Best Subaru Outback Car Insurance in 2025 (Your Guide to the Top 10 Companies)

The best Subaru Outback car insurance comes from State Farm, USAA, and Geico, featuring outstanding coverage and value. State Farm stands out with its competitive pricing at just $47/mo, while USAA is praised for exceptional customer satisfaction. Geico completes the top picks with its extensive coverage options.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Apr 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Subaru Outback

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Subaru Outback

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Subaru Outback

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

For those seeking the best Subaru Outback car insurance, State Farm, USAA, and Geico stand out as top choices. State Farm offers highly competitive rates, USAA is renowned for exceptional customer satisfaction, and Geico delivers comprehensive coverage options.

Each provider excels in key areas, making them the leading choices for Subaru Outback owners.

Each provider excels in key areas, making them the leading choices for Subaru Outback owners.

Our Top 10 Company Picks: Best Subaru Outback Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 10% A++ Military Savings USAA

#3 25% A++ Affordable Rates Geico

#4 25% A+ Comprehensive Coverage Allstate

#5 12% A+ Discounts Variety Progressive

#6 12% A Add-on Options Liberty Mutual

#7 10% A++ Optional Coverages Travelers

#8 15% A Claims Process Farmers

#9 20% A Customer Satisfaction American Family

#10 10% A Non-standard Drivers The General

Compare these top providers to find the ideal coverage for your needs. See more details on our guide titled “Car Insurance Coverage.”

Find cheap car insurance quotes by entering your ZIP code above.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Noteworthy Bundling Savings for Subaru Outback Drivers: State Farm offers a 17% reduction for consolidating multiple insurance policies, which is a significant advantage for Subaru Outback owners. This savings provides considerable financial relief when combining auto coverage with other policies like home or renters insurance.

- Outstanding Customer Assistance with a Reliable A.M. Best Rating: State Farm boasts a B grade from A.M. Best, underscoring its solid reputation for financial reliability. This translates to exceptional customer support, with dedicated help and personalized care for Subaru Outback drivers.

- Extensive Coverage Options Tailored to Diverse Requirements: State Farm presents a broad array of coverage alternatives designed to meet varied needs, from basic auto insurance to specialized plans. Subaru Outback drivers benefit from customized solutions addressing specific needs, such as long-distance travel or off-road adventures. Unlock details in our article called, “State Farm Car Insurance Review.”

Cons

- Less Aggressive Bundling Discounts Compared to Competitors: Although State Farm offers a 17% bundling discount, this rate may not be as competitive as those available from other insurers, possibly resulting in lower overall savings for Subaru Outback drivers.

- Potentially Higher Premium Rates: Even with the bundling discount, State Farm’s premium rates may be relatively high for certain coverage levels. Subaru Outback owners might discover that premiums are still substantial, particularly in areas with elevated insurance costs.

#2 – USAA: Best for Military Savings

Pros

- Generous Military Savings for Subaru Outback Owners: USAA offers a 10% discount specifically for military personnel, which is particularly advantageous for Subaru Outback drivers who are active duty or veterans. This reduction reflects USAA’s commitment to supporting the military community.

- Superior Financial Stability with A++ Rating: USAA’s A++ rating from A.M. Best highlights its exceptional financial strength. This high rating ensures that Subaru Outback owners receive reliable and secure coverage, supported by a highly reputable insurer. Discover insights in our article called, “USAA Car Insurance Review.”

- Exclusive Advantages and Services for Military Members: USAA’s insurance policies include benefits and services tailored for military families. Subaru Outback drivers in the armed forces enjoy unique perks, including specialized support and additional advantages.

Cons

- Restricted Eligibility for Non-Military Individuals: USAA’s services are exclusively available to military members and their families, meaning Subaru Outback drivers who are not part of the military may not benefit from USAA’s offerings.

- Lower Bundling Discounts Compared to Some Rivals: While USAA offers a 10% discount for bundling, this rate may be lower than those provided by other insurers. Subaru Outback drivers seeking more substantial savings through bundling might find better options elsewhere.

#3 – Geico: Best for Affordable Rates

Pros

- Attractive Bundling Discounts for Subaru Outback Owners: Geico offers a competitive 25% discount for combining multiple policies, which is highly beneficial for Subaru Outback drivers looking to lower their insurance costs. This reduction makes Geico a strong choice for those prioritizing affordability.

- Exceptional Financial Reliability with A++ Rating: Geico’s A++ rating from A.M. Best highlights its superior financial stability. This ensures that Subaru Outback drivers receive dependable and consistent coverage, backed by a financially robust insurer. If you want to learn more about the company, head to our guide titled, “Geico Car Insurance Review.”

