Cheapest New Mexico Car Insurance Rates in 2025 (Save Big With These 10 Companies!)

The top providers for the cheapest New Mexico car insurance rates come from State Farm, Progressive, and Geico, with minimum rates starting at $24 per month. These companies offer competitive pricing, excellent customer service, and a range of coverage options, making them the best choices for New Mexico drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

UPDATED: Jun 29, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 29, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage for New Mexico

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for New Mexico

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for New Mexico

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the cheapest New Mexico car insurance rates are State Farm, Progressive, and Geico, with starting rates as low as $24 per month.

These companies stand out due to their competitive pricing, excellent customer service, and comprehensive coverage options.

Our Top 10 Company Picks: Cheapest New Mexico Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $24 B Customer Service State Farm

#2 $30 A+ Snapshot Program Progressive

#3 $31 A++ Affordable Premiums Geico

#4 $32 A++ Financial Stability Travelers

#5 $33 A++ Multi-Policy Discounts Auto-Owners

#6 $36 A Safe-Driving Discounts American Family

#7 $46 A Local Agents Farmers

#8 $55 A+ Comprehensive Coverage Allstate

#9 $56 A Customizable Policies Liberty Mutual

#10 $76 A+ Many Discounts Nationwide

In New Mexico, drivers can secure liability coverage, ensuring affordability and quality. To gain further insights, consult our comprehensive guide titled “Compare Car Insurance by Coverage Type.”

This article delves into why these providers are the best choices for New Mexico residents and how to maximize savings on your car insurance.

- Compare New Mexico Car Insurance Rates

Avoid overpaying for your car insurance by entering your ZIP code above in our free comparison tool to find which company has the lowest rates.

- State Farm is the top pick for its balance of competitive pricing, with rates at $24/mo

- Compare quotes to find the best car insurance rates in New Mexico

- Meet NM’s minimum coverage requirements to avoid legal issues and fines

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Excellent Customer Service: State Farm car insurance review highlights the company’s high customer satisfaction, showcasing its reliable support and assistance to policyholders.

- Wide Range of Coverage Options: State Farm offers various coverage options, allowing customers to customize their policies to suit their needs.

- Discounts: State Farm provides numerous discounts, including safe driver, multi-policy, and good student discounts, helping customers save more on their premiums.

Cons

- Higher Rates for High-Risk Drivers: Drivers with poor driving records may find State Farm’s rates to be higher compared to other insurers.

- Limited Availability of Certain Discounts: Not all discounts are available in every state or for every policyholder, potentially limiting savings for some customers.

#2 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: The usage-based insurance program, Snapshot, allows drivers to potentially lower their premiums based on their driving habits.

- Variety of Coverage Options: Progressive provides a wide array of coverage options, including gap insurance, rideshare coverage, and custom parts coverage.

- Strong Financial Ratings: Progressive car insurance review highlights the company’s strong financial stability, ensuring reliable and efficient claim payouts.

Cons

- Rates for High-Risk Drivers: Progressive’s rates can be higher for drivers with poor credit scores or bad driving records compared to other insurers.

- Customer Satisfaction: While generally positive, some reviews indicate mixed experiences with customer service, particularly concerning claim handling.

#3 – Geico: Best for Affordable Premiums

Pros

- Competitive Pricing: Geico car insurance review highlights that Geico provides some of the lowest car insurance rates in the industry, making it a great choice for budget-conscious drivers.

- User-Friendly Online Platform: Their website and mobile app are highly rated for ease of use, allowing customers to manage policies, file claims, and get quotes quickly.

- Wide Range of Discounts: Geico provides numerous discounts, including those for safe driving, multiple policies, good students, and military members.

Cons

- Mixed Customer Service Reviews: While many customers are satisfied, some have reported issues with customer service responsiveness and resolution times.

- Limited Local Agent Availability: Geico primarily operates online and over the phone, which might not be ideal for those who prefer in-person interactions.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for Financial Stability

Pros

- Comprehensive Coverage Options: Travelers offers a wide variety of coverage options, including accident forgiveness, new car replacement, and gap insurance.

