Free Car Insurance Comparison

Compare quotes from the top car insurance companies and save!

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Drivers can save $859/yr* by comparing car insurance

*based on a survey of 1,000 car insurance customers

Stop overpaying for coverage – enter your ZIP code to COMPARE and SAVE!

Car Insurance Comparison

Are you plagued with questions about car insurance? Questions like: What is the best insurance comparison site? How do I find the best car insurance rates? What insurance company has the best rates? What’s the the best way to compare car insurance quotes?

Well, you have come to the right place to CarInsuranceComparison.com because let’s face it — choosing car insurance can be a chore. It’s very time-consuming when you can’t compare quotes all in one place.

Unfortunately, since car insurance is required by law in almost every state and not having car insurance can really create more trouble than you need, it is critical to thoroughly compare car insurance before buying a policy.

It is important to know why you need to do a thorough auto insurance comparison, what you should be comparing, and how to evaluate your results to make the best selection.

Read on to learn the best way to compare car insurance rates, but if you just want to hop right to it begin your car insurance quotes comparison online, then there is no need to wait to buy car insurance ASAP!

Just enter your zip code on the top of this page for a free comparison of car insurance quotes from top car insurance companies near you!

Why You Need a Thorough Car Insurance Quotes Rate Comparison

Most of us make the mistake of thinking that car insurance policies are pretty much the same. “I just need to pick the policy with the best price and I’m good to go.” Nothing could be further from the truth.

While finding cheap car insurance is important (and we will tell you exactly how to do just that), each car insurance company (and there are a bunch of them out there) has many different policy types.

Each policy may have different levels of coverage, options, incentives, and discounts.

Take a few moments and get online quotes for cheap car insurance with a few of the best car insurance providers side-by-side, and you will see exactly why this is so important.

Also, the cost associated with each of these policies can vary greatly depending on the company you choose and the policy type, coverage amount, and any other of a dozen different options you might select.

Check out our auto insurance comparison chart then just enter your zip above for a free online car insurance quote comparison.

To make it even more interesting, consider that different cars models have different car insurance rates. If you have thought about comparing car insurance rates for different cars before buying one then you are already way ahead of the curve. Just enter your zip code above to get started.

What did you say?

We are the best car insurance quotes comparison site?

You make us blush!…

In all seriousness, you may get sick of hearing the often simplistic sounding advice from us to “compare free car insurance quotes online by just entering in your zip code” or to “do your homework and do an online insurance comparison of rates from all of the best car insurance companies.”

But hey, if a few minutes comparing quotes online ends up saving you $250 or more then it all works out quite nicely, doesn’t it?

What You Need to Consider in Your Car Insurance Comparison

The key issues you need to prioritize include

- The level of insurance coverage you need,

- The amount of money you can afford to pay for your car insurance, and

- The type of insurance company you want to do business with.

First, when you consider the level of insurance coverage you need you will need to do an honest evaluation of:

- Your driving habits,

- Your driving environment, and

- Your financial situation (i.e., how much costs could you afford with an accident/claim?)

Comparing policies from different car insurance companies is simple with our free car insurance comparison tool but keeping your head in the game and weighing all of your options is important to really save the big bucks and find an affordable car insurance policy.

Your driving habits matter. It also matters how, when, and where you drive. Since insurance companies will evaluate these factors, you should as well. Be honest with yourself:

- If you regularly drive past the speed limit,

- If your daily drive includes major interstates and thoroughfares, or

- If your commute is an hour each way through a populous city

then you might want to consider a higher level of coverage because you are in a higher risk category.

What that means is that your driving behavior, either good or bad will affect your chances of being classified as a high or low insurance risk.

This is important because if you realize your driving risk category, you can make a more informed decision on whether you need basic coverage or a policy that includes every option known to man.

Some companies realize that even a good drive can have an accident and offer accident forgiveness policies if you are usually a good driver.

The driving environment includes more than just the area you drive through each day. You need to consider:

- If you will be parking your vehicle on the street or if it will be locked in a garage,

- If you will be parking in any high crime areas or areas known for a high volume of vehicle accidents, or

- If the car you drive is a vehicle commonly targeted for theft.

Other considerations like if you have an alarm system or Lojack device installed can make a difference when deciding if you want coverage for theft of the vehicle. Installation of anti-theft devices will most likely lower your rates. (For more information, read our “LoJack Car Insurance Discounts“).

One of the biggest considerations when choosing any particular policy is to analyze how much cost you can afford in the event of an accident/claim.

How much you can afford can greatly affect how much coverage you can obtain as well as what type of company you can purchase from.

There are companies that will offer you basic liability coverage for a very small monthly payment, there are companies that offer platinum level coverage options for payments that might make some executives flinch.

You’ll need to find out where you fall between these two extremes — just remember that you often get what you pay for.

Also, when you’re researching policies and providers, ask about any and all discounts, incentives, or promotions each company might have to save you money on your policy.