- Cost-Effective Insurance Solutions: Geico is known for its focus on offering budget-friendly insurance options. Subaru Outback owners can benefit from reduced rates without compromising on coverage quality, making it an attractive choice for those mindful of expenses.

Cons

- Variable Discount Effectiveness: Although Geico provides a 25% bundling discount, the actual savings can vary based on individual circumstances and coverage requirements. Subaru Outback drivers might experience fluctuations in the discount’s impact depending on their specific situation.

- Potential Trade-Offs in Personalized Assistance: Geico’s focus on maintaining low rates may result in less personalized customer service compared to other insurers. Subaru Outback drivers might find that service is more transactional and less tailored to their unique needs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Broad Coverage Alternatives for Subaru Outback Drivers: Allstate offers a 25% discount for bundling, along with a wide selection of comprehensive coverage options. This ensures that Subaru Outback owners have access to extensive protection plans, catering to various needs.

- Strong Financial Backing with A+ Rating: With an A+ rating from A.M. Best, Allstate demonstrates solid financial strength and reliability. Subaru Outback drivers benefit from the assurance of being covered by a financially secure and established company. More information is available about this provider in our “Allstate Car Insurance Review.”

- Varied Coverage Plans: Allstate’s diverse array of insurance plans allows Subaru Outback drivers to select from numerous coverage levels and add-ons, providing flexibility and thorough protection tailored to individual preferences.

Cons

- Potentially Higher Premium Rates: Despite offering comprehensive coverage options, Allstate’s premium rates may be higher compared to some other insurers. Subaru Outback drivers might find that the cost of coverage remains relatively high, even with the bundling discount.

- Complex Policy Options: The extensive range of coverage and policy choices can sometimes lead to complexity. Subaru Outback owners might face challenges in navigating through the numerous options and understanding the details of their coverage.

#5 – Progressive: Best for Discounts Variety

Pros

- Varied Discount Opportunities for Subaru Outback Owners: Progressive’s 12% bundling discount, combined with a range of other discount options, provides Subaru Outback drivers with multiple ways to save on their insurance premiums. This variety enables a customized approach to achieving savings.

- Strong Financial Stability with A+ Rating: Progressive holds an A+ rating from A.M. Best, reflecting its solid financial strength and dependability. Subaru Outback drivers can rely on the insurer to offer consistent coverage and handle claims efficiently. Check out insurance savings in our complete article called, “Progressive Car Insurance Review.”

- Wide Array of Discount Opportunities: Beyond bundling, Progressive provides various discounts based on different criteria, such as driving habits and safety features. This flexibility allows Subaru Outback owners to benefit from additional savings opportunities.

Cons

- Moderate Bundling Discount Rate: At 12%, Progressive’s bundling discount is less significant compared to some competitors, potentially leading to lower overall savings for Subaru Outback drivers who rely heavily on bundling.

- Possible Higher Premiums: Despite offering various discounts, Progressive’s overall premium rates might still be higher compared to some other insurers. Subaru Outback drivers may find that, even with discounts, premiums remain relatively high.

#6 – Liberty Mutual: Best for Add-On Options

Pros

- Bundling Savings: Liberty Mutual provides a 12% reduction for combining insurance plans. This can lead to significant cost reductions on your Subaru Outback coverage, making it a cost-effective choice for those looking to merge their policies. Discover more about offerings in our article called, “Liberty Mutual Car Insurance Review.”

- Extensive Add-Ons: Liberty Mutual is noted for its broad range of optional enhancements. Subaru Outback owners can personalize their insurance with features such as roadside assistance and rental vehicle coverage, ensuring their specific needs are addressed.

- A.M. Best Rating: With an A rating from A.M. Best, Liberty Mutual exhibits robust financial stability and reliability. This rating assures Subaru Outback owners of dependable service and support.

Cons

- Smaller Discount Relative to Competitors: The 12% bundling discount from Liberty Mutual is modest compared to some competitors offering more generous reductions, which might limit the total savings on your Subaru Outback insurance.

- Potentially Higher Premiums: Even with the bundling discount, Liberty Mutual’s premiums could still be relatively high for certain coverage levels, potentially affecting the affordability of your Subaru Outback insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Optional Coverages

Pros

- Appealing Bundling Discount: Travelers offers a 10% discount for combining multiple policies, resulting in notable savings for your Subaru Outback when consolidating various insurance needs.

- Diverse Optional Coverages: Travelers is distinguished by its extensive selection of optional coverages. Subaru Outback owners can choose from various enhancements, such as gap coverage and upgraded vehicle protection, tailoring their insurance to specific preferences.