- Strong Financial Ratings: Travelers car insurance review highlights the company’s financial stability, ensuring they can efficiently handle a large volume of claims.

- Good Customer Service: Travelers generally receives positive feedback for its customer service, with representatives available to help with policy questions and claims.

Cons

- Discount Availability Varies: The availability and size of discounts can vary significantly depending on the state, making it less predictable.

- Limited Online Tools: Their online platform and mobile app are not as advanced or user-friendly as some of their competitors, which can be a drawback for tech-savvy customers.

#5 – Auto-Owners: Best for Multi-Policy Discounts

Pros

- Strong Financial Stability: With high ratings from financial rating agencies like A.M. Best, Auto-Owners is known for its financial stability, ensuring that claims are paid out reliably.

- Excellent Customer Service: Auto-Owners car insurance review highlights the company’s excellent customer service, with policyholders showcasing positive experiences in handling claims and customer inquiries.

- Multiple Discount Opportunities: The company offers various discounts, such as multi-policy, good student, and safe driver discounts, helping customers save money on premiums.

Cons

- Limited Availability: Auto-Owners Insurance is not available in all states, which can be a limitation for potential customers who live outside their coverage areas.

- No Online Quote Tool: The company does not offer an online quote tool, requiring customers to contact an agent for pricing information, which can be less convenient for those preferring to handle their insurance needs online.

#6 – American Family: Best for Safe-Driving Discounts

Pros

- Strong Customer Service: American Family is known for its strong customer service, with many customers praising the helpfulness and responsiveness of their agents and claims representatives.

- Digital Tools and Resources: The insurer offers a variety of online tools and resources, including a mobile app for managing policies, filing claims, and making payments, enhancing customer convenience.

- Discounts and Savings Programs: American Family car insurance review highlights various discounts, including multi-policy, loyalty, and defensive driver discounts, which assist customers in lowering their overall insurance expenses.

Cons

- Regional Limitations: American Family primarily operates in the Midwest and Western United States, limiting its availability to customers outside of these regions.

- Premium Increases: Some customers have noted that their premiums increased significantly upon policy renewal, which can be a concern for those looking for stable and predictable insurance costs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Local Agents

Pros

- Comprehensive Coverage Options: Farmers offers a wide range of coverage options, including standard policies and add-ons like roadside assistance and rental car reimbursement.

- Discount Opportunities: Farmers offers multiple discounts, such as multi-policy, good driver, and good student discounts, helping customers save money.

- Customizable Policies: Farmers car insurance review highlights how policyholders can customize their coverage to suit their specific needs, offering flexible options for various drivers.

Cons

- Higher Premiums: Farmers is often noted for having higher-than-average premiums compared to other insurers.

- Complex Claims Process: Some customers have reported that the claims process can be complicated and time-consuming.

#8 – Allstate: Best for Comprehensive Coverage

Pros

- Wide Range of Products: Allstate provides a variety of insurance products beyond auto insurance, including home, renters, and life insurance.

- Good Driver Discounts: Allstate car insurance review highlights substantial discounts for safe drivers, such as the Safe Driving Bonus and accident forgiveness.

- Innovative Tools: The Allstate mobile app and Drivewise program provide innovative tools for managing policies and monitoring driving habits.

Cons

- Mixed Customer Reviews: Allstate has received mixed reviews regarding customer service, with some clients reporting dissatisfaction with claim settlements.

- Potential for Rate Increases: Some policyholders have experienced unexpected rate increases upon renewal, which can be frustrating.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Comprehensive Coverage Options: Liberty Mutual offers a wide range of coverage options, including liability, collision, comprehensive, and specialty coverages like roadside assistance and gap insurance.

- Discounts: Liberty Mutual car insurance review showcases a variety of discount opportunities, including safe driver discounts, multi-policy discounts, and discounts for students and new customers.

