10 Best Car Insurance Companies for High-Risk Drivers in 2026

Compare the best car insurance companies for high-risk drivers and discover why State Farm, Progressive, and Allstate lead the market, with rates beginning at $22/month. These providers offer exceptional service and competitive rates, making them the top choices for high-risk drivers seeking reliable coverage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated April 2025

13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for High-Risk Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for High-Risk Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for High-Risk Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsThe top picks for the best car insurance companies for high-risk drivers are State Farm, Progressive, and Allstate, offering exceptional service and comprehensive coverage.

If you need high-risk insurance it is in your interest to find the best high car risk insurance companies around.

Our Top 10 Picks: Best Car Insurance Companies for High-Risk Drivers

| Company | Rank | A.M. Best | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A+ | 20% | Innovative Technology | Progressive | |

| #2 | A | 18% | Comprehensive Coverage | Liberty Mutual |

| #3 | A++ | 15% | Customer Service | State Farm | |

| #4 | A++ | 15% | Military Affiliation | USAA | |

| #5 | A | 15% | Customizable Policies | Farmers | |

| #6 | A | 14% | Loyalty Discounts | American Family | |

| #7 | A+ | 12% | Bundling Policies | Nationwide |

| #8 | A+ | 12% | Online Convenience | Esurance | |

| #9 | A+ | 10% | Claim Satisfaction | Allstate | |

| #10 | A | 10% | Roadside Assistance | AAA |

If you need high-risk insurance it is in your interest to find the best high-risk car insurance companies around.

More car insurance companies are now offering high-risk insurance policies, giving you more options from which to choose.

Every state has different laws regarding car insurance products, so an insurance company that is best in one state may not necessarily be the best in another state.

Compare multiple high-risk car insurance quotes online along with standard car insurance quotes by entering your ZIP code above.

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: Offers a 10% discount for bundling multiple insurance policies.

- High Low-Mileage Discount: Provides a 15% discount for drivers who travel fewer miles.

- Customer Service Excellence: Renowned for its exceptional customer support. Discover insights in our State Farm car insurance review.

Cons

- Limited Multi-Policy Discount: 10% may be lower compared to some competitors.

- Relative Premium Costs: Premiums can be higher for certain coverage levels despite discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Innovative Technology

Pros

- Advanced Technology: Leads with innovative solutions like usage-based pricing.

- Higher Multi-Policy Discount: Offers a 12% discount for multiple policies. Unlock details in our Progressive car insurance review.

- Substantial Low-Mileage Discount: Provides a significant 20% discount for low-mileage users.

Cons

- Variable Customer Reviews: Customer satisfaction can vary due to technology focus.

- Pricing Model Complexity: Technological assessment can complicate understanding rates.

#3 – Allstate: Best for Claim Satisfaction

Pros

- Strong Claims Process: Highly rated for efficient and satisfactory claim handling. Delve into our evaluation of Allstate car insurance review.

- Strong Multi-Policy Discount: Offers a competitive 15% discount for bundling policies.

- Comprehensive Coverage Options: Provides diverse coverage suited to various needs.

Cons

- Lower Low-Mileage Discount: Only a 10% discount for low-mileage, less than competitors.

- Premium Cost Concerns: Premiums can be high, impacting affordability.

#4 – Liberty Mutual: Best for Comprehensive Coverage

Pros

- Wide Range of Coverage: Known for offering comprehensive and varied policy options.

- High Low-Mileage Discount: Offers an 18% discount for drivers with low annual mileage.

- Flexible Policy Options: Adaptable coverages that can be tailored to individual needs. Access comprehensive insights in our Liberty Mutual car insurance review.

Cons

- Moderate Multi-Policy Discount: A 10% discount on bundling is not the highest available.

- Customer Service Variability: Experiences can vary greatly depending on the region.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Bundling Policies

Pros

- Focus on Bundling: Encourages customers to bundle policies with an 8% discount.

- Solid Low-Mileage Discount: Provides a 12% discount for low-mileage drivers. Discover more about offerings in our Nationwide car insurance discounts.

- Versatile Insurance Offerings: Offers a broad array of insurance products for bundling.

Cons

- Lower Multi-Policy Discount: At 8%, it’s lower than many competitors.

- Service Consistency Issues: Service quality may vary across different locations.

#6 – Farmers: Best for Customizable Policies

Pros

- Customizable Policies: Known for offering highly customizable insurance options.