- Excellent A.M. Best Rating: Travelers holds an A++ rating from A.M. Best, highlighting its superior financial strength and reliability. This high rating provides Subaru Outback owners with confidence in the insurer’s ability to handle their insurance needs effectively. Read up on the “Travelers Car Insurance Review” for more information.

Cons

- Moderate Bundling Discount: Although a 10% bundling discount is beneficial, it may not be as substantial as those provided by some competitors, potentially limiting the overall savings on your Subaru Outback coverage.

- Complex Coverage Choices: The wide range of optional coverages available can be overwhelming, necessitating careful consideration to ensure all necessary protections for your Subaru Outback are properly selected.

#8 – Farmers: Best for Claims Process

Pros

- Generous Bundling Discount: Farmers extends a 15% discount for bundling policies, offering considerable savings on Subaru Outback insurance when multiple plans are combined. This discount can significantly lower the overall cost of coverage. Delve into our evaluation of Farmers car insurance review.

- Efficient Claims Processing: Farmers is renowned for its streamlined and straightforward claims process. Subaru Outback owners benefit from an easy and prompt resolution when filing claims, ensuring a smooth experience.

- Reliable A.M. Best Rating: An A rating from A.M. Best reflects Farmers’ strong financial stability and dependability. Subaru Outback owners can rely on the insurer for consistent support and service.

Cons

- Discounts Not the Highest: While the 15% bundling discount is attractive, it may not match the higher discounts offered by some other insurers, which could affect overall savings for your Subaru Outback.

- Variable Premium Costs: Farmers’ premiums can fluctuate based on selected coverage options, which might impact the affordability of your Subaru Outback insurance, particularly if additional coverage is necessary.

#9 – American Family: Best for Customer Satisfaction

Pros

- Significant Bundling Discount: American Family provides a 20% discount for bundling multiple policies, resulting in substantial savings for Subaru Outback insurance when consolidating various plans. This discount is among the most competitive in the industry. Check out insurance savings in our complete guide titled, “American Family Car Insurance Review.”

- High Client Satisfaction: American Family is recognized for its excellent customer service and high satisfaction ratings. Subaru Outback owners benefit from responsive and supportive service throughout their insurance experience.

- Strong A.M. Best Rating: An A rating from A.M. Best underscores American Family’s financial reliability, ensuring Subaru Outback owners receive consistent and dependable coverage.

Cons

- Higher Premiums: Despite the generous 20% bundling discount, American Family’s premiums may be relatively high, which could influence the overall cost of insuring your Subaru Outback.

- Limited Coverage Options: While customer satisfaction is notable, American Family’s selection of coverage options might not be as broad as those offered by other insurers, potentially limiting customization for your Subaru Outback.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – The General: Best for Non-Standard Drivers

Pros

- Moderate Bundling Discount: The General offers a 10% discount for bundling policies, providing reasonable savings for Subaru Outback insurance when merging multiple plans. This discount helps reduce the overall insurance cost.

- Specialized Coverage for Unique Drivers: The General excels in serving non-standard drivers, including those with unique insurance needs. Subaru Outback owners with unconventional driving histories or specific requirements can benefit from tailored coverage options. Unlock details in our guide titled, “The General Car Insurance Review.”

- Satisfactory A.M. Best Rating: The General holds an A rating from A.M. Best, indicating a solid level of financial stability. Subaru Outback owners can count on the insurer to offer reliable support and coverage.

Cons

- Modest Bundling Discount: The 10% bundling discount, while useful, is relatively modest compared to higher discounts offered by other insurers, potentially limiting overall savings for your Subaru Outback.

- Potential Coverage Limitations: Despite its specialization in non-standard drivers, The General’s coverage options might not be as comprehensive as those provided by other insurers, which could impact the level of protection for your Subaru Outback.

Subaru Outback Insurance Rates: Compare Coverage Levels and Providers

When evaluating Subaru Outback insurance, understanding the rates for different coverage levels across providers is crucial. The table below highlights the minimum and full coverage monthly rates offered by various insurance companies.

Subaru Outback Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $63 $139

American Family $79 $177

Farmers $108 $240

Geico $54 $116

Liberty Mutual $90 $177

Progressive $87 $158

State Farm $53 $112

The General $123 $255

Travelers $92 $203

USAA $47 $102

For Subaru Outback insurance, USAA offers the lowest rates for both minimum and full coverage, starting at $47 and $102 per month, respectively. Geico follows closely with competitive pricing, offering minimum coverage at $54 and full coverage at $116.