- Convenient Online Tools: The company provides user-friendly online tools for managing policies, filing claims, and getting quotes, making it easy for customers to handle their insurance needs.

Cons

- Higher Premiums: Some customers report that Liberty Mutual’s premiums can be higher compared to other insurers, particularly for full coverage policies.

- Mixed Customer Service Reviews: While some customers have positive experiences, others have reported issues with claim handling and customer service responsiveness.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Nationwide Best for Many Discounts

Pros

- Discount Opportunities: Nationwide car insurance discounts highlights several savings opportunities, including multi-policy discounts, safe driver discounts, and discounts for new cars.

- Strong Financial Ratings: Nationwide is known for its financial stability, ensuring that it can meet its policyholders’ claims and obligations.

- Member Benefits: Policyholders have access to exclusive member benefits, such as identity theft protection and travel assistance, adding value to their insurance plans.

Cons

- Limited Local Agents in Some Areas: While Nationwide has a broad network, there may be fewer local agents in certain regions, which could be inconvenient for some customers.

- Complex Discount Qualifications: Some discounts have specific eligibility criteria that may be complex or difficult for all customers to meet, potentially limiting their accessibility.

New Mexico Car Insurance Coverage and Rates

You spend hundreds each year on car insurance. This dent in your wallet is painful, which is why most people want to make sure they are paying for something worthwhile. How do you know what coverages and rates best fit your needs? The types of car insurance coverage can be overwhelming to sift through.

State Farm offers the best overall value for car insurance in New Mexico with rates starting at just $24 per month.