- Good Discounts: 12% multi-policy and 15% low-mileage discounts. Check out insurance savings in our complete Farmers car insurance review.

- Tailored Insurance Solutions: Policies can be specifically tailored to unique needs.

Cons

- Higher Cost for Customization: Customized policies can come at a higher premium.

- Complexity in Policy Management: Customization might complicate managing policies.

#7 – American Family: Best for Loyalty Discounts

Pros

- Loyalty Rewards: Offers strong incentives for long-term customers. Read up on the American Family car insurance review for more information.

- Balanced Discounts: 10% multi-policy and 14% low-mileage discounts.

- Family-Focused Policies: Policies that cater specifically to family-related needs.

Cons

- Availability Limitations: Not as widely available as some larger insurers.

- Potential for Higher Base Rates: Base rates might be higher without discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – AAA: Best for Roadside Assistance

Pros

- Exceptional Roadside Assistance: Best-in-class service for roadside emergencies.

- Good Discount Rates: 7% multi-policy and 10% low-mileage discounts. More information is available about this provider in our AAA car insurance review.

- Additional Travel Benefits: Offers perks that benefit frequent travelers.

Cons

- Membership Requirement: Requires membership to access insurance products.

- Inconsistent Service Levels: Customer service quality can vary significantly.

#9 – USAA: Best for Military Affiliation

Pros

- Military-Focused Benefits: Tailored services and discounts for military members and families.

- High Discount Levels: Offers 12% multi-policy and 15% low-mileage discounts.

- Top-Tier Customer Service: Consistently rated highly for customer support. See more details on our USAA car insurance review.

Cons

- Restricted Eligibility: Services are limited to military personnel and their families.

- Limited Offerings for Civilians: Fewer product options are available for non-military.

#10 – Esurance: Best for Online Convenience

Pros

- Online Convenience: Specializes in digital-first insurance solutions. Learn more in our “How do you get an Esurance car insurance quote?“

- Competitive Discounts: 10% multi-policy and 12% low-mileage discounts.

- Efficient Claim Processing: Known for quick online claims services.

Cons

- Less Personal Interaction: Fewer opportunities for in-person service.

- Dependence on Digital Platforms: Heavy reliance on digital tools may not suit all customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