Surprisingly, a high coverage/high dollar policy can become affordable after deducting all possible discounts, adding all available incentives, and taking advantage of any promotions offered.

Finally, you will need to think about the type of service and stability you want from the insurance company you will be doing business with.

Despite the fact that insurance is one of the few products consumers purchase yet never want to use, it is inevitable that you will need to file a claim at some point.

When you do, you want to know that the insurance company you have been paying premiums to is still around to service that claim.

In addition, when they do service the claim you file, will they treat you as a valued customer, or an expense that needs to be settled?

You will want to know what type of service history the company enjoys, is this the type of company you could recommend to your mom or best friend? If so, there is a good chance it could be the company for you.

Evaluating Your Car Insurance Comparison Data

Once you have decided what coverage you want, how much you want to pay, and what type of company you want to service your insurance needs, you will need to gather data on the different companies that fit the bill.

Our comparison tool above is one great resource. Just a few clicks and you will have side-by-side comparison information ready for you to evaluate.

Once you are here, decide on your priorities. You can rank price, coverage, and service/brand stability from one to three. Use this weighted list to narrow down the field to one or two really good choices.

When your short list of car insurance companies is finished, no matter which option you select, you can be assured that your needs and wants will be met.

One final note: car insurance companies change rates regularly and often give considerable incentives to win new business from other companies.

So, once you have your short list of preferred insurance companies, don’t be afraid to go back and re-shop your options. We recommend you re-shop your rate and policy about every six months or so with your current provider.

Here are some car insurance factors to compare:

- Age and gender

- Driving record

- Credit score

- Location

- Policy type

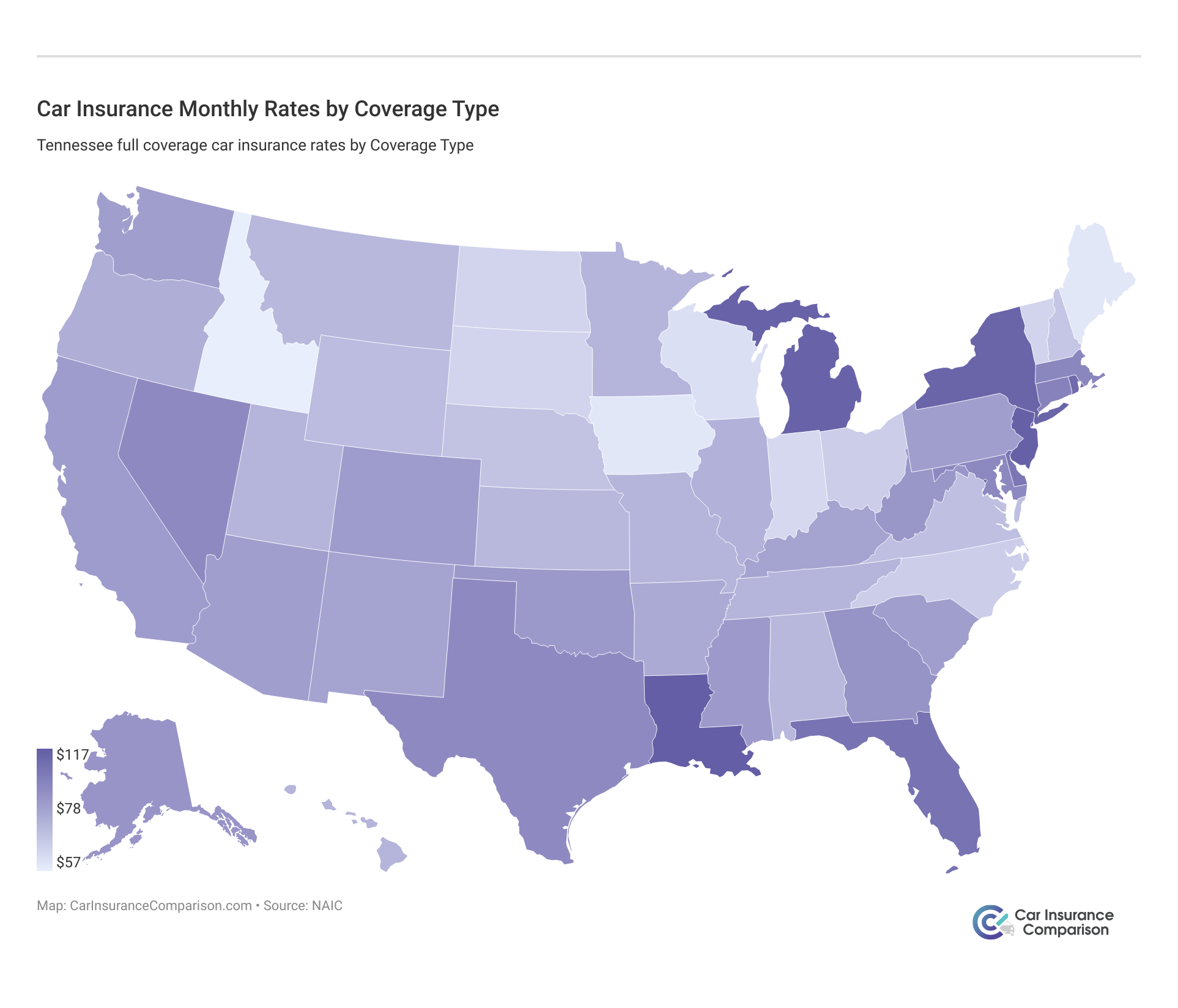

See how car insurance differs by state (just a single factor) below:

Get Free Car Insurance Quotes and Compare Rates!