On the higher end, The General has the highest rates, with minimum coverage at $123 and full coverage at $255. Providers such as State Farm and Progressive also offer reasonable rates, with State Farm providing minimum coverage at $53 and full coverage at $112, while Progressive’s rates start at $87 for minimum coverage and $158 for full coverage.

These rates vary based on the level of coverage and the insurer’s pricing structure, allowing Subaru Outback owners to choose a plan that best fits their budget and coverage needs. Access comprehensive insights into our article called “What is the minimum amount of liability car insurance coverage required?”

Subaru Outback Insurance Cost

The average Subaru Outback car insurance rates is $115 a month. Read up on the “How much car insurance coverage do I need for a new car?” for more information.

Subaru Outback Car Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $115 |

| Discount Rate | $68 |

| High Deductibles | $99 |

| High Risk Driver | $245 |

| Low Deductibles | $145 |

| Teen Driver | $420 |

Rates can vary based on factors like discounts, deductibles, and driver risk, making it crucial to explore options for potential savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of Subaru Outback Insurance

The Subaru Outback trim and model you choose will affect the total price you will pay for Subaru Outback insurance coverage. Check out insurance savings in our complete guide titled “How do you get the lowest down payment on car insurance?”

Age of the Vehicle

Older Subaru Outback models generally cost less to insure. For example, auto insurance rates for a 2020 Subaru Outback are $1,378, while 2010 Subaru Outback rates are $1,138, a difference of $240.

Subaru Outback Car Insurance Monthly Rates by Model Year & Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Subaru Outback | $370 | $530 | $390 | $1,420 |

| 2023 Subaru Outback | $365 | $520 | $388 | $1,410 |

| 2022 Subaru Outback | $360 | $515 | $386 | $1,405 |

| 2021 Subaru Outback | $355 | $510 | $384 | $1,398 |

| 2020 Subaru Outback | $348 | $500 | $372 | $1,378 |

| 2019 Subaru Outback | $332 | $482 | $390 | $1,362 |

| 2018 Subaru Outback | $320 | $478 | $398 | $1,354 |

| 2017 Subaru Outback | $308 | $466 | $416 | $1,348 |

| 2016 Subaru Outback | $298 | $446 | $430 | $1,332 |

| 2015 Subaru Outback | $282 | $430 | $442 | $1,312 |

| 2014 Subaru Outback | $270 | $400 | $452 | $1,280 |

| 2013 Subaru Outback | $260 | $376 | $456 | $1,250 |

| 2012 Subaru Outback | $248 | $338 | $460 | $1,204 |

| 2011 Subaru Outback | $232 | $310 | $460 | $1,160 |

| 2010 Subaru Outback | $224 | $292 | $464 | $1,138 |

This trend highlights the potential savings when insuring older vehicles.

Driver Age

Driver age can have a significant effect on the cost of Subaru Outback car insurance. For example, 30-year-old drivers pay approximately $61 more for their Subaru Outback car insurance than 40-year-old drivers.

Subaru Outback Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $650 |

| Age: 18 | $420 |

| Age: 20 | $260 |

| Age: 30 | $120 |

| Age: 40 | $115 |

| Age: 45 | $110 |

| Age: 50 | $105 |

| Age: 60 | $103 |

Overall, this message underscores the need for drivers to consider their age when evaluating insurance options and to be aware of how it impacts their insurance premiums.

Driver Location

Where you live can have a large impact on Subaru Outback insurance rates. For example, drivers in Jacksonville may pay $68 a month more than drivers in Indianapolis.

Subaru Outback Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $196 |

| New York, NY | $181 |

| Houston, TX | $180 |

| Jacksonville, FL | $167 |

| Philadelphia, PA | $154 |

| Chicago, IL | $152 |

| Phoenix, AZ | $133 |

| Seattle, WA | $111 |

| Indianapolis, IN | $98 |

| Columbus, OH | $95 |

This underscores the importance of considering local factors when assessing insurance costs and suggests that shopping around based on location could lead to potential savings.

Your Driving Record

Your driving record can have an impact on the cost of Subaru Outback auto insurance. Teens and drivers in their 20’s see the highest jump in their Subaru Outback car insurance with violations on their driving record.

Subaru Outback Car Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $650 | $880 | $1,220 | $860 |

| Age: 18 | $420 | $620 | $840 | $590 |

| Age: 20 | $260 | $400 | $560 | $380 |

| Age: 30 | $120 | $210 | $320 | $190 |

| Age: 40 | $115 | $200 | $310 | $185 |

| Age: 45 | $110 | $195 | $300 | $180 |

| Age: 50 | $105 | $190 | $290 | $175 |

| Age: 60 | $103 | $185 | $285 | $170 |

Overall, maintaining a clean driving record is crucial for managing and potentially reducing car insurance expenses.