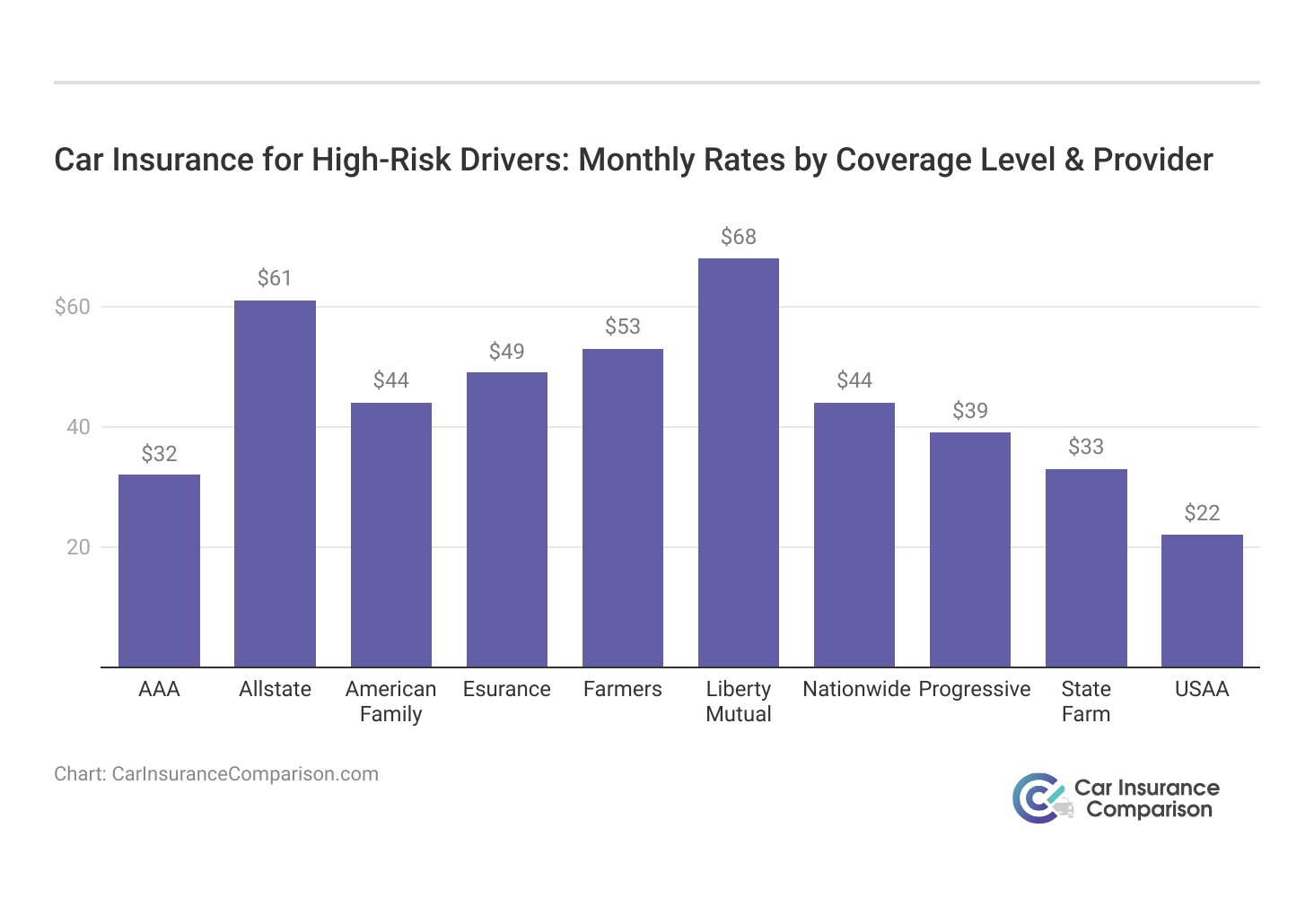

High-Risk Car Insurance Coverage Rates Overview

Understanding the average monthly car insurance rates is crucial for high-risk drivers seeking comprehensive coverage. The table below provides a detailed overview of the minimum and full coverage rates offered by various insurance companies.

Car Insurance for High-Risk Drivers: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $86 |

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Esurance | $49 | $128 |

| Farmers | $53 | $139 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| USAA | $22 | $59 |

When exploring coverage rates for high-risk auto insurance, the table showcases significant variations among the top insurance providers. State Farm offers budget-friendly options with a minimum coverage rate of $33 and a competitive full coverage rate of $86. Progressive, known for technological innovation, presents rates at $39 for minimum coverage and $105 for full coverage.

Allstate, emphasizing comprehensive claims service, stands at $61 for minimum coverage and $160 for full coverage. The rates provided by Liberty Mutual, Nationwide, Farmers, American Family, AAA, USAA, and Esurance further demonstrate the diversity of options available to high-risk drivers.

Careful consideration of these rates allows individuals to tailor their insurance choices to their unique circumstances, balancing cost-effectiveness with the level of coverage needed. For additional details, explore our comprehensive resource titled “Compare Monthly Car Insurance: Rates, Discounts, & Requirements.”

What Is Considered High-Risk Insurance

Every state has requirements set forth that insurance companies must comply with to do business in that state. Most insurance companies operate in multiple states, which means the insurance company’s requirements and rating structure may differ depending on where you live.

To find out what is legal in your state, you can check with the Insurance Commissioner of your state for a list of their rules.

For example, one state may allow a high-risk insurance company to use your credit report for determining your car insurance rate while another state may disallow the use of it.

Depending on your credit score and where you live, this may or may not be in your best interest with the various car insurance companies. To find out more, explore our guide titled “What is High-Risk Car Insurance?”

Reputation and Customer Service for High-Risk Insurance Companies

While it may be tempting to buy car insurance from the insurance company that offers you the lowest rate, that may not always be the best choice. If you are ever in an accident involving a claim, you need an insurance company that is going to be there for you to assist with the claims handling process quickly and efficiently.

Customer service is important whether you have a general question about your policy or an actual claim that needs to be submitted.

Some insurance companies are available by phone, local offices, and websites that allow you to do live chats 24/7 or even pay your bill or submit a claim online.

Reputation is a crucial factor in selecting an insurance company.

A business with a strong financial rating is important in the event you have a valid claim that needs to be paid.

A company that offers quality customer service, an excellent reputation, and fair rates is one of the best high-risk insurance companies. To learn more, explore our comprehensive resource on “Compare the Best Car Insurance Companies.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: High-Risk Car Insurance Companies

Exploring the world of high-risk auto insurance, this article delves into three distinct case studies that highlight how different insurance companies excel in providing specialized services. Each study focuses on a unique aspect of insurance, ranging from customer service excellence to innovative technology.

