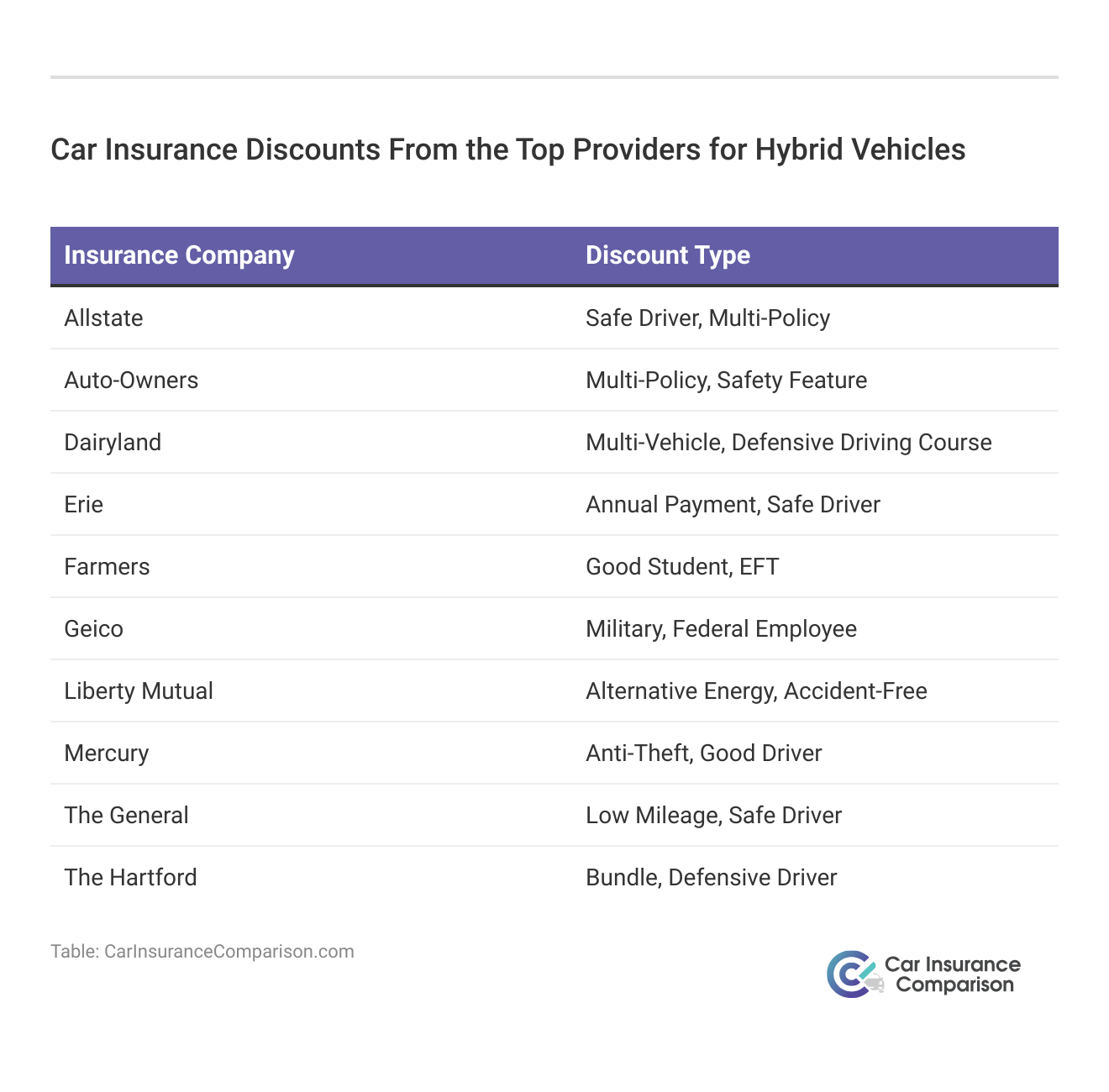

Insurance costs depend on the price of the car, the year, and your driving habits. So if you have an expensive car, you should expect to pay more. Thankfully, due to the popularity of hybrid technology, insurance companies are offering insurance discounts.