Brad Larson Licensed Insurance Agent

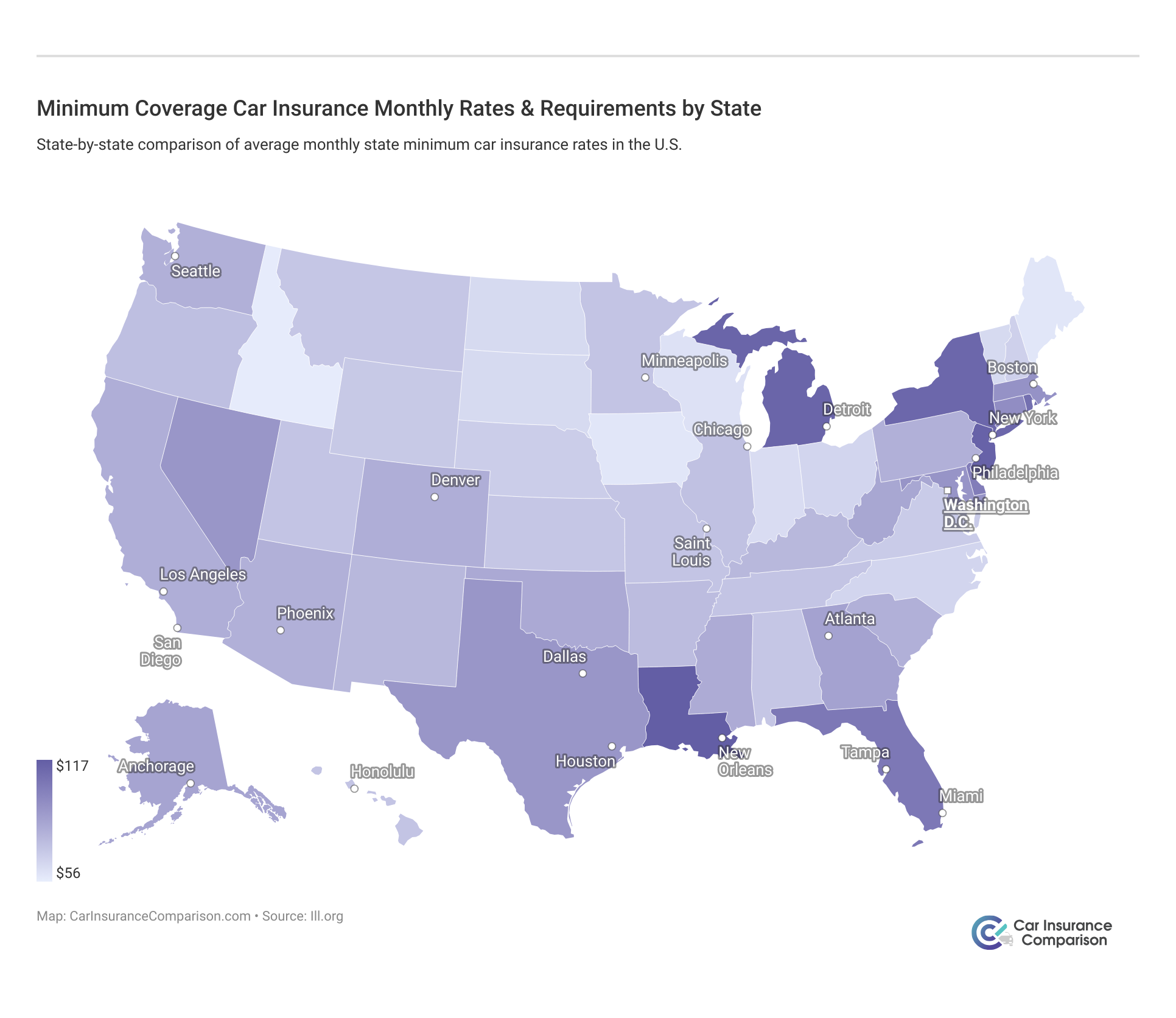

Luckily, we’ve covered New Mexico’s coverages and rates, so that you can see how rates compare and what coverages best fit your needs.Let’s jump right into it! Is car insurance required in New Mexico? Yes, every state has different insurance coverage requirements and costs, as we can see below.

In New Mexico, drivers must have minimum insurance coverage of $25,000 for injuries per person, $50,000 for total injuries per accident, and $10,000 for property damage. Uninsured motorist coverage is also required but can be opted out of by signing a form. For additional details, explore our comprehensive resource titled “Minimum Car Insurance Requirements by State.”

Driving without these minimum coverages is illegal and can result in fines, jail time, and license/registration suspension. Experts recommend purchasing additional coverage to avoid paying out-of-pocket costs if an accident exceeds your policy limits.

New Mexico Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $55 $158

American Family $36 $103

Auto-Owners $33 $87

Farmers $46 $131

Geico $31 $90

Liberty Mutual $56 $161

Nationwide $76 $96

Progressive $30 $86

State Farm $24 $69

Travelers $32 $91

Car insurance rates vary by provider and coverage level. State Farm offers the lowest rates with $24 for minimum coverage and $69 for full coverage. In contrast, Nationwide has the highest minimum coverage rate at $76, and Liberty Mutual has the highest full coverage rate at $161.

Other notable rates include Progressive at $30 for minimum and $86 for full coverage, and Geico at $31 for minimum and $90 for full coverage. Overall, State Farm and Progressive provide some of the most affordable options for car insurance in the state.