Subaru Outback Safety Ratings

Your Subaru Outback auto insurance rates are tied to the Subaru Outback’s safety ratings. See the breakdown below:

Subaru Outback Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The consistently high scores across all test types underscore its safety, which insurers often consider when setting premiums.

Subaru Outback Crash Test Ratings

Not only do good Subaru Outback crash test ratings mean you are better protected in a crash, but good Subaru Outback crash ratings also mean cheaper insurance rates.

Subaru Outback Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| Subaru Outback 2023 | 5 stars | 5 stars | 5 stars | 4 stars |

| Subaru Outback 2022 | 5 stars | 5 stars | 5 stars | 4 stars |

| Subaru Outback 2021 | 5 stars | 5 stars | 5 stars | 4 stars |

| Subaru Outback 2020 | 5 stars | 5 stars | 5 stars | 4 stars |

| Subaru Outback 2019 | 5 stars | 5 stars | 5 stars | 4 stars |

With consistent 5-star ratings in key areas and high marks overall, this vehicle offers excellent protection and may contribute to lower insurance premiums.

Subaru Outback Safety Features

The more safety features you have on your Subaru Outback, the more likely it is that you can earn a discount. The Subaru Outback’s safety features include:

- Driver Air Bag

- Passenger Air Bag

- Front Head Air Bag

- Rear Head Air Bag

- Front Side Air Bag

The extensive safety features of the Subaru Outback increase your chances of qualifying for insurance discounts.

Subaru Outback Insurance Loss Probability

The Subaru Outback’s insurance loss probability varies for each form of coverage. The lower percentage means lower Subaru Outback auto insurance rates; higher percentages mean higher Subaru Outback car insurance rates.

Subaru Outback Insurance Loss Probability

| Coverage | Loss Rate |

|---|---|

| Collision | -42% |

| Property Damage | -32% |

| Comprehensive | 6% |

| Personal Injury | -37% |

| Medical Payment | -36% |

| Bodily Injury | -32% |

Understanding different coverage types impact the overall insurance rates, guiding them in choosing the most cost-efficient insurance options based on loss probabilities.

Subaru Outback Finance and Insurance Cost

If you are financing a Subaru Outback, most lenders will require your carry higher Subaru Outback coverage options including comprehensive coverage, so be sure to shop around and compare Subaru Outback car insurance quotes from the best companies using our FREE tool below.

Tips for Reducing Subaru Outback Insurance Costs

You have more options at your disposal to save money on your Subaru Outback car insurance costs. For example, try these five tips:

- Get Subaru Outback auto insurance through Costco.

- Audit your Subaru Outback driving when you move to a new location or start a new job.

- Be picky about who drives your Subaru Outback.

- Compare insurance companies after moving.

- Ask about Subaru Outback low mileage discounts.