One thing is certain, we all need car insurance. If you have to have it, doesn’t it make sense to get the coverage you need, at the price you can afford, and with a company you feel you can truly count on?

Shopping car insurance may be a chore, but as important as being insured is, you will definitely want to take the time to do it right. Spend just a few quick minutes to enter your zip code into the box above and get started with your free car insurance quote comparison today!

- Recent Articles

- Stacked vs. Non-Stacked Car Insurance in 2025 [Differences Explained]

- Compare Pontiac Car Insurance Rates

- Compare Mitsubishi Car Insurance Rates [2025]

- Best Car Insurance Companies That Only Look Back 3 Years in 2025 (Top 10 Picks)

- Cheap Car Insurance for a Second Car in 2025 (Earn Savings With These 10 Companies!)

- Esurance Car Insurance Review for 2025 [Rates, Discounts & More!]

- Best Car Insurance Discounts for Federal Employees in 2025 [Save up to 40% With These Companies!]

- Uninsured and Underinsured Motorist Coverage (UM/UIM) in 2025 [Coverage Explained]

- Texas Farm Bureau Car Insurance Review for 2025 [See Ratings & Cost Here!]

- Farmers vs. Travelers Car Insurance Comparison [2025]

- Best Kia Telluride Car Insurance in 2025 (Check Out These 10 Companies)

- Liberty Mutual Car Insurance Review for 2025 [See Rates & Discounts Here]

- Best Car Insurance for 17-Year-Olds in 2025 (Top 10 Companies)

- Best Car Insurance for a Revoked Driver's License in 2025 (Top 10 Companies)

- Best Car Insurance for Independent Contractors in 2025 (Top 10 Companies)

- Best Car Insurance for Foreigners in 2025 (Your Guide to the Top 10 Companies)

- Best Low-Mileage Car Insurance in 2025 (Your Guide to the Top 10 Providers)

- Best Infiniti G35 Car Insurance in 2025 (Find the Top 10 Companies Here)

- Best Honda CR-V Car Insurance in 2025 (Compare the Top 10 Companies)

- Cheap Car Insurance for Minivans in 2025 (Save Money With These 8 Companies)

- Best Car Insurance for Car Dealerships in 2025 (Top 10 Companies Ranked)

- Best Car Insurance for Medical Students in 2025

- Best Toyota Venza Car Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best AAA Car Insurance Discounts in 2025 (Save 25% With This Company)

- Best Islamic Car Insurance in 2025 (Find the Top 10 Companies Here!)

- Geico vs. The General Car Insurance Comparison [2025]

- Geico vs. The Hartford Car Insurance Comparison [2025]

- Cheapest Alabama Car Insurance Rates in 2025 (Unlock Savings With These 10 Companies!)

- Best Nissan Altima Car Insurance in 2025 (Top 10 Companies Ranked)

- Best Alexandria, VA Car Insurance in 2025

- Can I sue my own car insurance company?

- Minimum Car Insurance Requirements by State [2025]

- Non-Profit Car Insurance Companies

- Best Chevrolet Corvette Z06 Car Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Lexus ES 330 Car Insurance in 2025 (Compare the Top 10 Companies)

- Stop Overpaying for Car Insurance

- Best Ford F-150 Car Insurance in 2025 (Compare the Top 10 Companies)

- Cheapest Indiana Car Insurance Rates in 2025 (Save With These 10 Companies)

- Best Chrysler Sebring Car Insurance in 2025 (Check Out the Top 10 Companies)

- Omaha Indemnity Car Insurance Review [2025]

- Assurant Car Insurance Review [2025]

- Mercer Insurance Group Car Insurance Review [2025]

- Prudential Car Insurance Review [2025]

- AutoOne Car Insurance Review [2025]

- Travelers Car Insurance Review [2025]

- Geico Car Insurance Review for 2025 [See if They’re a Good Fit]

- Cheap Car Insurance for Farm Vehicles in 2025 (Top 10 Low-Cost Companies)

- Farmers Car Insurance Review [2025]

- Best Car Insurance for 16-Year-Olds in 2025 (Top 10 Companies)

- Best Car Insurance for 18-Year-Olds in 2025 (Top 10 Companies)