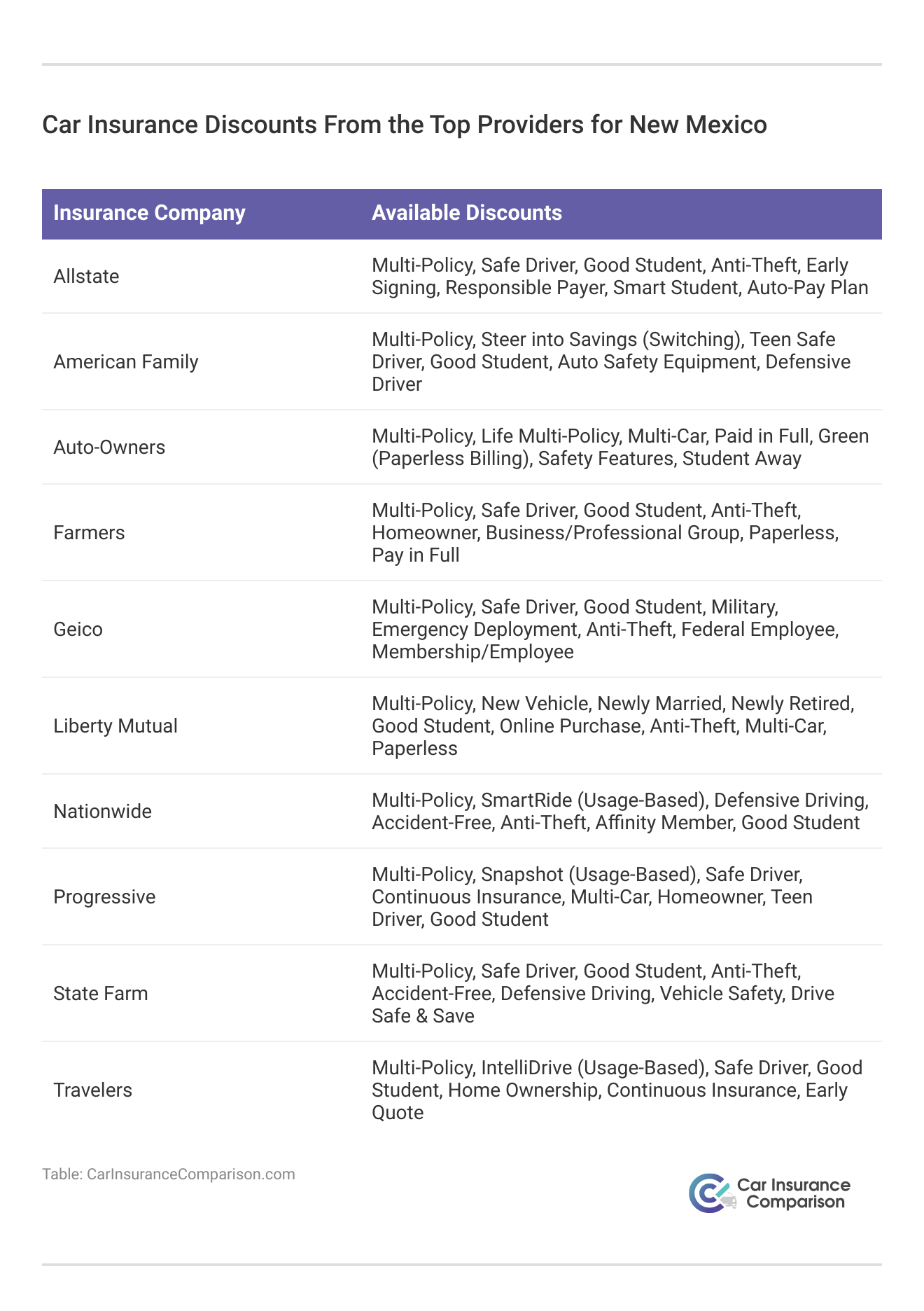

Top car insurance providers in New Mexico offer various discounts to help reduce premiums. Allstate, American Family, Auto-Owners, Farmers, Geico, Liberty Mutual, Nationwide, Progressive, State Farm, and Travelers all provide discounts for multi-policy, safe drivers, good students, and anti-theft measures, among other options.

Proof of Auto Insurance and Financial Impact in New Mexico

Whenever you are pulled over, register a car, or are in an accident, you must provide proof of financial responsibility, such as a current insurance ID card, a copy of your auto insurance policy, or a letter from your insurance company verifying coverage. To learn more, explore our comprehensive resource on insurance titled “Understanding Car Accidents.”

New Mexico uses an electronic system to track insurance status, accessible to officers during stops. Lack of proper insurance can result in registration suspension. In New Mexico, the average per capita disposable income is $33,358, with residents spending an average of $76 per month on car insurance, which is slightly lower than the national average.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Average Annual Car Insurance Rates in New Mexico

Understanding the average annual car insurance rates in New Mexico is crucial for residents looking to budget effectively. These rates typically include liability, collision, and comprehensive coverage, each contributing to the overall cost of maintaining insurance.