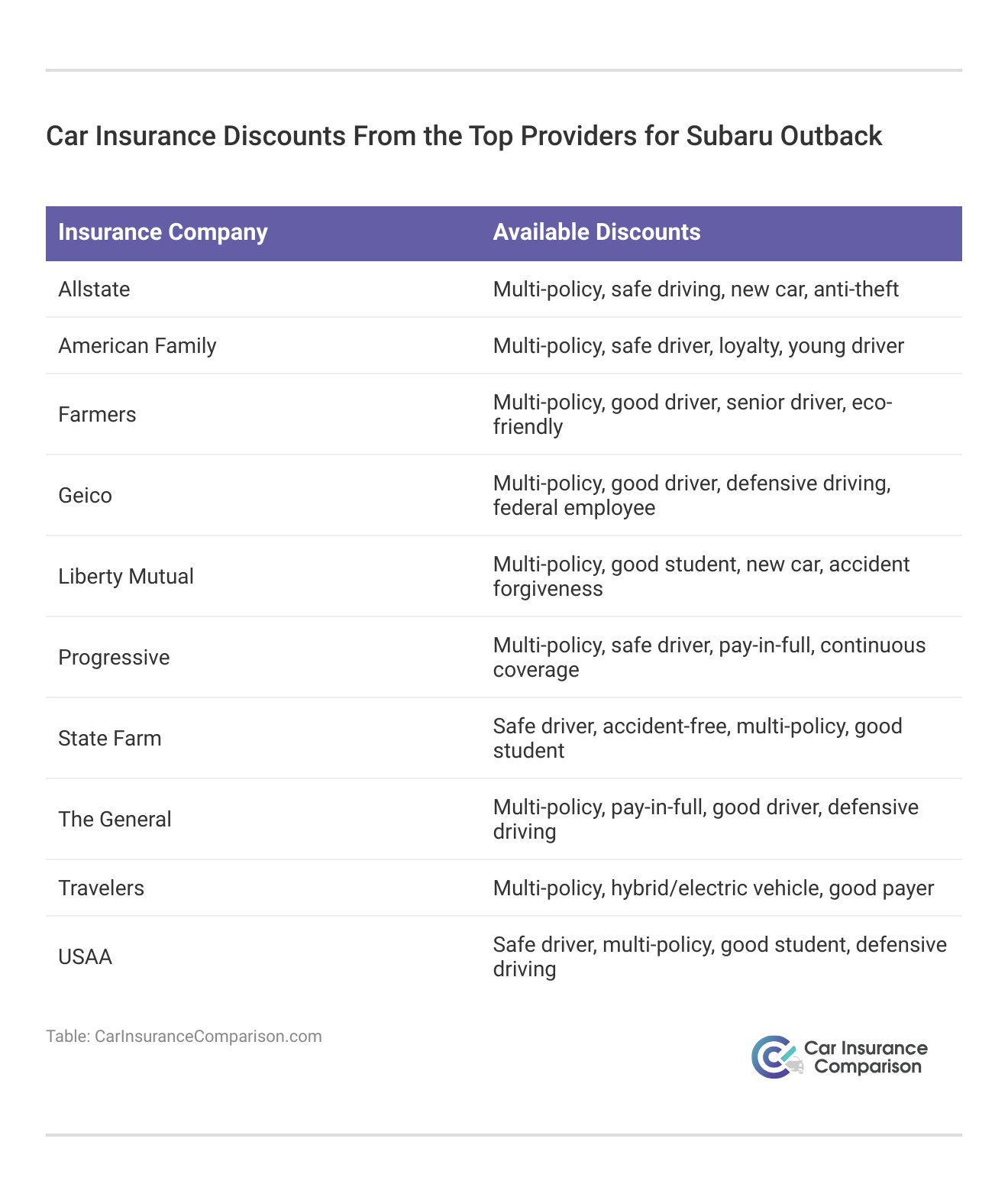

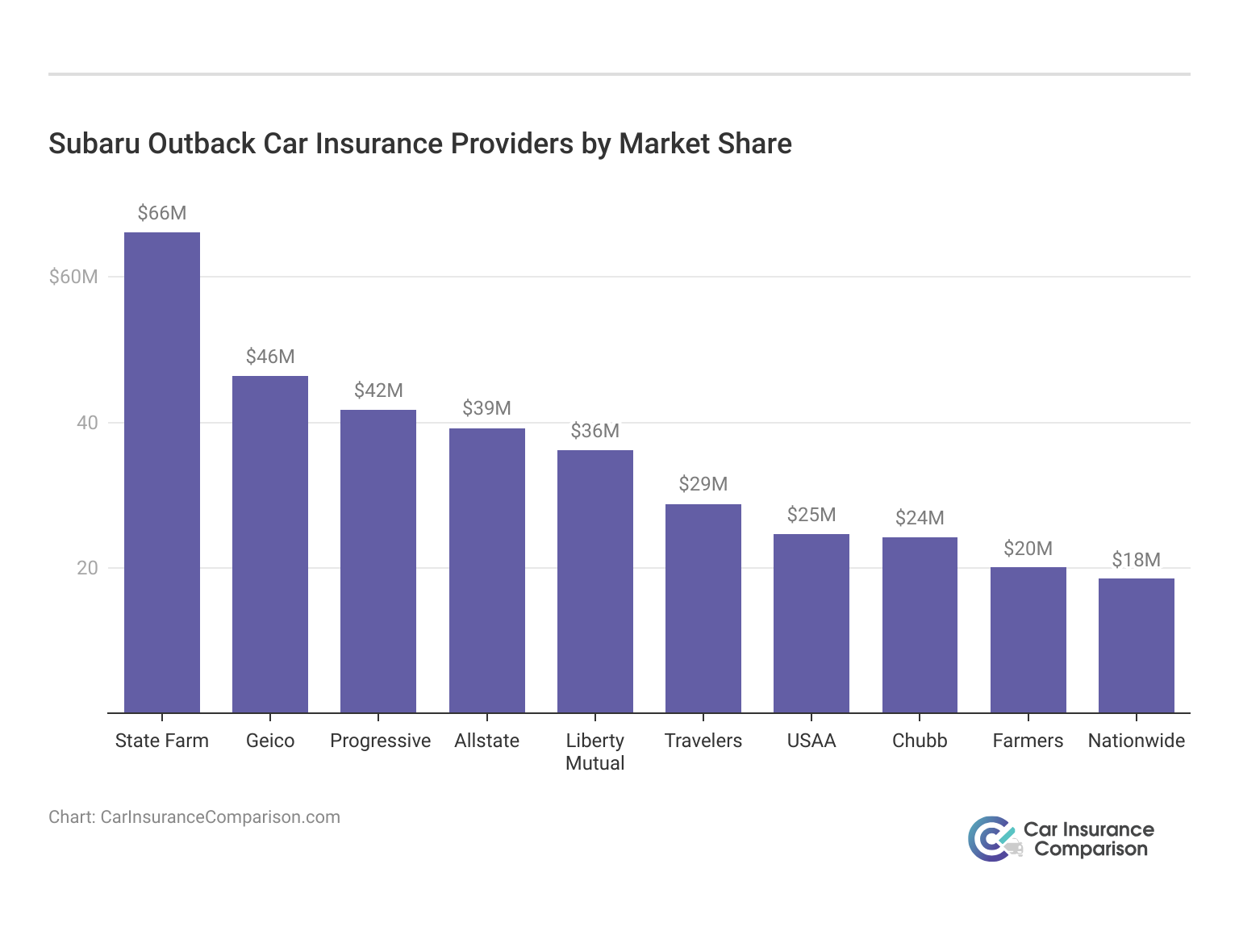

The best auto insurance companies for Subaru Outback car insurance rates will offer competitive rates, discounts, and account for the Subaru Outback’s safety features. The following list of car insurance companies outlines which companies hold the highest market share.

Consider using Costco for insurance, evaluating your driving when changing jobs or locations, limiting who drives your vehicle, comparing rates after moving, and asking for low mileage discounts.

Subaru Outback Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Top insurance companies like State Farm, Geico, and Progressive offer competitive rates and discounts. Discover more about offerings in our article called, “Is Basic Car Insurance Coverage a Smart Choice?“

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Compare Free Subaru Outback Insurance Quotes Online

You can start comparing quotes for Subaru Outback car insurance rates from some of the best car insurance companies by using our free online tool now.

Finding the best Subaru Outback car insurance rates is easy when you compare quotes from many different car insurance companies.

Finding the right insurance for your vehicle and your life requires research and careful consideration. Insurance companies offer different rates and different discounts based on a number of factors.

This is one reason why researching insurance companies before you buy is so extremely important. Nobody wants overpriced car insurance.

Subaru Outback Safety Features

During the search for car insurance on your Subaru Outback, it’s important that you know the many safety features of your car and what those features can do to lower your insurance rate.

The new Subaru Outback may have some features that you’re not yet familiar with and these features could positively affect the rate of your insurance on your new Subaru Outback.

These features include:

- Horizontal cylinders in the engine, making it sit lower in the vehicle. This engine provides a better center of gravity, which results in better handling around corners or up hills.