Justin Wright Licensed Insurance Agent

The best way to get lower car insurance rates is to take advantage of car insurance discounts, and many car insurance companies look at one thing to provide an insurance discount of up to 10 percent or more — whether or not you own a hybrid car. The mere fact that you own (or lease) a hybrid car entitles you to a discount on auto insurance with most providers. Check below to see what discounts you might qualify for thanks to your hybrid vehicle.

A hybrid driver is considered a safe driver because they drive fewer miles, so insurers are likely to provide discounts. One of the questions you’ll be asked in an insurance quote request form is what type of car you drive for this reason.

Some car insurance companies have even gone as far as creating programs specifically for hybrid vehicles, such as the Travelers Hybrid car insurance program. Your car insurance rates will certainly depend on your overall risk profile, but owning a hybrid car is one small advantage to cheaper car insurance rates.

How Hybrid Cars Work

The only difference between a hybrid car and a traditional gas vehicle is the way the engine operates. Hybrid cars are much more fuel efficient, using a combination of gas and electricity.

Is an electric car right for you? http://t.co/9rBdotJLOS #EarthDay pic.twitter.com/9hkoF7Zj0E

— Allstate (@Allstate) April 22, 2014

When hybrid cars were first introduced, a lot of public perception was incorrect. Some believed you have to charge these vehicles overnight, but that’s incorrect.

Fully electric vehicles, on the other hand, usually do require charging regularly.

Hybrid cars are powered by converting energy from gasoline to recharge the vehicles’ battery automatically, running the vehicle on the battery and then using the gasoline to automatically recharge the battery when needed. (For more information, read our “When will my hybrid car start to pay for itself?“).

Think of the battery and gas as always working together for better fuel efficiency — basically, you have a working relationship between gas and power under the hood. (For more information, read our The Most Fuel-Efficient Cars “).

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Most Popular Hybrid Cars

The Toyota Prius is the godfather of all hybrid vehicles. Benefiting from the first mover advantage, the Toyota Prius was the first hybrid vehicle to win over drivers in America and has since been selling at a rapid pace.

With a 50 mpg fuel efficiency and roomy interior, the Toyota Prius is the standard for hybrid cars.

Although, if you want to buy a hybrid vehicle, you do have other options. Many car manufacturers have introduced hybrid models to the marketplace, including GM, Ford, Lexus, Mercedes, and BMW. Hybrid cars now come in many different models, including sub-compact, luxury, and SUV.

Some of the most popular hybrid cars available today are:

Typical Passenger Cars

- 2011 Toyota Prius

- 2011 Honda Civic Hybrid

- 2011 Honda Insight

- 2011 Ford Fusion Hybrid

- Mercury Milan Hybrid

- Honda CR-Z Hybrid

- Nissan Altima Hybrid

- 2011 Toyota Camry Hybrid

Trucks and SUV’s

- 2011 Toyota Highlander Hybrid

- Chevrolet Silverado Hybrid

- Chevrolet Tahoe Hybrid

- GMC Sierra Hybrid

- GMC Yukon Hybrid

- Cadillac Escalade Hybrid

Luxury Hybrid Cars

- BMW X6 Hybrid

- Lexus HS 250h

- Lexus RX 450h

- Lexus GS 450h

- Mercedes ML 450 Hybrid

Just as there are plenty of hybrid vehicle options, so too does your insurance depend on what you drive. If you’re concerned about higher prices, make sure to compare auto insurance costs by vehicle to find the best rates.

Pros and Cons of Hybrid Cars

There is no catch except that hybrid cars are generally priced more than typical vehicles.