By examining these averages, New Mexicans can gain insight into how much they should expect to spend annually, allowing them to plan their finances accordingly and ensure they are adequately covered.

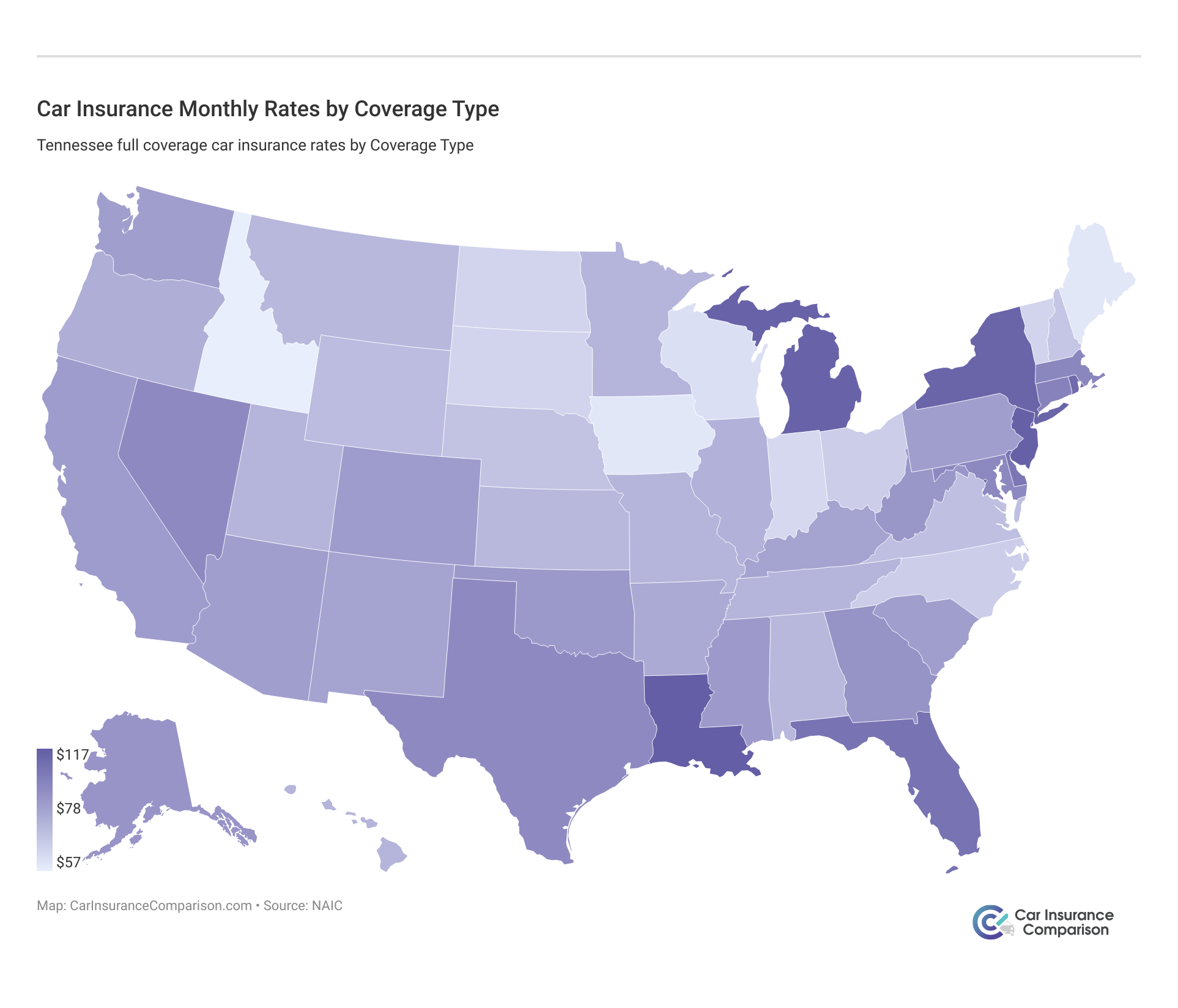

What coverages should you have? Some coverages, such as liability car insurance coverage, are required. A good insurance plan, though, has all three core coverages. We have listed the main coverages in New Mexico below.