- Four-wheel disc brakes with four-channel anti-lock brake system, electronic brake force distribution for when you’re carrying uneven loads, and brake assist for emergency stopping. All of these features are standard in the new Subaru Outback.

- Hill Holder, an electronic automatic parking brake, which keeps you from rolling backward on a hill but releases as soon as you pull forward.

- More ground clearance to help get your new Subaru Outback over whatever terrain you decide to take it over.

- Vehicle Dynamics Control (VDC) monitors vehicle stability and applies brakes individually or cuts engine power when it senses a loss of control.

These features come standard on your new Outback and assist in lowering your car insurance rates by reducing the chances of you having an accident.

Exploring the Available Optional Features for the Subaru Outback

When purchasing your vehicle, you can consider adding several features to potentially reduce your insurance rate. These include power locks, which enhance security by allowing you to lock and unlock your vehicle with ease. An alarm system can further protect your car by deterring theft and alerting you to any unauthorized access.

Wheel locks are a practical addition for alloy wheels, helping to prevent theft. Additionally, an auto-dimming rearview mirror can improve safety by reducing glare from headlights behind you.

These enhancements not only boost your vehicle’s security but also demonstrate a proactive approach to reducing potential risks, making them valuable for cost savings. Access comprehensive insights into our “Anti-Theft Car Insurance Discounts.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Comprehensive Guide to Subaru Outback Safety Ratings

Insurance companies are also going to look at the fact that the Subaru Outback was rated IIHS Top Safety Pick vehicle of the year, along with having the highest crash test rating in all government crash tests from the NHTSA.

State Farm provides extensive coverage options, including specialized plans for off-road adventures, perfectly tailored for Subaru Outback drivers.