- Case Study #1 – A Cornerstone in Customer Service Excellence: A bustling urban dealership faced the challenge of securing high-risk car insurance with a focus on customer service excellence. State Farm emerged as the cornerstone, providing not only comprehensive coverage options but also excelling in customer service.

- Case Study #2 – Pioneering the Future of Insurance: A family-oriented suburban dealership sought innovation and technological ingenuity in high-risk car insurance. Progressive, known for pioneering the future of insurance, became the preferred choice. Suburban Auto Haven capitalized on Progressive’s forward-thinking approach, implementing safe driving practices to maximize incentives.

- Case Study #3 – Ensuring Satisfaction Through Comprehensive Claims Service: Specializing in trucks and agricultural vehicles, a rural dealership prioritized comprehensive claims service in its high-risk insurance search. Allstate, renowned for its commitment to satisfaction, provided tailored policies for personalized coverage.

These case studies showcase how tailored insurance solutions can effectively address the diverse needs of high-risk clients.

State Farm stands out as the top choice for high-risk car insurance, combining customer service excellence with comprehensive coverage options.

Melanie Musson Published Insurance Expert

Companies like State Farm, Progressive, and Allstate have demonstrated their ability to adapt and excel, ensuring customer satisfaction across various challenging scenarios. Access comprehensive insights in our “Best Car Insurance for High-Risk Drivers.”

Who Has the Cheapest High-Risk Insurance

Insurance companies charge a higher premium for high-risk insurance policies than for policies that are issued for drivers who qualify for standard car insurance (For more information, read our “What is included in a standard car insurance policy?”).

The rate may be based on a few different factors, including your age, driving record, credit report, and what constitutes you as a high-risk driver.

Once you are considered to be a high-risk driver then you are most likely going to pay a lot more for your car insurance. However, that does not mean that every insurance company will offer you the same rate.

Most insurance companies do have competitive pricing, so you can get a lower rate by simply shopping around for one. You can shop for rates now by entering your ZIP code in the quote tool provided.

Frequently Asked Questions

What is high-risk insurance?

High-risk insurance is coverage for drivers who are considered more likely to file claims or be involved in accidents due to factors like their driving record or credit report.

For additional details, explore our comprehensive resource titled “How do you file a car insurance claim?“

How can I find out the requirements in my state?

Check with your state’s Insurance Commissioner to learn about the specific legal requirements and regulations for high-risk insurance in your state.

What should I consider when choosing a high-risk insurance company?

Consider factors like reputation, customer service, and financial stability when selecting a high-risk insurance company.

Which company offers the cheapest high-risk insurance?

High-risk insurance premiums are generally higher, but rates can vary among insurance companies. It’s best to compare quotes from multiple companies to find the most affordable option.

How can I save on high-risk insurance?

While high-risk insurance may be more expensive, you can potentially save by maintaining a clean driving record, improving your credit score, and taking advantage of any available discounts offered by insurance companies.

To find out more, explore our guide titled “How far back do car insurance companies look?“

What is the best car insurance for high-risk drivers?

State Farm offers the most competitive rates and comprehensive coverage for high-risk drivers, making it an excellent choice.

Where can I find the best high-risk auto insurance?

Progressive is known for its innovative technology and flexible policies, ideal for high-risk auto insurance.

Which are the best high-risk auto insurance companies?

The top picks include State Farm, Progressive, and Allstate due to their exceptional service and diverse coverage options.

What is the best high-risk insurance available?

Liberty Mutual offers comprehensive high-risk insurance with a focus on broad coverage options and significant low-mileage discounts.

To learn more, explore our comprehensive resource on “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

What company offers the best high-risk car insurance?

Allstate stands out for high-risk car insurance with its strong focus on claim satisfaction and tailored policies.

Which companies are the best for high-risk car insurance?

Who are the best high-risk insurance companies?

Which company offers the best rates for high-risk auto insurance?

Where can I find cheap high-risk insurance companies?

What are good companies for high-risk auto insurance?

What are the top high-risk auto insurance companies?

Which are reputable high-risk insurance companies?

Who are the leading high-risk auto insurance carriers?

How can I get a high-risk auto insurance quote?

What should I know about high-risk car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.