New Mexico Car Insurance Monthly Rates vs. U.S. Average by Coverage Type

| Coverage Type | New Mexico Rates | U.S. Average Rates |

|---|---|---|

| Liability | $488 | $538 |

| Collision | $276 | $322 |

| Comprehensive | $172 | $148 |

New Mexico’s core coverage costs, including liability, collision, and comprehensive insurance, are all lower than the national average, which is encouraging for residents. This means that, on average, New Mexicans pay less for their essential car insurance needs compared to the rest of the country, helping them save money while still ensuring they have adequate protection.

Essential Add-Ons and Coverage Options for New Mexico Drivers

In New Mexico, adding Medpay and uninsured/underinsured motorist coverage to your insurance plan is highly recommended. Medpay covers medical costs from accidents, while uninsured/underinsured coverage protects you if you collide with an uninsured driver. To delve deeper, refer to our in-depth report titled “Compare Uninsured/Underinsured Motorist (UM/UIM) Coverage: Rates, Discounts, & Requirements.”

State Farm offers unbeatable value with the lowest rates and top-notch coverage in New Mexico.

Michelle Robbins Licensed Insurance Agent

This is crucial as New Mexico ranks 3rd in the U.S. for uninsured drivers, with 20% of drivers lacking insurance. Although both coverages’ loss ratios have decreased, indicating fewer claims being paid, it’s vital to ensure you have sufficient coverage to avoid financial strain from accidents.

Essential New Mexico Driving Laws and Insurance Requirements

Following state laws and having insurance are essential for New Mexico drivers. Minimum liability insurance is mandatory, with higher rates for high-risk drivers. Discounts like good driver and student are available, but there is no low-cost insurance program. Insurance fraud is a crime with severe penalties.

Claims must be filed within three years for personal injury and four years for property damage. Driving without insurance results in fines, imprisonment, and license suspension. Proof of insurance is required during traffic stops or accidents. Teen drivers can get a learner’s license at 15, and drivers over 75 must renew their licenses annually with a vision test.

New residents must update their car insurance and driver’s license. Careless and reckless driving have penalties. New Mexico is an at-fault state for accidents. Drivers must keep right if slower than traffic and move over for stationary vehicles with flashing lights. Seat belt use is mandatory, with specific rules for children. Rideshare drivers need special insurance.

New Mexico has strict DUI laws and regulates distracted driving. Route 285 is dangerous, and vehicle theft is high in Albuquerque. Fatality rates are higher on rural roads. EMS response times are typically under an hour. Most residents own two cars, and commute times are shorter than the national average. Understanding New Mexico’s driving laws ensures safety and compliance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Case Studies: Tailored Car Insurance Solutions in New Mexico

In this compilation, we explore five case studies that showcase how residents of New Mexico have successfully navigated their car insurance options to find the best solutions for their specific circumstances.

- Case Study #1 – Affordable Coverage for a Young Professional: Sarah Johnson, a 26-year-old marketing specialist from Albuquerque, NM, found affordable and comprehensive coverage through State Farm by leveraging multi-policy and good driver discounts.

- Case Study #2 – Maximum Savings for a Family of Four: The Martinez family from Santa Fe, NM, secured significant savings and robust coverage with Progressive, utilizing multi-car and good student discounts to manage their insurance costs effectively.

- Case Study #3 – Comprehensive Protection for a Retiree: Robert Lewis, a 68-year-old retiree from Las Cruces, NM, opted for Geico’s comprehensive coverage, benefiting from low mileage and safe driving discounts to keep his premiums manageable.