Brad Larson Licensed Insurance Agent

When searching for auto insurance on your Outback, it’s essential to shop around and compare quotes. The free quote tool on this page will allow you to compare rates online. Rates will vary from region to region.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Frequently Asked Questions

How much does Subaru Outback car insurance cost on average?

The average cost is $115 per month.

For additional details, explore our comprehensive resource titled “Buying Car Insurance for Your New Car.”

Can good drivers save money on Subaru Outback insurance?

Yes, good drivers can save up to $177 per year compared to higher risk drivers.

What factors affect Subaru Outback insurance cost?

Factors include vehicle model, driver age, location, and driving record.

Do Subaru Outback safety ratings affect insurance rates?

Yes, cars with good safety ratings generally have lower insurance rates.

How can I save money on Subaru Outback insurance?

Practice safe driving, maintain a good record, and explore available discounts.

To find out more, explore our guide titled “Does driving less affect car insurance rates?”

What are the 2018 Subaru Outback insurance rates?

The average insurance rates for a 2018 Subaru Outback vary by provider, but they generally start around $100 per month. Factors like driving history and location can influence the final rate.

How much does insurance cost for a 2023 Subaru Outback?

Insurance cost for a 2023 Subaru Outback averages about $115 per month. Rates can differ based on coverage levels, location, and driver profile.

What is the average insurance cost for a Subaru Outback?

The average insurance cost for a Subaru Outback is approximately $115 monthly. This can vary based on coverage options, driver history, and location.

What is the best car insurance for Subaru Outback?

The best car insurance for a Subaru Outback includes providers like State Farm, USAA, and Geico. They offer competitive rates and comprehensive coverage options tailored for Subaru Outback owners.

To learn more, explore our comprehensive resource on “Collision vs. Comprehensive: What is the Difference?”

How does insurance for Subaru Outback compare across different providers?

Insurance for Subaru Outback varies significantly among providers. Top companies like State Farm and USAA often provide the best rates and coverage options for Subaru Outback owners.

How much is Subaru insurance cost on average?

The average Subaru insurance cost is around $115 per month. This can vary based on the specific model, coverage options, and individual driving history.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

What are Subaru insurance rates for different models?

Subaru insurance rates vary by model. For example, the Subaru Outback and Subaru Crosstrek have average rates around $115 and $100 monthly, respectively. Rates depend on coverage choices and driving factors.

What is a common issue with Subaru Outback insurance claims?

Common issues with Subaru Outback insurance claims can include disputes over windshield damage, problems with cooling system repairs, and claims related to oil leaks. These issues can affect the overall insurance experience and may impact claim processing times.

Learn more by reading our guide titled “Car Insurance Claims.”

Is the insurance cost for a Subaru Outback high for long-distance driving?

The insurance cost for a Subaru Outback is generally not higher for long-distance driving. Its overall safety features and reliability contribute to a reasonable insurance rate, making it a cost-effective option for frequent road trips.

Does the Subaru Outback qualify for luxury car insurance rates?

No, the Subaru Outback does not qualify for luxury car insurance rates. While it offers a premium driving experience, especially in models like the Outback Touring, it is classified as a standard vehicle, which typically results in more affordable insurance rates compared to luxury cars.

Why are insurance rates for the Subaru Outback relatively low?

Insurance rates for the Subaru Outback are relatively low due to its excellent safety features, including its Symmetrical All-Wheel Drive and high safety ratings. These factors reduce the risk of accidents and damages, contributing to lower insurance premiums.

Which Subaru Outback model offers the best insurance rates?

Insurance rates for the Subaru Outback are generally similar across various model years. However, newer models like the 2022 Outback may have slightly higher rates due to their higher value. For the best insurance rates, consider models with good safety records and lower repair costs.

Access comprehensive insights into our guide titled “Compare Car Insurance Rates by State.”

Are Subaru Outback engines considered low-risk for insurance?

Yes, Subaru Outback engines are considered low-risk for insurance purposes. Their durability and reliability contribute to fewer claims related to engine failures, which can help keep insurance premiums lower.

What are some factors that make the Subaru Outback more affordable to insure?

The Subaru Outback is more affordable to insure due to its strong safety features, such as advanced driver assistance systems, and its reputation for reliability. These factors contribute to lower risk profiles, which insurers consider when setting rates.

How does the Subaru Outback compare to other vehicles in terms of insurance rates?

The Subaru Outback generally has lower insurance rates compared to high-performance and luxury vehicles. Its safety features and reliability contribute to its favorable insurance costs, making it a cost-effective option compared to more expensive or high-risk vehicles.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.