On the upside, you get to save the earth, take advantage of lower car insurance rates, and experience many other special breaks, such as:

- Possible income tax deduction

- Possible employer incentives to assist with the purchase of a vehicle

- Lower fuel costs

- Special driving privileges by states (free HOV tags in many states)

While car insurance companies are never going to offer incredibly cheap car insurance after a DUI conviction or reckless driving history just because you own a Hybrid, these vehicles do provide a lot of benefits over traditional cars in terms of value, risk, and environmental factors.

Find the Best Car Insurance for Hybrids Today

Whether you own a traditional car or a hybrid vehicle, driving without insurance is never a good idea. Hybrid car insurance may cost a bit more, but finding an affordable policy is possible with a bit of research.

Enter your ZIP code below to access car insurance rates from multiple companies for the best car insurance companies for hybrid cars today.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Are hybrids more expensive to insure?

Compared to similar-sized gas-powered cars, hybrid cars can have higher insurance rates. The insurance premiums for hybrids may be around 7% higher due to their higher value and potentially more expensive repairs. However, insurance companies also offer discounts for hybrid car owners, recognizing them as safe drivers who drive fewer miles. Taking advantage of these discounts can help lower your insurance rates.

Additionally, learning how to compare multiple online car insurance quotes for free will help you find the lowest rates.

What is a hybrid car and how do hybrid vehicles work?

A hybrid car is a vehicle that combines a traditional gasoline engine with an electric motor. The engine operates by converting energy from gasoline to automatically recharge the vehicle’s battery. The car can run on the battery or use gasoline to recharge the battery when needed. This combination of gas and electric power makes hybrid cars more fuel-efficient compared to traditional gas vehicles.

What are the most popular hybrid cars?

The Toyota Prius is one of the most popular hybrid cars and is known for its fuel efficiency and spacious interior. As a bonus, car insurance costs for a Toyota Prius are usually affordable.

Other popular hybrid models come from car manufacturers like GM, Ford, Lexus, Mercedes, and BMW. Hybrid cars now come in various models, including sub-compact, luxury, and SUVs, offering a range of options for buyers.

What are the disadvantages of owning a hybrid car?

While there are several advantages to owning a hybrid car, such as lower fuel consumption and potential insurance discounts, there are some disadvantages to consider. The primary disadvantage is that hybrid cars are generally priced higher than typical vehicles. Additionally, repair costs for hybrid cars can be higher due to the expensive parts like battery systems. However, these disadvantages are often outweighed by the long-term savings on fuel and potential insurance discounts.

Can I compare insurance rates for hybrid cars?

Yes, you can compare insurance rates for hybrid cars using our free quote tool. By entering your ZIP code, you can receive quotes from multiple insurance companies, allowing you to compare and find the best insurance rates for your hybrid vehicle. Remember to consider both the cost of insurance and the coverage options provided by different companies to make an informed decision.

What is the best insurance company for hybrid cars?

According to our research, the best hybrid car insurance comes from Allstate, Auto-Owners, and Dairyland.

Can you get high-risk car insurance for a hybrid?

You can get high-risk auto insurance if you drive a hybrid, but it might take some shopping around. Some companies don’t insure high-risk drivers, while others charge much higher rates. If you have multiple speeding tickets, at-fault accidents, or DUIs, you can find the best rates by shopping at the best car insurance companies for high-risk drivers.

Are hybrid and electric vehicles the same?

While both are eco-friendly options compared to traditional cars, there is one main difference. Electric vehicles don’t need a drop of gas to run, while hybrids require some fuel. There’s also a difference in insurance prices — our car insurance guide has more information.

Which companies have the cheapest rates for hybrid cars?

We found that Dairyland, Geico, and Mercury are the cheapest overall companies for hybrid car insurance. However, you’ll need to compare rates to ensure the company you buy from has the lowest quotes for you.

Should you get full coverage for a hybrid?

If you can afford it, experts suggest purchasing full coverage for a hybrid. The best full coverage car insurance protects you from a wide variety of damage and ensures you won’t lose your car.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.