- Case Study #4 – Reliable Coverage for a Small Business Owner: Lisa Chen, a 34-year-old bakery owner from Roswell, NM, found Nationwide’s customizable policies ideal for her needs, bundling her commercial and personal auto insurance for maximum savings.

- Case Study #5 – Specialized Coverage for a High-Risk Driver: Alex Ramirez, a 30-year-old freelance graphic designer from Taos, NM, chose Farmers Insurance for its support for high-risk drivers, taking advantage of discounts from defensive driving courses to lower his premiums.

These case studies demonstrate that with careful consideration and comparison, New Mexico residents can find car insurance solutions that are both cost-effective and comprehensive. By identifying their specific needs and taking advantage of available discounts, they have managed to secure the protection they require without breaking the bank.

State Farm delivers the best car insurance in New Mexico with unbeatable low rates and exceptional coverage.

Daniel Walker Licensed Insurance Agent

Whether you are in a similar situation or facing unique insurance challenges, these examples offer valuable insights into how you too can find the right coverage for your vehicle. For a thorough understanding, refer to our detailed analysis titled “Compare Car Insurance Rates by Vehicle Make and Model.”

Summary: Cheapest Car Insurance Rates in New Mexico

For affordable car insurance in New Mexico, State Farm starts at $24/month, Progressive at $30, and Geico at $31. Minimum liability coverage required is $25,000 per person, $50,000 per accident, and $10,000 for property damage. To expand your knowledge, refer to our comprehensive handbook titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

Uninsured motorist coverage is also mandatory unless declined in writing. Given the high rate of uninsured drivers in the state, adding Medpay and uninsured/underinsured motorist coverage is advisable. Comparing rates and coverage options from these top providers will help New Mexico drivers secure affordable and comprehensive insurance.

Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool below to see affordable car insurance quotes.

Frequently Asked Questions

How much is car insurance per month in New Mexico?

Car insurance rates in New Mexico vary, but the average cost is approximately $76 per month. State Farm offers the lowest rates starting at $24 per month for minimum coverage.

Who is known for the cheapest car insurance in New Mexico?

State Farm is known for offering the cheapest car insurance in New Mexico, with minimum coverage rates starting at $24 per month.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Who has the lowest insurance rates for new drivers in New Mexico?

State Farm and Geico are typically the best options for new drivers in New Mexico, offering competitive rates and various discounts to help reduce costs.

To gain profound insights, consult our extensive guide titled “Car Insurance Discounts: Compare the Best Discounts.”

Which car insurer is best in New Mexico?

State Farm is often considered the best car insurer in New Mexico due to its low rates, excellent customer service, and comprehensive coverage options.

Is it illegal to not have car insurance in New Mexico?

Yes, it is illegal to drive without car insurance in New Mexico. The state requires minimum liability coverage, and driving without it can result in fines, license suspension, and other penalties.

Is New Mexico a no-fault state for car insurance?

No, New Mexico is not a no-fault state. It operates under a fault-based system, meaning the driver responsible for the accident pays for the damages.

For a comprehensive overview, explore our detailed resource titled “Compare No-Fault Car Insurance: Rates, Discounts, & Requirements.”

What does an uninsured motorist cover in New Mexico?

Uninsured motorist coverage in New Mexico protects you if you are in an accident with a driver who does not have insurance. It can cover medical expenses, lost wages, and other related costs.

At what age is car insurance cheapest in New Mexico?

Car insurance rates typically decrease as drivers gain more experience and maintain a clean driving record. The cheapest rates are generally offered to drivers in their mid-30s to early 50s.

Which car insurance is best for a new driver in New Mexico?

For new drivers in New Mexico, Progressive and Geico are great choices due to their affordable premiums and discounts for safe driving and good students.

To enhance your understanding, explore our comprehensive resource on insurance titled “Safe Driver Car Insurance Discounts.”

What is an insurance premium?

An insurance premium is the amount you pay for your car insurance policy. It can be paid monthly, quarterly, or annually, and it covers the cost of your insurance coverage for the specified period.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.